North America Naval Vessels Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD1759

November 2024

93

About the Report

North America Naval Vessels Market Overview

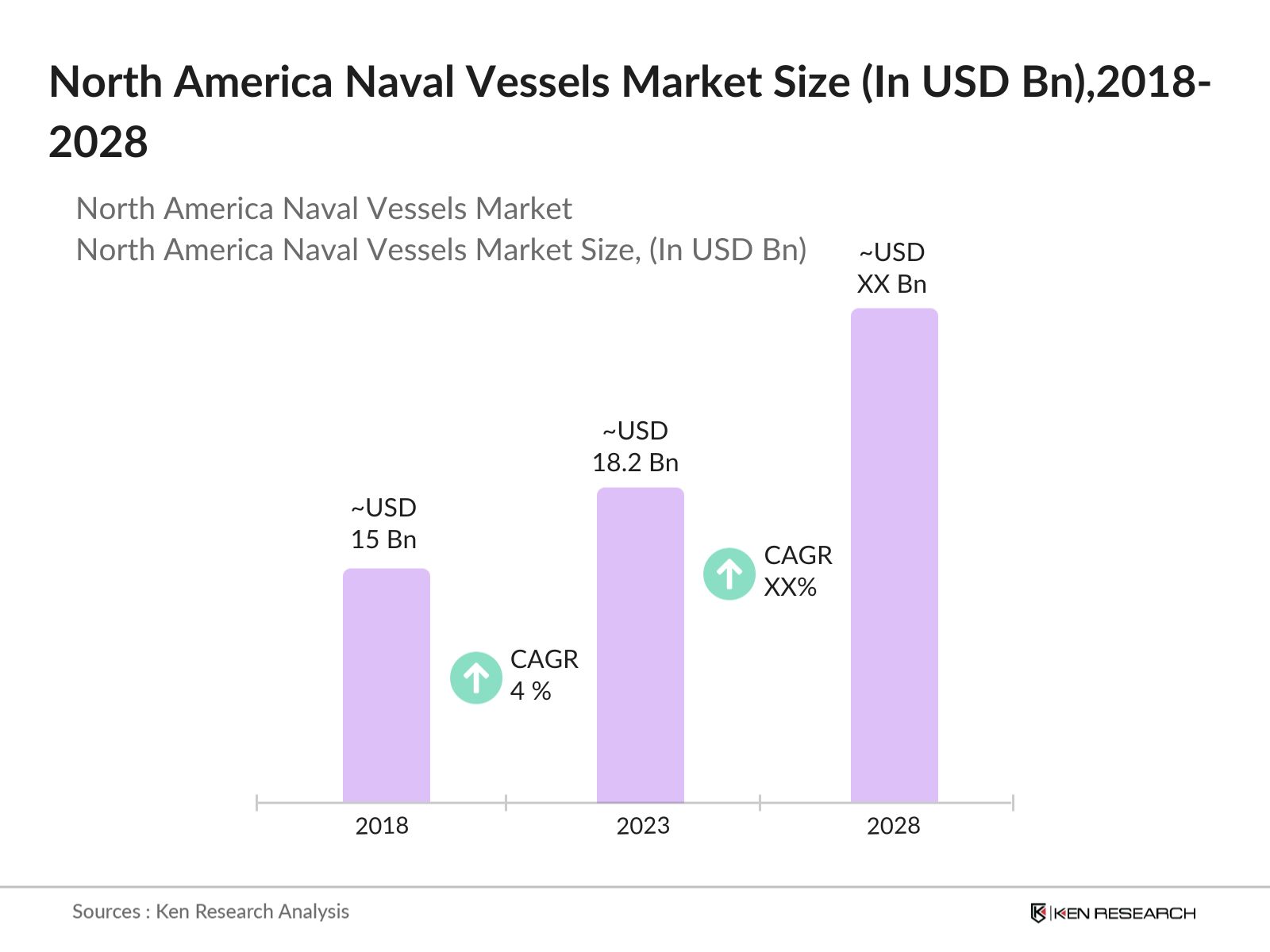

- In 2023, the North America Naval Vessels Market was valued at USD 18.2 billion, driven by increased defense spending and the need for advanced naval capabilities to ensure maritime security and geopolitical stability. The market's growth is fueled by the modernization of naval fleets, development of next-generation vessels, and rising investments in naval technologies, including autonomous systems and advanced weaponry.

- Key players in the naval vessels market include Huntington Ingalls Industries, General Dynamics Corporation, Lockheed Martin Corporation, BAE Systems plc, and Northrop Grumman Corporation. These companies are leading the industry with innovative solutions that include the construction of aircraft carriers, submarines, destroyers, frigates, and amphibious assault ships.

- The United States holds a massive share of the North American market due to its substantial defense budget and focus on naval supremacy. The U.S. Navy's ongoing procurement of new vessels, including the Columbia-class submarines and the Gerald R. Ford-class aircraft carriers, highlights its commitment to maintaining a powerful maritime force.

- In 2023, Lockheed Martin Corporation secured a contract to develop an advanced frigate, enhancing the combat capabilities of the U.S. Navy. This development underscores the ongoing technological advancements within the naval vessels market, focusing on integrating cutting-edge technology into new and existing fleets.

North America Naval Vessels Market Segmentation

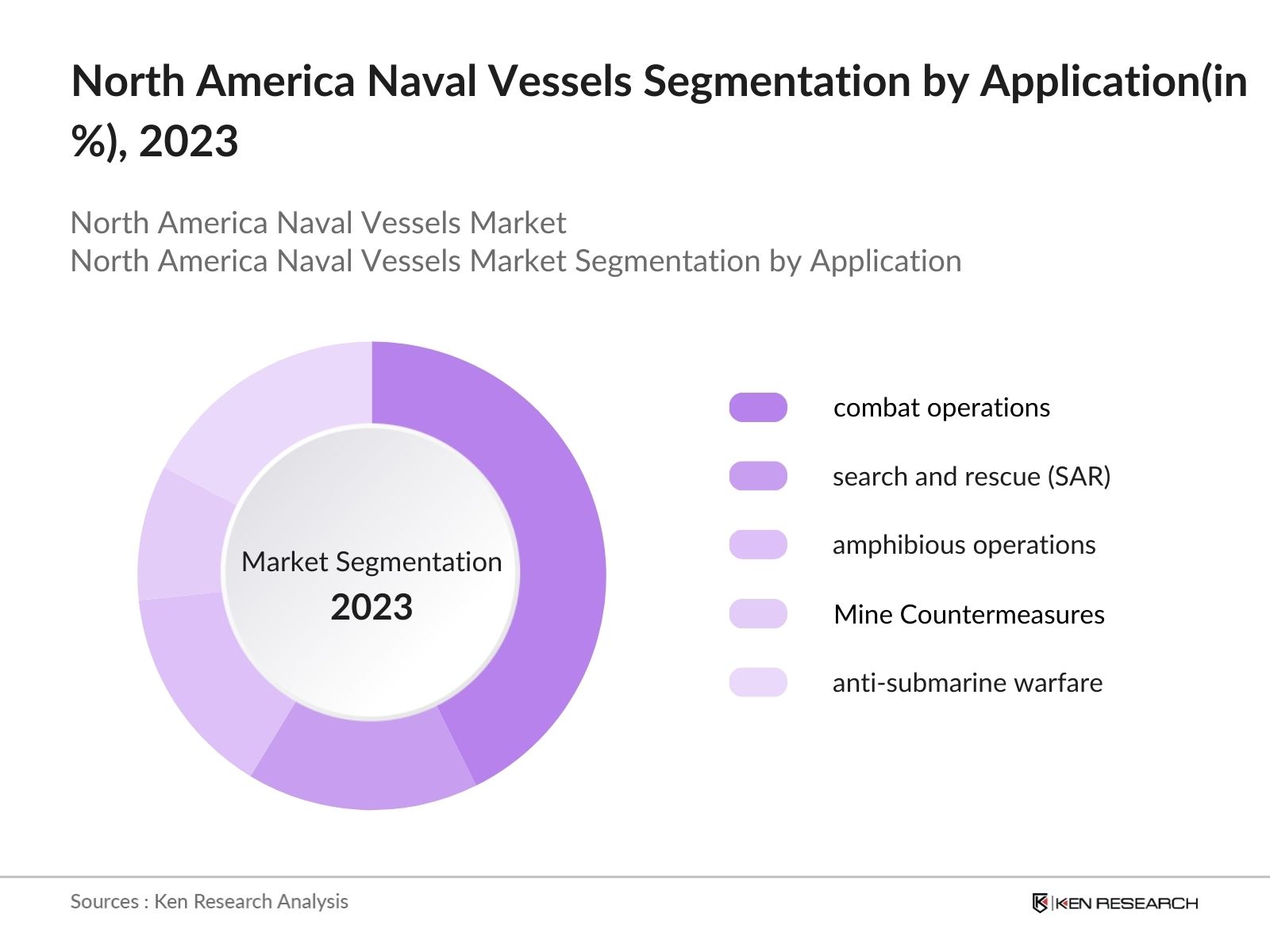

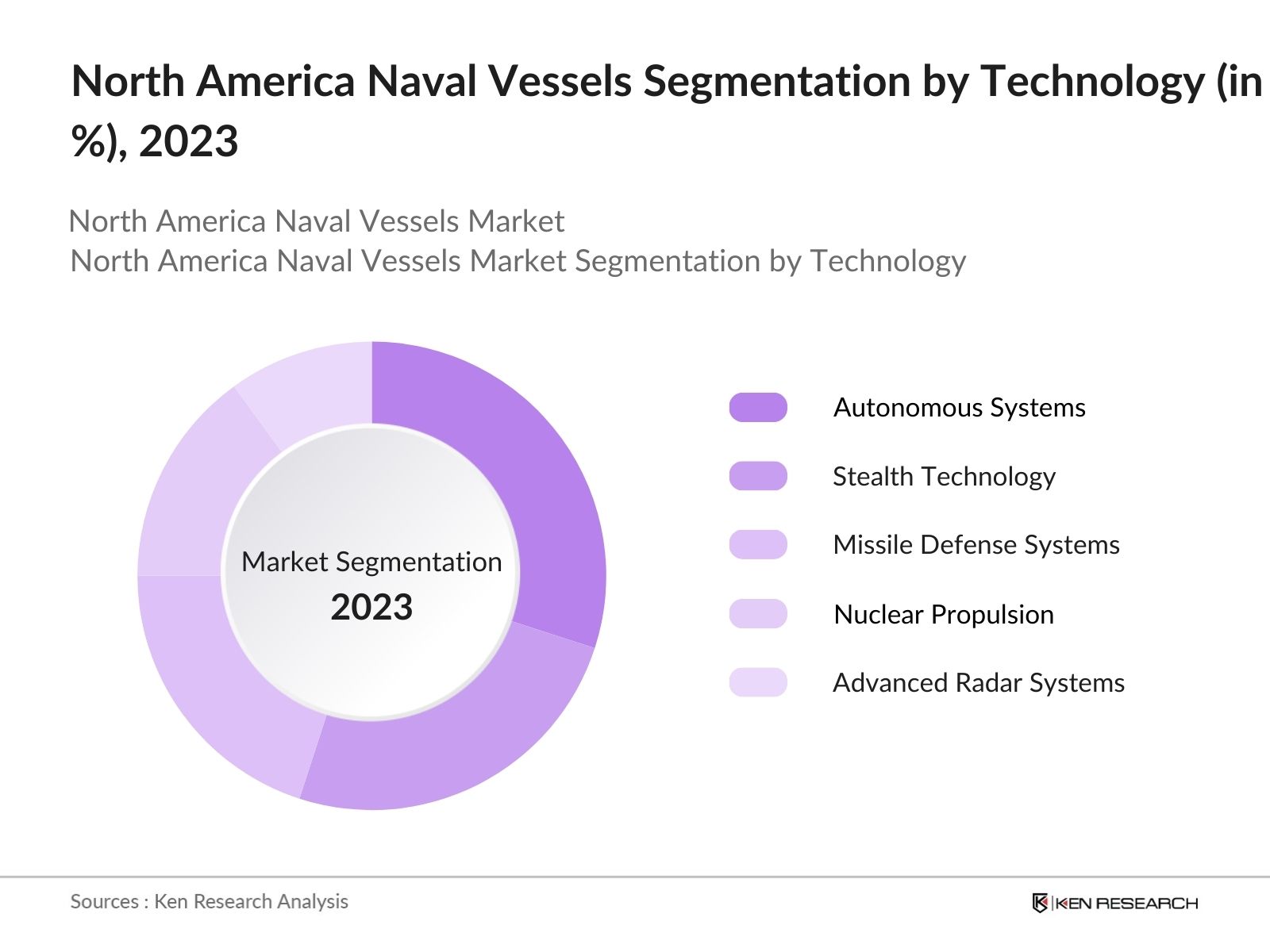

The North America Naval Vessels Market can be segmented based on application, technology, and region:

- By Application: The market is segmented into combat operations, search and rescue (SAR), amphibious operations, mine countermeasures, and anti-submarine warfare (ASW). In 2023, combat operations led the market due to geopolitical tensions, while maritime patrol and surveillance also saw high demand due to rising security concerns.

- By Technology: The market is segmented into autonomous systems, stealth technology, missile defense systems, nuclear propulsion, and advanced radar systems. In 2023, autonomous systems led the market due to increasing investments in unmanned naval vehicles for surveillance and reconnaissance missions.

- By Region: The market is segmented into the United States and Canada. The United States led the regional market in 2023, holding the largest share due to its advanced naval capabilities and significant defense expenditures.

North America Naval Vessels Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Huntington Ingalls Industries |

1886 |

Newport News, USA |

|

General Dynamics Corporation |

1952 |

Falls Church, USA |

|

Lockheed Martin Corporation |

1995 |

Bethesda, USA |

|

BAE Systems plc |

1999 |

Farnborough, UK |

|

Northrop Grumman Corporation |

1939 |

Falls Church, USA |

- Huntington Ingalls Industries: In June 2023, HII announced that its Newport News Shipbuilding division received contract modifications totaling USD 393.3 million from the U.S. Navy to shift some post-completion work into the main construction contract for the USS John F. Kennedy and set a new delivery date of July 31, 2025.

- General Dynamics Corporation: General Dynamics Electric Boat division in 2023 launched the first Columbia-class submarine, a new generation of ballistic missile submarines designed to replace the aging Ohio-class. The company also opened a new manufacturing facility dedicated to submarine construction, aiming to increase production efficiency and meet future demand.

North America Naval Vessels Market Analysis

Market Growth Drivers:

- Increasing Defense Budgets: The defense budgets in North America, particularly in the United States, have been consistently rising, driven by the need to address growing geopolitical tensions and enhance military capabilities. The U.S. defense budget reached USD 858 billion in 2023, up from USD 782 billion in 2022, reflecting a focus on modernizing naval fleets and investing in advanced naval vessels. This increase in defense spending is aimed at maintaining naval superiority and ensuring national security, thus boosting the demand for new and upgraded naval vessels.

- Naval Modernization Initiatives: Several naval modernization initiatives are underway in North America, aimed at replacing aging vessels with newer, more technologically advanced platforms. The U.S. Navys ongoing Columbia-class submarine program is expected to replace the aging Ohio-class submarines, with the first Columbia-class submarine scheduled for delivery in 2028. Such initiatives are critical for maintaining operational readiness and are driving investments in the development and procurement of advanced naval vessels.

- Rising Threats in Maritime Security: The increase in maritime threats, including piracy, territorial disputes, and illicit trafficking, is prompting North American countries to strengthen their naval capabilities. The U.S. Navy has been enhancing its presence in the Indo-Pacific region to counter potential threats and ensure freedom of navigation. This heightened focus on maritime security is leading to increased demand for versatile and advanced naval vessels capable of addressing a wide range of threats and missions.

Market Challenges:

- Naval Modernization Initiatives: Several naval modernization initiatives are underway in North America, aimed at replacing aging vessels with newer, more technologically advanced platforms. The U.S. Navys ongoing Columbia-class submarine program is expected to replace the aging Ohio-class submarines, with the first Columbia-class submarine scheduled for delivery in 2028.

- Rising Threats in Maritime Security: The increase in maritime threats, including piracy, territorial disputes, and illicit trafficking, is prompting North American countries to strengthen their naval capabilities. The U.S. Navy has been enhancing its presence in the Indo-Pacific region to counter potential threats and ensure freedom of navigation.

Government Initiatives

- U.S. Navys Columbia-Class Submarine Program: The U.S. Navy's Columbia-class submarine program aims to replace the aging Ohio-class ballistic missile submarines, ensuring the continued effectiveness of the U.S. nuclear deterrent. The program has allocated USD 128 billion for the construction of 12 new submarines, with the first expected to be delivered in 2028. This initiative underscores the U.S. government's commitment to modernizing its naval capabilities and maintaining a robust defense posture.

- Shipyard Infrastructure Optimization Program (SIOP): The U.S. Navys Shipyard Infrastructure Optimization Program aims to modernize its public shipyards to ensure they can efficiently maintain and upgrade the fleet. The program involves a USD 21 billion investment over 20 years to improve infrastructure, equipment, and dry docks at four major shipyards. This initiative is critical for enhancing the Navys operational readiness and extending the service life of its vessels.

North America Naval Vessels Market Future Outlook

The North America Naval Vessels Market is expected to continue its growth, driven by ongoing naval modernization efforts, technological advancements, and increasing defense budgets.

Future Market Trends:

- Growth in Stealth Technology: Stealth technology is set to become a critical component in naval vessel design, allowing for enhanced operational secrecy and reduced detection by adversaries. Advancements in materials and design techniques will further drive this trend.

- Integration of Artificial Intelligence (AI) and Machine Learning: The integration of AI and machine learning technologies will be pivotal in advancing decision-making, predictive maintenance, and operational efficiency on naval vessels, enabling automated and more effective responses.

North America Naval Vessels Market Scope:

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

|

By Vessel Type |

Aircraft Carriers Submarines Destroyers Frigates Corvettes Amphibious Ships |

|

By Application |

Combat Operations Amphibious Operations Mine Countermeasures search and rescue (SAR) Anti-Submarine Warfare |

|

By Technology |

Autonomous Systems Stealth Technology Missile Defense Systems Nuclear Propulsion Advanced Radar Systems |

|

By End-User |

Naval Forces Coast Guards Defense Contractors Government Bodies |

Products

Key Target Audience:

Defense Ministries

Naval Forces and Coast Guards

Naval Contractors and Subcontractors

Military Equipment Manufacturers

Government and Regulatory Bodies (DoD, CSIS, NORAD)

Defense Technology Providers

Research & Academic Institutions

Naval Architects and Engineers

Marine Security Companies

Banks and Financial Bodies

Defense Analysts and Consultants

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Huntington Ingalls Industries

General Dynamics Corporation

Lockheed Martin Corporation

BAE Systems plc

Northrop Grumman Corporation

Raytheon Technologies Corporation

Thales Group

L3Harris Technologies, Inc.

Austal USA

Fincantieri Marine Group

Rolls-Royce Holdings plc

Naval Group

Saab AB

Leonardo S.p.A.

Rheinmetall AG

Table of Contents

1. North America Naval Vessels Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Naval Vessels Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Naval Vessels Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Defense Budgets

3.1.2. Naval Modernization Initiatives

3.1.3. Rising Threats in Maritime Security

3.2. Restraints

3.2.1. High Costs of Naval Vessel Development

3.2.2. Regulatory and Environmental Compliance

3.2.3. Skilled Labor Shortages

3.3. Opportunities

3.3.1. Technological Innovations in Naval Systems

3.3.2. Public-Private Partnerships

3.3.3. Expansion of Unmanned Naval Vessels

3.4. Trends

3.4.1. Growth in Stealth Technology

3.4.2. Integration of AI and Machine Learning

3.4.3. Integration of Cybersecurity Measures

3.5. Government Regulation

3.5.1. U.S. Navys Columbia-Class Submarine Program

3.5.2. Shipyard Infrastructure Optimization Program (SIOP)

3.5.3. Great Green Fleet Initiative

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. North America Naval Vessels Market Segmentation, 2023

4.1. By Vessel Type (in Value %)

4.1.1. Aircraft Carriers

4.1.2. Submarines

4.1.3. Destroyers

4.1.4. Frigates

4.1.5. Corvettes

4.1.6. Amphibious Ships

4.2. By Application (in Value %)

4.2.1. Combat Operations

4.2.2. Maritime Patrol and Surveillance

4.2.3. Amphibious Operations

4.2.4. Mine Countermeasures

4.2.5. Anti-Submarine Warfare

4.3. By Technology (in Value %)

4.3.1. Autonomous Systems

4.3.2. Stealth Technology

4.3.3. Missile Defense Systems

4.3.4. Nuclear Propulsion

4.3.5. Advanced Radar Systems

4.4. By End-User (in Value %)

4.4.1. Naval Forces

4.4.2. Coast Guards

4.4.3. Defense Contractors

4.4.4. Government Agencies

4.5. By Region (in Value %)

4.5.1. United States

4.5.2. Canada

5. North America Naval Vessels Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Huntington Ingalls Industries

5.1.2. General Dynamics Corporation

5.1.3. Lockheed Martin Corporation

5.1.4. BAE Systems plc

5.1.5. Northrop Grumman Corporation

5.1.6. Raytheon Technologies Corporation

5.1.7. Thales Group

5.1.8. L3Harris Technologies, Inc.

5.1.9. Austal USA

5.1.10. Fincantieri Marine Group

5.1.11. Rolls-Royce Holdings plc

5.1.12. Naval Group

5.1.13. Saab AB

5.1.14. Leonardo S.p.A.

5.1.15. Rheinmetall AG

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. North America Naval Vessels Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. North America Naval Vessels Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. North America Naval Vessels Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. North America Naval Vessels Future Market Segmentation, 2028

9.1. By Vessel Type (in Value %)

9.2. By Application (in Value %)

9.3. By Technology (in Value %)

9.4. By End-User (in Value %)

9.5. By Region (in Value %)

10. North America Naval Vessels Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1. Identifying Key Variables:

Building an ecosystem of major entities in the North America Naval Vessels Market and referencing multiple secondary and proprietary databases to conduct desk research. This includes gathering industry-level information on market drivers, challenges, and key players, as well as understanding technological advancements and regulatory impacts.

Step 2. Market Building:

Collecting statistics on the North America Naval Vessels market over the years, including historical market size, growth rates, and adoption of naval technologies. We will analyze market share, revenue generated by major players, and emerging trends to ensure accuracy and reliability in the data presented.

Step 3. Validating and Finalizing:

Formulating market hypotheses and conducting CATIs (Computer-Assisted Telephone Interviews) with industry experts from leading naval companies. These interviews will help validate the collected statistics and provide insights into operational and financial aspects directly from company representatives.

Step 4. Research Output:

Our team will engage with multiple naval technology providers to understand the dynamics of market segments, consumer preferences, and sales trends. This process will validate the derived statistics using a bottom-to-top approach, ensuring that the final data accurately reflects the actual market conditions.

Frequently Asked Questions

01. How big is the North America Naval Vessels Market?

In 2023, the North America Naval Vessels Market was valued at USD 18.2 billion. The market is driven by increased defense spending, the need for advanced naval capabilities, and ongoing fleet modernization efforts.

02. What are the challenges in the North America Naval Vessels Market?

The key challenges in the North America Naval Vessels Market include the high costs associated with the development and maintenance of advanced naval vessels and the stringent environmental regulations that must be adhered to. Additionally, geopolitical tensions necessitate continuous advancements and upgrades, adding to operational costs.

03. Who are the major players in the North America Naval Vessels Market?

Major players in the North America Naval Vessels Market include Huntington Ingalls Industries, General Dynamics Corporation, Lockheed Martin Corporation, BAE Systems plc, and Northrop Grumman Corporation. These companies are leading the market with innovative naval vessel designs and technologies.

04. What are the growth drivers of the North America Naval Vessels Market?

The primary growth drivers of the North America Naval Vessels Market include increased defense spending, technological advancements in naval systems, and the growing focus on maritime security. These factors are contributing to the expansion and modernization of naval fleets in the region.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.