North America River Cruise Market Outlook to 2030

Region:North America

Author(s):Shreya Garg

Product Code:KROD7884

December 2024

93

About the Report

North America River Cruise Market Overview

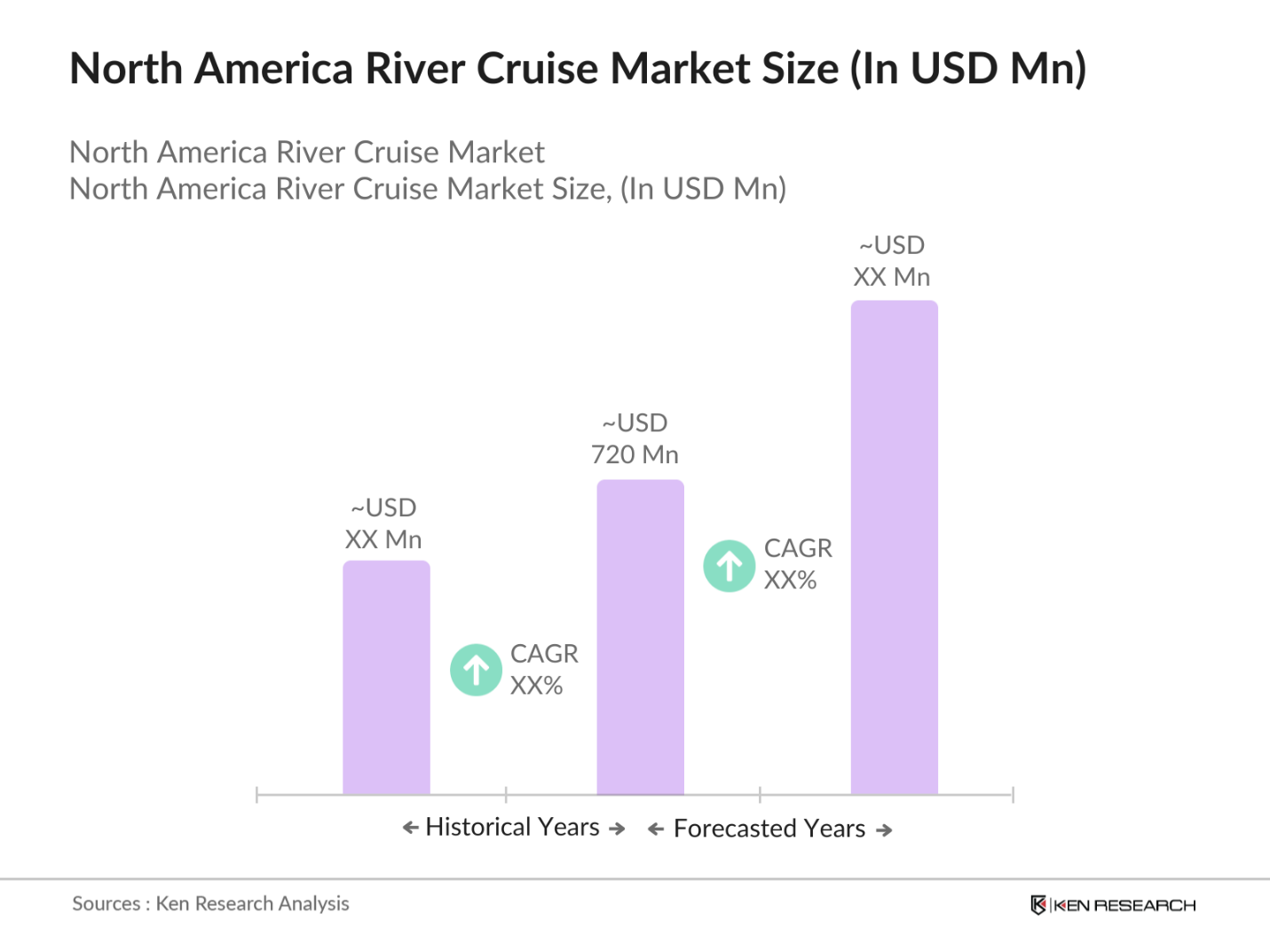

- The North America river cruise market is valued at USD 720 million, based on a five-year historical analysis. This growth is driven by increasing consumer interest in immersive travel experiences, the expansion of river cruise itineraries, and the rising affluence of travelers seeking unique and leisurely exploration options.

- The United States dominates the North American river cruise market, primarily due to its extensive and navigable river systems, such as the Mississippi and Columbia rivers. These waterways offer diverse cultural and historical experiences, attracting both domestic and international tourists. Additionally, the presence of well-established cruise operators and infrastructure further solidifies the U.S.'s leading position in this market.

- Governments are implementing stringent environmental regulations to mitigate the ecological impact of river cruising. The European Union's Green Deal aims to reduce greenhouse gas emissions by 55% by 2030, affecting transportation sectors, including river cruises. Compliance requires operators to invest in cleaner technologies and adopt sustainable practices, ensuring adherence to environmental standards and contributing to global conservation efforts.

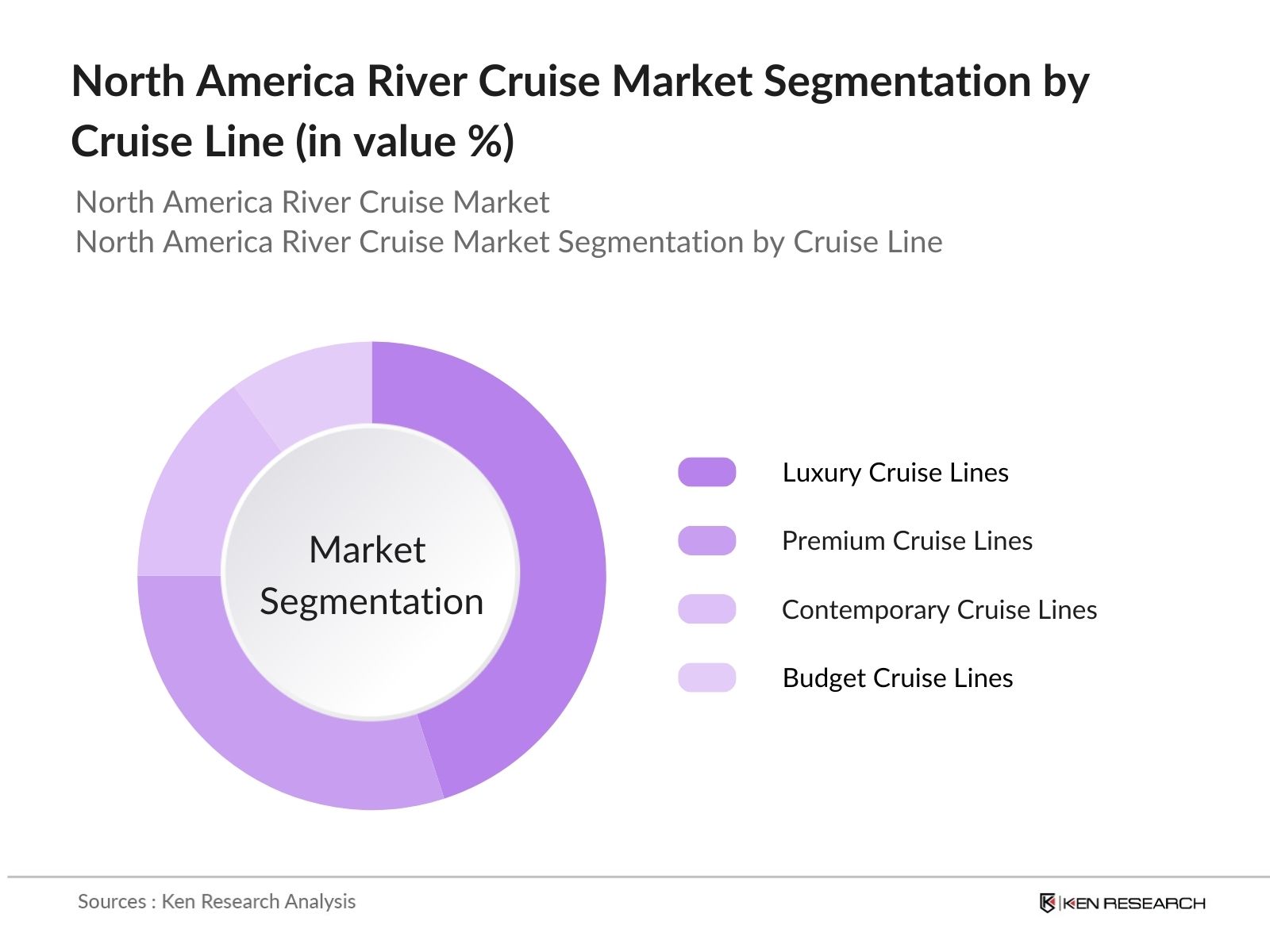

North America River Cruise Market Segmentation

By Cruise Line: The North America river cruise market is segmented by cruise line into luxury cruise lines, premium cruise lines, contemporary cruise lines, and budget cruise lines. Luxury cruise lines hold a dominant market share due to their high-end amenities, personalized services, and exclusive itineraries that cater to affluent travelers seeking premium experiences.

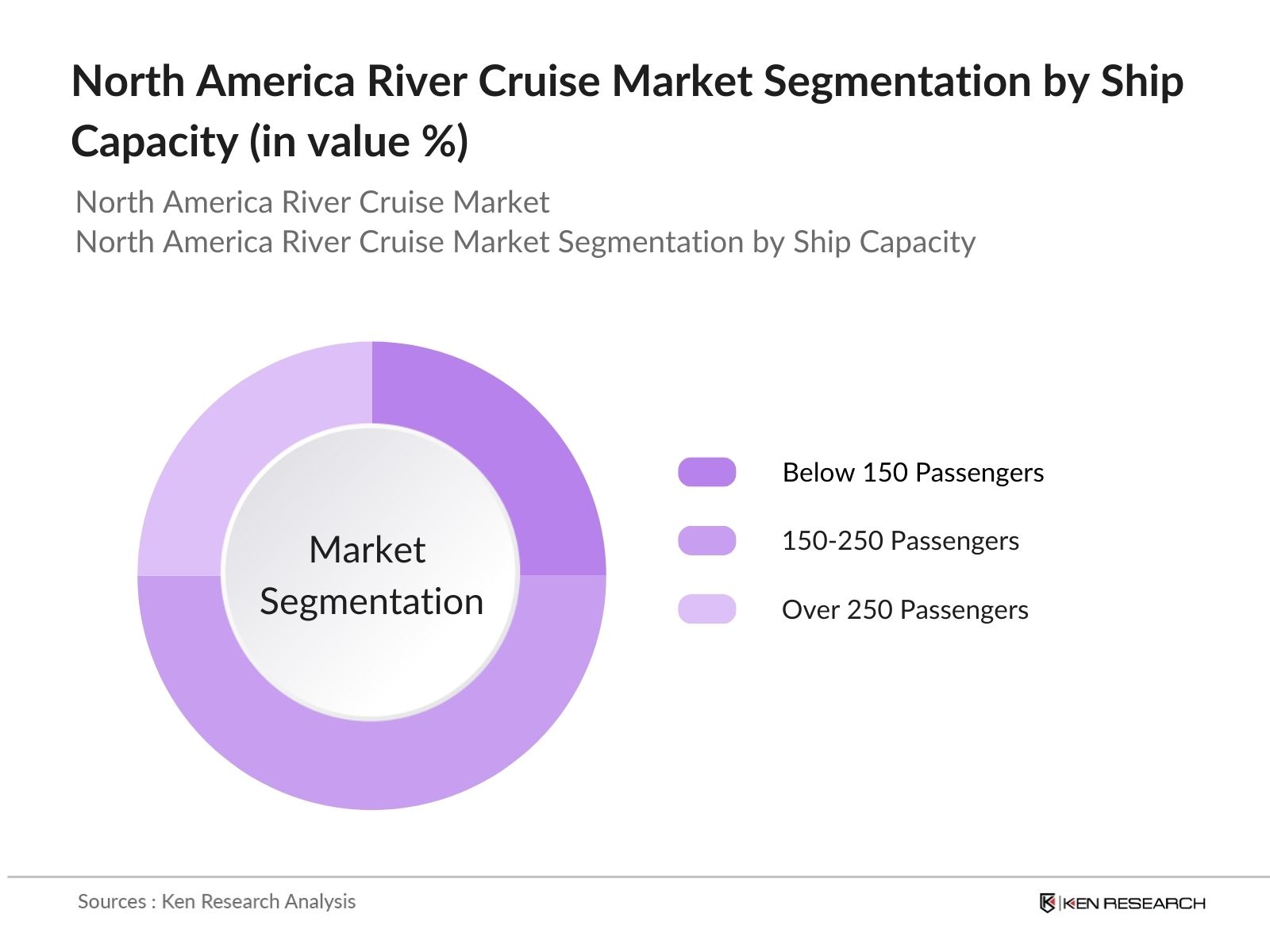

By Ship Capacity: The market is also segmented by ship capacity into vessels accommodating below 150 passengers, 150-250 passengers, and over 250 passengers. Ships with a capacity of 150-250 passengers dominate the market, offering a balance between intimacy and social interaction, which appeals to travelers desiring personalized services without the crowding of larger vessels.

North America River Cruise Market Competitive Landscape

The North America river cruise market is characterized by a mix of established operators and emerging players, each striving to capture market share through unique offerings and strategic expansions. The competitive landscape is influenced by factors such as fleet size, itinerary diversity, and customer satisfaction.

North America River Cruise Industry Analysis

Growth Drivers

- Increasing Popularity of River Cruising: River cruising has gained significant traction as travelers seek unique and immersive experiences. In 2023, the global tourism industry saw a resurgence, with international tourist arrivals reaching 960 million, a 66% increase from the previous year, indicating a strong recovery post-pandemic. This surge reflects a growing interest in diverse travel options, including river cruises, which offer intimate access to cultural and historical sites. The United Nations World Tourism Organization (UNWTO) reported that Europe, a prime region for river cruises, accounted for 585 million international tourist arrivals in 2023, underscoring the continent's appeal to travelers.

- Expansion of River Cruise Itineraries and Destinations: River cruise operators are continually expanding their itineraries to include new and diverse destinations. In 2023, the number of river cruise passengers in Europe reached 1.8 million, reflecting a growing demand for varied routes. The European River Cruise Association noted that the Danube and Rhine rivers remain popular, but there's an increasing interest in less-traveled rivers like the Douro in Portugal and the Elbe in Germany. This expansion caters to travelers seeking novel experiences and contributes to the industry's growth.

- Growing Affluence and Disposable Income: Rising global affluence has positively impacted the travel industry, including river cruises. According to the World Bank, global GDP per capita increased to $12,263 in 2023, up from $11,433 in 2022, indicating higher disposable incomes. This economic growth enables more individuals to afford luxury travel experiences. The International Monetary Fund (IMF) projects continued economic expansion, suggesting sustained demand for premium travel options like river cruises.

Market Challenges

- Seasonal Limitations: River cruising is often subject to seasonal constraints, particularly in regions with harsh winters or fluctuating water levels. For instance, the Danube River experienced low water levels in 2023, affecting cruise operations during certain months. The European Environment Agency reported that climate change is contributing to more frequent and severe droughts, impacting river navigability. These seasonal limitations pose challenges for cruise operators in maintaining consistent schedules and revenue streams.

- Environmental Concerns: The environmental impact of river cruising has come under scrutiny, with concerns about emissions, waste management, and ecosystem disruption. The European Commission has introduced stricter environmental regulations for inland waterway vessels, aiming to reduce emissions and promote sustainable practices. Compliance with these regulations requires significant investment from cruise operators in cleaner technologies and operational adjustments, presenting both challenges and opportunities for the industry.

North America River Cruise Market Future Outlook

Over the next five years, the North America river cruise market is expected to experience significant growth, driven by continuous expansion of itineraries, advancements in vessel technology, and increasing consumer demand for unique travel experiences. Operators are likely to invest in sustainable practices and enhance onboard amenities to attract a broader demographic, including younger travelers and families. Additionally, collaborations with local communities and tourism boards are anticipated to enrich cultural offerings and provide authentic experiences, further propelling market growth.

Future Market Opportunities

- Untapped River Routes: Exploring less-traveled rivers presents significant growth opportunities for the river cruise industry. Regions like Southeast Asia, with rivers such as the Mekong and Irrawaddy, are gaining popularity among travelers seeking unique cultural experiences. The UNWTO noted a 10% increase in tourist arrivals to Asia in 2023, indicating a growing interest in the region. Developing new itineraries in these areas can attract a broader customer base and diversify revenue streams.

- Demand for Themed Cruises: Themed cruises, focusing on specific interests like culinary arts, history, or wellness, are increasingly popular. A survey by the European Travel Commission found that 35% of travelers in 2023 preferred experiences centered around personal interests. River cruise operators offering specialized itineraries can cater to this demand, enhancing customer satisfaction and loyalty. For example, wine-themed cruises along the Rhine and Danube have attracted enthusiasts seeking immersive experiences.

Scope of the Report

|

Cruise Line |

Luxury Cruise Lines |

|

Ship Capacity |

Below 150 Passengers |

|

Vessel Type |

Barge |

|

Cabin Type |

Standard |

|

Itinerary Focus |

Cultural and Historical |

Products

Key Target Audience

Cruise Line Operators

Travel Agencies and Tour Operators

Shipbuilders and Marine Equipment Manufacturers

Hospitality and Service Providers

Government and Regulatory Bodies (e.g., U.S. Coast Guard, Federal Maritime Commission)

Investors and Venture Capitalist Firms

Environmental and Conservation Organizations

Local Tourism Boards and Cultural Associations

Companies

Major Players

Viking River Cruises

American Cruise Lines

Uniworld Boutique River Cruises

Avalon Waterways

American Queen Voyages

AmaWaterways

Tauck River Cruises

Scenic Luxury Cruises & Tours

Emerald Waterways

Crystal River Cruises

Grand Circle Cruise Line

Riviera Travel

CroisiEurope

A-ROSA River Cruises

Lindblad Expeditions

Table of Contents

North America River Cruise Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

North America River Cruise Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

North America River Cruise Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Popularity of River Cruising

3.1.2 Expansion of River Cruise Itineraries and Destinations

3.1.3 Growing Affluence and Disposable Income

3.1.4 Technological Advancements in Cruise Vessels

3.2 Market Challenges

3.2.1 Seasonal Limitations

3.2.2 Environmental Concerns

3.2.3 Competition from Ocean Cruises

3.3 Opportunities

3.3.1 Untapped River Routes

3.3.2 Demand for Themed Cruises

3.3.3 Partnerships with Local Tourism Boards

3.4 Trends

3.4.1 Adoption of Sustainable Practices

3.4.2 Customization of Cruise Experiences

3.4.3 Integration of Smart Technologies

3.5 Government Regulations

3.5.1 Environmental Compliance Standards

3.5.2 Safety and Security Protocols

3.5.3 Passenger Rights and Protections

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

North America River Cruise Market Segmentation

4.1 By Cruise Line (In Value %)

4.1.1 Luxury Cruise Lines

4.1.2 Premium Cruise Lines

4.1.3 Contemporary Cruise Lines

4.1.4 Budget Cruise Lines

4.2 By Ship Capacity (In Value %)

4.2.1 Below 150 Passengers

4.2.2 150-250 Passengers

4.2.3 Over 250 Passengers

4.3 By Vessel Type (In Value %)

4.3.1 Barge

4.3.2 Paddlewheeler

4.3.3 Motor Cruiser

4.4 By Cabin Type (In Value %)

4.4.1 Standard

4.4.2 Deluxe

4.4.3 Suite

4.4.4 Accessible

4.5 By Itinerary Focus (In Value %)

4.5.1 Cultural and Historical

4.5.2 Nature and Wildlife

4.5.3 Wine and Gastronomy

4.5.4 Active and Adventure

North America River Cruise Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Viking River Cruises

5.1.2 American Cruise Lines

5.1.3 Uniworld Boutique River Cruises

5.1.4 Avalon Waterways

5.1.5 Tauck River Cruises

5.1.6 AmaWaterways

5.1.7 American Queen Voyages

5.1.8 Scenic Luxury Cruises & Tours

5.1.9 Emerald Waterways

5.1.10 Crystal River Cruises

5.1.11 Grand Circle Cruise Line

5.1.12 Riviera Travel

5.1.13 CroisiEurope

5.1.14 A-ROSA River Cruises

5.1.15 Lindblad Expeditions

5.2 Cross Comparison Parameters

5.2.1 Fleet Size

5.2.2 Number of Destinations

5.2.3 Average Passenger Capacity

5.2.4 Year Established

5.2.5 Revenue

5.2.6 Market Share

5.2.7 Customer Satisfaction Ratings

5.2.8 Number of Employees

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

North America River Cruise Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

North America River Cruise Future Market Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

North America River Cruise Future Market Segmentation

8.1 By Cruise Line (In Value %)

8.2 By Ship Capacity (In Value %)

8.3 By Vessel Type (In Value %)

8.4 By Cabin Type (In Value %)

8.5 By Itinerary Focus (In Value %)

North America River Cruise Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the North America River Cruise Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the North America River Cruise Market. This includes assessing market penetration, the ratio of cruise operators to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple river cruise operators to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the North America River Cruise Market.

Frequently Asked Questions

01 How big is the North America River Cruise Market?

The North America river cruise market is valued at USD 720 million, driven by increasing consumer demand for immersive and culturally rich travel experiences across iconic rivers such as the Mississippi and Columbia.

02 What are the major challenges in the North America River Cruise Market?

Challenges in this North America river cruise market include seasonal limitations affecting operation schedules, competition from ocean cruises, and regulatory hurdles related to environmental and safety compliance.

03 Who are the key players in the North America River Cruise Market?

Key players in North America river cruise market include Viking River Cruises, American Cruise Lines, Uniworld Boutique River Cruises, Avalon Waterways, and American Queen Voyages, all of which leverage their strong fleet and diverse itineraries to capture significant market share.

04 What factors drive growth in the North America River Cruise Market?

Growth drivers in the North America river cruise market include the expansion of itineraries, rising affluence among consumers, and increasing demand for customized travel experiences that focus on culture, history, and nature.

05 What trends are shaping the future of the North America River Cruise Market?

Trends influencing the North America river cruise market include a focus on sustainable practices, the use of smart technologies onboard, and the development of themed cruises catering to specific interests such as culinary, historical, and adventure tourism.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.