North America Propolis Market Outlook to 2030

Region:North America

Author(s):Paribhasha Tiwari

Product Code:KROD4029

December 2024

93

About the Report

North America Propolis Market Overview

- The North America Propolis market is valued at USD 253 million, driven by the increasing use of propolis in health and wellness products. This growth is fueled by a rising consumer preference for natural and organic supplements, pharmaceuticals, and cosmetics. Propolis, known for its antimicrobial and anti-inflammatory properties, is increasingly popular among health-conscious consumers. The demand for propolis in natural skincare and alternative medicine has contributed to steady growth, making it a key player in the North American market.

- The United States and Canada dominate the North American Propolis market. The United States leads due to its well-established pharmaceutical industry and consumer awareness about natural health products. Canada follows closely, driven by its strong health and wellness culture. Both countries benefit from high consumer spending on premium health products, which propels the demand for propolis across various applications, including pharmaceuticals and cosmetics.

- In 2024, the U.S. Department of Agriculture (USDA) allocated over $200 million towards initiatives aimed at supporting beekeepers and improving pollinator health. This government support is essential for ensuring the sustainability of propolis production, as bee populations are directly responsible for its availability. The USDA's efforts include grants for bee habitat restoration and research on reducing pesticide impacts, which aim to stabilize the supply chain for propolis manufacturers.

North America Propolis Market Segmentation

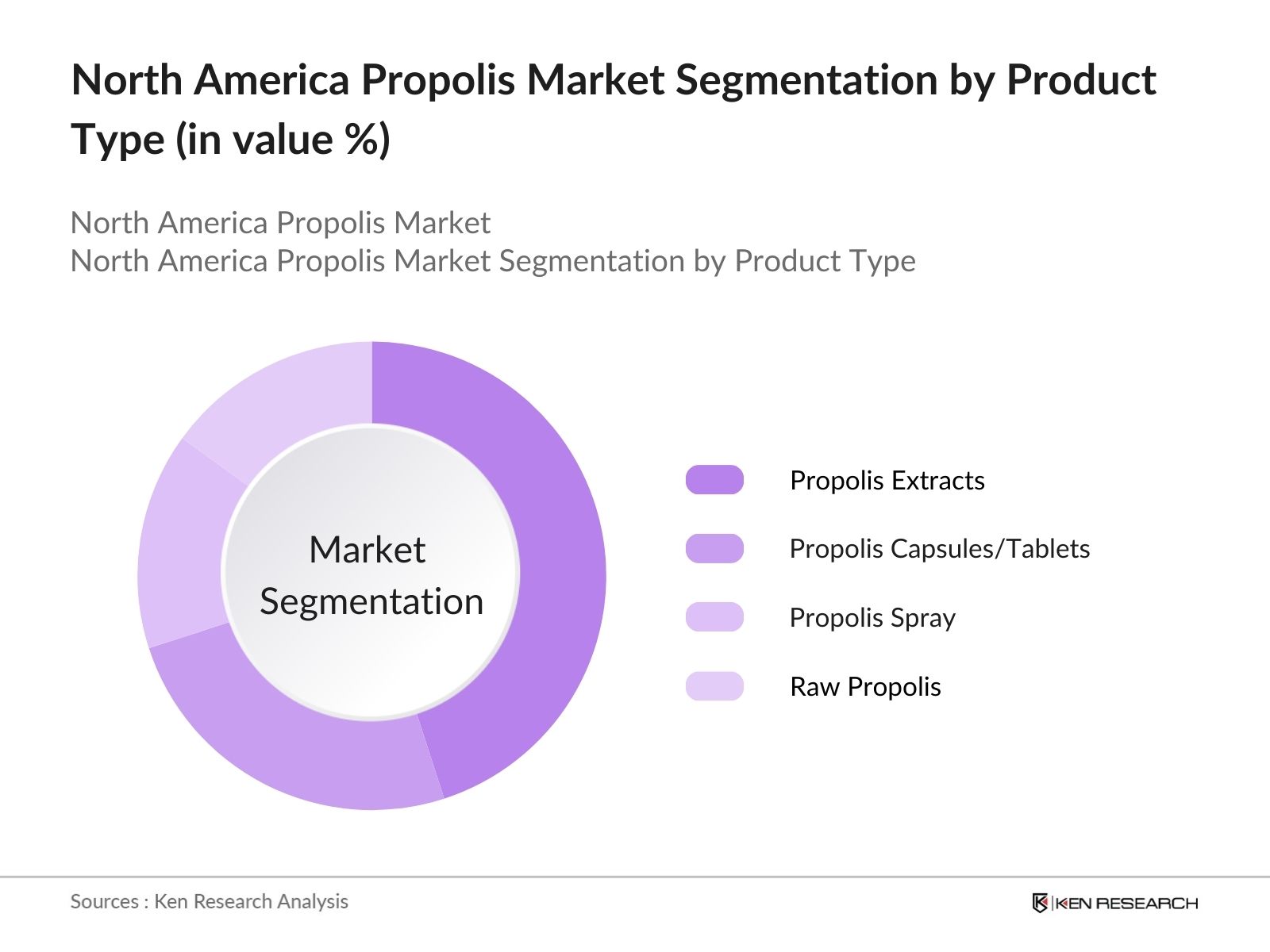

By Product Type: The North America Propolis market is segmented by product type into raw propolis, propolis extracts, propolis capsules/tablets, and propolis spray. Propolis extracts hold the dominant market share, mainly due to their high concentration of bioactive compounds, which make them more effective for therapeutic purposes. Extracts are widely used in pharmaceuticals and supplements, particularly for their immune-boosting properties. The increased demand for propolis extracts in dietary supplements has positioned this segment as the market leader.

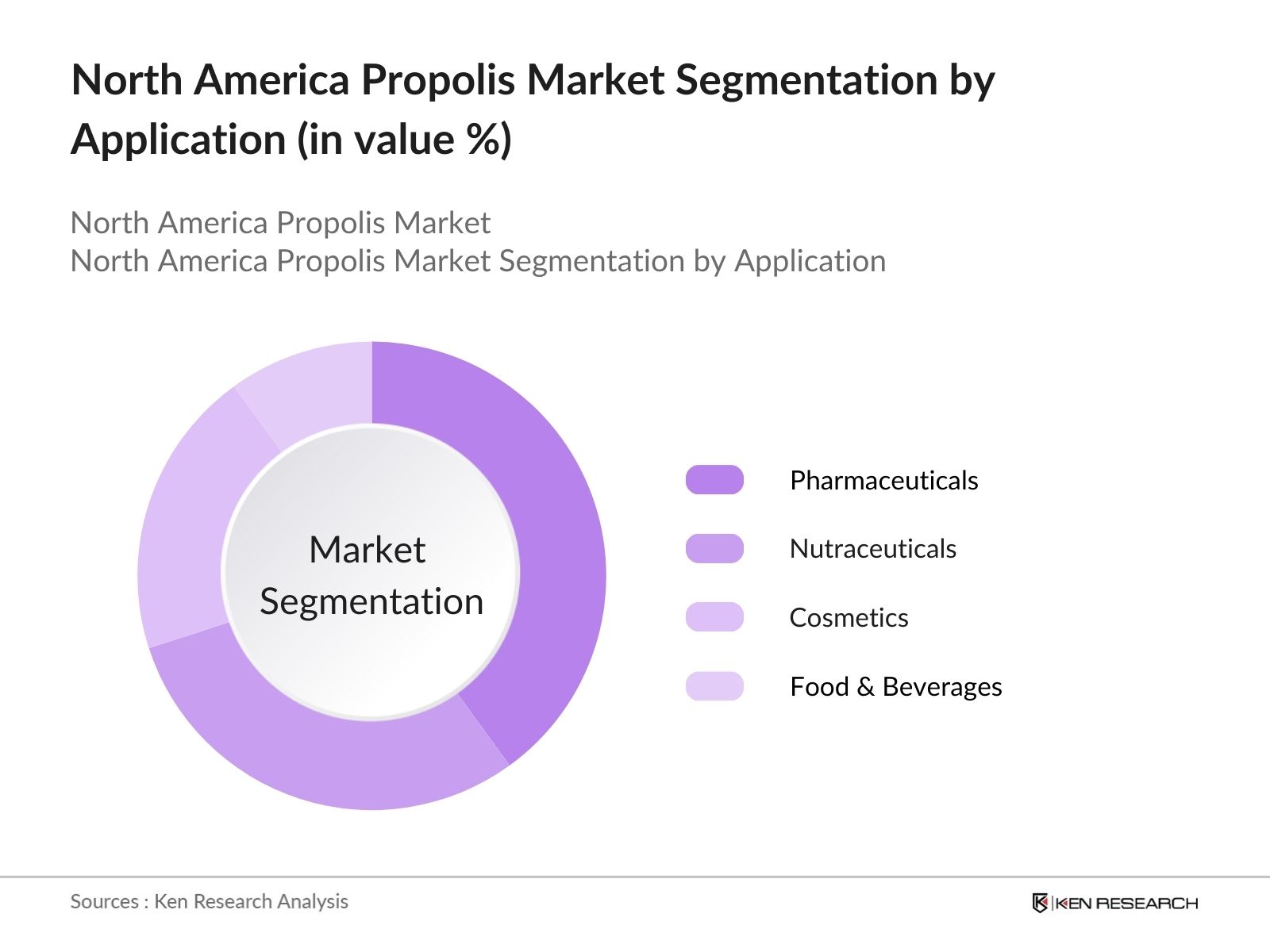

By Application: The North America Propolis market is segmented by application into pharmaceuticals, nutraceuticals, cosmetics, and food and beverages. Pharmaceuticals hold the dominant market share due to propolis medicinal properties, which include antimicrobial, antiviral, and anti-inflammatory effects. The pharmaceutical industry extensively uses propolis in cold and flu remedies, wound healing products, and immune support supplements. This dominance is driven by the growing consumer preference for natural and effective health products over synthetic alternatives.

North America Propolis Market Competitive Landscape

The North America Propolis market is characterized by intense competition among key players, including a mix of established companies and emerging brands. The market is consolidated, with a few leading players holding a significant share due to their strong distribution networks, high-quality products, and strategic marketing initiatives. Companies like NaturaNectar, Comvita, and Bee Health have a substantial presence due to their focus on research and development, product innovation, and commitment to sustainability. The competition is also shaped by increasing consumer demand for organic and sustainably sourced propolis.

|

Company Name |

Established Year |

Headquarters |

Product Range |

Sustainability Initiatives |

Innovation Focus |

Distribution Network |

R&D Investment (%) |

Market Presence |

|

NaturaNectar |

2011 |

United States |

- | - | - | - | - | - |

|

Comvita |

1974 |

New Zealand |

- | - | - | - | - | - |

|

Bee Health |

1992 |

United Kingdom |

- | - | - | - | - | - |

|

Herb Pharm |

1979 |

United States |

- | - | - | - | - | - |

|

Y.S. Eco Bee Farms |

1985 |

United States |

- | - | - | - | - | - |

North America Propolis Market Analysis

Growth Drivers

- Increasing Demand for Natural Ingredients: Consumers in North America are increasingly shifting towards natural products, driven by concerns over synthetic ingredients and their impact on health. This trend is evident in the rising demand for propolis, a natural bee-derived substance. The U.S. health supplements market, which prominently features natural ingredients like propolis, is projected to see substantial demand, supported by a 2024 per capita healthcare expenditure of $13,900. This growth reflects the increasing consumer preference for chemical-free, natural solutions in wellness products, especially in the U.S. and Canada.

- Rise in Health and Wellness Trends: Health-conscious behavior is expanding across North America, where there is a robust focus on preventative healthcare. In 2024, the North American healthcare sector is expected to receive $4.1 trillion in healthcare funding, which is influencing consumers' preference for functional products like propolis. Propolis is valued for its antimicrobial and anti-inflammatory properties, contributing to its incorporation into various health products as consumers prioritize natural remedies that align with overall wellness trends.

- Expanding Use in Pharmaceuticals: The pharmaceutical industry in North America has started integrating propolis into formulations due to its antioxidant, antibacterial, and healing properties. Propolis is increasingly used in treatments for conditions like ulcers, burns, and infections, given its natural healing capabilities. The growing adoption of natural ingredients in pharmaceuticals further boosts the demand for high-quality propolis across the region.

Market Challenges

- Fluctuations in Raw Material Availability (Bee Production Variability): Propolis production is directly linked to bee populations, which have faced fluctuations due to factors such as climate change and pesticide use. In North America, bee populations have seen a decline of 44% over recent years. This variability significantly affects the availability of raw propolis, creating supply chain challenges for manufacturers. The dependence on a steady supply from bees means that changes in environmental conditions could lead to shortages, hindering the industry's growth potential.

- Lack of Standardization in Propolis Products (Product Quality): One major challenge in the North American propolis market is the lack of standardization across products, which can lead to inconsistencies in quality and potency. In 2024, regulatory frameworks in the U.S. and Canada still lack uniform guidelines for the certification and quality control of propolis products. This makes it difficult for consumers to trust the authenticity of products, potentially limiting market expansion until stricter regulatory standards are adopted to ensure consistent product quality.

North America Propolis Market Future Outlook

Over the next five years, the North America Propolis market is expected to witness substantial growth, driven by the expanding consumer preference for natural health products and the rise in the demand for propolis in pharmaceutical and nutraceutical applications. Increasing research on the health benefits of propolis, particularly in boosting immunity and improving skin health, will further propel market growth.

Market Opportunities

- Innovation in Propolis Extraction Technologies (Extraction Efficiency): Advances in extraction technologies are enhancing the efficiency of propolis production in North America. New methods, such as supercritical CO2 extraction, are gaining traction due to their ability to preserve the bioactive compounds in propolis without using harmful solvents. As a result, the production process has become more sustainable, aligning with the regions push towards green technology, with over $200 billion allocated to sustainability innovation in 2024. This presents an opportunity for manufacturers to scale up production while reducing costs.

- Rising Trend of Clean Label Products (Clean Label Demand): The demand for clean label products is on the rise in North America, where consumers increasingly prioritize transparency in ingredients and sourcing. In 2024, 65% of U.S. consumers reported a preference for clean label products that are natural, non-GMO, and free of artificial additives. This shift presents a significant opportunity for propolis manufacturers to capitalize on the clean label trend by marketing their products as natural and sustainably sourced, which aligns with consumer expectations.

Scope of the Report

|

By Product Type |

Raw Propolis Propolis Extract Propolis Capsules/Tablets Propolis Spray |

|

By Application |

Pharmaceuticals Nutraceuticals Cosmetics Food and Beverages |

|

By Form |

Powder Liquid Capsules Paste |

|

By Distribution Channel |

Online Retail Specialty Stores Supermarkets and Hypermarkets Pharmacies |

|

By Country |

United States Canada Mexico |

Products

Key Target Audience

Pharmaceutical Manufacturers

Nutraceutical Companies

Cosmetics and Skincare Brands

Health and Wellness Retailers

Online Health Product Retailers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, Health Canada)

Natural Product Manufacturers

Companies

Players Mentioned in the Report:

NaturaNectar

Comvita

Bee Health

Herb Pharm

Y.S. Eco Bee Farms

NOW Foods

Manuka Health

Apis Flora

Propolis Gold

Green Health

Table of Contents

1. North America Propolis Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Propolis Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Propolis Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Natural Ingredients (Consumer Preference)

3.1.2. Rise in Health and Wellness Trends (Health Consciousness)

3.1.3. Expanding Use in Pharmaceuticals (Pharmaceutical Applications)

3.1.4. Growing Demand in Cosmetics and Skincare (Cosmetics Industry)

3.2. Market Challenges

3.2.1. Fluctuations in Raw Material Availability (Bee Production Variability)

3.2.2. Lack of Standardization in Propolis Products (Product Quality)

3.2.3. High Costs of Quality Propolis (Price Sensitivity)

3.3. Opportunities

3.3.1. Innovation in Propolis Extraction Technologies (Extraction Efficiency)

3.3.2. Rising Trend of Clean Label Products (Clean Label Demand)

3.3.3. Growth in E-commerce Channels for Health Products (Online Retail)

3.4. Trends

3.4.1. Increasing Usage in Dietary Supplements (Dietary Supplementation)

3.4.2. Development of Organic Propolis Products (Organic Segment Growth)

3.4.3. Incorporation in Functional Foods and Beverages (Functional Foods)

3.5. Government Regulation

3.5.1. FDA and Health Canada Regulations (Product Compliance)

3.5.2. Import-Export Policies for Propolis (Trade Policies)

3.5.3. Labeling Standards (Product Labeling)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. North America Propolis Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Raw Propolis

4.1.2. Propolis Extract

4.1.3. Propolis Capsules/Tablets

4.1.4. Propolis Spray

4.2. By Application (In Value %)

4.2.1. Pharmaceuticals

4.2.2. Nutraceuticals

4.2.3. Cosmetics

4.2.4. Food and Beverages

4.3. By Form (In Value %)

4.3.1. Powder

4.3.2. Liquid

4.3.3. Capsules

4.3.4. Paste

4.4. By Distribution Channel (In Value %)

4.4.1. Online Retail

4.4.2. Specialty Stores

4.4.3. Supermarkets and Hypermarkets

4.4.4. Pharmacies

4.5. By Country (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Propolis Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. NaturaNectar

5.1.2. Apis Flora

5.1.3. Bee Health

5.1.4. Herb Pharm

5.1.5. Y.S. Eco Bee Farms

5.1.6. NOW Foods

5.1.7. Comvita

5.1.8. Natures Way

5.1.9. Manuka Health

5.1.10. Apitherapy

5.1.11. Green Health

5.1.12. Uniflora

5.1.13. Propolis Gold

5.1.14. BeeVital

5.1.15. NutriGold

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, Key Strategies, R&D Investment, Market Presence, Sustainability Initiatives, Pricing Strategy, Innovation Focus)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

6. North America Propolis Market Regulatory Framework

6.1. Health and Safety Regulations (Food and Drug Laws)

6.2. Propolis Standards and Certifications (Organic Certification)

6.3. Import and Export Regulations (International Trade Compliance)

7. North America Propolis Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Propolis Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Form (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Country (In Value %)

9. North America Propolis Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Market Penetration Strategies

9.3. Marketing and Branding Recommendations

9.4. White Space Opportunity Identification

Research Methodology

Step 1: Identification of Key Variables

The first step involves developing an ecosystem map to outline all key stakeholders in the North America Propolis market. Secondary research, supported by proprietary databases, is used to gather comprehensive market data, including trends, demand drivers, and market challenges. The goal is to identify the critical variables influencing the market.

Step 2: Market Analysis and Construction

In this phase, historical data is analyzed to track market performance. This involves understanding market penetration, sales growth of propolis-based products, and the relationship between distribution channels and end consumers. This data helps ensure accuracy in market size estimations and forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions and hypotheses are tested through consultations with industry experts and key decision-makers from major companies. These interviews provide valuable operational insights and help refine our analysis.

Step 4: Research Synthesis and Final Output

The final stage includes synthesizing data from direct market interactions, including interviews with manufacturers, to validate the bottom-up approach. This process ensures that the market analysis is comprehensive and accurate, resulting in a final report that provides a detailed and validated view of the North America Propolis market.

Frequently Asked Questions

1. How big is the North America Propolis Market?

The North America Propolis market is valued at USD 253 million, driven by the growing demand for natural health and wellness products, particularly in the pharmaceutical and cosmetic industries.

2. What are the challenges in the North America Propolis Market?

Challenges in the North America Propolis market include the fluctuating availability of raw materials, lack of product standardization, and the high costs associated with premium propolis products.

3. Who are the major players in the North America Propolis Market?

Key players in the North America Propolis market include NaturaNectar, Comvita, Bee Health, Herb Pharm, and Y.S. Eco Bee Farms. These companies dominate due to their strong distribution networks, product innovation, and focus on sustainability.

4. What are the growth drivers of the North America Propolis Market?

The North America Propolis market is driven by the increasing consumer preference for natural health products, the rise of propolis in pharmaceutical applications, and expanding use in cosmetics and nutraceuticals.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.