North America Online Trading Market Outlook to 2030

Region:North America

Author(s):Shubham Kashyap

Product Code:KROD5390

December 2024

94

About the Report

North America Online Trading Market Overview

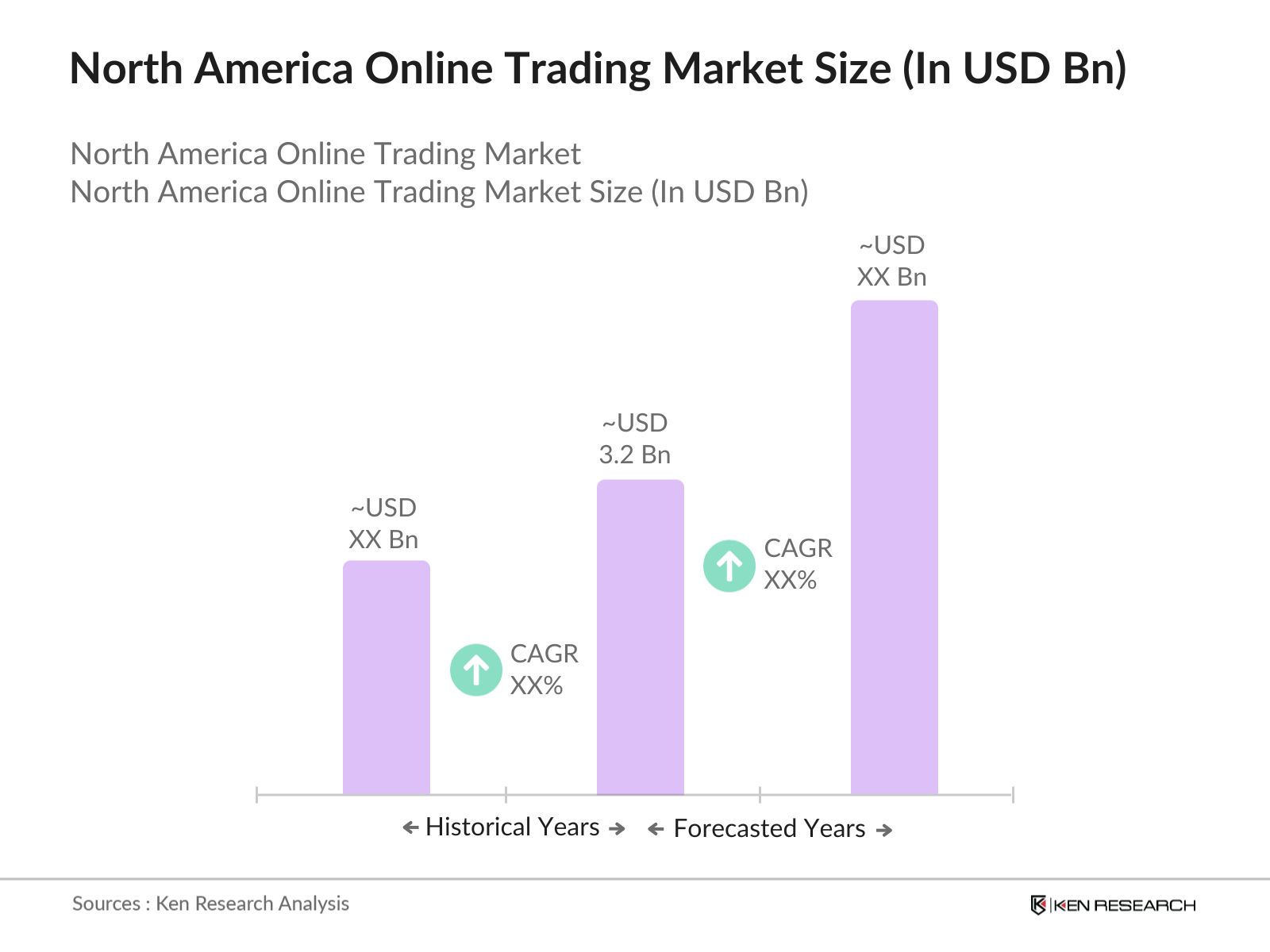

- The North America Online Trading Market is valued at USD 3.2 billion, primarily driven by the exponential growth of digital financial platforms, increasing internet penetration, and the widespread adoption of mobile trading applications across the region. The market exhibits steady growth as technological advancements enhance trading experiences, while regulatory support and the diversification of financial instruments contribute to its expansion. Key factors such as the rise of retail investors, the integration of artificial intelligence in trading algorithms, and the increasing demand for real-time trading data solidify North America as a leading market for online trading globally.

- Major demand centers for online trading in North America include the United States, Canada, and Mexico. The United States dominates due to its robust financial infrastructure, presence of major stock exchanges like the NYSE and NASDAQ, and a large base of retail and institutional investors. Canada benefits from its stable economy and high internet connectivity, fostering a conducive environment for online trading platforms. Mexico is emerging as a significant market driven by economic growth, increasing smartphone penetration, and rising financial literacy among its population. The strategic geographical locations of these countries, coupled with advanced technological ecosystems, enhance their market presence and drive the dominance of online trading in the region.

- The Financial Industry Regulatory Authority (FINRA) establishes comprehensive compliance requirements for online trading platforms operating in North America. In 2024, FINRA mandated that all online brokers implement stringent anti-money laundering (AML) protocols, including real-time transaction monitoring and customer identity verification processes. These requirements aim to prevent illicit activities and ensure the legitimacy of trading activities. Additionally, FINRA enforces rules regarding fair trading practices, dispute resolution, and transparent communication with clients.

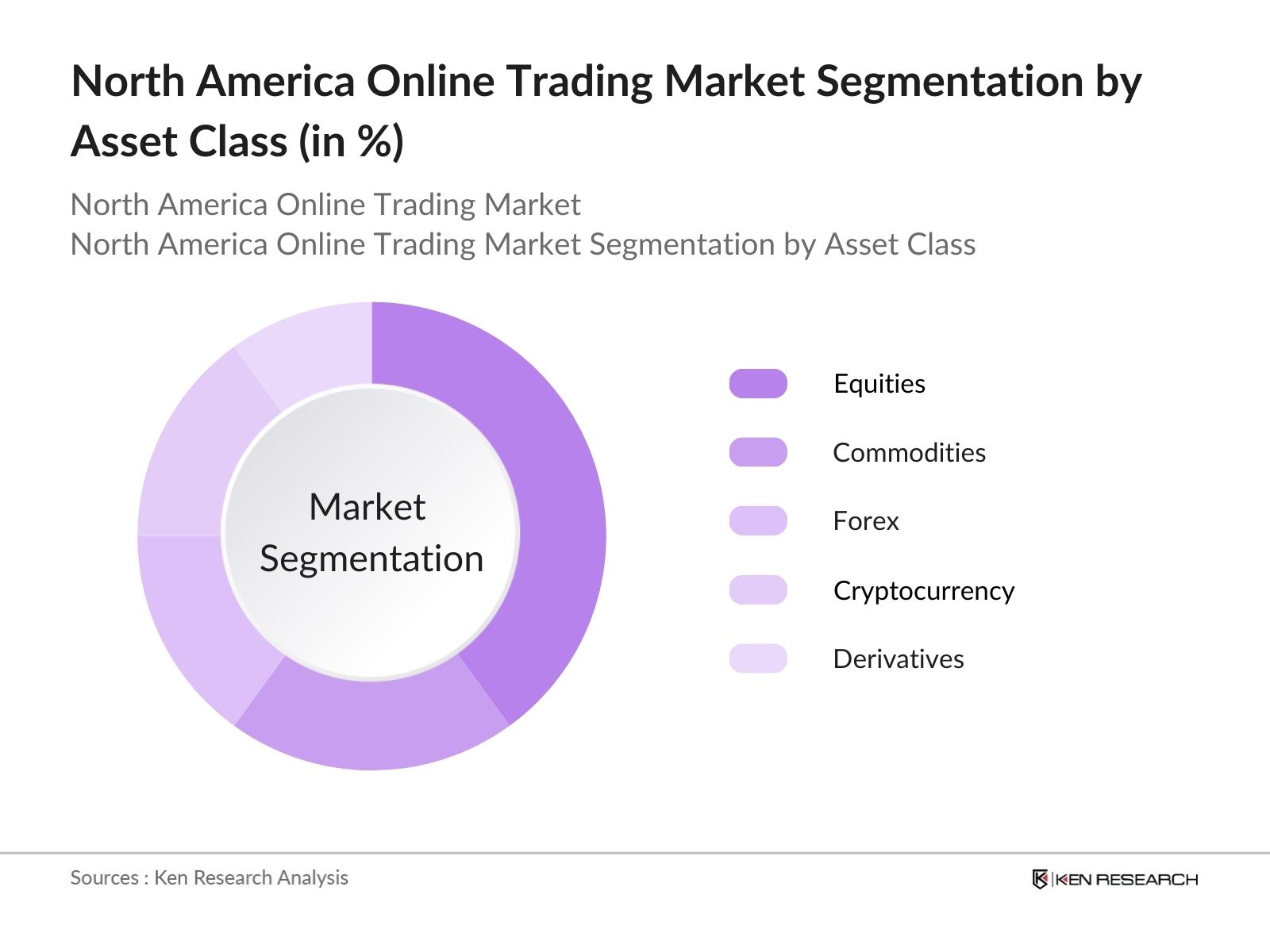

North America Online Trading Market Segmentation

- By Asset Class: The Market is segmented by asset class into Equities, Commodities, Forex, Cryptocurrency, and Derivatives. Recently, the Equities segment has a dominant market share within this segmentation. This trend can be attributed to the extensive presence of major stock exchanges such as the NYSE and NASDAQ, which offer a wide range of trading options. Additionally, the increasing participation of retail investors, driven by user-friendly trading platforms and educational resources, has significantly contributed to the prominence of equities trading in the market.

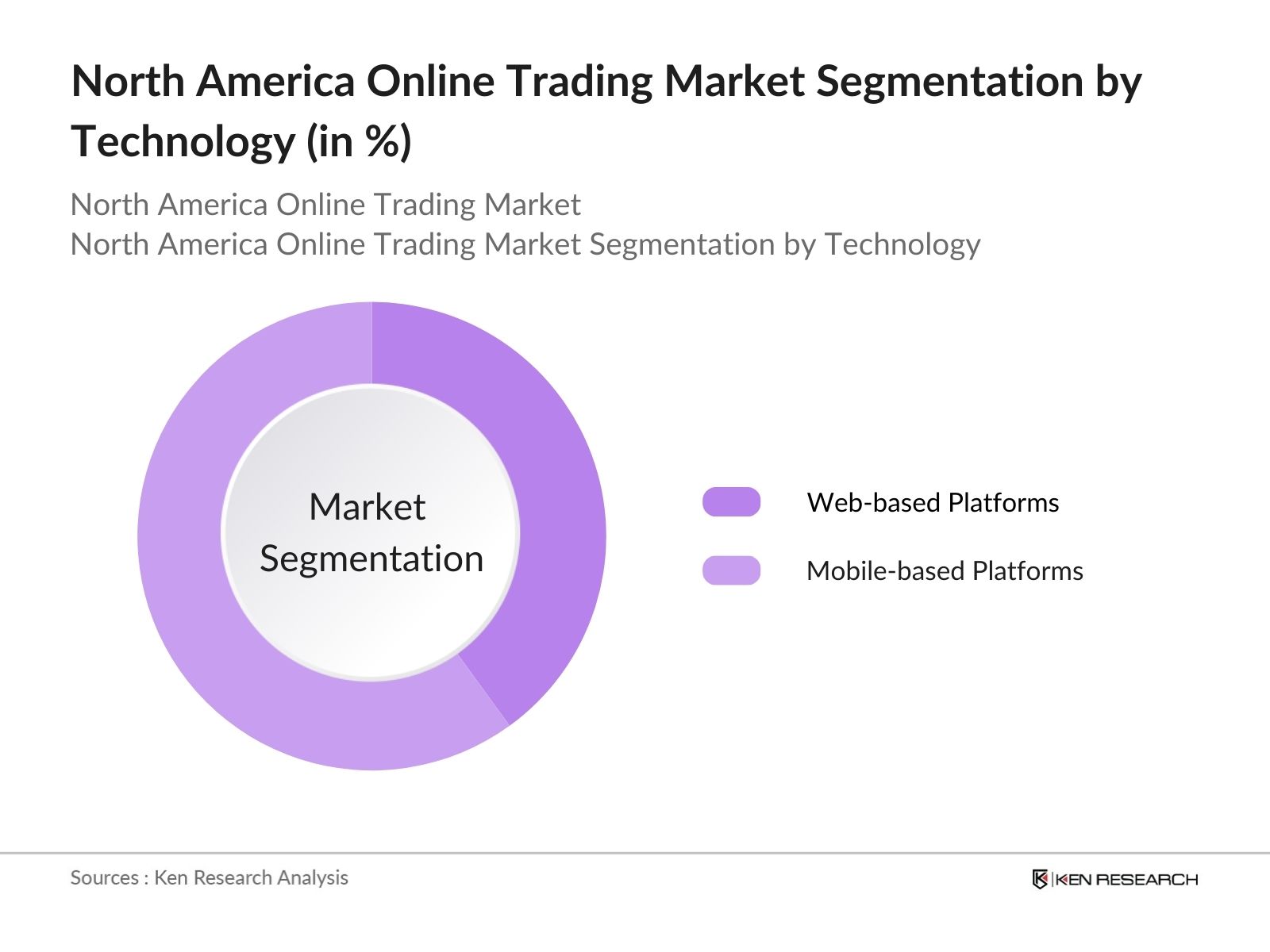

- By Technology: The market is further segmented by technology into Web-based Platforms and Mobile-based Platforms. Mobile-based Platforms have emerged as the leading segment within this classification, holding a significant market share in 2023. The surge in smartphone usage and the demand for on-the-go trading capabilities have propelled the growth of mobile trading applications. Enhanced functionalities such as real-time notifications, seamless user interfaces, and advanced charting tools on mobile devices have made trading more accessible and convenient for users, driving the dominance of this segment.

North America Online Trading Market Competitive Landscape

The North America Online Trading Market is dominated by a few major players, including Robinhood Markets, Inc., E*TRADE Financial Corporation, TD Ameritrade, Charles Schwab Corporation, and Fidelity Investments. This consolidation highlights the significant influence of these key companies, which leverage their extensive technological infrastructure, comprehensive product offerings, and strong brand loyalty to maintain their market positions. These firms continuously innovate by integrating advanced trading tools, enhancing user experiences, and expanding their service portfolios to attract a diverse range of investors.

North America Online Trading Market Analysis

Growth Drivers

- Increasing Internet Penetration and Mobile Adoption: The proliferation of internet access in North America significantly fuels the online trading market. As of 2024, the United States has approximately 313 million internet users, while Canada has around 38 million, according to the World Bank. Enhanced connectivity enables seamless access to trading platforms, facilitating real-time transactions and data analysis. Mobile trading applications offer users the flexibility to trade on-the-go, attracting a broader demographic of retail investors. The integration of advanced technologies such as artificial intelligence and machine learning in trading platforms further enhances user experience and trading efficiency, driving market growth.

- Advancements in Trading Technologies: Continuous innovations in trading technologies, including algorithmic trading, automated investment strategies, and blockchain integration, are key growth drivers for the North America Online Trading Market. These advancements enable more efficient and secure trading operations, reducing latency and increasing transaction speeds. Additionally, the development of sophisticated analytics tools and real-time data feeds empower traders to make informed decisions, thereby increasing market participation and liquidity. The adoption of cloud computing and cybersecurity measures also ensures the reliability and safety of trading platforms, fostering investor confidence and market expansion.

- Rising Adoption of Mobile Devices: The adoption of mobile devices plays a crucial role in the growth of the online trading market in North America. As of 2024, there are over 300 million smartphones in use across the United States and Canada combined, as reported by the Federal Communications Commission (FCC). The increasing reliance on smartphones for financial transactions has led to the development of mobile trading apps that offer real-time market data, trading capabilities, and personalized financial insights. In 2023, mobile app downloads for trading platforms exceeded 50 million, indicating a strong preference for mobile-based trading solutions.

Challenges

- Cybersecurity Concerns: As the online trading market expands, the risk of cyber threats and data breaches increases, posing significant challenges for market participants. Ensuring the security of sensitive financial data and protecting trading platforms from malicious attacks are critical concerns that require continuous investment in advanced security measures. Cybersecurity breaches can undermine investor trust and lead to substantial financial losses, affecting the overall market stability and growth prospects.

- Regulatory Compliance: Navigating the complex regulatory landscape is a major challenge for online trading platforms in North America. Compliance with diverse regulations set by bodies such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) requires significant resources and can impact operational flexibility. Additionally, evolving regulatory standards necessitate ongoing adjustments to trading practices and platform functionalities, which can be resource-intensive and may slow down the pace of innovation.

North America Online Trading Market Future Outlook

The North America Online Trading Market is poised for robust growth, supported by continuous advancements in trading technologies, increasing adoption of artificial intelligence and machine learning, and the expanding base of retail investors. The rise of blockchain technology and the integration of decentralized finance (DeFi) platforms are anticipated to revolutionize trading practices. Additionally, regulatory developments aimed at enhancing market transparency and security will foster investor confidence and facilitate sustainable market growth. The emergence of new financial instruments and the globalization of trading platforms will further contribute to the market's dynamic expansion.

Future Market Opportunities

- Integration of Artificial Intelligence and Machine Learning: The adoption of AI and machine learning technologies is expected to transform the online trading landscape by enabling more sophisticated trading algorithms, personalized investment strategies, and enhanced risk management systems. These technologies can analyze vast amounts of data to identify trading opportunities, predict market trends, and optimize portfolio performance, providing traders with a competitive edge and driving market growth.

- Expansion of Cryptocurrency Trading: The increasing acceptance and regulatory clarity surrounding cryptocurrencies present significant growth opportunities for the online trading market. As more institutional investors and retail traders seek exposure to digital assets, trading platforms are expanding their cryptocurrency offerings to include a wider range of digital currencies and blockchain-based financial products. This expansion not only diversifies trading options but also attracts a new segment of tech-savvy investors, contributing to the overall growth of the market.

Scope of the Report

|

By Asset Class |

Equities |

|

By Participant Type |

Retail Traders |

|

By Technology |

Web-based Platforms |

|

By Service Type |

Brokerage Services |

|

By Region |

United States |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA))

Brokerage Firms

Fintech Companies

Hedge Funds

Asset Management Firms

Cryptocurrency Exchanges

Companies

Players Mentioned in the Report

Robinhood Markets, Inc.

E*TRADE Financial Corporation

TD Ameritrade

Charles Schwab Corporation

Fidelity Investments

Interactive Brokers LLC

Coinbase Global, Inc.

Binance.US

Webull

SoFi Technologies, Inc.

TradeStation Group

Ally Invest

Merrill Edge

Vanguard Group

Scottrade

Table of Contents

01 North America Online Trading Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02 North America Online Trading Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03 North America Online Trading Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Internet Penetration

3.1.2. Rising Adoption of Mobile Devices

3.1.3. Enhanced Trading Technologies

3.1.4. Regulatory Support

3.2. Market Challenges

3.2.1. Cybersecurity Concerns

3.2.2. High Competition

3.2.3. Volatility in Financial Markets

3.3. Opportunities

3.3.1. Expansion into Emerging Markets

3.3.2. Development of AI-driven Trading Solutions

3.3.3. Partnerships with Financial Institutions

3.4. Trends

3.4.1. Rise of Social Trading Platforms

3.4.2. Integration of Blockchain Technology

3.4.3. Increased Use of Robo-Advisors

3.5. Regulatory Framework

3.5.1. SEC Regulations

3.5.2. FINRA Compliance Requirements

3.5.3. Data Privacy Laws

3.5.4. International Trade Compliance

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

04 North America Online Trading Market Segmentation

4.1. By Asset Class (In Value %)

4.1.1. Equities

4.1.2. Commodities

4.1.3. Forex

4.1.4. Cryptocurrency

4.1.5. Derivatives

4.2. By Participant Type (In Value %)

4.2.1. Retail Traders

4.2.2. Institutional Traders

4.3. By Technology (In Value %)

4.3.1. Web-based Platforms

4.3.2. Mobile-based Platforms

4.4. By Service Type (In Value %)

4.4.1. Brokerage Services

4.4.2. Advisory Services

4.4.3. Trading Tools and Analytics

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

05 North America Online Trading Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Robinhood Markets, Inc.

5.1.2. E*TRADE Financial Corporation

5.1.3. TD Ameritrade

5.1.4. Charles Schwab Corporation

5.1.5. Fidelity Investments

5.1.6. Interactive Brokers LLC

5.1.7. Coinbase Global, Inc.

5.1.8. Binance.US

5.1.9. Webull

5.1.10. SoFi Technologies, Inc.

5.1.11. TradeStation Group

5.1.12. Ally Invest

5.1.13. Merrill Edge

5.1.14. Vanguard Group

5.1.15. Scottrade

5.2. Cross Comparison Parameters

- Number of Users

- Transaction Volume

- Market Share

- Revenue

- Regulatory Compliance

- Technology Adoption

- Customer Satisfaction

- Growth Rate

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06 North America Online Trading Market Regulatory Framework

6.1. Securities Regulations

6.2. Compliance Requirements

6.3. Licensing Processes

07 North America Online Trading Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08 North America Online Trading Market Future Market Segmentation

8.1. By Asset Class (In Value %)

8.2. By Participant Type (In Value %)

8.3. By Technology (In Value %)

8.4. By Service Type (In Value %)

8.5. By Region (In Value %)

09 North America Online Trading Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the North America Online Trading Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the North America Online Trading Market. This includes assessing market penetration, the ratio of retail to institutional traders, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATI) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple trading platform providers to acquire detailed insights into product features, user experiences, technological advancements, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the North America Online Trading Market.

Frequently Asked Questions

01. How big is the North America Online Trading Market?

The North America Online Trading Market is valued at USD 3.2 billion, driven by increasing internet penetration, the widespread adoption of mobile trading applications, and advancements in trading technologies. These factors have collectively contributed to the substantial growth and expansion of the market.

02. What are the challenges in the North America Online Trading Market?

Challenges in the North America Online Trading Market include cybersecurity concerns, high competition among numerous trading platforms, and market volatility. Additionally, regulatory compliance and the need for continuous technological advancements pose significant hurdles for market participants.

03. Who are the major players in the North America Online Trading Market?

Key players in the North America Online Trading Market include Robinhood Markets, Inc., E*TRADE Financial Corporation, TD Ameritrade, Charles Schwab Corporation, and Fidelity Investments. These companies dominate the market due to their extensive technological infrastructure, comprehensive product offerings, and strong brand loyalty.

04. What are the growth drivers of the North America Online Trading Market?

The North America Online Trading Market is propelled by factors such as increased internet penetration, the rise in mobile device usage, advancements in trading technologies, and favorable regulatory frameworks. Additionally, the growing interest in diverse financial instruments and the integration of artificial intelligence are significant growth drivers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.