North America Organic Flour Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD4222

November 2024

99

About the Report

North America Organic Flour Market Overview

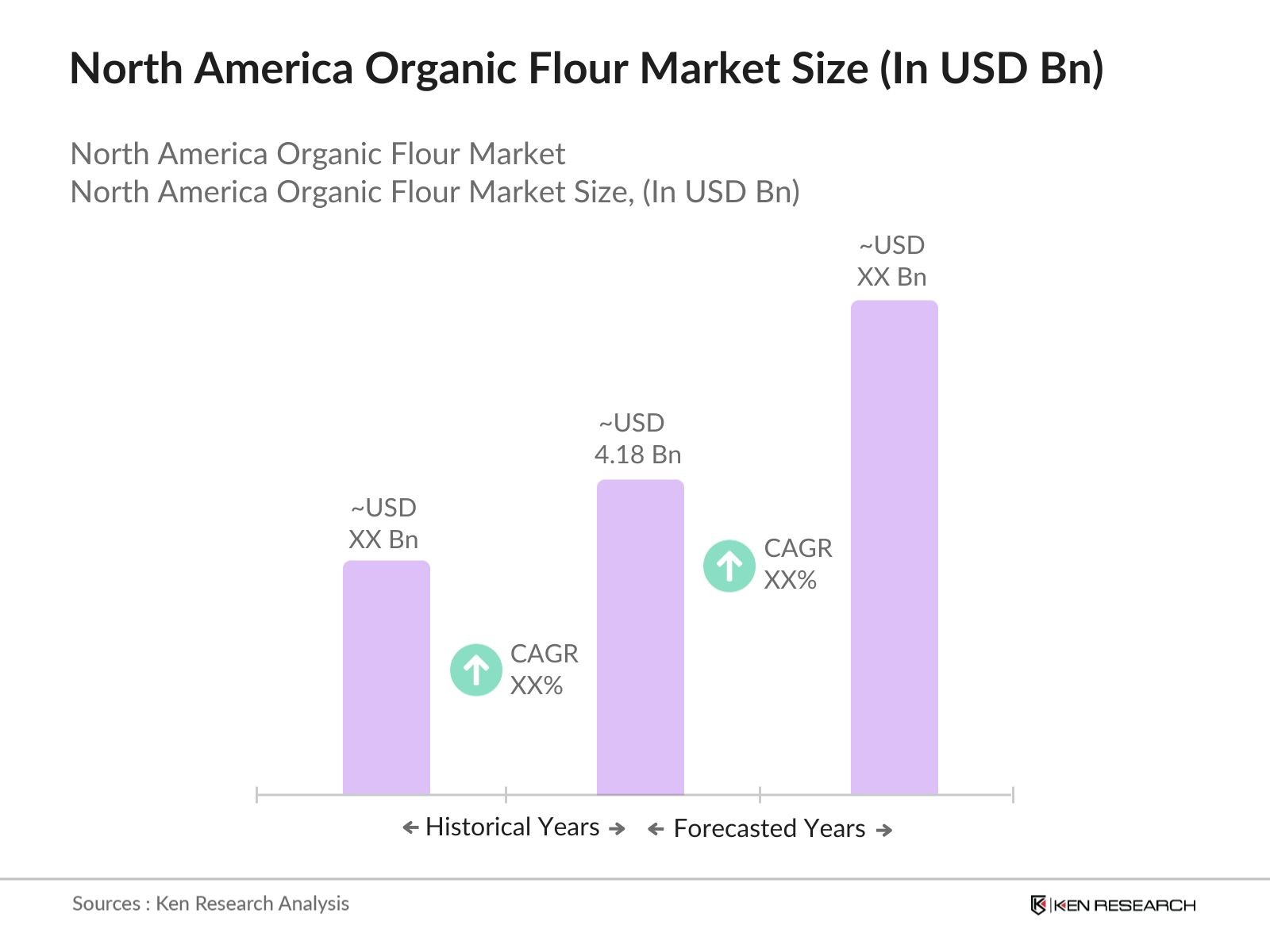

- The North America organic flour market is valued at USD 4.18 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer awareness of health benefits associated with organic products, leading to a surge in demand for organic flour. Additionally, supportive government policies and the expansion of organic farming practices have contributed to the market's expansion.

- The United States dominates the North American organic flour market due to its well-established organic farming infrastructure and a large consumer base inclined towards health-conscious food choices. Canada follows, benefiting from its robust agricultural sector and growing consumer preference for organic products. Mexico, while smaller in market size, is experiencing growth driven by increasing organic farming initiatives and rising domestic demand.

- Governments worldwide have established stringent organic certification standards to ensure the integrity of organic products. In the United States, the USDA's National Organic Program (NOP) enforces regulations that require organic products to be produced without synthetic chemicals, genetically modified organisms, or irradiation. These standards mandate that organic farms and processors undergo annual inspections and maintain detailed records of their operations.

North America Organic Flour Market Segmentation

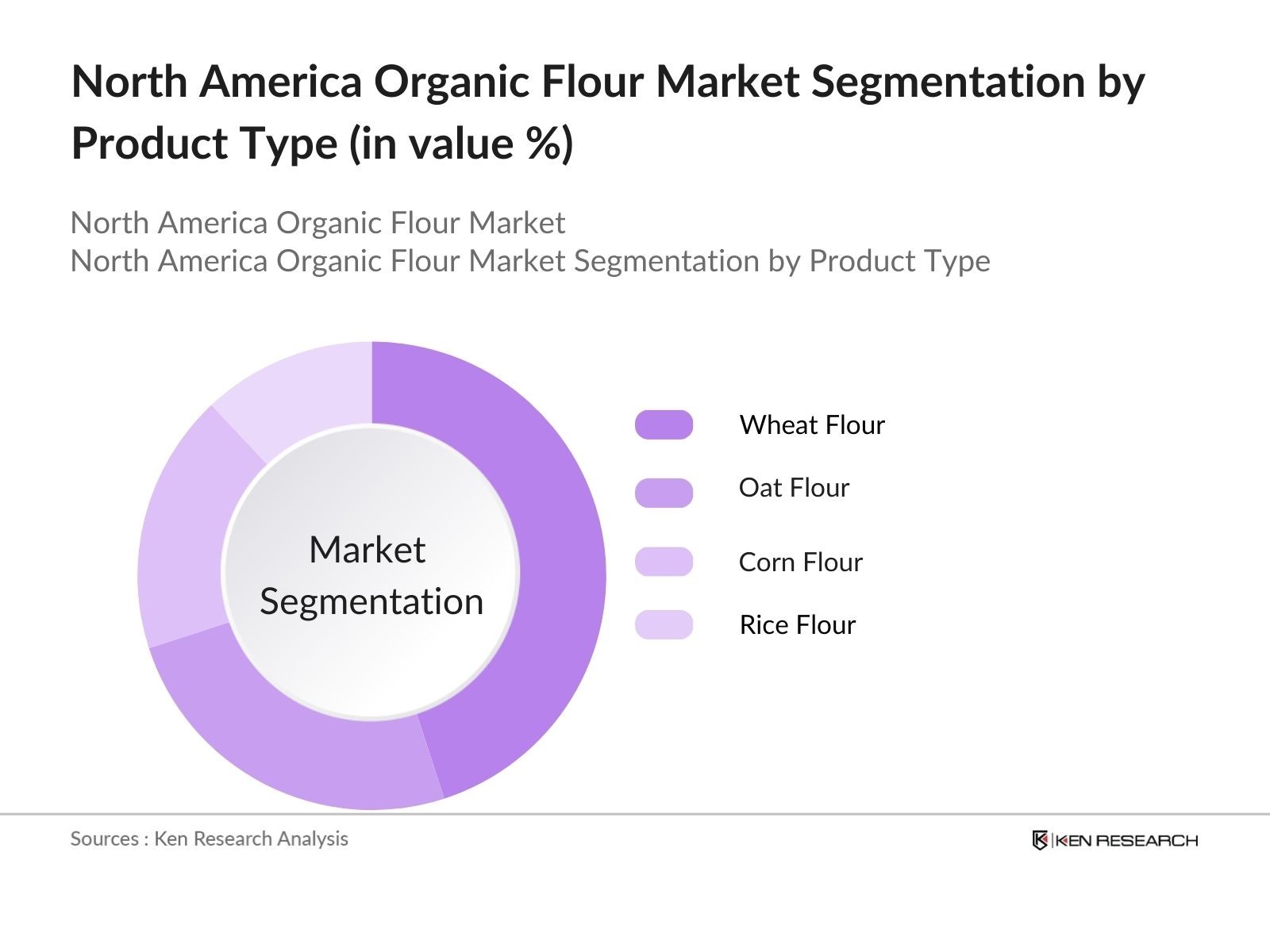

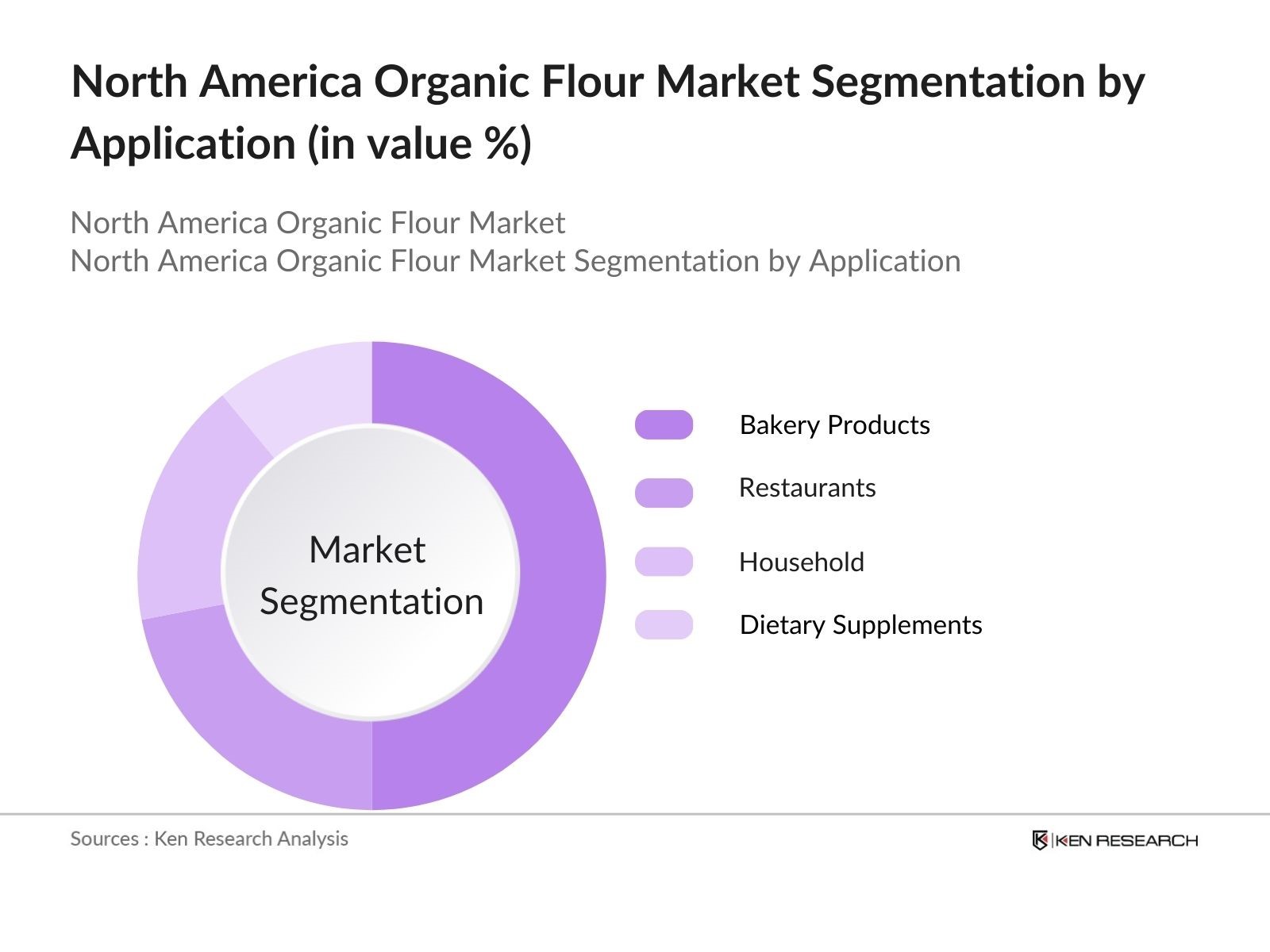

The North America organic flour market is segmented by product type and by application.

- By Product Type: The North America organic flour market is segmented by product type into wheat flour, oat flour, corn flour, rice flour, and others. Wheat flour holds a dominant market share in this segment, attributed to its widespread use in various baked goods and staple foods. The versatility of wheat flour in culinary applications and its nutritional benefits make it a preferred choice among consumers.

- By Application: The market is further segmented by application into bakery products, restaurants, household, dietary supplements, and others. Bakery products dominate this segment, driven by the high consumption of bread, pastries, and other baked goods made from organic flour. The growing trend of artisanal and health-focused baking has also contributed to the prominence of this sub-segment.

North America Organic Flour Market Competitive Landscape

The North America organic flour market is characterized by the presence of several key players who contribute significantly to the market dynamics. These companies have established strong distribution networks and offer a diverse range of organic flour products to cater to varying consumer preferences.

| Company | Established Year | Headquarters |

|---|---|---|

| General Mills | 1928 | Minneapolis, Minnesota |

| Fairhaven Organic Flour Mill | 2000 | Fairhaven, Washington |

| King Arthur Flour | 1790 | Norwich, Vermont |

| To Your Health Sprouted Flour | 2007 | Florida, USA |

| Great River Organic Milling | 1999 | Minnesota |

North America Organic Flour Market Analysis

Growth Drivers

- Increasing Consumer Preference for Organic Products: In recent years, there has been a notable shift in consumer behavior towards organic products. For instance, in France, the area of organically farmed land decreased by 54,000 hectares in 2023, indicating a decline in demand for organic products. This trend is attributed to factors such as inflation and consumer confusion over product labels.

- Rising Health Awareness: The global emphasis on health and wellness has led to increased consumption of organic foods. In India, farmers are adopting natural farming methods to combat the effects of extreme weather and improve crop resilience. For example, in Andhra Pradesh, approximately 700,000 farmers have transitioned to natural farming practices, supported by government initiatives.

- Expansion of Organic Farming Practices: The adoption of organic farming practices is growing worldwide. The World Bank has significantly increased its investment in climate-smart agriculture, with financing for such projects reaching nearly $3 billion annually. This investment supports the transition towards sustainable agricultural practices, including organic farming.

Market Challenges

- Higher Production Costs: Organic farming often incurs higher production costs due to labor-intensive practices and the use of organic inputs. In Vermont, USA, organic dairy farmers are seeking $9.2 million in state support to offset increased costs for feed, fuel, and labor, which have risen due to inflation and supply chain disruptions.

- Limited Availability of Organic Grains: The supply of organic grains is constrained by factors such as lower yields and limited cultivation areas. In France, the reduction of 54,000 hectares in organically farmed land in 2023 has impacted the availability of organic grains, affecting the supply chain for organic products.

North America Organic Flour Market Future Outlook

Over the next five years, the North America organic flour market is expected to show significant growth driven by continuous consumer demand for health-conscious products, advancements in organic farming techniques, and supportive government policies promoting organic agriculture. The increasing trend towards gluten-free and specialty flours is also anticipated to contribute to market expansion.

Market Opportunities

- Technological Advancements in Organic Farming: Innovations in organic farming techniques, such as the use of bio-fertilizers and pest management solutions, are enhancing productivity. The World Bank's investment in climate-smart agriculture includes support for technologies that improve resilience and reduce greenhouse gas emissions, benefiting organic farmers.

- Expansion into Untapped Markets: Emerging markets present opportunities for organic products. The World Bank's Global Agriculture and Food Security Program has announced $121 million in new grants for nine national governments, aiming to strengthen sustainable and inclusive food systems, which can facilitate the growth of organic markets in these regions.

Scope of the Report

|

By Product Type |

Wheat Flour |

|

By Category

|

Conventional |

|

By Application

|

Bakery Products |

|

By Distribution Channel |

Supermarkets & Hypermarkets Online Retail |

|

By Region |

US Canada Mexico |

Products

Key Target Audience

Organic Flour Manufacturers

Food and Beverage Companies

Retailers and Supermarkets

Health and Wellness Brands

Restaurants and Bakeries

Dietary Supplement Producers

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., USDA, FDA)

Companies

Players Mention in the Report:

General Mills

King Arthur Baking Company

Bob's Red Mill

Ardent Mills

Bay State Milling Company

Fairhaven Organic Flour Mill

To Your Health Sprouted Flour

Great River Organic Milling

Doves Farm Foods

Aryan International

Archer Daniels Midland Co.

Heartland Mill Inc.

The Hain Celestial Group Inc.

Sunrise Flour Mill

Lindley Mills Inc.

Table of Contents

Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Consumer Preference for Organic Products

3.1.2. Rising Health Awareness

3.1.3. Expansion of Organic Farming Practices

3.1.4. Government Support and Subsidies

3.2. Market Challenges

3.2.1. Higher Production Costs

3.2.2. Limited Availability of Organic Grains

3.2.3. Supply Chain Constraints

3.3. Opportunities

3.3.1. Technological Advancements in Organic Farming

3.3.2. Expansion into Untapped Markets

3.3.3. Product Diversification

3.4. Trends

3.4.1. Adoption of Gluten-Free Organic Flour

3.4.2. Growth of Online Retail Channels

3.4.3. Increased Demand for Ancient Grain Flours

3.5. Government Regulations

3.5.1. Organic Certification Standards

3.5.2. Labeling Requirements

3.5.3. Import and Export Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Wheat Flour

4.1.2. Oat Flour

4.1.3. Corn Flour

4.1.4. Rice Flour

4.1.5. Others

4.2. By Category (In Value %)

4.2.1. Conventional

4.2.2. Gluten-Free

4.3. By Application (In Value %)

4.3.1. Bakery Products

4.3.2. Restaurants

4.3.3. Household

4.3.4. Dietary Supplements

4.3.5. Others

4.4. By Distribution Channel (In Value %)

4.4.1. Supermarkets & Hypermarkets

4.4.2. Convenience Stores

4.4.3. Online Retail

4.4.4. Others

4.5. By Country (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. General Mills

5.1.2. Fairhaven Organic Flour Mill

5.1.3. King Arthur Flour

5.1.4. To Your Health Sprouted Flour

5.1.5. Great River Organic Milling

5.1.6. Ardent Mills

5.1.7. Doves Farm Foods

5.1.8. Bay State Milling Company

5.1.9. Bob's Red Mill

5.1.10. Aryan International

5.1.11. Archer Daniels Midland Co.

5.1.12. Heartland Mill Inc.

5.1.13. The Hain Celestial Group Inc.

5.1.14. Sunrise Flour Mill

5.1.15. Lindley Mills Inc.

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, Distribution Network, Recent Developments)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

Regulatory Framework

6.1. Organic Certification Processes

6.2. Compliance Requirements

6.3. Environmental Standards

Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Category (In Value %)

8.3. By Application (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Country (In Value %)

Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the North America Organic Flour Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the North America Organic Flour Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple organic flour manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the North America Organic Flour Market.

Frequently Asked Questions

How big is the North America Organic Flour Market?

The North America organic flour market is valued at USD 4.18 billion, based on a five-year historical analysis. The market is driven by increased consumer awareness of health benefits and government support for organic farming practices.

What are the challenges in the North America Organic Flour Market?

Challenges include higher production costs due to organic farming practices, limited availability of organic grains, and supply chain constraints. These factors impact market penetration and profitability.

Who are the major players in the North America Organic Flour Market?

Key players include General Mills, King Arthur Baking Company, Bob's Red Mill, Ardent Mills, and Bay State Milling Company. These companies dominate due to strong distribution networks, diverse product portfolios, and commitment to sustainability.

What are the growth drivers of the North America Organic Flour Market?

The market is propelled by increasing consumer demand for health-conscious products, advancements in organic farming, and supportive government policies. Rising popularity of gluten-free and specialty flours further accelerates growth.

Which segment dominates the North America Organic Flour Market?

The bakery products application segment dominates the market due to high consumption of bread, pastries, and baked goods. The versatility of wheat flour also plays a key role in this segment's prominence.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.