North America Radar Detector Market Outlook to 2030

Region:North America

Author(s):Meenakshi

Product Code:KROD4373

October 2024

89

About the Report

North America Radar Detector Market Overview

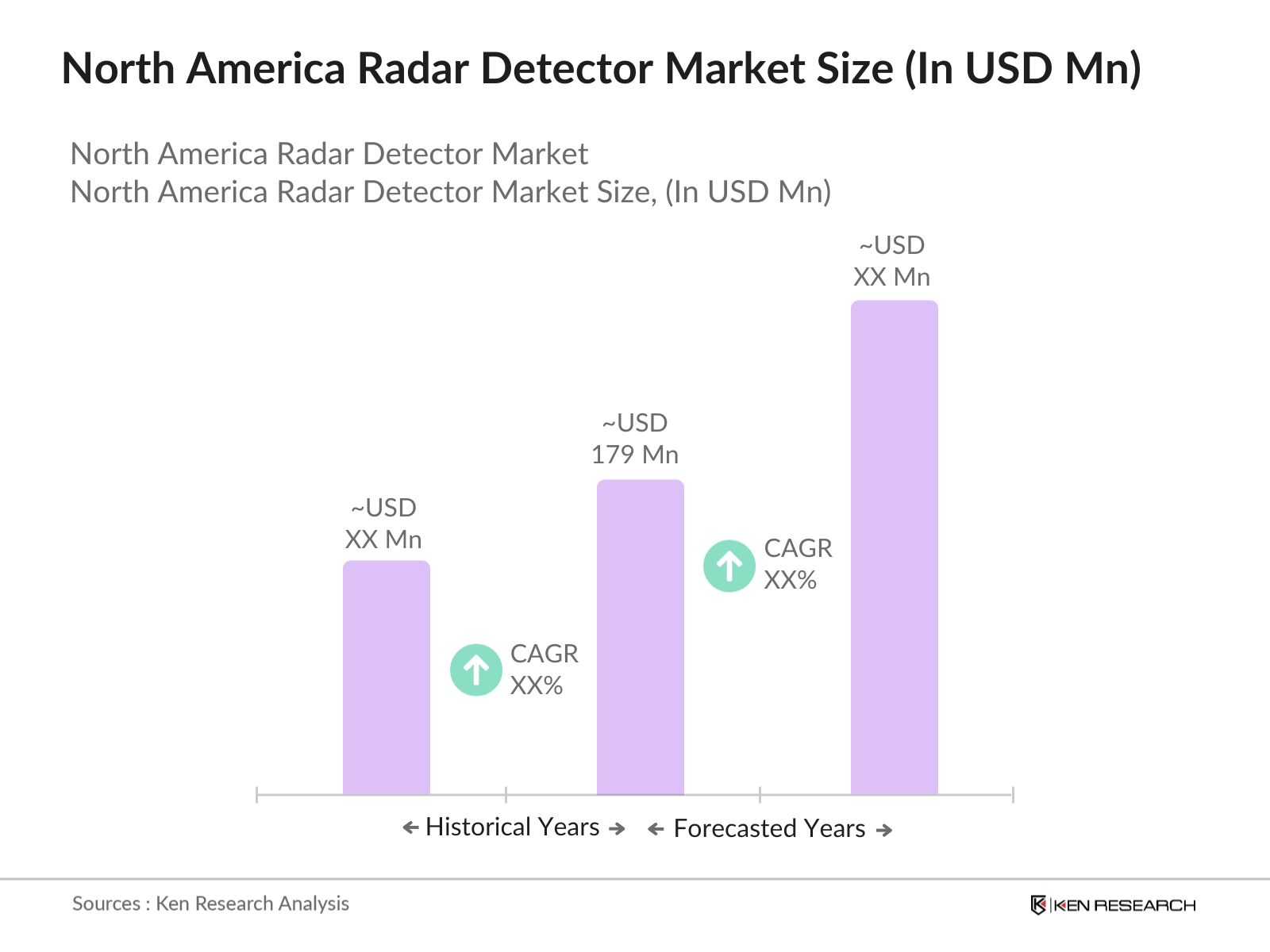

- The North America Radar Detector Market is valued at USD 179 million, based on a five-year historical analysis. This market is driven primarily by the increasing demand for advanced driving assistance systems (ADAS) and growing concerns about road safety among consumers. With the integration of radar detectors into smart vehicles and the development of AI-powered radar technologies, the market has seen steady growth in recent years, driven by technological advancements and consumer awareness.

- The U.S. dominates the market due to its large consumer base, vast highway networks, and increasing demand for advanced driver safety technologies. Major cities like Los Angeles, Houston, and New York have higher adoption rates because of strict traffic enforcement and the prevalence of speed detection technologies in these regions. Canada is another key market, where demand is bolstered by the increasing use of radar detectors in commercial trucking fleets.

- The Canadian government's investment in the modernization of North American Aerospace Defense Command (NORAD), announced in June 2022 with a budget of$38.6 billion, includes enhancements to surveillance systems that could indirectly influence the radar detector market by improving overall detection technologies in the region.

North America Radar Detector Market Segmentation

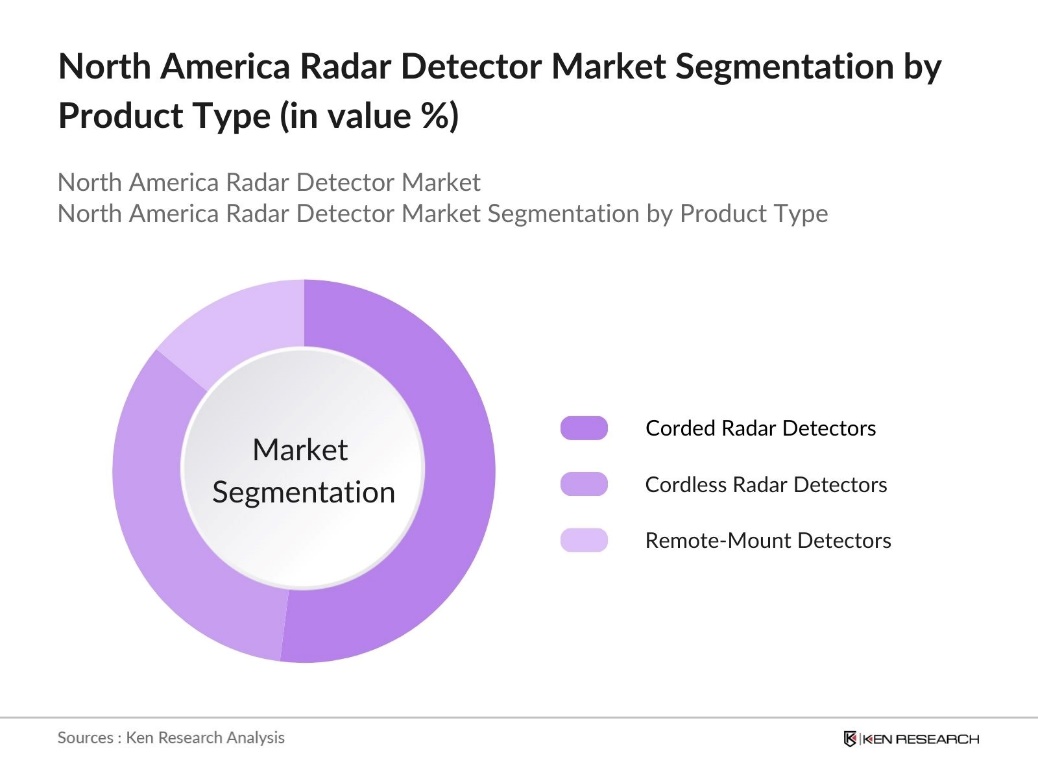

By Product Type: The North America radar detector market is segmented by product type into corded radar detectors, cordless radar detectors, and remote-mount radar detectors. Corded radar detectors currently dominate the market because they offer superior performance in terms of sensitivity and detection range. These devices are often favored by high-performance drivers and commercial users who prioritize accuracy and reliability in speed detection. Despite the growing popularity of cordless radar detectors for their convenience, corded radar detectors continue to hold the largest market share due to their enhanced detection capabilities and lower price point.

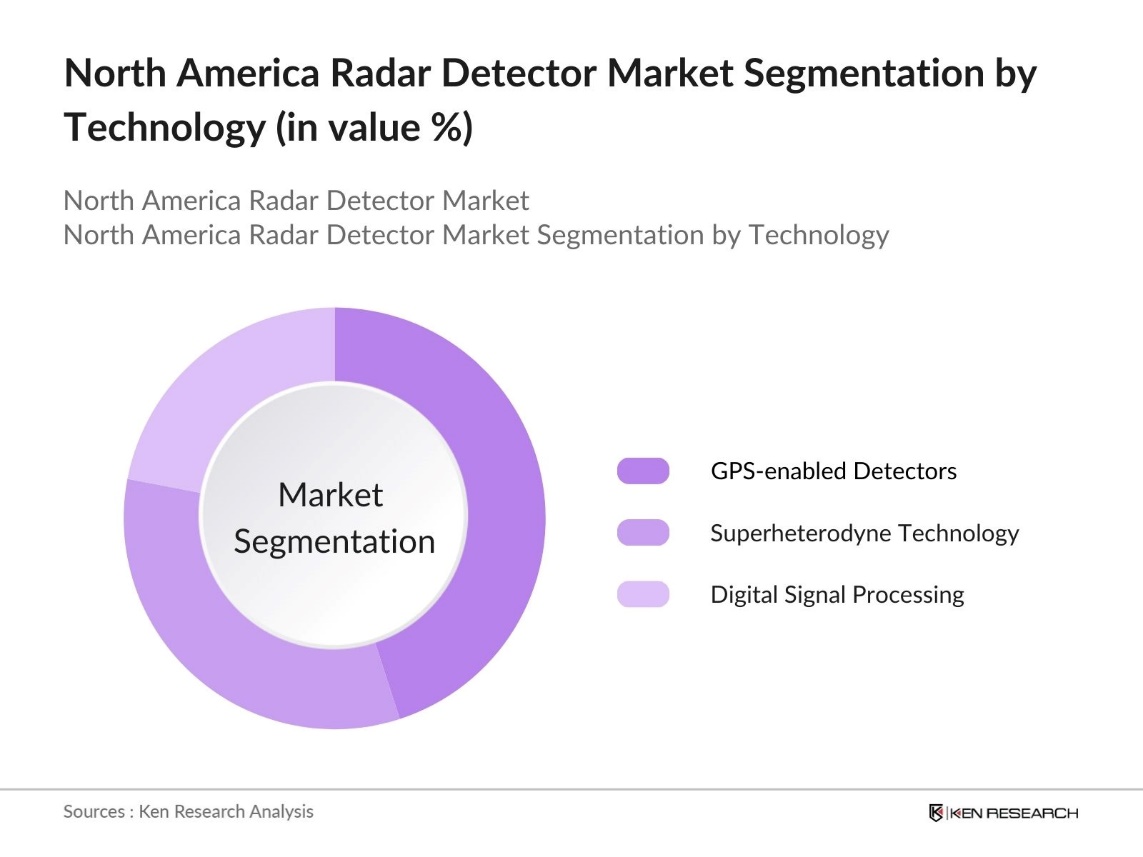

By Technology: The North America radar detector market is also segmented by technology into superheterodyne technology, digital signal processing (DSP), and GPS-enabled radar detectors. GPS-enabled radar detectors lead the market segment due to their ability to provide location-based alerts and integrate with smartphone applications for real-time updates on speed traps and red-light cameras. This technology is especially favored by long-distance drivers and truck fleets, where the combination of radar detection and GPS tracking offers an all-in-one solution for enhanced road safety.

North America Radar Detector Market Competitive Landscape

The North America radar detector market is dominated by a few major players, including brands like Cobra Electronics Corporation, Escort Inc., and Uniden America Corporation. These companies have established strong market positions through advanced product offerings and strong distribution channels across the U.S. and Canada. While smaller players and niche brands focus on innovative features, the established brands continue to dominate due to their well-established customer base and strong partnerships with automotive retailers.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD Mn) |

R&D Spending (USD Mn) |

Product Range |

Tech Integration (AI/ML) |

Global Presence |

Patent Ownership |

|

Cobra Electronics Corporation |

1961 |

Chicago, Illinois |

|||||||

|

Escort Inc. |

1978 |

West Chester, Ohio |

|||||||

|

Uniden America Corporation |

1966 |

Irving, Texas |

|||||||

|

Valentine Research, Inc. |

1991 |

Cincinnati, Ohio |

|||||||

|

Radenso |

2015 |

Cincinnati, Ohio |

North America Radar Detector Industry Analysis

Growth Drivers

- Increasing Demand for Road Safety: In 2022, the National Highway Traffic Safety Administration (NHTSA) estimated that approximately 42,795 people died in motor vehicle traffic crashes in the United States, marking a slight decrease of about 0.3% from the previous year, which had recorded 42,939 fatalities in 2021. This data highlights the rising importance of technologies that enhance driver awareness and reduce accidents. Radar detectors contribute to safer driving by helping drivers comply with speed limits and avoid potential road hazards, contributing to their growing demand in North America.

- Legislative and Regulatory Developments (Radar Detection Legality by State): Legislation regarding radar detectors varies across North America, with 12 U.S. states either banning or restricting their use as of 2024. For example, radar detectors are illegal in Virginia and the District of Columbia. The continuous updates to traffic regulations highlight the need for consumers to remain informed about legality when purchasing radar detectors. As states enact stricter traffic safety regulations, the demand for devices compliant with regional legislation is expected to increase, driving the growth of the radar detector market in states where their use is allowed.

- Increasing Consumer Awareness (Product Awareness Metrics): Consumer awareness around radar detectors has significantly increased, driven by the rise of online discussions and educational content provided by retailers. More consumers are becoming informed about the benefits and legal considerations of using radar detectors, particularly in high-traffic regions. This heightened awareness is leading to a growing demand for radar detectors in markets where traffic regulation enforcement is strict, making radar detection devices more appealing to drivers seeking to avoid potential speeding penalties and improve road safety.

Market Challenges

- Stringent Regulations in Specific Regions (Regulatory Compliance in US States): Radar detectors face strict regulations in certain regions like Virginia and Washington, D.C., where their use is entirely prohibited. This restriction creates a challenge for the market in those areas, limiting the overall potential for radar detector sales. Other states are considering similar regulatory measures, which could pose further obstacles to market growth. These legislative trends highlight the need for compliance and legal awareness when marketing and selling radar detectors across the U.S.

- High Costs of Advanced Radar Detectors (Cost-Benefit Analysis): The high cost of advanced radar detectors, particularly those integrated with technologies like artificial intelligence, presents a significant barrier for many consumers. Devices equipped with the latest features are often expensive, making them less accessible to a broader audience. This financial challenge is compounded by the fact that many households already spend substantial amounts on other automotive-related expenses, reducing the likelihood of discretionary purchases like radar detectors.

North America Radar Detector Market Future Outlook

Over the next five years, the North America radar detector market is expected to experience steady growth driven by advancements in radar detection technologies, such as artificial intelligence (AI) and machine learning (ML), and the growing demand for smart, connected automotive safety solutions. The increasing adoption of smart vehicles and the integration of radar detectors into advanced driving systems are anticipated to bolster market demand.

Market Opportunities

- Growth in Smart Vehicles Integration (Smart Radar Detector Integration): The integration of radar detectors into smart vehicle systems presents a growing opportunity for the market. As more vehicles come equipped with advanced driver assistance systems (ADAS), radar detectors are becoming compatible with these smart technologies. Automakers are increasingly incorporating such systems, allowing radar detectors to seamlessly integrate with other in-vehicle connectivity features.

- Expanding Aftermarket Sales Channels: The rise of e-commerce has opened new avenues for aftermarket radar detector sales. Online platforms, particularly large retailers, are playing a key role in facilitating easier access to these products. The convenience of purchasing radar detectors through e-commerce, coupled with the increasing preference for online shopping, is driving growth in the aftermarket segment. This shift toward digital sales channels is likely to continue expanding the market, especially among tech-savvy consumers seeking convenience and variety in their radar detector options.

Scope of the Report

|

Product Type |

Corded Radar Detectors Cordless Radar Detectors Remote-Mount Radar Detectors |

|

Technology |

Superheterodyne Technology DSP (Digital Signal Processing) GPS-enabled Radar Detectors |

|

Distribution Channel |

Online Retail Offline Retail (Auto Parts Stores, Electronics Retailers) |

|

Application |

Personal Use Commercial Use (Trucking, Fleet Management) |

|

Region |

U.S. Canada Mexico |

Products

Key Target Audience

Radar Detector Manufacturing Companies

Delivery and Logistics Companies

Tech Innovation Firms

Long-Distance Trucking Companies

Government and Regulatory Bodies (e.g., Federal Communications Commission, National Highway Traffic Safety Administration)

Banks and Financial Institutions

Investments and Venture Capitalist Firms

Companies

Major Players

Cobra Electronics Corporation

Beltronics

Uniden America Corporation

Escort Inc.

K40 Electronics

Radenso

Valentine Research, Inc.

Whistler Group

Rocky Mountain Radar

Radenso Radar

PNI Sensor Corporation

NetRadar

Stinger

Blinder International

Target Automotive

Table of Contents

1. North America Radar Detector Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Radar Detector Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Radar Detector Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Road Safety

3.1.2. Advancements in Radar Detection Technology

3.1.3. Legislative and Regulatory Developments (Radar Detection Legality by State)

3.1.4. Increasing Consumer Awareness (Product Awareness Metrics)

3.2. Market Challenges

3.2.1. Stringent Regulations in Specific Regions (Regulatory Compliance in US States)

3.2.2. High Costs of Advanced Radar Detectors (Cost-Benefit Analysis)

3.2.3. Consumer Hesitation due to Legal Risks

3.3. Opportunities

3.3.1. Growth in Smart Vehicles Integration (Smart Radar Detector Integration)

3.3.2. Expanding Aftermarket Sales Channels

3.3.3. Increased Use of AI and Machine Learning in Radar Detection

3.4. Trends

3.4.1. Miniaturization and Portability of Devices

3.4.2. Shift Towards Subscription-Based Services (Subscription Revenue Models)

3.4.3. Integration with Mobile Apps and GPS (Tech Integration Metrics)

3.5. Government Regulation

3.5.1. Federal and State Regulations on Radar Detectors (State-Specific Legislation)

3.5.2. Penalties and Fines for Use (Legal Penalties)

3.5.3. Certification and Compliance Requirements

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Retailers, Law Enforcement Agencies)

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. North America Radar Detector Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Corded Radar Detectors

4.1.2. Cordless Radar Detectors

4.1.3. Remote-Mount Radar Detectors

4.2. By Technology (In Value %)

4.2.1. Superheterodyne Technology

4.2.2. DSP (Digital Signal Processing)

4.2.3. GPS-enabled Radar Detectors

4.3. By Distribution Channel (In Value %)

4.3.1. Online Retail

4.3.2. Offline Retail (Auto Parts Stores, Electronics Retailers)

4.4. By Application (In Value %)

4.4.1. Personal Use

4.4.2. Commercial Use (Trucking, Fleet Management)

4.5. By Region (In Value %)

4.5.1. U.S.

4.5.2. Canada

4.5.3. Mexico

5. North America Radar Detector Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Cobra Electronics Corporation

5.1.2. Beltronics

5.1.3. Uniden America Corporation

5.1.4. Escort Inc.

5.1.5. K40 Electronics

5.1.6. Radenso

5.1.7. Valentine Research, Inc.

5.1.8. Whistler Group

5.1.9. Rocky Mountain Radar

5.1.10. Radenso Radar

5.1.11. PNI Sensor Corporation

5.1.12. NetRadar

5.1.13. Stinger

5.1.14. Blinder International

5.1.15. Target Automotive

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Market Share, R&D Investment, Patent Ownership, Product Range)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Radar Detector Market Regulatory Framework

6.1. State-by-State Radar Detector Legislation (Radar Detector Legality by Region)

6.2. Federal Regulations (Regulatory Authorities & Agencies)

6.3. Compliance and Certification Processes (Product Testing and Approval)

7. North America Radar Detector Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Radar Detector Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Technology (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. North America Radar Detector Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavior Insights (Consumer Segmentation)

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the North America Radar Detector Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the North America Radar Detector Market. This includes assessing market penetration, the ratio of product types, and revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIS) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple radar detector manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the North America Radar Detector market.

Frequently Asked Questions

01. How big is the North America Radar Detector Market?

The North America Radar Detector Market was valued at USD 179 million. The demand is driven by advancements in detection technology and increasing road safety concerns.

02. What are the challenges in the North America Radar Detector Market?

The primary challenges in the North America Radar Detector Market include stringent state-level regulations on radar detector usage and the high costs associated with advanced radar detectors, which can deter potential buyers.

03. Who are the major players in the North America Radar Detector Market?

Key players in North America Radar Detector Market include Cobra Electronics Corporation, Escort Inc., Uniden America Corporation, Valentine Research, and Radenso. These companies have strong distribution networks and offer innovative product features.

04. What are the growth drivers of the North America Radar Detector Market?

The North America Radar Detector Market is propelled by advancements in radar detection technology, increasing demand for road safety, and the integration of AI and ML to enhance device performance and reliability.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.