North America Pre Fabricated House Market Outlook to 2030

Region:North America

Author(s):Paribhasha Tiwari

Product Code:KROD4547

December 2024

87

About the Report

North America Prefabricated House Market Overview

- The North America prefabricated house market is valued at USD 25 billion, according to industry data based on a five-year historical analysis. The market is driven by the growing demand for affordable housing, combined with rapid advancements in construction technologies that streamline the building process. Modular homes, panelized structures, and other forms of prefabrication are becoming more appealing due to shorter construction times and lower overall costs, especially in urban areas experiencing housing shortages.

- The United States and Canada dominate the North American prefabricated housing market. The U.S. leads due to its large population base, rising urbanization, and the increasing appeal of sustainable and energy-efficient homes. Additionally, various states in the U.S. have introduced regulations that favor green construction, further bolstering the demand. Canada, known for its harsh winters, has adopted prefabricated homes for their insulation efficiency and faster build times, particularly in regions like Ontario and Quebec, where housing shortages are prevalent.

- In 2024, the U.S. Department of Housing and Urban Development allocated $2.8 billion to affordable housing programs that include the use of prefabricated homes. These funds are part of a broader effort to address the housing crisis, particularly in cities like New York and Los Angeles. Prefabricated homes are increasingly seen as a solution for low-income housing projects, offering a faster, more cost-effective alternative to traditional construction methods. Federal tax credits are also available to developers who use prefabricated techniques in designated affordable housing zones.

North America Prefabricated House Market Segmentation

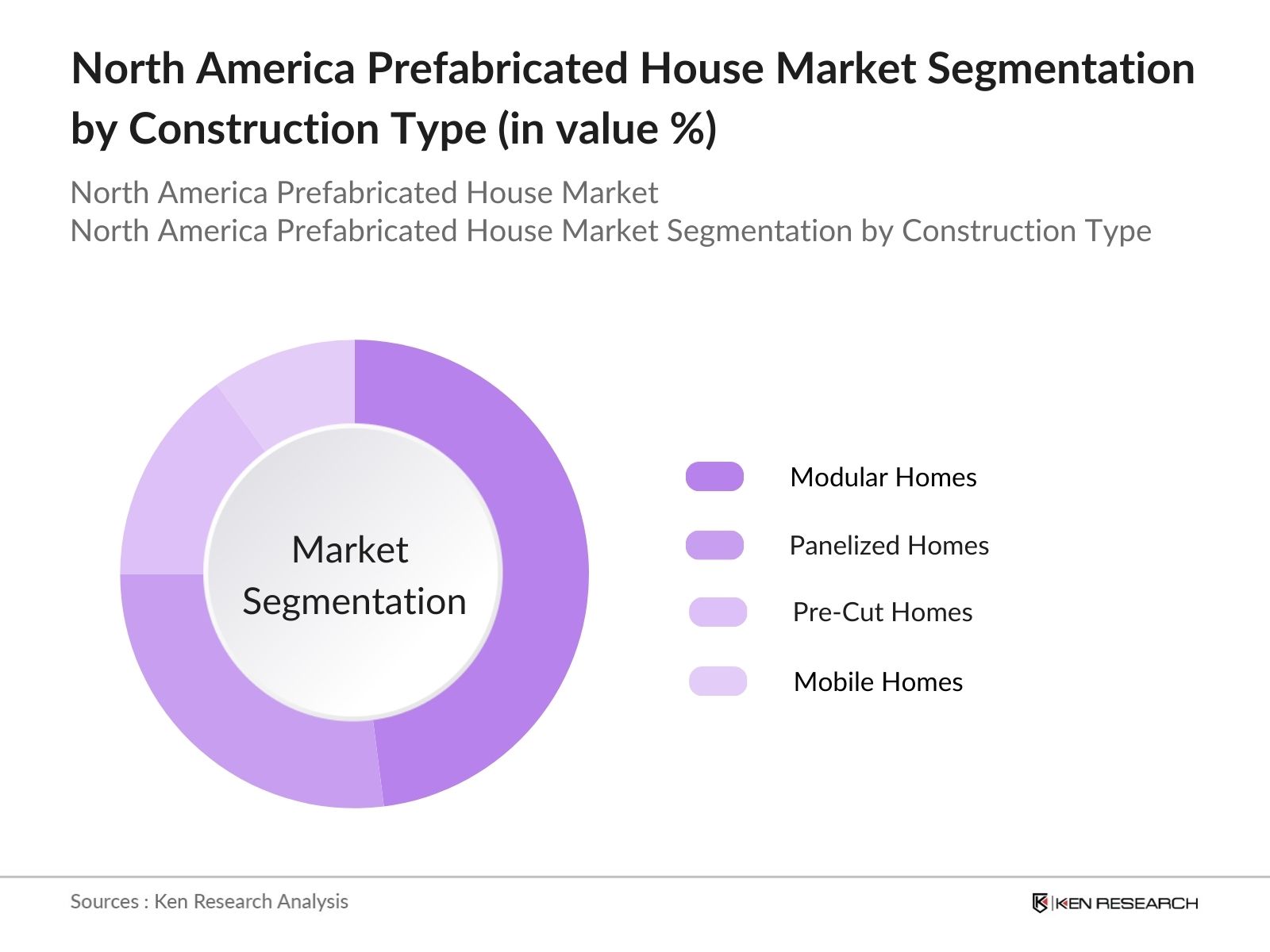

By Construction Type: The North American prefabricated house market is segmented by construction type into modular homes, panelized homes, pre-cut homes, and mobile homes. Modular homes dominate the market share due to their flexibility, ability to be customized, and superior quality compared to other types. These homes are built in controlled environments, ensuring precise manufacturing that meets modern standards. Modular homes are particularly popular in regions experiencing labor shortages or where rapid construction is necessary, such as urban areas with increasing housing demands.

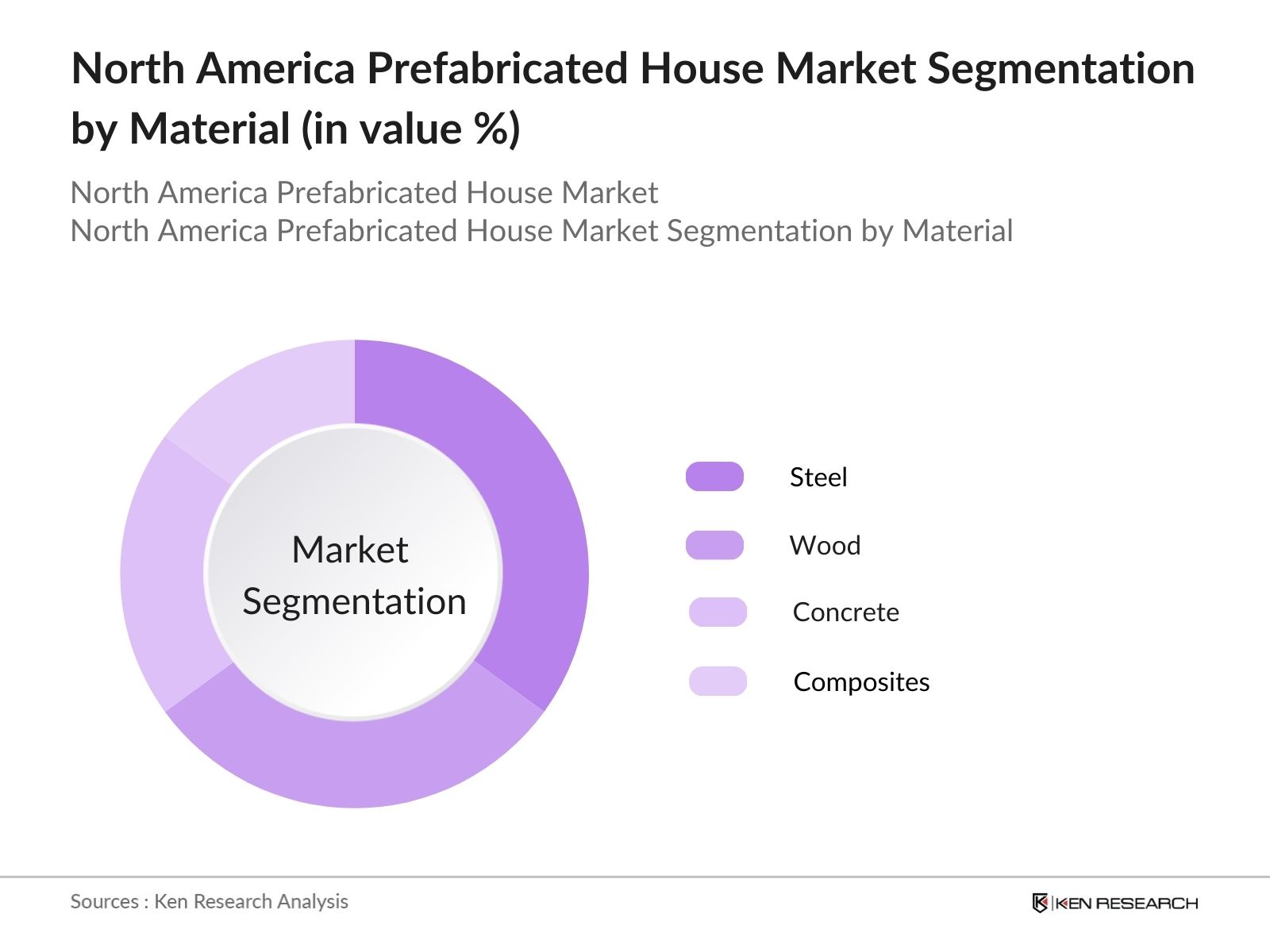

By Material: The market is also segmented by material into steel, wood, concrete, and composites. Steel leads the market share due to its durability and ability to withstand extreme weather conditions, making it a preferred choice in areas prone to hurricanes, tornadoes, or other natural disasters. Steel-framed prefabricated homes are also favored for their longevity and low maintenance requirements, which appeal to consumers seeking both value and resilience in their investments.

North America Prefabricated House Market Competitive Landscape

The North America prefabricated house market is characterized by several key players that dominate through technological innovations, strategic partnerships, and expanding market footprints. These companies leverage advancements in materials, construction techniques, and customer-focused solutions to strengthen their market positions.

|

Company Name |

Established Year |

Headquarters |

Employees |

Revenue |

Product Offering |

Market Share |

Manufacturing Capacity |

Geographical Reach |

|

Clayton Homes |

1956 |

Tennessee, USA |

- | - | - | - | - | - |

|

Cavco Industries Inc. |

1965 |

Arizona, USA |

- | - | - | - | - | - |

|

Champion Home Builders Inc. |

1953 |

Michigan, USA |

- | - | - | - | - | - |

|

Skyline Champion Corporation |

1951 |

Indiana, USA |

- | - | - | - | - | - |

|

Redman Homes |

1937 |

Indiana, USA |

- | - | - | - | - | - |

North America Prefabricated House Market Analysis

Growth Drivers

- Rising Housing Shortages in Key Urban Areas: In 2024, the U.S. Department of Housing and Urban Development reported that major cities like New York and San Francisco face a housing shortage of over 2.3 million units. Prefabricated housing offers an efficient, scalable solution to this gap due to its shorter construction times. With urban migration increasing, particularly in cities like Toronto and Chicago, the need for quick, affordable housing solutions is becoming urgent, driving demand for prefabricated homes.

- Increasing Energy Efficiency Standards: In 2024, the U.S. Department of Energy emphasized the role of energy-efficient homes in reducing carbon emissions. Prefabricated homes, with their tight construction and the use of sustainable materials, can meet stringent energy efficiency guidelines. Over 500,000 prefabricated homes in North America are now designed to meet Energy Star requirements, reflecting a strong consumer preference for homes that reduce long-term energy consumption and operational costs.

- Rapid Population Growth in Southern States: The U.S. Census Bureau reported a population increase of 2.1 million people in southern states like Texas, Florida, and Georgia in 2024. These areas are seeing an unprecedented demand for new housing. Prefabricated homes, which can be constructed faster and more affordably than traditional homes, are increasingly viewed as a solution to this growing demand. Developers in Texas have already adopted prefabricated construction for large-scale housing projects, where time-to-market is a critical factor.

Market Challenges

- Regulatory Barriers in Zoning and Building Codes: Building codes and zoning laws continue to present significant hurdles for the prefabricated housing market. As of 2024, the National Association of Realtors reported that less than 15% of U.S. cities have streamlined the approval process for prefabricated homes. In many regions, outdated regulations make it difficult to integrate these homes into existing neighborhoods, limiting their deployment. Additionally, the lack of standardization in building codes across North America creates inconsistencies in the approval process, further slowing market growth.

- Perception of Prefabricated Homes as Low-Quality: According to the U.S. Department of Commerce, consumer perceptions of prefabricated homes remain a challenge, with only 34% of homebuyers considering them equal in quality to traditionally built homes in 2024. This misconception persists despite technological advancements in materials and construction methods. Overcoming this perception issue is critical for widespread adoption, especially in higher-income markets where custom-built homes are seen as status symbols. The industry is making efforts to market prefabricated homes as high-quality, durable, and customizable, but the stigma still affects demand.

North America Prefabricated House Market Future Outlook

Over the next five years, the North America prefabricated house market is expected to experience substantial growth driven by rising housing demand in urban areas, increasing government initiatives to promote affordable and sustainable housing, and continued advancements in construction technologies. As labor shortages persist in the construction industry, prefabricated homes will likely gain further traction due to their shorter construction cycles and reduced labor dependency.

Market Opportunities

- Expansion into urban areas: With urban housing shortages affecting cities such as New York, Chicago, and Toronto, there is a significant opportunity for prefabricated homes to provide a rapid solution. Prefabricated houses, which can be constructed more quickly and affordably than traditional homes, are an attractive option for meeting this growing demand while addressing concerns over urban sprawl and housing availability.

- Technological integration: Emerging technologies like Building Information Modeling (BIM), 3D printing, and advanced modular construction techniques are poised to revolutionize the prefabricated housing industry. The incorporation of 3D printing into modular designs also enhances customization options, offering more flexibility to meet consumer demands. These technological advancements provide a path for the prefabricated housing market to expand by overcoming current design limitations and increasing overall construction efficiency.

Scope of the Report

|

By Construction Type |

Modular Homes Panelized Homes Pre-Cut Homes Mobile Homes |

|

By Material |

Steel, Wood Concrete Composites |

|

By End-User |

Residential Commercial Institutional |

|

By Sales Channel |

Direct Sales Distributors Online |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience

Real Estate Developers

Modular and Prefabrication Construction Companies

Housing and Urban Development Departments (U.S. Department of Housing and Urban Development)

Architects and Construction Firms

Insurance Companies

Renewable Energy Solution Providers

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Green Building Council, Energy Star)

Companies

Players Mentioned in the Report:

Clayton Homes

Cavco Industries Inc.

Champion Home Builders Inc.

Skyline Champion Corporation

Redman Homes

Palm Harbor Homes

Fleetwood Homes

Deltec Homes

Blu Homes

Stratford Homes

Table of Contents

1. North America Prefabricated House Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Prefabricated House Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Prefabricated House Market Analysis

3.1. Growth Drivers

3.1.1. Rising demand for affordable housing (affordable housing demand)

3.1.2. Advancements in manufacturing technology (automation & robotics in construction)

3.1.3. Government incentives for green construction (green building regulations)

3.1.4. Shortened construction time (construction cycle efficiency)

3.2. Market Challenges

3.2.1. Regulatory barriers (zoning laws, building codes)

3.2.2. Perception issues regarding quality (consumer confidence and misconceptions)

3.2.3. High transportation costs (logistics and delivery constraints)

3.2.4. Limited customization options (consumer preference for custom designs)

3.3. Opportunities

3.3.1. Expansion into urban areas (urban housing shortages)

3.3.2. Technological integration (BIM, 3D printing, and modular construction)

3.3.3. Adoption of sustainable materials (eco-friendly and energy-efficient materials)

3.3.4. Strategic partnerships with real estate developers (developer and prefab collaborations)

3.4. Trends

3.4.1. Rising use of smart home features (IoT and smart home integration)

3.4.2. Growth of net-zero energy homes (energy efficiency and net-zero trends)

3.4.3. Increased demand for eco-friendly prefabrication (sustainability)

3.4.4. Growth in multi-family prefabricated units (multi-unit and shared living spaces)

3.5. Government Regulation

3.5.1. HUD regulations on prefabricated housing

3.5.2. State-specific building codes and requirements (state-level regulation)

3.5.3. Incentives for affordable housing projects (government subsidy programs)

3.5.4. Energy efficiency standards (LEED certifications, Energy Star homes)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. North America Prefabricated House Market Segmentation

4.1. By Construction Type (In Value %)

4.1.1. Modular Homes

4.1.2. Panelized Homes

4.1.3. Pre-Cut Homes

4.1.4. Mobile Homes

4.2. By Material (In Value %)

4.2.1. Steel

4.2.2. Wood

4.2.3. Concrete

4.2.4. Composites

4.3. By End-User (In Value %)

4.3.1. Residential

4.3.2. Commercial

4.3.3. Institutional

4.4. By Sales Channel (In Value %)

4.4.1. Direct Sales

4.4.2. Distributors

4.4.3. Online

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Prefabricated House Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Clayton Homes

5.1.2. Cavco Industries Inc.

5.1.3. Champion Home Builders Inc.

5.1.4. Skyline Champion Corporation

5.1.5. Redman Homes

5.1.6. Palm Harbor Homes

5.1.7. Commodore Homes

5.1.8. Fleetwood Homes

5.1.9. Deltec Homes

5.1.10. Stratford Homes

5.1.11. Impresa Modular

5.1.12. Lindal Cedar Homes

5.1.13. Blu Homes

5.1.14. Wheelhaus

5.1.15. Unity Homes

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Year Established, Revenue, Market Share, Geographical Reach, Product Offerings, Manufacturing Capacity)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. North America Prefabricated House Market Regulatory Framework

6.1. Building Codes and Zoning Laws

6.2. Energy Efficiency Certifications (LEED, Energy Star)

6.3. Affordable Housing Incentives (Government Initiatives)

6.4. Environmental Compliance Standards

7. North America Prefabricated House Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Prefabricated House Future Market Segmentation

8.1. By Construction Type (In Value %)

8.2. By Material (In Value %)

8.3. By End-User (In Value %)

8.4. By Sales Channel (In Value %)

8.5. By Region (In Value %)

9. North America Prefabricated House Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Strategic Partnerships with Developers

9.3. Marketing and Brand Awareness Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process begins by constructing an ecosystem map encompassing all major stakeholders in the North America prefabricated house market. This step involves extensive desk research using proprietary databases to gather key industry insights, with a primary focus on defining critical variables such as consumer behavior, construction material trends, and technological advancements.

Step 2: Market Analysis and Construction

In this phase, historical market data is compiled and analyzed to understand the penetration of prefabricated houses in urban and rural areas. Additionally, supply-demand dynamics are evaluated, including the cost of materials and housing affordability, to estimate the market's revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through expert interviews conducted via computer-assisted telephone interviews (CATIs). These interviews involve professionals from leading prefabricated housing companies and industry associations, providing real-time insights that help refine the market forecasts and data.

Step 4: Research Synthesis and Final Output

The final stage involves direct engagement with manufacturers and real estate developers to verify sales data, customer preferences, and product performance. This step ensures the accuracy of data and strengthens the final report with real-world insights from industry participants.

Frequently Asked Questions

01. How big is the North America Prefabricated House Market?

The North America prefabricated house market is valued at USD 25 billion. It is primarily driven by the increasing demand for affordable and sustainable housing solutions, coupled with technological advancements in construction.

02. What are the challenges in the North America Prefabricated House Market?

Challenges in the North America prefabricated house market include regulatory barriers such as stringent building codes, the perception of inferior quality, and logistical difficulties associated with transporting prefabricated materials to construction sites.

03. Who are the major players in the North America Prefabricated House Market?

Major players in the North America prefabricated house market include Clayton Homes, Cavco Industries Inc., Champion Home Builders Inc., Skyline Champion Corporation, and Redman Homes. These companies dominate due to their scale, product innovation, and strong distribution networks.

04. What are the growth drivers of the North America Prefabricated House Market?

Growth drivers in the North America prefabricated house market include increasing urbanization, government initiatives promoting affordable housing, technological innovations in construction, and consumer demand for eco-friendly and energy-efficient homes.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.