North America Military Drone Market Outlook to 2030

Region:North America

Author(s):Shreya

Product Code:KROD8332

November 2024

100

About the Report

North America Military Drone Market Overview

The North America military drone market is valued at USD 5.1 billion, reflecting a robust five-year historical growth pattern driven by increased military budgets and technological advancements. The demand for drones is fueled by their versatility in ISR (Intelligence, Surveillance, and Reconnaissance) and combat applications, with significant investment into high-tech unmanned aerial systems (UAS) from government agencies and defense sectors. The U.S. Department of Defenses initiatives and spending on autonomous and AI-integrated drone technology has positioned North America as a leader in this space.

The United States holds a dominant position in the North America military drone market, largely due to the countrys advanced defense infrastructure and high allocation of funds toward drone technology development. Canada also plays a role with a growing focus on surveillance and border security operations. The U.S. dominance is further reinforced by strategic collaborations between the defense sector and private tech companies, as well as policy initiatives that support the rapid development and deployment of military drones.

Export control regulations in North America restrict military-grade UAV sales, ensuring controlled access to advanced technology. In 2023, the U.S. government-imposed restrictions on over 30 high-capability drones, limiting their export to allied countries only. This measure highlights North America's stringent export policies and commitment to protecting advanced defense technologies

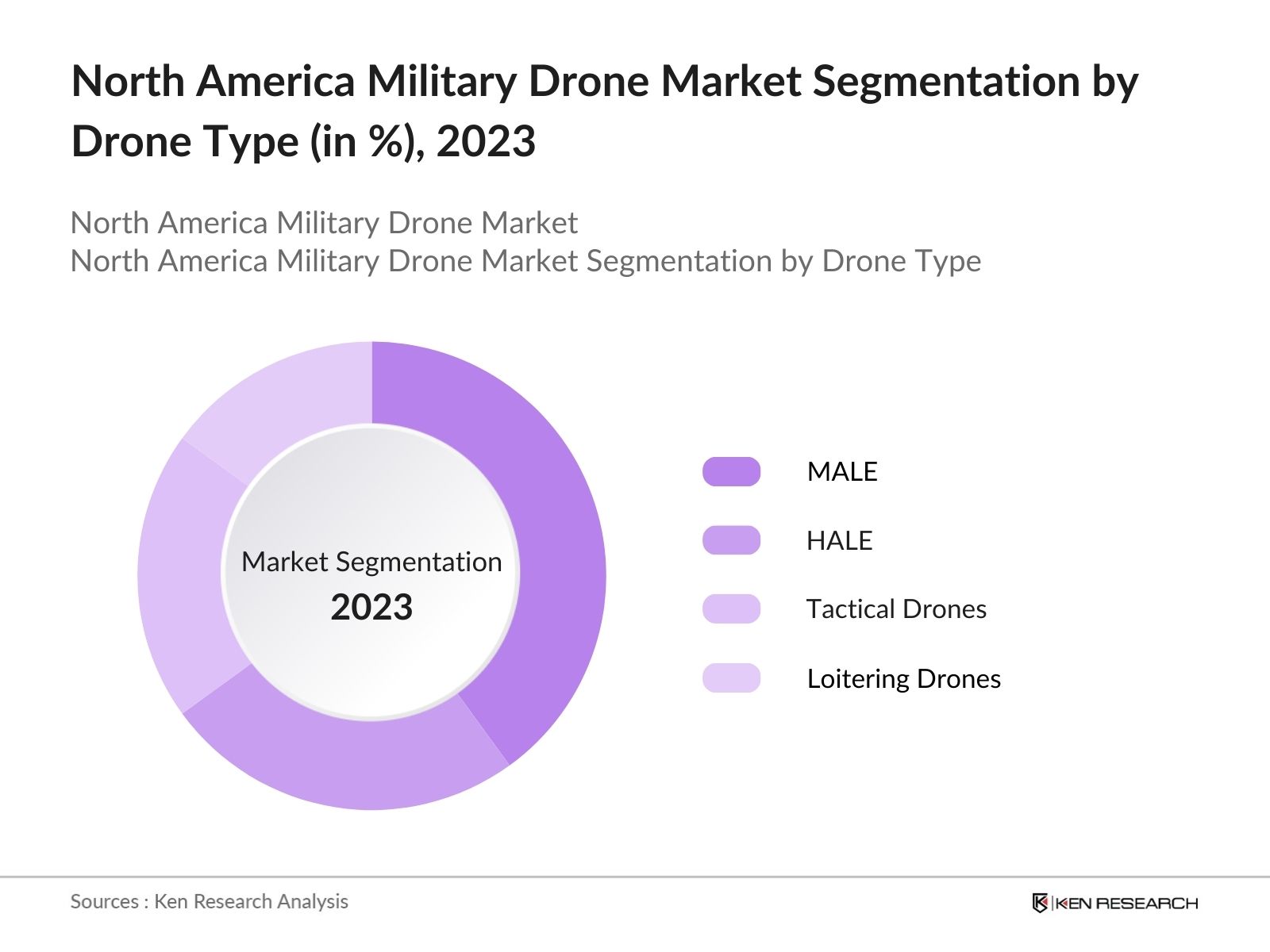

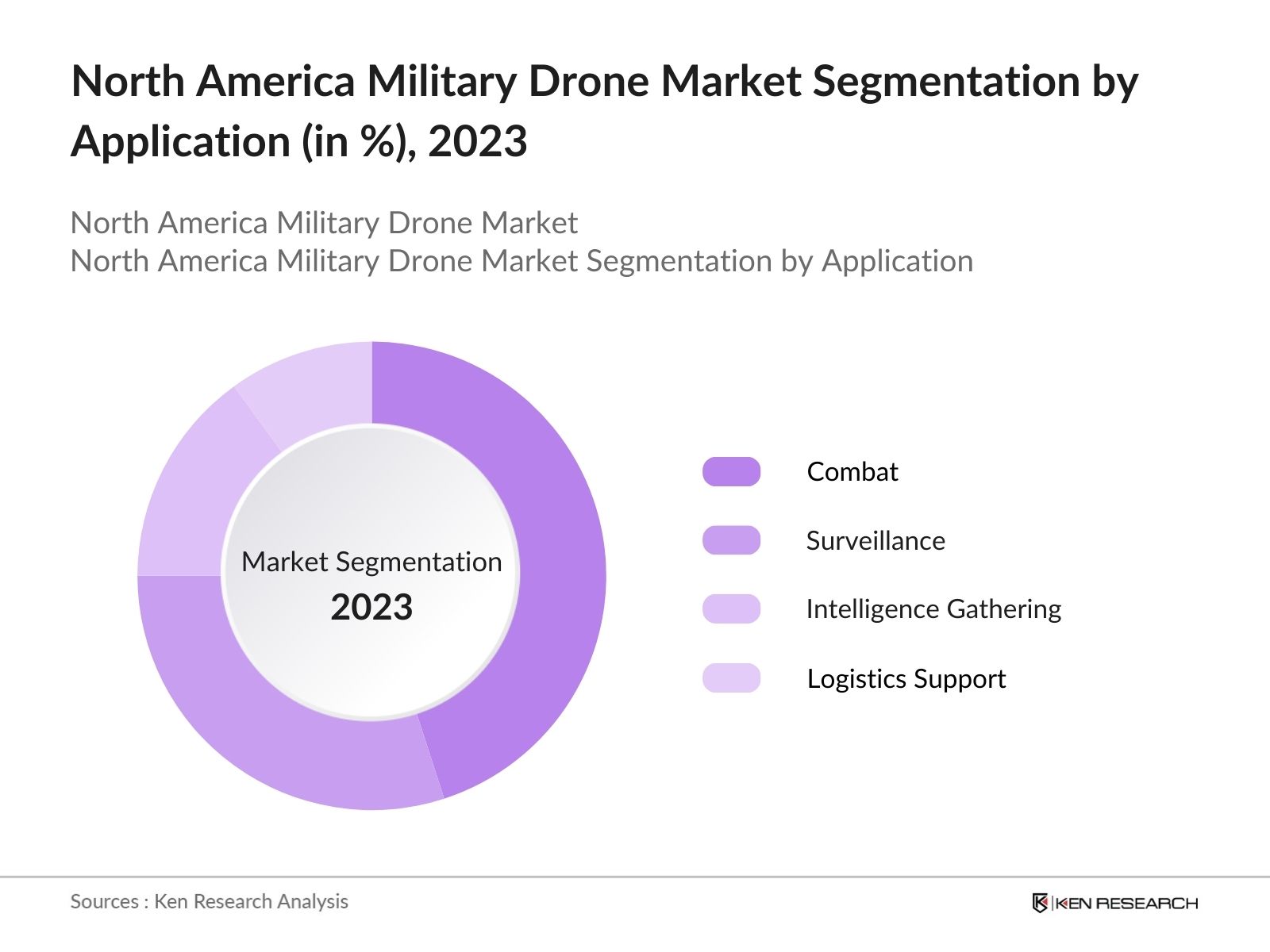

North America Military Drone Market Segmentation

By Drone Type: The market is segmented by drone type into MALE (Medium Altitude Long Endurance), HALE (High Altitude Long Endurance), tactical drones, and loitering drones. Recently, MALE drones have a dominant market share within this segment, due to their ability to perform extended surveillance missions and target acquisition with precision. Their operational flexibility and reliability in various combat and ISR operations have driven their high adoption rates, particularly among defense agencies.

By Application: The market is segmented by application into combat, surveillance, intelligence gathering, and logistics support. The combat segment holds a significant share due to the high demand for drones capable of offensive missions and the ability to carry weaponized payloads. Combat drones are critical for precision strikes, reducing human risk and enhancing mission success rates, making them a vital component of modern military strategies.

North America Military Drone Market Competitive Landscape

The North America military drone market is dominated by key players, including major defense contractors and specialized drone manufacturers. Their competitive edge is maintained through extensive R&D, strategic government contracts, and collaborations. The market's structure highlights the role of companies such as Northrop Grumman and Boeing Defense, which are pivotal in technological innovation and production.

|

Company |

Year Established |

Headquarters |

R&D Investment |

Production Capacity |

Defense Contracts |

Global Reach |

Patent Portfolio |

|

Northrop Grumman |

1939 |

Falls Church, VA |

|||||

|

General Atomics |

1955 |

San Diego, CA |

|||||

|

Boeing Defense |

1916 |

Chicago, IL |

|||||

|

Lockheed Martin |

1995 |

Bethesda, MD |

|||||

|

Textron Systems |

1923 |

Providence, RI |

North America Military Drone Industry Analysis

Growth Drivers

Advancements in UAV Technology: The North American military drone market has experienced significant growth, supported by advances in drone technology, particularly in AI-enabled autonomy and real-time data processing. The U.S. Department of Defense invested $1.7 billion in 2023 for the development of AI technologies specifically for UAVs, enhancing autonomous capabilities critical for ISR missions. These advancements allow for rapid data collection and situational analysis in dynamic environments, positioning North America at the forefront of military drone technology.

Rising Defense Expenditure: Rising defense budgets have strongly impacted the North American military drone sector. In 2024, U.S. defense spending was reported at $857 billion, marking a notable increase over the previous year. A considerable portion of these funds was directed toward UAV acquisition and operational integration within the armed forces. Additionally, the Canadian Department of National Defence allocated $26 billion in 2023 to defense programs, emphasizing enhanced UAV usage across its branches to address modern security demands.

Increased Adoption of ISR: ISR missions have become a core focus for North American military drone applications. In 2024, 65% of the U.S. Department of Defenses drone operations were dedicated to ISR, particularly across high-conflict regions and sensitive borders. The allocation of $2.2 billion to ISR-related UAV activities in the U.S. underscores the vital role of drones in intelligence gathering, surveillance, and reconnaissance, showcasing North America's robust ISR infrastructure for military operations.

Market Challenges

Regulatory Hurdles: The Federal Aviation Administration (FAA) and the Department of Defense (DoD) enforce strict regulations on UAV usage within North America, impacting military operations. In 2023, the FAA introduced updated airspace requirements for military drones, restricting operations in certain regions. The DoD has allocated $1.5 billion for regulatory compliance across its drone programs, reflecting the growing need for streamlined regulatory measures to accommodate military UAV operations while ensuring security and safety standards.

High Operational Costs: The operational costs associated with military drones remain a significant challenge. As of 2024, it costs the U.S. military approximately $5,000 per hour to operate a high-end UAV model, such as the MQ-9 Reaper. Such operational expenses place a strain on military budgets, affecting broader adoption. The Canadian military also faces financial challenges, with operational costs per flight hour for advanced drones reaching nearly CAD 6,000, indicating the need for more cost-efficient UAV technologies.

North America Military Drone Market Future Outlook

The North America military drone market is poised to experience steady growth in the near future, driven by evolving defense needs and technological advancements. The integration of AI, machine learning, and swarm capabilities is expected to redefine military strategies, with drones becoming indispensable in ISR and combat operations. Additionally, increased government funding for next-generation drone technologies will support growth as defense agencies prioritize security and innovation.

Future Market Opportunities

Integration of AI and Machine Learning in Drones: The integration of AI and machine learning has presented vast opportunities within the military drone sector. In 2023, the U.S. DoD invested $1.7 billion into AI technologies to optimize real-time decision-making and autonomous navigation capabilities in drones. Enhanced AI capabilities enable UAVs to carry out complex ISR missions autonomously, further positioning North America as a global leader in defense technology innovation.

Expansion in Border Surveillance Applications: Drone applications in border surveillance have expanded rapidly across North America. In 2023, the U.S. allocated $900 million to enhance UAV usage along its southern border, enabling real-time data collection and surveillance. This funding allowed for the deployment of advanced UAV models in border patrol operations, enhancing security measures and situational awareness across high-risk areas, thereby emphasizing the growing strategic importance of drones for surveillance.

Scope of the Report

|

Segment |

Sub-segments |

|---|---|

|

Drone Type |

MALE HALE Tactical Drones Loitering Drones |

|

Application |

Combat, Surveillance Intelligence Gathering Logistics Support |

|

Payload |

EO/IR Sensors Radar Systems Laser Designators SIGINT/COMINT Systems |

|

End-User |

Army Navy Air Force Homeland Security |

|

Region |

United States Canada Mexico Rest of North America |

Products

Key Target Audience

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Department of Defense, FAA)

Military and Defense Contractors

Drone Manufacturers

Surveillance and Border Security Agencies

Homeland Security Departments

Technology Integrators for Military Operations

Research and Development Centers in Defense Technologies

Companies

Major Players

Northrop Grumman

General Atomics

Boeing Defense

Lockheed Martin

Textron Systems

Raytheon Technologies

AeroVironment Inc.

Kratos Defense & Security Solutions

L3Harris Technologies

Thales Group

Elbit Systems

Leonardo S.p.A

Israel Aerospace Industries

Saab AB

FLIR Systems

Table of Contents

1. North America Military Drone Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. North America Military Drone Market Size (in USD Mn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Military Drone Market Analysis

3.1 Growth Drivers

3.1.1 Advancements in UAV Technology

3.1.2 Rising Defense Expenditure

3.1.3 Increased Adoption of ISR (Intelligence, Surveillance, and Reconnaissance)

3.1.4 Expanding Drone Application in Combat

3.2 Market Challenges

3.2.1 Regulatory Hurdles (FAA, DoD)

3.2.2 High Operational Costs

3.2.3 Technical Limitations

3.3 Opportunities

3.3.1 Integration of AI and Machine Learning in Drones

3.3.2 Expansion in Border Surveillance Applications

3.3.3 Rising Demand for Autonomous Drones

3.4 Trends

3.4.1 Increasing Deployment in Combat Zones

3.4.2 Use of Swarm Technology

3.4.3 Integration with C-UAS (Counter-UAS) Systems

3.5 Government Regulation

3.5.1 FAA Regulations on Drone Usage

3.5.2 DoD Guidelines on Military Drone Operations

3.5.3 Export Control Regulations

3.5.4 UAV Certification and Compliance Standards

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. North America Military Drone Market Segmentation

4.1 By Drone Type (in Value %)

4.1.1 MALE (Medium Altitude Long Endurance)

4.1.2 HALE (High Altitude Long Endurance)

4.1.3 Tactical Drones

4.1.4 Loitering Drones

4.2 By Application (in Value %)

4.2.1 Combat

4.2.2 Surveillance

4.2.3 Intelligence Gathering

4.2.4 Logistics Support

4.3 By Payload (in Value %)

4.3.1 Electro-Optical/Infrared (EO/IR) Sensors

4.3.2 Radar Systems

4.3.3 Laser Designators

4.3.4 SIGINT and COMINT Systems

4.4 By End-User (in Value %)

4.4.1 Army

4.4.2 Navy

4.4.3 Air Force

4.4.4 Homeland Security

4.5 By Region (in Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

5. North America Military Drone Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Northrop Grumman

5.1.2 General Atomics

5.1.3 Boeing Defense

5.1.4 Lockheed Martin

5.1.5 Textron Systems

5.1.6 Raytheon Technologies

5.1.7 AeroVironment Inc.

5.1.8 Kratos Defense & Security Solutions

5.1.9 L3Harris Technologies

5.1.10 Thales Group

5.1.11 Elbit Systems

5.1.12 Leonardo S.p.A

5.1.13 Israel Aerospace Industries

5.1.14 Saab AB

5.1.15 FLIR Systems

5.2 Cross-Comparison Parameters (Revenue, Headquarters, Inception Year, Production Capacity, Defense Contracts, R&D Investment, Global Reach, Patent Portfolio)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. North America Military Drone Market Regulatory Framework

6.1 Compliance with ITAR (International Traffic in Arms Regulations)

6.2 Certification Standards (DoD, FAA)

6.3 Export Control Regulations

6.4 UAV Airworthiness Standards

7. North America Military Drone Future Market Size (in USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America Military Drone Future Market Segmentation

8.1 By Drone Type (in Value %)

8.2 By Application (in Value %)

8.3 By Payload (in Value %)

8.4 By End-User (in Value %)

8.5 By Region (in Value %)

9. North America Military Drone Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

An initial stage involves establishing an ecosystem map encompassing primary stakeholders in the North America military drone market. Using both proprietary and secondary research databases, the goal is to pinpoint essential variables driving the market, such as defense budgets and technological advancements.

Step 2: Market Analysis and Construction

In this stage, historical data on market dynamics, UAV usage ratios, and defense allocations are analyzed. This phase also includes evaluating deployment trends and revenue generation across sub-segments to verify market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are crafted and validated through direct interviews with defense industry experts. These consultations provide insight into operational nuances and financial dynamics, contributing to more precise and validated market estimations.

Step 4: Research Synthesis and Final Output

The final synthesis involves collaborating with drone manufacturers to gain insights on UAV segment performance and consumer demands. This bottom-up approach ensures a comprehensive and verified overview of the North America military drone market.

Frequently Asked Questions

01. How big is the North America Military Drone Market?

The North America military drone market is valued at around USD 5.1 billion, supported by the continuous evolution in UAV technology and increasing defense expenditures.

02. What challenges exist in the North America Military Drone Market?

Key challenges in the North America military drone market include regulatory limitations, high operational costs, and technological limitations such as power constraints, which impact the scalability and functionality of drones in prolonged operations.

03. Who are the major players in the North America Military Drone Market?

The North America military drone market features significant players like Northrop Grumman, Boeing Defense, General Atomics, and Lockheed Martin, companies renowned for their robust R&D and defense contracts.

04. What are the growth drivers in the North America Military Drone Market?

Primary drivers in the North America military drone market include increased military budgets, demand for ISR operations, and the integration of autonomous and AI-driven capabilities within defense strategies.

05. Which application segments dominate the North America Military Drone Market?

The combat and surveillance segments lead in the North America military drone market due to the critical role drones play in offensive missions, threat detection, and intelligence gathering.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.