North America Military Helicopters Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD6602

December 2024

88

About the Report

North America Military Helicopters Market Overview

- The North America Military Helicopters Market is valued at USD 2.5 billion, based on a five-year historical analysis. This market is primarily driven by substantial defense budgets, particularly in the United States, which invests heavily in modernizing its helicopter fleets. Rising geopolitical tensions and an increasing need for advanced military aircraft technology have further propelled market growth. The shift towards next-generation helicopter systems, including advancements in autonomous and hybrid propulsion technologies, is also playing a key role in expanding the market.

- Key cities and countries dominating the North America military helicopter market include the United States and Canada. The U.S. dominates due to its leading position in global military spending and its vast defense infrastructure. The presence of major defense contractors and advanced military technology capabilities makes the U.S. the dominant player in the market. Canada also contributes significantly with its consistent investments in upgrading its helicopter fleet for defense and peacekeeping operations.

- The U.S. Army has awarded a $75 million contract to RTX Corporation for the production of 600 Coyote 2C Interceptors. This contract, part of a rapid acquisition authority initiative, supports the counter-unmanned aircraft systems (C-UAS) mission. The Coyote interceptors are key in countering small drones and unmanned aircraft, integrating into mobile and fixed defense systems. This effort, led by the Armys Program Executive Office for Missiles and Space, emphasizes rapid procurement to meet increasing demands for counter-drone technology.

North America Military Helicopters Market Segmentation

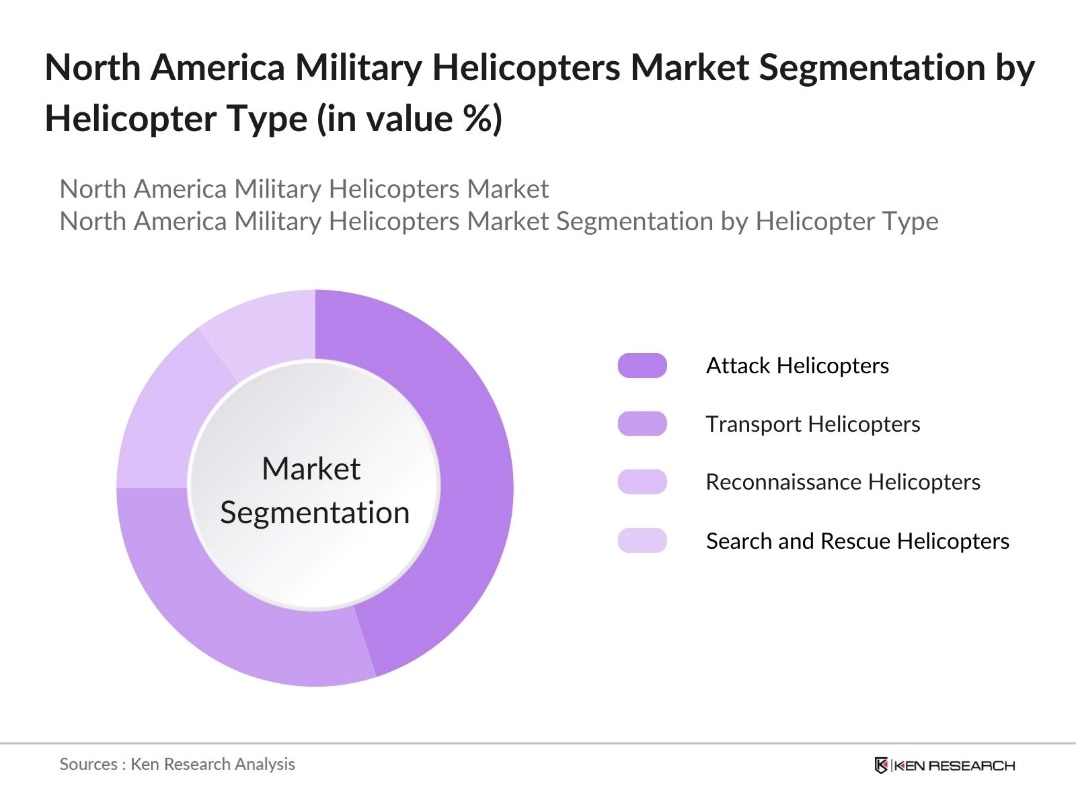

By Helicopter Type: The North America Military Helicopters market is segmented by helicopter type into Attack Helicopters, Transport Helicopters, Reconnaissance Helicopters, and Search and Rescue Helicopters. Attack helicopters have a dominant market share due to their vital role in modern warfare and combat operations. Their effectiveness in providing close air support, anti-tank missions, and surveillance makes them a critical asset for military operations. Furthermore, the continuous development of advanced weaponry systems for attack helicopters has further solidified their position in the market.

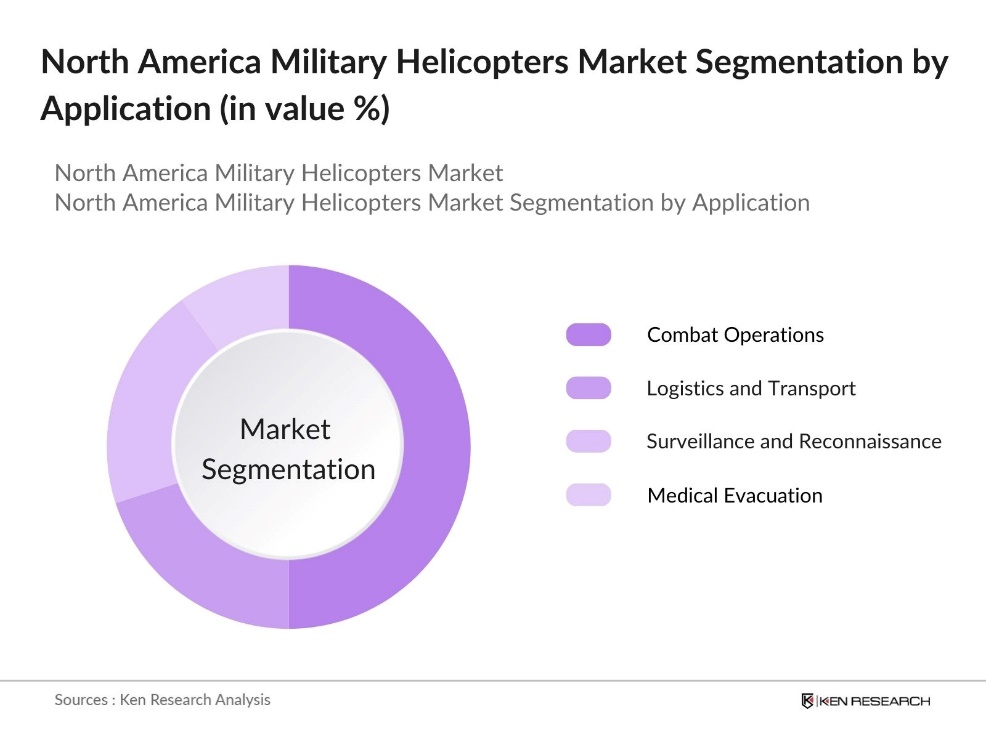

By Application: The North America Military Helicopters market is segmented by application into Combat Operations, Logistics and Transport, Surveillance and Reconnaissance, and Medical Evacuation. Combat operations have the largest market share within this segmentation. The growing demand for helicopters equipped with advanced combat systems, the need for rapid deployment of troops, and their versatility in various terrains contribute to the dominance of this segment. Helicopters in combat operations are essential for quick response and tactical superiority.

North America Military Helicopters Market Competitive Landscape

The market is dominated by several key players, which hold a significant influence due to their extensive R&D capabilities, global partnerships, and government contracts. The presence of large multinational corporations ensures technological innovation and continuous upgrades in military helicopter systems.

|

Company |

Established |

Headquarters |

R&D Investment |

Military Contracts |

Global Presence |

Annual Revenue |

No. of Employees |

Key Product |

|

Lockheed Martin Corporation |

1995 |

Bethesda, MD, USA |

||||||

|

Boeing Defense, Space & Security |

1939 |

Arlington, VA, USA |

||||||

|

Airbus Helicopters |

1992 |

Marignane, France |

||||||

|

Bell Textron Inc. |

1935 |

Fort Worth, TX, USA |

||||||

|

Northrop Grumman Corporation |

1939 |

Falls Church, VA, USA |

North America Military Helicopters Industry Analysis

Growth Drivers

- Increasing Defense Budgets: In North America, particularly in the U.S., defense spending has seen a consistent rise, with the Department of Defense (DoD) budget reaching approximately $841.4 billion for fiscal year 2024. This figure is part of a broader national defense budget that totals $883.7 billion, which includes allocations for other defense-related activities and programs. A notable portion is allocated to airpower modernization, including military helicopters, which are vital for reconnaissance, transport, and combat operations.

- Modernization of Armed Forces: North Americas military forces are undergoing extensive modernization programs. For instance, In December 2022, the Army awarded a $1.3 billion contract to Bell Textron for the FLRAA program, with an initial obligation of $232 million for preliminary design work. These efforts focus on enhancing speed, agility, and combat readiness with advanced helicopters that replace aging fleets. The need to counter evolving threats has prompted the U.S. and Canada to heavily invest in helicopters with superior mobility, advanced avionics, and enhanced survivability.

- Growing Geopolitical Conflicts: Geopolitical tensions involving Russian and Chinese activities have heightened North America's focus on aerial defense. The U.S. military is increasingly investing in multi-role helicopters to ensure rapid-response capabilities, especially in regions like the Asia-Pacific and Eastern Europe. These pressures are driving the development of helicopters that can operate in varied environments, ensuring operational readiness in complex terrains and scenarios.

Market Challenges

- High Acquisition and Operating Costs: Military helicopters are costly to acquire and maintain, with substantial expenses related to procurement, fuel, and maintenance. These high costs place significant financial pressure on defense budgets, making it challenging for North American defense forces to maintain large fleets. The ongoing need for regular upkeep and the specialized resources required for their operation further strain budgets, impacting the overall operational readiness of the fleets.

- Stringent Export Regulations: Military helicopter exports from North America face strict regulations, especially in the U.S., where export laws limit sales to certain countries. These restrictions create challenges for manufacturers, reducing their ability to expand into international markets. The regulations also complicate defense collaborations with foreign allies, making it harder for North American companies to participate in global defense projects and grow their export opportunities.

North America Military Helicopters Market Future Outlook

Over the next five years, the North America Military Helicopters market is expected to show significant growth driven by the ongoing modernization of defense forces, increasing government support, and rising geopolitical tensions. The development of advanced helicopter systems with autonomous capabilities and hybrid propulsion technologies is anticipated to revolutionize the market.

Market Opportunities

- Emergence of Unmanned Combat Aerial Vehicles (UCAVs): The North American military is increasingly adopting UCAVs, which offer autonomous capabilities for reconnaissance and strike missions. These systems are seen as complementary or potential replacements for certain helicopter roles. The growing use of UCAVs provides an opportunity for military helicopter manufacturers to innovate by integrating autonomous technologies into their designs, improving both operational flexibility and range.

- International Defense Partnerships and Collaborations: International defense partnerships provide North Americas military-industrial sector with opportunities for joint ventures, co-production, and technology sharing with allied nations. These collaborations enable the development of advanced helicopters and open up export possibilities, allowing North American manufacturers to expand their global reach. By aligning with strategic defense objectives, these partnerships enhance technological innovation and strengthen international defense ties.

Scope of the Report

|

By Helicopter Type |

Attack Helicopters Transport Helicopters Reconnaissance Helicopters Search and Rescue Helicopters |

|

By Application |

Combat Operations Logistics and Transport Surveillance and Reconnaissance Medical Evacuation |

|

By Technology |

Conventional Helicopters Advanced Helicopters (Stealth, Autonomous) Hybrid Propulsion Helicopters |

|

By System |

Airframe Avionics Engine Weaponry Systems |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience

Defense Contracting Firms

Cybersecurity Firms

Aircraft Manufacturing Companies

Government and Regulatory Bodies (Federal Aviation Administration, International Traffic in Arms Regulations)

Bank and Financial Institutions

Investment and Venture Capitalist Firms

Companies

Players Mentioned in the Report

Lockheed Martin Corporation

Boeing Defense, Space & Security

Airbus Helicopters

Bell Textron Inc.

Sikorsky Aircraft Corporation

Leonardo S.p.A.

Northrop Grumman Corporation

Raytheon Technologies Corporation

General Dynamics Corporation

Kaman Aerospace Corporation

MD Helicopters, Inc.

Korean Aerospace Industries

Hindustan Aeronautics Limited (HAL)

Russian Helicopters, JSC

Embraer Defense & Security

Table of Contents

1. North America Military Helicopters Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Military Helicopters Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Military Helicopters Market Analysis

3.1. Growth Drivers (Military Budget Allocation, Geopolitical Tensions, Technological Advancements)

3.1.1. Increasing Defense Budgets

3.1.2. Modernization of Armed Forces

3.1.3. Growing Geopolitical Conflicts

3.1.4. Technological Developments in Combat Systems

3.2. Market Challenges (High Production Costs, Export Regulations, Maintenance Complexity)

3.2.1. High Acquisition and Operating Costs

3.2.2. Stringent Export Regulations

3.2.3. Technical Complexity and Maintenance Burden

3.3. Opportunities (Next-Generation Helicopters, Defense Collaborations, Technological Upgradation)

3.3.1. Emergence of Unmanned Combat Aerial Vehicles (UCAVs)

3.3.2. International Defense Partnerships and Collaborations

3.3.3. Innovation in Helicopter Manufacturing and Weaponry

3.4. Trends (Autonomous Capabilities, Modular Designs, Hybrid Propulsion Systems)

3.4.1. Rising Focus on Autonomous Military Helicopters

3.4.2. Modular Helicopter Designs

3.4.3. Hybrid Propulsion and Fuel Efficiency Initiatives

3.5. Government Regulations (Defense Export Controls, Military Procurement Standards, Safety Regulations)

3.5.1. U.S. International Traffic in Arms Regulations (ITAR)

3.5.2. Department of Defense (DoD) Helicopter Procurement Guidelines

3.5.3. Federal Aviation Administration (FAA) Military Safety Standards

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. North America Military Helicopters Market Segmentation

4.1. By Helicopter Type (In Value %)

4.1.1. Attack Helicopters

4.1.2. Transport Helicopters

4.1.3. Reconnaissance Helicopters

4.1.4. Search and Rescue Helicopters

4.2. By Application (In Value %)

4.2.1. Combat Operations

4.2.2. Logistics and Transport

4.2.3. Surveillance and Reconnaissance

4.2.4. Medical Evacuation

4.3. By Technology (In Value %)

4.3.1. Conventional Helicopters

4.3.2. Advanced Helicopters (Stealth, Autonomous, and Electric)

4.3.3. Hybrid Propulsion Helicopters

4.4. By System (In Value %)

4.4.1. Airframe

4.4.2. Avionics

4.4.3. Engine

4.4.4. Weaponry Systems

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Military Helicopters Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Lockheed Martin Corporation

5.1.2. Boeing Defense, Space & Security

5.1.3. Airbus Helicopters

5.1.4. Bell Textron Inc.

5.1.5. Sikorsky Aircraft Corporation

5.1.6. Leonardo S.p.A.

5.1.7. Northrop Grumman Corporation

5.1.8. Raytheon Technologies Corporation

5.1.9. General Dynamics Corporation

5.1.10. Kaman Aerospace Corporation

5.1.11. MD Helicopters, Inc.

5.1.12. Korean Aerospace Industries

5.1.13. Hindustan Aeronautics Limited (HAL)

5.1.14. Russian Helicopters, JSC

5.1.15. Embraer Defense & Security

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Fleet Size, R&D Investments, Global Presence, Contracts with Defense Ministries)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Military Helicopters Market Regulatory Framework

6.1. Export Controls and Regulations

6.2. Military Procurement Standards

6.3. Certification and Compliance Processes

7. North America Military Helicopters Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Military Helicopters Future Market Segmentation

8.1. By Helicopter Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By System (In Value %)

8.5. By Region (In Value %)

9. North America Military Helicopters Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the North America Military Helicopters Market. This step is supported by extensive desk research, utilizing secondary and proprietary databases to gather comprehensive industry-level information. The primary goal is to define and analyze critical variables driving market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data on the North America Military Helicopters Market. This includes market penetration, fleet size, government procurement trends, and revenue generation. Additionally, an evaluation of military service statistics is performed to ensure the accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through in-depth consultations with military experts and helicopter manufacturers. These discussions provide valuable operational and financial insights, refining the market data and ensuring precision in estimates.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with military helicopter manufacturers to acquire insights into product segments, sales performance, and evolving defense strategies. These discussions verify and complement the data from the bottom-up research, ensuring a robust and validated analysis.

Frequently Asked Questions

01. How big is the North America Military Helicopters market?

The North America Military Helicopters Market was valued at USD 2.5 billion, driven by increasing defense budgets, rising geopolitical tensions, and the modernization of armed forces across the region.

02. What are the challenges in the North America Military Helicopters market?

Challenges in North America Military Helicopters Market include high acquisition and operating costs, stringent export regulations, and the technical complexity of maintenance, which can hinder operational efficiency for military forces.

03. Who are the major players in the North America Military Helicopters market?

Key players in North America Military Helicopters Market include Lockheed Martin Corporation, Boeing Defense, Space & Security, Airbus Helicopters, Bell Textron Inc., and Sikorsky Aircraft Corporation, all of which dominate due to their advanced technologies and military contracts.

04. What are the growth drivers for the North America Military Helicopters market?

The North America Military Helicopters Market Growth is driven by defense investments, increasing demand for advanced combat helicopters, and the introduction of next-generation helicopter systems with autonomous capabilities and hybrid propulsion technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.