North America Office Furniture Market Outlook to 2030

Region:North America

Author(s):Naman Rohilla

Product Code:KROD10820

December 2024

85

About the Report

North America Office Furniture Market Overview

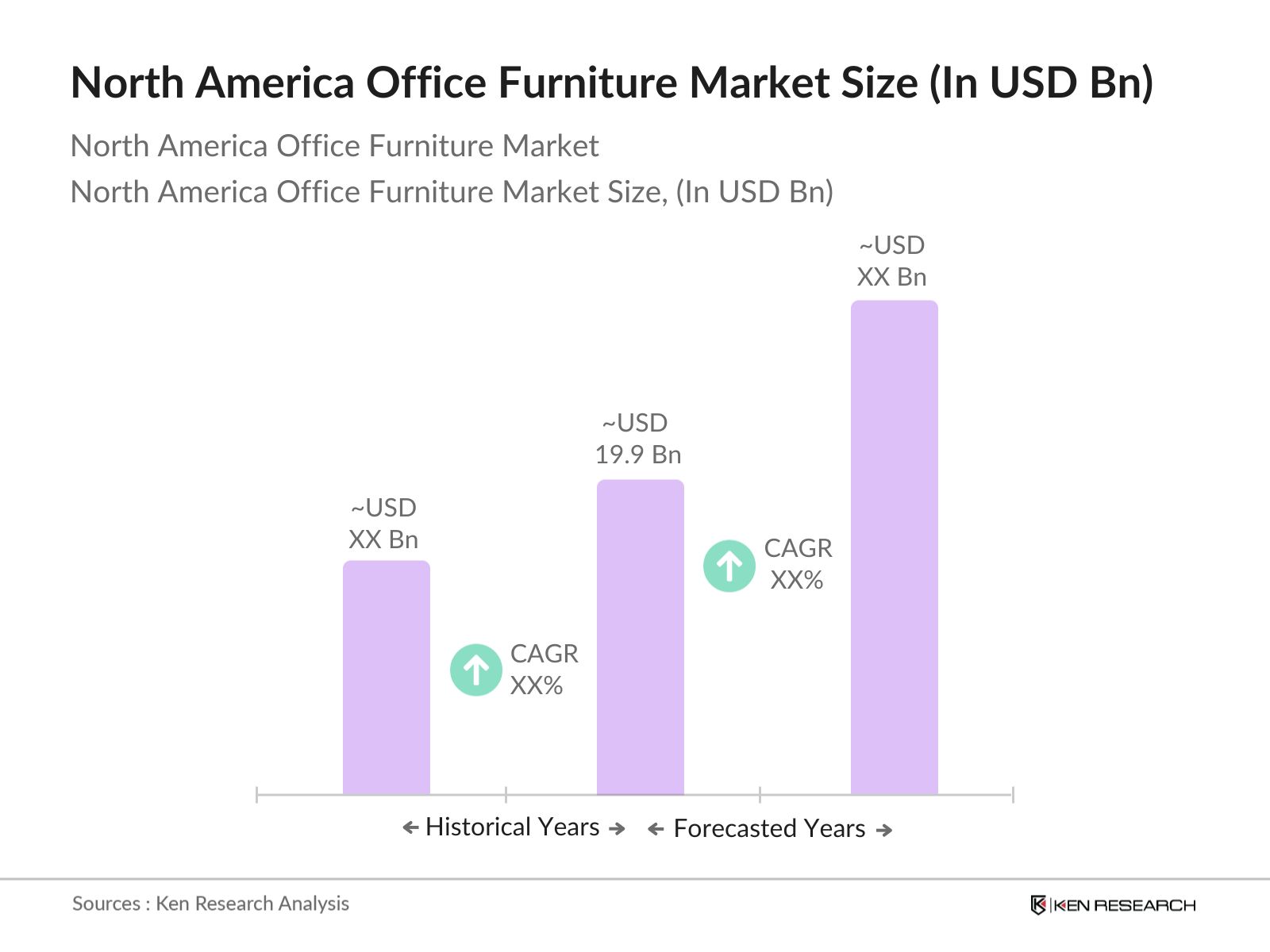

- The North American office furniture market is a segment within the broader furniture industry, driven by the expansion of commercial real estate and the increasing emphasis on ergonomic and sustainable office environments. The market was valued at approximately USD 19.9 billion, reflecting steady growth over the past five years.

- The United States stands as the dominant player in this market, primarily due to its substantial corporate sector and continuous investments in office infrastructure. The presence of numerous multinational corporations and a robust economy contribute to the country's leading position in the office furniture industry.

- The Occupational Safety and Health Administration (OSHA) sets vital regulations impacting the office furniture market, particularly concerning ergonomic standards. In 2023, OSHA reported that workplace injuries related to poor ergonomics cost U.S. businesses over $60 billion annually. Consequently, companies are increasingly investing in ergonomic office furniture to comply with OSHA guidelines, reducing injury risks and enhancing employee productivity.

North America Office Furniture Market Segmentation

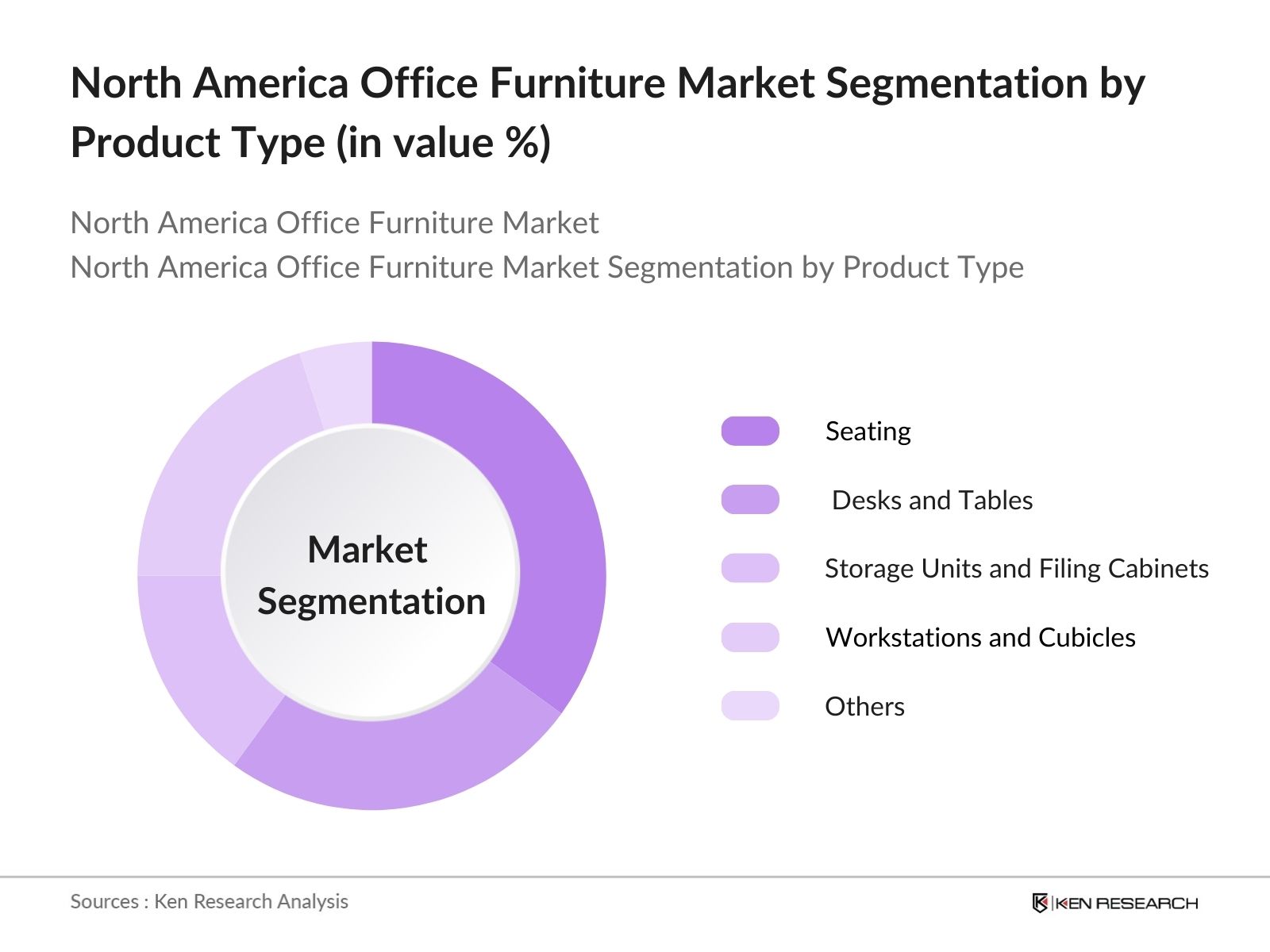

- By Product Type: The market is segmented by product type into seating, desks and tables, storage units and filing cabinets, workstations and cubicles, and others (including partitions and accessories). Among these, seating holds a dominant market share, driven by the increasing focus on employee comfort and ergonomics. Companies are investing in high-quality chairs that support posture and reduce fatigue, thereby enhancing productivity.

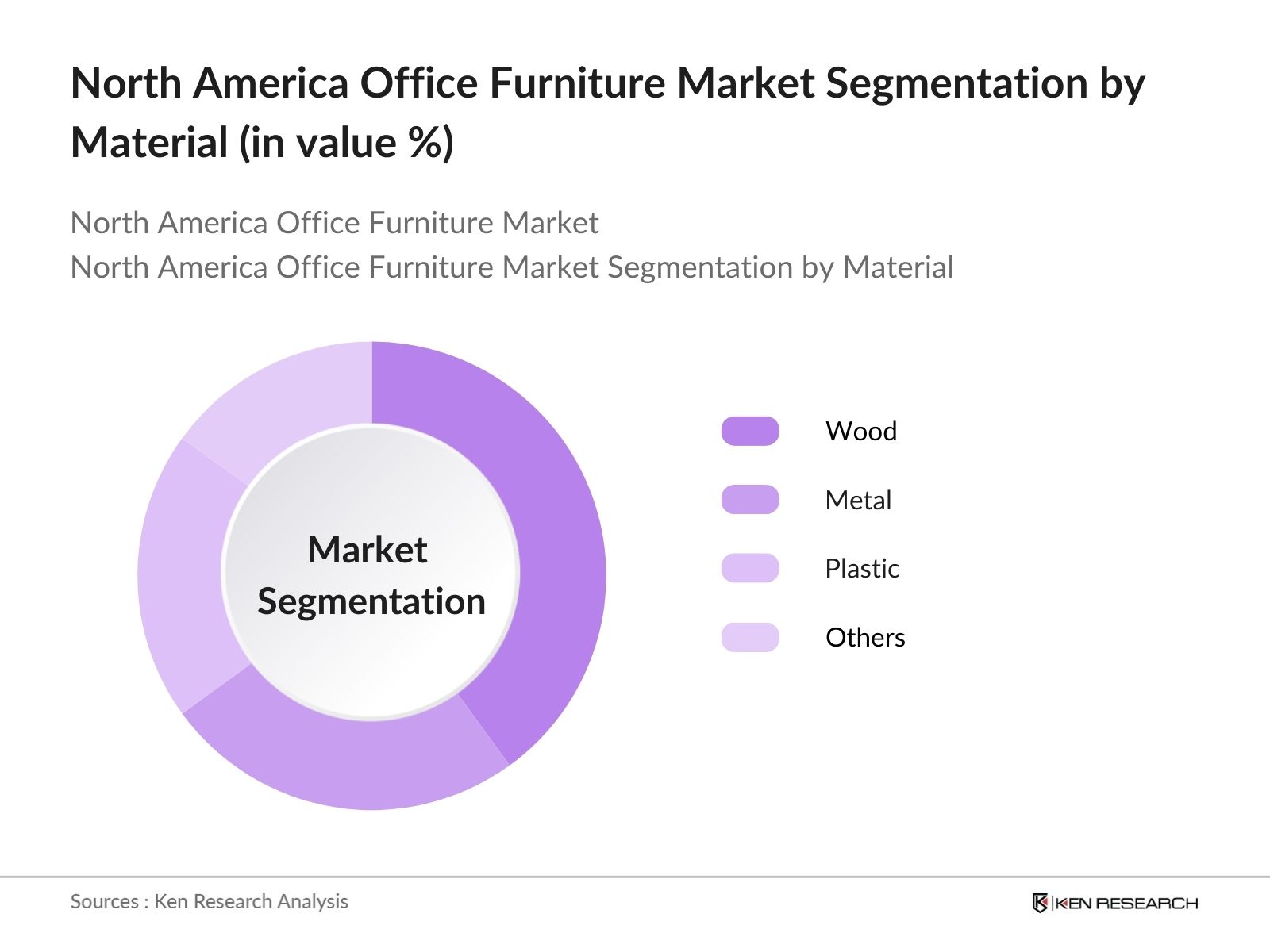

- By Material: The market is also segmented by material into wood, metal, plastic, and others (such as glass and composite materials). Wooden furniture leads this segment, attributed to its aesthetic appeal and durability. The preference for wood is further bolstered by its versatility in design and the growing trend towards sustainable and eco-friendly office environments.

North America Office Furniture Market Competitive Landscape

The North American office furniture market is characterized by the presence of several key players who contribute to its dynamics. These companies are engaged in continuous innovation and strategic initiatives to maintain their competitive edge.

North America Office Furniture Market Analysis

Market Growth Drivers

- Expansion of Commercial Real Estate Sector: The expansion of the commercial real estate sector is a primary driver of growth in the North America office furniture market. In 2023, the commercial real estate sector in the U.S. was valued at approximately $19 trillion, reflecting significant investment in office spaces as businesses rebound from the pandemic. The construction of new office buildings and the renovation of existing ones are contributing to an increase in demand for modern and functional office furniture. As of mid-2023, over 100 million square feet of new office space was under construction across major U.S. cities, indicating a robust recovery in the sector.

- Increased Focus on Office Space Optimization: With the rise of remote work, companies are prioritizing office space optimization to enhance productivity and efficiency. A 2023 survey indicated that 78% of businesses are re-evaluating their office layouts to accommodate flexible work environments, aiming to utilize less space while maintaining functionality. This trend is driving the need for innovative furniture solutions that maximize space utilization, such as modular and multi-functional furniture. By optimizing office layouts, companies can reduce operational costs and improve employee satisfaction, further fueling the demand for new office furniture designs.

- Growing Emphasis on Employee Well-being and Ergonomics: The growing emphasis on employee well-being has significantly impacted the office furniture market. According to the Bureau of Labor Statistics, in 2022, U.S. companies invested over $700 billion in employee wellness programs, highlighting a trend towards creating healthier work environments. Ergonomic furniture has been shown to reduce workplace injuries and enhance employee productivity, prompting businesses to invest in ergonomic chairs and desks. In fact, research shows that workplaces with ergonomic solutions report a 20% reduction in employee absenteeism, underscoring the importance of investing in employee health.

Market Challenges

- High Initial Costs of Ergonomic Furniture: Despite the benefits of ergonomic furniture, high initial costs pose a significant challenge for businesses. In 2023, the average price of ergonomic office chairs was around $600, while standing desks ranged from $400 to $1,200. Many small and medium-sized enterprises (SMEs) struggle to justify these expenditures, particularly in a fluctuating economic environment. Consequently, while companies recognize the long-term benefits of ergonomic solutions, the upfront investment remains a barrier to widespread adoption, particularly among budget-conscious organizations.

- Fluctuations in Raw Material Prices: The office furniture market faces challenges from fluctuating raw material prices, particularly for wood and metals. In 2022, the price of plywood surged by over 30% compared to the previous year, driven by supply chain disruptions and increased demand in construction. Additionally, the prices of steel and aluminum, essential for furniture manufacturing, have experienced volatility due to geopolitical tensions and trade policies. These fluctuations in raw material costs can significantly affect the production costs of office furniture, leading to higher prices for consumers and reduced margins for manufacturers.

North America Office Furniture Market Future Outlook

Over the next five years, the North American office furniture market is expected to experience growth, driven by the continuous evolution of workplace environments and the adoption of hybrid work models. The increasing emphasis on sustainability and the integration of technology into office furniture are anticipated to further propel market expansion.

Market Opportunities

- Rising Demand for Sustainable and Eco-friendly Furniture: The rising demand for sustainable and eco-friendly office furniture presents a opportunity for market growth. As of 2023, 54% of U.S. consumers expressed a preference for environmentally friendly products, with many companies committing to sustainability initiatives. The furniture industry is responding by increasing the use of recycled materials and eco-friendly manufacturing processes. According to the U.S. Environmental Protection Agency, businesses that adopt sustainable practices can reduce operational costs by up to 25%, encouraging more firms to invest in green office furniture solutions.

- Growth of E-commerce Distribution Channels: The growth of e-commerce distribution channels is transforming how office furniture is marketed and sold. In 2022, online sales of office furniture accounted for $12 billion, representing a 15% increase from the previous year. The convenience of online shopping, coupled with the rise of direct-to-consumer brands, is changing consumer behavior and expanding market access. By 2025, it is projected that e-commerce will represent over 25% of total office furniture sales, encouraging traditional retailers to enhance their online presence and digital marketing strategies.

Scope of the Report

|

Segment |

Sub-segments |

|

Product Type |

Seating |

|

Material |

Wood |

|

Price Range |

Economy |

|

End-User |

Corporate Offices |

|

Distribution Channel |

Offline |

Products

Key Target Audience

Corporate Offices

Healthcare Facilities

Educational Institutions

Government Offices

Co-working Spaces

Hospitality Industry

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Occupational Safety and Health Administration)

Companies

Players Mentioned in the Report

Steelcase Inc.

Herman Miller Inc.

Haworth Inc.

HNI Corporation

Knoll Inc.

Teknion Corporation

Global Furniture Group

Kimball International Inc.

OFS Brands Holdings Inc.

Allsteel Inc.

Table of Contents

1. North America Office Furniture Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. North America Office Furniture Market Size (USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Office Furniture Market Analysis

3.1 Growth Drivers

3.1.1 Expansion of Commercial Real Estate Sector

3.1.2 Increased Focus on Office Space Optimization

3.1.3 Growing Emphasis on Employee Well-being and Ergonomics

3.1.4 Technological Advancements in Furniture Design

3.2 Market Challenges

3.2.1 High Initial Costs of Ergonomic Furniture

3.2.2 Fluctuations in Raw Material Prices

3.2.3 Supply Chain Disruptions

3.3 Opportunities

3.3.1 Rising Demand for Sustainable and Eco-friendly Furniture

3.3.2 Growth of E-commerce Distribution Channels

3.3.3 Increasing Adoption of Hybrid Work Models

3.4 Trends

3.4.1 Integration of Smart Technologies in Office Furniture

3.4.2 Customization and Modular Furniture Solutions

3.4.3 Adoption of Biophilic Design Elements

3.5 Government Regulations

3.5.1 Occupational Safety and Health Administration (OSHA) Standards

3.5.2 Environmental Protection Agency (EPA) Guidelines

3.5.3 Trade Policies and Tariffs

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. North America Office Furniture Market Segmentation

4.1 By Product Type (Value %)

4.1.1 Seating

4.1.2 Desks and Tables

4.1.3 Storage Units and Filing Cabinets

4.1.4 Workstations and Cubicles

4.1.5 Others (Partitions, Accessories)

4.2 By Material (Value %)

4.2.1 Wood

4.2.2 Metal

4.2.3 Plastic

4.2.4 Others (Glass, Composite Materials)

4.3 By Price Range (Value %)

4.3.1 Economy

4.3.2 Mid-Range

4.3.3 Premium

4.3.4 Luxury

4.4 By End-User (Value %)

4.4.1 Corporate Offices

4.4.2 Healthcare Facilities

4.4.3 Educational Institutions

4.4.4 Government Offices

4.4.5 Others (Co-working Spaces, Hospitality)

4.5 By Distribution Channel (Value %)

4.5.1 Offline

4.5.2 Online

5. North America Office Furniture Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Steelcase Inc.

5.1.2 Herman Miller Inc.

5.1.3 Haworth Inc.

5.1.4 HNI Corporation

5.1.5 Knoll Inc.

5.1.6 Teknion Corporation

5.1.7 Global Furniture Group

5.1.8 Kimball International Inc.

5.1.9 OFS Brands Holdings Inc.

5.1.10 Allsteel Inc.

5.1.11 HON Company

5.1.12 La-Z-Boy Incorporated

5.1.13 Humanscale Corporation

5.1.14 KI Furniture

5.1.15 National Office Furniture

5.2 Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Regional Presence, Strategic Initiatives, R&D Investments, Manufacturing Capabilities, Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

6. North America Office Furniture Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Future Market Size (USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Future Market Segmentation

8.1 By Product Type (Value %)

8.2 By Material (Value %)

8.3 By Price Range (Value %)

8.4 By End-User (Value %)

8.5 By Distribution Channel (Value %)

9. North America Office Furniture Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the North American Office Furniture Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the North American Office Furniture Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple office furniture manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the North American Office Furniture market.

Frequently Asked Questions

01. How big is the North American Office Furniture Market?

The North American office furniture market was valued at USD 19.9 billion, reflecting steady growth over the past five years.

02. What are the challenges in the North American Office Furniture Market?

Challenges include high initial costs of ergonomic furniture, fluctuations in raw material prices, and supply chain disruptions. Additionally, the market faces competition from low-cost imports and the need to adapt to changing workplace trends.

03. Who are the major players in the North American Office Furniture Market?

Key players in the market include Steelcase Inc., Herman Miller Inc., Haworth Inc., HNI Corporation, and Knoll Inc. These companies dominate due to their extensive distribution networks, strong brand presence, and diverse product portfolios.

04. What are the growth drivers of the North American Office Furniture Market?

The market is propelled by factors such as the expansion of commercial real estate, increased focus on office space optimization, growing emphasis on employee well-being and ergonomics, and technological advancements in furniture design.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.