North America Set Top Box Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD7602

November 2024

82

About the Report

North America Set Top Box Market Overview

- The North American set-top box (STB) market is valued at USD 6 billion, a segment of the consumer electronics industry, driven by technological advancements and evolving consumer preferences. In 2023, the market was, reflecting a steady demand for devices that facilitate access to digital television and streaming services.

- The United States stands as the dominant player in the North American STB market, primarily due to its large consumer base and high adoption rates of advanced television services. The country's robust infrastructure supports widespread distribution and utilization of set-top boxes, catering to a diverse range of content consumption needs.

- The Federal Communications Commission (FCC) enforces regulations to ensure that set-top boxes meet specific technical standards, including energy efficiency and interoperability. the relevant Energy Star specification for set-top boxes is Version 5.1, which became effective on March 31, 2023. These regulations necessitate that manufacturers design devices that adhere to stringent guidelines, influencing production processes and costs.

North America Set Top Box Market Segmentation

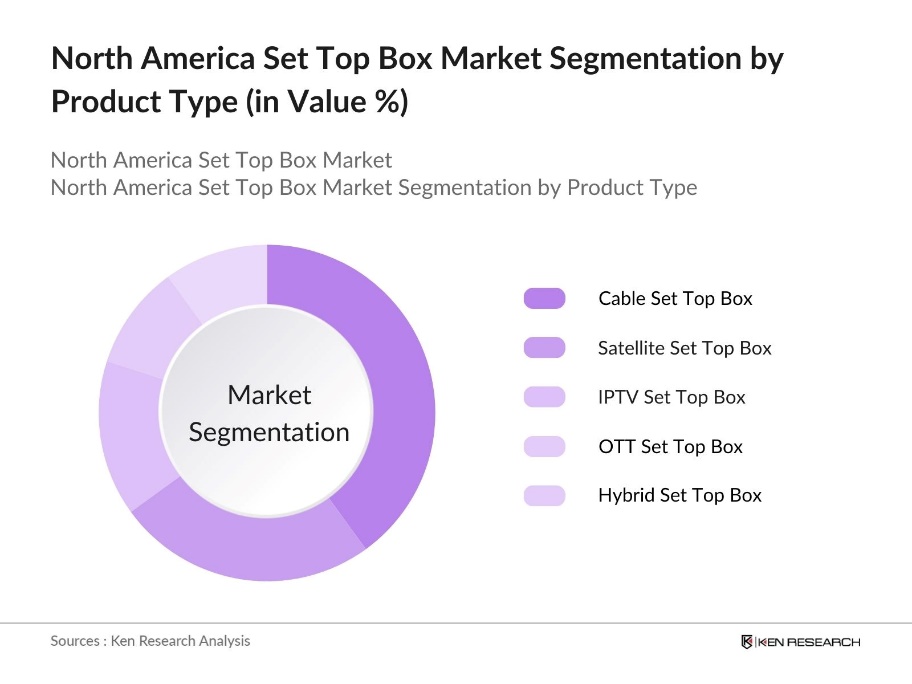

By Product Type: The market is segmented into cable, satellite, IPTV, OTT, and hybrid set-top boxes. Among these, cable set-top boxes have traditionally held a significant market share, driven by established cable television networks and consumer loyalty. However, the OTT segment is rapidly gaining traction, fueled by the increasing popularity of streaming services that offer on-demand content.

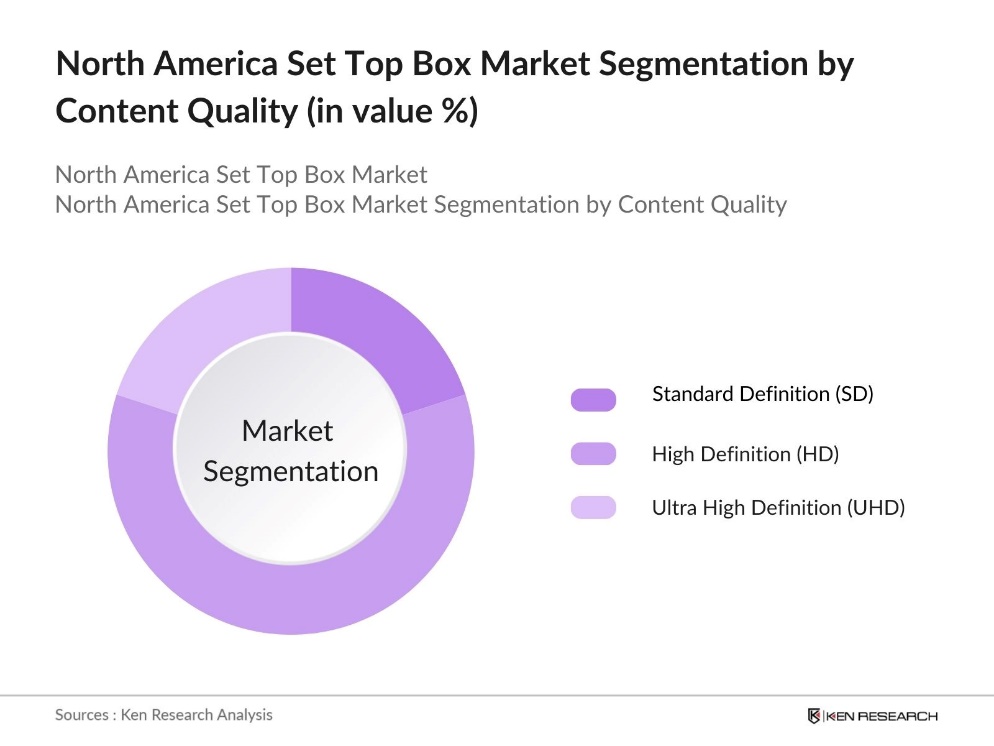

By Content Quality: The market is segmented by Content quality segmentation includes Standard Definition (SD), High Definition (HD), and Ultra High Definition (UHD) set-top boxes. HD set-top boxes dominate the market, as consumers increasingly demand higher picture quality for an enhanced viewing experience. The transition from SD to HD has been accelerated by broadcasters and content providers upgrading their offerings to meet consumer expectations.

North America Set Top Box Market Competitive Landscape

The North American STB market is characterized by the presence of both established and emerging players, each contributing to the market's competitive dynamics.

North America Set Top Box Industry Analysis

Growth Drivers

- Rising Demand for OTT Services: The surge in Over-The-Top (OTT) services has significantly influenced the North American set-top box market. In 2023, the number of users for over-the-top (OTT) video services in the United States which represents about 75% of the U.S. population. This growing user base has driven the demand for advanced set-top boxes capable of seamlessly integrating streaming platforms, enhancing user experience, and accommodating the diverse content preferences of consumers.

- Technological Advancements: Technological innovations have been pivotal in shaping the set-top box market. The integration of features such as voice control, 4K resolution, and artificial intelligence has elevated user engagement. For instance, the adoption of 4K Ultra HD televisions in North America reached over 50 million units in 2023, necessitating compatible set-top boxes to deliver optimal viewing experiences.

- Digitalization Initiatives: Government digitalization initiatives have driven the shift from analog to digital broadcasting, pushing demand for digital set-top boxes in North America. Policies requiring digital receivers for over-the-air television enhance compliance and broadcast quality. These efforts replace outdated systems, offering consumers improved access to diverse digital content and stimulating growth in the digital set-top box market.

Market Challenges

- Cord-Cutting Trend: The trend of cord-cutting presents a notable challenge to the set-top box market, as many households are shifting from traditional pay-TV services to streaming alternatives. This shift lowers demand for conventional set-top boxes, pushing manufacturers to adapt by incorporating streaming functionalities into their devices to remain competitive.

- High Competition: The set-top box market faces strong competition from smart TVs and streaming devices, which often offer built-in streaming capabilities. This competition drives manufacturers to continuously innovate and differentiate their products to maintain relevance and appeal to consumers looking for integrated viewing solutions.

North America Set Top Box Market Future Outlook

Over the next five years, the North American set-top box market is expected to experience moderate growth, driven by continuous technological advancements and the integration of smart features. The shift towards OTT platforms and the demand for UHD content are anticipated to shape the market dynamics, encouraging manufacturers to innovate and offer more versatile devices.

Market Opportunities

- Integration with Smart Home Devices: The rise of smart home ecosystems opens new opportunities for set-top box integration. As more households adopt smart home technology, set-top boxes that can connect and interact with these devices offer enhanced convenience and centralized control, appealing to consumers looking for cohesive, streamlined home automation solutions.

- Expansion of 4K and 8K Content: The growing availability of 4K and 8K content is driving demand for compatible set-top boxes. This trend offers manufacturers opportunities to meet consumer preferences for high-resolution, immersive viewing experiences, catering to the markets increasing appetite for premium visual quality in home entertainment.

Scope of the Report

|

By Product Type |

Cable Set Top Box |

|

By Content Quality |

Standard Definition (SD) Ultra High Definition (UHD) |

|

By End User |

Residential |

|

By Distribution Channel |

Online |

|

By Region |

United States |

Products

Key Target Audience

Set-Top Box Manufacturers

Telecommunication Companies

Broadcasting Companies

Technology Industry

Government and Regulatory Bodies (e.g., Federal Communications Commission)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Comcast Corporation

AT&T Inc.

Dish Network Corporation

Cisco Systems, Inc.

ARRIS International plc (CommScope)

Roku Inc.

Apple Inc.

Amazon.com, Inc.

Samsung Electronics Co., Ltd.

Sony Corporation

Table of Contents

1. North America Set Top Box Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Set Top Box Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Set Top Box Market Analysis

3.1. Growth Drivers (Rising Demand for OTT Services, Technological Advancements, Digitalization Initiatives)

3.1.1. Rising Demand for OTT Services

3.1.2. Technological Advancements

3.1.3. Digitalization Initiatives

3.1.4. Increasing HD Content Consumption

3.2. Market Challenges (Cord-Cutting Trend, High Competition, Regulatory Constraints)

3.2.1. Cord-Cutting Trend

3.2.2. High Competition

3.2.3. Regulatory Constraints

3.2.4. High Manufacturing Costs

3.3. Opportunities (Integration with Smart Home Devices, Expansion of 4K and 8K Content, Cloud-Based Set Top Boxes)

3.3.1. Integration with Smart Home Devices

3.3.2. Expansion of 4K and 8K Content

3.3.3. Cloud-Based Set Top Boxes

3.4. Trends (Adoption of Android-Based Set Top Boxes, Voice Control Features, Personalized Content Recommendations)

3.4.1. Adoption of Android-Based Set Top Boxes

3.4.2. Voice Control Features

3.4.3. Personalized Content Recommendations

3.5. Government Regulation (FCC Regulations, Import Tariffs, Content Licensing Laws)

3.5.1. FCC Regulations

3.5.2. Import Tariffs

3.5.3. Content Licensing Laws

3.5.4. Net Neutrality Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. North America Set Top Box Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Cable Set Top Box

4.1.2. Satellite Set Top Box

4.1.3. IPTV Set Top Box

4.1.4. OTT (Over-The-Top) Set Top Box

4.1.5. Hybrid Set Top Box

4.2. By Content Quality (In Value %)

4.2.1. Standard Definition (SD)

4.2.2. High Definition (HD)

4.2.3. Ultra High Definition (UHD)

4.3. By End User (In Value %)

4.3.1. Residential

4.3.2. Commercial

4.4. By Distribution Channel (In Value %)

4.4.1. Online

4.4.2. Offline

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Set Top Box Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Comcast Corporation

5.1.2. AT&T Inc.

5.1.3. Dish Network Corporation

5.1.4. Cisco Systems, Inc.

5.1.5. ARRIS International plc (CommScope)

5.1.6. Roku Inc.

5.1.7. Apple Inc.

5.1.8. Amazon.com, Inc.

5.1.9. Samsung Electronics Co., Ltd.

5.1.10. Sony Corporation

5.1.11. Google LLC

5.1.12. Technicolor SA

5.1.13. Humax Co., Ltd.

5.1.14. Skyworth Digital Holdings Ltd.

5.1.15. EchoStar Corporation

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, R&D Investment, Geographical Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. North America Set Top Box Market Regulatory Framework

6.1. FCC Regulations

6.2. Import Tariffs

6.3. Compliance Requirements

6.4. Certification Processes

7. North America Set Top Box Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Set Top Box Future Market Segmentation

8.1. By Product Type (In Value %)

8.1.1. Cable Set Top Box

8.1.2. Satellite Set Top Box

8.1.3. IPTV Set Top Box

8.1.4. OTT Set Top Box

8.1.5. Hybrid Set Top Box

8.2. By Content Quality (In Value %)

8.2.1. Standard Definition (SD)

8.2.2. High Definition (HD)

8.2.3. Ultra High Definition (UHD)

8.3. By End User (In Value %)

8.3.1. Residential

8.3.2. Commercial

8.4. By Distribution Channel (In Value %)

8.4.1. Online

8.4.2. Offline

8.5. By Region (In Value %)

8.5.1. United States

8.5.2. Canada

8.5.3. Mexico

9. North America Set Top Box Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the North America Set Top Box Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the North America Set Top Box Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple set-top box manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the North America Set Top Box market.

Frequently Asked Questions

01. How big is the North America Set Top Box Market?

The North America Set Top Box Market was valued at USD 6 billion, driven by technological advancements and evolving consumer preferences.

02. What are the challenges in the North America Set Top Box Market?

Challenges in North America Set Top Box Market include the cord-cutting trend, high competition among manufacturers, and regulatory constraints that impact market dynamics.

03. Who are the major players in the North America Set Top Box Market?

Key players in North America Set Top Box Market include Comcast Corporation, AT&T Inc., Dish Network Corporation, Roku Inc., and Apple Inc., each contributing significantly to the market.

04. What are the growth drivers of the North America Set Top Box Market?

The North America Set Top Box Market is propelled by factors such as the rising demand for OTT services, technological advancements, and digitalization initiatives across the region.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.