North America Probiotics Food and Cosmetics Market Size, Segments, Outlook and Revenue Forecast 2022-2027 by Product Type (Probiotics Food & Beverages, Dietary Supplements, Cosmetics), Ingredients (Bacteria, Yeast), Function (Regular, Preventive Healthcare, Therapeutic), Distribution Channel (Hypermarkets/ Supermarkets, Pharmacies/ Drugstores, Specialty stores, Online) and Major Countries (U.S., Canada, Mexico and Rest of North America)

Region:North America

Author(s):Divya Kamboj and Jyothika Borah

Product Code:KRBR19

September 2022

140

About the Report

Market Overview

Probiotics are live microorganisms that are known for providing several health benefits when taken in adequate amounts or applied externally to the body. Probiotics are already present in the body and help it to work in the most efficient way. They can be found in various specialty food products such as dietary supplements, yogurt, and other fermented foods. It can also be infused in beauty products so as to apply to the skin.

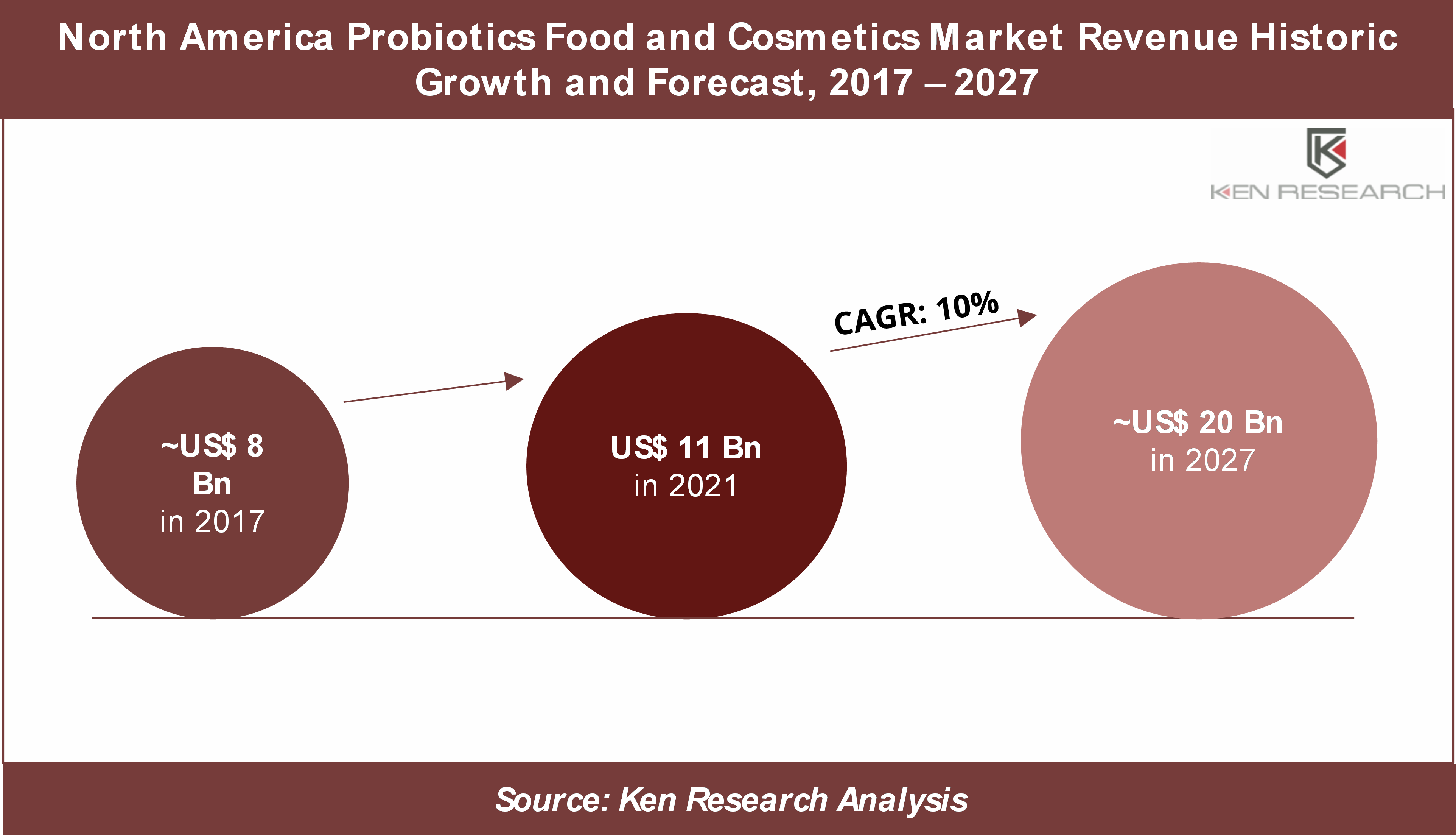

The North America Probiotics Food and Cosmetics Market is expected to record a positive CAGR of 10% during the forecast period (2022-2027) and cross US$ 20 Bn by 2027, due to the rising demand for probiotics products, notably in food and beverages.

- Multiple benefits to body and skin with the use of probiotics products and rising demand for nutritional food as compared to other medicated products are major growth drivers for the North America Probiotics Food and Cosmetics market. For instance, according to a 2020 Food & Health Survey by the International Food Information Council, 54% of all consumers, and 63% of those aged over 50 in the U.S., are inclined more toward the healthfulness of their food and beverage options in 2020 than they did in 2010.

- In addition, the high potential demonstrated by probiotics for the treatment or prevention of various diseases such as cardiovascular diseases, cancers, neurodegenerative disorders, and inflammatory diseases is increasing its demand in people of different age groups for preventive healthcare functions.

- Multiple global brands in the functional food and beverage sector have launched innovative probiotic-fortified products in the market helping the growth. For instance, Farmi Piimatoostus Ltd. launched fermented buttermilk and a number of packaged snacks with probiotics.

- Strong customer buying power and the presence of producers of immunity-boosting food products in the North American region act as an opportunity for the market to grow in the near future.

According to a 2022 survey conducted by a key supplier of probiotics, Chr. Hansen, Nearly 48% of people in North America consume probiotics almost daily either in foods or supplements. As per the data from the U.S. Department of Agriculture Economic Research Service, in the year 2021, the per capita consumption of yogurts in the U.S. was 14.9 pounds.

- However, the high cost of the research and development process for the manufacturing of probiotics and the overall higher cost of probiotics supplements as compared to other dietary supplements acts as a major challenge to this market growth.

The COVID-19 crisis has brought diverse opportunities in the Probiotics Food and Cosmetic market as it offered numerous benefits that helped people fight the virus in the easiest way. Probiotics were used as supplements that proved to be an effective method for combating the virus. The COVID-19 pandemic has been largely acting as a catalyst for probiotic product demand in the U.S. The global pandemic escalated the demand for immunity-boosting food products and supplements among people of every age group. In recent months, the use of probiotics is increasing gradually which can also be noticed in some of the major players in the market. On whole, COVID-19 pandemic has benefited the probiotics industry, particularly in 2020, by intensifying the trend towards immunity-boosting food products and supplements.

Scope of the Report

North America Probiotics Food and Cosmetics Market is segmented by Product Type, Ingredients, Function, and Distribution Channel. In addition, the report also covers market size and forecasts for the region's three major countries' probiotics food and cosmetics markets. The revenue used to size and forecast the market for each segment is USD billion.

|

By Product Type |

|

|

By Ingredients |

|

|

By Function |

|

|

By Distribution Channel |

|

|

By Geography |

|

Key Trends by Market Segment

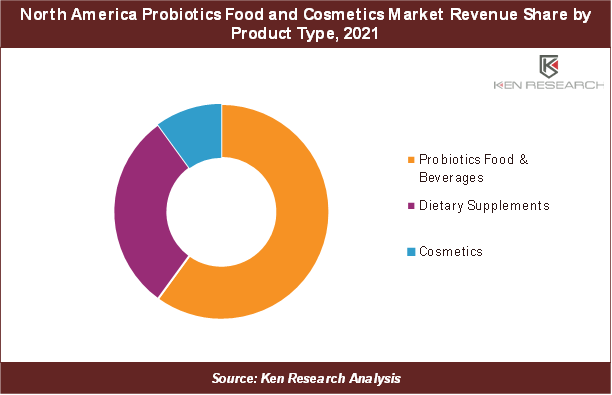

By Product Type: Probiotics Food and Beverages segment holds the largest share of the North American Probiotics Food and Cosmetics market in terms of product type.

- Probiotics Food and Beverages segment is likely to retain its dominant share in the market by 2027.

- The increasing awareness regarding diabetes, the immune system, and various other health problems among U.S. people had increased the demand for probiotics foods.

- Surge in the number of health-conscious adults in developed countries, impacted the demand for probiotics-infused food and beverages.

By Ingredients:Bacteria segment accounts for the majority of the share in the North America Probiotics Food and Cosmetics Market, as most of the probiotic food and beverage and dietary supplement products are made of bacterial strains, most notably employing lactobacillus or lactic acid bacteria. All the manufacturers are developing their products using bacterial strains, a few products are available in the market having yeast strains.

- In August 2021, BLIS Technologies expanded its portfolio with the launch of a new brand that contains probiotic strains specific to the skin. The company claims its new product to be the only one that utilizes a live strain of bacteria.

- Continuous R&D activities are carried out on different types of strains that can be used as probiotics. For instance, BLIS Technologies has net sales of around USD 5 Mn, out of which the company is investing approximately 20% of the overall sales in its research and development activities on bacteria strains.

- In October 2021, Biomillenia and Probiotic Group Luxembourg (PBGL) signed an R&D collaboration agreement aimed at the isolation and characterization of novel strains to be used as the next-generation active ingredients for future products.

- In September 2021, Navipharm developed duo-strain probiotics that target health conditions such as allergic rhinitis, improvement of anxiety and sleep, liver protection, and many female health conditions. The company launched its products built under its in-house Duobiome technology under the brand, Bicrome.

By Function: Preventive Healthcare segment holds the largest market share in the North American Probiotics Food and Cosmetics Market as people are consuming probiotics as supplements for the prevention of any health concerns.

- Demand for probiotics for preventive healthcare is increasing due to growth in health issues that encourages market players to invest in R&D and launch new &innovative probiotics products.

- High in demand in developed countries as they prevent the occurrence of diseases by strengthening the immune system.

- Growing understanding of the need for preventive health, as well as a slew of research indicating advantages in areas like immunity, cognition, and skin care, the market has seen tremendous development.

- According to a survey by Natural Marketing Institute in May 2020, the number of probiotic users in the United States climbed by 66% as it helped in treating several health problems and helped in preventing certain critical health issues.

By Distribution Channel: Hypermarkets/Supermarkets segment holds the largest market share in the North America Probiotics Food and Cosmetics Market as it is the most popular channel for the purchase of protein-based supplement products due to the convenience of shopping and the availability of multiple brands.

- Supermarkets provide an opportunity for the customers to talk to a knowledgeable sales staff and choose from a variety of supplements available in the store.

- The U.S. has a total of 63,348 supermarkets selling various types of supplements to customers. The number of stores is continuously growing in the country.

- In the U.S., retailers offer in-store seminars to educate customers on the benefits of probiotics. This practice attracts people of different age groups to try the product after having learned its benefits for health.

By Geography: U.S. accounts for the largest share of the market among all countries within the total North America Probiotics Food and Cosmetics Market.

- The U.S. is the major production hub for probiotics. Many key players in the market have developed their manufacturing plants in California.

- For Instance, in 2020, Dupont built its manufacturing facility for the production of probiotics in California, U.S. The plant is located in Fountain Valley, California and the company produces high-quality probiotics for the dietary supplement and food and beverage industries in it.

- Florida has a maximum number of supplement stores in the country that sells probiotics products. It is the highest sales generating state in the U.S. for probiotics.

- In Canada, Alberta has one of the top 5 most integrated health systems in the world and is also the production hub for probiotics. The University of Alberta develops high-quality probiotic strains to be used in products in improving the health of animals.

Competitive Landscape

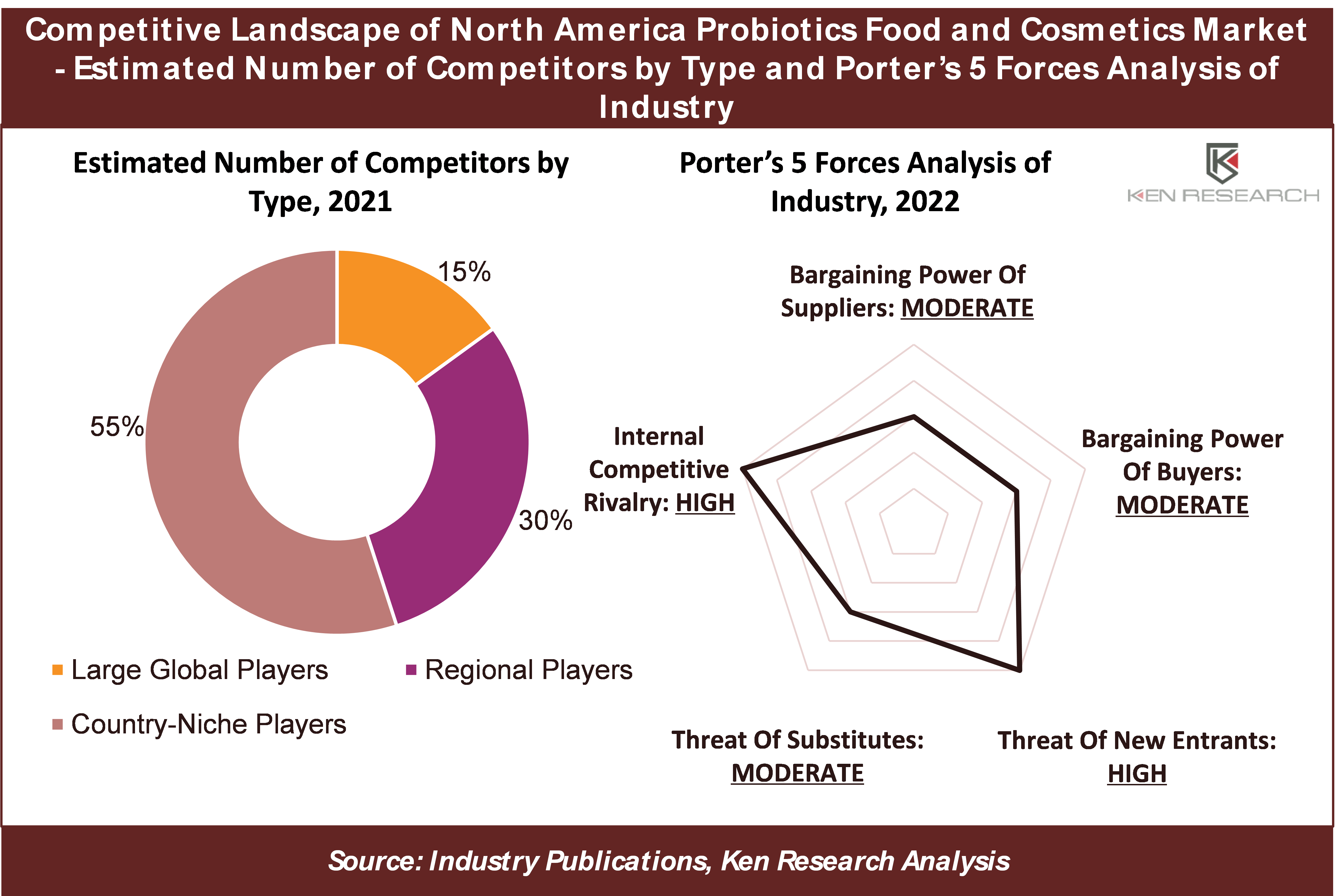

The North America Probiotics Food and Cosmetics market is highly competitive with ~150 players which include globally diversified players, regional players as well as a large number of country-niche players having their own niche in food & beverages and cosmetics industries. Most of the country-niche players are probiotics strains suppliers.

Large global players control nearly half of the market, while regional players hold the second largest share. Some of the major players in the market include Kerry Group plc, Yakult Honsha Co., Ltd, Probi, BioGaia AB, Nestlé, BLIS Technologies, Procter & Gamble, DuPont, ADM, H&H Group, Estée Lauder Inc, Esse Skincare, among others.

The leading global specialist companies such as Yakult Honsha Co., Ltd, BLIS Technologies, Estée Lauder Inc, and Esse Skincare are highly focused on providing a significant number of probiotics food and cosmetics products that can be used across multiple industries, including food and beverages, cosmetics, pharmaceuticals, animal feed and more.

Recent Developments Related to Major Players

- In February 2022, Kerry Group reached an agreement to acquire a leading biotechnology innovation company, c-Lecta. The acquisition will act as an opportunity and help the company in the expansion of its technology portfolio and manufacturing capabilities of bio-processing and bio-transformation of enzymes.

- In February 2022, Nestlé announced the acquisition of core brands of The Bountiful Company, including Osteo Bi-Flex®, Nature’s Bounty®, Puritan’s Pride®, Solgar®, Ester-C®, and Sundown®. The acquisition established the company as the industry leader in herbals, vitamins, minerals and supplements.

- In January 2022, BioGaia AB acquired 100% shares of Nutraceutics Corporation through its US subsidiary, BioGaia Biologics Inc. The acquisition helped the company to extend its nutraceuticals product portfolio by merging the acquired company’s technologies and products.

- In August 2021, Yakult Honsha Co., Ltd established the Haikou Branch in Haikou, Hainan Province, China and started selling Yakult and Yakult Light fermented milk drinks at supermarkets and other retail stores.

- In July 2021, Probi acquired BLIS Technologies, a New Zealand-based probiotic company with an investment of USD 6.36 Mn. With this investment, Probi owned 13% of the company’s shares. This strategic partnership will help the company to grow its business in New Zealand, Australia, North America, and North America.

- In April 2021, Kerry Group plc acquired a leading supplier of Ayurvedic botanical ingredients, Natreon, Inc. The acquired company is in the business of supplying scientifically tested Ayurvedic extracts to the functional food and beverage industry globally. The acquisition helped the company in technological growth and significantly expanded the company’s leadership position.

Conclusion

The North America Probiotics Food and Cosmetics Market is estimated to continue an exponential growth that is witnessed since 2017, during the forecast period is also, primarily driven by rising demand for immunity-boosting food products and supplements among people of every age group. Though the market is highly competitive with over 150 participants, few global players control the dominant share and regional players also hold a significant share.

Key Topics Covered in the Report: -

- Snapshot of North America Probiotics Food and Cosmetics Market

- Industry Value Chain and Ecosystem Analysis

- Market size and Segmentation of North America Probiotics Food and Cosmetics Market

- Historic Growth of Overall North America Probiotics Food and Cosmetics Market and Segments

- Competition Scenario of the Market and Key Developments of Competitors

- Porter’s 5 Forces Analysis of North America Probiotics Food and Cosmetics Industry

- Overview, Product Offerings, and SWOT Analysis of Key Competitors

- Covid 19 Impact on the Overall North America Probiotics Food and Cosmetics Market

- Future Market Forecast and Growth Rates of the Total North America Probiotics Food and Cosmetics Market and by Segments

- Analysis of Probiotics Food and Cosmetics Market in Major North America Countries

- Major Production / Consumption Hubs in the Major North American Countries

- Major Production/Supply and Consumption/Demand Hubs in Each Major North America Country

- Major Country-wise Historic and Future Market Growth Rates of the Total Market and Segments

- Overview of Notable Emerging Competitor Companies within Each Major Country

Major Companies Profiled in the Report

- Kerry Group plc.

- Probi

- Nestlé

- Estée Lauder Inc

- ADM

- DuPont

- BLIS Technologies

- BioGaia AB

- Yakult Honsha Co., Ltd.

- Estée Lauder Inc

- Procter & Gamble

- H&H Group

- Esse Skincare

Notable Emerging Companies Mentioned in the Report

- Lallemand Inc.

- Lifeway Foods, Inc

- Protexin

- Ganeden, Inc.

- Deerland Probiotics & Enzymes Inc.

- KeVita, Inc.

- Evolve BioSystems

- Cell Biotech Co., Ltd.

- Probiotical S.p.A.

- NutraScience Labs

- LaFlore Probiotic Skincare

- The Clorox Company

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report

- Probiotics Food Manufacturers

- Probiotics Cosmetics Manufacturers

- Probiotics Beverages Manufacturers

- Bacteria Strain Suppliers for Probiotics Food

- Bacteria Strain Suppliers for Probiotics Cosmetics

- Organic Food Manufacturers

- Local Cosmetics Manufacturers

- Potential Investors in Probiotics Food Companies

- Potential Investors in Probiotics Cosmetics Companies

- Probiotics Food Distributors

- Probiotics Cosmetics Distributors

- Probiotics Beverages Distributors

- Probiotics Laboratory Technology and Service Providers

- Emerging and Startup Probiotics Companies in the Market

- Probiotics Strain Developing Institutes

- Probiotics Research Institutes

- Government Departments of Biotechnology

- Ministries and Departments of Food and Nutrition

- Ministries and Departments of Healthcare

- Ministries and Departments of Agriculture and Animal Husbandry

- Importers and Distributors of Probiotics Food

- Importers and Distributors of Probiotics Cosmetics

- Food and Nutrition Research Institutes

- Food and Nutrition Regulatory Authorities

Time Period Captured in the Report

- Historical Period: 2017-2021

- Forecast Period: 2022-2027F

Frequently Asked Questions

- What is the Study Period of this Market Report?

The North America Probiotics Food and Cosmetics Market is covered from 2017 – 2027 in this report, which includes a forecast for the period 2022-2027.

- What is the Future Growth Rate of the North America Probiotics Food and Cosmetics Market?

The North America Probiotics Food and Cosmetics Market is expected to witness a CAGR of about 10% over the next 5 years.

- What are the Key Factors Driving the North American Probiotics Food and Cosmetics Market?

The increasing popularity of probiotic dietary supplements and rising awareness of probiotics and their long-term benefits are expected to be the primary drivers of this market.

-

Which is the Largest Product Type Segment within the North American Probiotics Food and Cosmetics Market?

Probiotics Food and Beverages holds the largest share of the North American Probiotics Food and Cosmetics market.

- Who are the Key Players in North America Probiotics Food and Cosmetics Market?

Kerry Group plc, Yakult Honsha Co., Ltd, Probi, BioGaia AB, Nestlé, BLIS Technologies, Procter & Gamble, DuPont, ADM, H&H Group, Estée Lauder Inc, Esse Skincare, among others are the major companies operating in North America Probiotics Food and Cosmetics Market.

Products

Companies

Major Companies Profiled in the Report: -

Kerry Group plc.

Probi

Nestlé

Estée Lauder Inc

ADM

DuPont

BLIS Technologies

BioGaia AB

Yakult Honsha Co., Ltd.

Estée Lauder Inc

Procter & Gamble

H&H Group

Esse Skincare

Notable Emerging Companies Mentioned in the Report

Lallemand Inc.

Lifeway Foods, Inc

Protexin

Ganeden, Inc.

Deerland Probiotics & Enzymes Inc.

KeVita, Inc.

Evolve BioSystems

Cell Biotech Co., Ltd.

Probiotical S.p.A.

NutraScience Labs

LaFlore Probiotic Skincare

The Clorox Company

Table of Contents

- 1. Executive Summary

1.1 Highlights of North America Probiotics Food and Cosmetics Market Historic Growth & Forecast

1.2 Highlights of Market Trends, Challenges, and Competition

1.3 Highlights of Market Revenue Share by Segments

- 2. Market Overview and Key Trends Impacting Growth

2.1 North America Probiotics Food and Cosmetics Market Taxonomy

2.2 Industry Value Chain

2.3 The Ecosystem of Major Entities in North America Probiotics Food and Cosmetics market

2.4 Government Regulations & Developments

2.5 Key Growth Drivers & Challenges Impacting the Market

2.6 COVID-19 Impact on North America Probiotics Food and Cosmetics market

2.7 Total North America Probiotics Food and Cosmetics Market Historic Growth by Segment Type, 2017-2021

2.7.1 By Product Type

2.7.2 By Ingredients

2.7.3 By Function

2.7.4 By Distribution Channel

2.7.5 By Major Countries

2.8 Total North America Probiotics Food and Cosmetics Market Historic Growth and Forecast, 2017-2027

2.9 Key Takeaways

- 3. Total North America - Market Segmentation by Product Type, Historic Growth, Outlook & Forecasts

3.1 Market Definition - Segmentation by Product Type

3.2 Market Revenue Share, Historic Growth, Outlook and Forecasts by Product Type, 2017-2027

3.2.1 Probiotics Food & Beverages

3.2.2 Dietary Supplements

3.2.3 Cosmetics

3.2.4 Key Takeaways from Market Segmentation by Product Type

- 4. Total North America- Market Segmentation by Ingredients, Historic Growth, Outlook & Forecasts

4.1 Market Definition - Segmentation by Ingredients

4.2 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Ingredients, 2017-2027

4.2.1 Bacteria

4.2.2 Yeast

4.2.3 Key Takeaways from Market Segmentation by Ingredients

- 5. Total North America- Market Segmentation by Function, Historic Growth, Outlook & Forecasts

5.1 Market Definition - Segmentation by Function

5.2 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Function, 2017-2027

5.2.1 Regular

5.2.2 Preventive Healthcare

5.2.3 Therapeutic

5.2.4 Key Takeaways from Market Segmentation by Function

- 6. Total North America- Market Segmentation by Distribution Channel, Historic Growth, Outlook & Forecasts

6.1 Market Definition - Segmentation by Distribution Channel

6.2 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Distribution Channel, 2017-2027

6.2.1 Hypermarkets/ Supermarkets

6.2.2 Pharmacies/ Drugstores

6.2.3 Specialty stores

6.2.4 Online

6.2.5 Key Takeaways from Market Segmentation by Distribution Channel

- 7. Industry / Competition Analysis - Competitive Landscape

7.1 Types of Players (Competitors) & Business Models

7.2 Porter’s 5 Forces Analysis of North America’s Probiotics Food and Cosmetics Competitors

7.3 Key Developments in the North America Probiotics Food and Cosmetics Sector Impacting Market Growth

7.4 Comparison of Leading Competitors within North America Probiotics Food and Cosmetics market, 2021

7.5 Comparison of Leading Competitors within North America Probiotics Food and Cosmetics Market by Coverage of Technology Segments, 2021

7.6 Comparison of Leading Competitors within North America Probiotics Food and Cosmetics Market by Coverage of Application, 2021

7.7 Comparison of Leading Competitors within North America Probiotics Food and Cosmetics Market by Coverage of Generation and Delivery Mode, 2021

7.8 Key Takeaways from Competitive Landscape

- 8. Key Competitor Profiles (Company Overview, Product Offerings, SWOT Analysis)

8.1 Kerry Group plc.

8.2 Probi

8.3 Nestlé

8.4 Estée Lauder Inc

8.5 ADM

8.6 DuPont

8.7 BLIS Technologies

8.8 BioGaia AB

8.9 Yakult Honsha Co., Ltd.

8.10 Estée Lauder Inc

8.11 Procter & Gamble

8.12 H&H Group

8.13 Esse Skincare

- 9. Geographic Analysis & Major Countries Market Historic Growth, Outlook, and Forecasts

9.1 Major Countries Comparison of Macroeconomic Factors

9.2 Total North America- Market Revenue Share, Historic Growth, Outlook and Forecasts by Geography, 2017-2027

9.3 Major Countries Market Analysis, Historic Growth, Outlook & Forecasts

9.4 U.S. – Probiotics Food and Cosmetics Market Analysis

9.4.1 Major Production and Consumption Hubs in the U.S.

9.4.2 Notable Emerging Probiotics Food and Cosmetics Companies in the U.S.

9.4.3 Market Revenue Share, Historic Growth, Outlook and Forecasts by Product Type, 2017-2027

9.4.4 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Ingredients, 2017-2027

9.4.5 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Function, 2017-2027

9.4.6 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Distribution Channel, 2017-2027

9.5 Canada – Probiotics Food and Cosmetics Market Analysis

9.5.1 Major Production and Consumption Hubs in Canada

9.5.2 Notable Emerging Probiotics Food and Cosmetics Companies in Canada

9.5.3 Market Revenue Share, Historic Growth, Outlook and Forecasts by Product Type, 2017-2027

9.5.4 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Ingredients, 2017-2027

9.5.5 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Function, 2017-2027

9.5.6 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Distribution Channel, 2017-2027

9.6 Mexico – Probiotics Food and Cosmetics Market Analysis

9.6.1 Major Production and Consumption Hubs in Mexico

9.6.2 Market Revenue Share, Historic Growth, Outlook and Forecasts by Product Type, 2017-2027

9.6.3 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Ingredients, 2017-2027

9.6.4 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Function, 2017-2027

9.6.5 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Distribution Channel, 2017-2027

- 10. Industry Expert’s Opinions/Perspectives

10.1 Notable Statements/Quotes from Industry Experts and C-Level Executives on Current Status and Future Outlook of the Market

- 11. Analyst Recommendation

10.1 Analyst Recommendations on Identified Major Opportunities and Potential Strategies to Gain from Opportunities

- 12. Appendix

12.1 Research Methodology - Market Size Estimation, Forecast, and Sanity Check Approach

12.2 Sample Discussion Guide

12.3 Disclaimer

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.