North America Pre-owned Luxury Watches Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD9164

December 2024

97

About the Report

North America Pre-Owned Luxury Watches Market Overview

- The North America Pre-Owned Luxury Watches Market is valued at USD 8.2 billion, driven by several factors, including the growing consumer preference for high-end timepieces at more affordable prices and the increasing acceptance of pre-owned luxury goods. With a shift in consumer behavior toward sustainability and the circular economy, the market continues to expand, particularly as more consumers view pre-owned watches as a smart investment.

- Cities like New York, Los Angeles, and Miami, along with Canadas major hubs such as Toronto and Vancouver, dominate the market. These cities are known for their affluent populations, high concentration of luxury retailers, and robust demand for second-hand luxury goods. The influence of well-established auction houses and strong resale platforms has solidified these cities as preeminent markets for pre-owned luxury watches.

- U.S. policies targeting counterfeit goods are stringent, and the sale of counterfeit watches can result in severe penalties. In 2024, the Bureau of Justice Assistance announced a program aimed at supporting state, local, and tribal jurisdictions in preventing and reducing intellectual property theft. Laws around intellectual property rights are being actively enforced, particularly in the luxury watch segment, to curb the rise of counterfeit products in online and offline marketplaces. These policies are critical to maintaining consumer trust in the pre-owned market

North America Pre-Owned Luxury Watches Market Segmentation

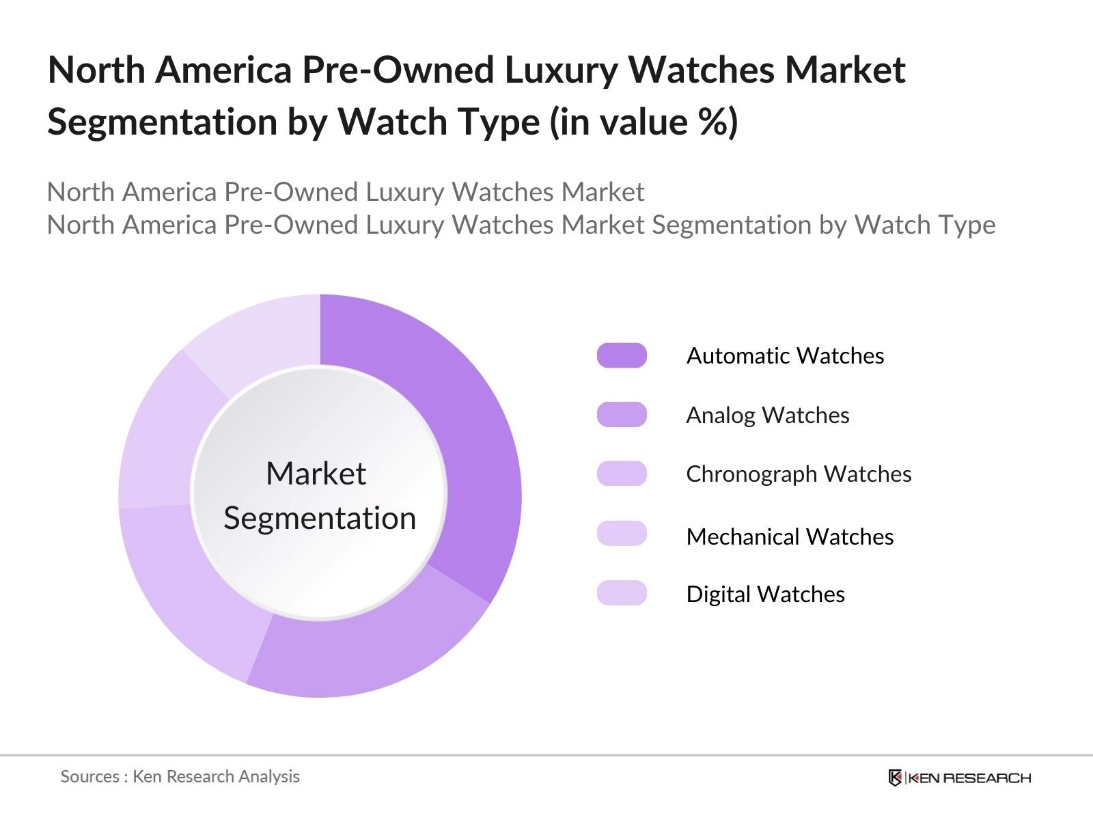

By Watch Type: The North America pre-owned luxury watches market is segmented by watch type into analog watches, digital watches, automatic watches, chronograph watches, and mechanical watches. Recently, automatic watches have dominated the market share due to their technical sophistication and craftsmanship. These timepieces are highly coveted for their self-winding capabilities and timeless appeal. Iconic brands such as Rolex, Patek Philippe, and Audemars Piguet continue to fuel demand for automatic watches among collectors and luxury enthusiasts. The resale value of these watches often remains high, which further encourages the growth of this segment.

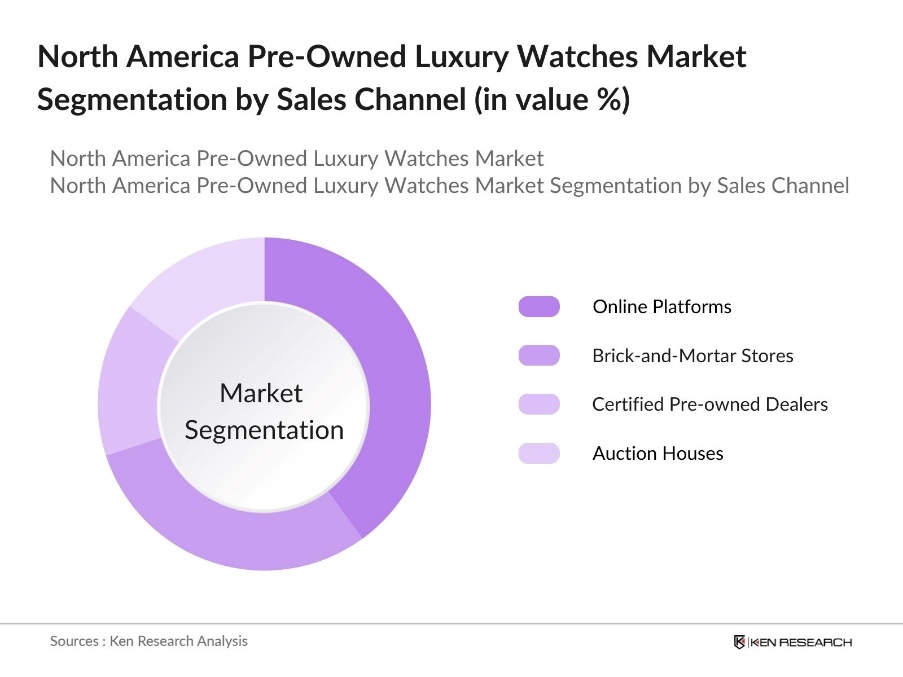

By Sales Channel: The North America pre-owned luxury watches market is segmented by sales channels into online platforms, brick-and-mortar stores, certified pre-owned dealers, and auction houses. Online platforms have seen a significant rise in market share, primarily due to the convenience and vast array of choices they offer. Platforms such as Chrono24 and WatchBox have become trusted marketplaces for buyers seeking authenticity and value. The ability to verify and authenticate luxury watches online has eased consumer concerns, driving the dominance of this segment.

North America Pre-Owned Luxury Watches Market Competitive Landscape

The market is characterized by the presence of several key players who have established themselves through their focus on authenticity, customer service, and a strong online presence. The competitive landscape is shaped by a blend of well-known e-commerce platforms and traditional luxury watch retailers. Companies such as WatchBox and Crown & Caliber have introduced innovative services, such as in-house authentication and watch repair, which gives them a competitive edge over smaller, less-established platforms.

|

Company Name |

Establishment Year |

Headquarters |

Authentication Process |

Warranty Offered |

Number of Locations |

Revenue Model |

Customer Demographics |

Online vs Physical Presence |

|

WatchBox |

2017 |

Philadelphia |

||||||

|

Crown & Caliber |

2013 |

Atlanta |

||||||

|

The RealReal |

2011 |

San Francisco |

||||||

|

Chrono24 |

2003 |

Karlsruhe |

||||||

|

Bobs Watches |

1999 |

Newport Beach |

North America Pre-Owned Luxury Watches Industry Analysis

Growth Drivers

- Growing Demand for Luxury Goods: The demand for luxury goods in North America continues to rise as disposable income levels increase across key demographics. The Federal Reserve reported that U.S. household net worth rose to approximately $163.8 trillion in the second quarter of 2024. This growth in affluence has sparked greater interest in luxury goods, including pre-owned luxury watches.

- Expansion of E-commerce and Online Platforms: The e-commerce sector in North America continues to grow at a rapid pace, with luxury watch retailers increasingly capitalizing on digital sales platforms. In the United States specifically, e-commerce sales are estimated to be around $1 trillion by the end of 2023. This expansion has provided pre-owned luxury watch sellers greater access to a broader audience, further facilitating the shift from traditional retail to online marketplaces.

- Rising Affluent Population in North America: The increasing number of affluent individuals in North America is fueling demand for luxury goods, including pre-owned luxury watches. As wealth grows, particularly among those with significant disposable income, there is a stronger interest in high-end items. Additionally, a rising middle class is investing in luxury products as symbols of status and value, driving further growth in the pre-owned luxury watch market.

Market Challenges

- Counterfeit Product Issues: The prevalence of counterfeit luxury watches poses a major challenge to the pre-owned market in North America. These fake products erode consumer trust and hinder the growth of the resale industry. Despite improvements in authentication methods, counterfeit watches continue to flood the market, particularly through online platforms where regulation is less stringent. This ongoing issue impacts buyer confidence, making it a critical challenge for the pre-owned luxury watch sector.

- Limited Supply of High-Demand Brands: The pre-owned luxury watch market faces limitations in the availability of high-demand brands like Rolex and Patek Philippe. These exclusive brands produce limited quantities, and with increasing consumer interest, the supply struggles to meet demand. This scarcity creates competition among buyers and limits the availability of specific models, particularly limited edition timepieces, adding pressure to the market's supply chain.

North America Pre-Owned Luxury Watches Market Future Outlook

Over the next five years, the North America pre-owned luxury watches market is expected to experience continued growth driven by factors such as increased consumer confidence in the authenticity of pre-owned products, advancements in digital platforms, and the rising trend of luxury goods investment. Sustainability is also playing a larger role, as more consumers opt for second-hand luxury items as a means to support eco-friendly practices without compromising on style or status.

Market Opportunities

- Technological Advancements in Authentication Tools: Technological advancements like blockchain and AI-powered authentication tools are creating new growth opportunities in the pre-owned luxury watch market. These innovations provide tamper-proof methods for verifying authenticity, significantly reducing the risk of counterfeit goods entering the market. As these authentication tools become more sophisticated, they build greater trust among buyers, especially in online transactions. This increased confidence in the authenticity of watches makes the pre-owned luxury watch market more attractive to a broader audience.

- Strategic Partnerships with Auction Houses and Watchmakers: Collaborations between pre-owned watch sellers and prestigious auction houses or watchmakers present a significant growth opportunity. These strategic partnerships enhance the credibility and visibility of pre-owned luxury watch sellers while offering watchmakers an additional revenue stream. Such alliances improve transparency in the resale market, boosting buyer confidence. As a result, these partnerships help attract more affluent buyers, further solidifying the position of pre-owned luxury watches in the market.

Scope of the Report

|

By Watch Type |

Analog Watches Digital Watches Chronograph Watches Automatic Watches Mechanical Watches |

|

By Sales Channel |

Online Platforms Brick-and-Mortar Stores Auction Houses Certified Pre-owned Dealers |

|

By End-user |

Men Women Unisex |

|

By Price Range |

Under $5,000 $5,000 - $10,000 $10,000 - $20,000 Above $20,000 |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience

Watch Investment Funds and Collectible Investment Firms

Personal Wealth Management and Financial Advisory Firms

Luxury Corporate Gifting Companies

Government and Regulatory Bodies (U.S. Department of Commerce)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

WatchBox

Crown & Caliber

The RealReal

Chrono24

Bobs Watches

Govberg Jewelers

Analog Shift

Tourneau

Watchfinder & Co.

TrueFacet

Table of Contents

1. North America Pre-Owned Luxury Watches Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Pre-Owned Luxury Watches Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Pre-Owned Luxury Watches Market Analysis

3.1. Growth Drivers

3.1.1. Growing Demand for Luxury Goods

3.1.2. Increasing Consumer Confidence in Pre-Owned Products

3.1.3. Expansion of E-commerce and Online Platforms

3.1.4. Rising Affluent Population in North America

3.2. Market Challenges

3.2.1. Counterfeit Product Issues

3.2.2. Limited Supply of High-demand Brands

3.2.3. Lack of Standardization in Authentication

3.3. Opportunities

3.3.1. Technological Advancements in Authentication Tools

3.3.2. Strategic Partnerships with Auction Houses and Watchmakers

3.3.3. Growth in Digital Marketplaces for Pre-Owned Luxury Watches

3.4. Trends

3.4.1. Shift from Traditional to Digital Sales Channels

3.4.2. Growing Popularity of Limited Edition Timepieces

3.4.3. Integration of Blockchain for Watch Authentication

3.5. Government Regulations

3.5.1. Import and Export Regulations on High-Value Goods

3.5.2. Policies Regarding Counterfeit Products

3.5.3. Compliance with Environmental and Ethical Standards in Resale

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. North America Pre-Owned Luxury Watches Market Segmentation

4.1. By Watch Type (In Value %)

4.1.1. Analog Watches

4.1.2. Digital Watches

4.1.3. Chronograph Watches

4.1.4. Automatic Watches

4.1.5. Mechanical Watches

4.2. By Sales Channel (In Value %)

4.2.1. Online Platforms

4.2.2. Brick-and-Mortar Stores

4.2.3. Auction Houses

4.2.4. Certified Pre-Owned Dealers

4.3. By End-user (In Value %)

4.3.1. Men

4.3.2. Women

4.3.3. Unisex

4.4. By Price Range (In Value %)

4.4.1. Under $5,000

4.4.2. $5,000 - $10,000

4.4.3. $10,000 - $20,000

4.4.4. Above $20,000

4.5. By Country (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Pre-Owned Luxury Watches Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. WatchBox

5.1.2. Crown & Caliber

5.1.3. The RealReal

5.1.4. Chrono24

5.1.5. Bobs Watches

5.1.6. Govberg Jewelers

5.1.7. Analog Shift

5.1.8. Tourneau

5.1.9. Watchfinder & Co.

5.1.10. TrueFacet

5.1.11. Watch Rapport

5.1.12. SwissWatchExpo

5.1.13. Radcliffe Jewelers

5.1.14. LUX Second Hand

5.1.15. WatchBox MX

5.2. Cross Comparison Parameters (Brand Value, Number of Physical Locations, Online Traffic, Inception Year, Authentication Process, Product Range, Average Transaction Value, Customer Service Standards)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Pre-Owned Luxury Watches Market Regulatory Framework

6.1. Tax Regulations for High-Value Goods

6.2. Authentication and Compliance Requirements

6.3. Import Duties on Luxury Goods

7. North America Pre-Owned Luxury Watches Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Pre-Owned Luxury Watches Future Market Segmentation

8.1. By Watch Type (In Value %)

8.2. By Sales Channel (In Value %)

8.3. By End-user (In Value %)

8.4. By Price Range (In Value %)

8.5. By Country (In Value %)

9. North America Pre-Owned Luxury Watches Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involved mapping out the pre-owned luxury watch market ecosystem in North America. This stage used both secondary research from proprietary databases and government publications. The aim was to identify critical drivers such as consumer behavior, supply chain dynamics, and authentication technologies.

Step 2: Market Analysis and Construction

This phase focused on compiling historical data related to the pre-owned luxury watches market, examining key indicators such as revenue, growth rate, and consumer buying patterns. Various metrics were evaluated to understand the penetration and volume distribution within different sales channels.

Stp 3: Hypothesis Validation and Expert Consultation

Key market assumptions were validated through interviews with industry experts and executives from major pre-owned luxury watch dealers. These consultations were crucial in refining data and aligning it with real-time market dynamics, particularly regarding consumer trust in pre-owned goods.

Step 4: Research Synthesis and Final Output

The final stage integrated the insights obtained from the interviews and secondary research to produce a comprehensive market report. This ensured the analysis accurately reflected current market trends, challenges, and growth opportunities within the North America pre-owned luxury watches market.

Frequently Asked Questions

01. How big is the North America pre-owned luxury watches market?

The North America pre-owned luxury watches market is valued at USD 8.2 billion, driven by increased consumer demand for luxury goods and the growing acceptance of pre-owned items among affluent buyers.

02. What are the challenges in the North America pre-owned luxury watches market?

Challenges in North America pre-owned luxury watches market include the proliferation of counterfeit products, a limited supply of high-demand brands, and the absence of industry-wide standardization for authentication processes. Addressing these issues is critical for market growth.

03. Who are the major players in the North America pre-owned luxury watches market?

Key players in the North America pre-owned luxury watches market include WatchBox, Crown & Caliber, The RealReal, Chrono24, and Bobs Watches. These companies dominate due to their strong authentication processes, broad product offerings, and customer-centric service models.

04. What are the growth drivers of the North America pre-owned luxury watches market?

The North America pre-owned luxury watches market is propelled by factors such as growing consumer interest in luxury goods, the expansion of digital marketplaces, and an increasing focus on sustainability through the resale of high-value items.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.