North America Predictive Maintenance Market Outlook to 2030

Region:North America

Author(s):Shreya

Product Code:KROD2296

October 2024

87

About the Report

North America Predictive Maintenance Market Overview

The North America Predictive Maintenance market is valued at USD 3.9 billion, driven by the rapid adoption of IoT technologies and advanced data analytics in industries such as manufacturing, energy, and transportation. Businesses are increasingly recognizing the value of predictive maintenance in minimizing downtime, optimizing asset utilization, and reducing operational costs. The application of machine learning and artificial intelligence (AI) algorithms in predicting equipment failures has enhanced the efficiency of industrial operations, making predictive maintenance a cornerstone in Industry 4.0.

Key cities and regions driving the predictive maintenance market include the United States and Canada. The dominance of these regions is attributed to their robust industrial sectors, particularly in manufacturing and energy. In the United States, cities like Houston, known for its oil and gas industry, and Detroit, with its automotive manufacturing, lead the demand for predictive maintenance solutions. In Canada, cities like Toronto and Vancouver drive the market due to the widespread adoption of cloud-based and AI-driven solutions.

Governments across North America are promoting Industry 4.0 initiatives, which include the adoption of advanced technologies such as predictive maintenance. The U.S. government invested $500 million in 2023 to promote digital transformation in manufacturing, driving predictive maintenance adoption across sectors. This policy push has led to a significant increase in predictive maintenance implementation, particularly in industries that rely on heavy machinery.

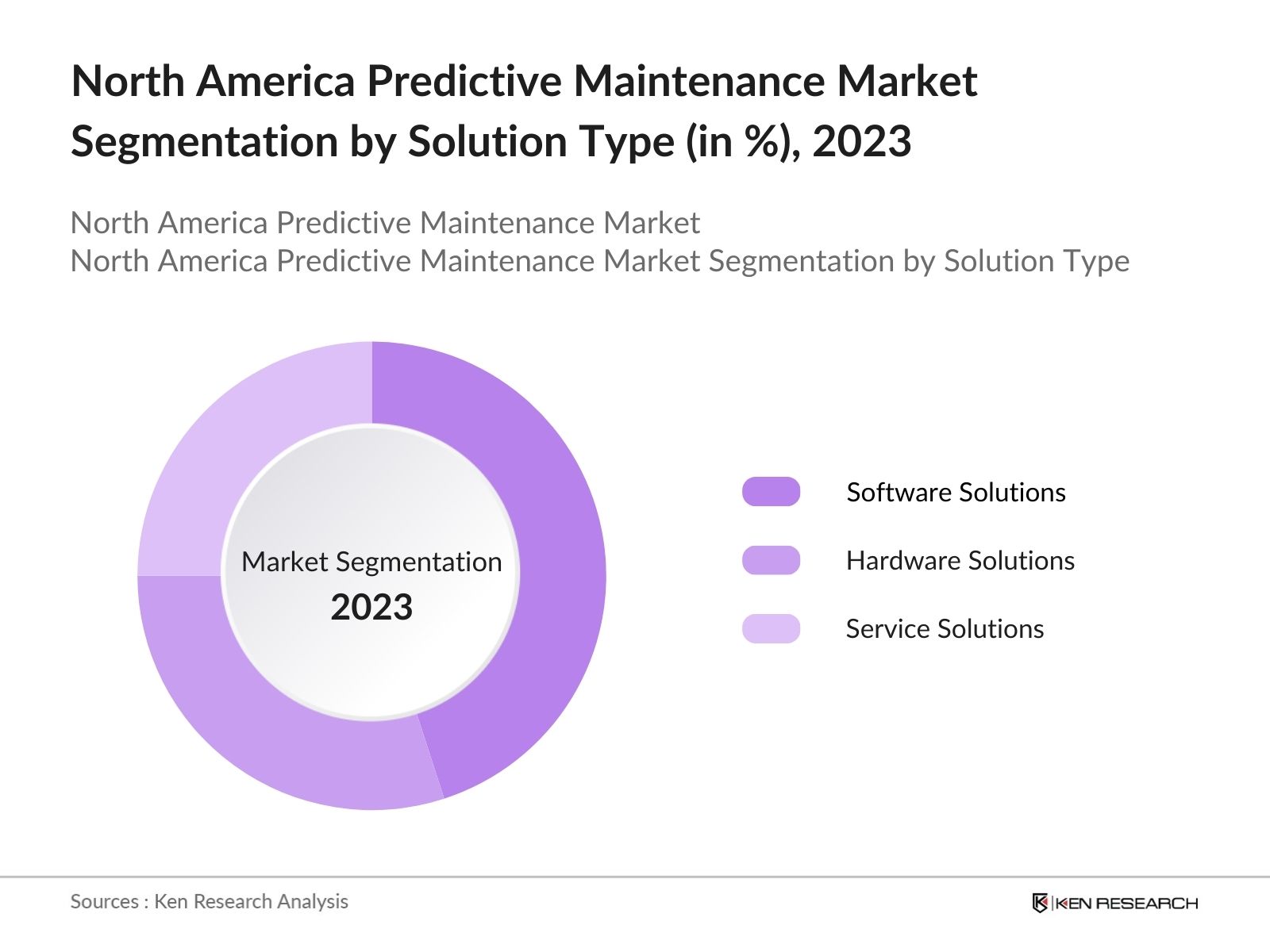

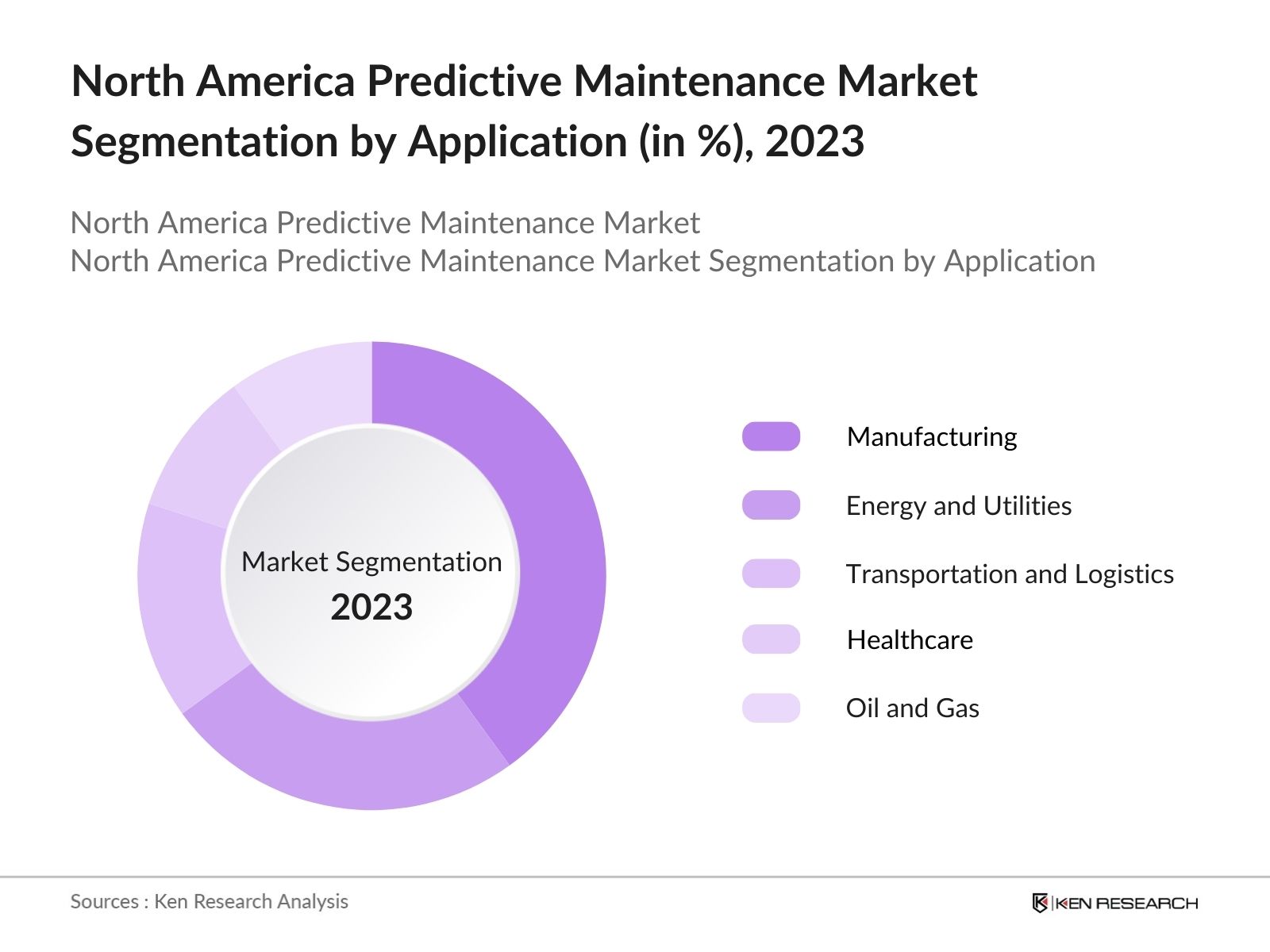

North America Predictive Maintenance Market Segmentation

By Solution Type: The market is segmented by solution type into software solutions, hardware solutions, and service solutions. Software solutions hold a dominant market share, primarily due to the growing implementation of advanced data analytics, machine learning, and AI algorithms. Businesses are investing in software tools that can predict failures based on historical data, enabling proactive decision-making. Companies prefer scalable, cloud-based software solutions for real-time monitoring and analytics, enhancing the overall efficiency of their predictive maintenance operations.

By Application: Predictive maintenance is applied across various industries, including manufacturing, energy and utilities, transportation and logistics, healthcare, and oil and gas. The manufacturing segment dominates due to the high potential for cost savings and efficiency improvements in machinery-heavy operations. Predictive maintenance is particularly useful in manufacturing, where unplanned downtimes can result in significant financial losses. Manufacturers are increasingly investing in IoT-based predictive solutions to monitor critical assets and optimize operational efficiency.

North America Predictive Maintenance Market Competitive Landscape

The North America Predictive Maintenance market is dominated by several major players who are setting the trends in technology, innovation, and strategy. Key players include global tech giants and niche players offering specialized predictive maintenance solutions. These companies are competing based on their cloud-based solutions, AI algorithms, customer service, and ability to scale their platforms for different industries.

|

Company Name |

Establishment Year |

Headquarters |

AI Capabilities |

IoT Integration |

Industry Focus |

Market Penetration |

Customer Base |

Partnership Network |

|

IBM Corporation |

1911 |

New York, USA |

||||||

|

Siemens AG |

1847 |

Munich, Germany |

||||||

|

GE Digital |

2011 |

California, USA |

||||||

|

Microsoft Corporation |

1975 |

Washington, USA |

||||||

|

Schneider Electric |

1836 |

Rueil-Malmaison, France |

North America Predictive Maintenance Industry Analysis

Growth Drivers

Industrial Automation: North America’s industrial automation sector continues to drive the adoption of predictive maintenance solutions, with over 21% of manufacturing firms incorporating automation systems into their operations in 2023. This is fueled by the rise in production efficiency requirements and the need to reduce unplanned downtimes, leading to significant cost savings. The U.S. industrial production index rose by 3.8 points between 2022 and 2024, signaling an increasing reliance on automated machinery, which requires advanced maintenance techniques such as predictive maintenance to sustain performance. This trend is supported by federal investments in Industry 4.0 technologies.

Data Analytics Integration: Incorporating data analytics, particularly artificial intelligence (AI) and machine learning (ML), into predictive maintenance has been a key growth driver. In 2023, more than 40% of large manufacturers in North America used AI-driven systems to predict equipment failure, saving the industry approximately $16 billion annually in reduced maintenance costs and downtime. The U.S. Bureau of Economic Analysis reported that AI-based industrial applications have grown by 15% from 2022 to 2024, reflecting the pivotal role data analytics plays in optimizing operations across industries.

Cost Reduction Initiatives: North American manufacturers are under increasing pressure to reduce operational costs and improve efficiency. Predictive maintenance helps achieve these goals by minimizing machine failures, reducing unplanned downtime by 30-40%, and improving equipment lifespan. In 2023, companies in the U.S. and Canada saved approximately $23 billion due to predictive maintenance programs. These savings are crucial in sectors such as automotive and aerospace, where equipment reliability directly influences production volumes and supply chain stability.

Market Challenges

High Implementation Costs: The implementation of predictive maintenance solutions remain expensive due to the initial costs of sensors, software, and integration into legacy systems. In North America, the average cost for deploying such systems in manufacturing facilities ranges between $300,000 to $500,000. This financial burden is particularly heavy for small and mid-sized enterprises (SMEs), where capital allocation is often limited. According to the U.S. Bureau of Labor Statistics, investment in advanced technology systems increased by only 6% annually from 2022 to 2024, partially due to the high entry costs.

Lack of Skilled Workforce: The shortage of a skilled workforce capable of managing and interpreting data from predictive maintenance systems is a significant challenge. By 2024, it’s estimated that there will be a gap of over 2.4 million workers in the U.S. manufacturing sector, affecting the deployment of advanced maintenance solutions. The National Skills Coalition reported that only 14% of manufacturing workers had advanced data analytics skills in 2023, a gap that directly impacts the effectiveness of predictive maintenance adoption across industries.

North America Predictive Maintenance Market Future Outlook

Over the next few years, the North America Predictive Maintenance market is expected to experience sustained growth, driven by ongoing technological advancements in IoT, AI, and machine learning. As more businesses shift towards predictive strategies to reduce operational costs and improve asset reliability, the demand for predictive maintenance solutions will continue to rise. Cloud-based platforms are likely to play a pivotal role in the market’s growth, offering scalability and flexibility to various industries. The continued push towards Industry 4.0, coupled with increasing investments in smart factory technologies, will further boost market growth.

Future Market Opportunities

Increased Adoption in SMEs: SMEs in North America are increasingly adopting predictive maintenance solutions as part of their digital transformation efforts. In 2023, over 15% of SMEs in the U.S. integrated predictive maintenance technologies, a significant increase from 9% in 2022. The U.S. Small Business Administration reported that the adoption of such systems can reduce machine downtime by 45% in SMEs, driving operational efficiencies and profitability. This growth opportunity is further supported by government initiatives promoting digital transformation within smaller enterprises.

Cloud-Based Solutions: Cloud-based predictive maintenance solutions are gaining traction in North America, allowing businesses to deploy scalable systems without high upfront costs. By 2023, more than 35% of predictive maintenance platforms were offered as SaaS (Software-as-a-Service) solutions, enabling easier integration with existing IT infrastructure. This shift toward cloud solutions has reduced deployment time by 30%, helping businesses achieve operational improvements faster. The U.S. Department of Commerce highlighted the importance of cloud technology in fostering digital growth across industries.

Scope of the Report

|

Solution Type |

Software Solutions |

|

Hardware Solutions |

|

|

Service Solutions |

|

|

Deployment Mode |

On-premise |

|

Cloud-based |

|

|

Application |

Manufacturing |

|

Energy and Utilities |

|

|

Transportation and Logistics |

|

|

Healthcare |

|

|

Oil and Gas |

|

|

Technology |

AI and Machine Learning |

|

IoT and Sensors |

|

|

Big Data Analytics |

|

|

Region |

United States |

|

Canada |

|

|

Mexico |

Products

Key Target Audience

Manufacturing Companies

Energy and Utilities Providers

Transportation and Logistics Firms

Oil and Gas Operators

Healthcare Organizations

Government and Regulatory Bodies (U.S. Department of Energy, U.S. Environmental Protection Agency)

Banks and Financial Institutes

Investments and Venture Capitalist Firms

Cloud Service Providers

Companies

Major Players in the Market

IBM Corporation

Siemens AG

GE Digital

Microsoft Corporation

Schneider Electric

Rockwell Automation

SAP SE

PTC Inc.

Uptake Technologies

Augury Inc.

Hitachi Vantara

Software AG

C3.ai

SparkCognition

TIBCO Software

Table of Contents

1. North America Predictive Maintenance Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Predictive Maintenance Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Predictive Maintenance Market Analysis

3.1. Growth Drivers

3.1.1. Industrial Automation (Industry-specific automation trends)

3.1.2. Data Analytics Integration (Usage of AI/ML for predictive insights)

3.1.3. Cost Reduction Initiatives (Operational efficiency improvements)

3.1.4. IoT Adoption in Equipment Maintenance (Smart sensors and monitoring)

3.2. Market Challenges

3.2.1. High Implementation Costs (Cost of deployment and integration)

3.2.2. Lack of Skilled Workforce (Talent gap in handling advanced systems)

3.2.3. Data Privacy Concerns (Compliance with regional data laws)

3.3. Opportunities

3.3.1. Increased Adoption in SMEs (SME digital transformation initiatives)

3.3.2. Cloud-Based Solutions (Expansion of SaaS offerings in predictive maintenance)

3.3.3. Expansion in Non-Industrial Sectors (Healthcare, utilities, and smart cities)

3.4. Trends

3.4.1. Digital Twins for Predictive Insights (Real-time digital replicas of assets)

3.4.2. Edge Computing Integration (Reduced latency in predictive operations)

3.4.3. Mobile Predictive Maintenance Solutions (Adoption of mobile apps for monitoring)

3.5. Government Regulation

3.5.1. North American Manufacturing Regulation Impact (Regulatory impacts on manufacturing)

3.5.2. Energy Efficiency Standards (Government mandates on energy-efficient operations)

3.5.3. Industry 4.0 Initiatives (Policies promoting advanced manufacturing technologies)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Key partnerships, collaborations, and value chain insights)

3.8. Porters Five Forces (Competitive analysis specific to the market)

3.9. Competitive Ecosystem

4. North America Predictive Maintenance Market Segmentation

4.1. By Solution Type (In Value %)

4.1.1. Software Solutions

4.1.2. Hardware Solutions

4.1.3. Service Solutions

4.2. By Deployment Mode (In Value %)

4.2.1. On-premise

4.2.2. Cloud-based

4.3. By Application (In Value %)

4.3.1. Manufacturing

4.3.2. Energy and Utilities

4.3.3. Transportation and Logistics

4.3.4. Healthcare

4.3.5. Oil and Gas

4.4. By Technology (In Value %)

4.4.1. AI and Machine Learning

4.4.2. IoT and Sensors

4.4.3. Big Data Analytics

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Predictive Maintenance Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. IBM Corporation

5.1.2. Siemens AG

5.1.3. GE Digital

5.1.4. Microsoft Corporation

5.1.5. SAP SE

5.1.6. Schneider Electric

5.1.7. Rockwell Automation

5.1.8. PTC Inc.

5.1.9. Uptake Technologies

5.1.10. Augury Inc.

5.1.11. Hitachi Vantara

5.1.12. Software AG

5.1.13. C3.ai

5.1.14. SparkCognition

5.1.15. TIBCO Software

5.2. Cross Comparison Parameters (Revenue, Number of Employees, Headquarters, Inception Year, Key Technologies, Customer Segments, Global Presence, Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Predictive Maintenance Market Regulatory Framework

6.1. Industry Standards (ISO, ANSI regulations for equipment maintenance)

6.2. Compliance Requirements (Industry-specific regulatory compliance)

6.3. Certification Processes (Predictive maintenance certifications)

7. North America Predictive Maintenance Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Predictive Maintenance Future Market Segmentation

8.1. By Solution Type (In Value %)

8.2. By Deployment Mode (In Value %)

8.3. By Application (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. North America Predictive Maintenance Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the first stage, an ecosystem map of the North America Predictive Maintenance market is developed. This includes identifying key stakeholders, industry-specific challenges, and critical variables influencing market dynamics. Extensive secondary research from credible sources is conducted to gather industry insights.

Step 2: Market Analysis and Construction

This phase involves collecting historical market data and analyzing trends, market penetration, and industry performance. Key performance indicators, such as asset failure rates and revenue impacts of downtime, are analyzed to derive a holistic view of the market.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses generated from secondary research are validated through discussions with industry experts, including professionals from key companies. These consultations provide insight into real-world market challenges and opportunities.

Step 4: Research Synthesis and Final Output

The final step integrates all collected data, including insights from both primary and secondary sources, to construct a validated and comprehensive report. Data accuracy is ensured through cross-verification with industry experts and proprietary databases.

Frequently Asked Questions

1 How big is the North America Predictive Maintenance Market?

The North America Predictive Maintenance Market is valued at USD 3.9 billion, driven by the increasing demand for efficient asset management solutions and the integration of AI and IoT technologies in various industries.

2 What are the challenges in the North America Predictive Maintenance Market?

Key challenges in the North America Predictive Maintenance Market include the high initial costs of implementation, the need for skilled professionals to manage predictive systems, and concerns related to data privacy and cybersecurity, particularly in cloud-based solutions.

3 Who are the major players in the North America Predictive Maintenance Market?

Major players in the North America Predictive Maintenance Market include IBM Corporation, Siemens AG, GE Digital, Microsoft Corporation, and Schneider Electric, with a strong focus on providing innovative AI-driven solutions for predictive maintenance.

4 What are the growth drivers of the North America Predictive Maintenance Market?

The North America Predictive Maintenance Market is propelled by advancements in AI, machine learning, and IoT technologies, along with the growing need for industries to reduce operational costs by minimizing equipment downtime.

5 What industries are leading in the adoption of predictive maintenance solutions?

Manufacturing and energy sectors lead the adoption of predictive maintenance solutions, as these industries heavily rely on machinery uptime for operational efficiency and cost optimization in the North America Predictive Maintenance Market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.