North America Pharmaceuticals Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD3446

December 2024

90

About the Report

North America Pharmaceuticals Market Overview

- The North America pharmaceuticals market, based on a detailed five-year historical analysis, is valued at USD 625 billion. This market is driven by several factors including increasing healthcare expenditures, advanced R&D initiatives, and growing demand for innovative drug therapies. The continuous rise in chronic diseases like cancer, diabetes, and cardiovascular ailments, along with an aging population, is significantly fueling the growth. Investment in biosimilars and biologics, alongside strong regulatory support from the FDA, further drives the pharmaceutical market in the region.

- The United States dominates the North American pharmaceutical market due to its well-established healthcare system, robust drug development infrastructure, and high levels of public and private sector investment. Cities like New York, Boston, and San Francisco serve as innovation hubs with strong academic-industry collaborations, extensive research institutions, and proximity to venture capital. Additionally, Canadas favorable regulatory environment and Mexicos growing pharmaceutical manufacturing capabilities contribute to the regional dominance.

- The Affordable Care Act (ACA) continues to play a pivotal role in shaping the U.S. pharmaceutical market. As of 2023, over 16 million Americans were enrolled in healthcare plans under the ACA, significantly increasing access to medications. The ACA's policy reforms have placed caps on drug prices and expanded insurance coverage, driving demand for a broad range of pharmaceutical products, especially for low-income populations. This increased demand, coupled with policy-driven price negotiations, creates both challenges and opportunities for pharmaceutical companies.

North America Pharmaceuticals Market Segmentation

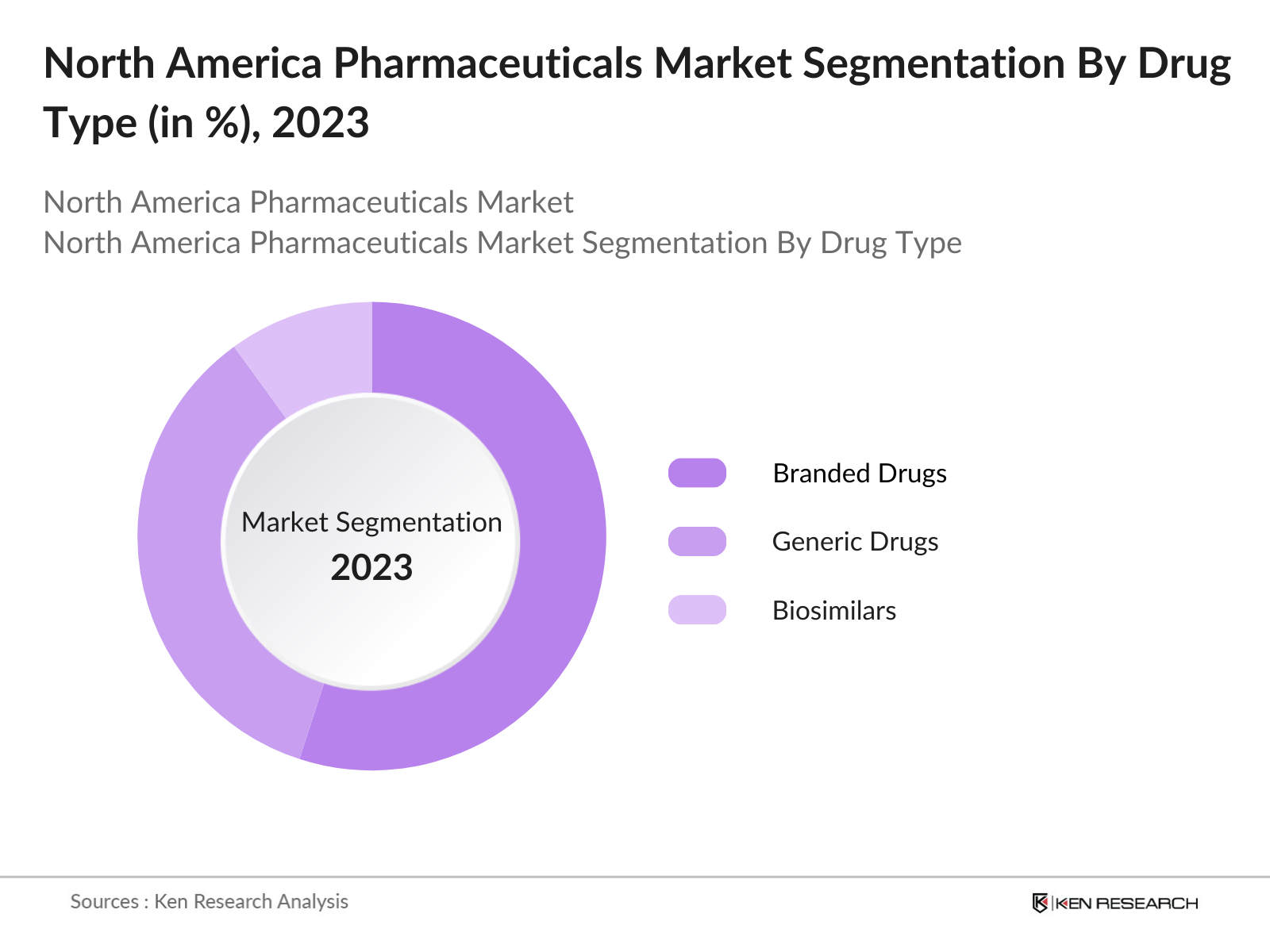

By Drug Type: The North America pharmaceuticals market is segmented by drug type into generic drugs, branded drugs, and biosimilars. Recently, branded drugs have had a dominant market share in the drug type segment due to their continued innovation and patent protections, allowing companies to capitalize on high pricing strategies and extensive R&D investment. Major players like Pfizer and Merck heavily invest in patented drugs for chronic diseases and oncology, maintaining their stronghold on the market.

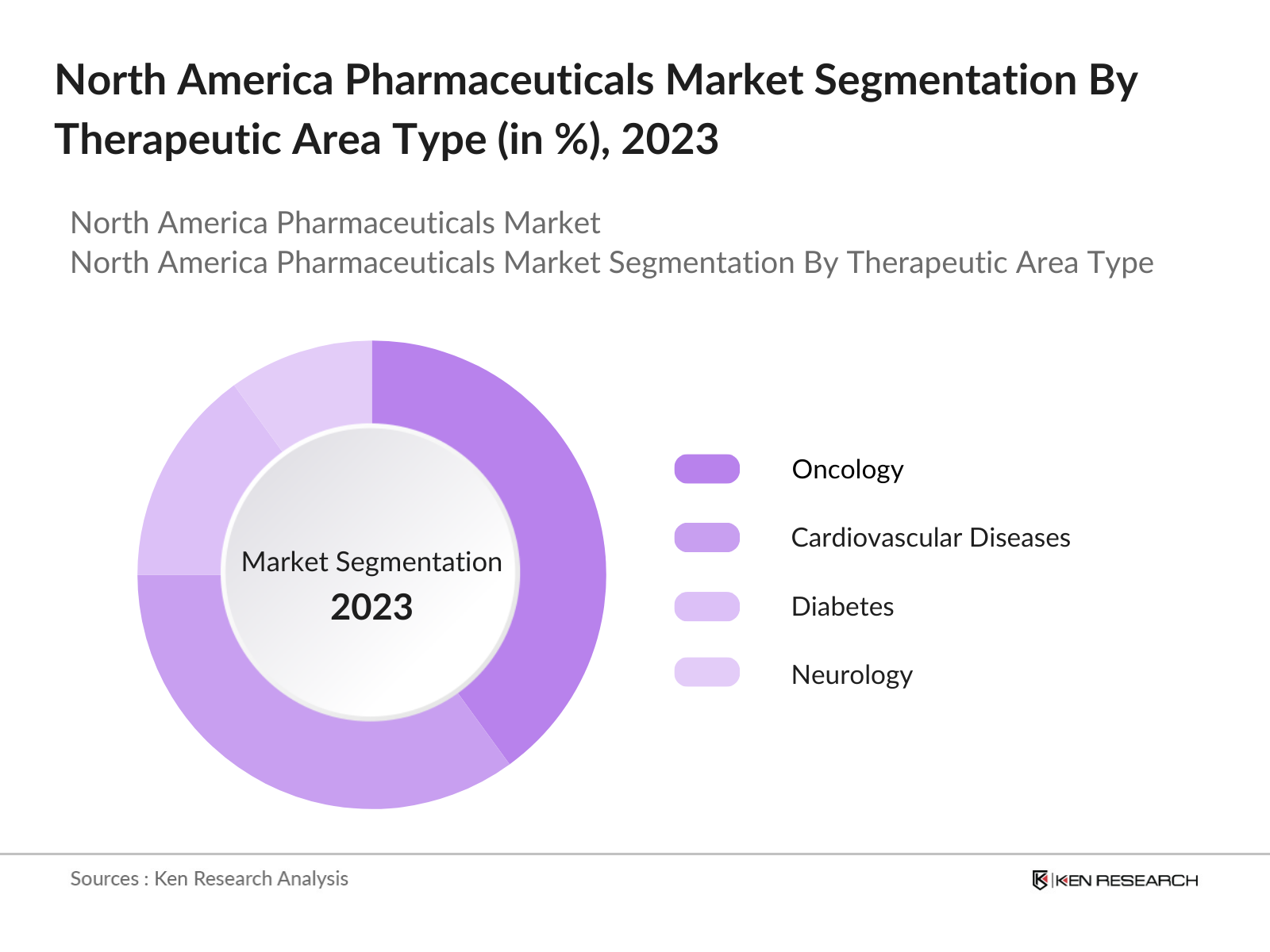

By Therapeutic Area: The North America pharmaceuticals market is further segmented by therapeutic area into oncology, cardiovascular diseases, diabetes, neurology, and respiratory diseases. Oncology is the leading therapeutic area, driven by rising cancer incidences and a surge in oncology-focused drug development. The demand for novel cancer therapies such as immunotherapies and targeted therapies has propelled this segment forward. High R&D spending and numerous clinical trials in oncology drugs are notable factors driving the market share.

North America Pharmaceuticals Market Competitive Landscape

The North America pharmaceuticals market is characterized by the presence of key players that have consolidated their position through robust research capabilities and extensive product portfolios. Companies like Pfizer, Johnson & Johnson, and Merck & Co. dominate the market through innovation in biologics, strong distribution channels, and a focus on acquiring or partnering with smaller biotech firms. The dominance of these players ensures a competitive edge in terms of product offerings and market reach.

|

Company |

Establishment Year |

Headquarters |

R&D Investment (2023) |

Revenue (2023) |

Product Portfolio |

Patent Holdings |

Key Therapeutic Area |

|

Pfizer Inc. |

1849 |

New York, USA |

- |

- |

- |

- |

- |

|

Johnson & Johnson |

1886 |

New Jersey, USA |

- |

- |

- |

- |

- |

|

Merck & Co. |

1891 |

New Jersey, USA |

- |

- |

- |

- |

- |

|

Bristol-Myers Squibb |

1887 |

New York, USA |

- |

- |

- |

- |

- |

|

Amgen Inc. |

1980 |

California, USA |

- |

- |

- |

- |

- |

North America Pharmaceuticals Industry Analysis

Growth Drivers

- Aging Population: The aging population in North America is a significant driver for the pharmaceutical market. As of 2023, approximately 57 million individuals in the U.S. are aged 65 and older, contributing to increased demand for medications that address age-related conditions such as arthritis, cardiovascular diseases, and Alzheimer's. By 2025, this number is expected to further drive the demand for chronic disease management and geriatric care. Canada's aging demographic follows a similar trajectory, with 18.5% of the population aged 65 and over, placing increased pressure on healthcare systems and pharmaceutical demand.

- Rise in Chronic Diseases: Chronic diseases, such as diabetes, cardiovascular diseases, and cancer, continue to rise in North America, driving pharmaceutical demand. The Centers for Disease Control and Prevention (CDC) reported that over 40% of adults in the U.S. suffer from at least two chronic diseases. This leads to growing reliance on pharmaceuticals for long-term disease management. In Canada, chronic diseases account for nearly 60% of all deaths annually, according to the Public Health Agency of Canada. These statistics underscore the need for continuous drug supply, especially for long-term, chronic treatments.

- Advancements in Drug Development: Recent advancements in biotechnology and drug research are key growth drivers in the North American pharmaceutical market. With 35 new drugs approved by the U.S. Food and Drug Administration (FDA) in 2022 alone, North America remains a hub for pharmaceutical innovation. The development of mRNA vaccines and CRISPR gene-editing technology are notable examples that have accelerated drug approval processes and expanded treatment possibilities. Furthermore, partnerships between pharma and tech companies have driven research breakthroughs, fueling innovation and expanding treatment capabilities for a wide range of diseases.

Market Challenges

- Stringent FDA Regulations: Pharmaceutical companies in North America face stringent regulatory scrutiny from the FDA, which poses challenges in getting new drugs approved. On average, it takes 10 years for a new drug to move from concept to market approval, with the FDA approving only around 20-30% of new drug applications annually. Strict regulations on clinical trials, safety, and efficacy are critical for ensuring public health but can result in prolonged development timelines and increased costs for pharmaceutical companies.

- High R&D Costs: Research and development (R&D) costs are a substantial challenge in the North American pharmaceutical industry. The cost of developing a single new drug exceeds $1 billion due to extensive clinical trials and regulatory hurdles. According to the U.S. Department of Commerce, pharma companies collectively spent more than $100 billion on R&D in 2022. These high costs limit the number of new entrants into the market and increase the financial burden on existing players, forcing them to optimize their operations and consider partnerships or acquisitions.

North America Pharmaceuticals Market Future Outlook

Over the next five years, the North America pharmaceuticals market is expected to experience significant growth, driven by an aging population, rising demand for biologics, and ongoing technological advancements in personalized medicine. Additionally, the increasing adoption of telemedicine and e-prescriptions will reshape the distribution and consumption of pharmaceuticals. Government initiatives to accelerate the approval process for new drugs and the expansion of healthcare coverage will further propel market growth.

Opportunities

- Biologics and Biosimilars: The biologics and biosimilars sector presents significant growth opportunities for North America's pharmaceutical industry. In 2023, biologics accounted for over 40% of total pharmaceutical spending in the U.S., with biosimilars emerging as a cost-effective alternative. The FDA approved 39 biosimilars by 2023, significantly increasing their presence in the market. As biologics continue to be a primary treatment for complex diseases like cancer and autoimmune disorders, biosimilars offer opportunities for pharmaceutical companies to expand their portfolios and reduce healthcare costs.

- Pharmaceutical Exports to Emerging Markets: North American pharmaceutical companies are increasingly focusing on expanding exports to emerging markets, such as Latin America and Southeast Asia. The U.S. pharmaceutical export value to emerging markets reached approximately $50 billion in 2022. With governments in emerging economies improving healthcare infrastructure and access to medications, the demand for North American pharmaceutical products is rising. Companies can leverage this trend to increase their global market share and tap into new revenue streams by exporting drugs that cater to the specific needs of these regions.

Scope of the Report

Drug Type |

Generic Drugs Branded Drugs Biosimilars |

Therapeutic Area |

Cardiovascular Diseases Oncology Neurology Diabetes Respiratory Diseases |

Distribution Channel |

Hospital Pharmacies Retail Pharmacies E-Pharmacies |

Dosage Form |

Tablets, Injections Topical Preparations Inhalers |

Region |

United States Canada Mexico |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Pharmaceutical Manufacturing Companies

Government and Regulatory Bodies (e.g., FDA, Health Canada)

Hospitals and Healthcare Industries

Drug Distribution Companies

Contract Research Organizations (CROs)

Biotech Startups

Investment and Venture Capitalist Firms

Private and Public Healthcare Insurance Providers

Companies

Market Players Mentioned in the Report:

Pfizer Inc.

Johnson & Johnson

Merck & Co.

Bristol-Myers Squibb

Amgen Inc.

Gilead Sciences

AbbVie Inc.

Eli Lilly and Company

AstraZeneca

Novartis

Roche

Sanofi

GlaxoSmithKline

Teva Pharmaceuticals

Takeda Pharmaceuticals

Table of Contents

1. North America Pharmaceuticals Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Pharmaceuticals Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Pharmaceuticals Market Analysis

3.1. Growth Drivers

3.1.1. Aging Population (Demographics)

3.1.2. Rise in Chronic Diseases (Healthcare Demand)

3.1.3. Advancements in Drug Development (Innovation)

3.1.4. Government Support and Subsidies (Policy and Regulation)

3.2. Market Challenges

3.2.1. Stringent FDA Regulations (Regulatory Compliance)

3.2.2. High R&D Costs (Financial Challenges)

3.2.3. Patent Expiration (Market Erosion)

3.3. Opportunities

3.3.1. Biologics and Biosimilars (Product Innovation)

3.3.2. Pharmaceutical Exports to Emerging Markets (Geographical Expansion)

3.3.3. Personalized Medicine (Therapeutic Customization)

3.4. Trends

3.4.1. Growth of E-Pharmacy (Digital Health)

3.4.2. Increased Focus on Mental Health Medications (Market Focus)

3.4.3. Collaborations in R&D between Pharma and Biotech Companies (Strategic Partnerships)

3.5. Government Regulation

3.5.1. Affordable Care Act (Healthcare Policy)

3.5.2. Medicare and Medicaid Drug Pricing Policies (Pricing Controls)

3.5.3. FDA Approval Process (Regulatory Compliance)

3.6. SWOT Analysis

3.6.1. Strengths

3.6.2. Weaknesses

3.6.3. Opportunities

3.6.4. Threats

3.7. Stake Ecosystem

3.7.1. Pharma Companies

3.7.2. Suppliers and Distributors

3.7.3. Regulatory Bodies

3.8. Porters Five Forces

3.8.1. Bargaining Power of Buyers

3.8.2. Bargaining Power of Suppliers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes

3.8.5. Industry Rivalry

3.9. Competition Ecosystem

3.9.1. Key Players Analysis

3.9.2. Emerging Players

4. North America Pharmaceuticals Market Segmentation

4.1. By Drug Type (In Value %)

4.1.1. Generic Drugs

4.1.2. Branded Drugs

4.1.3. Biosimilars

4.2. By Therapeutic Area (In Value %)

4.2.1. Cardiovascular Diseases

4.2.2. Oncology

4.2.3. Neurology

4.2.4. Diabetes

4.2.5. Respiratory Diseases

4.3. By Distribution Channel (In Value %)

4.3.1. Hospital Pharmacies

4.3.2. Retail Pharmacies

4.3.3. E-Pharmacies

4.4. By Dosage Form (In Value %)

4.4.1. Tablets

4.4.2. Injections

4.4.3. Topical Preparations

4.4.4. Inhalers

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Pharmaceuticals Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Pfizer Inc.

5.1.2. Johnson & Johnson

5.1.3. Merck & Co.

5.1.4. Gilead Sciences

5.1.5. Amgen Inc.

5.1.6. Bristol-Myers Squibb

5.1.7. AbbVie Inc.

5.1.8. Eli Lilly and Company

5.1.9. AstraZeneca

5.1.10. Novartis

5.1.11. Roche

5.1.12. Sanofi

5.1.13. GlaxoSmithKline

5.1.14. Teva Pharmaceuticals

5.1.15. Takeda Pharmaceuticals

5.2 Cross Comparison Parameters

5.2.1. Number of Employees

5.2.2. Headquarters

5.2.3. Inception Year

5.2.4. Revenue

5.2.5. R&D Investment

5.2.6. Market Share

5.2.7. Product Portfolio

5.2.8. Patent Portfolio

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. North America Pharmaceuticals Market Regulatory Framework

6.1 FDA Compliance

6.2 Intellectual Property Rights

6.3 Patent Law

6.4 Clinical Trial Approval Process

7. North America Pharmaceuticals Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America Pharmaceuticals Future Market Segmentation

8.1 By Drug Type (In Value %)

8.2 By Therapeutic Area (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Dosage Form (In Value %)

8.5 By Region (In Value %)

9. North America Pharmaceuticals Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step in the research methodology focuses on creating an ecosystem map of the North America pharmaceuticals market. This includes identifying key stakeholders such as pharmaceutical manufacturers, regulatory bodies, and healthcare providers. Extensive desk research was conducted using proprietary databases and secondary sources to capture the market's primary influencing factors.

Step 2: Market Analysis and Construction

The next phase involved analyzing historical data to assess the market's growth trajectory. This included revenue generation from branded and generic drugs, regulatory landscape analysis, and the introduction of new drug therapies. Quantitative assessments were conducted to ensure the data's reliability.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through consultations with industry experts using computer-assisted telephone interviews (CATIs). Key insights were gathered on R&D trends, drug pricing dynamics, and regulatory bottlenecks, which helped refine the market estimations.

Step 4: Research Synthesis and Final Output

The final step involved a comprehensive synthesis of all data points and insights, including direct interviews with pharmaceutical executives. The report was corroborated with a bottom-up approach to ensure the data's accuracy and relevance to market stakeholders.

Frequently Asked Questions

01. How big is the North America Pharmaceuticals Market?

The North America pharmaceuticals market, valued at USD 625 billion, is driven by robust drug development pipelines, high healthcare expenditures, and advancements in biologics and biosimilars.

02. What are the challenges in the North America Pharmaceuticals Market?

Challenges include high R&D costs, stringent FDA regulations, and patent expirations, which put pressure on pricing and profitability for pharmaceutical companies.

03. Who are the major players in the North America Pharmaceuticals Market?

Major players include Pfizer, Johnson & Johnson, Merck & Co., Bristol-Myers Squibb, and Amgen Inc. These companies dominate through innovation, strong patent portfolios, and extensive distribution networks.

04. What are the growth drivers of the North America Pharmaceuticals Market?

Growth is driven by rising chronic disease cases, an aging population, and increased R&D investment in novel therapies such as immunotherapies and gene therapies.

05. What opportunities exist in the North America Pharmaceuticals Market?

Opportunities lie in the expanding biosimilars market, growth in personalized medicine, and increased focus on oncology and diabetes drugs.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.