North America Sales Intelligence Market Outlook to 2030

Region:North America

Author(s):Meenakshi

Product Code:KROD2024

October 2024

97

About the Report

North America Sales Intelligence Market Overview

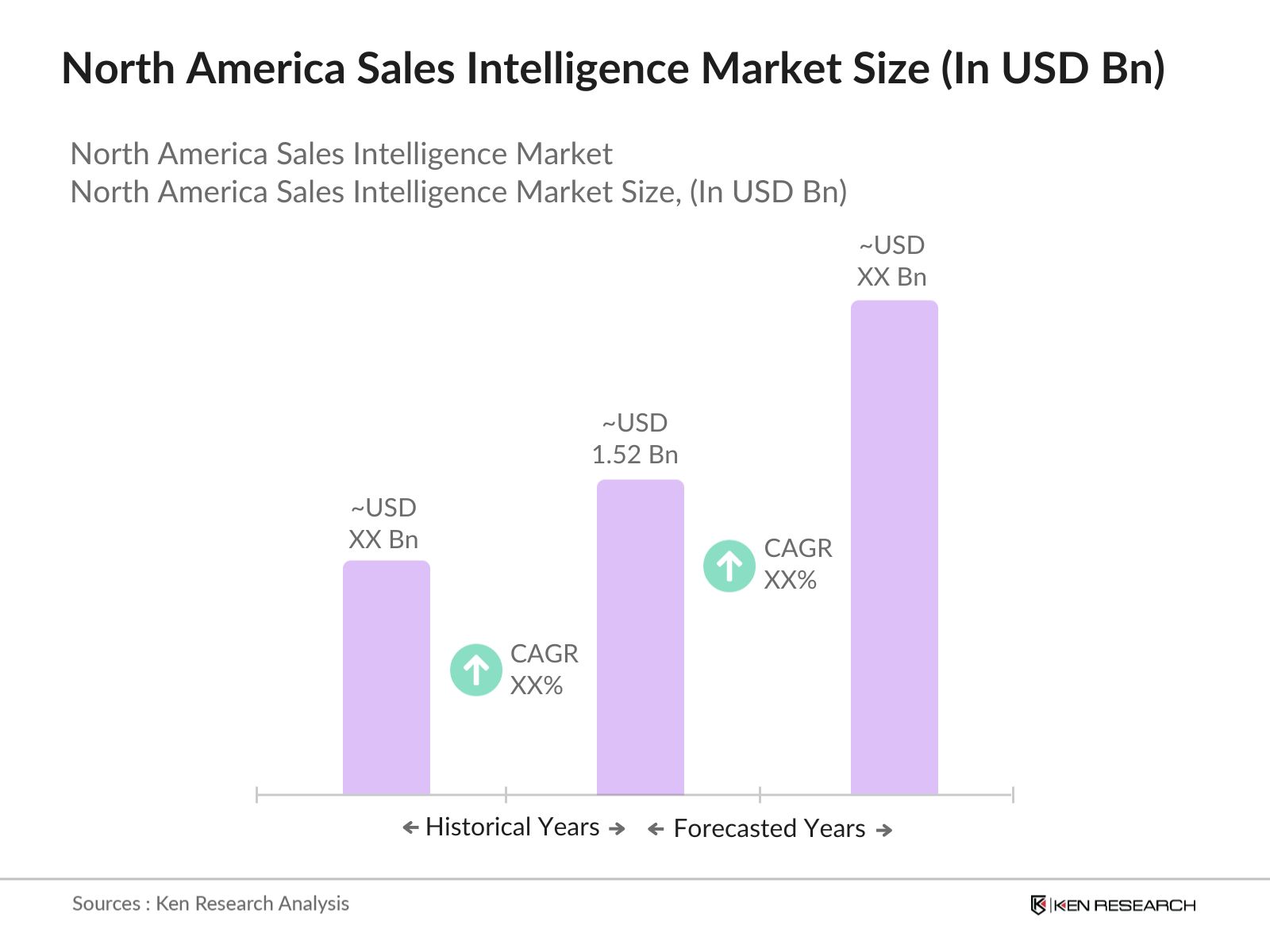

- The North America Sales Intelligence market is valued at USD 1.52 billion, based on a five-year historical analysis. This market is driven by the increasing demand for data-driven sales processes, the rise of artificial intelligence (AI) and machine learning (ML) integration in sales tools, and the growing need for companies to enhance customer experience through real-time data insights. Large enterprises and SMEs alike are investing heavily in Sales Intelligence platforms to optimize sales performance and achieve better customer targeting and engagement. These trends are boosting market growth across multiple sectors.

- The dominance in this market is primarily seen in major U.S. cities like New York, San Francisco, and Chicago, where companies have long-established technology and sales ecosystems. The high concentration of technology startups and leading enterprises in these cities drives the demand for sales intelligence tools, as organizations increasingly rely on data analytics to fuel growth. Furthermore, the U.S. market is characterized by its advanced digital infrastructure, supporting widespread adoption of sales technologies.

- The U.S. government has implemented initiatives to reduce tax compliance burdens, but businesses still face significant costs. Recent efforts include the Corporate Alternative Minimum Tax (CAMT), introduced in 2022, which targets large corporations, adding complexity to the tax landscape. Additionally, international initiatives like the OECD's Pillar Two rules, aimed at multinational corporations, are increasing compliance costs. Lawmakers are considering reforms to simplify tax codes, including reducing unnecessary reporting and introducing clearer regulations for international operations.

North America Sales Intelligence Market Segmentation

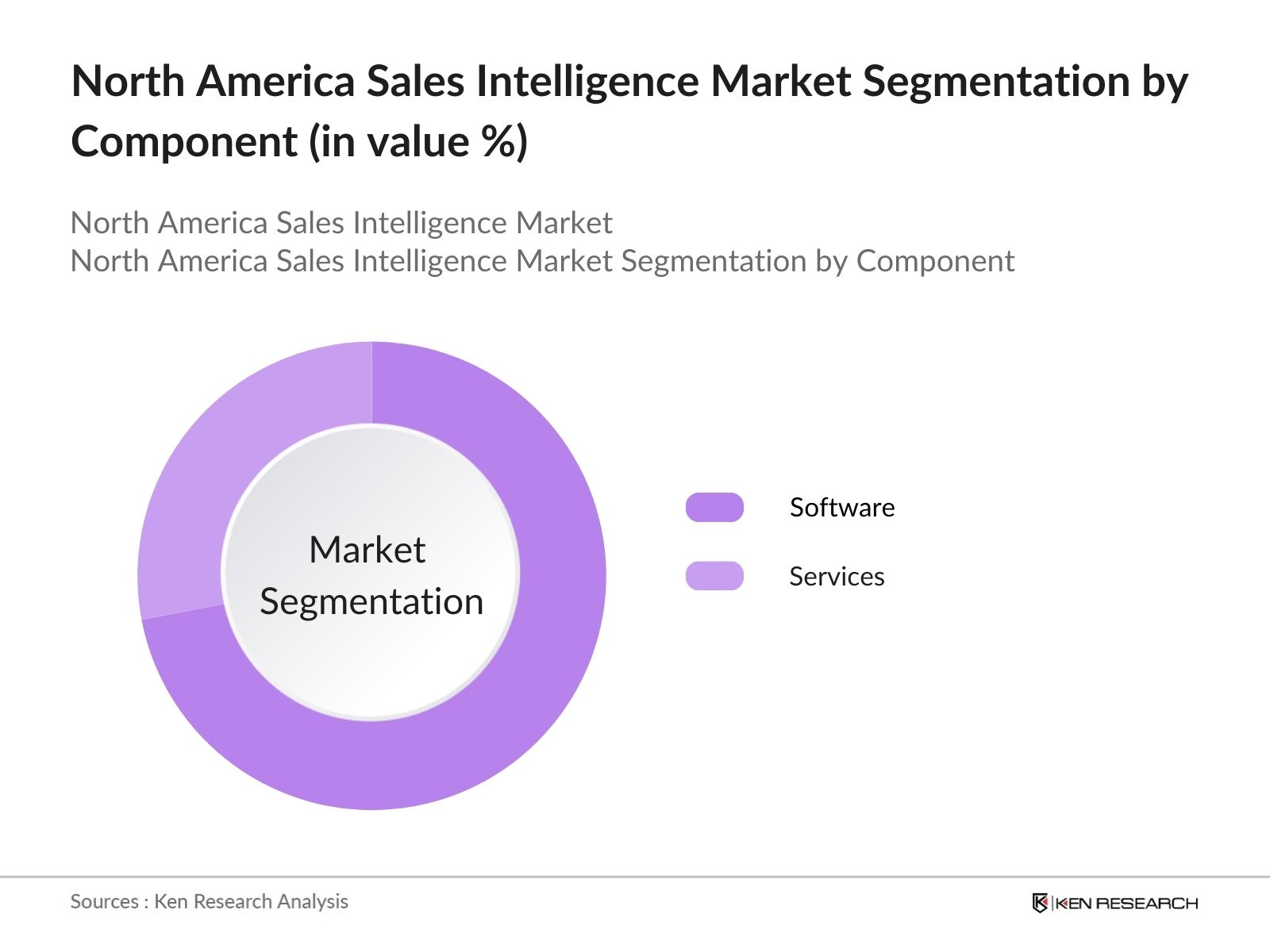

By Component: The North America Sales Intelligence market is segmented by component into Software and Services. Among these, Software holds a dominant market share due to the increasing adoption of AI-powered platforms that automate the sales process, provide data analytics, and enhance lead generation. The scalability and customization offered by various software solutions have made this segment the preferred choice for businesses aiming to streamline their sales efforts. Additionally, the rise of cloud-based solutions is driving the demand for software that can seamlessly integrate with existing CRM systems.

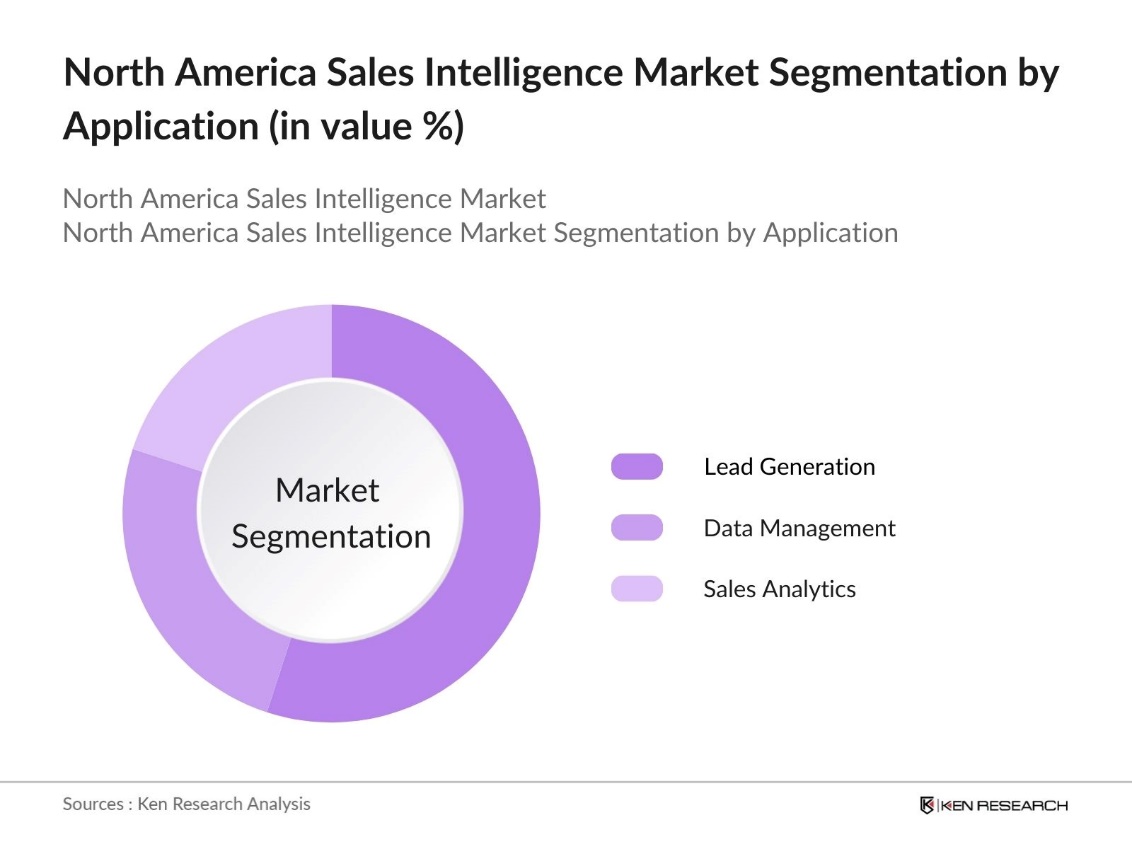

By Application: The North America Sales Intelligence market is segmented by application into Lead Generation, Data Management, and Sales Analytics. Lead Generation has been the most dominant application due to the increasing need for businesses to capture high-quality leads and convert them into sales. As companies focus on improving their lead targeting through better insights, advanced algorithms, and AI-driven predictive analytics, this sub-segment continues to outperform other applications. The ability to gather real-time data on potential leads has become a crucial factor in enhancing conversion rates.

North America Sales Intelligence Market Competitive Landscape

The North America Sales Intelligence market is dominated by several key players that have solidified their positions through innovative solutions and strategic partnerships. The market's consolidation highlights the significant role these companies play in shaping the industry by offering cutting-edge AI-powered platforms that enhance sales processes and improve customer relationship management.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD Bn) |

Global Reach |

AI Integration |

Cloud Services |

Key Clients |

Product Portfolio |

|

Salesforce |

1999 |

San Francisco |

|||||||

|

Oracle Corporation |

1977 |

Redwood Shores |

|||||||

|

ZoomInfo |

2000 |

Vancouver, WA |

|||||||

|

Dun & Bradstreet |

1841 |

Short Hills, NJ |

|||||||

|

InsideView |

2005 |

San Francisco |

North America Sales Intelligence Industry Analysis

Growth Drivers

- Increased Adoption of AI and Machine Learning: The adoption of AI and machine learning in sales intelligence is transforming the landscape of decision-making in North American enterprises. Various sources indicate a significant increase in the use of AI tools within sales operations. For instance, it is noted that 88% of Chief Sales Officers (CSOs) are investing or considering investments in AI analytics tools, highlighting a strong trend towards automation and data-driven decision-making in sales.

- Expansion of SaaS and Cloud Platforms: The expansion of SaaS and cloud platforms in North America is revolutionizing the sales intelligence market. While Amazon is planning to invest $100 billion in AI-focused data centers over the next decade, this figure pertains specifically to Amazons investments and not the overall cloud infrastructure investment in the US for 2023. This has led to the rapid deployment of sales intelligence tools as cloud-based platforms provide real-time insights into customer behavior and sales metrics, enabling companies to scale operations seamlessly while reducing overhead costs associated with traditional infrastructure.

- Growing Demand for Customer Relationship Management (CRM) Integration: The integration of sales intelligence tools with Customer Relationship Management (CRM) platforms is becoming increasingly essential for businesses. By linking sales intelligence with CRM systems, companies can enhance customer insights and streamline decision-making processes. This integration enables seamless data flow across various customer interaction points, allowing enterprises to personalize interactions and improve customer retention.

Market Challenges

- Data Privacy and Compliance Regulations: North American companies must adhere to stringent data privacy and compliance regulations such as the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR). These regulations require businesses to handle customer data responsibly and within legal boundaries. Compliance with these laws poses challenges for many companies, as it increases the complexity of implementing sales intelligence tools.

- High Initial Investment in AI Technologies: AI technologies offer substantial benefits in the long term, but the high initial investment required can be a significant barrier for many organizations. The cost of implementing AI and machine learning solutions, along with the need for skilled professionals to manage these systems, presents challenges for small and medium-sized enterprises (SMEs). This financial burden can slow the adoption of AI technologies in sales intelligence, particularly for companies with limited resources, affecting their ability to compete with larger organizations in the market.

North America Sales Intelligence Market Future Outlook

Over the next five years, the North America Sales Intelligence market is expected to see robust growth due to the increasing reliance on data to drive sales strategies and decision-making processes. As companies prioritize digital transformation, the integration of AI and ML into sales platforms will continue to grow, offering real-time insights and predictive analytics that enhance lead management, customer targeting, and sales efficiency.

Market Opportunities

- Emergence of Predictive Analytics in Sales: Predictive analytics is rapidly becoming a key opportunity in the sales intelligence market, enabling businesses to forecast sales trends and make data-driven decisions. These tools provide real-time insights into customer behavior, allowing sales teams to anticipate needs and take proactive measures. By using predictive models, companies can refine their sales strategies, improving decision accuracy and driving more effective customer engagement. This shift is transforming how businesses approach sales, making predictive analytics a valuable asset in optimizing performance and enhancing customer satisfaction.

- Increasing Role of Customer Data Platforms (CDP): Customer Data Platforms (CDPs) are becoming increasingly integral to the sales intelligence landscape in North America. CDPs allow organizations to centralize and synchronize customer data across marketing, sales, and customer service channels in real-time. This holistic view of customer interactions enables businesses to target their sales efforts more precisely and personalize communication, resulting in more efficient and effective engagement.

Scope of the Report

|

Component |

Software Services |

|

Deployment Mode |

On-Premise Cloud-Based |

|

Application |

Lead Generation Data Management Sales Analytics |

|

Enterprise Size |

SMEs Large Enterprises |

|

Industry Vertical |

BFSI Retail IT and Telecom Manufacturing Healthcare |

Products

Key Target Audience

E-commerce Platforms

BFSI (Banking, Financial Services, and Insurance) Companies

Telecommunications Companies

Government and Regulatory Bodies (Federal Communications Commission, Federal Trade Commission)

Investors and Venture Capital Firms

Companies

Major Players

Salesforce

Oracle Corporation

ZoomInfo

Dun & Bradstreet

InsideView

Clearbit

LinkedIn Sales Navigator

DiscoverOrg

DataFox (Oracle)

UpLead

Groove

HubSpot

Vainu

Outreach

Bombora

Table of Contents

1. North America Sales Intelligence Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Sales Intelligence Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Sales Intelligence Market Analysis

3.1. Growth Drivers

3.1.1. Increased Adoption of AI and Machine Learning

3.1.2. Expansion of SaaS and Cloud Platforms

3.1.3. Growing Demand for Customer Relationship Management (CRM) Integration

3.1.4. Data-Driven Decision-Making Across Enterprises

3.2. Market Challenges

3.2.1. Data Privacy and Compliance Regulations

3.2.2. High Initial Investment in AI Technologies

3.2.3. Integration Issues with Legacy Systems

3.3. Opportunities

3.3.1. Emergence of Predictive Analytics in Sales

3.3.2. Increasing Role of Customer Data Platforms (CDP)

3.3.3. Growing Demand for Real-Time Data Insights

3.4. Trends

3.4.1. Integration of Sales Intelligence with Social Selling

3.4.2. Use of Natural Language Processing (NLP) in Lead Scoring

3.4.3. Growth of Self-Service Sales Intelligence Platforms

3.5. Government Regulation

3.5.1. Data Privacy Laws (CCPA, GDPR)

3.5.2. Cloud Compliance Standards

3.5.3. IT Infrastructure and Security Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. North America Sales Intelligence Market Segmentation

4.1. By Component (In Value %)

4.1.1. Software

4.1.2. Services

4.2. By Deployment Mode (In Value %)

4.2.1. On-Premise

4.2.2. Cloud-Based

4.3. By Application (In Value %)

4.3.1. Lead Generation

4.3.2. Data Management

4.3.3. Sales Analytics

4.4. By Enterprise Size (In Value %)

4.4.1. SMEs

4.4.2. Large Enterprises

4.5. By Industry Vertical (In Value %)

4.5.1. BFSI

4.5.2. Retail

4.5.3. IT and Telecom

4.5.4. Manufacturing

4.5.5. Healthcare

5. North America Sales Intelligence Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Salesforce

5.1.2. Oracle Corporation

5.1.3. ZoomInfo

5.1.4. Dun & Bradstreet

5.1.5. InsideView

5.1.6. Clearbit

5.1.7. LinkedIn Sales Navigator

5.1.8. DiscoverOrg

5.1.9. DataFox (Oracle)

5.1.10. UpLead

5.1.11. Groove

5.1.12. HubSpot

5.1.13. Vainu

5.1.14. Outreach

5.1.15. Bombora

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Global Reach, Product Portfolio, Key Clients, Funding Rounds)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. North America Sales Intelligence Market Regulatory Framework

6.1. Data Privacy Regulations

6.2. Compliance Requirements

6.3. Certification Processes

7. North America Sales Intelligence Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Sales Intelligence Future Market Segmentation

8.1. By Component (In Value %)

8.2. By Deployment Mode (In Value %)

8.3. By Application (In Value %)

8.4. By Enterprise Size (In Value %)

8.5. By Industry Vertical (In Value %)

9. North America Sales Intelligence Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research begins with identifying the most critical factors influencing the North America Sales Intelligence market, such as technological advancements, consumer behavior, and macroeconomic conditions. Data is sourced from secondary databases and proprietary industry reports to construct an ecosystem map.

Step 2: Market Analysis and Construction

Using historical data from industry reports and proprietary tools, the market is segmented and analyzed based on components and applications. The analysis covers market penetration, demand trends, and sales analytics to ensure data accuracy.

Step 3: Hypothesis Validation and Expert Consultation

To validate initial market assumptions, expert consultations are conducted with professionals from top Sales Intelligence providers. These interviews help verify market trends and validate projections.

Step 4: Research Synthesis and Final Output

In the final stage, a comprehensive analysis is carried out through direct engagement with major stakeholders in the Sales Intelligence market. Insights from these interviews provide the basis for accurate and validated market size and forecasts.

Frequently Asked Questions

01. How big is the North America Sales Intelligence Market?

The North America Sales Intelligence Market is valued at USD 1.52 billion. This market size is driven by the increasing need for data-driven decision-making in sales processes, as companies seek to enhance customer engagement and optimize sales strategies.

02. What are the challenges in the North America Sales Intelligence Market?

Challenges in North America Sales Intelligence Market include data privacy concerns due to stringent regulations like GDPR and CCPA, high initial costs of AI-powered platforms, and the complexity of integrating these tools with existing CRM systems.

03. Who are the major players in the North America Sales Intelligence Market?

Major players in the North America Sales Intelligence Market include Salesforce, Oracle Corporation, ZoomInfo, Dun & Bradstreet, and InsideView. These companies dominate due to their extensive product portfolios, global reach, and strong integration of AI and cloud technologies.

04. What are the growth drivers for the North America Sales Intelligence Market?

The growth of the Sales Intelligence market is driven by the increasing adoption of AI and ML in sales platforms, the rising demand for customer data analytics, and the integration of these tools with existing enterprise CRM systems.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.