Region:North America

Author(s):Dev

Product Code:KRAA0467

Pages:87

Published On:August 2025

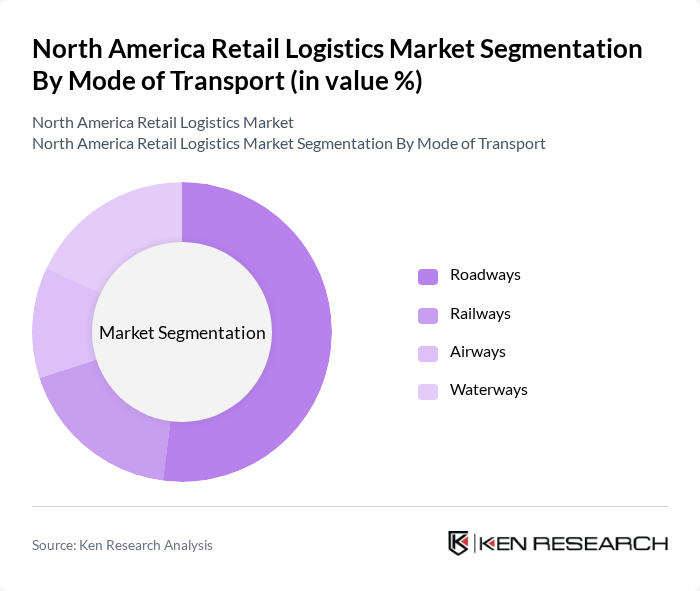

By Mode of Transport:The North America Retail Logistics Market is segmented by mode of transport into roadways, railways, airways, and waterways. Each mode plays a crucial role in the logistics ecosystem, with roadways being the most utilized due to their flexibility and reach. Railways offer cost-effective solutions for bulk transportation, while airways provide speed for time-sensitive deliveries. Waterways are essential for international shipping and large cargo movements. Roadways account for the largest share, reflecting the region’s reliance on trucking and last-mile delivery networks .

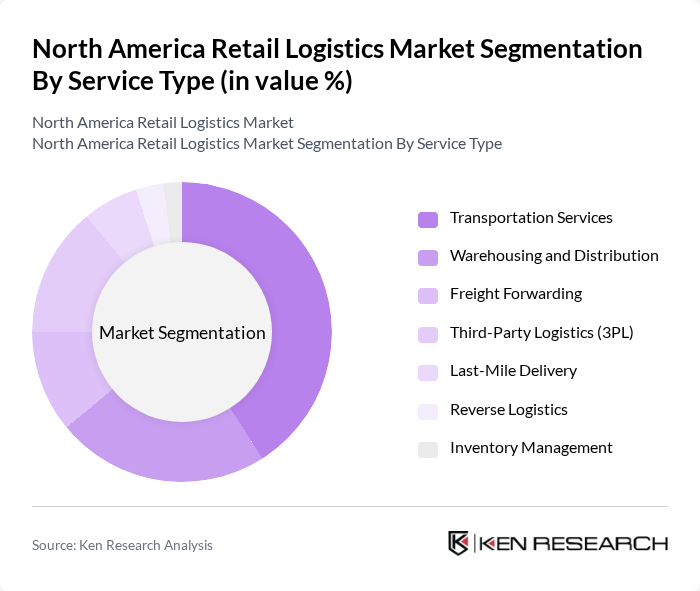

By Service Type:The market is also segmented by service type, including transportation services, warehousing and distribution, freight forwarding, third-party logistics (3PL), last-mile delivery, reverse logistics, and inventory management. Transportation services dominate the market due to the essential nature of moving goods. Warehousing and distribution are critical for managing inventory efficiently, while last-mile delivery has gained prominence with the rise of e-commerce and consumer demand for rapid fulfillment .

The North America Retail Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as FedEx Corporation, UPS Inc., DHL Supply Chain, XPO Logistics, Inc., C.H. Robinson Worldwide, Inc., J.B. Hunt Transport Services, Inc., Ryder System, Inc., DB Schenker, Kuehne + Nagel International AG, Penske Logistics, Geodis, Expeditors International of Washington, Inc., CEVA Logistics, Schneider National, Inc., Total Quality Logistics (TQL), APL Logistics Ltd., Maersk Logistics & Services, Purolator Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The North American retail logistics market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As e-commerce continues to expand, logistics providers will increasingly adopt automation and AI to enhance efficiency and reduce costs. Additionally, sustainability will become a focal point, with companies investing in eco-friendly practices. The integration of advanced data analytics will further optimize supply chain operations, ensuring that retailers can meet the growing demand for fast and reliable delivery services.

| Segment | Sub-Segments |

|---|---|

| By Mode of Transport | Roadways Railways Airways Waterways |

| By Service Type | Transportation Services Warehousing and Distribution Freight Forwarding Third-Party Logistics (3PL) Last-Mile Delivery Reverse Logistics Inventory Management |

| By End-User | Apparel and Footwear Electronics Food and Beverage Home Goods Health and Beauty Automotive Others |

| By Distribution Channel | Online Retail Brick-and-Mortar Stores Wholesalers Direct Sales Others |

| By Technology | Warehouse Management Systems (WMS) Transportation Management Systems (TMS) Inventory Management Software Automation Technologies (Robotics, Drones, IoT) Real-Time Tracking Solutions Others |

| By Country | United States Canada Mexico Others |

| By Customer Segment | B2B B2C Government Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Operations | 100 | Logistics Directors, Supply Chain Managers |

| E-commerce Fulfillment Strategies | 60 | eCommerce Operations Managers, IT Directors |

| Last-Mile Delivery Solutions | 50 | Delivery Managers, Fleet Operations Supervisors |

| Inventory Management Practices | 40 | Inventory Control Managers, Warehouse Supervisors |

| Returns Management Processes | 45 | Customer Service Managers, Returns Analysts |

The North America Retail Logistics Market is valued at approximately USD 62 billion, reflecting significant growth driven by the demand for efficient supply chain solutions, e-commerce expansion, and advancements in logistics technology.