North America Paints and Coatings Market Outlook to 2030

Region:Global

Author(s):Meenakshi

Product Code:KROD4485

November 2024

84

About the Report

North America Paints and Coatings Market Overview

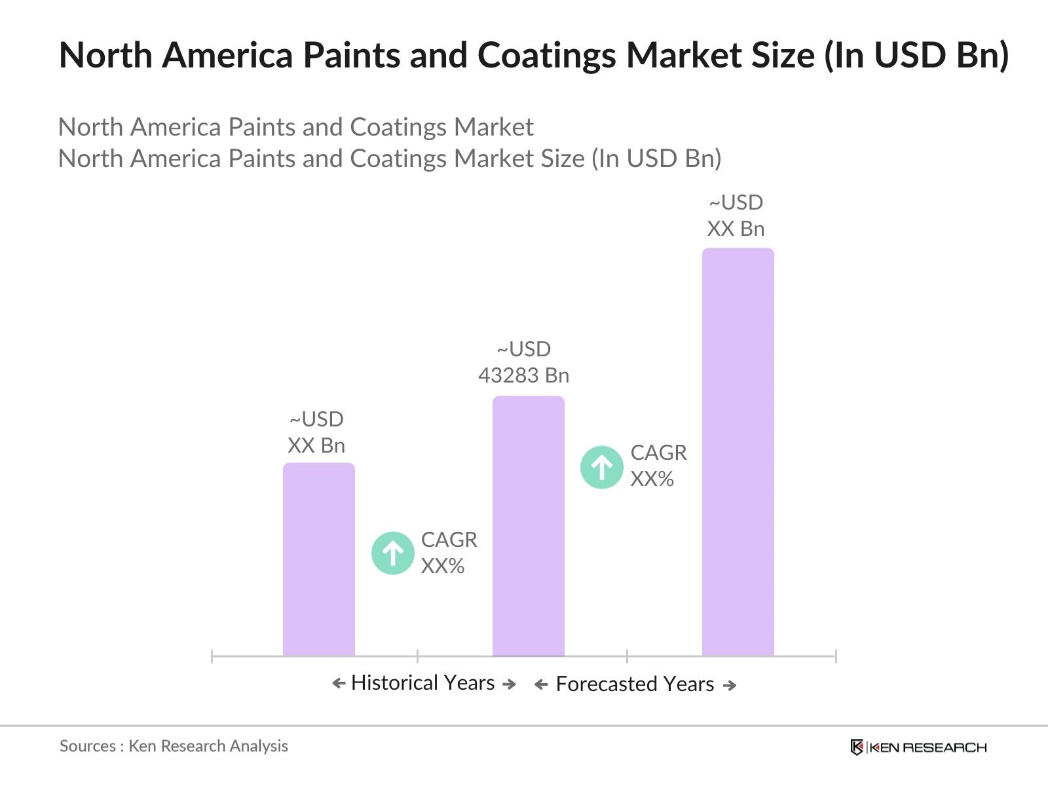

- The North America Paints and Coatings Market is valued at 43,283 billion, based on a five-year historical analysis. This growth is primarily driven by the expanding construction and automotive sectors, along with increasing demand for environmentally friendly and durable coating solutions. The market has seen significant investments in R&D to create coatings that comply with stringent environmental regulations, especially regarding volatile organic compound (VOC) emissions.

- Dominant regions in this market include the United States and Canada. The United States dominates due to its large-scale infrastructure projects, residential housing demand, and a robust automotive industry. Additionally, the rising focus on sustainability and energy-efficient building materials, coupled with government incentives for green building certifications like LEED, has further solidified its leading position.

- Recycling programs for paints, such as PaintCare, have expanded in North America, promoting the proper disposal and recycling of unused paints. PaintCare just announced through its latest annual report that in 2023 the organization collected 807,872 gallons of leftover paint from households and businesses in Colorado, further driving the use of environmentally responsible products.

North America Paints and Coatings Market Segmentation

By Product Type: The North America Paints and Coatings market is segmented by product type into architectural coatings, industrial coatings, automotive coatings, and marine coatings. Architectural coatings hold a dominant market share due to increased construction activities in the residential and commercial sectors. These coatings are widely used for interior and exterior applications, with a focus on aesthetics and protection. The rise in home renovation trends, especially the DIY market, has boosted demand for decorative coatings, making this segment a key driver in the overall market.

By Formulation: The market is also segmented by formulation type into waterborne coatings, solventborne coatings, powder coatings, and UV-cured coatings. Waterborne coatings dominate this segment due to their low environmental impact and compliance with VOC regulations. The trend toward sustainability has pushed manufacturers and consumers to adopt waterborne formulations over traditional solventborne options. Moreover, technological advancements have improved the performance and durability of waterborne coatings, making them suitable for a variety of applications, from residential to automotive.

North America Paints and Coatings Market Competitive Landscape

The North America Paints and Coatings market is dominated by a few major players that have a strong presence both regionally and globally. These companies are focusing on product innovation, mergers and acquisitions, and expanding their sustainability initiatives to maintain their competitive edge. The markets consolidation highlights the significant influence of key players such as Sherwin-Williams, PPG Industries, and AkzoNobel.

|

Company Name |

Establishment Year |

Headquarters |

Key Products |

Revenue (USD Bn) |

Number of Employees |

Market Strategy |

Sustainability Initiatives |

Geographical Presence |

|

Sherwin-Williams |

1866 |

Cleveland, USA |

||||||

|

PPG Industries |

1883 |

Pittsburgh, USA |

||||||

|

AkzoNobel |

1792 |

Amsterdam, Netherlands |

||||||

|

RPM International |

1947 |

Medina, USA |

||||||

|

Axalta Coating Systems |

1866 |

Philadelphia, USA |

North America Paints and Coatings Industry Analysis

Growth Drivers

- Construction Boom (residential, commercial, and infrastructure projects): The North American construction sector has experienced significant growth in both residential and commercial projects, which has directly impacted the paints and coatings market. The U.S. Census Bureau reported that total construction spending reached $1.94 trillion ($1,938.4 billion) in 2023, driven by an uptick in both public and private construction activities. Infrastructure development projects, especially in Canada, also contributed to heightened demand for paints and coatings in civil engineering projects like bridges and tunnels.

- Increasing Demand for Eco-Friendly and Low-VOC Paints: As environmental concerns rise, there has been growing demand for eco-friendly and low-VOC (volatile organic compound) paints. The U.S. Environmental Protection Agency (EPA) regulations have significantly reduced the allowable limits of VOC emissions, pushing manufacturers to develop and market environmentally responsible products. For instance, low-VOC paints typically contain fewer than 250 grams per liter, while zero-VOC paints contain less than 5 grams per liter of VOCs.

- Growth in the Automotive Industry (automotive coatings): Automotive coatings play a crucial role in enhancing vehicle durability and appearance. With rising production in both traditional and electric vehicles, demand for specialized coatings has increased. These coatings provide protection from environmental factors while offering aesthetic customization. As manufacturers focus on improving vehicle quality and sustainability, the need for advanced automotive coatings continues to grow across the North American market.

Market Challenges

- High Raw Material Costs (pigments, resins, solvents): The North American paints and coatings market faces significant challenges due to the rising costs of raw materials such as pigments, resins, and solvents. Increased demand, supply chain disruptions, and fluctuating oil prices have all contributed to higher production costs for manufacturers. These factors affect profit margins and create pressure on companies to manage pricing and supply efficiency, making cost management a central concern for the industry.

- Stringent Environmental Regulations (EPA VOC regulations): Stringent environmental regulations, particularly around VOC emissions, present ongoing challenges for the paints and coatings industry. The EPA enforces strict limits on VOC content, requiring manufacturers to reformulate products to meet these standards. This regulatory pressure drives up production costs and necessitates ongoing research and development to create compliant, eco-friendly alternatives, making regulatory compliance a significant hurdle for the market.

North America Paints and Coatings Market Future Outlook

The North America Paints and Coatings market is expected to witness steady growth over the coming years, driven by increasing demand for sustainable products, advancements in coating technologies, and rising infrastructure investments across the region. The trend toward environmentally friendly coatings, such as waterborne and powder formulations, is likely to continue gaining momentum, especially as regulatory pressures on VOC emissions intensify.

Market Opportunities

- Rise in Nanotechnology-Based Coatings: Nanotechnology-based coatings are gaining momentum in the North American paints and coatings market. These coatings use nanoparticles to enhance properties such as durability, UV resistance, and antimicrobial features, making them ideal for various applications. Industries like construction and healthcare are increasingly adopting these advanced coatings due to their superior performance, positioning nanotechnology-based coatings as a promising innovation in the market.

- Growth in Industrial Coatings Due to Manufacturing Expansion: The expansion of the manufacturing sector in North America is driving increased demand for industrial coatings. These coatings offer essential protection for machinery, equipment, and infrastructure by providing corrosion resistance and heat tolerance. As manufacturing plants modernize and expand, the need for durable and protective coatings continues to grow, making industrial coatings a key area of market opportunity.

Scope of the Report

|

Product Type |

Architectural Coatings Industrial Coatings Automotive Coatings Specialty Coatings Marine Coatings |

|

Formulation |

Waterborne Solventborne Powder Coatings UV-Cured Coatings |

|

Resin Type |

Acrylic Alkyd Epoxy Polyurethane |

|

Polyester |

|

|

Application |

Residential Commercial Industrial Automotive Marine |

|

Geography |

United States Canada Mexico |

Products

Key Target Audience

Paint and Coating Manufacturers

Industrial Coating

Automotive Manufacturers

Residential Construction Firms

Government and Regulatory Bodies (Environmental Protection Agency, Department of Energy)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Sherwin-Williams

PPG Industries

AkzoNobel

RPM International

Axalta Coating Systems

Nippon Paint Holdings

BASF Coatings

Valspar

Behr Process Corporation

Benjamin Moore & Co.

Table of Contents

1. North America Paints and Coatings Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (based on key drivers such as industrial demand, residential expansion, and eco-friendly initiatives)

1.4. Market Segmentation Overview

2. North America Paints and Coatings Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (e.g., regulatory changes, technological advancements, and market consolidation)

3. North America Paints and Coatings Market Analysis

3.1. Growth Drivers

3.1.1. Construction Boom (residential, commercial, and infrastructure projects)

3.1.2. Increasing Demand for Eco-Friendly and Low-VOC Paints

3.1.3. Growth in the Automotive Industry (automotive coatings)

3.1.4. Growing Consumer Preferences for Decorative Coatings (customized home interiors)

3.2. Market Challenges

3.2.1. High Raw Material Costs (pigments, resins, solvents)

3.2.2. Stringent Environmental Regulations (EPA VOC regulations)

3.2.3. Competition from Substitute Products (wallpapers, laminated panels)

3.3. Opportunities

3.3.1. Rise in Nanotechnology-Based Coatings

3.3.2. Growth in Industrial Coatings Due to Manufacturing Expansion

3.3.3. Expansion into Sustainable Coatings

3.4. Trends

3.4.1. Adoption of Waterborne Coatings

3.4.2. Growing Demand for Anti-Corrosive and Fire-Resistant Coatings

3.4.3. Increase in DIY (Do-It-Yourself) Painting Trends

3.5. Government Regulations

3.5.1. VOC Content Regulations (EPA standards)

3.5.2. Policies Supporting Green Building Certifications (LEED, ENERGY STAR)

3.5.3. Recycling Programs and Sustainability Initiatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. North America Paints and Coatings Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Architectural Coatings

4.1.2. Industrial Coatings

4.1.3. Automotive Coatings

4.1.4. Specialty Coatings

4.1.5. Marine Coatings

4.2. By Formulation (In Value %)

4.2.1. Waterborne

4.2.2. Solventborne

4.2.3. Powder Coatings

4.2.4. UV-Cured Coatings

4.3. By Resin Type (In Value %)

4.3.1. Acrylic

4.3.2. Alkyd

4.3.3. Epoxy

4.3.4. Polyurethane

4.3.5. Polyester

4.4. By Application (In Value %)

4.4.1. Residential

4.4.2. Commercial

4.4.3. Industrial

4.4.4. Automotive

4.4.5. Marine

4.5. By Geography (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Paints and Coatings Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors (Cross-Comparison Parameters: Revenue, Market Share, Geographical Presence, Key Products)

5.1.1. Sherwin-Williams

5.1.2. PPG Industries

5.1.3. AkzoNobel

5.1.4. BASF Coatings

5.1.5. RPM International

5.1.6. Axalta Coating Systems

5.1.7. Nippon Paint Holdings

5.1.8. Behr Process Corporation

5.1.9. Valspar

5.1.10. Benjamin Moore & Co.

5.1.11. Jotun

5.1.12. Hempel

5.1.13. Dunn-Edwards

5.1.14. Kansai Paint Co.

5.1.15. Sika AG

5.2. Cross Comparison Parameters (Revenue, Geographical Reach, Key Products, Innovation Initiatives, Sustainability Measures, Manufacturing Capacity, Key Markets Served, No. of Employees)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Joint Ventures, Partnerships, New Product Launches, R&D Investments)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Private Equity, Institutional Investors, Strategic Investments)

5.7. Venture Capital Funding

5.8. Government Grants and Incentives

5.9. Sustainability Initiatives (Circular Economy Programs, Recycling Initiatives)

6. North America Paints and Coatings Market Regulatory Framework

6.1. VOC Regulations

6.2. Compliance Standards (EPA, LEED Certification, Energy Efficiency Guidelines)

6.3. Certification Processes (GreenGuard, EcoLabel Certifications)

7. North America Paints and Coatings Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Paints and Coatings Future Market Segmentation

8.1. By Product Type

8.2. By Formulation

8.3. By Resin Type

8.4. By Application

8.5. By Geography

9. North America Paints and Coatings Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (Segmentation by User Type: Professional Painters vs. DIY Consumers)

9.3. Marketing Initiatives (E-commerce, Digital Strategies, Distribution Channel Optimization)

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the entire Paints and Coatings ecosystem in North America. Extensive desk research is conducted, relying on secondary and proprietary databases to gather data on the key drivers, challenges, and opportunities in the market.

Step 2: Market Analysis and Construction

In this phase, we analyze historical data, focusing on market penetration, sales channels, and revenue generation within the paints and coatings industry. We assess the relationship between suppliers and consumers and how market dynamics influence growth.

Step 3: Hypothesis Validation and Expert Consultation

Through CATIs with industry experts, including manufacturers and distributors, we validate key market hypotheses and refine our data. These insights provide an accurate depiction of current market trends and future outlook.

Step 4: Research Synthesis and Final Output

Finally, we engage with key players in the paints and coatings industry to gather further insights into product demand, technological advancements, and market opportunities. This data is combined with our primary research findings to deliver a comprehensive market report.

Frequently Asked Questions

01. How big is the North America Paints and Coatings Market?

The North America Paints and Coatings market is valued at 43,283 billion, driven by demand in the residential and industrial construction sectors, as well as advancements in sustainable coatings.

02. What are the challenges in the North America Paints and Coatings Market?

Key challenges in North America Paints and Coatings market include stringent VOC regulations, fluctuating raw material costs, and competition from alternative materials like wallpapers and laminated panels.

03. Who are the major players in the North America Paints and Coatings Market?

Major players in North America Paints and Coatings market include Sherwin-Williams, PPG Industries, AkzoNobel, RPM International, and Axalta Coating Systems. These companies dominate due to their strong R&D capabilities and extensive market presence.

04. What are the growth drivers of the North America Paints and Coatings Market?

The North America Paints and Coatings market g rowth is driven by increasing demand for eco-friendly and durable coatings, rising infrastructure investments, and advancements in automotive coatings technology.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.