North America Paracetamol Market Outlook to 2030

Region:North America

Author(s):Shubham Kashyap

Product Code:KROD6063

November 2024

95

About the Report

North America Paracetamol Market Overview

- The North America Paracetamol Market is valued at USD 730 million, based on a five-year historical analysis. This growth is driven by increased consumer demand for effective and accessible pain and fever relief options, alongside strong support from healthcare providers. Widespread use as an over-the-counter medication has positioned paracetamol as a first-line remedy for various common ailments, which contributes significantly to market expansion across retail, pharmacy, and e-commerce channels.

- The United States leads the North America Paracetamol Market, driven by an established healthcare system, extensive distribution networks, and high demand for over-the-counter medications. Key urban centers like New York, Los Angeles, and Chicago serve as major consumption hubs, attributed to high population densities and strong access to healthcare facilities. Canada also shows substantial demand due to its regulatory support for OTC medications and growing consumer awareness of paracetamols effectiveness in pain management.

- Paracetamol products are regulated by stringent FDA standards, which mandate comprehensive safety and efficacy data before approval. In 2024, the FDA increased oversight on labeling accuracy for paracetamol products, with more than 50 products audited for compliance with safety standards. These regulations emphasize consumer safety, impacting the market by ensuring that products meet strict quality requirements.

North America Paracetamol Market Segmentation

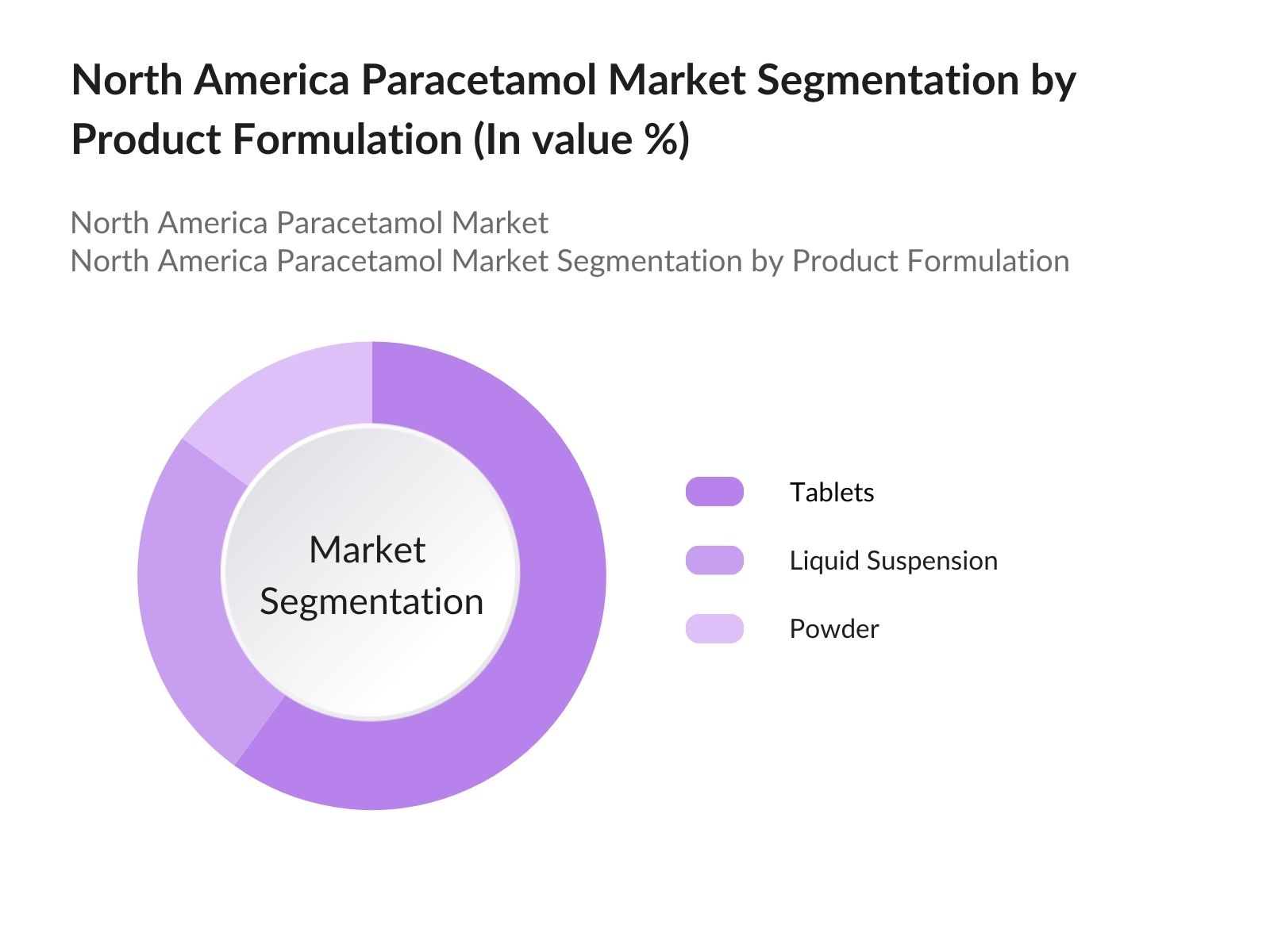

- By Product Formulation: The market is segmented by product formulation into tablets, liquid suspension, and powder. Among these, tablets hold a dominant market share, primarily due to convenience and standardized dosing options. The tablet formulation's ease of storage, distribution, and widespread availability across pharmacy chains and retail outlets make it the preferred choice among consumers. Healthcare providers also favor tablets for consistent dosing accuracy, adding to their market prominence.

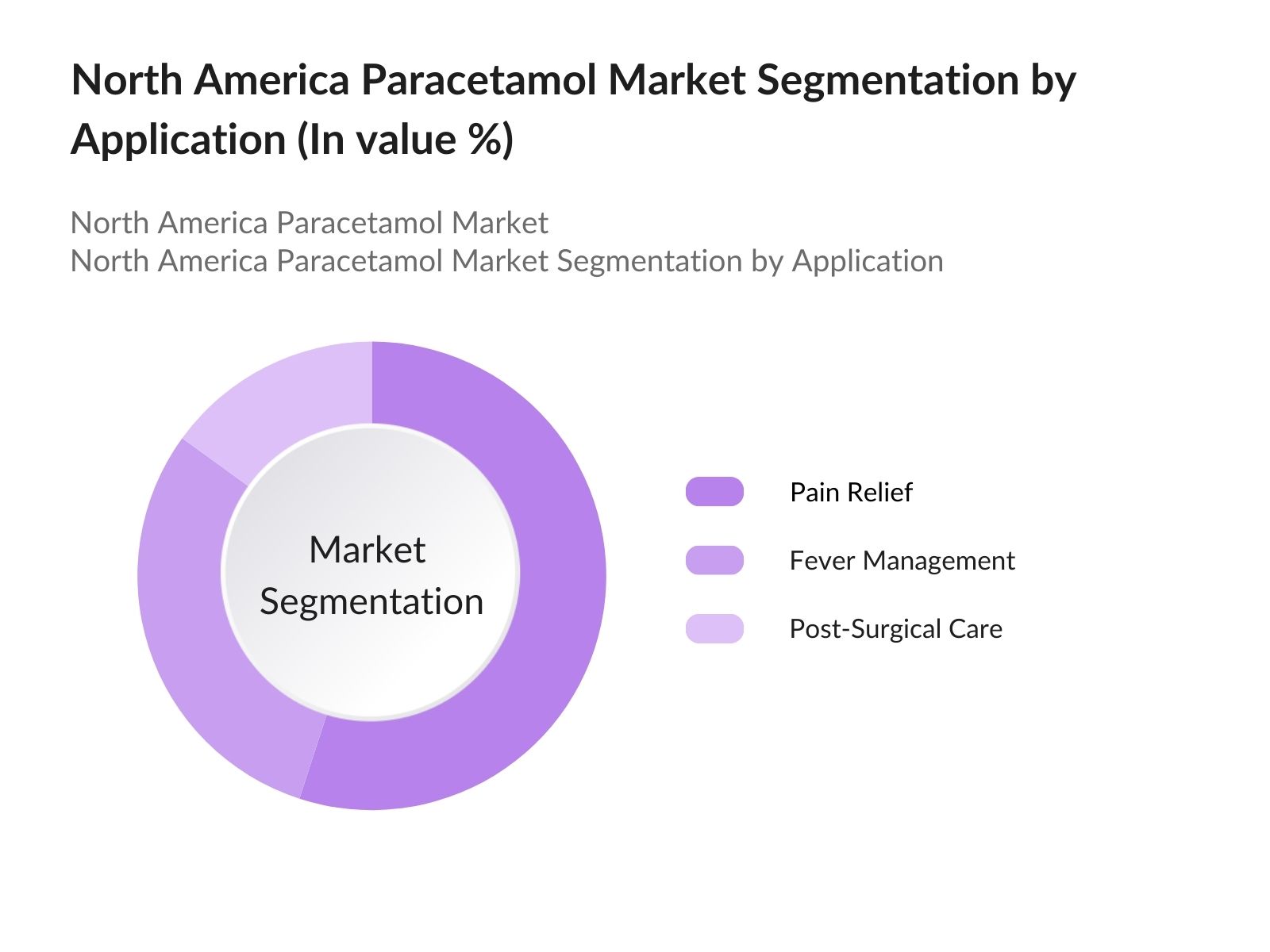

- By Application: The market is segmented by application into pain relief, fever management, and post-surgical care. The pain relief application holds a significant share due to paracetamols trusted status as an effective analgesic. Its widespread use for managing minor to moderate pain, coupled with physician recommendations, reinforces its dominant position. Additionally, the convenience and safety profile of paracetamol as a pain relief option have solidified its usage across diverse age groups, supporting growth in this segment.

North America Paracetamol Market Competitive Landscape

The North America Paracetamol Market is led by established pharmaceutical companies that capitalize on brand recognition, distribution networks, and extensive OTC portfolios. Companies like Johnson & Johnson and GlaxoSmithKline maintain a strong presence in the market, with robust production capabilities and direct-to-consumer channels.

North America Paracetamol Market Analysis

Growth Drivers

- Increasing Prevalence of Fever and Pain Disorders: With an increasing prevalence of fever and pain disorders in North America, paracetamol has become a commonly used medication for symptom relief. According to data from the Centers for Disease Control and Prevention (CDC), 13 million Americans reported significant pain issues in 2023, amplifying demand for over-the-counter analgesics like paracetamol. Fever prevalence also rose due to influenza and respiratory viruses, leading to an elevated need for paracetamol-based treatments for effective fever management. Paracetamol's adoption has grown significantly as a direct response to these statistics, making it essential in the OTC category.

- Demand Surge for Over-the-Counter (OTC) Medications: In 2024, the North American OTC medication market witnessed substantial growth, driven by increased public awareness and demand for readily accessible treatments like paracetamol. Government data from the U.S. National Health Interview Survey indicates that around millions of Americans aged 20+ used OTC medications for pain relief. The ease of access to paracetamol across drug stores, combined with regulatory support for OTC distribution, makes it a primary choice among consumers. The high usage rate highlights the public's reliance on these accessible solutions for daily pain management.

- Rising Adoption in Pain Management: Paracetamol has gained traction as a primary analgesic due to its efficacy and safety in pain management, particularly for those with chronic pain conditions. In 2023, millions of people in North America managed arthritis-related pain with OTC medications, predominantly paracetamol, according to the Arthritis Foundation's report. Paracetamols tolerability among users with varying pain thresholds, particularly among the elderly, has strengthened its role in pain management. This widespread adoption illustrates the critical role of paracetamol in non-prescription pain relief.

Market Challenges

- Concerns over Liver Toxicity: Liver toxicity risks associated with excessive paracetamol use have led to numerous public health advisories, creating a cautious approach among consumers and healthcare providers. Regulatory warnings emphasize the dangers of overuse, which has shaped both consumer perception and prescribing practices, presenting significant challenges for the market. This concern over safety has become a barrier for market expansion, with a strong focus on educating the public on safe dosage guidelines.

- Stringent Regulatory Approval Processes: The FDA enforces strict regulations on paracetamol products in North America, requiring rigorous safety and efficacy testing prior to market entry. This regulatory landscape presents challenges for manufacturers who must adhere to stringent compliance standards, resulting in lengthy approval timelines. These regulatory requirements, while ensuring product safety, can hinder market growth by delaying new product rollouts and increasing development costs for manufacturers seeking approval.

North America Paracetamol Market Future Outlook

The North America Paracetamol Market is anticipated to grow steadily for next five year, driven by the rising demand for OTC medications, advancements in pharmaceutical manufacturing, and the continued prevalence of self-medication practices. Innovations in product formulations, including extended-release options and child-safe packaging, are expected to enhance consumer accessibility. Additionally, e-commerce is set to play a larger role in distribution, broadening access to paracetamol products across urban and rural areas alike.

Future Market Opportunities

- Product Innovations Extended-Release Paracetamol): Pharmaceutical companies are focusing on innovations such as extended-release formulations to improve patient compliance. In 2024, thousands of new prescriptions for advanced paracetamol formulations were issued, indicating a positive response to these products. Extended-release versions offer prolonged pain relief, meeting patient demand for convenient, less frequent dosing, which enhances the appeal of paracetamol in chronic pain management.

- Expansion of Online Retail Channels: E-commerce channels have expanded rapidly, with online OTC sales accounting for 15 million transactions for paracetamol products in North America in 2023, per the U.S. Department of Commerce. The shift toward digital platforms facilitates broader access and convenience, especially for consumers in rural or underserved areas, and allows companies to offer competitive pricing. This trend reflects a strong opportunity for market growth through online channels, especially as digital healthcare services continue to rise.

Scope of the Report

|

By Product Formulation |

Tablets Liquid Suspension Powder |

|

By Application |

Pain Relief Fever Management Post-Surgical Care |

|

By Distribution Channel |

Hospital Pharmacies -Retail Pharmacies Online Pharmacies |

|

By End-User |

Hospitals Household Clinics |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience

Pharmaceutical Manufacturers

Government and Regulatory Bodies (U.S. Food and Drug Administration)

Hospitals and Healthcare Institutions

Retail Pharmacy Chains

Investors and Venture Capitalist Firms

Banks and Financial Institutions

E-commerce Platforms

Distribution and Wholesale Partners

Companies

Players Mentioned in the Report

Johnson & Johnson

GlaxoSmithKline plc

Sanofi

Bayer AG

Teva Pharmaceutical Industries Ltd.

Procter & Gamble Co.

Novartis AG

Pfizer Inc.

Amneal Pharmaceuticals

Sun Pharmaceutical Industries Ltd.

Hikma Pharmaceuticals PLC

Endo Pharmaceuticals Inc.

Perrigo Company plc

Lannett Company, Inc.

Bristol-Myers Squibb

Table of Contents

1. North America Paracetamol Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Paracetamol Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Paracetamol Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Prevalence of Fever and Pain Disorders

3.1.2. Demand Surge for Over-the-Counter (OTC) Medications

3.1.3. Rising Adoption in Pain Management

3.1.4. Expanding Geriatric Population

3.2. Market Challenges

3.2.1. Concerns over Liver Toxicity

3.2.2. Stringent Regulatory Approval Processes

3.2.3. Competition from Alternative Analgesics

3.3. Opportunities

3.3.1. Product Innovations (e.g., Extended-Release Paracetamol)

3.3.2. Expansion of Online Retail Channels

3.3.3. Partnerships with Healthcare Providers

3.4. Trends

3.4.1. Shift Toward Self-Medication

3.4.2. Increased Use of Paracetamol in Post-Surgery Recovery

3.4.3. Rise of Telemedicine-Driven Prescriptions

3.5. Government Regulation

3.5.1. FDA Standards and Compliance Requirements

3.5.2. Drug Labeling and Safety Warnings

3.5.3. Import-Export Restrictions

3.5.4. Substance Control and Prescription Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. North America Paracetamol Market Segmentation

4.1. By Product Formulation (In Value %)

4.1.1. Tablets

4.1.2. Liquid Suspension

4.1.3. Powder

4.2. By Application (In Value %)

4.2.1. Pain Relief

4.2.2. Fever Management

4.2.3. Post-Surgical Care

4.3. By Distribution Channel (In Value %)

4.3.1. Hospital Pharmacies

4.3.2. Retail Pharmacies

4.3.3. Online Pharmacies

4.4. By End-User (In Value %)

4.4.1. Hospitals

4.4.2. Household

4.4.3. Clinics

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Paracetamol Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Johnson & Johnson

5.1.2. GlaxoSmithKline plc

5.1.3. Sanofi

5.1.4. Bayer AG

5.1.5. Procter & Gamble Co.

5.1.6. Teva Pharmaceutical Industries Ltd.

5.1.7. Perrigo Company plc

5.1.8. Bristol-Myers Squibb

5.1.9. Novartis AG

5.1.10. Pfizer Inc.

5.1.11. Amneal Pharmaceuticals

5.1.12. Sun Pharmaceutical Industries Ltd.

5.1.13. Hikma Pharmaceuticals PLC

5.1.14. Endo Pharmaceuticals Inc.

5.1.15. Lannett Company, Inc.

5.2. Cross Comparison Parameters (Revenue, Market Position, Product Range, Manufacturing Capacity, Geographic Presence, Partnerships, R&D Investments, Employee Strength)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Paracetamol Market Regulatory Framework

6.1. Drug Approval Processes

6.2. Compliance Requirements

6.3. Certification Processes

7. North America Paracetamol Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Paracetamol Future Market Segmentation

8.1. By Product Formulation (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. North America Paracetamol Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step involves mapping all major stakeholders in the North America Paracetamol Market ecosystem. Extensive desk research with secondary data sources is used to establish critical variables influencing the market, including consumer behavior and regulatory impacts.

Step 2: Market Analysis and Construction

This phase involves analyzing historical data and trends in the North America Paracetamol Market. Key metrics, such as product distribution and sales channels, are assessed to build a reliable revenue forecast, focusing on accuracy and data integrity.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through expert interviews and consultations with pharmacists, industry practitioners, and healthcare providers. Insights gathered in this phase aid in refining the market outlook and adjusting data projections based on real-world insights.

Step 4: Research Synthesis and Final Output

In this phase, the synthesized research data from industry consultations are integrated into a final report. This ensures a comprehensive, validated outlook on the North America Paracetamol Market, delivering a robust analysis for stakeholders.

Frequently Asked Questions

01. How big is the North America Paracetamol Market?

The North America Paracetamol Market is valued at USD 730 million, driven by extensive demand for OTC pain and fever management solutions across pharmacies and retail stores.

02. What are the challenges in the North America Paracetamol Market?

Challenges include regulatory restrictions on dosage limits and fluctuations in raw material prices, which impact manufacturing costs and consumer pricing.

03. Who are the major players in the North America Paracetamol Market?

Key players include Johnson & Johnson, GlaxoSmithKline, Sanofi, Bayer, and Teva Pharmaceutical, known for their expansive distribution networks and established OTC portfolios.

04. What drives growth in the North America Paracetamol Market?

Growth is driven by strong consumer demand for pain and fever relief, regulatory support for OTC medications, and the widespread recommendation of paracetamol by healthcare providers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.