North America Retail Security Tags Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD9169

November 2024

85

About the Report

North America Retail Security Tags Market Overview

- The North America Retail Security Tags Market is valued at USD 225 million, based on a five-year historical analysis. This market is primarily driven by increasing incidents of retail shrinkage and the adoption of advanced anti-theft technologies, particularly RFID (Radio Frequency Identification) and EAS (Electronic Article Surveillance) systems. With retailers focusing on loss prevention and inventory accuracy, security tags have become essential, especially in high-risk sectors such as apparel, electronics, and pharmaceuticals, where shrinkage rates are substantial.

- The United States is the dominant market in North America for retail security tags due to the concentration of retail giants and technological infrastructure that supports advanced tagging solutions. Key cities such as New York, Los Angeles, and Chicago lead in adopting sophisticated retail technologies. The regulatory standards for retail loss prevention and the high prevalence of organized retail crime (ORC) in these regions further underscore the adoption of security tags.

- Radiofrequency regulation is critical in retail to avoid interference with other wireless systems. The Federal Communications Commission (FCC) enforces strict compliance on RFID tag frequencies, with over 90% of retail security tags in North America meeting these standards in 2024. Compliance ensures smooth operations in crowded wireless environments, a critical need for large retail chains.

North America Retail Security Tags Market Segmentation

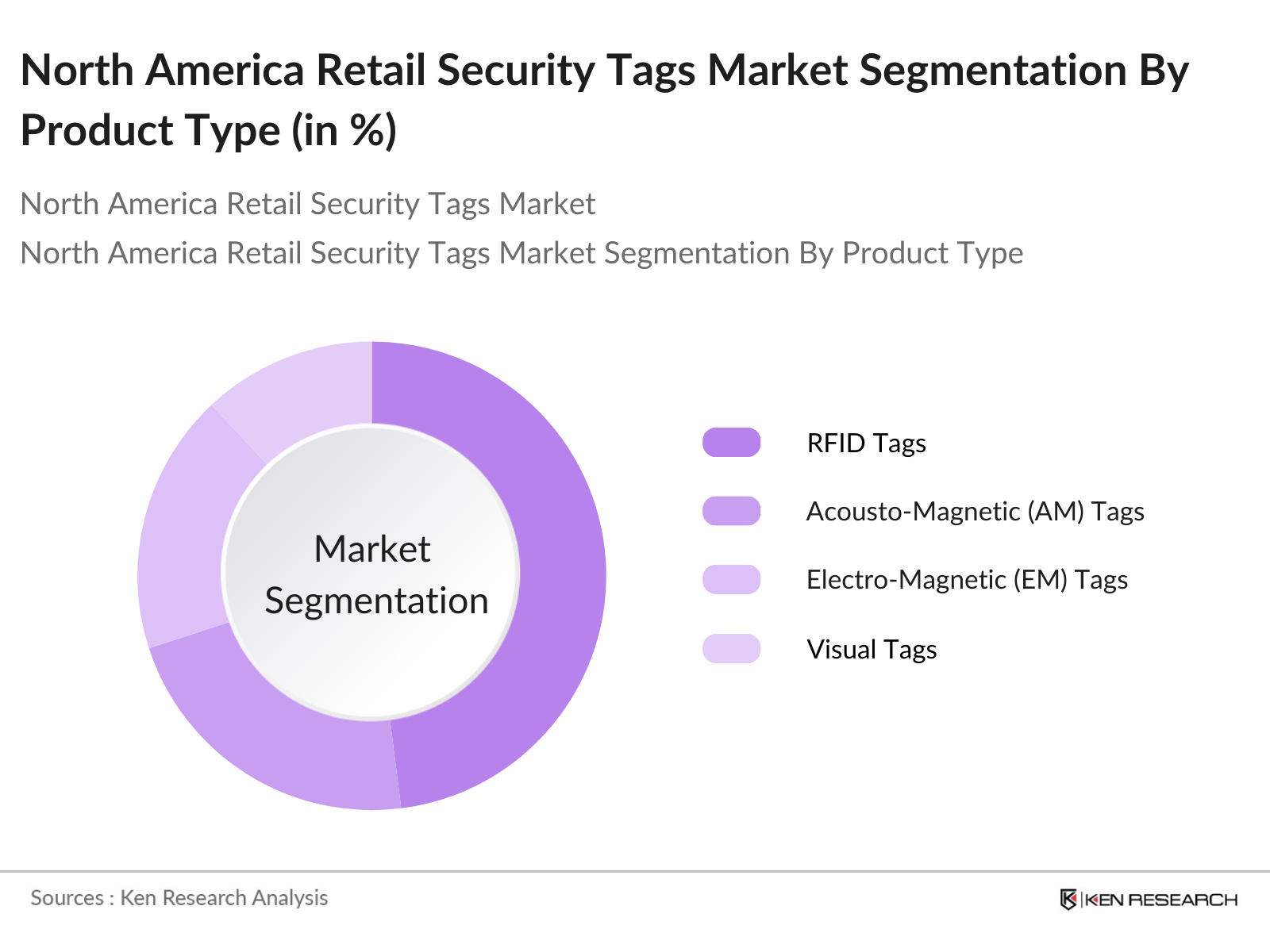

By Product Type: The North America Retail Security Tags market is segmented by product type into RFID Tags, Acousto-Magnetic (AM) Tags, Electro-Magnetic (EM) Tags, and Visual Tags. Recently, RFID Tags have gained a dominant market share within this segmentation due to their real-time tracking and high accuracy in theft prevention. The retail industry increasingly prefers RFID tags, as they enable efficient inventory management and offer superior security features.

By Application: The North America Retail Security Tags market is also segmented by application into Apparel, Consumer Electronics, Food and Beverages, Pharmaceuticals, and Others (Footwear, Accessories). Apparel holds the largest market share within this segmentation due to high shoplifting rates in this sector. Clothing retailers, particularly department stores and specialty apparel shops, increasingly invest in anti-theft solutions like tags to prevent retail shrinkage.

North America Retail Security Tags Market Competitive Landscape

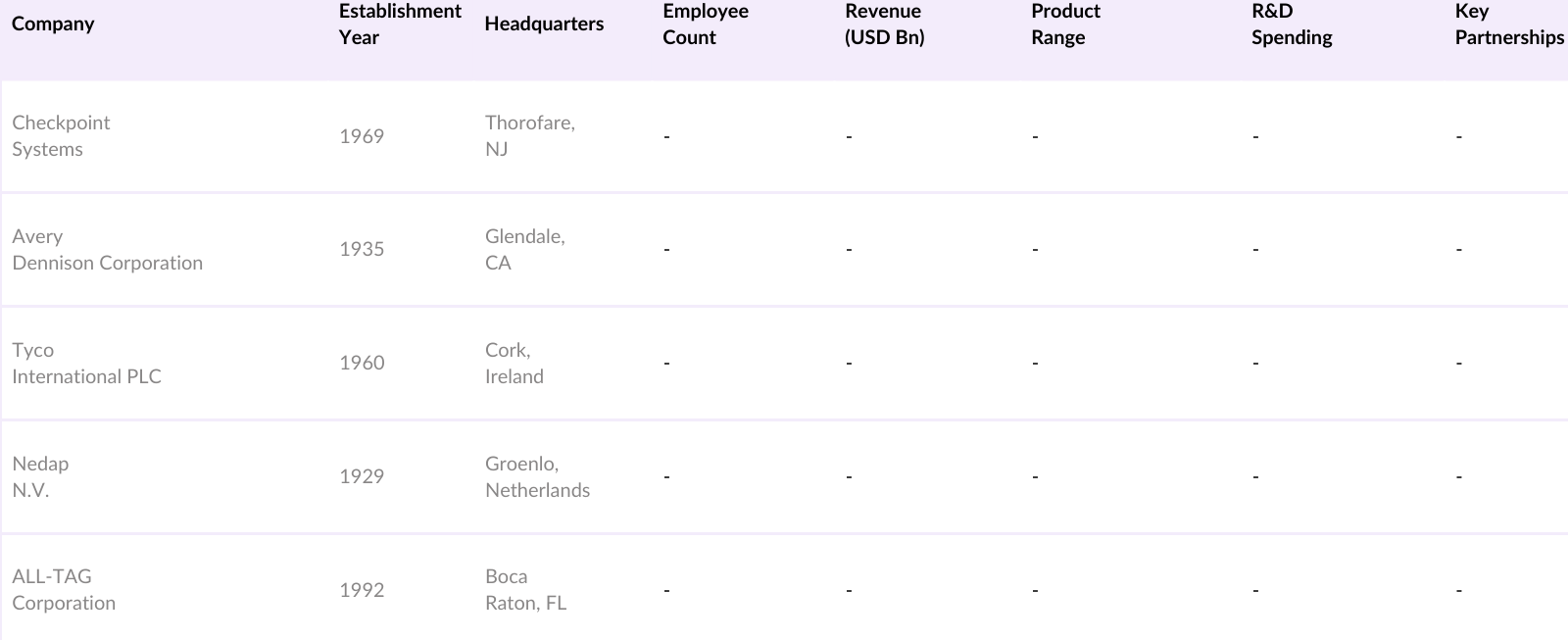

The North America Retail Security Tags market is dominated by several key players, who leverage technology and strategic partnerships to enhance their market position. Companies such as Checkpoint Systems and Tyco International lead with cutting-edge EAS solutions, while Avery Dennison has made strides in the RFID space. This consolidation highlights the substantial influence of these players on market trends and innovations.

North America Retail Security Tags Industry Analysis

Growth Drivers

- Technological Advancements in RFID and EAS (Electronic Article Surveillance) Systems: Technological innovations in RFID and EAS have increasingly streamlined retail security, with 85% of North American retailers reporting improvements in inventory visibility due to RFID adoption in 2024. RFID tagging reduces human error in inventory checks, reportedly lowering stock discrepancies by 25%. Additionally, EAS technology, particularly in high-theft product categories, has shown a 30% reduction in shrinkage incidents across major retail chains in the U.S. and Canada, according to the U.S. National Retail Federation.

- Rise in Retail Shrinkage Concerns: Retail shrinkage remains a pressing concern for the North American retail industry, with the U.S. reporting $90 billion in annual losses due to shrinkage in 2023, as per the National Association of Shoplifting Prevention. Retail security tags help mitigate this issue by reducing incidents of theft and product misplacement, improving overall profitability for retailers. The widespread adoption of such security measures is also influenced by the National Institute of Standards and Technology's research, demonstrating the positive impact of shrinkage control technologies.

- Growing Adoption of Security Tags in Organized Retail: The organized retail sector in North America is increasingly adopting security tags, with over 70% of large retail chains now utilizing RFID and EAS systems, according to 2024 data from the U.S. Bureau of Labor Statistics. As organized retail continues to grow, the demand for security tags has been bolstered by improved customer experience metrics and product protection. The National Retail Federations 2023 reports show a 20% improvement in customer satisfaction for retailers using security tags, largely due to decreased shoplifting and inventory issues.

Market Challenges

- High Costs of Installation and Maintenance: Installation and maintenance of retail security tags and RFID systems require significant capital, especially for smaller retailers, with average deployment costs ranging from $30,000 to $100,000 depending on store size. According to the U.S. Small Business Administration, high costs pose a barrier for smaller enterprises, limiting widespread adoption. Retailers must balance the financial benefits of security tags with operational expenses, impacting the adoption rate in smaller retail segments.

- Increasing Counterfeiting Risks: Counterfeit tags remain a challenge as counterfeiters develop techniques to bypass or disable RFID tags, affecting product authenticity and security. The Department of Homeland Security reported over $5 billion in counterfeit goods in 2023, underscoring the need for advanced security measures in retail. Retailers are increasingly investing in anti-counterfeiting tags with unique identification features to combat this risk, but implementation is still a challenge for widespread adoption.

North America Retail Security Tags Market Future Outlook

The North America Retail Security Tags Market is anticipated to witness steady growth due to advancements in security technology, increasing retail shrinkage challenges, and the growing need for inventory accuracy in both physical and e-commerce environments. With innovations in RFID and smart tagging solutions, the market will likely see expanded applications in logistics and real-time asset tracking, further reinforcing the relevance of security tags across retail formats.

Market Opportunities

- Integration of IoT and Smart Tagging Solutions: IoT-enabled smart tagging solutions offer retailers improved inventory management and real-time data insights, crucial for optimizing stock and enhancing customer satisfaction. According to the Federal Communications Commission, over 95% of retail locations in the U.S. have access to the infrastructure needed to support IoT integration, paving the way for advanced tagging systems. This trend enhances demand for IoT-based security tags, promising growth in the sector.

- Expansion of E-Commerce and Omnichannel Retailing: The rapid growth of e-commerce, valued at over $1.3 trillion in the U.S. alone in 2023, drives the need for source tagging, especially in warehouse management. Data from the U.S. Census Bureau indicates that the shift towards omnichannel retailing has prompted 60% of retailers to adopt security tags across digital and physical channels. This adoption mitigates theft, improves logistics, and supports inventory management in a multi-channel environment.

Scope of the Report

|

By Product Type |

RFID Tags |

|

By Application |

Apparel |

|

By Technology |

Radio Frequency Identification (RFID) |

|

By Retail Channel |

Brick and Mortar |

|

By Region |

United States |

Products

Key Target Audience

Retailers and Department Stores

Consumer Electronics Vendors

Apparel and Footwear Retailers

E-Commerce Platforms

Pharmaceuticals Distributors

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FCC for RFID regulation, National Retail Federation)

Retail Technology Solution Providers

Companies

Players Mentioned in the Report

Checkpoint Systems

Avery Dennison Corporation

Tyco International PLC

Johnson Controls

Nedap N.V.

ALL-TAG Corporation

3M Company

Ketec, Inc.

Hangzhou Century Co.

Universal Surveillance Systems (USS)

Table of Contents

1. North America Retail Security Tags Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. North America Retail Security Tags Market Size (in USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Retail Security Tags Market Analysis

3.1 Growth Drivers

3.1.1 Technological Advancements in RFID and EAS (Electronic Article Surveillance) Systems

3.1.2 Rise in Retail Shrinkage Concerns

3.1.3 Growing Adoption of Security Tags in Organized Retail

3.2 Market Challenges

3.2.1 High Costs of Installation and Maintenance

3.2.2 Increasing Counterfeiting Risks

3.2.3 Variability in Operational Standards

3.3 Opportunities

3.3.1 Integration of IoT and Smart Tagging Solutions

3.3.2 Expansion of E-Commerce and Omnichannel Retailing

3.3.3 Demand for Source Tagging by Manufacturers

3.4 Trends

3.4.1 Shift Towards Digital Retail Transformation

3.4.2 Increased Demand for Ultra-Small and Durable Tags

3.4.3 Adoption of Cloud-Based Security Tag Management Systems

3.5 Regulatory and Compliance Landscape

3.5.1 EAS Standards

3.5.2 Radiofrequency Regulation (RF Compliance)

3.5.3 Data Privacy and Security Laws

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. North America Retail Security Tags Market Segmentation

4.1 By Product Type (in Value %)

4.1.1 RFID Tags

4.1.2 Acousto-Magnetic (AM) Tags

4.1.3 Electro-Magnetic (EM) Tags

4.1.4 Visual Tags

4.2 By Application (in Value %)

4.2.1 Apparel

4.2.2 Consumer Electronics

4.2.3 Food and Beverages

4.2.4 Pharmaceuticals

4.2.5 Others (Footwear, Accessories)

4.3 By Technology (in Value %)

4.3.1 Radio Frequency Identification (RFID)

4.3.2 Electronic Article Surveillance (EAS)

4.4 By Retail Channel (in Value %)

4.4.1 Brick and Mortar

4.4.2 E-Commerce

4.4.3 Hybrid

4.5 By Country (in Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

5. North America Retail Security Tags Market Competitive Analysis

5.1 Profiles of Major Companies

5.1.1 Checkpoint Systems

5.1.2 Avery Dennison Corporation

5.1.3 Tyco International PLC

5.1.4 Johnson Controls

5.1.5 ALL-TAG Corporation

5.1.6 Nedap N.V.

5.1.7 Ketec, Inc.

5.1.8 3M Company

5.1.9 Guang Zhou Junye Packaging Co.

5.1.10 Hangzhou Century Co.

5.1.11 Universal Surveillance Systems (USS)

5.1.12 Hanmi IT

5.1.13 Sentry Technology Corporation

5.1.14 Se-Kure Controls, Inc.

5.1.15 ID Technologies

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Year Founded, Revenue, Product Range, R&D Expenditure, Market Share, Key Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. North America Retail Security Tags Market Regulatory Framework

6.1 Security Tagging Standards and Protocols

6.2 Compliance Requirements by Country

6.3 Certification Processes and Quality Standards

7. North America Retail Security Tags Market Future Size (in USD Billion)

7.1 Market Growth Projections

7.2 Key Drivers of Future Market Growth

8. North America Retail Security Tags Market Future Segmentation

8.1 By Product Type (in Value %)

8.2 By Application (in Value %)

8.3 By Technology (in Value %)

8.4 By Retail Channel (in Value %)

8.5 By Country (in Value %)

9. North America Retail Security Tags Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This stage involves mapping the North America Retail Security Tags Market ecosystem, engaging all key stakeholders. Extensive desk research is conducted, drawing from secondary and proprietary databases to capture industry-level data, with the primary aim to identify crucial variables impacting market dynamics.

Step 2: Market Analysis and Construction

Here, historical data for the market is compiled, covering aspects such as product adoption rates and technological penetration. The analysis examines the ratio of physical retail adoption of security tags to e-commerce, supporting a reliable assessment of revenue contributions from each segment.

Step 3: Hypothesis Validation and Expert Consultation

Initial market hypotheses are tested through computer-assisted interviews with industry experts from various segments. These consultations offer practical insights on revenue flow and product preferences, ensuring the accuracy of data projections.

Step 4: Research Synthesis and Final Output

This phase engages with multiple security tag manufacturers and retailers for detailed feedback on product performance, market demands, and consumer behavior. This collaboration helps validate the bottom-up market size approach, ensuring a robust analysis.

Frequently Asked Questions

1. How big is the North America Retail Security Tags Market?

The North America Retail Security Tags Market is valued at USD 225 million, based on a five-year historical analysis. This market is primarily driven by increasing incidents of retail shrinkage and the adoption of advanced anti-theft technologies, particularly RFID (Radio Frequency Identification) and EAS (Electronic Article Surveillance) systems.

2. What challenges does the North America Retail Security Tags Market face?

The market faces challenges such as high installation costs, counterfeiting risks, and regional regulatory compliance, which can impact the growth of security tagging solutions.

3. Who are the major players in the North America Retail Security Tags Market?

Key players include Checkpoint Systems, Avery Dennison, Tyco International, Nedap N.V., and ALL-TAG Corporation, each influencing market growth with unique product offerings.

4. What drives growth in the North America Retail Security Tags Market?

Growth is propelled by rising concerns about retail shrinkage, advancements in RFID technology, and increasing investments in organized retail security solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.