North America Prothrombin Complex Concentrate Market Outlook to 2030

Region:North America

Author(s):Naman Rohilla

Product Code:KROD9136

December 2024

98

About the Report

North America Prothrombin Complex Concentrate Market Overview

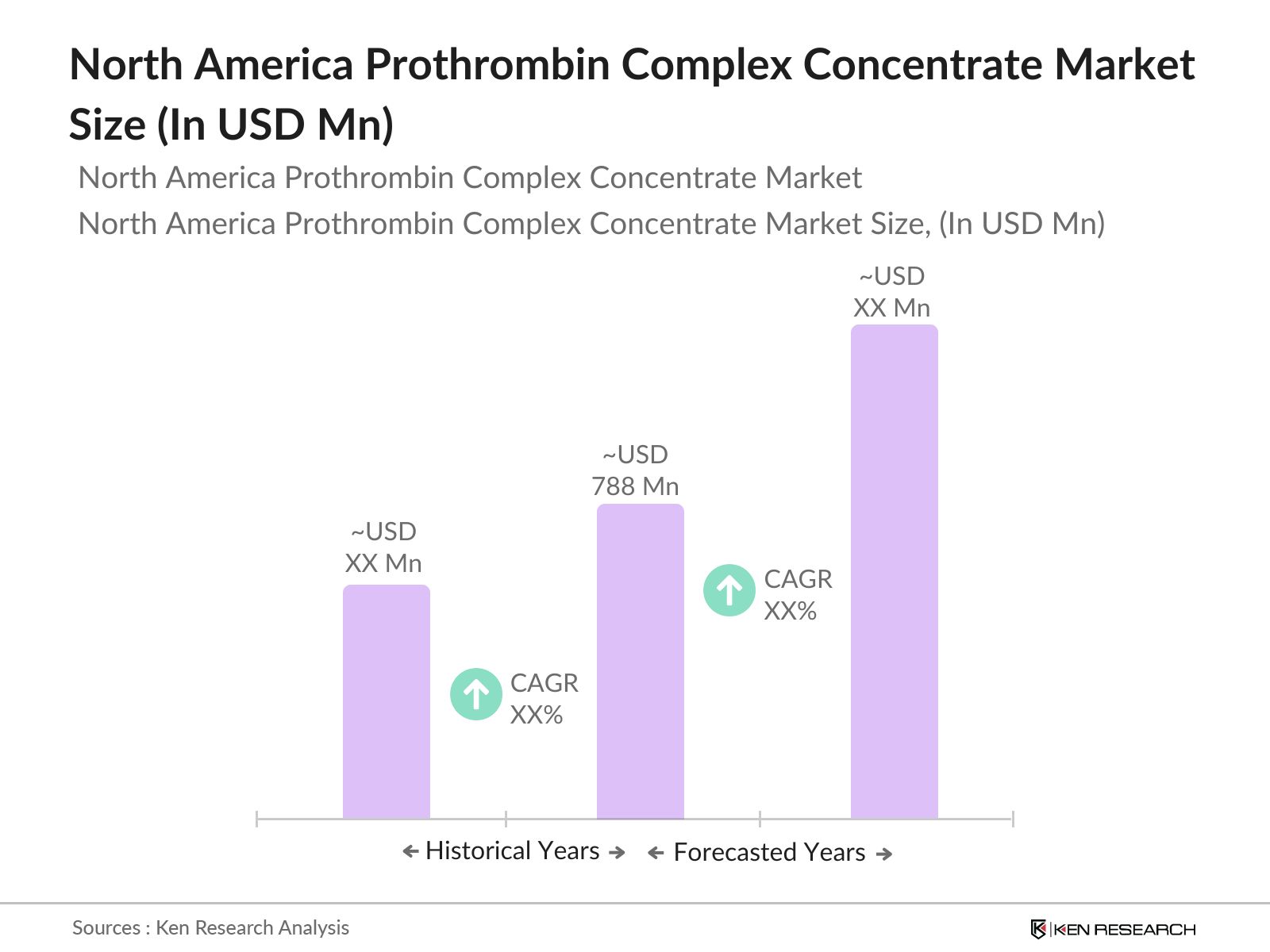

- The North America Prothrombin Complex Concentrate (PCC) market is valued at USD 788 million, based on a historical analysis. This valuation is underpinned by the increasing demand in treatments for haemophilia and urgent warfarin reversal, as PCCs have proven effective in rapid blood coagulation, a necessity for life-saving treatments. The market growth is further supported by government health programs aimed at improving access to such treatments and advancing blood coagulation therapies, which remain critical in trauma and surgical care. This growth trajectory demonstrates a robust infrastructure and healthcare investments across North America, enhancing PCC adoption and accessibility.

- The United States is the dominant market for Prothrombin Complex Concentrate in North America due to its advanced healthcare system, well-established distribution networks, and substantial investments in hematological research and biotechnology. Cities with high-density healthcare infrastructure, such as New York, Los Angeles, and Chicago, show a high concentration of healthcare facilities that utilize PCCs extensively for emergency and surgical treatments. Canada also contributes to market strength, particularly through government-backed healthcare programs that support PCC access and use, making it the second-largest contributor to market demand in the region.

- North American PCC manufacturers must comply with stringent FDA and EMA guidelines to ensure product safety and efficacy. In 2023, regulatory compliance costs for PCC manufacturers averaged $45 million annually, as they adhere to rigorous standards for blood-derived products. These guidelines safeguard patient health and align with North Americas regulatory framework for safe, high-quality therapeutic products.

North America Prothrombin Complex Concentrate Market Segmentation

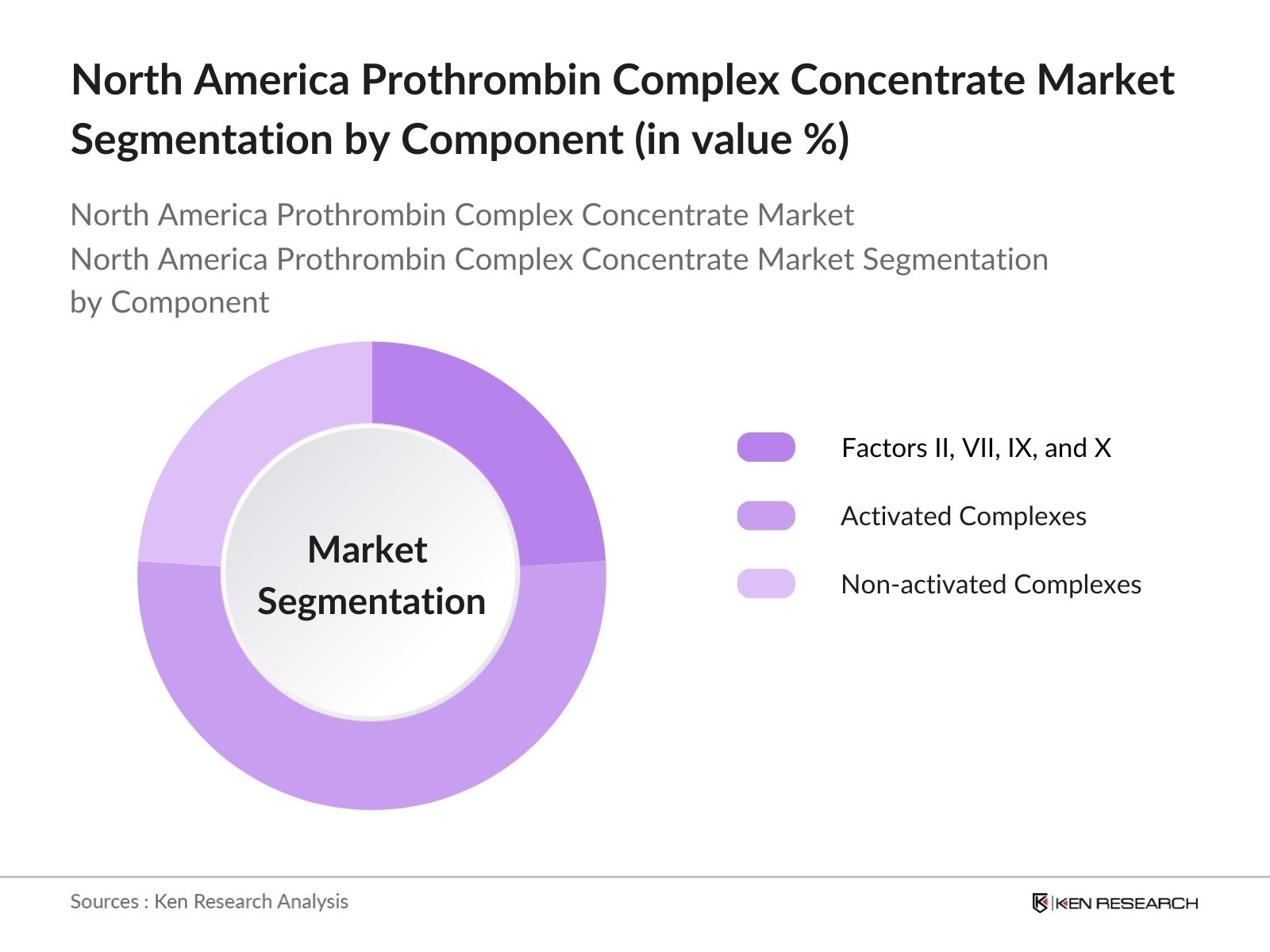

- By Component: The North America Prothrombin Complex Concentrate market is segmented by component into Factors II, VII, IX, and X, Activated Complexes, and Non-activated Complexes. Activated Complexes hold a dominant share within this segment. Activated complexes are highly preferred in acute medical settings due to their rapid action in reversing anticoagulation in life-threatening bleeding episodes. All necessary clotting factors in activated form support their wide application in urgent treatments, such as warfarin reversal and trauma care. This demand is compounded by the continuous improvements in manufacturing standards and healthcare provider familiarity with using these complex therapies for efficient results.

- By End-User: The market is segmented by end-users into Hospitals, Specialty Clinics, and Homecare. Hospitals represent the largest market share in this category, given their critical role in providing emergency and surgical care. The extensive use of PCCs in hospital emergency departments for acute cases requiring rapid coagulation support underscores their dominance. Hospitals in North America have invested in hematology and coagulation departments, where PCCs play a crucial role in patient outcomes, especially in urban healthcare centers. Furthermore, hospitals have streamlined procurement channels that ensure uninterrupted PCC availability, further solidifying their demand.

North America Prothrombin Complex Concentrate Market Competitive Landscape

The North America Prothrombin Complex Concentrate market is characterized by a strong presence of both global and local players, contributing to a competitive landscape with a high level of research and development activity, partnerships, and strategic expansions. Major industry players focus on clinical efficacy and innovation, reinforcing market consolidation.

North America Prothrombin Complex Concentrate Market Analysis

Market Growth Drivers

- Rising Demand in Haemophilia Treatment: The demand for prothrombin complex concentrate (PCC) in haemophilia treatment is bolstered by the increasing prevalence of haemophilia in North America. In the U.S., the CDC estimates over 20,000 individuals live with haemophilia A and B. PCCs play a critical role in providing a safer alternative to blood transfusions, reducing the risk of complications in coagulation therapies. The FDA has approved PCC for urgent treatments, aligning with growing medical needs. Public health investments to manage haemophilia treatments in 2023 reached $1.2 billion, underscoring the financial support behind PCC applications in haemophilia.

- Increasing Adoption in Warfarin Reversal: PCC has become the preferred solution in emergency warfarin reversal cases, a key growth driver given the widespread use of anticoagulants. In 2023, over 1.8 million individuals in the U.S. were prescribed warfarin, creating a substantial market for PCC. PCCs provide rapid coagulation, reducing hospital recovery times. FDA approvals for PCC applications in anticoagulation reversal reflect increased healthcare focus on safe, efficient therapies, spurred by over $450 million allocated to blood-related therapies by U.S. healthcare agencies in 2023.

- Technological Advancements in Blood Coagulation Therapies: Technological advancements in coagulation therapy have increased PCCs efficacy and application, with cutting-edge formulations offering faster action and stability. Since 2022, development in recombinant coagulation technology has seen funding of nearly $700 million across North America, particularly in the U.S. and Canada, focusing on recombinant and plasma-derived PCCs. These advancements are poised to improve treatment outcomes, especially in emergency settings, enhancing patient safety and clinical effectiveness.

Market Challenges

- High Production Costs: PCC production involves complex manufacturing processes that elevate costs, impacting affordability and access. In 2023, manufacturing costs for recombinant blood products like PCC in North America averaged 2.5 times higher than standard blood products due to rigorous quality control and purification processes. These high costs challenge widespread adoption, as healthcare providers must balance affordability with efficacy.

- Regulatory Hurdles: Strict regulatory standards for blood-derived products require PCC manufacturers to meet stringent quality and safety standards, affecting market entry. Compliance with FDA and Health Canada regulations in 2023 required an average of $45 million in annual investments for regulatory adherence by North American producers. These high compliance costs, necessary for ensuring product safety, limit market flexibility and extend the time needed for product approval.

North America Prothrombin Complex Concentrate Market Future Outlook

Over the next few years, the North America Prothrombin Complex Concentrate market is expected to witness continuous growth driven by enhanced demand in acute medical treatments, the introduction of innovative coagulation therapies, and sustained investments in healthcare infrastructure. The expansion of biotechnology capabilities and an increased focus on emergency response medical supplies will continue to boost this markets development, with a specific emphasis on streamlined PCC production and distribution channels.

Market Opportunities

- Expansion in Telemedicine: Telemedicine's growth in North America facilitates broader PCC treatment access in remote areas, addressing geographical constraints. Telemedicine services expanded by 27% in 2023, supporting rural and underserved patients who may benefit from PCC-based therapies in emergency bleeding disorders. The U.S. Telehealth Market, valued at over $50 billion in 2023, has increasingly enabled patients to consult hematologists remotely, streamlining access to PCC treatments where immediate healthcare infrastructure is limited.

- Growing Investments in Biotechnology: Investments in biotechnology across North America are boosting PCC R&D, driving innovations and applications in bleeding disorder treatments. In 2023, North American biotech firms invested around $8.3 billion into blood product research, focusing on advanced PCC formulations with broader therapeutic applications. This investment provides an opportunity for breakthrough developments, improving PCC efficacy, reducing side effects, and expanding treatment use cases

Scope of the Report

|

By Component |

Factors II, VII, IX, and X Activated Complexes Non-activated Complexes |

|

By Application |

Haemophilia Treatment Vitamin K Deficiency Warfarin Reversal |

|

By End-User |

Hospitals Specialty Clinics Homecare |

|

By Distribution Channel |

Hospital Pharmacies Retail Pharmacies Online Channels |

|

By Geography |

United States Canada Mexico |

Products

Key Target Audience

Hematology Clinics and Hospitals

Specialty Care Clinics

Pharmaceutical and Biotech Companies

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, Health Canada)

Research and Development Institutions

Emergency Medical Response Units

Healthcare Product Distributors

Companies

Players Mentioned in the Report

Grifols S.A.

CSL Behring LLC

Octapharma AG

Baxter International Inc.

Kedrion Biopharma Inc.

Sanquin Blood Supply Foundation

Shire Pharmaceuticals (Takeda)

China Biologic Products Holdings, Inc.

Emergent BioSolutions

LFB S.A.

Table of Contents

1. North America Prothrombin Complex Concentrate Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. North America Prothrombin Complex Concentrate Market Size (In USD)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Prothrombin Complex Concentrate Market Analysis

3.1 Growth Drivers

3.1.1 Rising Demand in Haemophilia Treatment

3.1.2 Increasing Adoption in Warfarin Reversal

3.1.3 Technological Advancements in Blood Coagulation Therapies

3.1.4 Government Initiatives Supporting Hematological Therapies

3.2 Market Challenges

3.2.1 High Production Costs (Manufacturing Constraints)

3.2.2 Regulatory Hurdles (FDA and Health Canada Compliance)

3.2.3 Limited Awareness Among Patients

3.2.4 Supply Chain Disruptions in Raw Material Sourcing

3.3 Opportunities

3.3.1 Expansion in Telemedicine (Treatment Access)

3.3.2 Growing Investments in Biotechnology

3.3.3 Demand in Trauma and Surgical Procedures

3.3.4 Research in Genetic Disorders (Broader Application)

3.4 Trends

3.4.1 Integration of AI in Coagulation Studies

3.4.2 Shift to Recombinant Product Alternatives

3.4.3 Growth of Point-of-Care Testing in Rural Areas

3.4.4 Hospital-based Distribution Channels

3.5 Government Regulation

3.5.1 Compliance with FDA and EMA Guidelines

3.5.2 National Blood Policy Alignment

3.5.3 Funding Programs for Hematology Treatments

3.5.4 Licensing Requirements for Prothrombin Complex Concentrate

3.6 SWOT Analysis

3.7 Supply Chain and Stakeholder Analysis

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. North America Prothrombin Complex Concentrate Market Segmentation

4.1 By Component (In Value %)

4.1.1 Factors II, VII, IX, and X

4.1.2 Activated Complexes

4.1.3 Non-activated Complexes

4.2 By Application (In Value %)

4.2.1 Haemophilia Treatment

4.2.2 Vitamin K Deficiency

4.2.3 Warfarin Reversal

4.3 By End-User (In Value %)

4.3.1 Hospitals

4.3.2 Specialty Clinics

4.3.3 Homecare

4.4 By Distribution Channel (In Value %)

4.4.1 Hospital Pharmacies

4.4.2 Retail Pharmacies

4.4.3 Online Channels

4.5 By Geography (In Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

5. North America Prothrombin Complex Concentrate Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Grifols S.A.

5.1.2 CSL Behring LLC

5.1.3 Octapharma AG

5.1.4 Baxter International Inc.

5.1.5 Kedrion Biopharma Inc.

5.1.6 Sanquin Blood Supply Foundation

5.1.7 Shire Pharmaceuticals (Takeda)

5.1.8 China Biologic Products Holdings, Inc.

5.1.9 Emergent BioSolutions

5.1.10 LFB S.A.

5.1.11 Bayer AG

5.1.12 Green Cross Corp

5.1.13 Novo Nordisk A/S

5.1.14 Bio Products Laboratory

5.1.15 ProSpec-Tany Technogene Ltd.

5.2 Cross Comparison Parameters (Revenue, Product Portfolio, R&D Investment, Market Penetration, Strategic Partnerships, Manufacturing Facilities, Customer Base, Operational Territories)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 R&D Developments

5.8 Product Launch and Pipeline Assessment

6. North America Prothrombin Complex Concentrate Market Regulatory Framework

6.1 Safety and Compliance Standards

6.2 Licensing and Approval Processes

6.3 Patient Privacy and Data Protection Laws

6.4 Import and Export Regulations

7. Future Market Segmentation (In Value %)

7.1 By Component

7.2 By Application

7.3 By End-User

7.4 By Distribution Channel

7.5 By Geography

8. Analysts Recommendations

8.1 Market Entry Strategies

8.2 Marketing Initiatives

8.3 Strategic Partnerships

8.4 Value Chain Optimization

8.5 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step involves developing a stakeholder ecosystem map across the North America Prothrombin Complex Concentrate market. Extensive secondary research through industry databases and publications helped identify variables such as product types, demand across healthcare segments, and regulatory impact.

Step 2: Market Analysis and Construction

Historical data was compiled, analyzing market penetration, supplier-distributor networks, and healthcare facility concentration. This phase includes assessing revenue streams and the competitive landscape across geographic areas to ensure comprehensive coverage.

Step 3: Hypothesis Validation and Expert Consultation

A combination of industry expert interviews and Computer-Assisted Telephone Interviews (CATI) with professionals in coagulation therapy fields validated market hypotheses. These insights facilitated an in-depth understanding of operational trends and regulatory influences.

Step 4: Research Synthesis and Final Output

The final stage consolidates detailed inputs from multiple healthcare facilities, industry practitioners, and market reports. This synthesis provides validated market insights, segmented accurately to reflect North Americas specific needs and consumer behaviors in the PCC market.

Frequently Asked Questions

01. How big is the North America Prothrombin Complex Concentrate Market?

The North America Prothrombin Complex Concentrate market is valued at USD 788 million, propelled by rising demands in emergency coagulation treatments and trauma care.

02. What are the challenges in the North America Prothrombin Complex Concentrate Market?

Key challenges include high production costs, regulatory hurdles, and the need for skilled professionals in hematological treatments. Supply chain disruptions also impact the markets growth.

03. Who are the major players in the North America Prothrombin Complex Concentrate Market?

Major players include Grifols S.A., CSL Behring LLC, Octapharma AG, Baxter International Inc., and Kedrion Biopharma Inc. Their extensive distribution networks and innovative product portfolios contribute to their market leadership.

04. What drives growth in the North America Prothrombin Complex Concentrate Market?

Growth is driven by increased demand for blood coagulation therapies in acute and emergency settings, advancements in treatment protocols, and substantial healthcare investments.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.