North America Orthodontics Market Outlook to 2030

Region:North America

Author(s):Paribhasha Tiwari

Product Code:KROD3453

November 2024

92

About the Report

North America Orthodontics Market Overview

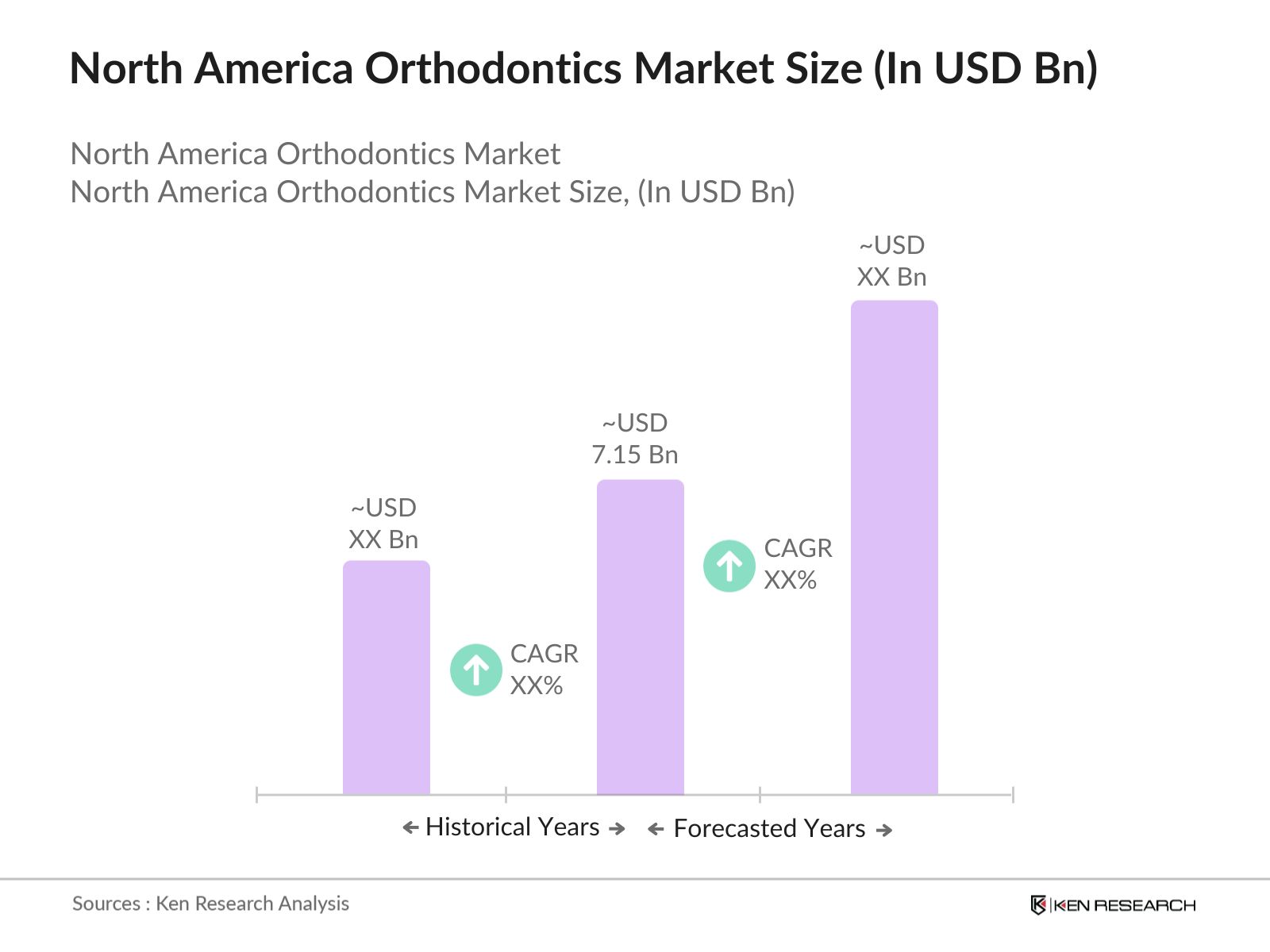

- The North America Orthodontics market is valued at USD 7.15 billion, based on a five-year historical analysis. The market has experienced consistent growth, driven primarily by the increasing prevalence of malocclusion, growing demand for aesthetic treatments such as invisible aligners, and advancements in orthodontic technology, including digital workflows and 3D printing. Additionally, the rise in disposable income, coupled with the expansion of orthodontic services through digital platforms, has contributed significantly to market growth.

- The dominant countries in the North American orthodontics market include the United States and Canada. The United States leads the market due to its advanced healthcare infrastructure, high disposable income, and strong consumer demand for aesthetic dental treatments. Major urban centers such as New York, Los Angeles, and Chicago have a high concentration of orthodontic practices, driven by both population density and the availability of premium services. Canadas orthodontics market, while smaller, benefits from growing awareness of orthodontic treatments and increasing adoption of advanced technologies.

- Government is recently making efforts to expand healthcare access and coverage for orthodontic treatments under Medicaid and other federal health programs. These initiatives aim to reduce the out-of-pocket expenses for orthodontic care, especially for children and low-income families, increasing affordability and accessibility to essential dental and orthodontic treatments. This policy shift is expected to drive greater demand for orthodontic supplies and services in the region.

North America Orthodontics Market Segmentation

By Product Type: The North America Orthodontics market is segmented by product type into fixed braces, removable braces, and auxiliary devices. Removable braces, including clear aligners, dominate the market share. This is primarily due to the rising demand for aesthetic, non-invasive orthodontic solutions. Clear aligners like Invisalign have gained popularity among adult consumers, offering a discreet alternative to traditional braces. The adoption of these products is further supported by advancements in digital treatment planning, which improves precision and outcomes.

By Age Group: The orthodontics market in North America is segmented by age group into children, teenagers, and adults. The adult segment holds a significant market share due to the growing awareness of orthodontic treatments for cosmetic purposes and the availability of advanced, less invasive options such as clear aligners. This segment has seen an increase in treatment demand, particularly among working professionals who seek aesthetic dental care but prefer treatments that do not interfere with their appearance or lifestyle.

North America Orthodontics Market Competitive Landscape

The North America Orthodontics market is highly competitive, with key players adopting various strategies such as mergers, acquisitions, product innovation, and expansion to maintain their market position. The market is dominated by both local and global players, with some companies focusing on cutting-edge technologies, including AI-driven treatment planning and 3D-printed orthodontic devices. For example, Align Technology, the maker of Invisalign, has a stronghold in the clear aligner segment, while traditional players like 3M and Henry Schein continue to lead in fixed orthodontic solutions.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD Bn) |

Product Portfolio |

R&D Investment |

Regional Presence |

Strategic Alliances |

Innovation Capabilities |

|

Align Technology Inc. |

1997 |

San Jose, USA |

- | - | - | - | - | - | - |

|

3M Company |

1902 |

St. Paul, USA |

- | - | - | - | - | - | - |

|

Henry Schein Inc. |

1932 |

Melville, USA |

- | - | - | - | - | - | - |

|

Dentsply Sirona Inc. |

1899 |

Charlotte, USA |

- | - | - | - | - | - | - |

|

Ormco Corporation |

1960 |

Orange, USA |

- | - | - | - | - | - | - |

North America Orthodontics Market Analysis

Growth Drivers

- Increasing Prevalence of Malocclusion: Malocclusion affects a large segment of the North American population. The American Dental Association reports that 7 out of 10 individuals have some form of malocclusion, with over 65 million people in the U.S. requiring orthodontic treatment. This widespread issue increases the need for braces and aligners, driving the orthodontics market. Untreated malocclusion leads to speech issues and dental decay, further fueling the demand for corrective procedures.

- Technological Advancements (Digital Orthodontics, 3D Printing): Innovations such as intraoral scanners and 3D printers have transformed orthodontic treatment in North America. More than $2 billion has been invested in healthcare-related 3D printing technologies, improving the precision of aligners and reducing treatment times. AI-powered digital impressions and treatment planning have made orthodontic procedures more efficient and accurate, enhancing patient outcomes and attracting more people to seek treatment.

- Growing Aesthetic Awareness (Aligners, Cosmetic Orthodontics): Increasing awareness around aesthetics has fueled demand for cosmetic orthodontics, particularly clear aligners. Around 45 million adults in the U.S. are interested in improving their smile, with aligners being a popular choice due to their discreet appearance. Social media has also contributed to the demand for cosmetic treatments as people prioritize personal appearance. In Canada, demand for aesthetic orthodontics has grown by 20% in the last year.

Market Challenges

- High Treatment Costs (Traditional Braces, Clear Aligners): The high cost of orthodontic treatment remains a significant barrier, with traditional braces priced between $5,000 and $8,000, and clear aligners costing $3,500 to $6,000. These high prices are driven by complex procedures and specialized materials, making orthodontic care inaccessible for many families, particularly those without insurance.

- Limited Insurance Coverage for Orthodontics: Many insurance plans in North America do not fully cover orthodontic treatments, which are often considered cosmetic rather than essential. Less than 50% of private dental insurance plans cover orthodontic care comprehensively, leaving patients with substantial out-of-pocket expenses. This limited coverage restricts access to treatment, especially for low-income families.

North America Orthodontics Market Future Outlook

Over the next five years, the North American orthodontics market is expected to show robust growth, driven by the rising demand for aesthetic dental treatments, technological advancements, and the expansion of digital orthodontics. Continuous product innovation, such as the development of AI-powered aligners and tele-orthodontics, will further accelerate market growth. The increasing adoption of clear aligners among adults and the integration of digital workflows in orthodontic treatment planning are key factors expected to shape the future of the market.

Market Opportunities

- Growing Demand for Invisible Aligners: Invisible aligners have gained popularity due to their convenience and aesthetic appeal. In 2023, 1.4 million people in the U.S. opted for clear aligners. The demand for these aligners is expected to grow as more individuals become aware of the advantages they offer, such as being discreet, removable, and more comfortable than traditional braces.

- Expansion of Tele-Orthodontics: Tele-orthodontics is gaining traction, particularly in rural areas where access to in-person care is limited. With 30% of rural households in the U.S. gaining access to high-speed internet in 2023, tele-orthodontics has become a feasible solution. Patients can now use at-home impression kits and receive virtual consultations, expanding the orthodontics market in underserved regions.

Scope of the Report

|

By Product Type |

Fixed Braces (Metal, Ceramic) Removable Braces (Clear Aligners) Auxiliary Devices (Headgear, Retainers) |

|

By Age Group |

Children Teenagers Adults |

|

By End User |

Hospitals Dental Clinics Orthodontic Practices Direct-to-Consumer Platforms |

|

By Treatment Type |

Conventional Orthodontics Digital Orthodontics Cosmetic Orthodontics |

|

By Country |

United States Canada |

Products

Key Target Audience

Orthodontists and Dental Clinics

Orthodontic Device Manufacturers

Distributors and Suppliers

Dental Labs and Service Providers

Government and Regulatory Bodies (FDA, Health Canada)

Insurance Companies

Private Equity and Venture Capital Firms

Direct-to-Consumer Platforms

Companies

Players Mentioned in the report:

Align Technology Inc.

3M Company

Henry Schein Inc.

Dentsply Sirona Inc.

Ormco Corporation

Straumann Group

American Orthodontics

G&H Orthodontics

DB Orthodontics

Great Lakes Orthodontics, Ltd.

Rocky Mountain Orthodontics

SmileDirectClub

OrthoFX

ClearCorrect

Danaher Corporation

Table of Contents

1. North America Orthodontics Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (CAGR, Historical and Projected)

1.4 Market Segmentation Overview

2. North America Orthodontics Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis (Growth Trends and Forecast)

2.3 Key Market Developments and Milestones

3. North America Orthodontics Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Prevalence of Malocclusion

3.1.2 Technological Advancements (Digital Orthodontics, 3D Printing)

3.1.3 Growing Aesthetic Awareness (Aligners, Cosmetic Orthodontics)

3.1.4 Rising Disposable Income

3.2 Market Challenges

3.2.1 High Treatment Costs (Traditional Braces, Clear Aligners)

3.2.2 Limited Insurance Coverage for Orthodontics

3.2.3 Lack of Skilled Orthodontists in Rural Areas

3.3 Opportunities

3.3.1 Growing Demand for Invisible Aligners

3.3.2 Expansion of Tele-Orthodontics

3.3.3 Integration of AI in Treatment Planning

3.4 Trends

3.4.1 Rise of Direct-to-Consumer (DTC) Orthodontics

3.4.2 Personalized Treatment Solutions

3.4.3 Increasing Adoption of Orthodontic Apps

3.5 Regulatory Environment

3.5.1 FDA Approvals for Orthodontic Devices

3.5.2 Reimbursement Policies for Orthodontic Treatments

3.5.3 Certification Requirements for Orthodontists

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.7.1 Orthodontists

3.7.2 Dental Labs and Manufacturers

3.7.3 Insurance Providers

3.7.4 Consumers (Patients)

3.8 Porters Five Forces Analysis

3.8.1 Bargaining Power of Suppliers

3.8.2 Bargaining Power of Buyers

3.8.3 Threat of New Entrants

3.8.4 Threat of Substitutes

3.8.5 Competitive Rivalry

3.9 Competition Ecosystem

4. North America Orthodontics Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Fixed Braces (Metal, Ceramic)

4.1.2 Removable Braces (Clear Aligners, Retainers)

4.1.3 Auxiliary Devices (Headgear, Palatal Expanders)

4.2 By Age Group (In Value %)

4.2.1 Children

4.2.2 Teenagers

4.2.3 Adults

4.3 By End User (In Value %)

4.3.1 Hospitals

4.3.2 Dental Clinics

4.3.3 Orthodontic Practices

4.3.4 Direct-to-Consumer Platforms

4.4 By Treatment Type (In Value %)

4.4.1 Conventional Orthodontics

4.4.2 Digital Orthodontics

4.4.3 Cosmetic Orthodontics

4.5 By Country (In Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

5. North America Orthodontics Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Align Technology Inc.

5.1.2 3M Company

5.1.3 Henry Schein Inc.

5.1.4 Dentsply Sirona Inc.

5.1.5 Danaher Corporation

5.1.6 Straumann Group

5.1.7 American Orthodontics

5.1.8 Ormco Corporation

5.1.9 G&H Orthodontics

5.1.10 DB Orthodontics

5.1.11 Great Lakes Orthodontics, Ltd.

5.1.12 Rocky Mountain Orthodontics

5.1.13 SmileDirectClub

5.1.14 OrthoFX

5.1.15 ClearCorrect

5.2 Cross Comparison Parameters (Market specific: No. of Employees, Headquarters, Revenue, Market Share, Product Portfolio, Regional Presence, Innovation Capabilities, Strategic Alliances)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Private Equity Investments

6. North America Orthodontics Market Regulatory Framework

6.1 Government Dental Health Programs (Medicare, Medicaid Coverage)

6.2 Compliance Requirements for Orthodontic Devices (FDA, Health Canada Approvals)

6.3 Licensing and Certification for Orthodontists

7. North America Orthodontics Market Future Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America Orthodontics Market Future Segmentation

8.1 By Product Type (In Value %)

8.2 By Age Group (In Value %)

8.3 By End User (In Value %)

8.4 By Treatment Type (In Value %)

8.5 By Country (In Value %)

9. North America Orthodontics Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the North America Orthodontics market ecosystem, identifying all major stakeholders such as orthodontists, device manufacturers, and end-users. Desk research was conducted using both secondary and proprietary databases to gather comprehensive information on market dynamics, focusing on key variables like product adoption rates, patient demographics, and technological advancements.

Step 2: Market Analysis and Construction

In this phase, historical market data was compiled and analyzed to assess the penetration of orthodontic services across various age groups and product types. The ratio of orthodontic practices to population density, along with consumer demand for specific products like clear aligners, was evaluated to estimate revenue trends and service quality.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on market growth, driven by the adoption of advanced technologies and consumer preferences, were validated through interviews with orthodontists and industry experts. Insights gained from consultations helped refine and corroborate the collected data.

Step 4: Research Synthesis and Final Output

The final step involved direct interaction with major orthodontic device manufacturers to gain deeper insights into product segments, sales performance, and emerging trends like tele-orthodontics. This engagement helped ensure a comprehensive and accurate analysis of the North America Orthodontics market.

Frequently Asked Questions

01. How big is the North America Orthodontics Market?

The North America Orthodontics market is valued at approximately USD 7.15 billion, driven by factors such as the increasing prevalence of malocclusion and growing demand for aesthetic orthodontic treatments like clear aligners.

02. What are the challenges in the North America Orthodontics Market?

Challenges include high treatment costs, limited insurance coverage, and a shortage of skilled orthodontists in rural areas, which impacts the accessibility of orthodontic care across the region.

03. Who are the major players in the North America Orthodontics Market?

Key players include Align Technology Inc., 3M Company, Henry Schein Inc., Dentsply Sirona Inc., and Ormco Corporation. These companies dominate the market due to their extensive product portfolios, innovation capabilities, and strong distribution networks.

04. What are the growth drivers of the North America Orthodontics Market?

Growth drivers include increasing demand for non-invasive aesthetic treatments, advancements in orthodontic technologies, and rising disposable incomes. The integration of digital workflows is also significantly enhancing treatment efficiency and outcomes.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.