North America Plastic Pallets Market Outlook to 2030

Region:North America

Author(s):Naman Rohilla

Product Code:KROD8397

December 2024

96

About the Report

North America Plastic Pallets Market Overview

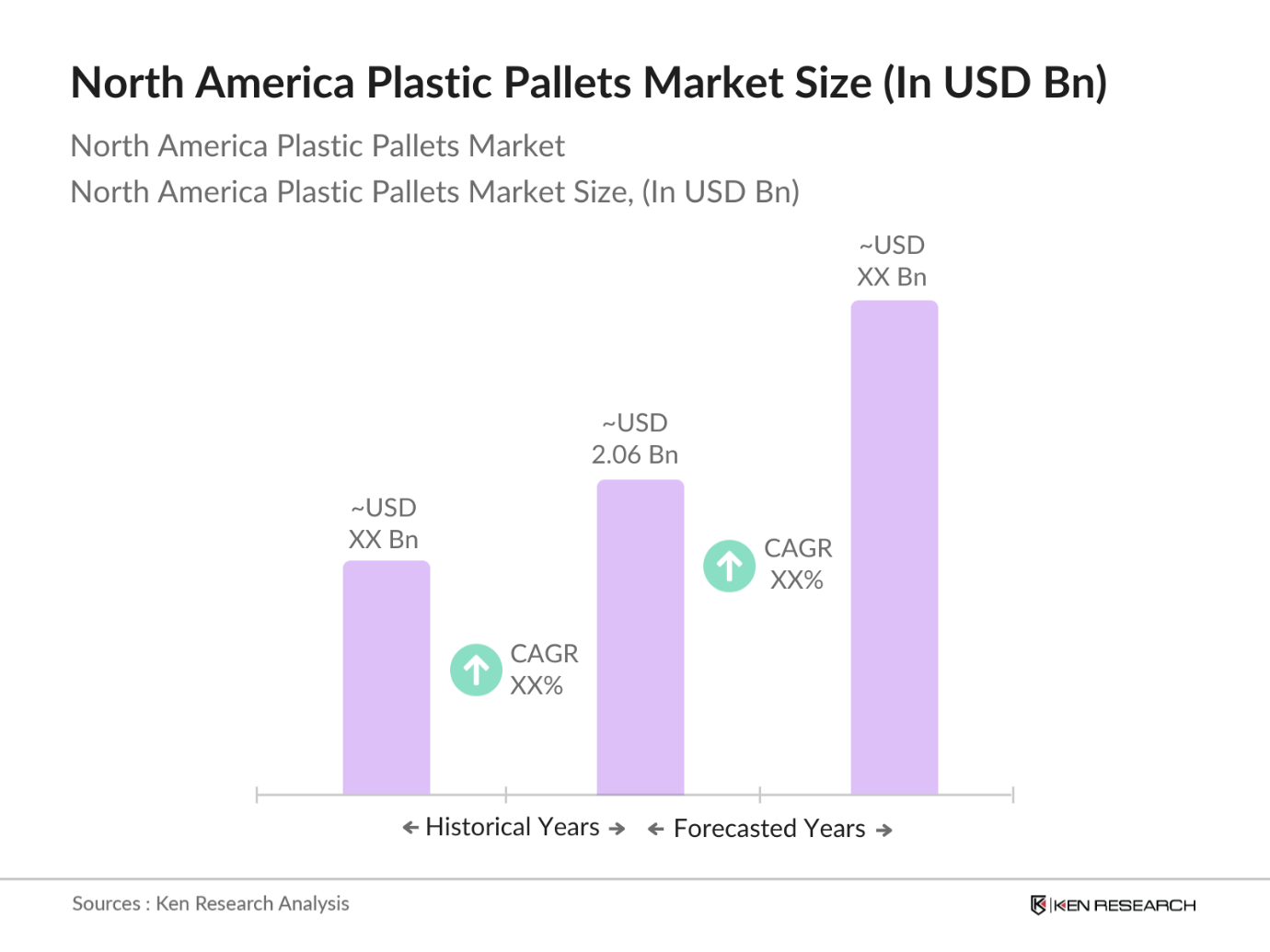

- The North America plastic pallets market is valued at USD 2.06 billion, driven by a notable shift toward sustainable, reusable materials that reduce environmental impact. The food and beverage, pharmaceutical, and e-commerce sectors are leading this demand, prioritizing plastic pallets over wood to meet strict hygiene and sustainability standards. The industry also benefits from government incentives and regulations that encourage businesses to adopt reusable materials, contributing to steady market growth.

- The United States dominates the plastic pallets market in North America due to its well-established logistics infrastructure and high e-commerce activity. Additionally, the U.S. government provides incentives for adopting sustainable materials, further encouraging plastic pallet use. Canada is also significant due to growing agricultural and food sectors, with initiatives such as the Sustainable Canadian Agricultural Partnership supporting reusable packaging solutions.

- The United States-Mexico-Canada Agreement (USMCA) has positively impacted the plastic pallets market by promoting seamless trade within North America. Under USMCA, import and export tariffs on recyclable materials, including plastic pallets, have been minimized, facilitating cross-border transactions. U.S. Census Bureau data shows a 14% increase in trade between the U.S. and Canada in 2023, largely driven by USMCA provisions that benefit industries using recyclable plastic materials. This regulatory support fosters a more favorable trade environment for plastic pallets.

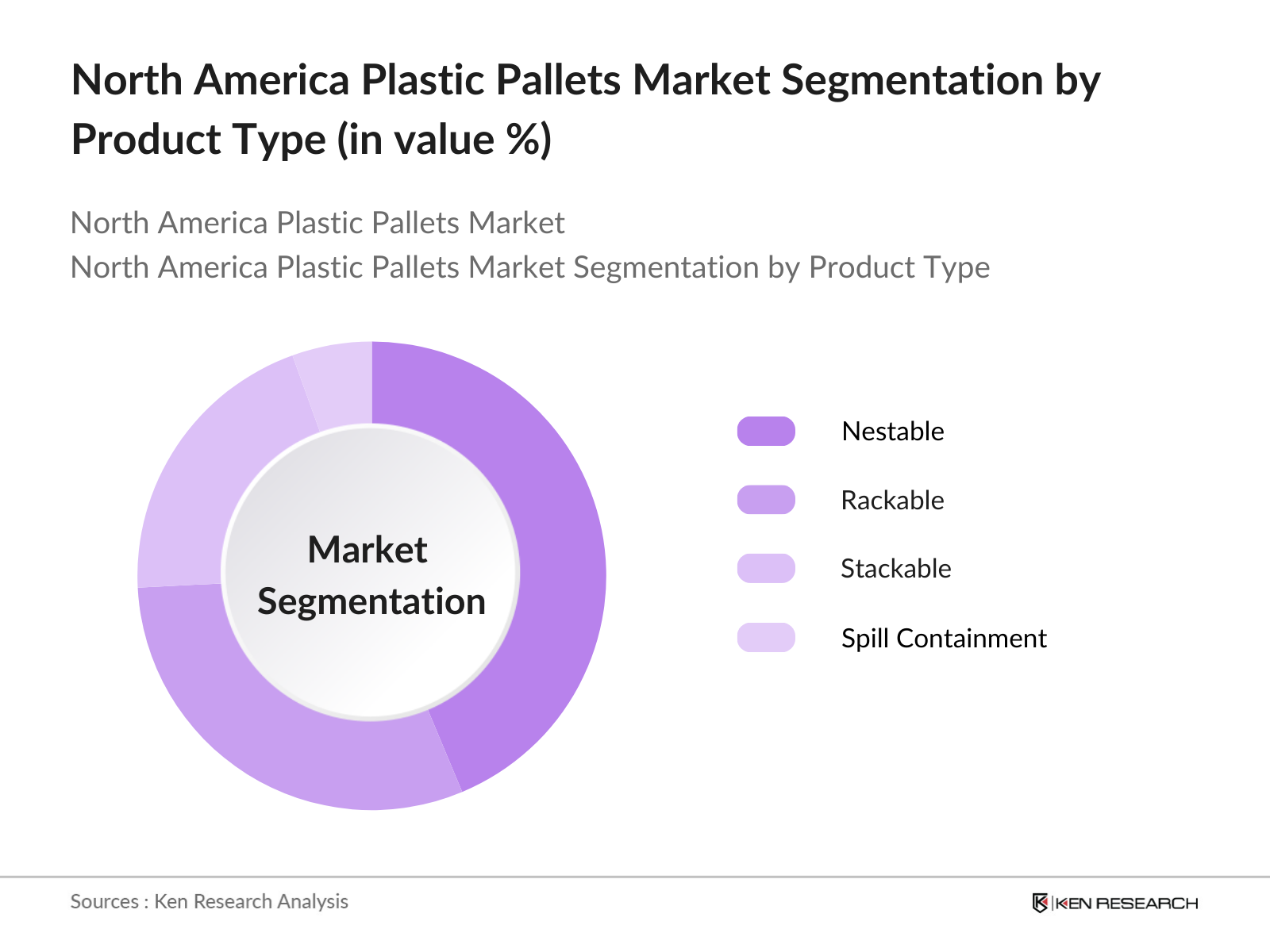

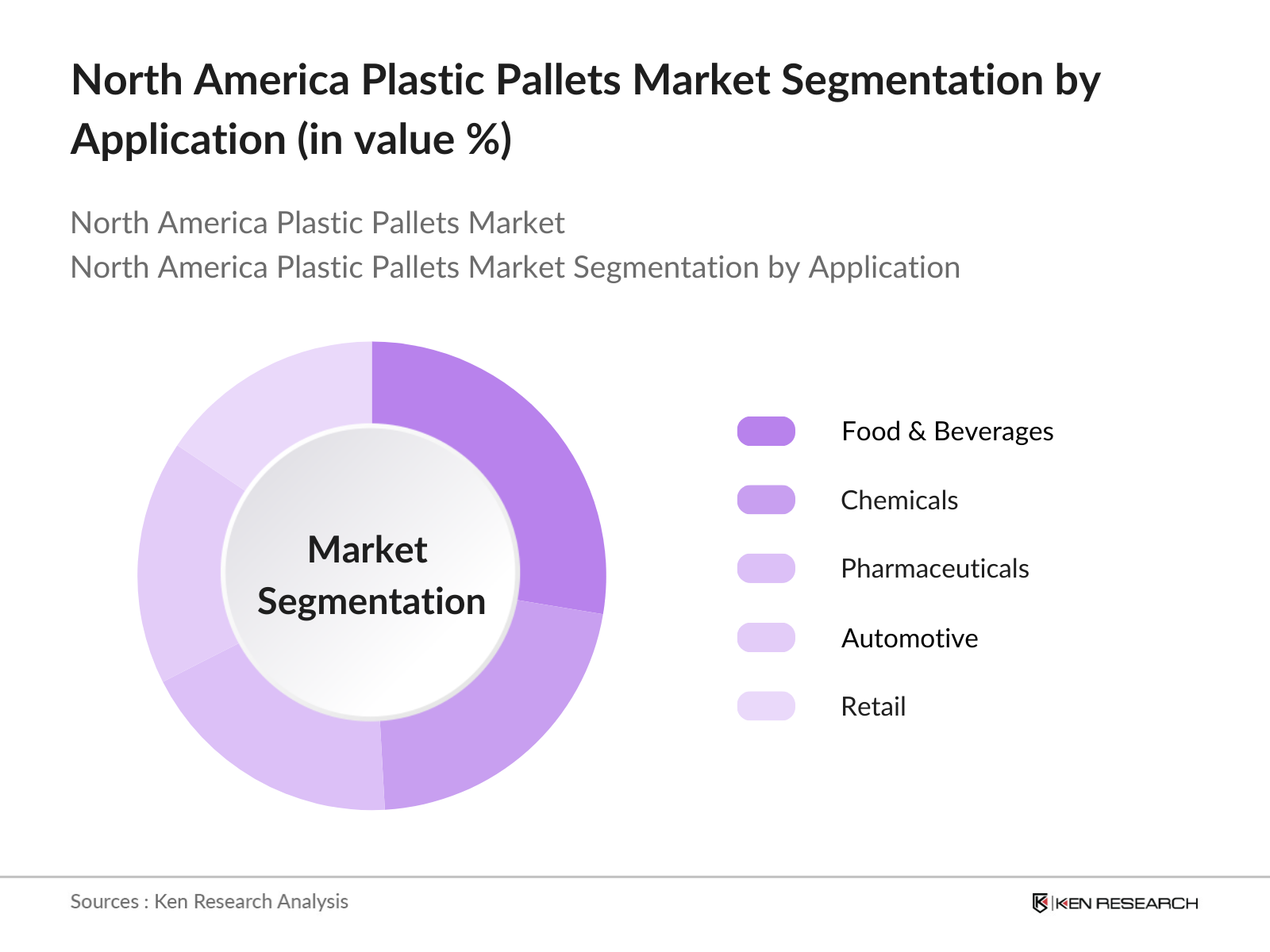

North America Plastic Pallets Market Segmentation

- By Product Type: The North America plastic pallets market is segmented by product type into nestable, rackable, stackable, and spill containment pallets. Nestable pallets hold a dominant share within this segmentation due to their space-saving design, which is ideal for transportation and storage in warehouses. They are also cost-effective, making them favorable for applications where weight and space efficiency are critical, such as food exports and fast-moving consumer goods (FMCG) sectors. This preference for nestable pallets is largely due to their affordability and stackability, which reduces logistics costs.

- By Application: Segmented by application, the North America plastic pallets market includes food & beverages, chemicals, pharmaceuticals, automotive, and retail sectors. Food & beverages hold a leading share due to strict hygiene standards that favor plastic pallets over wood, which can harbor pests and bacteria. Plastic pallets are widely used for handling fresh produce and storing dairy, meat, and beverages, contributing to their significant demand in this segment. The shift from wood to plastic also aligns with regulatory requirements for hygiene and safety within the food industry.

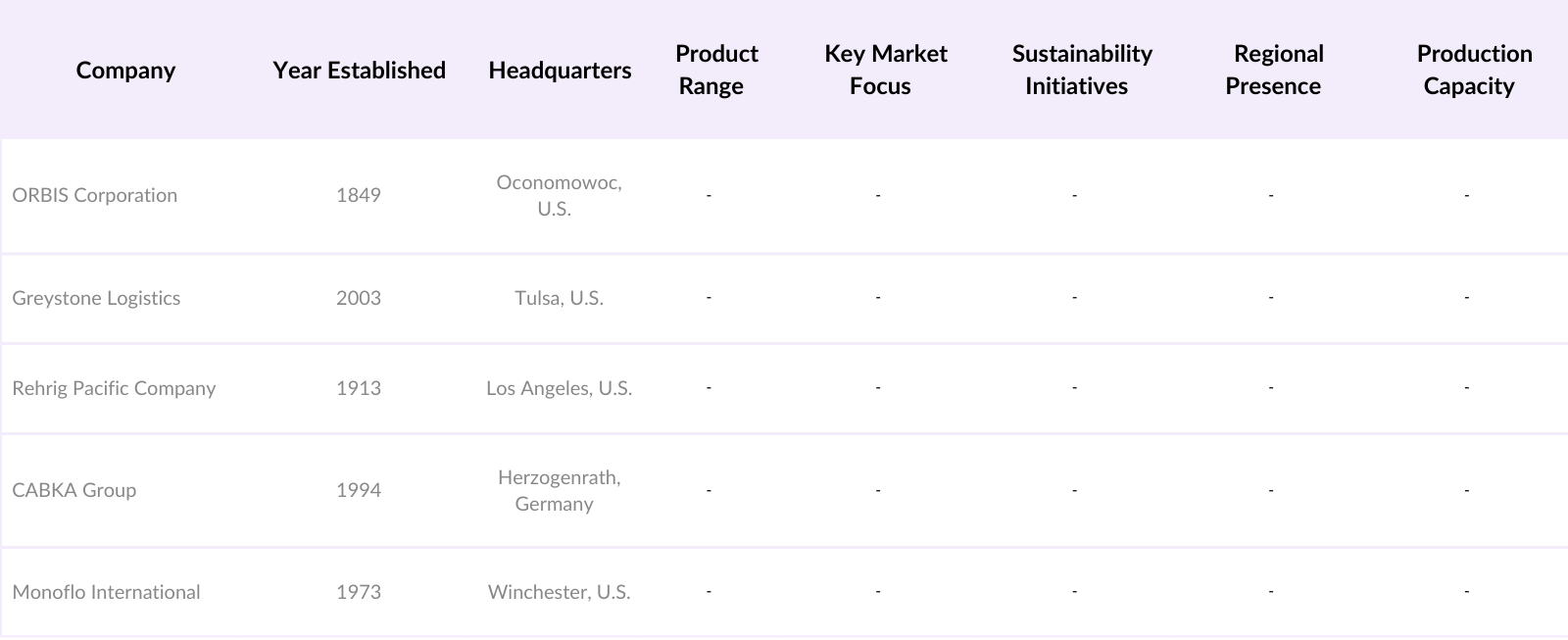

North America Plastic Pallets Market Competitive Landscape

The North America plastic pallets market is consolidated, with major players focusing on innovation, sustainability, and geographical expansion to strengthen their presence. The market is primarily influenced by large, established companies, which leverage economies of scale and extensive distribution networks to maintain a competitive edge.

North America Plastic Pallets Market Analysis

North America Plastic Pallets Market Growth Drivers

- Sustainability Push: The North American plastic pallets market is experiencing substantial growth due to a strong sustainability emphasis. Government-led sustainability initiatives, such as the USDA's Rural Energy for America Program (REAP), offer grants and loans to companies adopting sustainable practices, driving demand for reusable and recyclable plastic pallets. REAP, which disbursed $375 Billion for sustainable projects in 2023, reflects this increasing trend. Additionally, USDA data indicates a rise in demand for recycled materials in manufacturing, with over 22 Billion tons of recycled plastics integrated into industrial products in 2023. This shift underscores the sustainability drive shaping the plastic pallets market.

- Growth in E-Commerce and Logistics: The growth of e-commerce and logistics in North America, supported by the United States-Mexico-Canada Agreement (USMCA), is fueling the plastic pallets market. According to the U.S. Census Bureau, e-commerce retail sales reached $1.06 trillion in 2023, marking significant growth. Logistics providers increasingly prefer plastic pallets due to their lightweight and durability, which enhance transportation efficiency. The USMCA provisions streamlined cross-border trade, leading to a 14% rise in imports and exports among North American countries in 2023, further boosting the logistics demand for plastic pallets in these sectors.

- Shift from Wood to Plastic Pallets: The shift from wood to plastic pallets in North America is driven by the durability and hygiene advantages of plastic. According to the U.S. Department of Agriculture, wood pallets in food and pharmaceutical logistics face a high risk of contamination and degradation. Plastic pallets, which can withstand approximately 80% more reuse cycles compared to wood, are preferred for industries where hygiene and long lifespan are essential. USDA reports indicate a 20% reduction in cross-contamination risk with plastic, making them popular in sectors requiring strict hygiene standards.

North America Plastic Pallets Market Challenges

- High Production Costs: Plastic pallet production faces high tooling costs and resin price volatility, impacting manufacturers' profit margins. According to the U.S. Department of Commerce, in 2023, resin material prices fluctuated by up to 30%, driven by raw material shortages and global supply chain disruptions. These price fluctuations increase the production costs for plastic pallets, making them less competitive with traditional wooden pallets. Companies in North America report production cost increases of nearly 18% due to tooling and resin expenses, posing a financial challenge in the market.

- Competition from Alternative Materials: Plastic pallets face competition from wood and metal alternatives, which offer unique benefits in different applications. The USDA notes that wood pallets, which constituted around 77% of the North American pallet market in 2023, remain popular for heavy-duty applications due to their lower upfront cost. Metal pallets, preferred for high-weight loads in industries like automotive and aerospace, have a longer lifecycle than plastic, with a lifespan over double that of recycled plastic pallets. This competitive landscape limits the adoption of plastic pallets, particularly for high-weight applications.

North America Plastic Pallets Market Future Outlook

Over the coming years, the North America plastic pallets market is anticipated to grow steadily, driven by rising demands for sustainable, durable, and lightweight pallet solutions. This growth is supported by continuous innovation in pallet design, including IoT-enabled and RFID-tracked pallets, which optimize inventory management. Additionally, increased investment in logistics infrastructure by e-commerce and retail sectors will further boost the market as companies seek reliable, reusable solutions for high-frequency goods transport.

North America Plastic Pallets Market Opportunities

- Technological Advancements: The integration of automation and advanced injection molding in plastic pallet manufacturing presents significant opportunities. The National Institute of Standards and Technology (NIST) reports that automated injection molding processes in North America improve production efficiency by approximately 35%, reducing labor costs. Additionally, the shift toward automation supports customizable pallet designs to meet diverse industry needs, particularly in logistics and food sectors where custom pallets are required. Enhanced production flexibility through technology is driving the use of plastic pallets across various applications.

- Expansion in Emerging Industries: Growth in North Americas pharmaceutical and food sectors is creating demand for hygienic and durable plastic pallets. According to the U.S. Food and Drug Administration (FDA), over 15 Billion pallets are used annually in food and pharmaceutical logistics, with an increasing shift to plastic due to contamination concerns with wood. In 2023, the pharmaceutical market in North America expanded by 10%, with stringent FDA guidelines promoting plastic pallet usage for safety and hygiene. This sector growth provides a solid opportunity for plastic pallet adoption in these emerging markets.

Scope of the Report

Product Type | Nestable Rackable Stackable Spill Containment Pallets |

Material Type | HDPE LDPE PP |

Application | Food & Beverages Chemicals Pharmaceuticals Automotive Retail |

End-Use Industry | FMCG Industrial Manufacturing Warehousing E-commerce |

Country | U.S. Canada Mexico |

Products

Key Target Audience

Plastic Pallet Manufacturers

Food & Beverage Companies

Pharmaceutical and Chemical Manufacturers

Automotive Supply Chain Managers

Banks and Financial Institutions

Warehouse and Logistics Companies

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (USDA, FDA)

E-commerce and Retail Operators

Companies

Players Mentioned in the Report

ORBIS Corporation

Greystone Logistics

Rehrig Pacific Company

CABKA Group

Monoflo International

Polymer Solutions International

Perfect Pallet, Inc.

Brambles Ltd. (CHEP)

Euro Pool Group

TranPak, Inc.

Table of Contents

1. North America Plastic Pallets Market Overview

1.1. Definition and Market Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Driven by demand for lightweight and durable pallets, resistance to pests)

1.4. Market Segmentation Overview

2. North America Plastic Pallets Market Size (In USD Billion)

2.1. Historical Market Size (Impact of sustainability on plastic pallet demand)

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Plastic Pallets Market Analysis

3.1. Growth Drivers

3.1.1. Sustainability Push (Demand for reusable and recyclable pallets)

3.1.2. Growth in E-Commerce and Logistics (Driven by USMCA)

3.1.3. Government Incentives (USDA programs and tax breaks)

3.1.4. Shift from Wood to Plastic Pallets (Hygiene, durability advantages)

3.2. Market Challenges

3.2.1. High Production Costs (Expensive tooling and resin price volatility)

3.2.2. Competition from Alternative Materials (Wood and metal pallets)

3.2.3. Limited Application for Heavy Loads (Nestable pallets limitations)

3.3. Opportunities

3.3.1. Technological Advancements (Automation and injection molding)

3.3.2. Expansion in Emerging Industries (Growth in pharmaceuticals and food sectors)

3.3.3. Increasing Adoption of IoT-Enabled Pallets (Smart logistics solutions)

3.4. Trends

3.4.1. Preference for Recycled HDPE Pallets (Environmental focus)

3.4.2. Growing Use in Food & Beverage (Stringent hygiene regulations)

3.4.3. Expanding Use in Pharmaceutical Logistics (Temperature-sensitive product handling)

3.5. Government Regulations

3.5.1. USMCA and Trade Agreements Impact

3.5.2. Tax Incentives for Sustainable Practices

3.5.3. FDA Regulations (Impact on pallet use in food and pharmaceuticals)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, suppliers, and regulatory bodies)

3.8. Porters Five Forces

3.9. Competitive Landscape Analysis

4. North America Plastic Pallets Market Segmentation

4.1. By Product Type (In Revenue %)

4.1.1. Nestable

4.1.2. Rackable

4.1.3. Stackable

4.1.4. Spill Containment Pallets

4.2. By Material Type (In Revenue %)

4.2.1. High-Density Polyethylene (HDPE)

4.2.2. Low-Density Polyethylene (LDPE)

4.2.3. Polypropylene (PP)

4.3. By Application (In Revenue %)

4.3.1. Food & Beverages

4.3.2. Chemicals

4.3.3. Pharmaceuticals

4.3.4. Automotive

4.3.5. Retail

4.4. By End-Use Industry (In Revenue %)

4.4.1. FMCG

4.4.2. Industrial Manufacturing

4.4.3. Warehousing & Logistics

4.4.4. E-commerce

4.5. By Country (In Revenue %)

4.5.1. U.S.

4.5.2. Canada

4.5.3. Mexico

5. North America Plastic Pallets Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. ORBIS Corporation

5.1.2. Greystone Logistics

5.1.3. Rehrig Pacific Company

5.1.4. CABKA Group

5.1.5. Monoflo International

5.1.6. Polymer Solutions International

5.1.7. Allied Plastics, Inc.

5.1.8. Perfect Pallet, Inc.

5.1.9. Brambles Ltd.

5.1.10. TMF Corporation

5.1.11. PalletOne Inc.

5.1.12. Brambles Limited (CHEP)

5.1.13. Euro Pool Group

5.1.14. TranPak, Inc.

5.1.15. Cabka North America, Inc.

5.2. Cross Comparison Parameters (Material Type, Load Capacity, Price Range, Stackability, Durability, Hygiene Standards, Availability, Customization)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Plastic Pallets Market Regulatory Framework

6.1. Environmental Standards and Regulations

6.2. Compliance Requirements (FDA, USDA)

6.3. Sustainability Certification Processes

7. North America Plastic Pallets Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Plastic Pallets Future Market Segmentation

8.1. By Product Type (In Revenue %)

8.2. By Material Type (In Revenue %)

8.3. By Application (In Revenue %)

8.4. By End-Use Industry (In Revenue %)

8.5. By Country (In Revenue %)

9. North America Plastic Pallets Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

We begin by constructing an ecosystem map that includes all stakeholders within the North America Plastic Pallets Market. This step relies on desk research from secondary sources to identify critical market variables, including key players, material preferences, and regulatory influences.

Step 2: Market Analysis and Construction

We then compile and assess historical data on the North America Plastic Pallets Market, analyzing growth drivers and usage patterns. This phase includes evaluating product demand statistics to ensure reliability in revenue forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are refined through expert interviews, providing operational and financial insights from industry practitioners. This approach helps verify initial data and gain a deeper understanding of market dynamics.

Step 4: Research Synthesis and Final Output

Engagement with multiple manufacturers provides product insights, consumer preferences, and segment performance data, ensuring a comprehensive analysis that validates findings from the bottom-up approach.

Frequently Asked Questions

01. How big is the North America Plastic Pallets Market?

The North America plastic pallets market is valued at USD 2.06 billion, with growth fueled by rising demand for durable and sustainable materials, particularly from the food and beverage sector.

02. What are the primary challenges in the North America Plastic Pallets Market?

Key challenges include high production costs due to material fluctuations and competition from alternative pallet materials, such as wood and metal.

03. Who are the major players in the North America Plastic Pallets Market?

Major companies include ORBIS Corporation, Greystone Logistics, Rehrig Pacific Company, CABKA Group, and Monoflo International, known for their innovation in sustainable pallets.

04. What factors drive the growth of the North America Plastic Pallets Market?

The market is driven by demand for lightweight, recyclable pallets, growing e-commerce, and supportive regulations incentivizing sustainable materials.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.