North America Project Portfolio Management Market Outlook to 2030

Region:North America

Author(s):Naman Rohilla

Product Code:KROD8425

December 2024

88

About the Report

North America Project Portfolio Management Market Overview

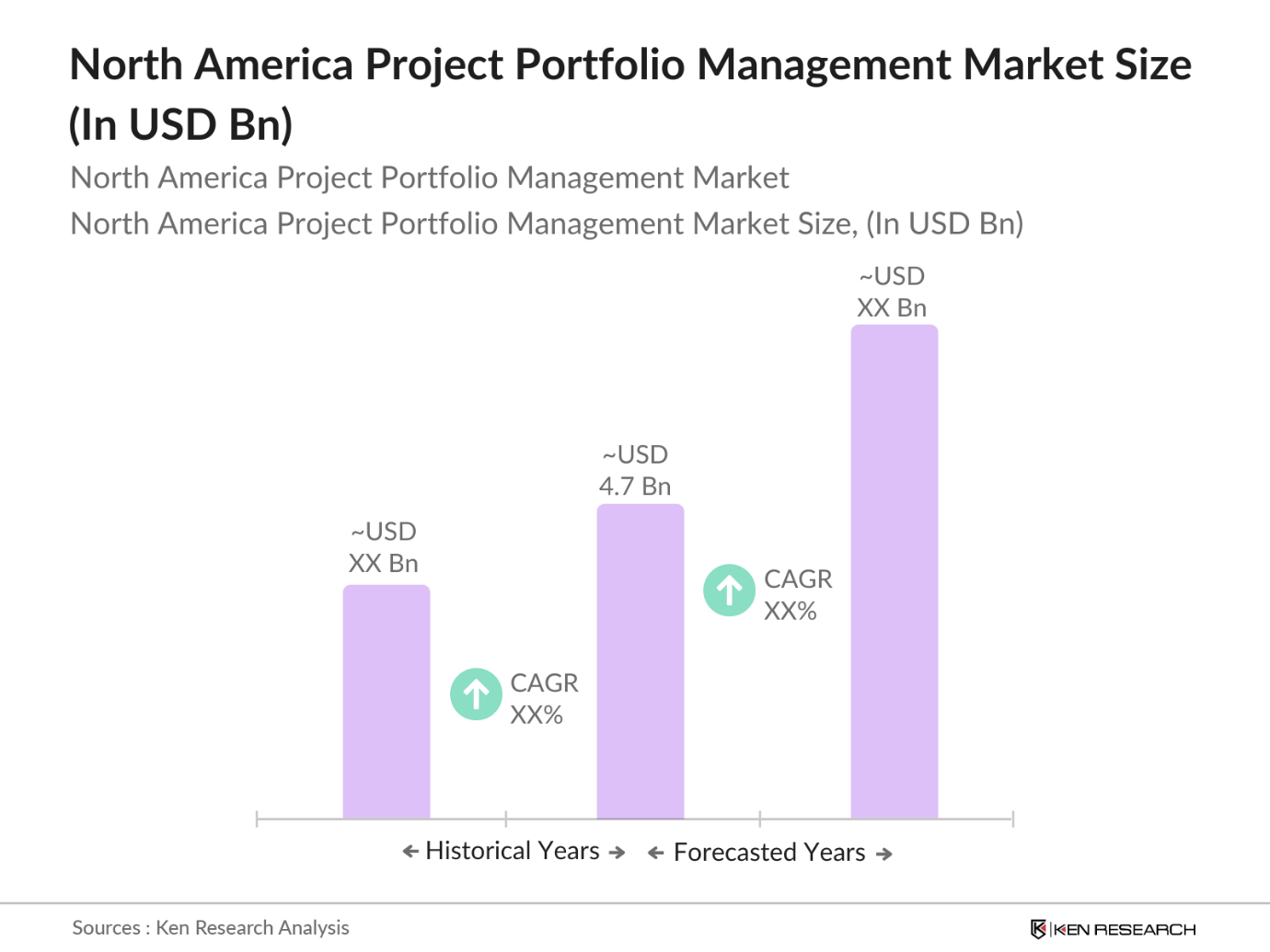

- The North America Project Portfolio Management market reached a valuation of USD 4.7 billion in recent analyses. This market size is influenced by factors like the rapid adoption of digital and cloud-based solutions and growing demand from sectors requiring agile project management, particularly in IT, BFSI, and healthcare. The need to manage extensive data and portfolios effectively has also been a driver, with cloud PPM solutions growing as a result of their flexibility and cost-efficiency benefits.

- The United States and Canada are the dominant regions in the North America PPM market due to their well-established IT infrastructure and strong presence of multinational corporations across sectors. These countries have been early adopters of PPM solutions, driven by their need for streamlined project management tools that help meet stringent compliance requirements. The substantial investment in technology across industries further solidifies their lead in the PPM market.

- Strict data privacy standards like GDPR and HIPAA require organizations handling sensitive data to implement robust security frameworks. In North America, over 70% of firms in health and finance sectors adhere to HIPAA-compliant PPM solutions to ensure data security in project management. These standards mandate consistent compliance checks and audits, impacting overall project costs and necessitating advanced PPM software integration for secure data handling.

North America Project Portfolio Management Market Segmentation

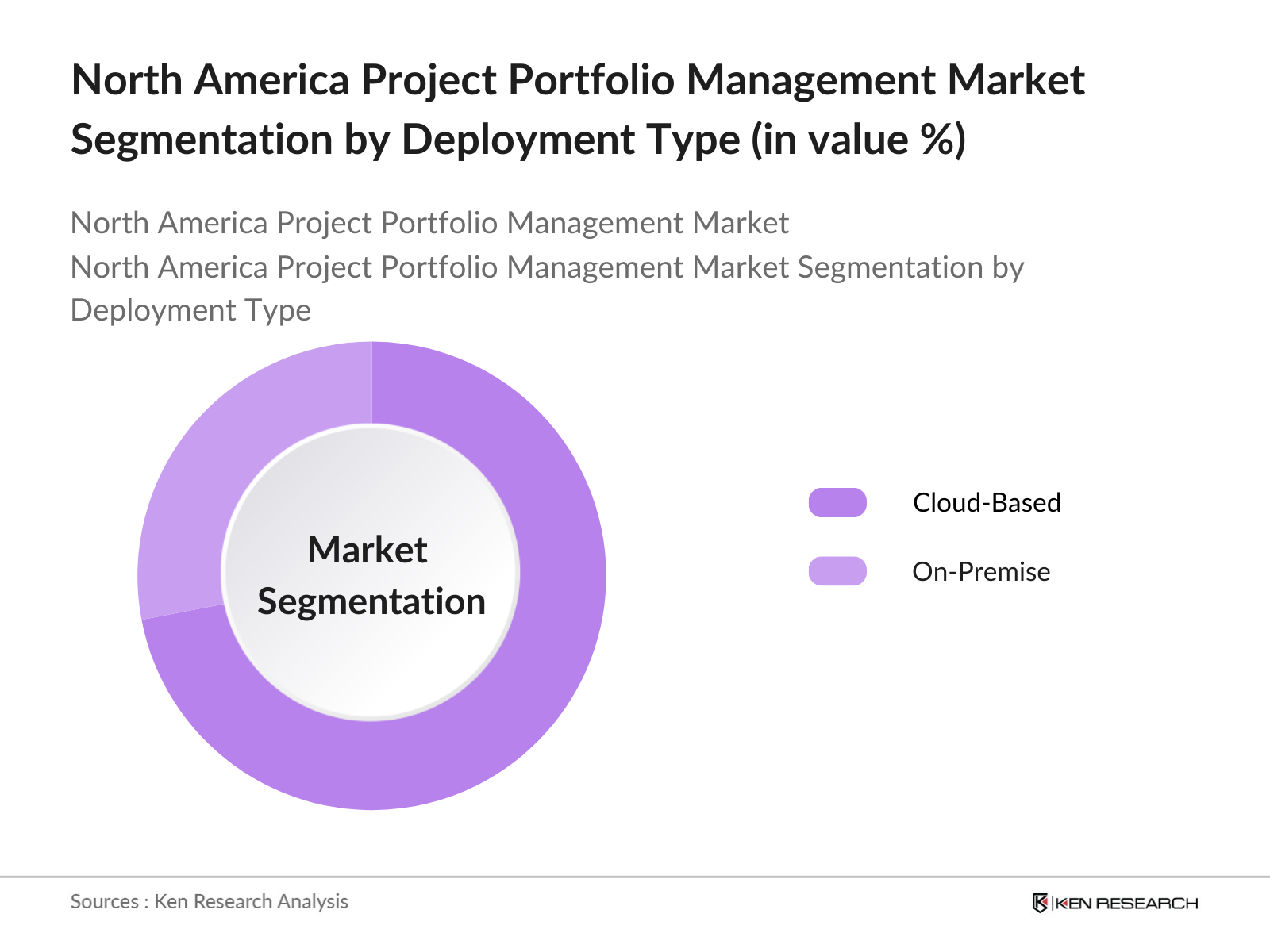

- By Deployment Type: The North America PPM market is segmented by deployment type into Cloud and On-Premise solutions. The cloud-based segment dominates the market, largely due to its remote accessibility, cost efficiency, and scalability, which are highly favored by enterprises operating in a dynamic business environment. Cloud PPM solutions allow companies to manage resources flexibly, making them especially popular among small and medium enterprises.

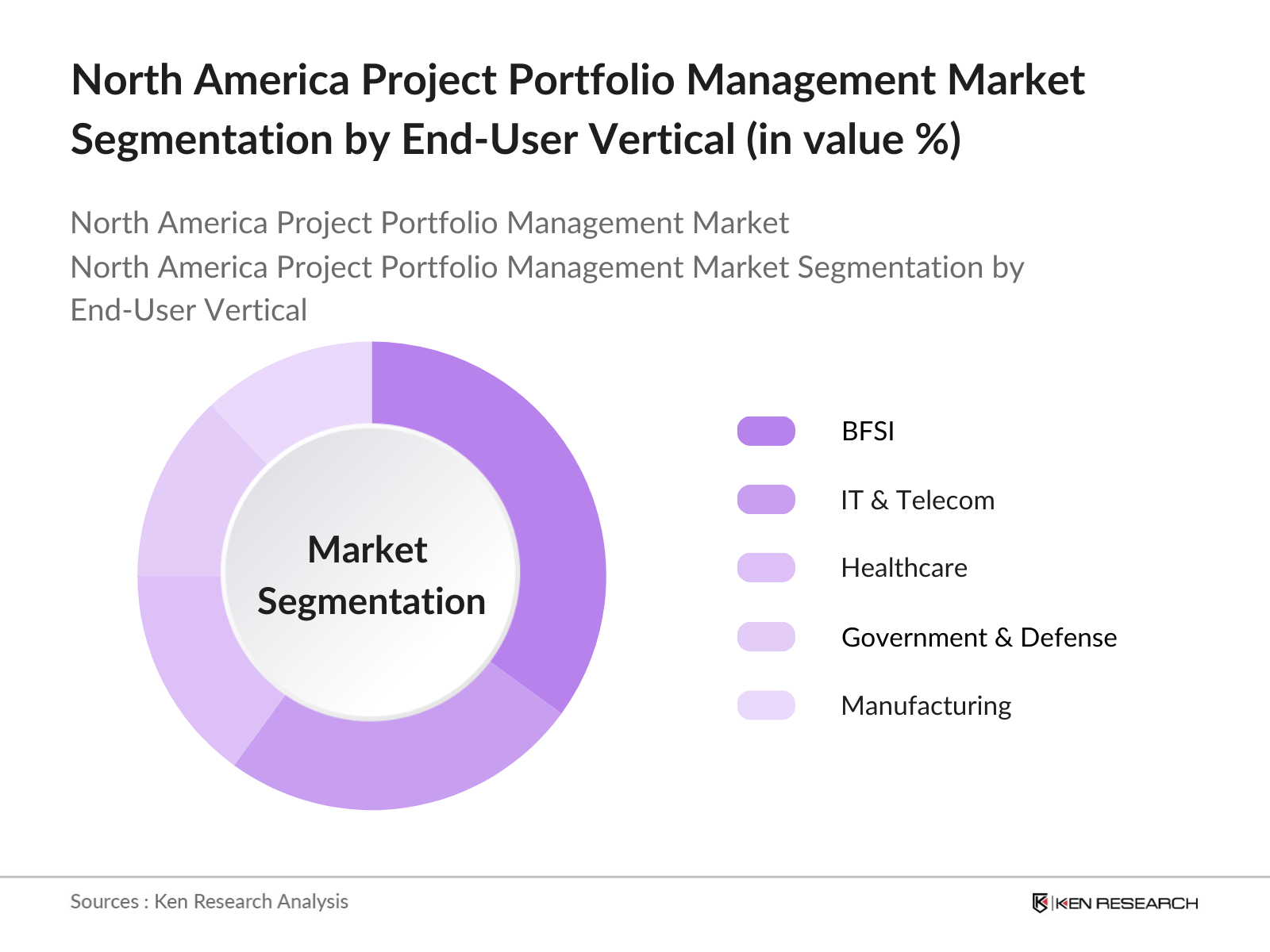

- By End-User Vertical: North Americas PPM market segmentation by vertical includes IT & Telecommunications, BFSI, Healthcare, Government & Defense, and Manufacturing. The BFSI sector currently leads in market share due to the complexity of banking operations and the increasing need to manage large portfolios effectively. The sectors adoption of PPM solutions stems from the requirement for high data security and streamlined processes to handle complex transactions.

North America Project Portfolio Management Market Competitive Landscape

The North America PPM market is characterized by several key players who hold market influence. These companies focus on continuous innovation, strategic partnerships, and enhancing product capabilities to maintain their competitive edge.

North America Project Portfolio Management (PPM) Market Analysis

North America Project Portfolio Management Market Growth Drivers

- Rise in Remote and Hybrid Work Culture: The hybrid and remote work models have impacted North American work culture. As of 2024, about 14% of employees work fully remote, while another 29% follow a hybrid schedule. This change has led to increased demand for remote project management tools that support dispersed teams effectively. The shift is not only providing employees with flexibility but is also noted for boosting productivity by saving commuting timeestimated to improve productivity by roughly 8 hours per week on average for remote workers, who avoid traditional commute constraints.

- Demand for Enhanced Resource Optimization: With project demands rising across industries, optimizing resources efficiently has become critical. In North America, industries like technology and financial services are leading in adopting resource management tools as they navigate high project loads and constrained staffing. This increased emphasis on maximizing team output aligns with recent World Bank reports indicating that productivity in high-skill roles is vital for sustaining economic growth. PPM solutions are thus sought for automating and fine-tuning resource allocation across complex, multi-layered projects to boost operational effectiveness.

- Integration of AI in PPM Solutions: AI integration in PPM systems has accelerated, especially as organizations aim to enhance decision-making and streamline project workflows. About 80% of large firms in North America are leveraging AI-driven tools for predictive analytics, helping project managers mitigate risks proactively by analyzing patterns in real-time data. Such advanced capabilities align with macroeconomic goals for heightened productivity, as AI-powered automation is predicted to contribute billions in added output value by optimizing time-intensive tasks in project management.

North America Project Portfolio Management Market Challenges

- Data Security and Compliance: With increased remote work and data flows, compliance with data protection regulations such as GDPR and CCPA has grown complex and challenging. Nearly 85% of North American companies report stringent measures in place to meet compliance requirements, which is costly and requires advanced security features. The regulatory burden is high, impacting both SMEs and larger enterprises that handle sensitive project data across borders.

- High Initial Investment Costs for On-Premise Solutions: Despite the advantages, on-premise PPM solutions require substantial upfront investment, making it challenging for smaller businesses. North Americas tech expenditure analysis indicates that medium-sized enterprises spend an average of USD 150,000 to USD 200,000 annually on infrastructure alone, impacting smaller firms budgets substantially. This high entry cost often deters SMEs from adopting such solutions, pushing them toward cloud-based alternatives instead.

North America Project Portfolio Management Market Future Outlook

The North American PPM market is poised for steady growth, supported by the increasing integration of AI and cloud-based solutions in PPM tools. Rising demand from small and medium-sized enterprises for affordable and flexible project management tools is expected to drive market growth. Additionally, with remote and hybrid work models now firmly established across various industries, the demand for scalable, collaborative PPM solutions is likely to expand further.

North America Project Portfolio Management Market Opportunities

- Growing Popularity of Cloud-Based and SaaS PPM Solutions: The demand for flexible, cost-effective solutions has driven interest in cloud-based PPM tools. Currently, about 70% of North American organizations utilize SaaS-based project management tools, appreciating their adaptability and lower capital expenditure. This shift aligns with trends indicating increased investments in cloud infrastructure, reflecting a broader preference for scalable, cost-effective technology in managing complex projects.

- Demand from SMEs for Cost-Effective PPM Tools: Small and medium-sized enterprises (SMEs) are increasingly adopting affordable PPM solutions to streamline their project processes. North America houses over 20 million SMEs, and a substantial portion of these firms are looking for solutions that do not require high initial investments, which has spurred demand for adaptable, pay-per-use PPM models. This trend in flexible solution adoption supports the current economic climate, favoring operational cost efficiency for smaller businesses.

Scope of the Report

|

Deployment Type |

Cloud On-Premise |

|

Component |

Solutions Services |

|

Organization Size |

Large Enterprises Small & Medium Enterprises (SMEs) |

|

End-User Verticals |

IT & Telecom BFSI Healthcare Government & Defense Manufacturing |

|

Region |

United States Canada |

Products

Key Target Audience

IT and Technology Decision Makers

Project Management Offices (PMOs)

Investor and Venture Capitalist Firms

Banks and Financial Institutions

Compliance and Regulatory Authorities (e.g., CCPA, GDPR bodies)

Government and Regulatory Bodies (e.g., Federal Trade Commission, Data Protection Authorities)

Large Enterprises (Operational Heads, Chief Technology Officers)

Financial Institutions (Banking Operations Heads, Risk Management)

Healthcare Organizations (Healthcare Project Managers, Data Privacy Heads)

Companies

Players Mentioned in the Report

Microsoft Corporation

Oracle Corporation

SAP SE

Broadcom Inc.

Planview Inc.

Hewlett Packard Enterprise Development LP

Adobe Inc. (Workfront)

Atlassian Corporation Plc

ServiceNow Inc.

Asana Inc.

Table of Contents

1. North America Project Portfolio Management (PPM) Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Key Market Characteristics (e.g., High Adoption of Cloud PPM Solutions)

1.4 Market Segmentation Overview

2. North America Project Portfolio Management (PPM) Market Size (in USD Billion)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Major Market Developments (e.g., Expansion in IT and BFSI Sectors)

3. North America Project Portfolio Management (PPM) Market Dynamics

3.1 Growth Drivers

3.1.1 Rise in Remote and Hybrid Work Culture (Remote Project Management)

3.1.2 Demand for Enhanced Resource Optimization

3.1.3 Integration of AI in PPM Solutions

3.1.4 Increasing Investments in IT and Cloud Infrastructure

3.2 Market Challenges

3.2.1 Data Security and Compliance (GDPR, CCPA)

3.2.2 High Initial Investment Costs for On-Premise Solutions

3.2.3 Complexity in Implementing Multi-Level PPM Solutions

3.3 Opportunities

3.3.1 Growing Popularity of Cloud-Based and SaaS PPM Solutions

3.3.2 Demand from SMEs for Cost-Effective PPM Tools

3.3.3 Expansion of PPM Applications in Non-Traditional Sectors (e.g., Healthcare)

3.4 Trends

3.4.1 Increased Adoption of Agile Project Management

3.4.2 Integration with BI and Analytics Tools

3.4.3 Rise in Demand for Real-Time Data-Driven PPM

3.5 Regulatory Environment

3.5.1 Data Privacy Regulations (GDPR, HIPAA Compliance)

3.5.2 Industry-Specific Compliance Standards (e.g., ISO Certifications)

3.5.3 Emerging Digital Governance Standards

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.8.1 Bargaining Power of Suppliers

3.8.2 Bargaining Power of Buyers

3.8.3 Threat of New Entrants

3.8.4 Threat of Substitutes

3.8.5 Competitive Rivalry in the PPM Market

3.9 Competitive Landscape Overview

4. North America Project Portfolio Management (PPM) Market Segmentation

4.1 By Deployment Type (in Value %)

4.1.1 Cloud

4.1.2 On-Premise

4.2 By Component (in Value %)

4.2.1 Solutions

4.2.2 Services

4.3 By Organization Size (in Value %)

4.3.1 Large Enterprises

4.3.2 Small and Medium Enterprises (SMEs)

4.4 By End-User Verticals (in Value %)

4.4.1 IT & Telecommunications

4.4.2 BFSI (Largest Market Share)

4.4.3 Healthcare (Fastest Growing Segment)

4.4.4 Government & Defense

4.4.5 Manufacturing

4.4.6 Consumer Goods & Retail

4.5 By Region (in Value %)

4.5.1 United States

4.5.2 Canada

5. North America Project Portfolio Management (PPM) Market Competitive Analysis

5.1 Detailed Profiles of Key Competitors

5.1.1 Microsoft Corporation

5.1.2 Oracle Corporation

5.1.3 Broadcom Inc.

5.1.4 Hewlett Packard Enterprise

5.1.5 SAP SE

5.1.6 Adobe (Workfront)

5.1.7 Planview, Inc.

5.1.8 Atlassian Corporation

5.1.9 Smartsheet Inc.

5.1.10 ServiceNow Inc.

5.1.11 Asana Inc.

5.1.12 Wrike (Citrix)

5.1.13 Monday.com Ltd.

5.1.14 Workday Inc.

5.1.15 Upland Software Inc.

5.2 Cross-Comparison Parameters (Revenue, Headquarters, Market Share, Technology Adoption, Product Innovation, Cloud Integration, Security Compliance, Employee Count)

5.3 Market Share Analysis

5.4 Strategic Initiatives and Alliances

5.5 Mergers and Acquisitions

5.6 Investment and Funding Analysis

5.7 Private Equity and Venture Capital Investments

5.8 Government Grants and Support for PPM Innovation

6. North America Project Portfolio Management (PPM) Market Regulatory Framework

6.1 Data Privacy Laws (GDPR, CCPA Compliance)

6.2 Certification and Compliance Standards (ISO, HIPAA, SOC 2)

6.3 Industry-Specific Regulatory Requirements

6.4 Key Compliance Challenges and Solutions

7. Future Market Projections

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

7.3 Technological Innovations Shaping Future Demand

8. North America Project Portfolio Management (PPM) Market Analysts Recommendations

8.1 TAM/SAM/SOM Analysis

8.2 Customer Segmentation and Demand Mapping

8.3 White Space Opportunities

8.4 Strategic Initiatives for Market Penetration

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial stage involves mapping all stakeholders within the North America PPM ecosystem. This includes gathering insights from secondary and proprietary sources to identify variables impacting PPM demand and adoption rates.

Step 2: Market Analysis and Construction

This phase includes a comprehensive analysis of historical data related to PPM adoption, service quality, and revenue generation. We assess market trends and service performance metrics to construct accurate estimates of current market sizes.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated via computer-assisted interviews with industry experts and stakeholders. These insights provide a practical perspective on market growth, service needs, and technology adoption patterns.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing data from various sources, supplemented by expert interviews, to create a comprehensive, accurate, and validated analysis of the North American PPM market.

Frequently Asked Questions

01. How big is the North America Project Portfolio Management market?

The North America PPM market is valued at USD 4.7 billion, driven by the growing adoption of digital project management solutions and a robust technology infrastructure.

02. What are the key growth drivers in the North America PPM market?

Key drivers include the rising need for resource optimization, the integration of cloud and AI technologies in project management, and the shift to remote and hybrid work environments.

03. Who are the major players in the North America PPM market?

Major players include Microsoft Corporation, Oracle Corporation, SAP SE, Broadcom Inc., and Planview Inc., each contributing to market innovation and technology adoption.

04. Which segments dominate the North America PPM market?

Cloud deployment and the BFSI vertical currently dominate, with BFSI sectors leveraging PPM for complex portfolio management needs.

-

What challenges are present in the North America PPM market?

Challenges include data security and regulatory compliance, as well as high initial costs for on-premise solutions, which limit accessibility for smaller firms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.