North America Procurement Software Market Outlook to 2030

Region:Global

Author(s):Sanjna

Product Code:KROD6432

November 2024

83

About the Report

North America Procurement Software Market Overview

- The North America Procurement Software market is valued at USD 3 billion, driven by the increasing demand for automation in procurement processes and cloud-based solutions. This growth is attributed to the rising need for businesses to enhance their operational efficiency and streamline supply chains through advanced procurement systems. These systems help in reducing procurement costs and improving vendor management, which remains crucial for businesses across industries like manufacturing, healthcare, and IT.

- The United States dominates the North America procurement software market due to its mature technology ecosystem and the presence of a large number of procurement software providers, such as Oracle and SAP. Major cities like New York and San Francisco are hubs for technological innovation, where large enterprises are early adopters of new procurement systems to optimize business operations. Additionally, government regulations around transparency in procurement and data security are more robust in the US, fostering a conducive environment for procurement software solutions.

- North American procurement software providers are required to comply with various cybersecurity standards, including ISO 27001, GDPR, and the California Consumer Privacy Act (CCPA). According to the U.S. Federal Communications Commission (FCC), 2023 saw a 20% increase in regulatory compliance audits across the procurement software sector. Businesses must ensure that their platforms comply with these standards to avoid hefty penalties and legal challenges. The compliance burden is driving demand for secure, compliant procurement platforms across industries.

North America Procurement Software Market Segmentation

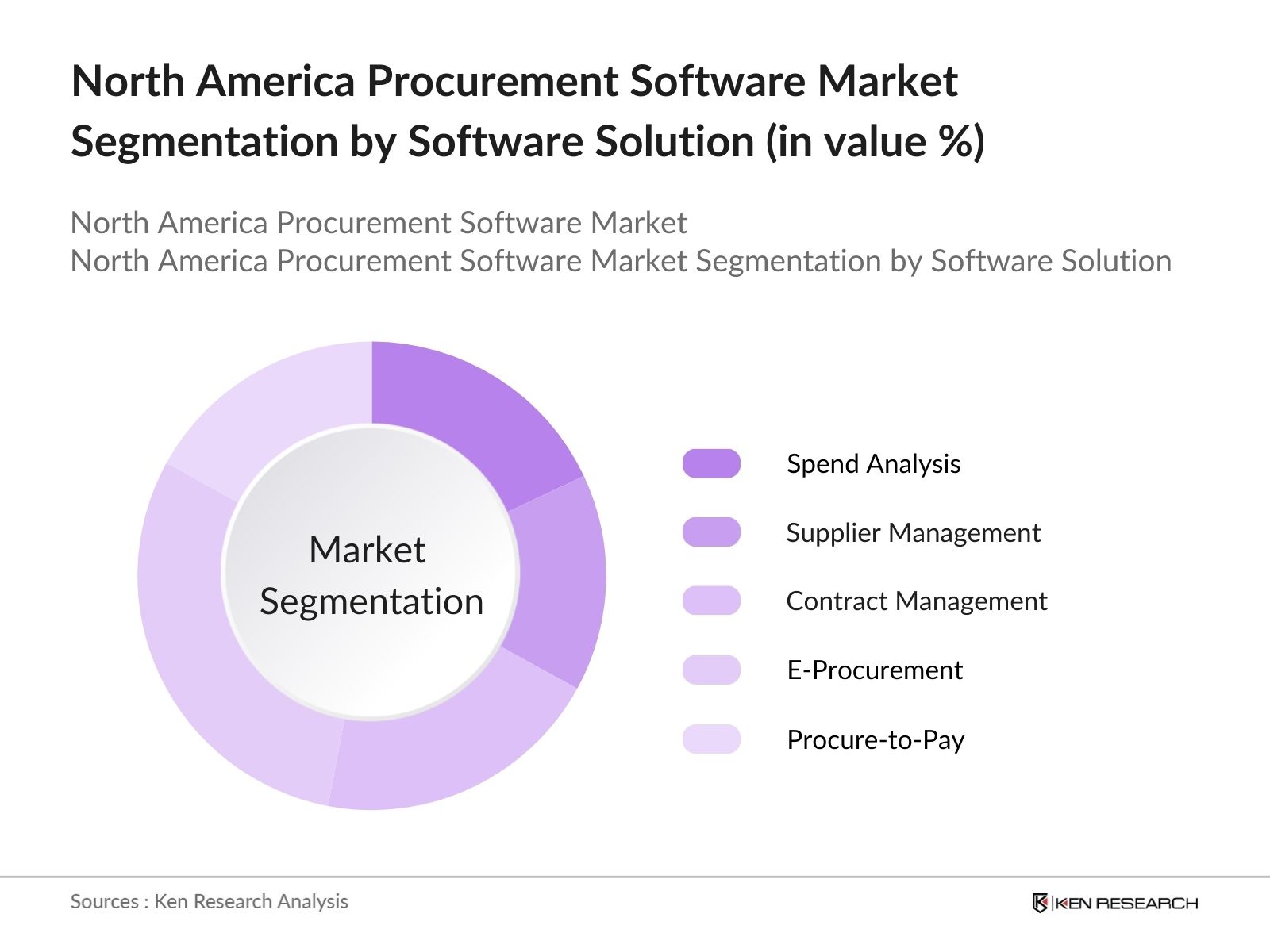

By Software Solution: The North America Procurement Software market is segmented by software solution into spend analysis, supplier management, contract management, e-procurement, and procure-to-pay solutions. Recently, e-procurement solutions have emerged as the dominant segment under the software solutions category due to the increasing adoption of digital platforms that enable organizations to streamline the entire procurement process, from purchase orders to supplier payments.

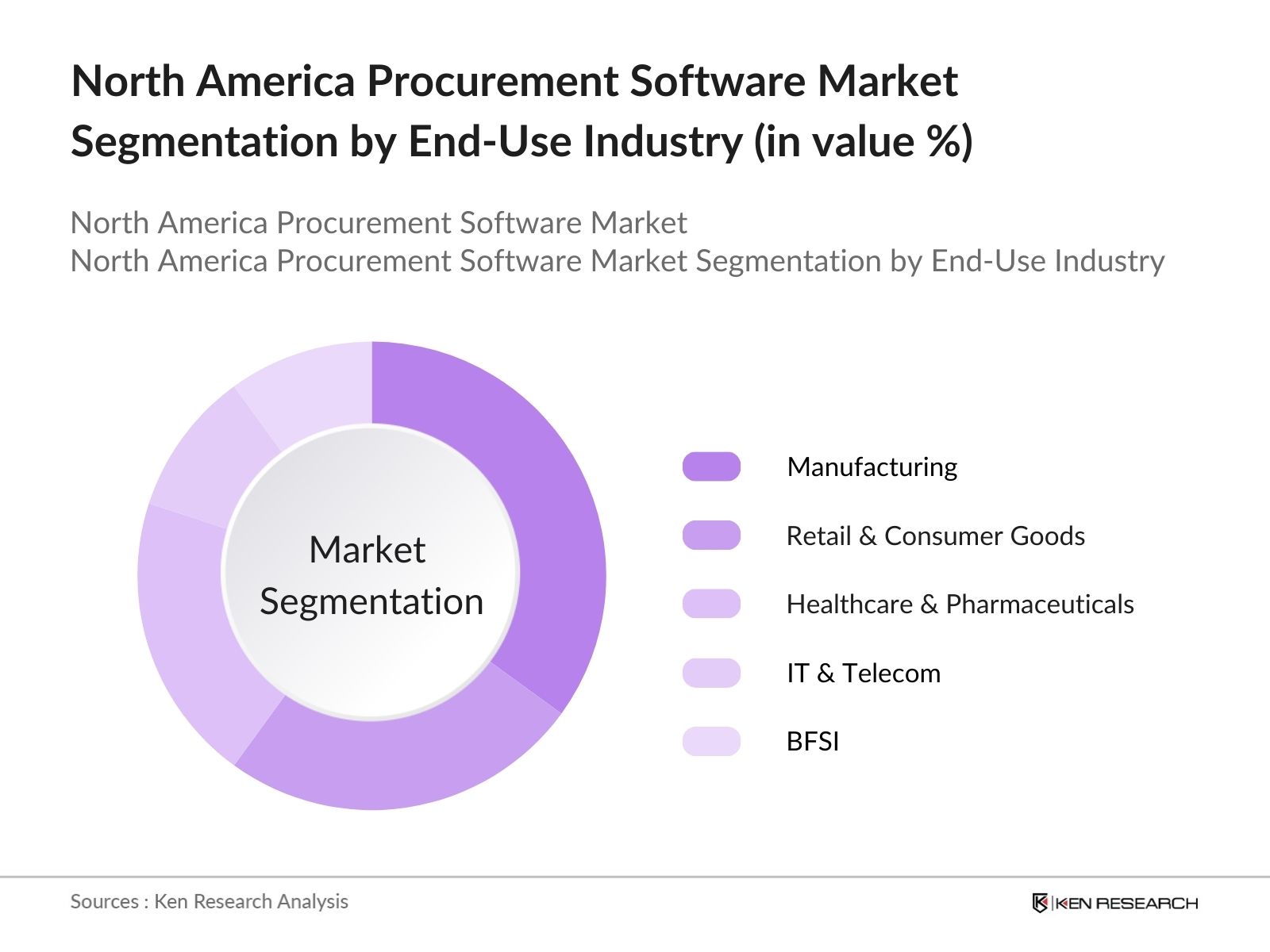

By End-Use Industry: The procurement software market is also segmented by end-use industry into manufacturing, retail & consumer goods, healthcare & pharmaceuticals, IT & telecom, and BFSI. Among these, the manufacturing industry holds a significant share due to the complexity of its supply chain processes, which necessitates effective procurement management to ensure timely delivery of materials and products. The use of procurement software in this sector helps manufacturers manage supplier relationships, track purchasing history, and optimize inventory management, thereby enhancing production efficiency and reducing costs.

By End-Use Industry: The procurement software market is also segmented by end-use industry into manufacturing, retail & consumer goods, healthcare & pharmaceuticals, IT & telecom, and BFSI. Among these, the manufacturing industry holds a significant share due to the complexity of its supply chain processes, which necessitates effective procurement management to ensure timely delivery of materials and products. The use of procurement software in this sector helps manufacturers manage supplier relationships, track purchasing history, and optimize inventory management, thereby enhancing production efficiency and reducing costs.

North America Procurement Software Market Competitive Landscape

North America Procurement Software Market Competitive Landscape

The North America Procurement Software market is dominated by several key players who have established strong market positions through technological innovation, strategic partnerships, and extensive product portfolios. The consolidation of the market is evidenced by the influence of companies like SAP, Oracle, and Coupa Software, who offer comprehensive procurement solutions that cater to the needs of various industries.

|

Company Name |

Established Year |

Headquarters |

Revenue (USD) |

Cloud Offering |

AI Integration |

Client Portfolio |

Global Presence |

Product Innovation |

Recent Acquisitions |

|

SAP SE |

1972 |

Walldorf, Germany |

- |

- |

- |

- |

- |

- |

- |

|

Oracle Corporation |

1977 |

Austin, TX, USA |

- |

- |

- |

- |

- |

- |

- |

|

Coupa Software Inc. |

2006 |

San Mateo, CA, USA |

- |

- |

- |

- |

- |

- |

- |

|

IBM Corporation |

1911 |

Armonk, NY, USA |

- |

- |

- |

- |

- |

- |

- |

|

GEP Worldwide |

1999 |

Clark, NJ, USA |

- |

- |

- |

- |

- |

- |

- |

North America Procurement Software Market Analysis

Growth Drivers

- Increasing Demand for Cost Efficiency: The North American procurement software market is experiencing a surge in demand due to the need for cost-efficiency in procurement processes. The U.S. federal government alone allocated over $6 trillion in expenditure in 2023, driving demand for solutions that streamline procurement and cut operational costs. Efficiency gains in automated procurement software can reduce procurement cycle times by up to 30% according to government procurement metrics. The focus on reducing manual intervention in procurement processes is driving enterprises toward implementing advanced procurement systems to manage operational costs.

- Rising Adoption of Cloud-Based Solutions: Cloud-based procurement solutions have gained significant traction in North America, with 60% of U.S. businesses adopting cloud-based SaaS (Software as a Service) solutions in 2024. This is largely driven by enterprises seeking to scale their procurement operations without the constraints of on-premise infrastructure. The adoption rate of cloud-based platforms is further boosted by the U.S. federal mandate requiring federal agencies to adopt cloud-first strategies.

- Automation and AI Integration in Procurement Processes: The adoption of AI-driven procurement software in North America has accelerated, with over 22% of procurement departments using AI tools in 2024 to automate tasks such as supplier selection and contract management. The U.S. Department of Defense implemented robotic process automation (RPA) across procurement units, cutting down manual tasks by nearly 40%. As AI and RPA continue to transform procurement operations, organizations are leveraging these technologies to streamline operations, reduce errors, and improve procurement cycle times, which directly contributes to operational efficiency.

Challenges

- Integration with Legacy Systems: According to the U.S. Department of Commerce, over 43% of U.S. companies still use outdated ERP systems that lack compatibility with modern procurement software solutions, leading to increased downtime and operational inefficiencies. The complexity and cost of retrofitting legacy systems to integrate with new software solutions continue to hinder the adoption of modern procurement technologies across several industries.

- High Initial Setup and Licensing Costs: Despite the efficiency and cost-saving potential of procurement software, many North American companies face barriers due to the high initial setup and licensing costs. Data from the U.S. Small Business Administration shows that small and medium-sized businesses (SMBs) often spend upwards of $100,000 in licensing and implementation fees for advanced procurement platforms. These high costs deter many smaller businesses from adopting these solutions, leaving them reliant on manual or outdated procurement processes.

North America Procurement Software Market Future Outlook

North America procurement software market is expected to experience robust growth driven by increased digital transformation initiatives across industries, growing adoption of AI-driven procurement systems, and a shift towards cloud-based procurement solutions. These factors will support the markets expansion, as organizations seek to improve efficiency, transparency, and cost-effectiveness in their procurement operations. The emphasis on automation and real-time data access will further boost the demand for integrated procurement platforms, especially in sectors like manufacturing, healthcare, and retail.

Market Opportunities

- Expansion of Cloud-Based Platforms: Small and medium enterprises (SMEs) in North America are increasingly adopting cloud-based procurement platforms to reduce infrastructure costs and improve operational efficiency. In 2024, cloud adoption among SMEs reached over 55%, particularly in sectors like manufacturing and retail, where agile procurement processes are vital. The U.S. federal governments push for cloud-first strategies is expected to further stimulate the growth of cloud-based procurement solutions among smaller businesses, enabling them to scale operations without significant capital investments.

- Growing Role of Data Analytics in Procurement: Procurement software integrated with big data analytics is gaining momentum, with 70% of large corporations in North America adopting predictive analytics tools by 2024, as per U.S. Census Bureau data. These analytics tools help procurement teams forecast demand, optimize supplier selection, and streamline procurement processes by analyzing real-time data. The demand for data-driven procurement strategies continues to grow, driven by the need to enhance operational efficiency and reduce procurement costs.

Scope of the Report

|

Segments |

Sub-Segments |

|

Software Solution |

Spend Analysis Supplier Management Contract Management e-Procurement Procure-to-Pay |

|

Deployment Mode |

Cloud-Based On-Premise |

|

Procurement Type |

Indirect Procurement Direct Procurement |

|

End-Use Industry |

Manufacturing Retail & Consumer Goods Healthcare & Pharmaceuticals IT & Telecom BFSI |

|

Region |

USA Canada Mexico |

Products

Key Target Audience

Procurement Software Developers

Manufacturing Firms (Automotive, Electronics)

Retail and Consumer Goods Companies

Healthcare & Pharmaceutical Companies

IT and Telecom Firms

BFSI Sector Enterprises

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Federal Acquisition Regulation Council, Office of Federal Procurement Policy)

Companies

Players Mentioned in the Report

SAP SE

Oracle Corporation

Coupa Software Inc.

IBM Corporation

GEP Worldwide

Zycus Inc.

Jaggaer

Basware Corporation

Proactis

Ivalua

Table of Contents

1. North America Procurement Software Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Procurement Types, Software Solutions, Deployment Modes, and End-Use Industries)

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Procurement Software Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Procurement Software Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Cost Efficiency (Efficiency Metrics)

3.1.2. Rising Adoption of Cloud-Based Solutions (Cloud & SaaS Penetration Rates)

3.1.3. Automation and AI Integration in Procurement Processes (AI and RPA Adoption Metrics)

3.1.4. Growing Focus on Supplier Management and Risk Mitigation (Supplier Relationship Management)

3.2. Market Challenges

3.2.1. Integration with Legacy Systems (Software Compatibility Issues)

3.2.2. High Initial Setup and Licensing Costs (Cost Metrics)

3.2.3. Cybersecurity and Data Privacy Concerns (Security Standards Compliance)

3.2.4. Vendor Lock-In Concerns (Contractual and Vendor Dependence Issues)

3.3. Opportunities

3.3.1. Expansion of Cloud-Based Platforms (Cloud Adoption Rate by SMEs)

3.3.2. Growing Role of Data Analytics in Procurement (Big Data and Predictive Analytics Utilization)

3.3.3. Increasing Demand for End-to-End Procurement Solutions (Procure-to-Pay Integration Metrics)

3.3.4. Enhanced Focus on Sustainable Procurement Practices (Green Procurement)

3.4. Trends

3.4.1. Implementation of AI and Blockchain in Procurement (Blockchain Usage in Supply Chain)

3.4.2. Growth in e-Procurement Solutions (e-Procurement Transactions Volume)

3.4.3. Shift Towards Mobile Procurement Solutions (Mobile Procurement Adoption Rates)

3.4.4. Increasing Use of Self-Service Platforms (B2B Self-Service Tools Penetration)

3.5. Government Regulation

3.5.1. Compliance with Cybersecurity Standards (ISO 27001, GDPR, CCPA Compliance)

3.5.2. Procurement Transparency Mandates (Government Procurement Guidelines)

3.5.3. Data Localization Regulations (Data Sovereignty Requirements)

3.5.4. Public Procurement Policies (Federal and State-Level Regulations)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Vendors, Providers, and End-Users)

3.8. Porters Five Forces

3.9. Competitive Landscape

4. North America Procurement Software Market Segmentation

4.1. By Software Solution (In Value %)

4.1.1. Spend Analysis

4.1.2. Supplier Management

4.1.3. Contract Management

4.1.4. e-Procurement

4.1.5. Procure-to-Pay

4.2. By Deployment Mode (In Value %)

4.2.1. Cloud-Based

4.2.2. On-Premise

4.3. By Procurement Type (In Value %)

4.3.1. Indirect Procurement

4.3.2. Direct Procurement

4.4. By End-Use Industry (In Value %)

4.4.1. Manufacturing

4.4.2. Retail & Consumer Goods

4.4.3. Healthcare & Pharmaceuticals

4.4.4. IT & Telecom

4.4.5. BFSI

4.5. By Region (In Value %)

4.5.1. USA

4.5.2. Canada

4.5.3. Mexico

5. North America Procurement Software Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. SAP SE

5.1.2. Oracle Corporation

5.1.3. Coupa Software Inc.

5.1.4. IBM Corporation

5.1.5. GEP Worldwide

5.1.6. Zycus Inc.

5.1.7. Jaggaer

5.1.8. Basware Corporation

5.1.9. Proactis

5.1.10. Ivalua

5.2. Cross Comparison Parameters (Revenue, Product Offerings, Innovation Index, Client Portfolio, Deployment Models, Market Reach, Partnerships, Employee Strength)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. North America Procurement Software Market Regulatory Framework

6.1. Data Security and Compliance Standards (HIPAA, GDPR, CCPA)

6.2. Public Procurement Compliance (Federal Acquisition Regulations)

6.3. Supplier Diversity Mandates (Minority-Owned Businesses)

6.4. Certification Processes (ISO Certifications for Software Solutions)

7. North America Procurement Software Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Procurement Software Future Market Segmentation

8.1. By Software Solution (In Value %)

8.2. By Deployment Mode (In Value %)

8.3. By Procurement Type (In Value %)

8.4. By End-Use Industry (In Value %)

8.5. By Region (In Value %)

9. North America Procurement Software Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Go-To-Market Strategy

9.4. White Space Opportunity Identification

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying the primary variables affecting the North America Procurement Software Market. These include the adoption rate of cloud-based solutions, AI integration in procurement processes, and cybersecurity regulations. Desk research was conducted using a blend of secondary and proprietary databases to ensure a holistic understanding of market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data on procurement software adoption across industries in North America was analyzed. This involved evaluating the penetration of procurement solutions in different sectors and assessing how new technologies like AI and blockchain are reshaping procurement processes.

Step 3: Hypothesis Validation and Expert Consultation

To ensure the accuracy of our findings, we engaged with industry experts through CATI (Computer-Assisted Telephone Interviews). Their insights were critical in validating our hypotheses about market growth drivers and the increasing role of AI in procurement.

Step 4: Research Synthesis and Final Output

In the final stage, the research synthesis involved aggregating insights from procurement software providers and major industry stakeholders to develop a comprehensive market report. This approach ensured that the final output was accurate, actionable, and validated by credible sources.

Frequently Asked Questions

01. How big is the North America Procurement Software Market?

The North America Procurement Software Market is valued at USD 3 billion, driven by the increasing adoption of digital procurement solutions across industries like manufacturing, retail, and healthcare.

02. What are the challenges in the North America Procurement Software Market?

Challenges in the North America Procurement Software market include high upfront costs, integration with legacy systems, and data security concerns. The complexity of managing vendor lock-in scenarios also presents a significant barrier for companies.

03. Who are the major players in the North America Procurement Software Market?

Major players in North America Procurement Software market include SAP SE, Oracle Corporation, Coupa Software Inc., GEP Worldwide, and Zycus Inc. These companies lead the market due to their extensive product portfolios, global reach, and robust cloud-based solutions.

04. What are the growth drivers of the North America Procurement Software Market?

North America Procurement Software market is propelled by factors such as increasing automation in procurement processes, the rising adoption of cloud-based software, and the integration of AI and blockchain technologies for improved supply chain transparency.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.