North America Pretzel Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD8421

December 2024

91

About the Report

North America Pretzel Market Overview

- The North America Pretzel Market is valued at USD 1.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for healthier snack alternatives among consumers. The surge in popularity of pretzels is due to their low-fat and low-calorie nature, making them an attractive option for health-conscious individuals. Additionally, product innovations like gluten-free and organic pretzels have expanded the market's appeal, providing more choices to consumers and encouraging repeat purchases.

- The market is dominated by the United States and Canada due to their well-established retail networks and a high degree of brand loyalty among consumers. The United States, in particular, benefits from a large number of established pretzel manufacturers, extensive distribution channels, and consumer preference for convenient snack options. Canada follows closely, leveraging the growth in demand for premium and organic snack options. The region's extensive retail chains and preference for ready-to-eat products further cement its position as a leading market.

- The U.S. Food and Drug Administration (FDA) imposes stringent regulations on processed snacks, including pretzels. As of 2023, the FDA requires snack manufacturers to provide detailed nutritional information on packaging, including calorie, sodium, and fat content. Pretzel producers must comply with these regulations to avoid penalties and ensure that their health claims meet FDA standards.

North America Pretzel Market Segmentation

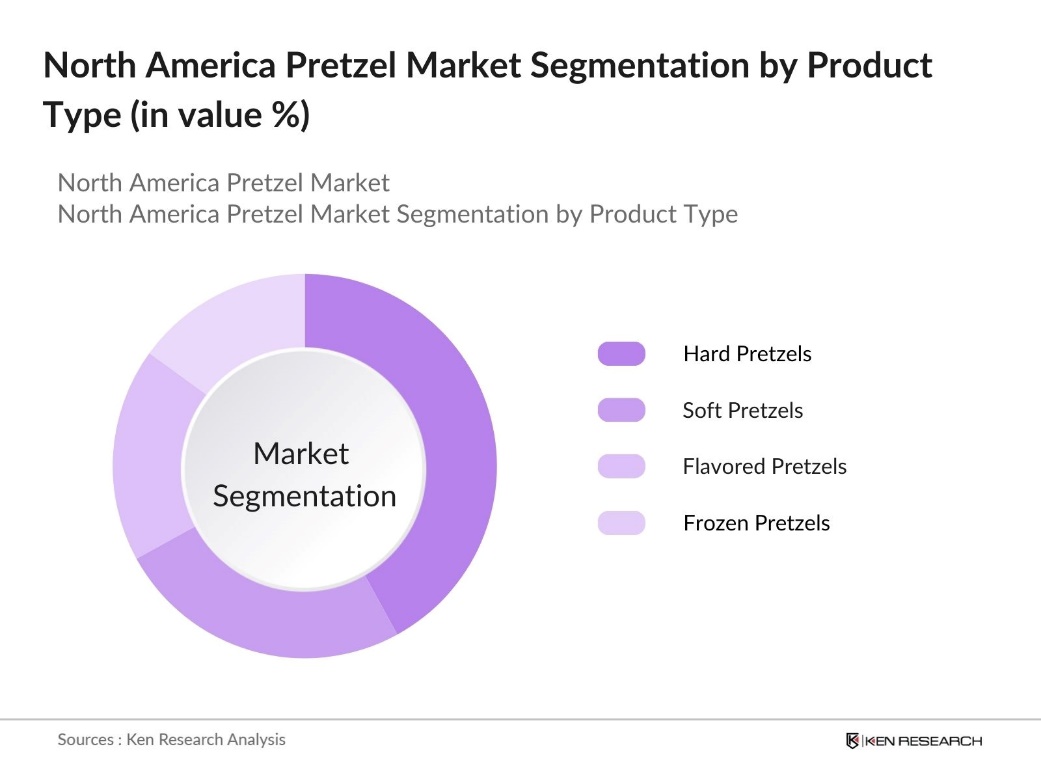

By Product Type: The North America Pretzel market is segmented by product type into hard pretzels, soft pretzels, flavored pretzels, and frozen pretzels. Recently, hard pretzels have emerged as the dominant market segment due to their long shelf life and convenience for consumers. These attributes make them a popular choice for households and retail stores, where storage life is a key factor. The variety of flavors and seasoning options in the hard pretzel segment also contribute to its broad consumer appeal, making it a staple in the snack aisle.

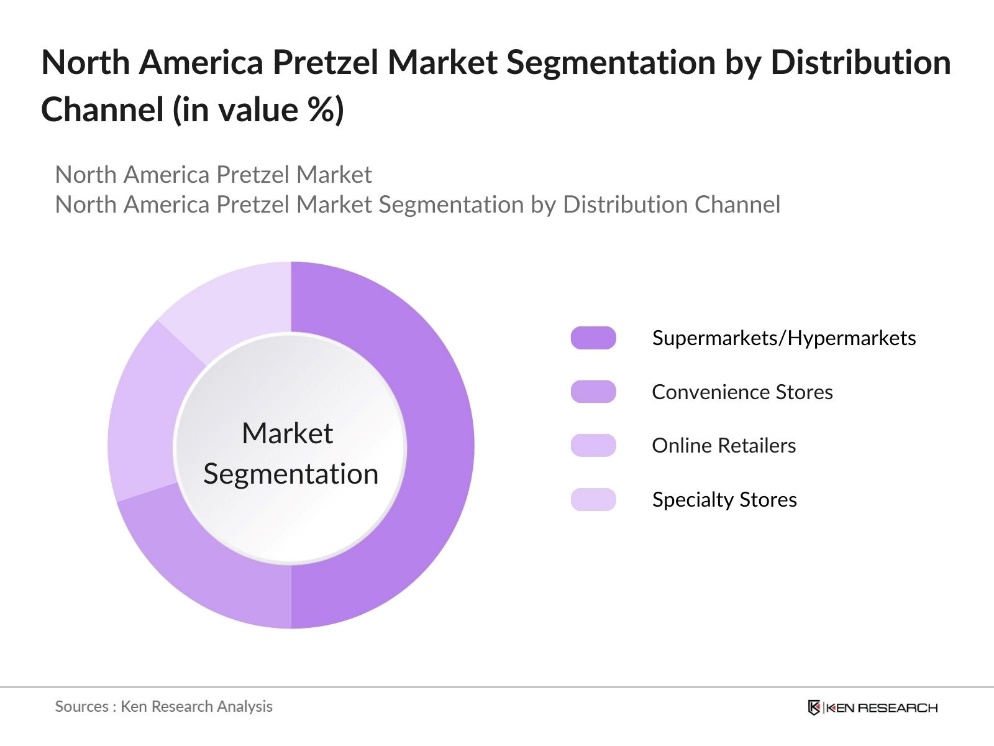

By Distribution Channel: The North America Pretzel market is segmented by distribution channel into supermarkets/hypermarkets, convenience stores, online retailers, and specialty stores. Supermarkets and hypermarkets dominate this segment due to their vast reach and ability to display a wide range of pretzel products. Their accessibility and the ability to purchase in bulk attract a large consumer base, making this channel the most significant in terms of volume sales. The rise of private-label brands within supermarkets has also boosted the demand for pretzels in this channel.

North America Pretzel Market Competitive Landscape

The North America Pretzel market is dominated by a few major players, including established snack manufacturers and brands that leverage their extensive distribution networks and strong brand presence. This consolidation highlights the significant influence of key companies, which consistently innovate and maintain a broad portfolio of products to cater to diverse consumer preferences.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

Annual Revenue (USD Bn) |

Product Range |

Geographic Reach |

Distribution Network |

Brand Loyalty |

Sustainability Initiatives |

|---|---|---|---|---|---|---|---|---|---|

|

Snyder's-Lance Inc. |

1912 |

Charlotte, NC |

|||||||

|

Campbell Soup Company |

1869 |

Camden, NJ |

|||||||

|

Utz Brands Inc. |

1921 |

Hanover, PA |

|||||||

|

Frito-Lay Inc. |

1932 |

Plano, TX |

|||||||

|

J&J Snack Foods Corp. |

1971 |

Pennsauken, NJ |

North America Pretzel Industry Analysis

Growth Drivers

- Expansion of Retail Channels (Online and Offline): The retail landscape in North America has expanded significantly, supporting the growth of pretzel sales through diverse channels. The U.S. Census Bureau reported that total retail e-commerce sales for the entire year of 2023 were estimated at $1,118.7 billion. Brick-and-mortar stores continue to hold a strong presence in across the U.S. and Canada, enhancing accessibility for snack foods. The shift towards omnichannel retailing has been pivotal in driving pretzel sales growth, allowing brands to reach a broader consumer base.

- Product Innovations (Gluten-Free, Organic Variants): Product innovation in gluten-free and organic pretzels has become a key growth driver in North America. The demand for gluten-free products is also on the rise, driven by the increase in celiac disease awareness, with approximately 3.2 million people in the U.S. following a gluten-free diet as per NIH data from 2024. This focus on product diversity is meeting evolving consumer preferences, making pretzels a versatile snack option.

- Rise of Private Label Brands: Private label brands have significantly driven the growth of the North American pretzel market, catering to budget-conscious consumers seeking quality options. Retail giants like Walmart and Kroger have expanded their private label snack ranges, including pretzels, enhancing market competition. This trend offers consumers a broader selection of affordable pretzel products, helping retailers boost brand loyalty while providing value-driven alternatives in an increasingly competitive market.

Market Challenges

- Fluctuations in Raw Material Prices (Wheat, Salt): The North American pretzel industry faces challenges due to variations in raw material prices, especially wheat and salt. These price fluctuations can affect production costs, putting pressure on manufacturers' profit margins and often resulting in higher retail prices. Such cost volatility makes it difficult for producers to maintain consistent pricing, which can impact demand as consumers react to price changes in their preferred snack products.

- Health Regulations and Labeling Standards: Strict health regulations and labeling standards create challenges for pretzel manufacturers in North America. Regulatory requirements mandate clear labeling for allergens, sodium content, and gluten presence. Non-compliance can result in product recalls, adding to operational complexities. Additionally, manufacturers must adhere to guidelines for reducing sodium levels in their products, which can increase production costs. These regulatory demands necessitate careful compliance to ensure product availability and maintain market competitiveness.

North America Pretzel Market Future Outlook

Over the next five years, the North America Pretzel market is expected to demonstrate moderate growth, driven by an increasing focus on health and wellness among consumers and the expansion of organic and gluten-free product lines. The demand for low-calorie, high-fiber snacks is likely to propel the market forward, while the growth of e-commerce channels will further enable brands to reach a wider audience. Additionally, strategic partnerships and mergers among key players are anticipated to enhance production capabilities and market penetration, supporting long-term market growth.

Market Opportunities

- Opportunities in Plant-Based Ingredients: Incorporating plant-based ingredients into pretzel manufacturing offers significant growth potential in North America. This trend aligns with the rising consumer interest in sustainable and health-conscious eating habits, including preferences for vegan and vegetarian options. By using ingredients like lentil flour, chickpea flour, and other plant-based alternatives, manufacturers can appeal to a broader audience seeking diverse, nutrient-rich snack choices, creating new avenues for product innovation and differentiation in the market.

- Growth in the Premium Pretzel Segment: The premium pretzel segment, encompassing artisanal and gourmet varieties, presents a valuable opportunity for market players. This segment is driven by consumers who value high-quality ingredients and unique flavors, showing a willingness to invest in more refined snack experiences. The trend toward small-batch, minimally processed pretzels also attracts health-conscious consumers. Expanding product lines to include premium offerings allows brands to differentiate themselves and tap into a growing consumer base seeking premium snack options.

Scope of the Report

|

Product Type |

Hard Pretzels Soft Pretzels Flavored Pretzels Frozen Pretzels |

|

Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retailers Specialty Stores |

|

Ingredient Type |

Wheat-Based Gluten-Free Organic Multi-Grain |

|

Flavor |

Salted, Unsalted Sweet (Cinnamon, Chocolate) Savory (Cheese, Jalapeno) |

|

Region |

United States Canada Mexico |

Products

Key Target Audience

E-commerce Platforms

Packaging Companies

Foodservice Companies

Government and Regulatory Bodies (FDA, USDA)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Snyder's-Lance Inc.

Campbell Soup Company (Pepperidge Farm)

Utz Brands Inc.

Frito-Lay Inc.

J&J Snack Foods Corp.

Pretzels Inc.

Unique Pretzel Bakery

Herr's Foods Inc.

Old Dutch Foods Inc.

Conagra Brands Inc.

Table of Contents

1. North America Pretzel Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Product Type, Distribution Channel, Region)

1.3. Market Growth Rate (Volume, Value)

1.4. Market Segmentation Overview

2. North America Pretzel Market Size (In USD Bn)

2.1. Historical Market Size (Volume, Value)

2.2. Year-On-Year Growth Analysis (Volume Growth Rate)

2.3. Key Market Developments and Milestones (Product Launches, Distribution Partnerships)

3. North America Pretzel Market Analysis

3.1. Growth Drivers (Consumer Preference, Health Trends, Innovations)

3.1.1. Increasing Demand for Healthy Snack Options

3.1.2. Expansion of Retail Channels (Online and Offline)

3.1.3. Product Innovations (Gluten-Free, Organic Variants)

3.1.4. Rise of Private Label Brands

3.2. Market Challenges (High Competition, Price Sensitivity, Supply Chain Disruptions)

3.2.1. Fluctuations in Raw Material Prices (Wheat, Salt)

3.2.2. Health Regulations and Labeling Standards

3.2.3. Impact of Substitute Products (Chips, Popcorn)

3.3. Opportunities (Market Expansion, Strategic Collaborations, E-commerce Growth)

3.3.1. Opportunities in Plant-Based Ingredients

3.3.2. Growth in the Premium Pretzel Segment

3.3.3. Export Potential to Emerging Markets

3.4. Trends (Premiumization, Functional Ingredients, Sustainability)

3.4.1. Demand for Organic and Clean Label Products

3.4.2. Use of Innovative Packaging Solutions

3.4.3. Focus on Sustainability and Eco-Friendly Practices

3.5. Government Regulations (Labeling Standards, Health Claims, Import Tariffs)

3.5.1. FDA Regulations for Processed Snacks

3.5.2. Tariffs on Wheat Imports

3.5.3. Organic Certification Requirements

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Value Chain Analysis (Raw Material Procurement, Processing, Distribution)

3.8. Porters Five Forces Analysis (Supplier Power, Buyer Power, Threat of Substitutes)

3.9. Competitive Landscape

4. North America Pretzel Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Hard Pretzels

4.1.2. Soft Pretzels

4.1.3. Flavored Pretzels

4.1.4. Frozen Pretzels

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Retailers

4.2.4. Specialty Stores

4.3. By Ingredient Type (In Value %)

4.3.1. Wheat-Based

4.3.2. Gluten-Free

4.3.3. Organic

4.3.4. Multi-Grain

4.4. By Flavor (In Value %)

4.4.1. Salted

4.4.2. Unsalted

4.4.3. Sweet (Cinnamon, Chocolate)

4.4.4. Savory (Cheese, Jalapeno)

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Pretzel Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Snyder's-Lance Inc.

5.1.2. Pretzels Inc.

5.1.3. Utz Brands Inc.

5.1.4. Campbell Soup Company (Pepperidge Farm)

5.1.5. Conagra Brands Inc.

5.1.6. Frito-Lay Inc.

5.1.7. Old Dutch Foods Inc.

5.1.8. Intersnack Group

5.1.9. Unique Pretzel Bakery

5.1.10. Herr's Foods Inc.

5.1.11. Snyder's of Hanover

5.1.12. Newmans Own Inc.

5.1.13. Wetzel's Pretzels LLC

5.1.14. Auntie Anne's Inc.

5.1.15. J&J Snack Foods Corp.

5.2. Cross-Comparison Parameters (Market Share, Product Portfolio, Distribution Network, Pricing Strategy, Product Innovation, Manufacturing Capabilities, Brand Reach, Customer Loyalty)

5.3. Market Share Analysis (By Revenue)

5.4. Strategic Initiatives (New Product Launches, Regional Expansions, Strategic Partnerships)

5.5. Mergers and Acquisitions (Impact Analysis)

5.6. Investment Analysis (Key Investments in Production Facilities)

5.7. Marketing and Branding Strategies (Ad Campaigns, Influencer Collaborations)

5.8. Distribution Strategy Analysis (Direct vs. Indirect Channels)

6. North America Pretzel Market Regulatory Framework

6.1. Food Safety Standards (FDA Compliance)

6.2. Labeling and Nutritional Information Requirements

6.3. Import and Export Regulations

6.4. Certification Processes (Organic, Gluten-Free)

7. North America Pretzel Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Pretzel Market Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Ingredient Type (In Value %)

8.4. By Flavor (In Value %)

8.5. By Region (In Value %)

9. North America Pretzel Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Pricing Strategy Optimization

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the North America Pretzel Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the North America Pretzel Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of product quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple snack manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the North America Pretzel market.

Frequently Asked Questions

01 How big is the North America Pretzel Market?

The North America Pretzel Market is valued at USD 1.5 billion, based on a five-year historical analysis. The market is driven by increasing demand for healthier snack options and the growing trend of organic and gluten-free products.

02 What are the challenges in the North America Pretzel Market?

Challenges in North America Pretzel Market include fluctuating raw material prices, intense competition among established brands, and the rising popularity of alternative snack products like chips and popcorn, which create a competitive environment.

03 Who are the major players in the North America Pretzel Market?

Key players in North America Pretzel Market include Snyder's-Lance Inc., Campbell Soup Company, Utz Brands Inc., Frito-Lay Inc., and J&J Snack Foods Corp. These companies dominate the market due to their extensive distribution networks, strong brand presence, and innovation in product offerings.

04 What are the growth drivers of the North America Pretzel Market?

The North America Pretzel Market is propelled by factors such as a growing preference for low-calorie snacks, product innovations like gluten-free variants, and the expansion of retail channels, including online platforms that offer greater convenience to consumers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.