North America Mannequin Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD8309

December 2024

91

About the Report

North America Mannequin Market Overview

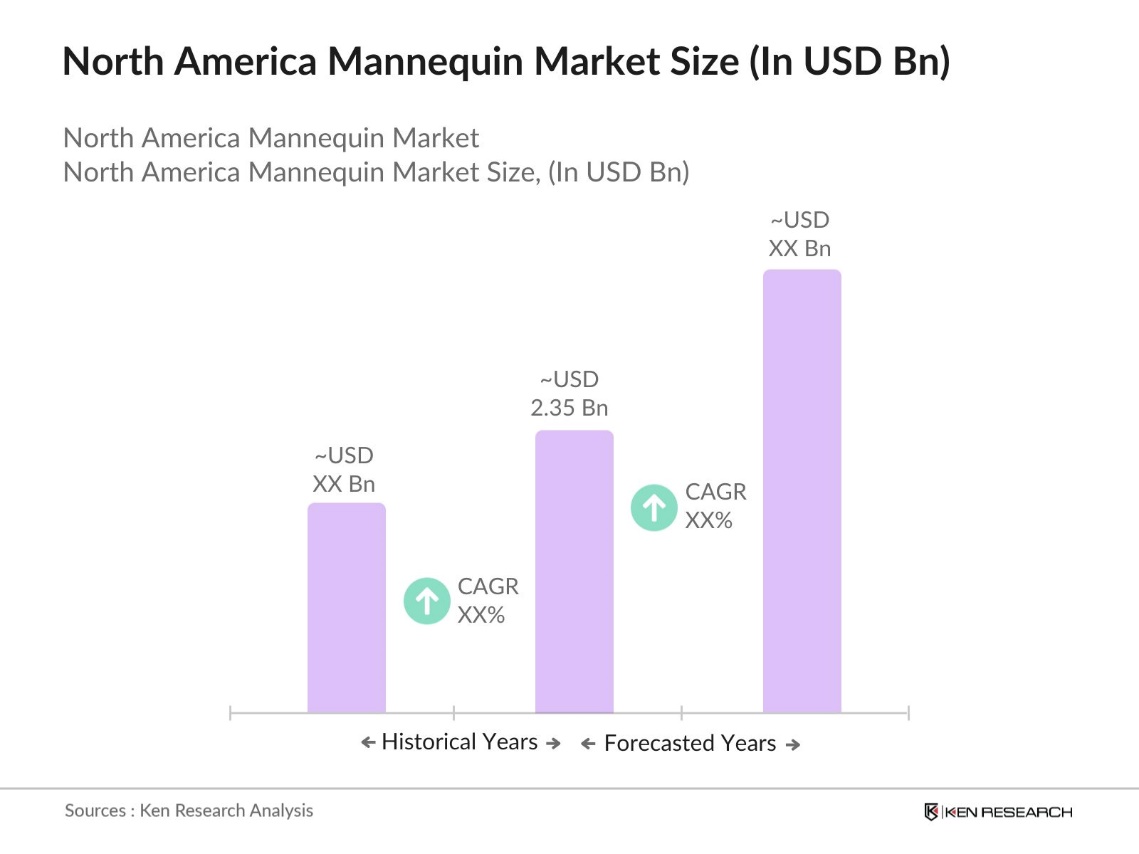

- The North America Mannequin Market is valued at USD 2.35 billion, based on a five-year historical analysis. The growth of the market is primarily driven by the expanding retail and fashion industries across the United States and Canada. Retailers are increasingly investing in visual merchandising strategies to attract in-store customers and enhance their window displays.

- The United States leads the North America mannequin market due to its strong retail landscape and the presence of numerous fashion hubs like New York City and Los Angeles. These cities are home to flagship stores of global fashion brands and host major fashion events, driving the demand for high-quality mannequins. Additionally, the preference for customization and eco-friendly mannequins is high in the U.S., making it a prime market for innovation.

- To promote sustainability, North American countries have introduced regulations encouraging the use of recyclable and biodegradable materials in manufacturing. The U.S. Environmental Protection Agency (EPA) reported that in 2024, implemented stricter guidelines for the use of non-biodegradable materials in products. This regulatory shift encourages manufacturers to adopt eco-friendly materials, driving the demand for sustainable mannequins.

North America Mannequin Market Segmentation

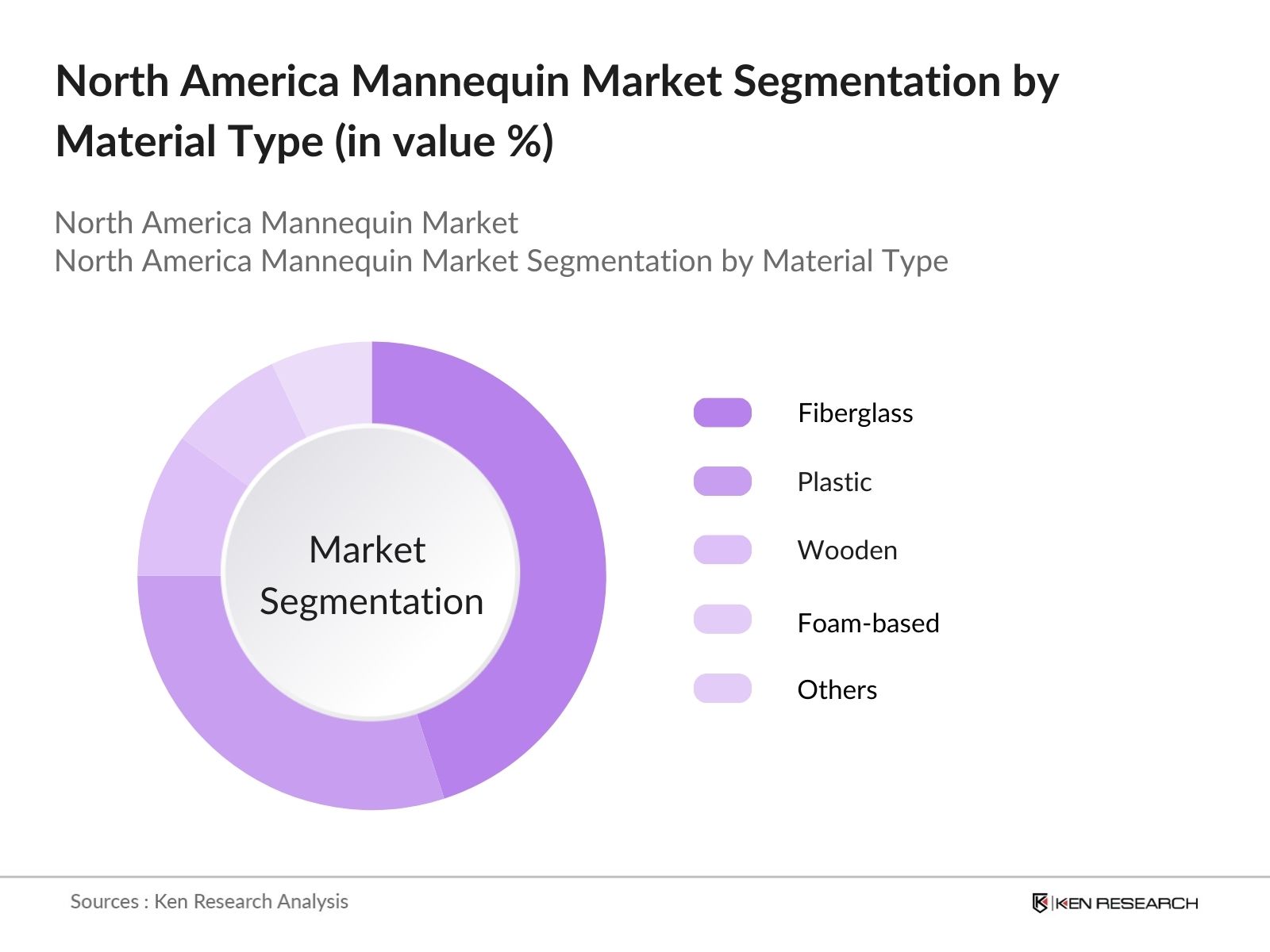

By Material Type: The North America Mannequin Market is segmented by material type into fiberglass, plastic, wooden, foam-based, and others (including metal and recycled materials). The Fiberglass mannequins hold a dominant market share under this segmentation, primarily due to their durability and ability to achieve intricate detailing. The high-quality finish provided by fiberglass makes it a preferred choice for luxury brands and high-end retail stores. Moreover, the lightweight nature of fiberglass facilitates easier transportation and handling, making it ideal for dynamic retail environments where mannequins are frequently repositioned.

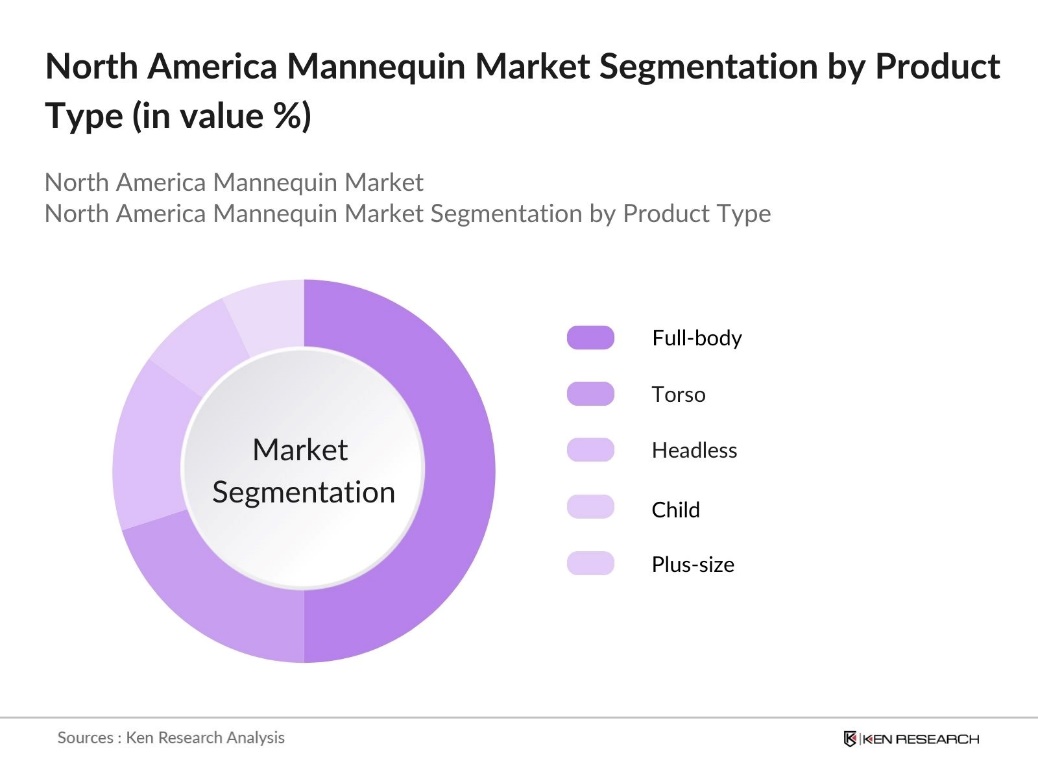

By Product Type: The North America Mannequin Market is segmented by product type into full-body mannequins, torso mannequins, headless mannequins, child mannequins, and plus-size mannequins. The Full-body mannequins dominate the market share in this segment, driven by their versatile use in various retail setups, including apparel, accessories, and footwear. Retailers and fashion brands favor full-body mannequins as they provide a complete visual representation, enhancing product display and customer experience. Their adaptability to different poses and customization options further enhance their popularity, particularly among premium and mid-range fashion retailers.

North America Mannequin Market Competitive Landscape

The market is characterized by a mix of established players and specialized manufacturers. The markets competitive landscape is consolidated with a few leading companies that dominate through extensive product portfolios and innovation in design and material use. Notable players include Bonaveri, which is known for its eco-friendly mannequins, and Rootstein, recognized for its luxury product lines. Smaller manufacturers focus on niche segments such as customizable and sustainable mannequins, catering to the evolving needs of the retail sector.

|

Company |

Established Year |

Headquarters |

Material Innovation |

Customization Options |

Sustainability Initiatives |

Number of Employees |

Revenue (USD Mn) |

Key Market Presence |

Product Portfolio Diversity |

|

Bonaveri |

1950 |

Italy, with US offices |

|||||||

|

Rootstein |

1959 |

London, UK, US division |

|||||||

|

Hans Boodt Mannequins |

1999 |

Netherlands, US branch |

|||||||

|

Fusion Specialties, Inc. |

1987 |

Colorado, USA |

|||||||

|

Mondo Mannequins |

1980 |

California, USA |

North America Mannequin Industry Analysis

Growth Drivers

- Expansion of Retail Sector: The retail sector in North America has seen substantial growth due to an increase in disposable incomes and consumer spending, with retail sales surpassing $8.3 trillion in the region in 2023. This growth has led to increased demand for mannequins in brick-and-mortar stores as visual merchandising tools. The rise in retail spaces, including shopping malls and specialty stores, has necessitated the use of mannequins for effective product displays, making them a crucial component in the retail industry.

- Technological Integration in Mannequin Design: Technological advancements, including 3D scanning and printing, are becoming prevalent in the mannequin industry. This allows retailers to create lifelike and varied mannequins that represent diverse body types. For instance, Gymshark, a British fitness brand, launched its flagship store in London, featuring mannequins created using 3D printing technology to offer an authentic representation of its products.

- Demand for Customized Mannequins: The demand for customized mannequins has surged as brands focus on aligning store aesthetics with consumer preferences. Customized mannequins enable retailers to create engaging, brand-specific visual displays that enhance the shopping experience. This trend is especially prominent among luxury brands, which use tailored mannequin designs to maintain their brand image, fostering a more personalized and appealing in-store environment that resonates with their target audiences.

Market Challenges

- High Production Costs: The manufacturing of high-quality mannequins requires durable materials and skilled craftsmanship, which often leads to elevated production costs. These expenses can strain the profitability of smaller manufacturers, who must balance maintaining product quality with managing costs. Rising costs for materials and labor make it challenging for these businesses to compete, especially when faced with cheaper alternatives from larger manufacturers or imported products.

- Rising Preference for Digital Fashion Displays: As digital transformation accelerates, many retailers are turning to virtual try-on and augmented reality solutions, reducing their reliance on physical mannequins. These digital alternatives offer a new way to engage customers, providing interactive experiences that traditional displays cannot match. This trend presents a challenge for the mannequin market, as brands explore innovative digital solutions that can replace or complement physical mannequins in their stores.

North America Mannequin Market Future Outlook

Over the next five years, the North America Mannequin Market is anticipated to witness steady growth, driven by the continued expansion of retail and fashion sectors, as well as the increasing adoption of visual merchandising strategies by e-commerce brands. Retailers are likely to invest further in sustainable mannequins to align with environmental regulations and consumer preferences for eco-friendly solutions. Technological advancements, such as 3D-printed mannequins and virtual mannequins for online platforms, are expected to open new opportunities for growth in the market.

Market Opportunities

- Growth in Sustainable Mannequin Production: The increasing focus on sustainability in retail has created opportunities for the production of eco-friendly mannequins made from biodegradable materials like bamboo and recycled plastics. This shift aligns with retailers efforts to adopt greener practices, making sustainable mannequins a more attractive option. As a result, manufacturers specializing in environmentally friendly mannequins are finding a growing niche, catering to retailers seeking to reduce their environmental footprint in displays.

- Market Expansion in Untapped Regions: North Americas smaller cities and towns have experienced growth in retail store openings, driven by a shift towards more localized shopping experiences. This expansion presents new opportunities for mannequin manufacturers, as these regions represent a relatively untapped market. With the demand for customized and standard mannequins increasing in these emerging retail hubs, manufacturers can extend their distribution networks to capture this potential growth.

Scope of the Report

|

Material Type |

Fiberglass Plastic Wooden Foam-based Others (Metal, Recycled Materials) |

|

Product Type |

Full-body Mannequins Torso Mannequins Headless Mannequins Child Mannequins Plus-size Mannequins |

|

Gender |

Male Female Unisex |

|

End User |

Apparel Stores E-commerce Platforms Museums and Art Exhibitions Cosmetics and Jewelry Stores |

|

Region |

USA Canada Mexico |

Products

Key Target Audience

E-commerce Platforms (Amazon, Shopify Stores)

Visual Merchandising Firms

Theatrical and Film Production Companies

Manufacturers and Distributors of Display Equipment

Government and Regulatory Bodies (U.S. Environmental Protection Agency)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Bonaveri

Rootstein

Hans Boodt Mannequins

Fusion Specialties, Inc.

Mondo Mannequins

Noa Brands

Global Display Projects Limited

New John Nissen Mannequins

AMKO Display

Mannequin Mall

Table of Contents

1. North America Mannequin Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Demand from Fashion Retail, E-commerce Adoption, Visual Merchandising)

1.4. Market Segmentation Overview

2. North America Mannequin Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Mannequin Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of Retail Sector

3.1.2. Rising E-commerce Penetration

3.1.3. Demand for Customized Mannequins

3.1.4. Technological Integration in Mannequin Design

3.2. Market Challenges

3.2.1. High Production Costs

3.2.2. Rising Preference for Digital Fashion Displays

3.2.3. Competition from Low-Cost Imports

3.3. Opportunities

3.3.1. Growth in Sustainable Mannequin Production

3.3.2. Market Expansion in Untapped Regions

3.3.3. Partnerships with Fashion Brands

3.4. Trends

3.4.1. Use of 3D Printing for Customization

3.4.2. Demand for Eco-friendly Mannequins

3.4.3. Shift Toward Virtual Mannequins

3.5. Government Regulations

3.5.1. Import Tariffs and Trade Policies

3.5.2. Regulations on Sustainable Material Usage

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Distributors, Retailers, E-commerce Platforms)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem (Competitive Landscape, Market Structure)

4. North America Mannequin Market Segmentation

4.1. By Material Type (In Value %)

4.1.1. Fiberglass

4.1.2. Plastic

4.1.3. Wooden

4.1.4. Foam-based

4.1.5. Others (Metal, Recycled Materials)

4.2. By Product Type (In Value %)

4.2.1. Full-body Mannequins

4.2.2. Torso Mannequins

4.2.3. Headless Mannequins

4.2.4. Child Mannequins

4.2.5. Plus-size Mannequins

4.3. By Gender (In Value %)

4.3.1. Male

4.3.2. Female

4.3.3. Unisex

4.4. By End User (In Value %)

4.4.1. Apparel Stores

4.4.2. E-commerce Platforms

4.4.3. Museums and Art Exhibitions

4.4.4. Cosmetics and Jewelry Stores

4.5. By Region (In Value %)

4.5.1. USA

4.5.2. Canada

4.5.3. Mexico

5. North America Mannequin Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Bonaveri

5.1.2. Rootstein

5.1.3. Noa Brands

5.1.4. Hans Boodt Mannequins

5.1.5. Global Display Projects Limited

5.1.6. New John Nissen Mannequins

5.1.7. Mondo Mannequins

5.1.8. AMKO Display

5.1.9. Mannequin Mall

5.1.10. Proportion London

5.1.11. Fusion Specialties, Inc.

5.1.12. Universal Display

5.1.13. Retail Resource

5.1.14. Mannequins Online

5.1.15. ABC Mannequins

5.2. Cross Comparison Parameters (Revenue, Production Capacity, Number of Patents, Market Share, R&D Expenditure, Geographic Presence, Number of Employees, Manufacturing Units)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Product Launches, Strategic Partnerships, Joint Ventures)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Recent Investments, Venture Capital Funding)

5.7. Government Grants and Subsidies

5.8. Private Equity Investments

6. North America Mannequin Market Regulatory Framework

6.1. Environmental Standards (Sustainable Material Requirements)

6.2. Import Tariffs on Mannequin Components

6.3. Compliance Requirements (Safety and Hazard Regulations)

6.4. Certification Processes (ISO, ASTM Standards)

7. North America Mannequin Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Rising Adoption of Visual Merchandising, Growth in Luxury Fashion Retail)

8. North America Mannequin Future Market Segmentation

8.1. By Material Type (In Value %)

8.2. By Product Type (In Value %)

8.3. By Gender (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

9. North America Mannequin Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (Retailers, E-commerce Brands, Museum Buyers)

9.3. Marketing Initiatives (Digital Campaigns, In-store Promotions)

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the North America Mannequin Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the North America Mannequin Market. This includes assessing market penetration, the ratio of manufacturers to retailers, and the resultant revenue generation. Furthermore, an evaluation of product customization trends will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple mannequin manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the North America Mannequin Market.

Frequently Asked Questions

01. How big is the North America Mannequin Market?

The North America Mannequin Market is valued at USD 2.35 billion, based on a five-year historical analysis. The market is primarily driven by demand from the retail and fashion sectors, particularly in urban centers with high retail activity.

02. What are the challenges in the North America Mannequin Market?

Challenges in North America Mannequin Market include the high cost of premium mannequins, competition from digital displays, and the demand for sustainable manufacturing processes. Adapting to changing consumer preferences and new retail technologies also poses a challenge for traditional mannequin manufacturers.

03. ho are the major players in the North America Mannequin Market?

Key players in the North America Mannequin Market include Bonaveri, Rootstein, Hans Boodt Mannequins, Fusion Specialties, Inc., and Mondo Mannequins. These companies dominate due to their extensive product offerings, focus on customization, and strong presence in the retail sector.

04. What drives the demand for fiberglass mannequins?

The demand for fiberglass mannequins is driven by their durability and superior finish, making them ideal for high-end displays. Additionally, their lightweight nature allows for easy handling and transportation, further contributing to their popularity in dynamic retail environments.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.