North America Polyurea Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD6633

November 2024

81

About the Report

North America Polyurea Market Overview

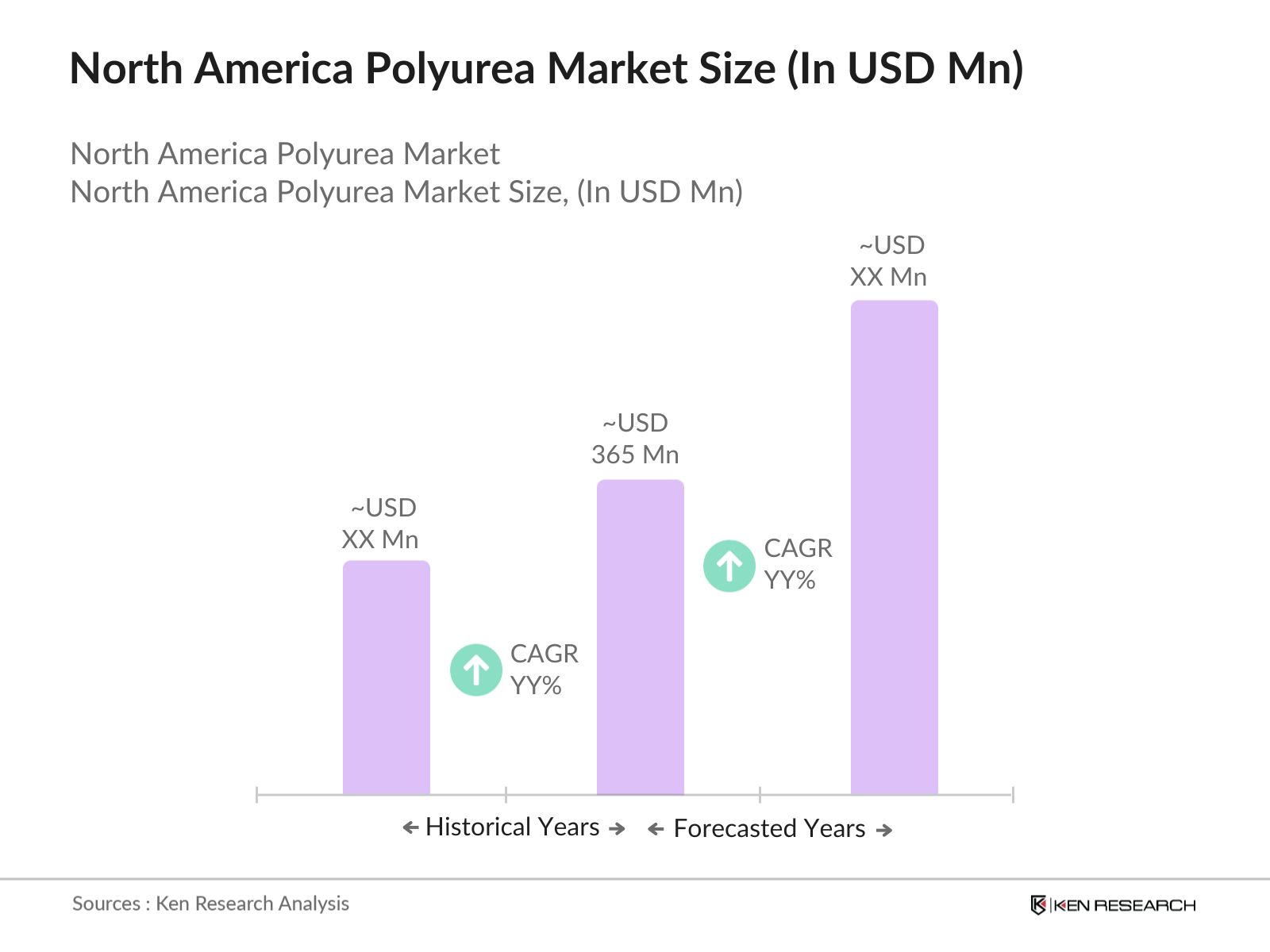

- The North America polyurea market is valued at USD 365 million. This market has seen consistent growth over the past five years, driven by rising demand for polyurea coatings in construction, automotive, and oil & gas industries. The materials superior propertiessuch as fast curing time, water resistance, and durabilityhave increased its adoption in waterproofing and protective coating applications.

- The U.S. and Canada are the leading regions within the market, primarily due to the heavy investments in infrastructure projects and the established automotive and oil & gas industries. The U.S., with its high rate of urbanization and industrialization, leads the market, while Canada benefits from favorable government initiatives promoting the use of eco-friendly and durable materials like polyurea.

- The $1.2 trillion U.S. government investment in infrastructure continues to drive the demand for high-performance coatings like polyurea, especially in critical areas like bridge repairs, highways, and public utility infrastructure. As of 2024, more than 25,000 infrastructure projects across the U.S. are underway, many of which require durable and environmentally compliant coatings such as polyurea.

North America Polyurea Market Segmentation

By Product Type: The market is segmented by product type into pure polyurea and hybrid polyurea. Pure polyurea has a dominant market share due to its superior performance in critical applications like industrial waterproofing and corrosion protection. The material offers exceptional resistance to chemicals, water, and abrasion, making it a preferred choice for industries that require high-performance coatings.

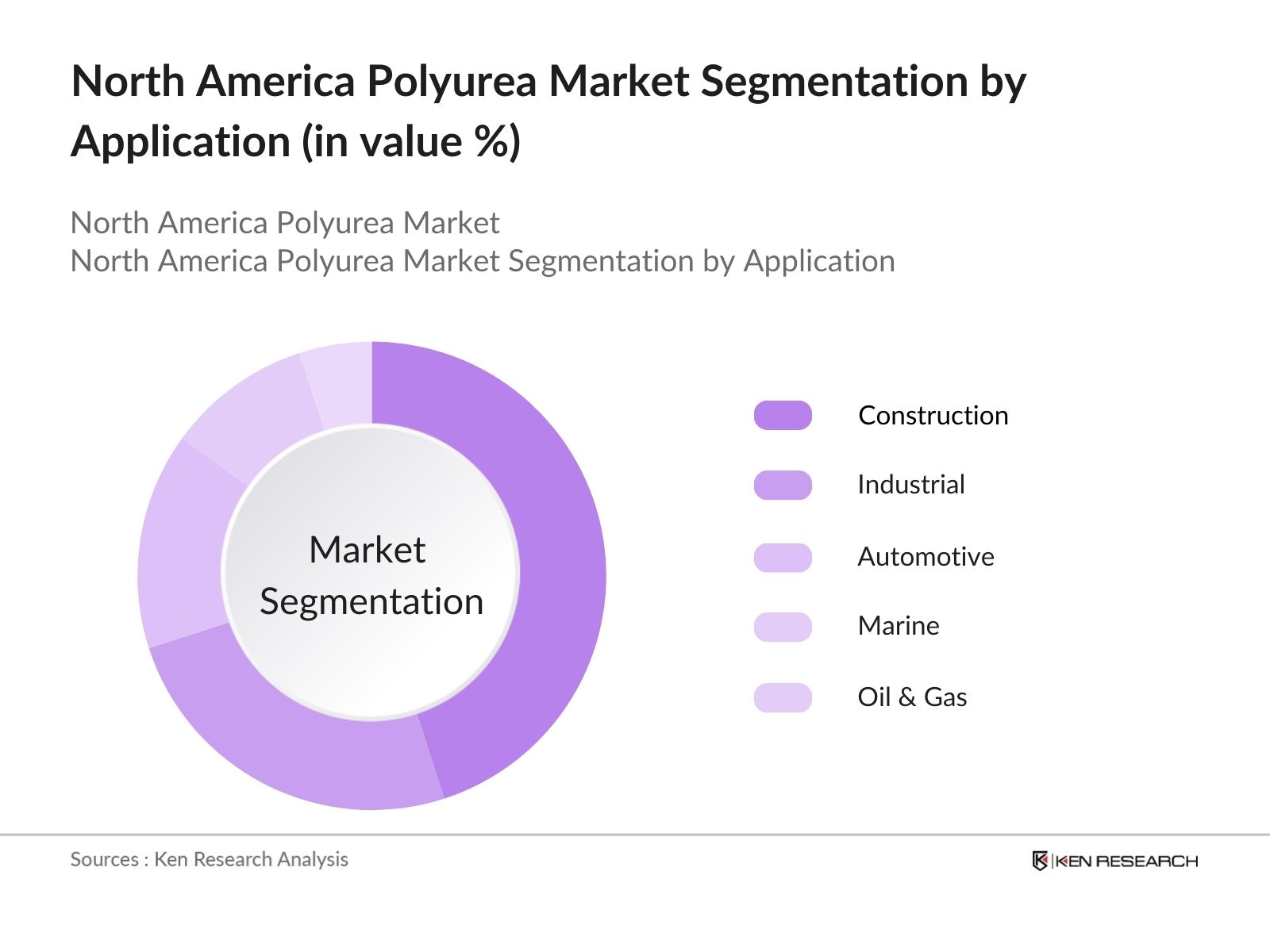

By Application: The market is segmented by application into construction, industrial, automotive, marine, and oil & gas. The construction segment holds the largest market share due to the rising demand for durable waterproofing solutions. Polyurea coatings are extensively used in roofs, bridges, and tunnels to prevent water ingress and extend the life of structures. In particular, the fast application and curing times of polyurea make it a favored material for time-sensitive infrastructure projects, driving its dominance in this segment.

North America Polyurea Market Competitive Landscape

The market is dominated by both global and local players that have established themselves through extensive R&D and product innovation. The market is moderately consolidated, with the top players focusing on expanding their regional presence and diversifying product offerings to cater to a wide array of industries, such as construction, automotive, and oil & gas.

|

Company Name |

Year of Establishment |

Headquarters |

Market Presence |

Product Portfolio |

R&D Investment |

Strategic Initiatives |

Manufacturing Capacity |

Geographic Presence |

Partnerships |

|

VersaFlex Incorporated |

1994 |

Kansas City, USA |

|||||||

|

BASF SE |

1865 |

Ludwigshafen, Germany |

|||||||

|

Huntsman Corporation |

1970 |

The Woodlands, USA |

|||||||

|

Covestro AG |

2015 |

Leverkusen, Germany |

|||||||

|

PPG Industries |

1883 |

Pittsburgh, USA |

North America Polyurea Market Analysis

Market Growth Drivers

- Infrastructure Development Initiatives in North America: The construction industry in North America, particularly in the United States, has seen substantial growth due to government initiatives such as the Infrastructure Investment and Jobs Act, which allocates $1.2 trillion for infrastructure development. Polyurea coatings are gaining prominence in construction projects due to their durability, flexibility, and resistance to harsh environmental conditions. The rising number of bridges, highways, and public utility projects in North America drives demand for polyurea as a protective and waterproofing coating, particularly in states like Texas and California, where infrastructure investments are highest.

- Increasing Adoption in Oil & Gas Industry: The polyurea market is benefiting from its growing application in the oil and gas industry, particularly for pipeline coatings, containment systems, and refineries. With the U.S. and Canada producing over 15 million barrels of oil per day combined in 2024, companies like Chevron and ExxonMobil are increasingly using polyurea to protect equipment and pipelines against corrosion, leaks, and environmental damage. This rising application is expected to strengthen the market position of polyurea in energy sector applications.

- Rising Demand for Waterproofing Solutions in the Commercial Real Estate Sector: The North American real estate sector, especially in commercial spaces, is forecasted to see significant investments exceeding $500 billion in 2024, leading to increased demand for waterproofing solutions. Polyurea coatings are extensively used for waterproofing in roofing systems, basements, and parking decks in high-rise commercial buildings in cities like New York, Chicago, and Toronto. The increasing emphasis on longevity and low maintenance in real estate projects drives the adoption of polyurea for these applications.

Market Challenges

- Complex Application Process: The application of polyurea requires highly specialized equipment and trained professionals, making it more complex than other coatings. A single polyurea application project can involve equipment costs ranging from $25,000 to $100,000, depending on the scope of the project. This complexity limits its use among smaller contractors and businesses that lack the required expertise, further slowing market expansion.

- Raw Material Price Fluctuations: The polyurea market heavily depends on raw materials derived from petrochemicals. Price volatility in the oil market directly impacts the cost of these materials. For instance, in 2024, crude oil prices ranged between $80 and $95 per barrel, causing fluctuations in the cost of isocyanates and polyetheramines, key ingredients in polyurea production. These fluctuations make it difficult for manufacturers to maintain stable profit margins.

North America Polyurea Market Future Outlook

Over the next five years, the North America polyurea industry is expected to witness robust growth, driven by increased demand from construction, automotive, and marine sectors. The growing trend toward using sustainable materials and the need for high-performance coatings in infrastructure projects will be key contributors to this expansion.

Future Market Opportunities

- Growth in Aerospace Applications: The aerospace industry will begin to integrate polyurea coatings for aircraft parts, offering enhanced durability and reduced weight compared to traditional coatings. By 2029, it is estimated that polyurea coatings will be used in over 1,500 new aircrafts in North America, contributing to their overall longevity and operational efficiency.

- Development of Smart Polyurea Coatings: In the future, polyurea coatings embedded with sensors for real-time monitoring of structural integrity will gain traction, particularly in critical infrastructure like bridges and tunnels. By 2029, over 2,000 infrastructure projects are expected to integrate smart polyurea coatings, providing valuable data on material wear and damage.

Scope of the Report

|

Product Type |

Pure Polyurea Hybrid Polyurea |

|

Application |

Construction Industrial Automotive Marine Oil & Gas |

|

Technology |

Spray Applied Hand Mix |

|

Raw Material |

Aromatic Isocyanates Aliphatic Isocyanates |

|

Region |

U.S. Canada Mexico |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Polyurea Manufacturers

Construction Companies

Automotive OEMs

Banks and Financial Institution

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Environmental Protection Agency, U.S. Department of Transportation)

Companies

Players Mentioned in the Report:

VersaFlex Incorporated

BASF SE

Huntsman Corporation

Covestro AG

PPG Industries

The Sherwin-Williams Company

Rhino Linings Corporation

ArmorThane USA Inc.

Nukote Coating Systems

Sika AG

Table of Contents

1. North America Polyurea Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Polyurea Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Polyurea Market Analysis

3.1. Growth Drivers

3.1.1. Infrastructure Expansion (Infrastructure Investment)

3.1.2. Industrial Applications (Manufacturing Growth)

3.1.3. Adoption of Sustainable Coatings (Eco-friendly Material Adoption)

3.1.4. Technological Advancements in Spray Equipment (Tech Adaptation)

3.2. Market Challenges

3.2.1. High Application Costs (Operational Costs)

3.2.2. Availability of Substitutes (Competitive Pricing Pressure)

3.2.3. Volatility in Raw Material Prices (Raw Material Fluctuations)

3.3. Opportunities

3.3.1. Rise in Demand for Waterproofing Solutions (Waterproofing Applications)

3.3.2. Expansion in Automotive Industry (Automotive Coatings)

3.3.3. Development of Advanced Hybrid Polyurea Systems (Innovation in Formulation)

3.4. Trends

3.4.1. Growth in Commercial Roofing Sector (Roofing Applications)

3.4.2. Use in Oil & Gas Pipelines (Corrosion Protection)

3.4.3. Increasing Focus on LEED-Certified Projects (Sustainability Initiatives)

3.5. Government Regulation

3.5.1. VOC Compliance Standards (Environmental Regulations)

3.5.2. Building Code Requirements (Construction Regulations)

3.5.3. Industry-Specific Health and Safety Standards (Worker Safety Standards)

3.5.4. Government Initiatives for Infrastructure Modernization (Government Projects)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Supply Chain Participants)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. North America Polyurea Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Pure Polyurea

4.1.2. Hybrid Polyurea

4.2. By Application (In Value %)

4.2.1. Construction

4.2.2. Industrial

4.2.3. Automotive

4.2.4. Marine

4.2.5. Oil & Gas

4.3. By Technology (In Value %)

4.3.1. Spray Applied

4.3.2. Hand Mix

4.4. By Raw Material (In Value %)

4.4.1. Aromatic Isocyanates

4.4.2. Aliphatic Isocyanates

4.5. By Region (In Value %)

4.5.1. U.S.

4.5.2. Canada

4.5.3. Mexico

5. North America Polyurea Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. VersaFlex Incorporated

5.1.2. BASF SE

5.1.3. Huntsman Corporation

5.1.4. Covestro AG

5.1.5. PPG Industries

5.1.6. The Sherwin-Williams Company

5.1.7. Nukote Coating Systems

5.1.8. Rhino Linings Corporation

5.1.9. ArmorThane USA Inc.

5.1.10. Sika AG

5.1.11. Graco Inc.

5.1.12. Teknos Group

5.1.13. Polycoat Products

5.1.14. SPI Performance Coatings

5.1.15. Ultimate Linings

5.2 Cross Comparison Parameters

5.2.1. Revenue

5.2.2. Market Share

5.2.3. Product Portfolio

5.2.4. R&D Investment

5.2.5. Manufacturing Capacity

5.2.6. Number of Employees

5.2.7. Geographical Presence

5.2.8. Strategic Partnerships

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7 Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Polyurea Market Regulatory Framework

6.1. Environmental Compliance Standards

6.2. Certification Requirements

6.3. Compliance Audits

7. North America Polyurea Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Polyurea Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Raw Material (In Value %)

8.5. By Region (In Value %)

9. North America Polyurea Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Competitive Landscape Positioning

9.3. Marketing and Sales Initiatives

9.4. White Space Opportunity Identification

Research Methodology

Step 1: Identification of Key Variables

The initial step involved mapping the entire North America polyurea market by identifying key stakeholders such as manufacturers, suppliers, and consumers. This ecosystem mapping was achieved through desk research, using industry reports, trade publications, and proprietary databases. The goal was to pinpoint critical variables like market growth drivers, pricing dynamics, and product differentiation.

Step 2: Market Analysis and Construction

We compiled and analyzed historical market data on polyurea usage in sectors such as construction, automotive, and oil & gas. This phase involved the evaluation of product demand, supply chain efficiency, and regulatory compliance within these industries. Revenue estimations were cross-referenced with manufacturer data to ensure accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding future growth trends and competitive landscape were tested and validated through interviews with industry experts. These included manufacturers, distributors, and end-users who provided insights on product performance, consumer preferences, and technological innovations.

Step 4: Research Synthesis and Final Output

Finally, the data gathered through the bottom-up approach was synthesized into a comprehensive market report. Polyurea manufacturers were directly consulted to verify assumptions and finalize projections, ensuring that the reports findings were grounded in actual market conditions.

Frequently Asked Questions

01. How big is the North America Polyurea Market?

The North America polyurea market is valued at USD 365 million, driven by the rising demand for protective coatings in construction and industrial applications.

02. What are the challenges in the North America Polyurea Market?

Challenges in the North America polyurea market include the high cost of polyurea coatings and competition from alternative products like epoxy and polyurethane. Additionally, volatility in raw material prices impacts the profitability of manufacturers.

03. Who are the major players in the North America Polyurea Market?

Key players in the North America polyurea market include VersaFlex Incorporated, BASF SE, Huntsman Corporation, Covestro AG, and PPG Industries, dominating through innovation, diverse product portfolios, and extensive market reach.

04. What are the growth drivers of the North America Polyurea Market?

Growth in the North America polyurea market is driven by the increasing adoption of polyurea in infrastructure projects, its use in waterproofing applications, and the demand from the automotive sector for protective coatings.

05. What are the trends in the North America Polyurea Market?

Emerging trends in the North America polyurea market include the rise in demand for eco-friendly coatings, technological advancements in spray equipment, and the increasing use of polyurea in the oil & gas sector for corrosion protection.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.