North America Powder Metallurgy Market Outlook to 2030

Region:North America

Author(s):Paribhasha Tiwari

Product Code:KROD10679

November 2024

94

About the Report

North America Powder Metallurgy Market Overview

- The North America Powder Metallurgy market is valued at USD 1.5 billion, based on a thorough five-year historical analysis. This market is largely driven by the aerospace, automotive, and medical industries, where precision and high-efficiency manufacturing capabilities are paramount. Powder metallurgys role in developing lightweight, durable, and near-net-shape components has particularly driven growth in the automotive sector as electric vehicles (EVs) and fuel-efficient solutions become prioritized.

- The market is dominated by the United States due to its high concentration of aerospace and defense players, as well as substantial investment in advanced manufacturing technologies. The presence of major players in aerospace technology and a high level of defense spending positions the U.S. as a leading country in powder metallurgy. Moreover, Canada follows due to its active automotive and machinery manufacturing sectors.

- North American government incentives, including tax breaks and grants, have directly boosted powder metallurgy use in the EV sector. By mid-2024, over $300 million in federal funding supported EV manufacturers, encouraging them to adopt lightweight powder metal components. These incentives have accelerated powder metallurgy's integration in EV production, as lightweight parts contribute to improved energy efficiency and vehicle range.

North America Powder Metallurgy Market Segmentation

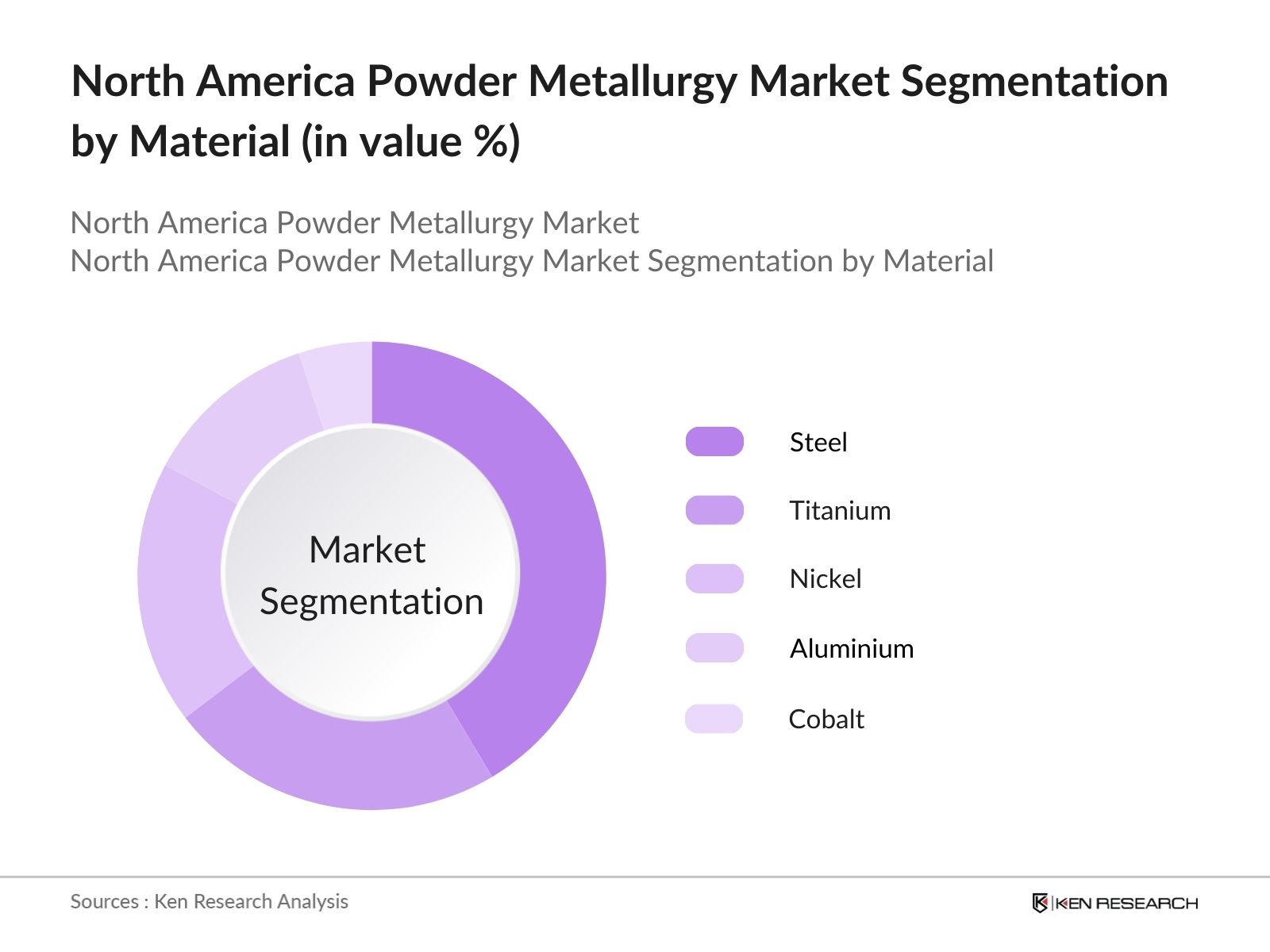

By Material: The North America Powder Metallurgy market is segmented by material type into steel, titanium, nickel, aluminum, and cobalt. Steel currently dominates this segmentation due to its extensive use in automotive and industrial applications where durability and strength are essential. This sub-segment benefits from established demand in automotive and heavy machinery, where steel is essential for its affordability and versatility in manufacturing high-strength, lightweight parts.

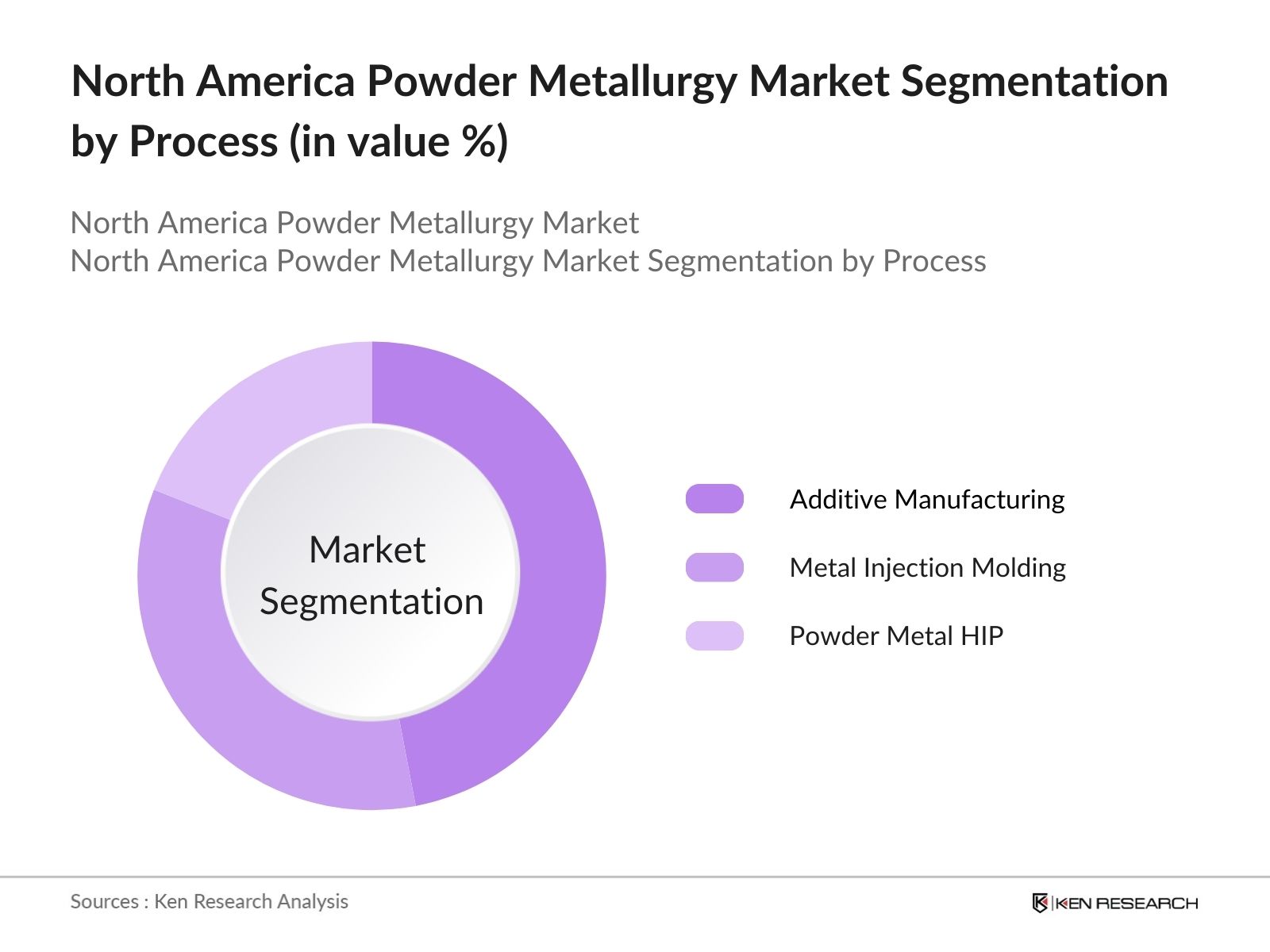

By Process: Powder metallurgy is further divided by process type, including Additive Manufacturing (3D Printing), Metal Injection Molding (MIM), and Powder Metal Hot Isostatic Pressing (PM HIP). Additive manufacturing has a dominant market share within this segmentation. Its extensive application in aerospace for creating complex, lightweight structures has elevated its position. This process's flexibility, rapid prototyping capabilities, and alignment with sustainable manufacturing trends contribute to its dominance.

North America Powder Metallurgy Market Competitive Landscape

The North America Powder Metallurgy market is dominated by a few significant players. This consolidation illustrates the influence of these key companies, each with substantial R&D resources and a focus on expanding their technical capabilities.

North America Powder Metallurgy Market Analysis

Growth Drivers

- Increased Adoption of Additive Manufacturing: The North American market sees additive manufacturing's rise as a major growth driver, especially in sectors like automotive and aerospace. Over 450 additive manufacturing units focused on powder metallurgy applications were operational by mid-2024, largely in the United States and Canada. These units allow rapid, flexible, and cost-effective production, aligning with industry shifts toward sustainable and on-demand manufacturing. The automotive sector alone implemented over 130 new additive units between 2023 and 2024, with a focus on PM parts, accelerating the market's adoption rate and highlighting significant economic value in terms of material usage efficiency and lower waste production.

- Demand for Lightweight Materials in Automotive and Aerospace: The North American automotive and aerospace industries, both estimated at over 350 million metric tons of production in 2024, are aggressively pushing for lightweight materials. Powder metallurgys inherent ability to produce high-strength, low-weight components addresses this demand. By 2024, the powder metallurgy sector has saved over 90,000 metric tons of raw materials in these industries due to efficient powder-based component manufacturing processes, making powder metallurgy critical in lightweight part production. This push not only improves vehicle fuel efficiency but also cuts down carbon emissions across the region.

- Technological Advances in Powder Production: Innovations in powder metallurgy processes, especially in powder atomization and reduction techniques, have allowed the North American market to produce nearly 250,000 tons of fine, high-purity powders annually as of 2024. These technological advancements enhance powder consistency and control, driving adoption in sectors requiring precision manufacturing. Advanced automation and quality control technologies have improved production efficiency by nearly 20% since 2023, making it feasible to cater to complex applications in automotive, aerospace, and medical sectors.

Market Challenges

- High Initial Capital Costs: Establishing powder metallurgy facilities in North America demands significant investment, with setup costs for advanced manufacturing units reaching nearly $2 million for medium-sized facilities. This capital-intensive nature poses barriers for smaller manufacturers, limiting market entry. As of 2024, over 70% of new entrants faced financing hurdles, impacting the adoption of advanced powder metallurgy methods in the region.

- Material Consistency and Quality Issues: Material consistency remains a challenge in powder metallurgy, particularly in high-specification applications. In 2024, quality control reports revealed that around 25,000 tons of powder-based products experienced production defects, primarily due to inconsistencies in powder density and purity. These issues have led to additional costs and production delays in industries such as aerospace and medical, where precision is paramount.

North America Powder Metallurgy Market Future Outlook

Over the next five years, the North America Powder Metallurgy market is anticipated to see substantial growth fueled by the automotive industry's shift toward EVs, the demand for sustainable manufacturing, and advancements in additive manufacturing. Innovations in powder material development and applications in renewable energy and robotics will further enhance growth prospects.

Market Opportunities

- Impact of Growing EV Market on PM Parts: The North American electric vehicle (EV) market has significantly boosted demand for powder metallurgy parts, especially in electric motor and battery components. In 2024, the EV sector consumed over 65,000 metric tons of powder metal for specialized components, with projections indicating a sustained increase as EV adoption grows. This demand aligns with the need for efficient, lightweight materials, positioning powder metallurgy as a crucial process in EV manufacturing.

- Adoption of Soft Magnetic Composites in Electronics: Soft magnetic composites (SMCs) produced through powder metallurgy processes have gained traction in the North American electronics industry. In 2024, over 15,000 metric tons of SMCs were used in consumer electronics, significantly enhancing energy efficiency. SMCs facilitate compact, energy-efficient designs, supporting the growth of miniaturized electronics in applications like inductors and transformers. The electronics markets increasing reliance on SMCs presents substantial growth potential for powder metallurgy.

Scope of the Report

|

By Material |

Titanium Nickel Steel Aluminum Cobalt |

|

By Process |

Additive Manufacturing Metal Injection Molding Powder Metal HIP |

|

By Application |

Aerospace & Defense Automotive Medical & Dental Oil & Gas Industrial Machinery |

|

By End-Use |

OEMs AM Operators |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience

Investors and Venture Capitalist Firms

OEMs and AM Operators

Aerospace and Defense Manufacturers

Automotive and Electric Vehicle Manufacturers

Medical Device Manufacturers

Industrial Equipment and Machinery Producers

Government and Regulatory Bodies (e.g., U.S. Department of Defense, U.S. Department of Energy)

Environmental and Sustainable Manufacturing Advocates

Companies

Players Mentioned in the Report:

Höganäs AB

GKN Sinter Metals

Rio Tinto Metal Powders

Liberty House Group

Molyworks Materials Corporation

CRS Holdings Inc.

Advanced Technology & Materials Co., Ltd.

Sandvik AB

JSC POLEMA

Carpenter Technology

Table of Contents

1. North America Powder Metallurgy Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics

1.4 Key Indicators and Metrics (Material Utilization Rate, Process Efficiency, Green Strength)

2. North America Powder Metallurgy Market Size

2.1 Historical Market Data (Revenue and Volume)

2.2 Year-On-Year Growth Analysis

2.3 Key Developments in Market Segments (Automotive, Aerospace, Medical)

3. North America Powder Metallurgy Market Analysis

3.1 Growth Drivers

3.1.1 Increased Adoption of Additive Manufacturing

3.1.2 Lightweight Demand in Automotive & Aerospace

3.1.3 Technological Advances in Powder Production

3.1.4 Sustainability Initiatives

3.2 Market Challenges

3.2.1 High Initial Capital Costs

3.2.2 Material Consistency Issues

3.2.3 Skilled Workforce Shortages

3.3 Opportunities

3.3.1 Growing EV Market Impact on PM Parts

3.3.2 Soft Magnetic Composites in Electronics

3.3.3 Strategic OEM Collaborations

3.4 Trends

3.4.1 Integration with Digital Manufacturing

3.4.2 Eco-Friendly Material Innovations

3.4.3 Rise of Custom Manufacturing Platforms

3.5 Government Regulations

3.5.1 Emissions & Fuel Efficiency Standards

3.5.2 Defense Industry Quality Certifications

3.5.3 Tax Incentives for Green Manufacturing

3.6 SWOT Analysis

3.7 Industry Stakeholders Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. North America Powder Metallurgy Market Segmentation

4.1 By Material (In Value %)

4.1.1 Titanium

4.1.2 Nickel

4.1.3 Steel

4.1.4 Aluminum

4.1.5 Cobalt

4.2 By Process (In Value %)

4.2.1 Additive Manufacturing (3D Printing)

4.2.2 Metal Injection Molding (MIM)

4.2.3 Powder Metal Hot Isostatic Pressing (PM HIP)

4.3 By Application (In Value %)

4.3.1 Aerospace & Defense

4.3.2 Automotive

4.3.3 Medical & Dental

4.3.4 Oil & Gas

4.3.5 Industrial Machinery

4.4 By End-Use (In Value %)

4.4.1 Original Equipment Manufacturers (OEMs)

4.4.2 Additive Manufacturing (AM) Operators

4.5 By Region (In Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

5. North America Powder Metallurgy Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Hoeganaes Corporation

5.1.2 GKN Sinter Metals

5.1.3 Rio Tinto Metal Powders

5.1.4 Sandvik AB

5.1.5 Liberty House Group

5.1.6 Molyworks Materials Corporation

5.1.7 JSC POLEMA

5.1.8 Advanced Technology & Materials Co., Ltd.

5.1.9 CRS Holdings Inc.

5.1.10 Rusal

5.1.11 Carpenter Technology

5.1.12 AMETEK Specialty Metal Products

5.1.13 Sumitomo Electric Industries

5.1.14 Capstan California

5.1.15 BASF SE

5.2 Cross Comparison Parameters (Material Innovation, Production Capacity, Geographical Presence, R&D Investment, Revenue, End-User Segments, Strategic Partnerships, Environmental Compliance)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Mergers, Acquisitions, Joint Ventures)

5.5 Investment Analysis (Public-Private Partnerships, Government Grants)

6. North America Powder Metallurgy Market Regulatory Framework

6.1 Standards for Environmental Impact

6.2 Industry-Specific Compliance

6.3 Certification and Quality Assurance Processes

7. North America Powder Metallurgy Future Market Size

7.1 Projections for Key Market Segments

7.2 Factors Impacting Future Market Growth

8. North America Powder Metallurgy Market Future Segmentation

8.1 By Material

8.2 By Process

8.3 By Application

8.4 By End-Use

8.5 By Region

9. Market Analysts Recommendations

9.1 Market Entry and Expansion Strategies

9.2 Target Customer Segmentation

9.3 Innovation and Product Development Opportunities

9.4 Potential White Spaces in Emerging Applications

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial step involved mapping all stakeholders within the North America Powder Metallurgy Market ecosystem. Using secondary and proprietary databases, comprehensive data was gathered on market dynamics, industry standards, and competitive parameters.

Step 2: Market Analysis and Construction

The next phase included compiling historical data on powder metallurgy applications across North America. Assessing key manufacturing metrics such as market penetration, the impact of technology on productivity, and service quality enabled a reliable estimate of the revenue structure.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated via interviews with industry experts and representatives from major companies. This provided insights into technological innovations, cost structures, and sustainability initiatives crucial to powder metallurgy.

Step 4: Research Synthesis and Final Output

The final stage consolidated findings from OEMs, AM operators, and material suppliers. This comprehensive approach ensured the report accurately reflects the market landscape, aligning with both industry trends and forecasted developments.

Frequently Asked Questions

01. How big is the North America Powder Metallurgy Market?

The North America Powder Metallurgy Market is valued at USD 1.5 billion, reflecting substantial growth from the aerospace, automotive, and medical sectors, which demand high-precision, lightweight components.

02. What are the challenges in the North America Powder Metallurgy Market?

Challenges in the North America Powder Metallurgy Market include high initial setup costs, issues with material consistency, and the need for a skilled workforce to operate advanced manufacturing technologies.

03. Who are the major players in the North America Powder Metallurgy Market?

Key players in the North America Powder Metallurgy Market include Hgans AB, GKN Sinter Metals, Rio Tinto Metal Powders, Liberty House Group, and Molyworks Materials Corporation. These companies are known for their technological capabilities and commitment to sustainable manufacturing.

04. What are the growth drivers of the North America Powder Metallurgy Market?

Growth drivers in the North America Powder Metallurgy Market include the shift towards electric vehicles, rising demand for lightweight materials, and technological advancements in additive manufacturing, which align with sustainability goals.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.