North America PMIC (Power Management Integrated Circuits) Market outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD7455

November 2024

84

About the Report

North America PMIC (Power Management Integrated Circuits) Market Overview

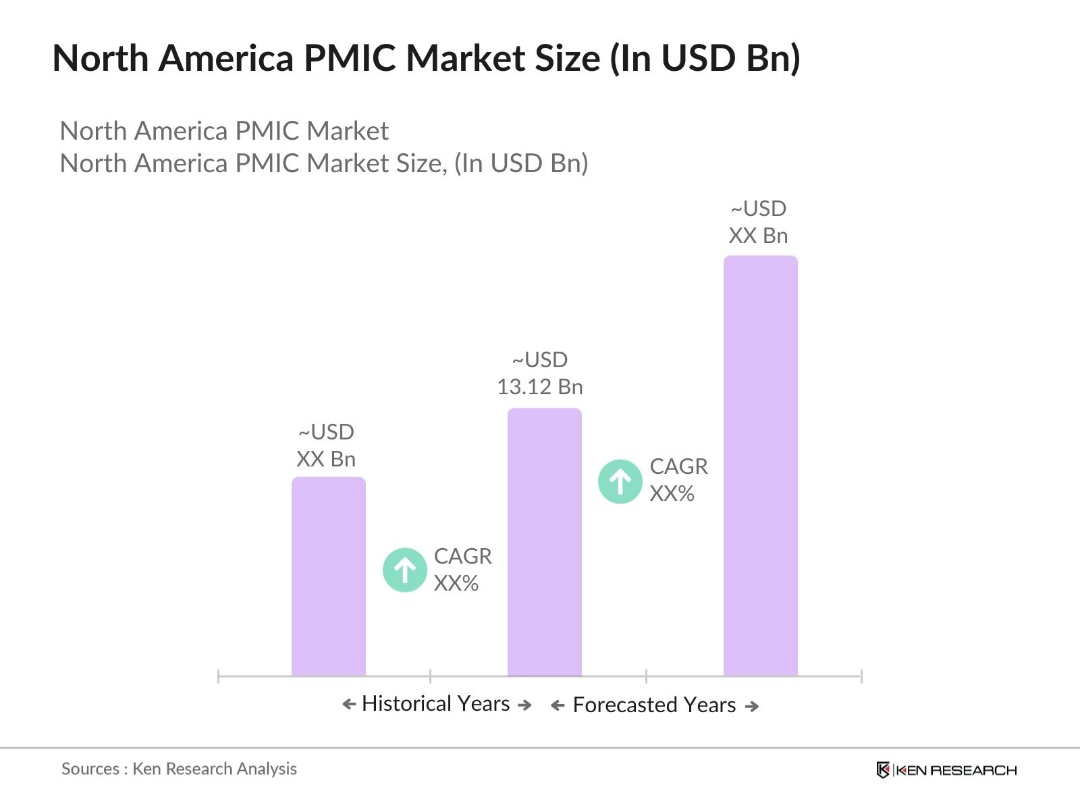

- The North America PMIC Market is valued at USD 13.12 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for energy-efficient electronic devices and the expansion of electric vehicles (EVs). PMICs play a critical role in managing power consumption in electronic devices, ensuring efficiency and prolonging battery life, making them indispensable in the EV, consumer electronics, and industrial automation sectors. The widespread shift toward sustainable energy solutions further boosts the market.

- The United States dominates the North America PMIC market, largely due to its advanced technological infrastructure and growing electric vehicle market. Additionally, Canada follows closely due to its increasing demand for renewable energy solutions and industrial automation. The dominance of these regions is attributed to their strong semiconductor industry, high investments in research and development, and supportive government policies promoting energy-efficient technologies.

- The U.S. Department of Energys Level VII energy conservation standards, introduced in 2023, aim to enhance the efficiency of external power supplies. This initiative mandates stricter energy consumption limits, pushing manufacturers to design more energy-efficient products. By lowering no-load power consumption and increasing average efficiency, this regulation supports energy conservation efforts and reduces greenhouse gas emissions. The initiative is set to benefit both consumers and businesses through reduced energy costs and environmental impact.

North America PMIC (Power Management Integrated Circuits) Market Segmentation

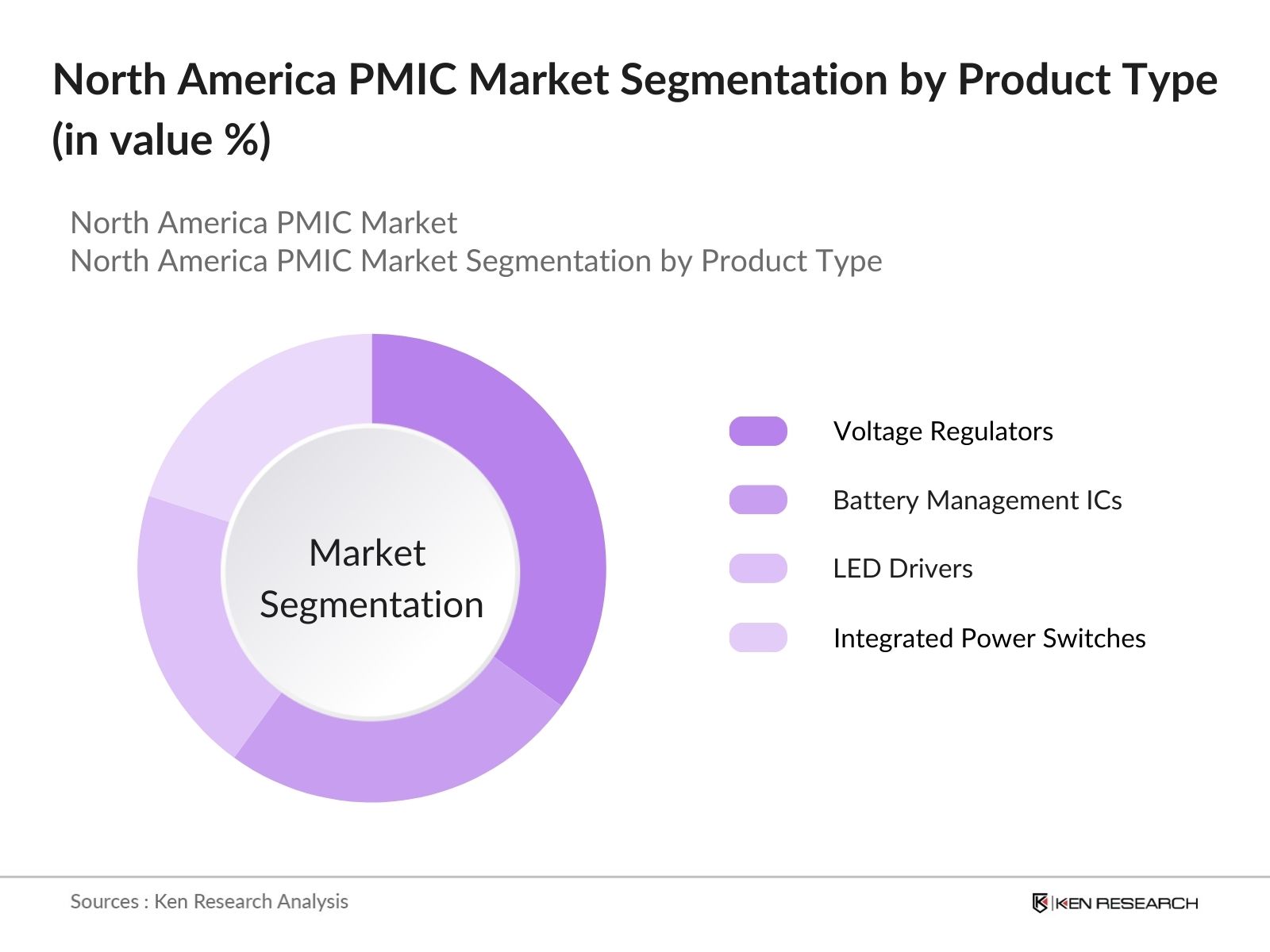

By Product Type: The North America PMIC market is segmented by product type into voltage regulators, battery management ICs, LED drivers, and integrated power switches. Voltage regulators hold a dominant market share in the product type segmentation. Their dominance is due to their critical role in maintaining the voltage levels across multiple applications, particularly in automotive and industrial electronics, where precise voltage control is crucial for operational stability.

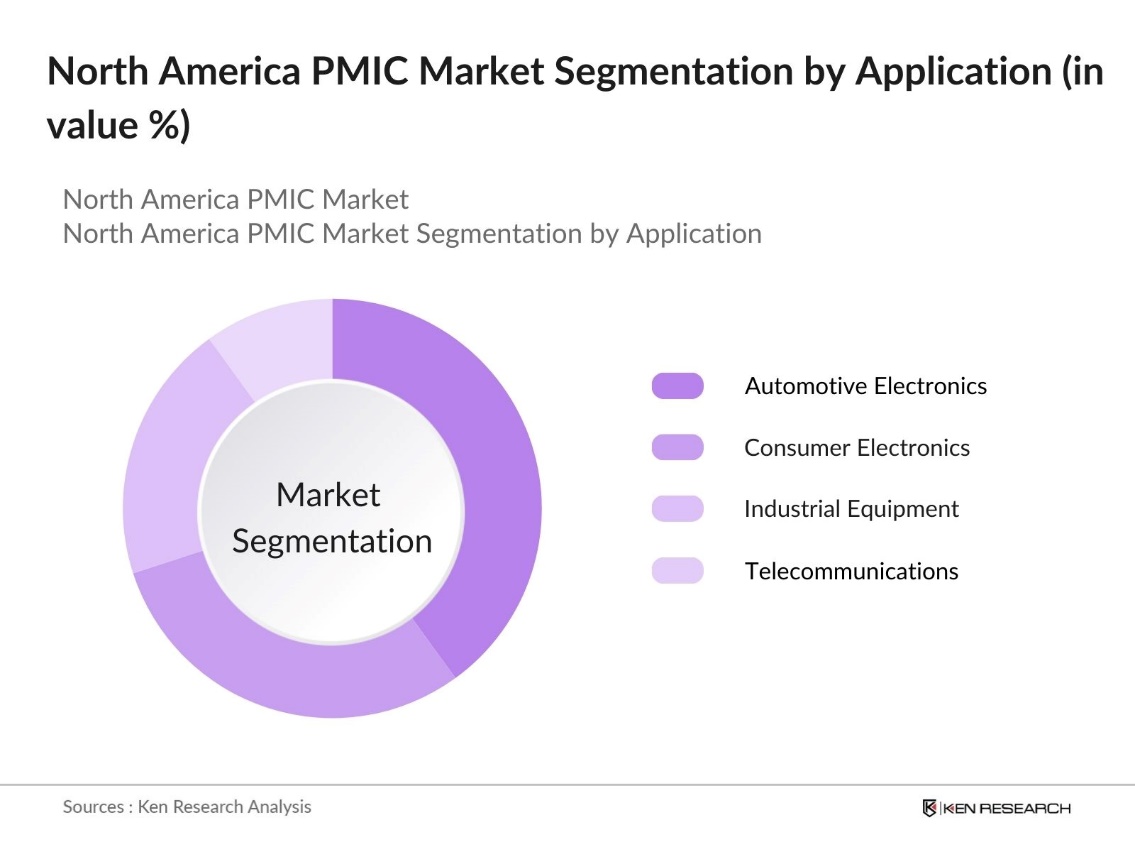

By Application: The North America PMIC market is also segmented by application into automotive electronics, consumer electronics, industrial equipment, and telecommunications. Automotive electronics lead in this segmentation, driven by the significant rise in electric vehicle adoption and the need for efficient battery management solutions. As the automotive sector shifts toward electrification, demand for PMICs to manage energy consumption and optimize performance has soared.

North America PMIC (Power Management Integrated Circuits) Market Competitive Landscape

The North America PMIC market is dominated by a few key players, including multinational companies with strong footholds in the semiconductor industry. These companies benefit from extensive R&D capabilities, robust product portfolios, and strategic partnerships that enhance their market position.

|

Company Name |

Establishment Year |

Headquarters |

Revenue |

Market Share |

R&D Investments |

Product Portfolio |

Key Markets |

Strategic Partnerships |

|

Texas Instruments |

1930 |

Dallas, Texas, USA |

||||||

|

ON Semiconductor |

1999 |

Phoenix, Arizona, USA |

||||||

|

Analog Devices, Inc. |

1965 |

Wilmington, Massachusetts |

||||||

|

STMicroelectronics |

1987 |

Geneva, Switzerland |

||||||

|

NXP Semiconductors |

2006 |

Eindhoven, Netherlands |

North America PMIC (Power Management Integrated Circuits) Industry Analysis

Growth Drivers

- Increasing Demand for Power-Efficient Electronics: The growing demand for power-efficient electronics in North America is driven by a surge in energy-conscious consumers and the rise of connected devices. In 2023, the region saw an increase in the production of energy-efficient devices of smart consumer electronics in the U.S. alone. This growth is supported by macroeconomic factors like the U.S. GDP, which grew by 2.5% in 2023, facilitating higher disposable income and increased spending on consumer electronics.

- Rising Adoption of Electric Vehicles (EVs): The electric vehicle (EV) market in North America is expanding rapidly in the U.S. This surge in EV adoption is driving demand for efficient power management integrated circuits (PMICs), essential for optimizing battery performance and power consumption in EVs. With government incentives like the $7,500 tax credit under the Inflation Reduction Act of 2022, EV adoption continues to rise, further boosting the PMIC market.

- Technological Advancements in Semiconductor Industry: Technological advancements in the semiconductor industry are fostering the development of advanced PMICs. Innovations in chip production and the implementation of cutting-edge technologies like AI are contributing to the efficiency and miniaturization of power management solutions. These developments are enabling PMICs to become more effective in managing energy consumption across various applications, including consumer electronics and electric vehicles.

Market Challenges

- High Design and Manufacturing Costs: The North American PMIC market faces challenges from the high costs associated with design and manufacturing. Developing advanced PMICs requires significant capital investment, which creates financial pressure on companies. This challenge is further compounded by the increasing costs of raw materials, making it more expensive to produce cutting-edge PMICs. These factors result in higher operational expenses for manufacturers, limiting their ability to scale production and innovate at a rapid pace.

- Supply Chain Disruptions: Supply chain disruptions have posed significant challenges for the North American PMIC market, especially following the global pandemic. Shortages of key components have led to delays in PMIC production, creating bottlenecks for industries reliant on these products. This has impacted sectors such as automotive and consumer electronics, leading to production delays and affecting market growth. The unpredictability of supply chains continues to challenge the market's ability to meet rising demand for PMICs.

North America PMIC (Power Management Integrated Circuits) Market Future Outlook

The North America PMIC market is set to experience continued growth in the coming years, driven by several factors including the rising adoption of electric vehicles, technological advancements in semiconductor manufacturing, and the increasing need for energy-efficient solutions. This market will likely see more product innovations as demand for smaller, more integrated, and higher-performing PMICs grows in line with evolving applications in electric vehicles, industrial automation, and wireless charging technologies.

Market Opportunities

- Growth in IoT Applications: The rapid expansion of IoT applications presents significant opportunities for the North American PMIC market. Industries such as healthcare, manufacturing, and smart homes are driving demand for efficient power management. PMICs play a critical role in ensuring these IoT devices operate smoothly while minimizing power consumption, providing a substantial growth opportunity for PMIC manufacturers. As more connected devices are adopted across various sectors, the need for advanced power management solutions continues to grow.

- Expanding Data Center Infrastructure: The growing data center infrastructure in North America presents another opportunity for the PMIC market. As data centers expand to accommodate the increasing demand for cloud services and digital transformation, there is a rising need for advanced PMICs to manage power consumption efficiently. These power management solutions are crucial for ensuring that data centers operate smoothly and sustainably, making them an essential component in the evolving data infrastructure landscape.

Scope of the Report

|

Product Type |

Voltage Regulators Battery Management ICs LED Drivers Integrated Power Switches |

|

Application |

Automotive Electronics Consumer Electronics Industrial Equipment Telecommunications |

|

Technology |

Analog PMICs Digital PMICs Hybrid PMICs |

|

End-User |

OEMs Aftermarket |

|

Region |

United States Canada Mexico |

Products

Key Target Audience

OEMs (Original Equipment Manufacturers)

Semiconductor Manufacturers

Electric Vehicle Manufacturers

Renewable Energy Companies

Telecommunication Equipment Manufacturers

Investors and venture capital Firms

Banks and Financial Institutions

Government and Regulatory Bodies (U.S. Department of Energy, Canadian Ministry of Innovation, Science and Industry)

Companies

Players Mentioned in the Report

Texas Instruments

Analog Devices, Inc.

ON Semiconductor

STMicroelectronics

NXP Semiconductors

Renesas Electronics

Maxim Integrated

ROHM Semiconductor

Microchip Technology Inc.

Qualcomm

Table of Contents

1. North America PMIC Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America PMIC Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America PMIC Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Power-Efficient Electronics

3.1.2. Rising Adoption of Electric Vehicles (EVs)

3.1.3. Technological Advancements in Semiconductor Industry

3.1.4. Government Incentives for Energy-Efficient Solutions

3.2. Market Challenges

3.2.1. High Design and Manufacturing Costs

3.2.2. Supply Chain Disruptions

3.2.3. Intense Competition from Asian Markets

3.3. Opportunities

3.3.1. Growth in IoT Applications

3.3.2. Expanding Data Center Infrastructure

3.3.3. Adoption of 5G Technology

3.4. Trends

3.4.1. Integration of AI in PMICs

3.4.2. Miniaturization of Power Management Solutions

3.4.3. Focus on Wireless Charging Technologies

3.5. Government Regulations

3.5.1. Energy Efficiency Standards (Inclusion of Energy Efficiency Policies)

3.5.2. Regulations on Electronic Waste Management (Mandatory Recycling Policies)

3.5.3. Trade Regulations and Tariff Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. North America PMIC Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Voltage Regulators

4.1.2. Battery Management ICs

4.1.3. LED Drivers

4.1.4. Integrated Power Switches

4.2. By Application (In Value %)

4.2.1. Automotive Electronics

4.2.2. Consumer Electronics

4.2.3. Industrial Equipment

4.2.4. Telecommunications

4.3. By Technology (In Value %)

4.3.1. Analog PMICs

4.3.2. Digital PMICs

4.3.3. Hybrid PMICs

4.4. By End-User (In Value %)

4.4.1. OEMs

4.4.2. Aftermarket

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America PMIC Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Texas Instruments

5.1.2. Analog Devices, Inc.

5.1.3. ON Semiconductor

5.1.4. Infineon Technologies AG

5.1.5. Qualcomm

5.1.6. STMicroelectronics

5.1.7. Maxim Integrated

5.1.8. Renesas Electronics

5.1.9. NXP Semiconductors

5.1.10. Microchip Technology Inc.

5.1.11. ROHM Semiconductor

5.1.12. Toshiba Electronic Devices

5.1.13. Dialog Semiconductor

5.1.14. Power Integrations

5.1.15. Skyworks Solutions

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Innovation Focus, Manufacturing Locations, Key Markets, Strategic Partnerships, R&D Investments)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Government Grants

5.8. Private Equity Investments

6. North America PMIC Market Regulatory Framework

6.1. Energy Efficiency Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. North America PMIC Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America PMIC Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. North America PMIC Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involved the identification of key variables influencing the North America PMIC Market. A combination of desk research and expert interviews was utilized to map the stakeholder ecosystem and gather relevant market data. The focus was on defining critical factors driving the market, such as product innovations and regulatory changes.

Step 2: Market Analysis and Construction

In the second step, market penetration data and historical trends were compiled to assess the current market scenario. This included a detailed examination of key market segments such as product type and applications, and analysis of how these segments have evolved over time.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were then validated through consultations with industry experts, including executives from semiconductor companies and OEMs. These discussions provided deep insights into market trends, challenges, and growth drivers, further refining the research findings.

Step 4: Research Synthesis and Final Output

The final phase focused on synthesizing the findings into a comprehensive report. This involved combining primary and secondary data sources to ensure accuracy, followed by rigorous cross-verification with industry experts to produce a credible and data-driven market report.

Frequently Asked Questions

01. How big is the North America PMIC Market?

The North America PMIC Market is valued at USD 13.12 billion, driven by increased demand for energy-efficient electronics, electric vehicles, and industrial automation solutions.

02. What are the challenges in the North America PMIC Market?

Challenges in the North America PMIC market include high production costs, supply chain disruptions, and competition from other global regions, particularly Asia.

03. Who are the major players in the North America PMIC Market?

Major players in the North America PMIC market include Texas Instruments, Analog Devices, ON Semiconductor, STMicroelectronics, and NXP Semiconductors, all of which are prominent due to their extensive product portfolios and strategic partnerships.

04. What are the growth drivers of the North America PMIC Market?

Key growth drivers in North America PMIC market include the rising adoption of electric vehicles, advancements in semiconductor technologies, and increased demand for energy-efficient power management solutions across multiple industries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.