North America Passive Optical Network (PON) Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD7772

December 2024

100

About the Report

North America Passive Optical Network (PON) Market Overview

- The North America Passive Optical Network (PON) market, currently valued at USD 3.5 billion, is driven by the increasing demand for high-speed internet connectivity, spurred by advancements in fiber-optic technology and the expansion of broadband access initiatives. These factors enhance data transmission capacities across multiple sectors, particularly in residential and commercial settings. Continuous investment in fiber-to-the-home (FTTH) deployments and the rise of 5G network integrations are pivotal, supporting the robust growth of PON systems as reliable, cost-efficient, and scalable alternatives to traditional network infrastructures.

- The United States leads in the North America PON market, primarily due to extensive fiber infrastructure and significant investment in network upgrades. Cities such as New York, San Francisco, and Seattle have embraced PON technologies to support high-density urban areas with high-speed connectivity, as demand from both businesses and consumers continues to grow. Additionally, Canada's major urban centers, including Toronto and Vancouver, are expanding fiber-to-the-premises (FTTP) projects, driven by government funding and public-private partnerships aimed at enhancing rural and urban connectivity alike.

- The Infrastructure Investment and Jobs Act in the U.S. allocated $65 billion for broadband expansion, prioritizing rural and underserved communities. This funding aims to bring fiber-optic connections to millions, supporting the deployment of passive optical networks. Such federal investment provides an economic foundation for expanding the PON market, targeting areas lacking robust connectivity.

North America Passive Optical Network (PON) Market Segmentation

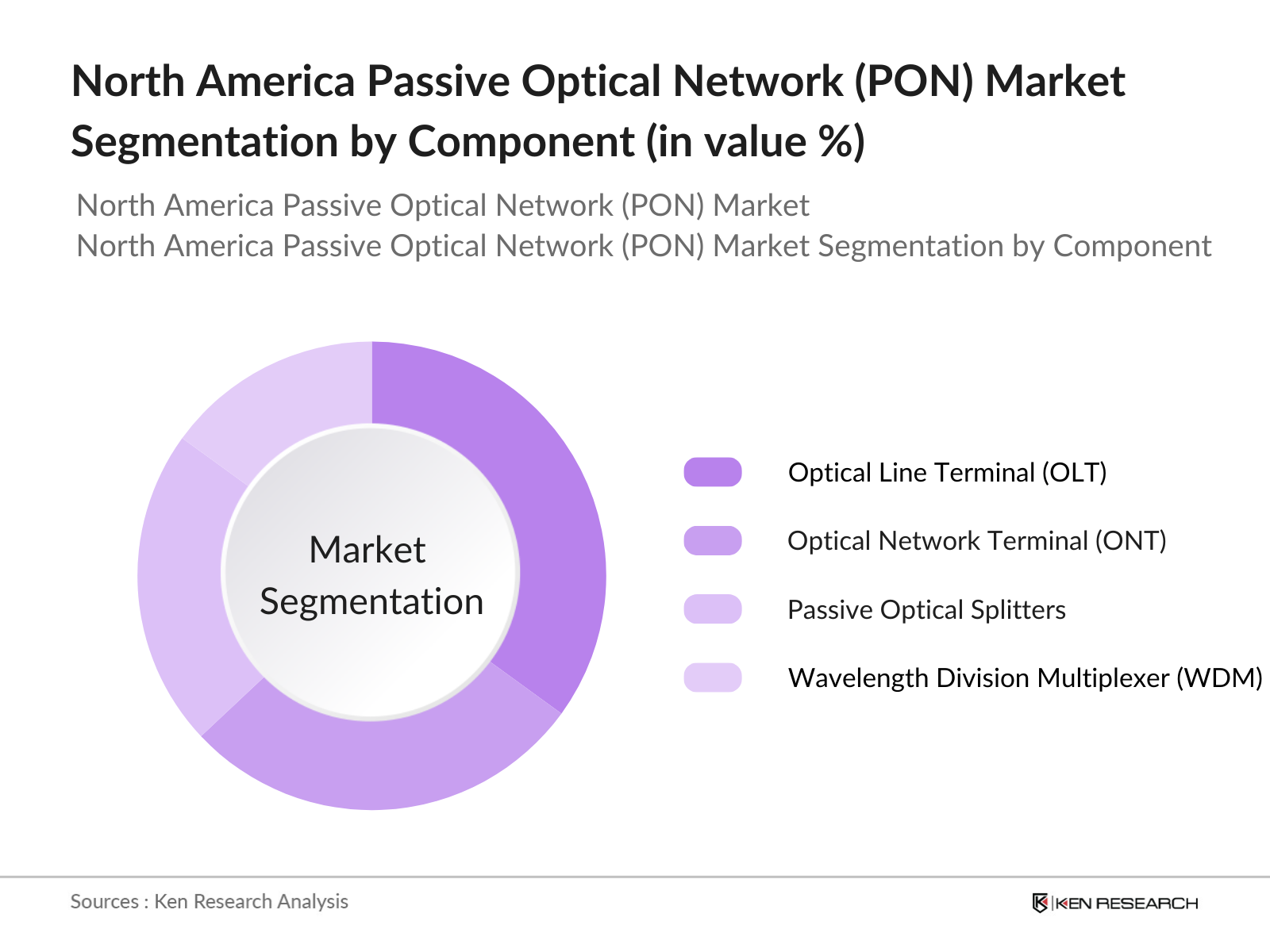

By Component: The market is segmented by component into Optical Line Terminal (OLT), Optical Network Terminal (ONT), Passive Optical Splitters, and Wavelength Division Multiplexer (WDM). Recently, Optical Line Terminals (OLTs) hold a dominant market share within this segmentation due to their critical role in managing data distribution across passive optical networks. OLTs are essential for ensuring efficient downstream and upstream data transmission between the providers network and multiple end-users, making them highly valuable in regions with growing demand for high-speed broadband services.

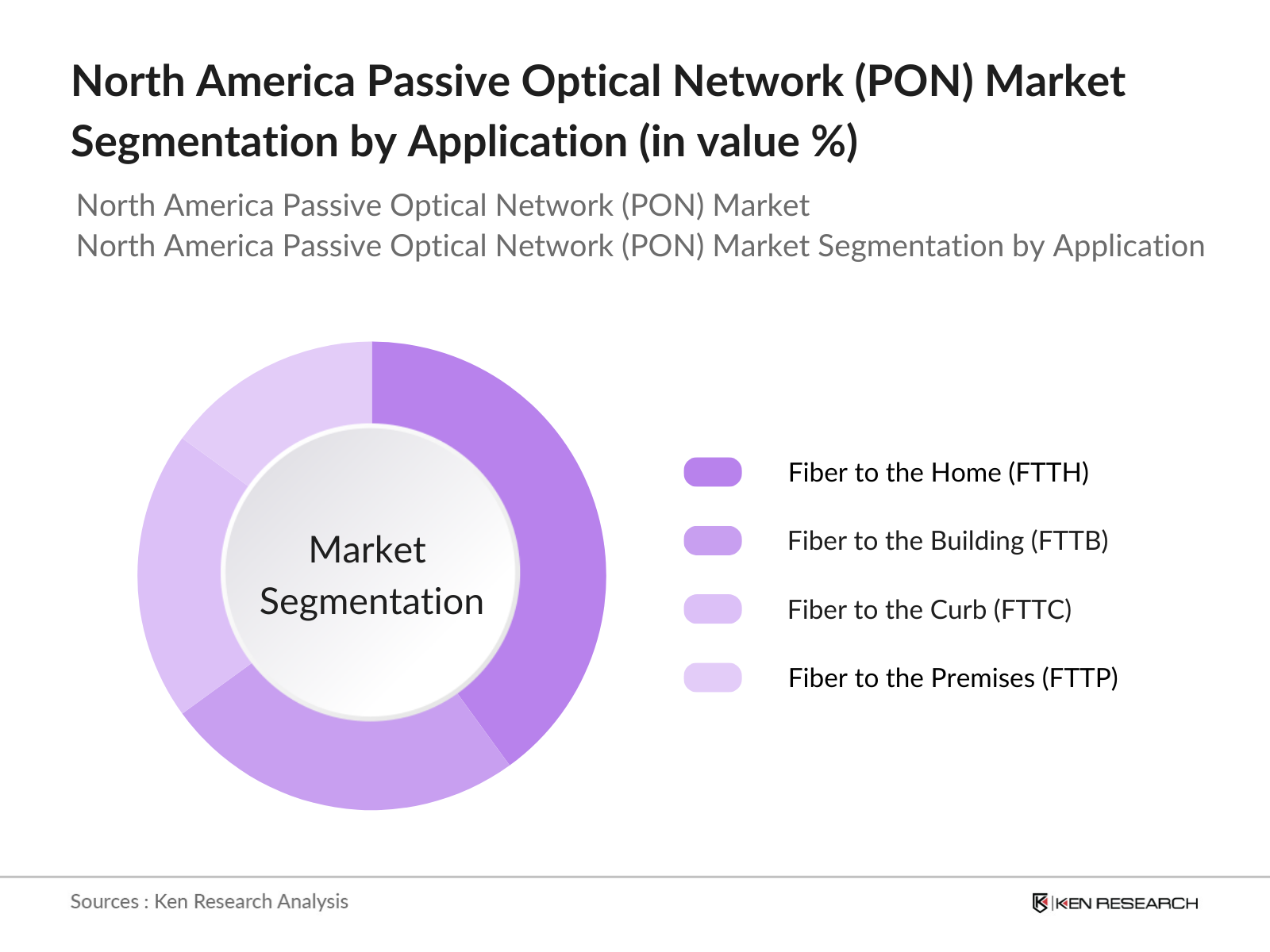

By Application: The market is further segmented by application into Fiber to the Home (FTTH), Fiber to the Building (FTTB), Fiber to the Curb (FTTC), and Fiber to the Premises (FTTP). FTTH currently dominates this segment, largely due to the increasing consumer demand for high-speed internet in residential areas. FTTH provides dedicated fiber connectivity to individual households, ensuring high data speeds, which aligns with the needs of consumers for online streaming, gaming, and remote work. This preference is fueled by continuous investments in residential broadband infrastructure.

North America Passive Optical Network (PON) Market Competitive Landscape

The North America PON market is characterized by the presence of both global and regional players, with major contributions from established technology firms. These players drive innovation through extensive research and development, focusing on enhancing the quality and scalability of PON systems. The dominance of these players highlights the competitive nature of the market, where companies invest in new product launches and technological advancements to secure a leading position.

|

Company Name |

Establishment Year |

Headquarters |

Revenue |

Employee Count |

Key Product |

PON Technology Focus |

Patent Portfolio |

Partnerships |

Regional Presence |

|

ADTRAN, Inc. |

1985 |

Huntsville, AL |

|||||||

|

Calix, Inc. |

1999 |

San Jose, CA |

|||||||

|

ZTE Corporation |

1985 |

Shenzhen, China |

|||||||

|

Huawei Technologies Co. |

1987 |

Shenzhen, China |

|||||||

|

Nokia Corporation |

1865 |

Espoo, Finland |

North America Passive Optical Network (PON) Industry Analysis

Growth Drivers

- Increased Demand for High-Speed Internet: The demand for high-speed internet has surged across North America, driven by increased digital activities, remote work, and digital services requiring enhanced bandwidth. In 2023, internet speeds in the U.S. averaged 227.15 Mbps for fixed broadband and 89.8 Mbps for mobile, a 15% increase over 2022 to support connectivity needs in urban and rural areas. This rise in internet speed is accompanied by government efforts to close the digital divide, such as the U.S. FCCs $65 billion allocation under the Infrastructure Investment and Jobs Act to boost broadband access nationwide.

- Rise of Cloud-Based Solutions: Cloud-based solutions have become essential in North America, fueling the need for faster, more reliable optical networks. Reports in 2024 indicate over 94% of enterprises have adopted cloud services for data storage and business processes, driven by security and scalability requirements. This trend supports the adoption of passive optical networks (PONs), which offer reliable data transfer rates essential for cloud computing demands. North Americas data center capacity reached 230 MW in 2023, underscoring the infrastructure required to maintain rapid data handling.

- Government Initiatives for Network Expansion: To address connectivity gaps, North American governments have invested heavily in network expansion initiatives. The U.S. governments Rural Digital Opportunity Fund earmarked $20 billion to provide broadband infrastructure in underserved areas by 2023, while Canada's Universal Broadband Fund allocated $2.75 billion to ensure broadband for rural areas. These programs aim to establish comprehensive network coverage and strengthen the passive optical network (PON) industry, particularly in regions lacking high-speed connectivity options.

Market Challenges

- High Initial Infrastructure Cost: Although PONs offer cost efficiency in the long run, the initial infrastructure investment remains high, with estimated deployment costs per kilometer reaching $35,000 in urban areas, and rising in rural, sparsely populated regions. According to the Federal Communications Commission, these costs hinder rapid deployment in low-density areas. Additionally, securing funding for extensive deployment often involves government grants and private investments, increasing the projects complexity and timeline.

- Limited Skilled Workforce: The PON industry requires a skilled workforce for installation and maintenance, yet North America has experienced a labor shortage in technical fields. In 2023, the U.S. Department of Labor reported approximately 40,000 unfilled roles for fiber-optic technicians, impacting service quality and slowing PON deployment. With fiber-optic networks continuing to expand, training initiatives and specialized technical education programs are required to mitigate workforce shortages.

North America Passive Optical Network (PON) Market Future Outlook

The North America PON market is poised for considerable growth, driven by factors such as the ongoing expansion of fiber networks, advancements in data transmission technology, and the increasing shift towards high-speed broadband access. Continuous government investments, particularly in rural and underserved areas, and public-private partnerships are expected to further support market expansion. Additionally, innovations in wavelength division multiplexing (WDM) and next-generation PON technologies will likely transform data handling capabilities and speed.

Future Market Opportunities

- Expansion in Rural and Underserved Areas: Rural areas in North America present significant growth opportunities for PON providers. Approximately 19 million Americans lacked broadband access as of 2023, according to FCC data, highlighting a gap PONs can bridge through efficient, low-maintenance networks. In Canada, similar connectivity gaps exist, with government programs like the Universal Broadband Fund aiming to provide full coverage by 2030, suggesting a growing demand for PON technologies in underserved regions.

- 5G Network Integrations: 5G networks rely heavily on fiber-optic connections for backhaul infrastructure, positioning PONs as a crucial element in 5G rollouts. North America saw a 14% increase in 5G subscriptions in 2023, indicating a rising need for fiber-based infrastructure to support ultra-fast data transmission. The PON market can leverage this trend by enabling faster, cost-effective deployment in tandem with 5G rollouts, especially in densely populated urban centers.

Scope of the Report

|

Component |

Optical Line Terminal (OLT) Optical Network Terminal (ONT) Passive Optical Splitters Wavelength Division Multiplexer (WDM) |

|

Structure Type |

Gigabit Passive Optical Network (GPON) Ethernet Passive Optical Network (EPON) Wavelength Division Multiplexed-PON (WDM-PON) |

|

Service |

Data Transmission Services Video Transmission Services Voice Transmission Services |

|

Application |

Fiber to the Home (FTTH) Fiber to the Building (FTTB) Fiber to the Curb (FTTC) Fiber to the Premises (FTTP) |

|

End-User |

Residential Commercial Industrial |

Products

Key Target Audience

Telecommunication Service Providers

Broadband Infrastructure Developers

Network Equipment Manufacturers

Fiber Optics Component Suppliers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Federal Communications Commission (FCC), Canadian Radio-television and Telecommunications Commission (CRTC))

Residential Internet Service Providers

Smart City Project Developers

Companies

Major Players

ADTRAN, Inc.

Calix, Inc.

ZTE Corporation

Huawei Technologies Co., Ltd.

Nokia Corporation

Cisco Systems, Inc.

Mitsubishi Electric Corporation

Ericsson AB

Tellabs, Inc.

Dasan Zhone Solutions, Inc.

Corning Incorporated

Fujitsu Limited

Sumitomo Electric Networks, Inc.

NEC Corporation

FiberHome Networks Co., Ltd.

Table of Contents

North America Passive Optical Network Market Overview

Definition and Scope

Market Taxonomy

Value Chain Analysis

Market Dynamics Overview

North America Passive Optical Network Market Size (In USD Mn)

Historical Market Size

Market Growth Analysis

Key Developments and Technological Advancements

North America Passive Optical Network Market Dynamics

Market Drivers

Increased Demand for High-Bandwidth Applications

Rising Adoption of Fiber to the Home (FTTH)

Growth of Cloud-Based Services

Enhanced Government Initiatives for Network Infrastructure

Market Challenges

High Capital Expenditure

Challenges in Network Security and Management

Limited Skilled Workforce in Fiber Technology

Opportunities

Expansion of 5G Infrastructure

Integration with Smart City Initiatives

Strategic Collaborations and Partnerships

Trends

Adoption of Software-Defined Networking (SDN)

Growth in GPON (Gigabit Passive Optical Networks)

Increased Deployment in Commercial and Enterprise Sectors

North America Passive Optical Network Market Regulatory Landscape

Federal and Regional Regulations

Compliance Requirements

Environmental Impact Standards

Certification Processes

North America Passive Optical Network Market Segmentation

5.1 By Component (In Value %)

5.1.1 Optical Line Terminal (OLT)

5.1.2 Optical Network Terminal (ONT)

5.1.3 Passive Optical Splitters

5.1.4 Wavelength Division Multiplexer (WDM)

5.2 By Structure Type (In Value %)

5.2.1 Gigabit Passive Optical Network (GPON)

5.2.2 Ethernet Passive Optical Network (EPON)

5.2.3 Wavelength Division Multiplexed-PON (WDM-PON)

5.3 By Service (In Value %)

5.3.1 Data Transmission Services

5.3.2 Video Transmission Services

5.3.3 Voice Transmission Services

5.4 By Application (In Value %)

5.4.1 Fiber to the Home (FTTH)

5.4.2 Fiber to the Building (FTTB)

5.4.3 Fiber to the Curb (FTTC)

5.4.4 Fiber to the Premises (FTTP)

5.5 By End-User (In Value %)

5.5.1 Residential

5.5.2 Commercial

5.5.3 Industrial

North America Passive Optical Network Competitive Landscape

Detailed Profiles of Major Companies

Nokia Corporation

Huawei Technologies Co., Ltd.

ZTE Corporation

Calix, Inc.

ADTRAN, Inc.

Cisco Systems, Inc.

Verizon Communications Inc.

Arris International, plc

D-Link Corporation

Fujitsu Limited

Broadcom Inc.

NEC Corporation

CommScope Holding Company, Inc.

Ericsson AB

Infinera Corporation

Cross Comparison Parameters (Number of Employees, Revenue, R&D Investment, Regional Presence, Technology Portfolio, Fiber Reach, Customer Base, Patent Holdings)

Market Share Analysis (In Value %)

Strategic Initiatives (Product Launches, Collaborations)

Mergers & Acquisitions

Investment Landscape

Government and Private Equity Funding

North America Passive Optical Network Market Analysis

SWOT Analysis

Porters Five Forces Analysis

Stakeholder Ecosystem

Competitor Mapping

North America Passive Optical Network Regulatory Framework

Network Standards

Compliance Regulations

Data Privacy Laws

Infrastructure Policies

Future Outlook for North America Passive Optical Network Market

Market Expansion Drivers

Infrastructure Upgrades and Technological Innovations

Growth Opportunities in Emerging Applications

North America Passive Optical Network Market Analyst Recommendations

Market Penetration Strategies

New Segment Identification

Key Regional Opportunities

Strategic Positioning for Growth

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the first phase, we mapped out the ecosystem of the North America Passive Optical Network (PON) Market. Extensive desk research was undertaken, drawing from credible secondary sources to pinpoint crucial factors impacting the market, such as fiber infrastructure expansions and technology partnerships.

Step 2: Market Analysis and Construction

During this step, we analyzed historical data, including market penetration rates across urban and rural regions, consumer adoption trends, and network infrastructure developments. Revenue patterns were studied to validate data accuracy.

Step 3: Hypothesis Validation and Expert Consultation

We established market hypotheses, subsequently validating them through consultations with industry experts across telecom companies. These insights were critical for confirming operational data and refining market assumptions.

Step 4: Research Synthesis and Final Output

The final stage involved consultations with PON technology manufacturers and ISPs to acquire in-depth data on product specifications, adoption rates, and end-user trends. This phase ensured a comprehensive and verified overview of the North America PON market.

Frequently Asked Questions

01 How big is the North America Passive Optical Network Market?

The North America PON market is valued at USD 3.53 billion, primarily driven by the rising demand for high-speed internet and fiber network expansion across the region.

02 What are the main challenges in the North America Passive Optical Network Market?

Key challenges in the North America PON market include high initial infrastructure costs, technical compatibility issues with existing network setups, and a limited skilled workforce.

03 Who are the major players in the North America Passive Optical Network Market?

Major players in the North America PON market include ADTRAN, Inc., Calix, Inc., ZTE Corporation, Huawei Technologies Co., Ltd., and Nokia Corporation, known for their significant investments in PON technology and network partnerships.

04 What factors drive the North America Passive Optical Network Market?

The North America PON market is driven by increasing demand for high-speed internet, government investment in broadband expansion, and advancements in optical transmission technologies.

05 What is the dominant application in the North America Passive Optical Network Market?

Fiber to the Home (FTTH) leads the applications in the North America PON market due to growing consumer demand for fast and reliable internet connectivity, particularly in urban and suburban regions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.