North America Pet Food Market Outlook to 2030

Region:Global

Author(s):Sanjna

Product Code:KROD5125

November 2024

90

About the Report

North America Pet Food Market Overview

- The North America pet food market is valued at USD 80 billion. This market is driven by the increasing trend of pet humanization, which has led to higher spending on premium and organic pet food products. Consumers are increasingly treating their pets as family members, and this shift in perception has spurred demand for high-quality, nutritious, and even customized pet food. Additionally, the rising adoption of pets, particularly in urban areas, is further bolstering the market.

- The USA dominates the North America pet food market due to its large pet-owning population, advanced manufacturing capabilities, and well-established distribution channels. Major cities like New York, Los Angeles, and Chicago serve as hubs for premium pet food brands, driven by the affluent customer base in these areas. Canada and Mexico are also significant markets, with rising pet ownership and evolving consumer preferences contributing to the steady growth of the pet food industry.

- The FDA plays a critical role in regulating the North American pet food market, ensuring compliance with AAFCO (Association of American Feed Control Officials) standards. In 2024, the FDA continued to enforce stringent regulations regarding the safety, labeling, and nutritional content of pet foods. Brands must adhere to these guidelines to avoid penalties and recalls, and the FDA has increased inspections and audits following the rise of grain-free and raw food products. Non-compliance can result in product recalls, which have impacted several manufacturers in recent years.

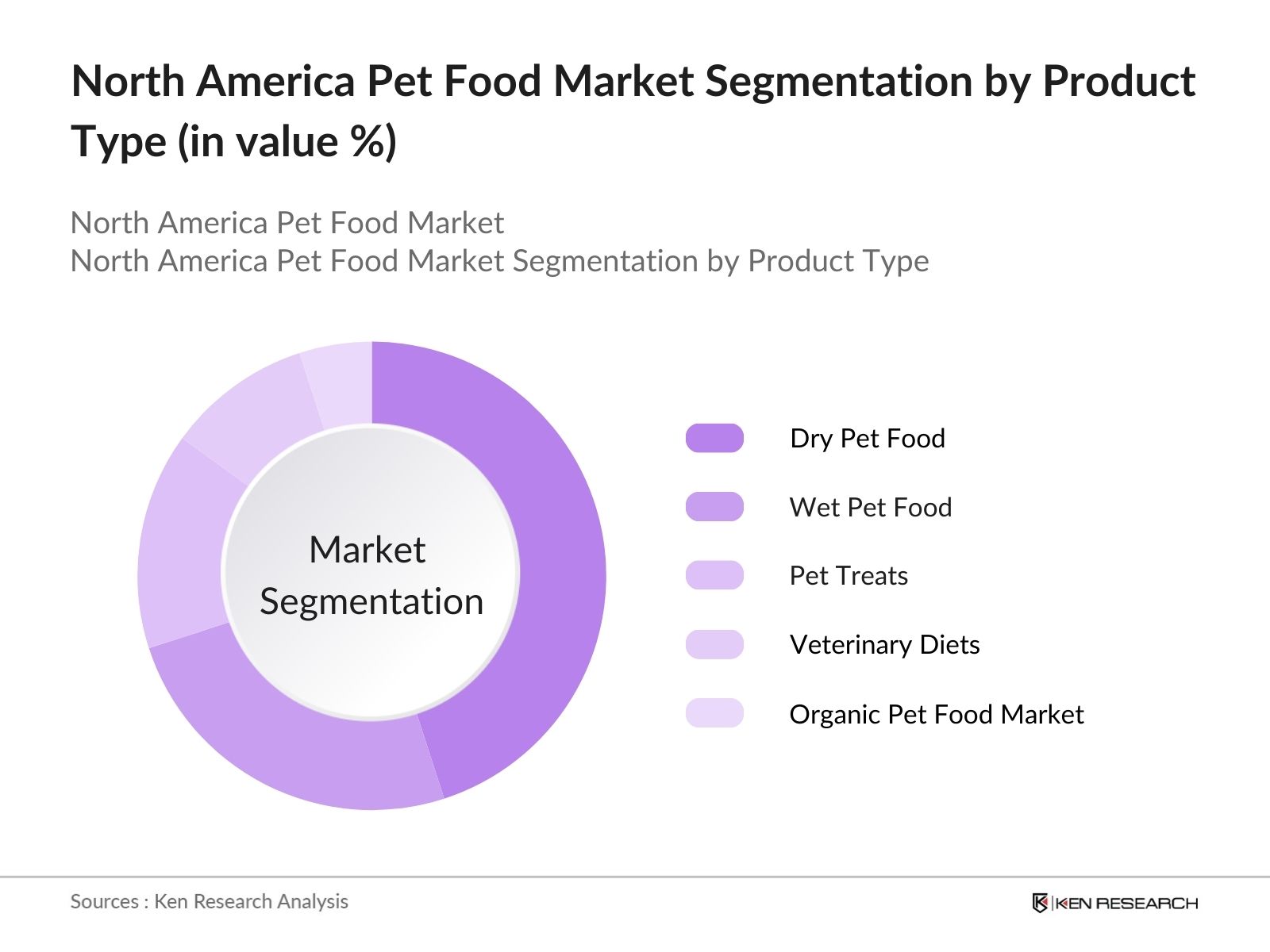

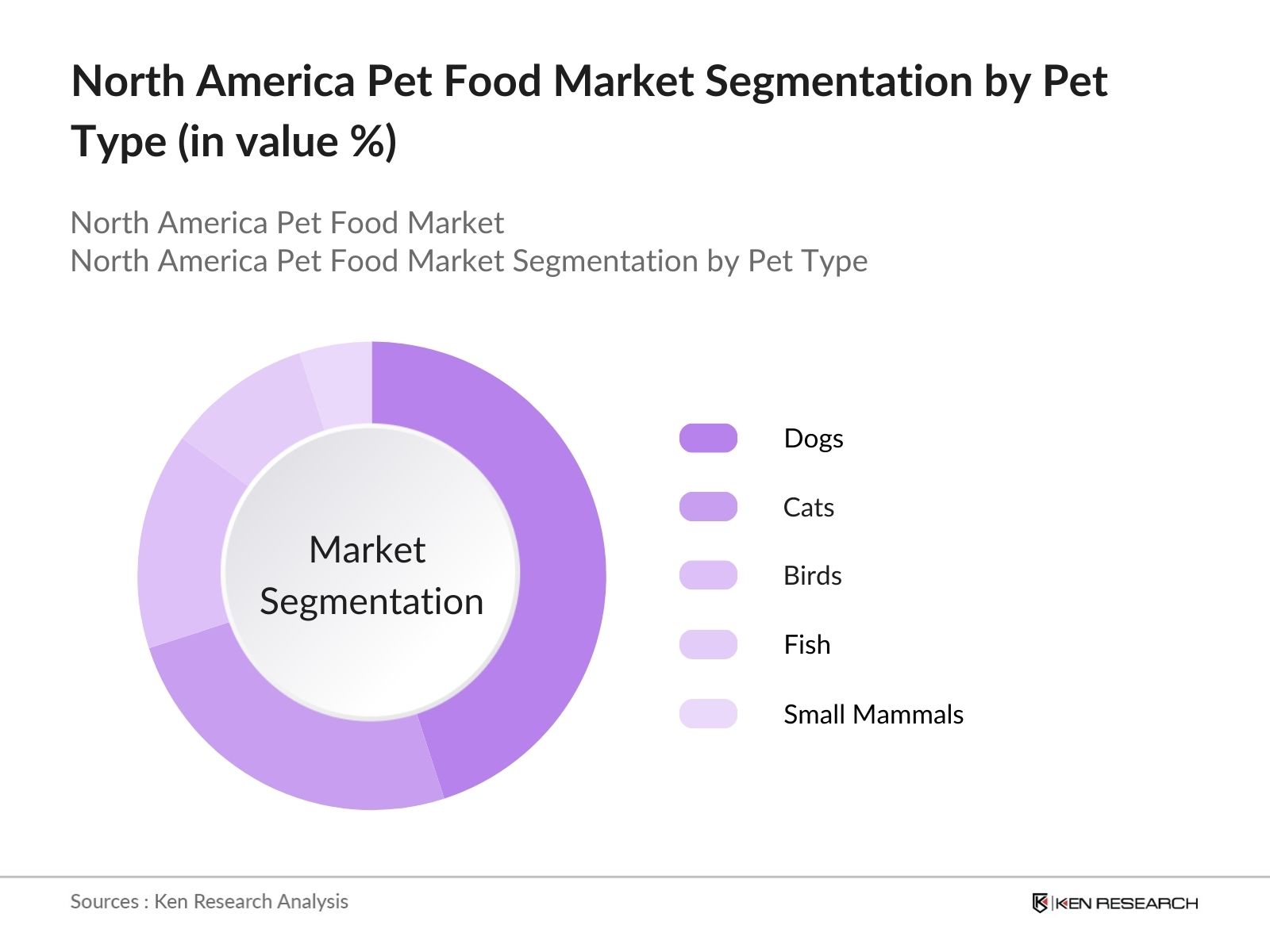

North America Pet Food Market Segmentation

By Product Type: The North America pet food market is segmented by product type into dry pet food, wet pet food, pet treats, veterinary diets, and organic pet food. Recently, dry pet food has held a dominant market share under the product type segmentation, driven by its convenience, longer shelf life, and cost-effectiveness. Pet owners, particularly those with large dogs, prefer dry food as it is easier to store and can be bought in bulk. Brands like Purina, Blue Buffalo, and Pedigree offer a wide variety of dry pet food options catering to various nutritional needs.

By Pet Type: The North America pet food market is further segmented by pet type into dogs, cats, birds, fish, and small mammals. The dog segment dominates the market, with a substantial share due to the higher number of households owning dogs compared to other pets. Dogs also have greater dietary requirements and consume more food, which is a significant driver of this segment. Pet owners are increasingly opting for specialized diets, which has led to a higher demand for premium and organic dog food.

Competitive Landscape

The North America pet food market is characterized by a mix of global conglomerates and local brands. The industry has seen increasing consolidation, with major companies dominating the market through acquisitions and product innovation. Brands such as Mars Petcare and Nestl Purina hold significant market shares due to their diverse portfolios and strong distribution networks.

|

Company Name |

Establishment Year |

Headquarters |

Revenue |

R&D Investment |

Product Portfolio |

Employee Count |

Global Presence |

Innovation Index |

Market Share |

|

Mars Petcare |

1935 |

McLean, Virginia |

- |

- |

- |

- |

- |

- |

- |

|

Nestl Purina PetCare |

1894 |

St. Louis, Missouri |

- |

- |

- |

- |

- |

- |

- |

|

Hills Pet Nutrition |

1939 |

Topeka, Kansas |

- |

- |

- |

- |

- |

- |

- |

|

Blue Buffalo Co., Ltd. |

2003 |

Wilton, Connecticut |

- |

- |

- |

- |

- |

- |

- |

|

J.M. Smucker (Big Heart) |

1897 |

Orrville, Ohio |

- |

- |

- |

- |

- |

- |

- |

The consolidation in the pet food industry is primarily driven by major players acquiring smaller, niche brands that focus on natural and organic pet food options. This strategy allows companies to tap into the growing demand for premium products and expand their product portfolios to include specialized dietary options for pets.

North America Pet Food Market Analysis

Growth Drivers

- Pet Humanization: The trend of pet humanization is a major driver in the North America pet food market, with over 90 million households owning a pet in 2024. This trend reflects a cultural shift where pets are treated as family members, leading to a rise in demand for high-quality, human-grade pet foods. In the U.S. These numbers highlight the robust demand for premium pet food options that cater to the health and wellness of pets.

- Demand for Premium and Organic Pet Foods: Consumer preference for premium and organic pet foods is driving significant growth in the North American pet food market. In 2024, organic pet foods accounted for 25% of total pet food sales, fueled by growing awareness of pet health and nutrition. Pet owners are willing to spend more on products with high nutritional value, clean labels, and transparency in sourcing. This shift is aligned with broader consumer trends favoring natural and sustainable products across other food sectors.

- E-commerce Expansion: E-commerce has emerged as a pivotal driver of growth in the North American pet food market. Online pet food and supply sales in the U.S. are projected to reach approximately $28.5 billion in 2024, reflecting a growth rate of about 12.8% annually over the past five years. The convenience of online shopping, combined with subscription services and the availability of a wide variety of specialized pet foods, has made e-commerce a dominant distribution channel.

Challenges

- Regulatory Hurdles: The North American pet food market faces stringent regulatory challenges, primarily through the Food and Drug Administration (FDA) and the Association of American Feed Control Officials (AAFCO). Pet food manufacturers must comply with complex labeling regulations, ingredient standards, and safety protocols. In 2024, increased scrutiny of raw pet food and grain-free diets, due to concerns over nutritional adequacy, has posed significant challenges for the industry.

- Rising Raw Material Costs: The cost of raw materials for pet food production has been rising, presenting a significant challenge to the North American market. Prices of essential ingredients like chicken, lamb, and grains have surged in 2024 due to supply chain disruptions and inflationary pressures. For instance, corn prices increased by 40% since 2022, exacerbating cost pressures for manufacturers. These rising costs are further compounded by transportation bottlenecks.

North America Pet Food Market Future Outlook

Over the next five years, the North America pet food market is expected to experience substantial growth due to continued product innovation, the rising trend of pet humanization, and increased awareness about pet health and nutrition. E-commerce is likely to play a pivotal role in driving sales, with more consumers opting to purchase pet food online due to convenience and a wider product selection. Additionally, sustainability initiatives and eco-friendly packaging will become important differentiators for pet food brands, as consumers become more environmentally conscious in their purchasing decisions.

Market Opportunities

- Growth of Customizable and Specialized Pet Diets: Brands offering breed-specific diets or catering to conditions like allergies, obesity, or diabetes have seen substantial growth. This demand is driven by pet owners' desire to tailor diets for optimal health, and technological advancements in data collection have enabled more precise nutritional formulations. Such specialized diets also cater to the growing trend of personalized pet care.

- Increasing Demand for Functional Pet Foods: According to the National Institutes of Health, functional foods now account for 20% of all pet food sales in the U.S. Ingredients like glucosamine for joint health or probiotics for digestion have become common additions to pet food formulations. This demand reflects the growing trend of pet owners seeking proactive health solutions, mirroring human health trends, and driving innovation within the pet food market.

Scope of the Report

|

Segment |

Sub-Segments |

|

By Product Type |

Dry Pet Food |

|

Wet Pet Food |

|

|

Pet Treats |

|

|

Veterinary Diets |

|

|

Organic Pet Food |

|

|

By Pet Type |

Dogs |

|

Cats |

|

|

Birds |

|

|

Fish |

|

|

Small Mammals |

|

|

By Ingredient |

Animal Derivatives |

|

Plant-Based Ingredients |

|

|

Insects |

|

|

Grains |

|

|

Others |

|

|

By Distribution Channel |

Specialty Pet Stores |

|

Supermarkets and Hypermarkets |

|

|

Online Retailers |

|

|

Veterinary Clinics |

|

|

Others |

|

|

By Region |

USA |

|

Canada |

|

|

Mexico |

Products

Key Target Audience

Pet Food Manufacturers

Private Label Pet Food Producers

Distribution and Logistics Companies

Pet Food Packaging Companies

E-commerce Platforms for Pet Products

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, AAFCO)

Companies

Major Players

Mars Petcare

Nestl Purina PetCare

Hills Pet Nutrition

Blue Buffalo Co., Ltd.

J.M. Smucker (Big Heart Pet Brands)

Diamond Pet Foods

Spectrum Brands (United Pet Group)

WellPet LLC

Champion Petfoods

Natures Variety

Freshpet, Inc.

Merrick Pet Care

Colgate-Palmolive (Hill's Science Diet)

General Mills

Royal Canin

Table of Contents

1. North America Pet Food Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Pet Food Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Pet Food Market Analysis

3.1. Growth Drivers

3.1.1. Pet Humanization (Pet ownership trends)

3.1.2. Demand for Premium and Organic Pet Foods (Consumer preferences)

3.1.3. Increased Pet Adoption Rates (Pet adoption statistics)

3.1.4. E-commerce Expansion (Online pet food sales data)

3.2. Market Challenges

3.2.1. Regulatory Hurdles (FDA regulations, labeling, safety standards)

3.2.2. Rising Raw Material Costs (Ingredients prices, supply chain issues)

3.2.3. Supply Chain Disruptions (Logistics and delivery challenges)

3.3. Opportunities

3.3.1. Growth of Customizable and Specialized Pet Diets (Breed-specific foods)

3.3.2. Increasing Demand for Functional Pet Foods (Foods targeting health benefits)

3.3.3. International Market Penetration (Export potential for North America brands)

3.4. Trends

3.4.1. Grain-Free and Raw Pet Foods (Dietary preferences)

3.4.2. Environmentally Friendly Packaging (Sustainability efforts)

3.4.3. Rise of Pet Treats and Supplements (Nutrition enhancements)

3.5. Government Regulations

3.5.1. FDA Regulations on Pet Food (Compliance with AAFCO standards)

3.5.2. Pet Food Safety Standards (Quality control measures)

3.5.3. Labelling and Ingredient Transparency (Labeling mandates)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. North America Pet Food Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Dry Pet Food

4.1.2. Wet Pet Food

4.1.3. Pet Treats

4.1.4. Veterinary Diets

4.1.5. Organic Pet Food

4.2. By Pet Type (In Value %)

4.2.1. Dogs

4.2.2. Cats

4.2.3. Birds

4.2.4. Fish

4.2.5. Small Mammals

4.3. By Ingredient (In Value %)

4.3.1. Animal Derivatives

4.3.2. Plant-Based Ingredients

4.3.3. Insects

4.3.4. Grains

4.3.5. Others

4.4. By Distribution Channel (In Value %)

4.4.1. Specialty Pet Stores

4.4.2. Supermarkets and Hypermarkets

4.4.3. Online Retailers

4.4.4. Veterinary Clinics

4.4.5. Others

4.5. By Region (In Value %)

4.5.1. USA

4.5.2. Canada

4.5.3. Mexico

5. North America Pet Food Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Mars Petcare

5.1.2. Nestl Purina PetCare

5.1.3. Hills Pet Nutrition

5.1.4. Blue Buffalo Co., Ltd.

5.1.5. J.M. Smucker (Big Heart Pet Brands)

5.1.6. Diamond Pet Foods

5.1.7. Spectrum Brands (United Pet Group)

5.1.8. WellPet LLC

5.1.9. Champion Petfoods

5.1.10. Natures Variety

5.1.11. Freshpet, Inc.

5.1.12. Merrick Pet Care

5.1.13. Colgate-Palmolive (Hill's Science Diet)

5.1.14. General Mills

5.1.15. Royal Canin

5.2. Cross Comparison Parameters (Headquarters, Inception Year, Revenue, Market Share, Innovation Index, Product Portfolio, Employee Count, R&D Investment etc.)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. North America Pet Food Market Regulatory Framework

6.1. FDA Standards for Pet Food

6.2. AAFCO Guidelines

6.3. USDA Pet Food Inspection Processes

6.4. Environmental Regulations on Pet Food Packaging

7. North America Pet Food Market Future Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Pet Food Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Pet Type (In Value %)

8.3. By Ingredient (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. North America Pet Food Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Segmentation and Targeting Strategy

9.3. Marketing and Advertising Tactics

9.4. Strategic Partnerships and Collaborations

9.5. Product Line Expansion Opportunities

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the North America Pet Food Market. This step is underpinned by extensive desk research, utilizing secondary sources and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the North America Pet Food Market. This includes assessing market penetration, the ratio of product segments, and revenue generation. An evaluation of consumer trends and preferences will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through consultations with industry experts representing various companies in the pet food industry. These consultations provide valuable insights into market trends, operational challenges, and growth drivers.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing insights from multiple pet food manufacturers to acquire detailed data on product segments, sales performance, consumer preferences, and other pertinent factors. This interaction ensures a comprehensive, accurate, and validated analysis of the North America Pet Food Market.

Frequently Asked Questions

1. How big is the North America Pet Food Market?

The North America pet food market is valued at USD 80 billion, driven by the trend of pet humanization and the rising demand for premium and organic pet food options.

2. What are the challenges in the North America Pet Food Market?

Challenges include regulatory hurdles, particularly regarding FDA and AAFCO compliance, rising raw material costs, and supply chain disruptions, which can impact production and distribution.

3. Who are the major players in the North America Pet Food Market?

Key players in the market include Mars Petcare, Nestl Purina PetCare, Hills Pet Nutrition, Blue Buffalo, and J.M. Smucker. These companies dominate due to their strong brand portfolios, extensive distribution networks, and continued product innovation.

4. What are the growth drivers of the North America Pet Food Market?

Growth is propelled by increasing pet ownership, the trend of treating pets as family members, and the rising demand for premium and organic pet foods that cater to specific dietary needs.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.