North America PCs Market Outlook to 2030

Region:North America

Author(s):Abhinav kumar

Product Code:KROD6682

December 2024

94

About the Report

North America PCs Market Overview

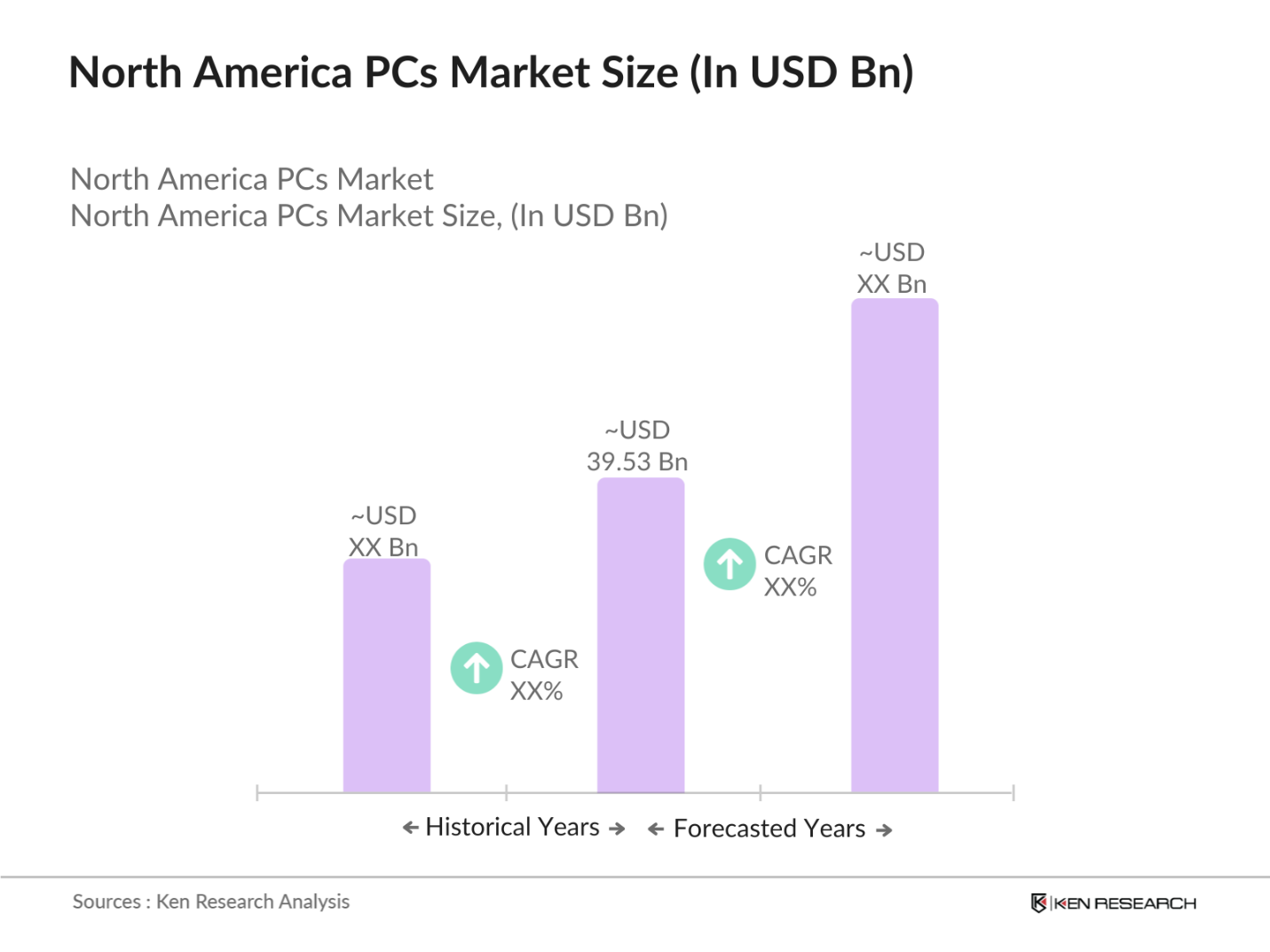

- The North America PCs market is valued at USD 39.53 billion, driven by strong consumer and enterprise demand for personal computing devices, particularly in the post-pandemic world. The rise of remote work, digital education, and the growing popularity of gaming and content creation have significantly boosted PC sales. Furthermore, the rapid innovation in processors and GPU technology has made personal computers more efficient, powerful, and suited for modern applications. This market growth is largely attributed to increased hardware demand from various sectors, with continued momentum observed through 2023, supported by stable economic growth and a robust tech ecosystem.

- The market is predominantly led by the United States and Canada, with major tech hubs like Silicon Valley, Seattle, and Toronto playing pivotal roles. These cities are home to the headquarters of tech giants such as Apple, Microsoft, and Intel, as well as thriving startups and innovative research institutions. The dominance of these regions is due to their strong technological infrastructure, high consumer demand for cutting-edge devices, and significant investments in R&D by both public and private sectors. Additionally, these areas benefit from a highly skilled workforce and favorable business environments.

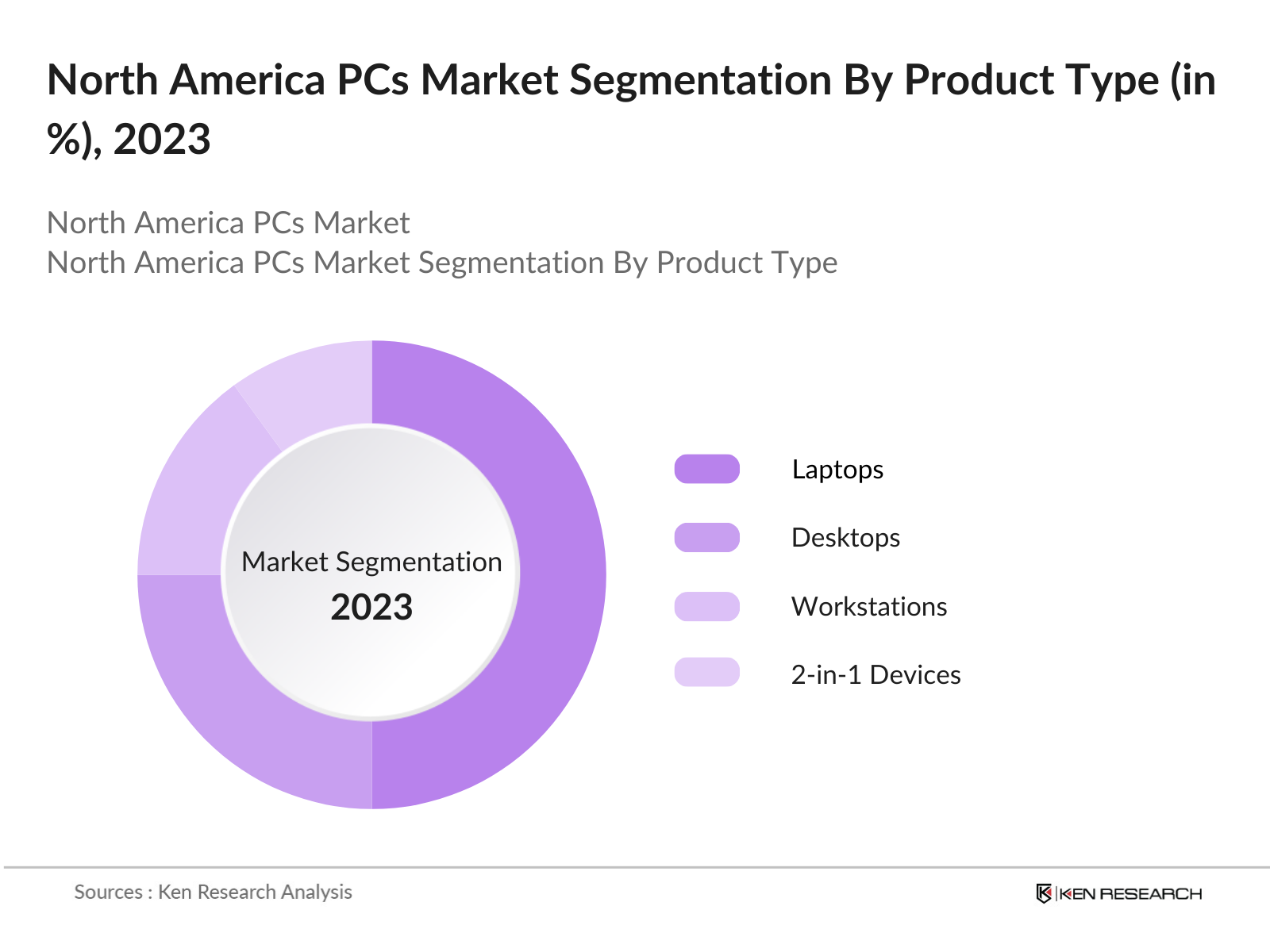

- The trend towards portable PCs, including laptops and 2-in-1 devices, is reshaping the North American PCs market landscape. In 2023, laptop sales accounted for over 60% of total PC sales in the region, driven by the increasing demand for mobility and flexibility in work and study environments. With an estimated 40 million remote workers in the U.S. as of 2023, the need for lightweight, powerful computing solutions has never been greater. Manufacturers are responding by introducing a range of portable devices that combine functionality with design, leading to innovations in battery life, performance, and connectivity options. As remote and hybrid work models become more prevalent, the demand for portable PCs is expected to grow, further influencing market dynamics.

North America PCs Market Segmentation

By Product Type: The North America PCs market is segmented by product type into desktops, laptops, workstations, and 2-in-1 devices. Desktops, while historically strong, have seen a decline in favor of more portable options. However, laptops have emerged as the dominant segment due to their versatility and portability. Laptops now dominate the market due to increased remote work and mobility needs. The widespread adoption of laptops is supported by advancements in battery life, processing power, and lightweight designs, making them the go-to choice for both consumers and businesses alike.

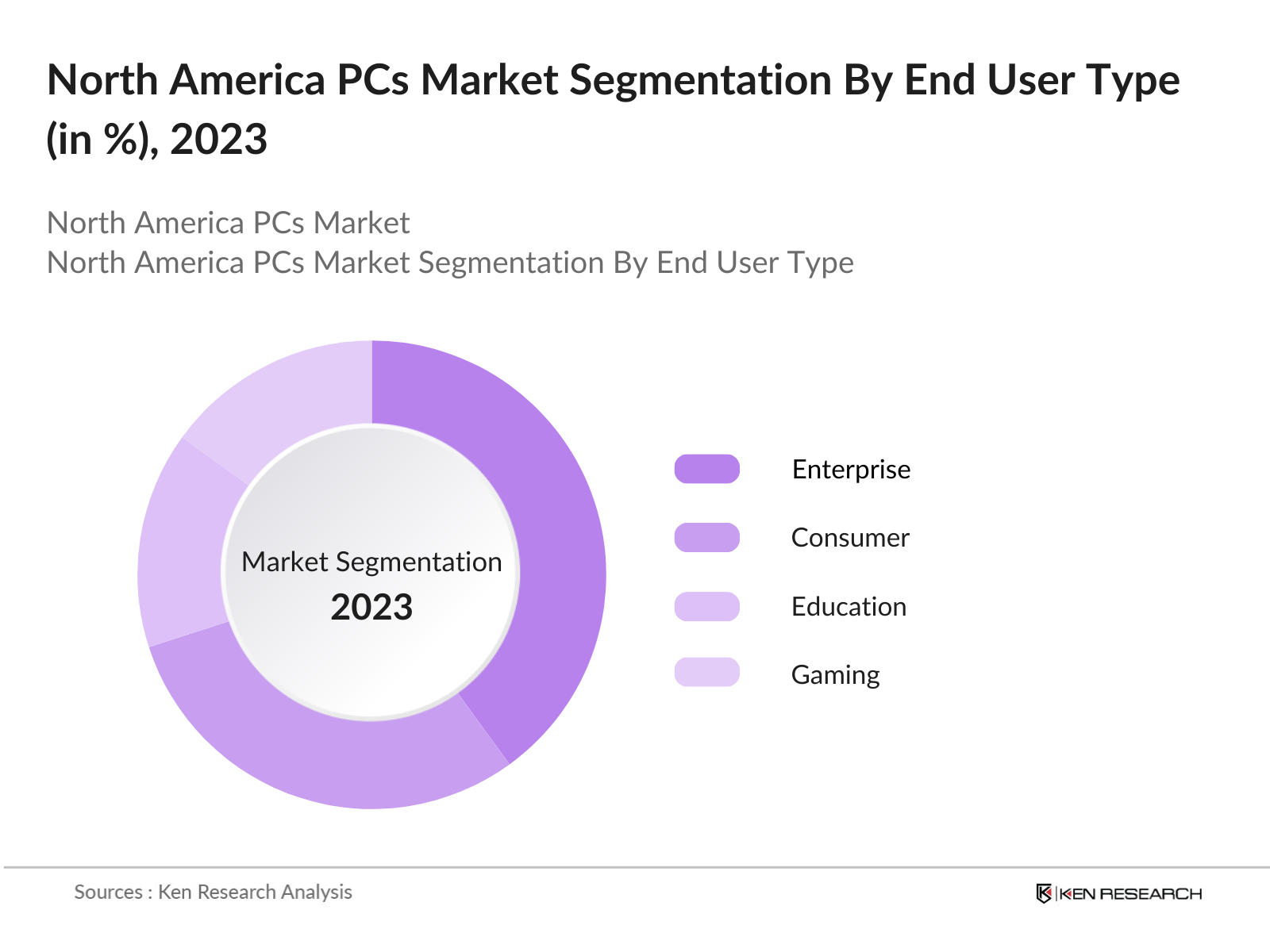

By End User: The market is segmented by end users into consumers, enterprises, education, and gaming. The enterprise segment holds a significant share due to continuous investments in corporate IT infrastructure. Large corporations and small businesses alike rely on high-performance PCs to support operations, with a focus on security, efficiency, and remote collaboration tools. The demand for business-grade PCs, particularly laptops with high-end security features and enhanced processing power, is driving this sub-segment's dominance in the market.

North America PCs Market Competitive Landscape

The North America PCs market is characterized by a few dominant players who control a significant portion of the market. These companies include tech giants such as Apple, Dell, HP, Lenovo, and Microsoft. The competitive landscape is shaped by constant innovation in hardware design, processing power, and consumer customization options. Companies like Apple and Dell lead the market by continuously evolving their product offerings with cutting-edge designs, while others like Microsoft and Lenovo excel in catering to enterprise users with high-end workstations and durable laptops designed for heavy workloads.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

Revenue |

R&D Expenditure |

Product Portfolio |

Sustainability Initiatives |

Customer Satisfaction |

|

Apple Inc. |

1976 |

Cupertino, CA, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Dell Technologies |

1984 |

Round Rock, TX, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Hewlett-Packard (HP) |

1939 |

Palo Alto, CA, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Lenovo Group |

1984 |

Beijing, China; Morrisville, NC, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Microsoft Corporation |

1975 |

Redmond, WA, USA |

_ |

_ |

_ |

_ |

_ |

_ |

North America PCs Industry Analysis

Growth Drivers

- Technological Innovation: The North American PCs market is experiencing substantial growth driven by rapid technological innovations, particularly in processor and GPU advancements. In 2023, the semiconductor industry reported that the global semiconductor sales reached approximately $600 billion, with a significant share attributed to high-performance processors and GPUs utilized in personal computers. The introduction of 5nm and 7nm technology nodes has significantly enhanced processing power while improving energy efficiency, which is critical for both consumer and enterprise segments. These advancements are facilitating more demanding applications, including artificial intelligence and gaming, which are increasingly adopted across North America. The impact of these innovations is underpinned by the substantial investments made in research and development, estimated at over $170 billion in the U.S. in 2022 alone, according to the National Science Foundation (NSF).

- Increasing Digitalization: The ongoing digitalization across various sectors in North America is significantly driving the demand for PCs. With the shift towards remote work and online education, the number of home office setups in the U.S. rose to 27% of the workforce in 2023, according to the U.S. Bureau of Labor Statistics. This has necessitated the acquisition of reliable computing devices to support productivity and learning. Moreover, the education sector's investment in technology, which was reported at around $12 billion for digital tools and infrastructure in 2022, reflects the rising trend of virtual classrooms and e-learning platforms.

- Rising Gaming Industry: The gaming industry in North America has seen explosive growth, directly impacting the PCs market. The esports market alone was valued at $1.4 billion in 2023, illustrating the increasing demand for high-performance gaming PCs capable of supporting competitive gaming. Furthermore, with an estimated 214 million gamers in the U.S. as of 2023, the requirement for PCs that offer enhanced graphics and speed has surged. This trend has led to a notable increase in sales of gaming-specific components, with GPUs experiencing a growth rate of 20% in units sold in 2022.

Market Challenges

- Supply Chain Disruptions: Supply chain disruptions have emerged as a critical challenge for the North American PCs market, particularly due to ongoing semiconductor shortages. In 2023, the semiconductor industry estimated a backlog of around 4 months for certain high-demand components, affecting the production timelines for PCs. These delays are exacerbated by logistics bottlenecks, which have seen shipping costs increase by 40% compared to pre-pandemic levels. The reliance on a limited number of semiconductor manufacturers has made the supply chain vulnerable to disruptions, further complicating procurement for PC manufacturers.

- Rising Component Costs: The rising costs of key components, particularly processors and GPUs, pose a significant challenge to the North American PCs market. In 2023, prices for high-performance GPUs have surged by 25% due to increased demand from gamers and content creators. Similarly, the average price of CPUs has risen by 15% as manufacturers grapple with supply constraints. This upward trend in component costs has translated to higher retail prices for PCs, limiting affordability for consumers and potentially dampening demand

North America PCs Market Future Outlook

Over the next few years, the North America PCs market is expected to demonstrate sustained growth, driven by increasing demand for high-performance devices across various sectors such as corporate, gaming, and education. The ongoing shift towards hybrid working models and the rising popularity of gaming are major factors that will continue to drive the market. Moreover, advancements in processors, memory technologies, and AI-driven applications will further enhance PC capabilities, maintaining steady demand from both enterprise and consumer markets.

Opportunities

- Expansion of Cloud Computing: The expansion of cloud computing presents significant opportunities for the North American PCs market, particularly in the realm of thin clients and virtual desktops. In 2023, the number of users leveraging cloud services in North America reached approximately 40 million, indicating a growing reliance on cloud-based solutions for business and personal use. This shift allows companies to reduce reliance on high-end PCs, as processing can occur in the cloud, leading to increased demand for thin clients, which typically have lower hardware requirements. The market for virtual desktops is projected to reach $20 billion in North America by 2025, driven by businesses looking to streamline operations and enhance flexibility. This transformation not only reduces costs but also paves the way for the development of new PC designs tailored for cloud environments. Source: Gartner.

- Growth in AR/VR Applications: The growth of augmented reality (AR) and virtual reality (VR) applications is creating substantial opportunities for the PCs market in North America. In 2023, AR/VR spending reached around $30 billion, primarily driven by advancements in gaming, training simulations, and educational tools. PCs equipped with advanced graphics capabilities are essential for developing and running these applications, leading to increased demand for high-performance systems. The growth of AR/VR is not limited to entertainment; sectors such as healthcare, real estate, and education are investing heavily in these technologies, further propelling the demand for PCs that can support complex virtual environments. This expanding ecosystem encourages innovation in hardware development, providing a platform for new software and applications.

Scope of the Report

|

By Product Type |

Desktops Laptops Workstations 2-in-1 Devices |

|

By End User |

Consumer Enterprise Education Gaming |

|

By Distribution Channel |

Online Retail Offline Retail Corporate Direct Sales IT Value-Added Resellers |

|

By Processor Type |

Intel AMD Apple Silicon |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Federal Trade Commission, Department of Commerce)

PC Companies

PC Component Companies

Enterprise IT Industries

Gaming and Esports Companies

Corporate IT Companies

Cloud Computing Service Companies

Companies

Players Mentioned in the Report:

Apple Inc.

Dell Technologies

Hewlett-Packard (HP)

Lenovo Group

Microsoft Corporation

Acer Inc.

ASUS

Razer Inc.

Alienware (Dell Subsidiary)

Samsung Electronics

Fujitsu

Panasonic

Toshiba

MSI (Micro-Star International)

Google (Chromebooks)

Table of Contents

1. North America PCs Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (YoY growth, average sales increase, consumption growth)

1.4. Market Segmentation Overview

2. North America PCs Market Size (In USD Bn)

2.1. Historical Market Size (Unit Shipments, Revenue)

2.2. Year-On-Year Growth Analysis (Sales Volume, Revenue Growth)

2.3. Key Market Developments and Milestones (Product Launches, Technological Advances)

3. North America PCs Market Analysis

3.1. Growth Drivers

3.1.1. Technological Innovation (Processor Evolution, GPU Advancements)

3.1.2. Increasing Digitalization (Remote Work, Education Trends)

3.1.3. Rising Gaming Industry (Esports Market, Demand for High-Performance PCs)

3.1.4. Corporate IT Infrastructure Investment (Enterprise Adoption of PCs)

3.2. Market Challenges

3.2.1. Supply Chain Disruptions (Semiconductor Shortages, Logistics Bottlenecks)

3.2.2. Rising Component Costs (Increased Prices of Processors, GPUs, etc.)

3.2.3. Market Saturation (Slowing Growth in Established Markets)

3.3. Opportunities

3.3.1. Expansion of Cloud Computing (Growth in Thin Clients, Virtual Desktops)

3.3.2. Growth in AR/VR Applications (PCs for Virtual Experiences, Developer Tools)

3.3.3. Increased Customization and Modular Designs (DIY PCs, Enthusiast Market)

3.4. Trends

3.4.1. Rise in Portable PCs (Laptops, 2-in-1 Devices)

3.4.2. Energy Efficiency and Sustainability (Green Computing Initiatives)

3.4.3. Integration of AI and Machine Learning (AI-enhanced PCs, Smarter Software)

3.5. Government Regulation

3.5.1. Import/Export Regulations (Tariffs, Trade Agreements Impacting PC Components)

3.5.2. Environmental Standards (E-Waste Management, Energy Star Ratings)

3.5.3. Data Privacy and Security Compliance (GDPR, CCPA, HIPAA)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (OEMs, Component Suppliers, Retailers)

3.8. Porters Five Forces (Supplier Power, Buyer Power, New Entrants, Substitutes, Competitive Rivalry)

3.9. Competition Ecosystem (Direct Competition, Indirect Competition)

4. North America PCs Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Desktops

4.1.2. Laptops

4.1.3. Workstations

4.1.4. 2-in-1 Devices

4.2. By End User (In Value %)

4.2.1. Consumer

4.2.2. Enterprise

4.2.3. Education

4.2.4. Gaming

4.3. By Distribution Channel (In Value %)

4.3.1. Online Retail

4.3.2. Offline Retail

4.3.3. Corporate Direct Sales

4.3.4. IT Value-Added Resellers (VARs)

4.4. By Processor Type (In Value %)

4.4.1. Intel

4.4.2. AMD

4.4.3. Apple Silicon

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America PCs Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Dell Technologies

5.1.2. Hewlett-Packard (HP)

5.1.3. Apple Inc.

5.1.4. Lenovo Group

5.1.5. Microsoft Corporation

5.1.6. ASUS

5.1.7. Acer Inc.

5.1.8. MSI (Micro-Star International)

5.1.9. Razer Inc.

5.1.10. Samsung Electronics

5.1.11. Alienware (Dell Subsidiary)

5.1.12. Fujitsu

5.1.13. Panasonic

5.1.14. Toshiba

5.1.15. Google (Chromebooks)

5.2 Cross Comparison Parameters (Revenue, Market Share, Units Sold, Innovation Focus, Sustainability Initiatives, Product Portfolio, Customer Satisfaction, Service Support)

5.3. Market Share Analysis (Percentage Market Control by Competitors)

5.4. Strategic Initiatives (Partnerships, Product Development, Market Expansion)

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7 Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America PCs Market Regulatory Framework

6.1. Import and Export Regulations (PC Components, Finished Products)

6.2. Taxation Policies (Impact on PC Manufacturing)

6.3. Environmental Compliance (E-Waste Handling, Emissions from Manufacturing)

7. North America PCs Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America PCs Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By End User (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Processor Type (In Value %)

8.5. By Region (In Value %)

9. North America PCs Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, an ecosystem map was created to identify all major stakeholders in the North America PCs market. Comprehensive desk research, utilizing secondary databases, was conducted to gather information about key market dynamics such as product innovation and consumer demand trends. This step was essential in determining the factors driving market growth and challenges.

Step 2: Market Analysis and Construction

Historical data from leading market players and industry reports were compiled to analyze the market's performance over the past five years. The market size was calculated based on shipment volumes, unit sales, and revenue generation. This analysis helped to understand market penetration rates across various segments and provided insights into demand-supply dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market trends and consumer behavior were validated through interviews with industry experts from top PC manufacturers. These consultations provided key insights into technological innovations and future market opportunities, allowing for a more accurate and reliable analysis.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing data from both primary and secondary research, including feedback from manufacturers and consumers. The output was cross-verified with industry benchmarks, ensuring that the report's findings are comprehensive, accurate, and reflective of the North America PCs market.

Frequently Asked Questions

01. How big is the North America PCs market?

The North America PCs market is valued at USD 39.53 billion, primarily driven by increasing consumer demand for portable computing devices and enterprise needs for high-performance systems.

02. What are the challenges in the North America PCs market?

Challenges in the market include semiconductor shortages, rising costs of key components like GPUs and processors, and potential market saturation in mature regions.

03. Who are the major players in the North America PCs market?

Key players include Apple, Dell Technologies, HP, Lenovo, and Microsoft, who dominate the market through continuous innovation and widespread consumer trust.

04. What are the growth drivers of the North America PCs market?

The market is driven by remote work, the growing gaming industry, increased enterprise IT spending, and advancements in computing technologies such as AI integration and virtual reality.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.