North America Microgrid Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD3412

December 2024

88

About the Report

North America Microgrid Market Overview

- The North America microgrid market is valued at USD 13 billion, driven by the increasing demand for energy resilience and the integration of renewable energy sources. The market has witnessed significant growth due to advancements in energy storage technologies and governmental incentives aimed at reducing carbon emissions. Microgrids are becoming crucial in critical infrastructure, providing stability in regions prone to natural disasters and grid failures.

- The dominant markets in North America include the United States and Canada, with the U.S. leading due to its strong regulatory frameworks, significant investments in clean energy, and demand from military, healthcare, and academic institutions. The U.S. also benefits from its large-scale deployment of renewable energy, making it a pioneer in microgrid technology adoption. Canada follows closely due to its emphasis on remote and off-grid microgrids, which are vital for rural areas with limited grid access.

- Federal funding programs have accelerated microgrid deployments in North America. In 2023, the U.S. Department of Energy allocated $500 million specifically for microgrid projects under the Grid Resilience and Innovation Partnerships Program. These funds target projects that increase energy reliability, particularly in vulnerable regions. Similarly, Canadas Green Infrastructure Fund, with a $2 billion allocation, supports renewable energy microgrids in rural and indigenous communities.

North America Microgrid Market Segmentation

By Grid Type: The market is segmented by grid type into grid-connected and off-grid/islanded. In recent years, off-grid microgrids have gained a dominant market share. The rising need for energy resilience in remote areas and critical facilities like hospitals and military bases drives this segment's growth. Off-grid microgrids provide a reliable power supply in locations that are prone to grid failures or are disconnected from traditional electricity networks.

By Application: The market is further segmented by application into commercial & industrial, utility, military, healthcare, and educational institutions. The commercial & industrial segment dominates the market due to the increasing need for uninterrupted power supply in data centers, manufacturing plants, and corporate campuses. The rising cost of electricity, combined with the need for sustainability, drives businesses to adopt microgrids.

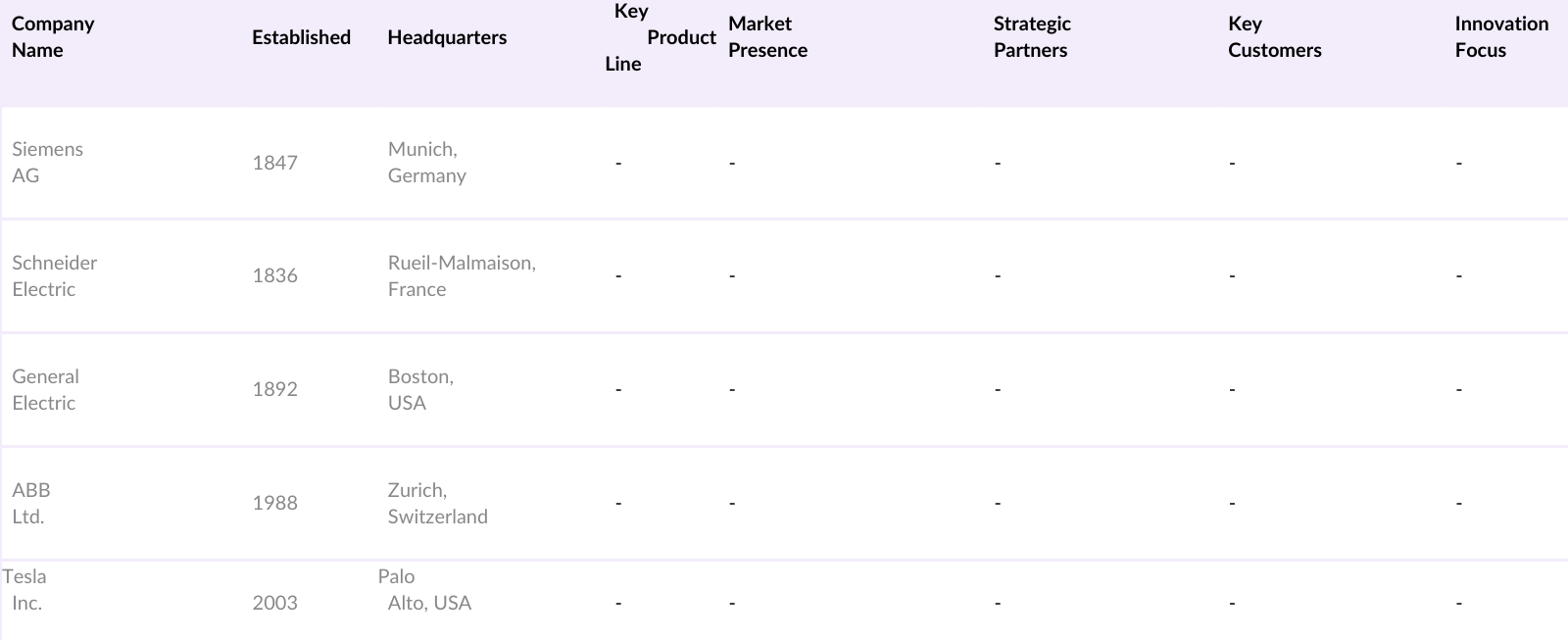

North America Microgrid Market Competitive Landscape

The North America Microgrid market is dominated by a few key players that have a strong foothold in microgrid technologies, energy storage solutions, and renewable energy integration. Companies like Siemens, Schneider Electric, and ABB lead the market, while innovative startups like Spirae and Tesla are making waves in energy storage and grid management. The consolidation of these companies has created a highly competitive landscape, with each player vying for dominance through mergers, partnerships, and new technology innovations.

North America Microgrid Industry Analysis

Growth Drivers

- Decarbonization Initiatives: The North America microgrid market is significantly influenced by regional decarbonization efforts, particularly in the U.S. and Canada. As of 2024, the United States aims to achieve a carbon pollution-free power sector by 2035, per the U.S. Department of Energy (DOE). Canada similarly targets net-zero emissions by 2050, with significant milestones in place for 2030. Microgrids are central to these strategies, as they enable localized renewable energy generation.

- Rising Energy Demand (Demand Side Management): Energy consumption in North America has been increasing steadily, with the U.S. consuming 101.6 quadrillion BTUs of energy in 2023, as per the U.S. Energy Information Administration (EIA). This surge necessitates better demand-side management, where microgrids play a crucial role in balancing energy loads, reducing strain on main grids, and promoting efficient energy distribution.

- Resilience against Natural Disasters: Natural disasters have intensified in recent years due to climate change, pushing governments to invest in microgrids for resilience. The National Oceanic and Atmospheric Administration (NOAA) reported that the U.S. faced 22-billion-dollar weather and climate disasters in 2023. In response, states like California and Texas have invested in microgrids to prevent widespread outages during wildfires and hurricanes.

Market Challenges

- High Capital Expenditure (CAPEX): Developing microgrids remains capital-intensive, with upfront costs estimated at $1 million to $5 million per megawatt for large-scale systems, according to the U.S. DOE. These high costs are primarily due to the integration of renewable energy, energy storage systems, and advanced software for grid management. While federal funding and state incentives help mitigate some expenses, businesses and municipalities must still invest heavily in infrastructure.

- Integration with Legacy Systems (Technical Barriers): The challenge of integrating microgrids with legacy systems is a significant technical barrier. North America's electricity grid infrastructure is aging, with 70% of transmission lines and power transformers over 25 years old, per the U.S. Department of Energy. This outdated infrastructure makes it difficult to incorporate advanced technologies like microgrids without extensive upgrades. The technical incompatibility often leads to delays in deployment and increased costs as utilities must modernize their grids to support distributed energy resources (DERs) and decentralized power systems.

North America Microgrid Market Future Outlook

Over the next five years, the North America microgrid market is expected to show robust growth, driven by technological advancements, increasing demand for decentralized energy systems, and rising environmental concerns. Government initiatives supporting renewable energy integration, combined with improved battery storage technology, are anticipated to accelerate market expansion.

Market Opportunities

- Advancements in Energy Storage Solutions: Energy storage technologies, particularly lithium-ion batteries, have seen remarkable advancements. As of 2024, the U.S. has installed over 1,700 MW of energy storage capacity, primarily paired with microgrids, per the EIA. This surge in capacity supports the grids flexibility and resilience, making it easier to integrate intermittent renewable sources like wind and solar. Emerging technologies such as solid-state batteries, which promise higher energy density and faster charge times, are also being tested for use in microgrid applications, offering significant potential for cost reduction and efficiency.

- Expansion of Off-Grid Applications: Off-grid microgrid installations are on the rise, particularly in remote and rural areas across North America. According to Natural Resources Canada, over 200 indigenous communities still rely on diesel generators for power, presenting a major opportunity for microgrid deployment. In the U.S., Alaska has been a leader in off-grid microgrids, with over 100 operational microgrids serving isolated communities.

Scope of the Report

|

By Grid Type |

Grid-Connected, Off-Grid/Islanded |

|

By Application |

Commercial & Industrial Utility Military Healthcare Educational Institutions |

|

By Component |

Power Generation (Solar PV, Wind, CHP, Diesel Generators) Energy Storage (Lithium-Ion Batteries, Flow Batteries, Others) Power Distribution Systems, Control Systems (SCADA, EMS) |

|

By Power Rating |

Less than 1 MW 1 MW to 5 MW Above 5 MW |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience

Commercial & Industrial Energy Consumers

Renewable Energy Developers

Energy Storage Providers

Government and Regulatory Bodies (U.S. Department of Energy, Canadian Ministry of Natural Resources)

Defense and Military Organizations

Utilities and Power Distribution Companies

Investors and Venture Capitalist Firms

Smart Grid Technology Providers

Companies

Players Mentioned in the Report

Siemens AG

Schneider Electric SE

General Electric

ABB Ltd.

Tesla Inc.

Hitachi Energy

Eaton Corporation

Honeywell International

Exelon Corporation

Spirae, LLC

Table of Contents

1. North America Microgrid Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Microgrid Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Microgrid Market Analysis

3.1. Growth Drivers

3.1.1. Decarbonization Initiatives

3.1.2. Rising Energy Demand (Demand Side Management)

3.1.3. Government Incentives and Regulatory Support

3.1.4. Resilience against Natural Disasters

3.2. Market Challenges

3.2.1. High Capital Expenditure (CAPEX)

3.2.2. Integration with Legacy Systems (Technical Barriers)

3.2.3. Complex Regulatory Landscape

3.3. Opportunities

3.3.1. Advancements in Energy Storage Solutions

3.3.2. Expansion of Off-Grid Applications

3.3.3. Growing Adoption of Distributed Energy Resources (DERs)

3.4. Trends

3.4.1. Integration with Smart Grid Technologies

3.4.2. Use of Artificial Intelligence in Microgrid Management

3.4.3. Rise of Peer-to-Peer Energy Trading Platforms

3.5. Government Regulation

3.5.1. Clean Energy Standards and Renewable Portfolio Standards

3.5.2. Federal Funding Programs

3.5.3. Regional Incentive Programs for Microgrids

3.5.4. Grid Interconnection Standards

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Buyers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes

3.8.5. Industry Rivalry

3.9. Competition Ecosystem

4. North America Microgrid Market Segmentation

4.1. By Grid Type (In Value %)

4.1.1. Grid-Connected

4.1.2. Off-Grid/Islanded

4.2. By Application (In Value %)

4.2.1. Commercial & Industrial

4.2.2. Utility

4.2.3. Military

4.2.4. Healthcare

4.2.5. Educational Institutions

4.3. By Component (In Value %)

4.3.1. Power Generation (Solar PV, Wind, CHP, Diesel Generators)

4.3.2. Energy Storage (Lithium-Ion Batteries, Flow Batteries, Others)

4.3.3. Power Distribution Systems

4.3.4. Control Systems (SCADA, EMS)

4.4. By Power Rating (In Value %)

4.4.1. Less than 1 MW

4.4.2. 1 MW to 5 MW

4.4.3. Above 5 MW

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Microgrid Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Siemens AG

5.1.2. Schneider Electric SE

5.1.3. General Electric

5.1.4. ABB Ltd.

5.1.5. Hitachi Energy

5.1.6. Eaton Corporation

5.1.7. Honeywell International

5.1.8. Exelon Corporation

5.1.9. Tesla Inc.

5.1.10. Spirae, LLC

5.1.11. PowerSecure, Inc.

5.1.12. Enbala Power Networks

5.1.13. Green Energy Corp

5.1.14. Bloom Energy

5.1.15. Advanced Microgrid Solutions

5.2 Cross Comparison Parameters (Market Share, Installed Capacity, Key Customers, Innovation Capabilities, Strategic Partnerships, Regional Presence, Project Pipeline, Technology Adoption)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Microgrid Market Regulatory Framework

6.1. Renewable Energy Standards

6.2. Microgrid Incentive Programs

6.3. Certification and Compliance Requirements

7. North America Microgrid Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Microgrid Future Market Segmentation

8.1. By Grid Type (In Value %)

8.2. By Application (In Value %)

8.3. By Component (In Value %)

8.4. By Power Rating (In Value %)

8.5. By Region (In Value %)

9. North America Microgrid Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves mapping key stakeholders within the North America Microgrid Market. Comprehensive desk research and proprietary databases are employed to identify critical variables influencing market dynamics, such as regulatory frameworks, technology adoption, and energy demand patterns.

Step 2: Market Analysis and Construction

In this step, historical data on the North America Microgrid Market is collected and analyzed. The analysis includes an evaluation of market penetration rates, installed capacity, and overall revenue generation. Statistical models are used to verify the accuracy of revenue estimates and future market trends.

Step 3: Hypothesis Validation and Expert Consultation

A set of hypotheses regarding market growth is developed and tested through consultations with industry experts from key companies. These consultations are conducted via computer-assisted telephone interviews (CATIs) to validate assumptions about market dynamics and the competitive landscape.

Step 4: Research Synthesis and Final Output

The final phase synthesizes insights gathered from industry consultations, combined with bottom-up analysis, to produce a detailed and validated market report. This stage ensures the accuracy of data related to market segmentation, revenue forecasts, and competitive intelligence.

Frequently Asked Questions

01. How big is the North America Microgrid Market?

The North America Microgrid Market is valued at USD 13 billion, driven by rising demand for decentralized energy solutions and increasing integration of renewable energy sources.

02. What are the challenges in the North America Microgrid Market?

North America Microgrid key challenges include high initial capital expenditure (CAPEX), integration with legacy grid systems, and complex regulatory hurdles in different states and regions.

03. Who are the major players in the North America Microgrid Market?

The North America Microgrid Market key players include Siemens AG, Schneider Electric SE, General Electric, ABB Ltd., and Tesla Inc., each holding a significant market presence due to their technological innovations and extensive portfolios.

04. What are the growth drivers of the North America Microgrid Market?

The North America Microgrid market is primarily driven by the need for energy resilience, increased use of renewable energy, and advancements in energy storage solutions, along with strong government incentives for microgrid deployment.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.