North America Satellite Launch Vehicle Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD1753

October 2024

97

About the Report

North America Satellite Launch Vehicle Market Overview

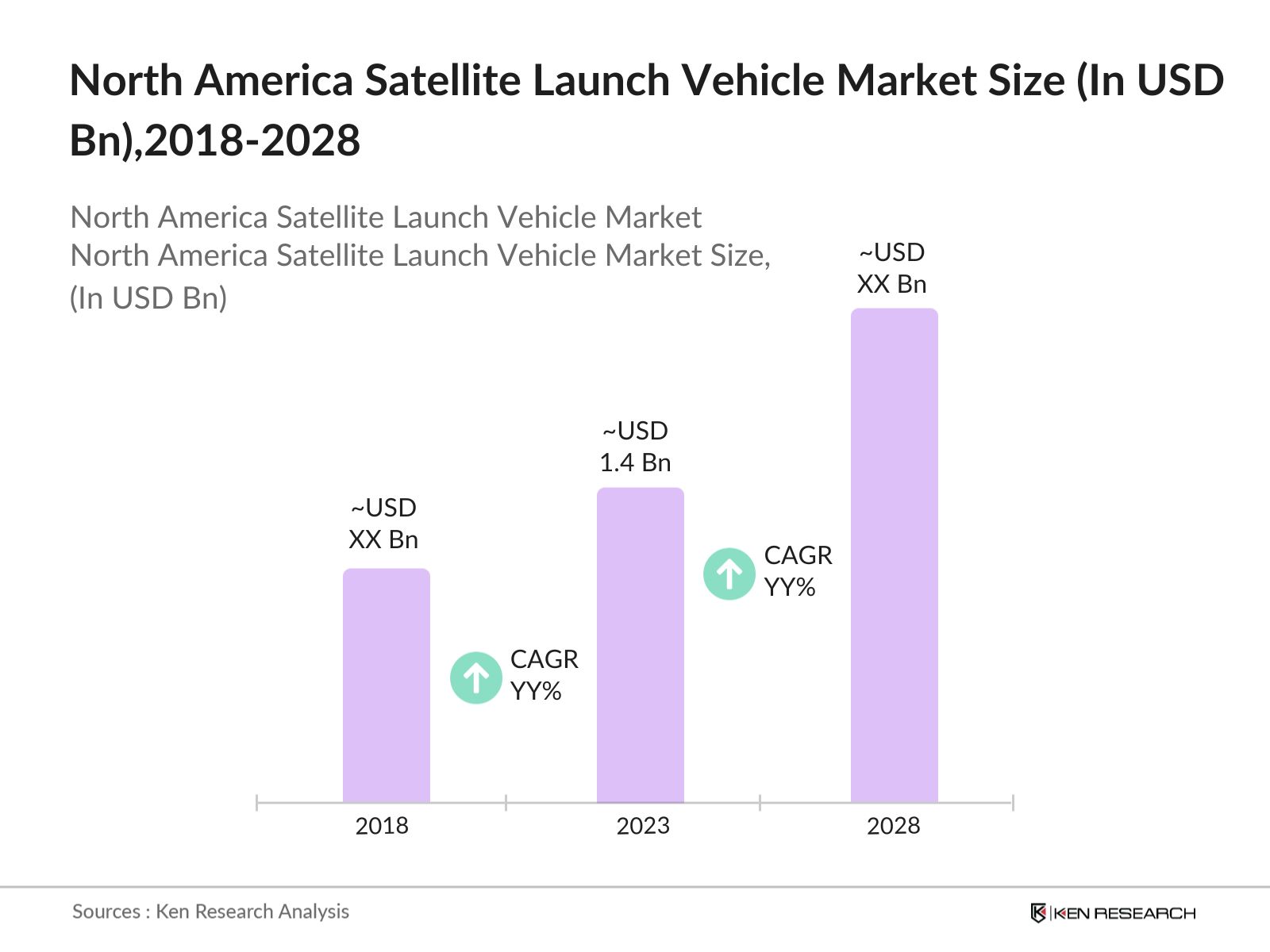

- The North America Satellite Launch Vehicle (SLV) Market was valued at USD 1.4 billion in 2023. The growth is primarily driven by the increasing demand for satellite-based services, including communications, earth observation, and navigation, as well as the rising interest in space exploration from both government and private sectors. The emergence of commercial space companies and the expansion of government space programs have further bolstered market expansion.

- The key players in the market are SpaceX, United Launch Alliance (ULA), Northrop Grumman, Blue Origin, and Rocket Lab. These companies have been instrumental in driving innovation and reducing the costs of launching satellites, which has made space more accessible. SpaceX, in particular, has revolutionized the market with its reusable Falcon rockets, which have significantly lowered the cost per launch.

- In 2023, Rocket Lab successfully launched its Electron rocket from Virginia, marking the companys first U.S. launch and expanding its reach within North America. This milestone strengthens Rocket Lab's position in the SLV market, with plans to increase launch frequency and support the growing demand for satellite deployment.

- California, particularly the Los Angeles area, is the dominant region in the market, hosting key players. The regions dominance is due to its well-established aerospace industry, proximity to key government agencies like NASA, and a robust supply chain for launch vehicle components.

North America Satellite Launch Vehicle Market Segmentation

The market is segmented into various factors like product, end-user, and region.

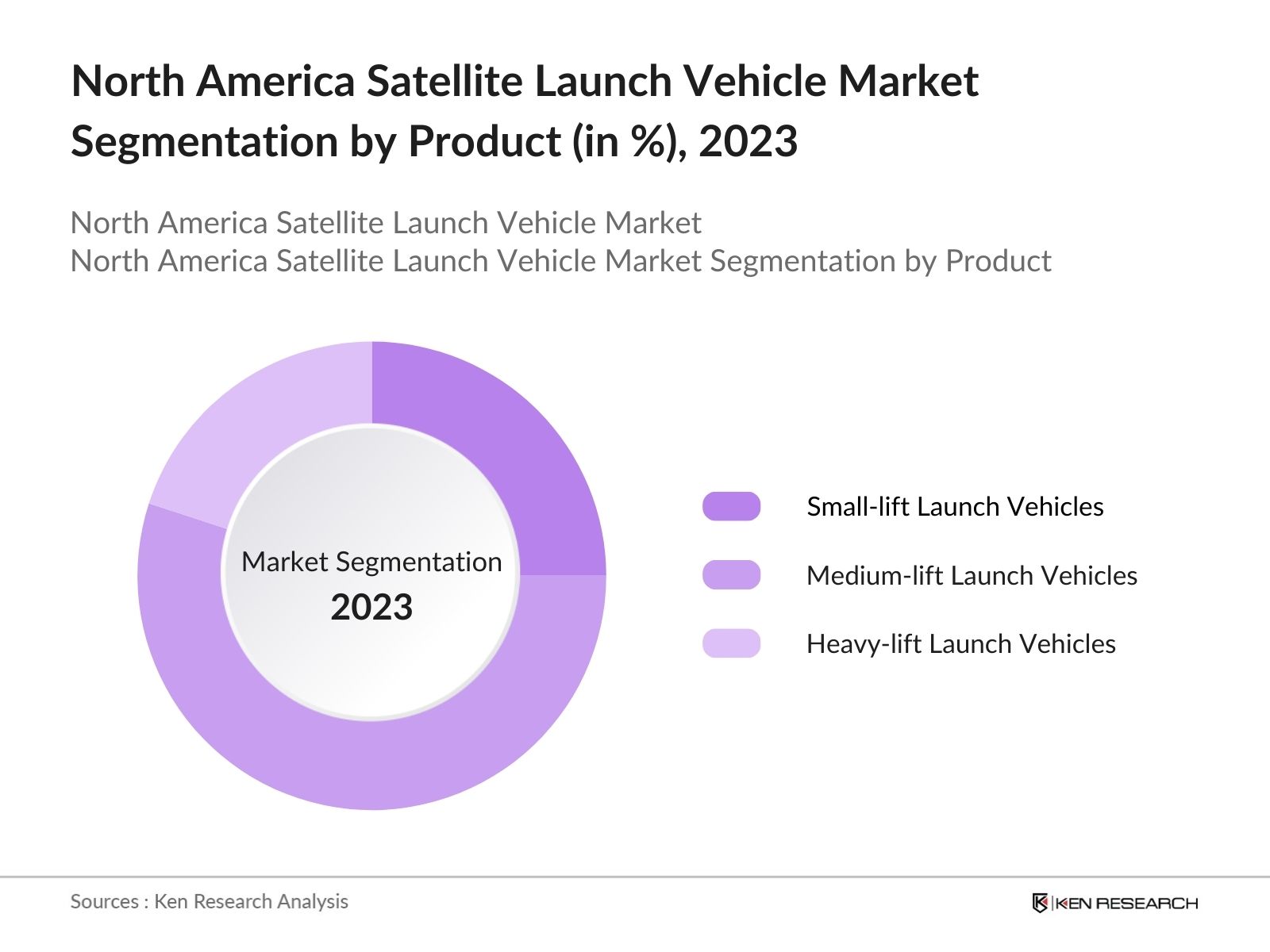

By Product: The market is segmented by product type into small-lift launch vehicles, medium-lift launch vehicles, and heavy-lift launch vehicles. In 2023, medium-lift launch vehicles held the dominant market share due to their versatility in launching a wide range of satellites, including communication, earth observation, and scientific research satellites.

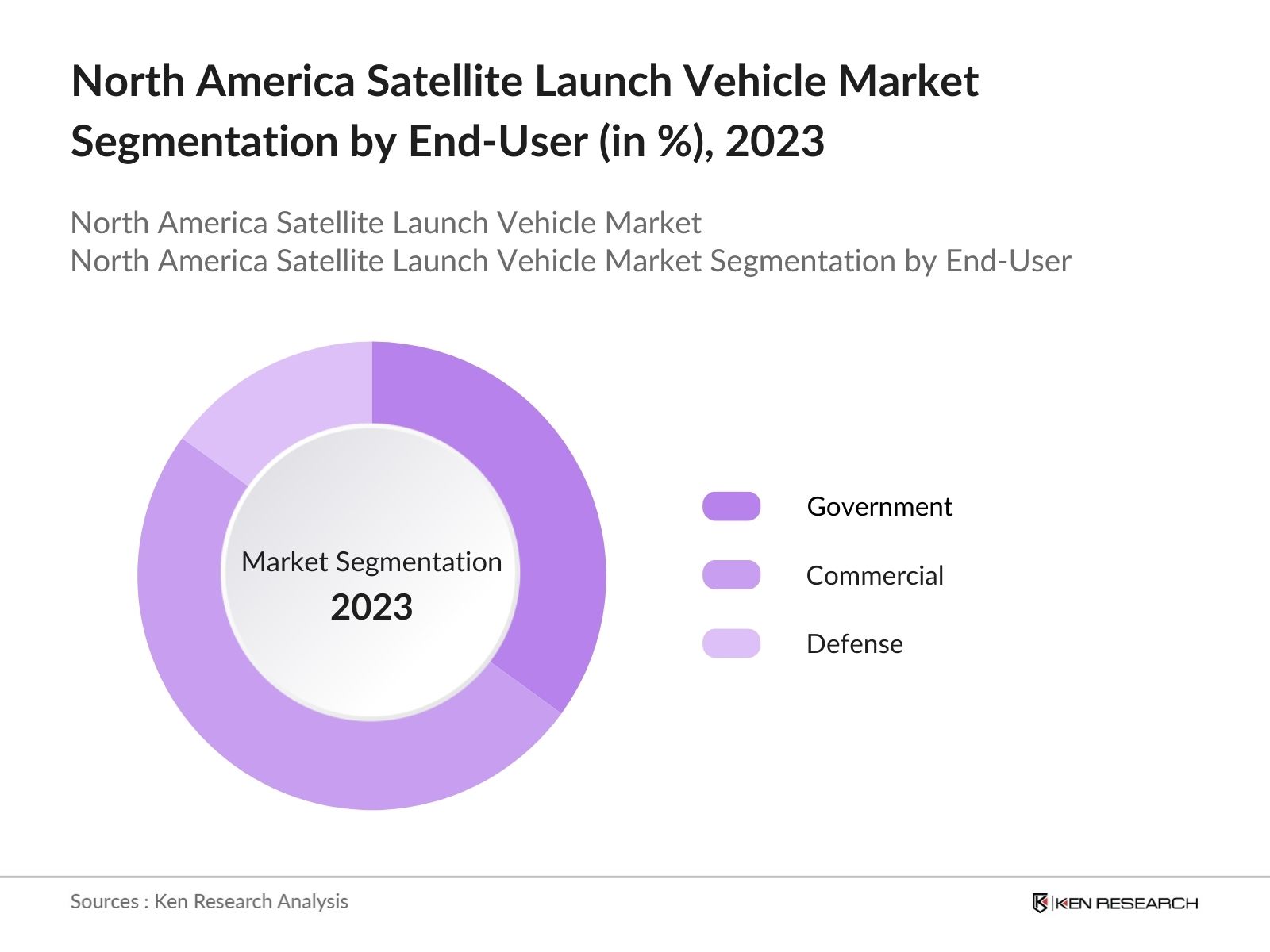

By End-User: The market is further segmented by end-users into government, commercial, and defense sectors. In 2023, the commercial sector emerged as the largest end-user segment, with growth in the commercial segment is attributed to the rising number of private companies entering the space industry and the increasing demand for satellite-based services such as broadband internet, satellite TV, and earth observation.

By Region: The market is segmented by region into the USA and Canada. In 2023, the USA held the dominant market share of its advanced space infrastructure, significant government funding, and the presence of leading companies such as SpaceX, ULA, and Blue Origin.

North America Satellite Launch Vehicle Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

SpaceX |

2002 |

Hawthorne, California |

|

United Launch Alliance (ULA) |

2006 |

Centennial, Colorado |

|

Northrop Grumman |

1939 |

Falls Church, Virginia |

|

Blue Origin |

2000 |

Kent, Washington |

|

Rocket Lab |

2006 |

Long Beach, California |

- SpaceX: In late 2024, SpaceX is set to launch the Fram2 mission, the first human spaceflight to explore Earth from a polar orbit. This mission will involve a crew of international adventurers and will conduct groundbreaking research, including studying auroras and capturing the first human X-ray images in space at altitudes of 425-450 km.

- Blue Origin: Blue Origin's New Glenn rocket is progressing towards its inaugural launch, anticipated in late 2024. Designed as a fully reusable heavy-lift vehicle, it aims to deliver over 45 metric tons to low Earth orbit, directly competing with SpaceX's Falcon Heavy and enhancing the competitive landscape of space launch services.

North America Satellite Launch Vehicle Market Analysis

Market Growth Drivers

- Increased Government Support in Space Infrastructure: In the first quarter of 2024, the U.S. space industry witnessed a surge with 41 launches completed by February, marking the fastest start of the Space Age. This rapid launch cadence is driven by advancements in commercial and civil spacecraft technology, fueling the growth of the market.

- Rising Demand for Satellite-Based Broadband Services: With more than 2,000 low-earth orbit (LEO) satellites deployed by mid-2024, the demand for satellite-based broadband services has surged, particularly in remote and underserved areas. Companies like SpaceX and Amazon's Project Kuiper are leading the charge, launching numerous satellites to create global broadband networks.

- Expansion of Commercial Space Ventures: By 2024, commercial space ventures have seen exponential growth, with over 150 private companies actively participating in satellite launches and related services. This includes startups and established aerospace firms investing in small-satellite constellations, earth observation satellites, and space tourism.

Market Challenges

- Space Debris and Collision Risk: By 2024, the number of trackable objects in orbit has surpassed 35,000, leading to heightened concerns over space debris and collision risks. The growing clutter in space has become a challenge for the SLV market, as it increases the complexity and cost of mission planning and satellite deployment. Addressing this issue requires the development of advanced debris mitigation technologies and more stringent regulatory frameworks.

- Supply Chain Disruptions: Ongoing global supply chain disruptions, exacerbated by geopolitical tensions and the lingering effects of the COVID-19 pandemic, have impacted the availability of critical components for launch vehicles. In 2024, delays in the delivery of key materials and parts have led to postponed launches and increased costs for manufacturers. This challenge underscores the need for more resilient and diversified supply chains in the SLV market.

Government Initiative

- U.S. Space Force Budget Increase: In 2024, the U.S. government increased the budget for the Space Force to USD 30 billion, with a significant portion allocated to satellite launch operations and the development of new SLVs. This budgetary boost is intended to enhance national security capabilities in space and support the deployment of next-generation military satellites, driving demand for advanced launch vehicles.

- Canadian Space Agency's Satellite Deployment Program: In 2023, the Canadian government launched a $1.012 billion initiative to enhance Earth observation capabilities, focusing on climate monitoring and environmental management through the RADARSAT+ program over the next 15 years. This initiative aims to bolster Canadas presence in space and stimulate domestic demand for launch vehicles, contributing to the overall growth of the SLV industry in North America.

North America Satellite Launch Vehicle Market Future Outlook

The future trends in the North America SLV Industry include a surge in small satellite launches, advancements in reusable launch vehicles, increased government-private sector collaborations, and the growth of space tourism.

Future Market Trends

- Growth in Small Satellite Launches: Over the next five years, the market will see a substantial increase in the number of small satellite launches, with more than 10,000 small satellites expected to be deployed by 2028. This trend will be driven by the proliferation of LEO satellite constellations for broadband services, earth observation, and IoT applications, necessitating frequent and cost-effective launch options.

- Advancement in Reusable Launch Vehicles: By 2028, advancements in reusable launch vehicle technology will become more widespread, with more companies adopting reusable systems to reduce costs and increase launch frequency. Reusability is expected to lower the cost of access to space significantly, making satellite deployment more affordable for a broader range of industries and applications.

Scope of the Report

|

By Product |

Small-lift Launch Vehicles Medium-lift Launch Vehicles Heavy-lift Launch Vehicles |

|

By End-User |

Government Commercial Defense |

|

By Region |

USA Canada |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Satellite manufacturing companies

Telecommunication companies

Bank and financial institutions

Investment firms focused on aerospace

Government Regulatory Bodies

Venture Capitalist

Companies

Players Mentioned in the Report:

SpaceX

United Launch Alliance (ULA)

Northrop Grumman

Blue Origin

Rocket Lab

Sierra Nevada Corporation

Boeing Defense, Space & Security

Lockheed Martin

Orbital ATK

Virgin Orbit

Firefly Aerospace

Relativity Space

Astrobotic Technology

Masten Space Systems

Vector Launch

Table of Contents

1. North America Satellite Launch Vehicle Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Satellite Launch Vehicle Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Satellite Launch Vehicle Market Analysis

3.1. Growth Drivers

3.1.1. Increased Government Investment

3.1.2. Rising Demand for Satellite-Based Services

3.1.3. Expansion of Commercial Space Ventures

3.1.4. Enhanced Government-Private Sector Collaborations

3.2. Restraints

3.2.1. High Costs of Development

3.2.2. Regulatory Hurdles

3.2.3. Space Debris and Collision Risk

3.2.4. Supply Chain Disruptions

3.3. Opportunities

3.3.1. Advancements in Reusable Technology

3.3.2. New Satellite Constellations

3.3.3. Growing Space Tourism Market

3.3.4. Expanding Space Defense Initiatives

3.4. Trends

3.4.1. Increased Use of Reusable Launch Vehicles

3.4.2. Growth of Small Satellite Launches

3.4.3. Development of Heavy-Lift Capabilities

3.4.4. Integration of AI and Data Analytics

3.5. Government Regulation

3.5.1. U.S. Space Force Initiatives

3.5.2. NASAs Artemis Program

3.5.3. Canadian Space Program Expansion

3.5.4. Mexicos National Space Program

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. North America Satellite Launch Vehicle Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Small-Lift Launch Vehicles

4.1.2. Medium-Lift Launch Vehicles

4.1.3. Heavy-Lift Launch Vehicles

4.2. By End-User (in Value %)

4.2.1. Government

4.2.2. Commercial

4.2.3. Defense

4.3. By Region (in Value %)

4.3.1. USA

4.3.2. Canada

5. North America Satellite Launch Vehicle Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. SpaceX

5.1.2. United Launch Alliance (ULA)

5.1.3. Northrop Grumman

5.1.4. Blue Origin

5.1.5. Rocket Lab

5.1.6. Sierra Nevada Corporation

5.1.7. Boeing Defense, Space & Security

5.1.8. Lockheed Martin

5.1.9. Orbital ATK

5.1.10. Virgin Orbit

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. North America Satellite Launch Vehicle Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. North America Satellite Launch Vehicle Market Regulatory Framework

7.1. U.S. Federal Aviation Administration (FAA) Regulations

7.2. Compliance Requirements

7.3. Certification Processes

8. North America Satellite Launch Vehicle Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. North America Satellite Launch Vehicle Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By End-User (in Value %)

9.3. By Region (in Value %)

10. North America Satellite Launch Vehicle Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step:1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building:

Collating statistics on this industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for North America Satellite Launch Vehicle industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output:

Our team will approach multiple satellite manufacturers companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such satellite manufacturers companies.

Frequently Asked Questions

01 How big is the North America Satellite Launch Vehicle market?

The North America Satellite Launch Vehicle (SLV) Market was valued at USD 1.4 billion in 2023. The growth is primarily driven by the increasing demand for satellite-based services, including communications, earth observation, and navigation, as well as the rising interest in space exploration from both government and private sectors.

02 What are the challenges in the North America Satellite Launch Vehicle market?

Challenges in the North America Satellite Launch Vehicle market include space debris and collision risks, high costs of launch vehicle development, regulatory hurdles, and supply chain disruptions affecting component availability.

03 Who are the major players in the North America Satellite Launch Vehicle market?

Key players in the North America Satellite Launch Vehicle market include Microsoft, OpenAI, IBM, Google, and Amazon Web Services (AWS), all of which are leading the development and innovation of AI-driven coding tools.

04 What are the main growth drivers of the North America Satellite Launch Vehicle market?

The growth of the North America Satellite Launch Vehicle market includes increasing government investment in space infrastructure, rising demand for satellite-based broadband services, expansion of commercial space ventures, and enhanced collaboration between governments and private companies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.