North America Skincare Market Outlook to 2030

Region:North America

Author(s):Sanjna

Product Code:KROD11060

December 2024

96

About the Report

North America Skincare Market Overview

- The North America skincare market is valued at USD 32 billion, driven primarily by a growing consumer focus on health, wellness, and personal care. Major drivers include increasing demand for anti-aging products, organic skincare, and innovations in dermatology-backed brands. With consumer awareness rising regarding the importance of skin health, brands are increasingly investing in clean, sustainable ingredients that appeal to health-conscious buyers.

- The United States leads the market, fueled by its robust retail infrastructure and high consumer spending. Additionally, metropolitan areas like New York, Los Angeles, and Chicago dominate due to their high population density, affluent customer base, and consumer preference for premium skincare products. Canada also plays a significant role in market growth, driven by a preference for natural and eco-friendly brands.

- The FDA enforces strict guidelines on skincare products in North America, particularly on ingredient safety and efficacy claims. As of December 29, 2023, all facilities that manufacture or process cosmetic products distributed in the U.S. are required to register with the FDA. This represents a shift from previous voluntary registration practices to mandatory compliance, ensuring better oversight of the cosmetics industry.

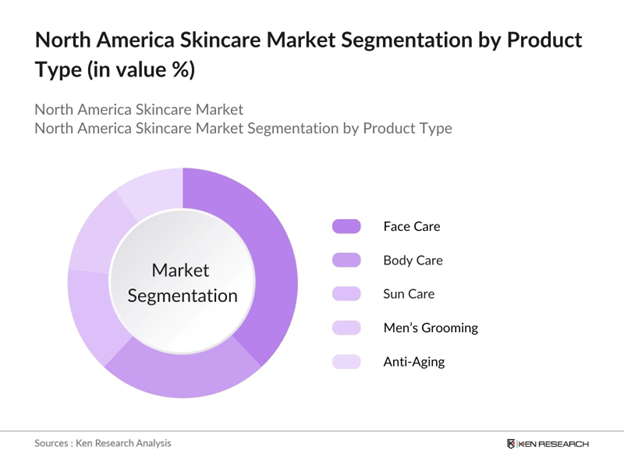

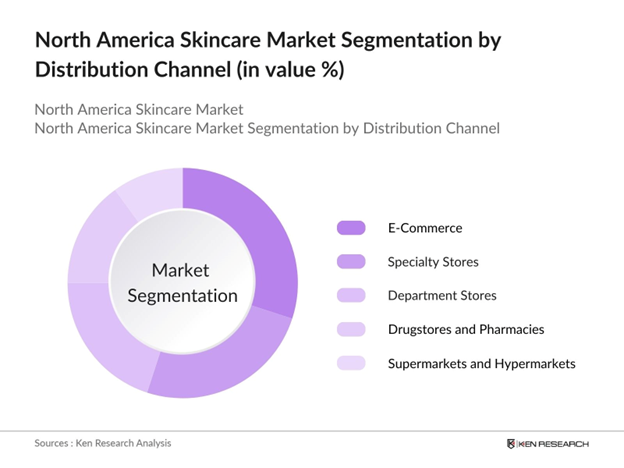

North America Skincare Market Segmentation

By Product Type: The North America skincare market is segmented by product type into face care, body care, sun care, mens grooming, and anti-aging products. Face care products, including moisturizers and serums, hold a dominant market share due to their daily use and essential role in personal care routines. Brands like Este Lauder and L'Oral have established strong consumer loyalty with innovative formulations and dermatologist-recommended products that cater to varied skin types, contributing to this segment's dominance.

By Distribution Channel: The market is segmented by distribution channel into e-commerce, specialty stores, department stores, drugstores and pharmacies, and supermarkets and hypermarkets. E-commerce channels are the leading segment due to the convenience and wide variety they offer. Online platforms such as Amazon, Sephora, and Ulta provide consumers with extensive choices, competitive pricing, and exclusive deals, which attract a significant share of the skincare market.

North America Skincare Market Competitive Landscape

The North America skincare market is dominated by key players who focus on technological advancements, product innovation, and sustainability. Global companies such as Este Lauder, L'Oral, and Johnson & Johnson have a strong presence, supported by their extensive research and development, innovative product launches, and robust distribution networks.

North America Skincare Market Analysis

Growth Drivers

- Increased Consumer Demand for Clean Beauty: Consumer awareness in North America regarding the harmful effects of certain chemicals in skincare products has spiked, resulting in a notable increase in demand for clean beauty products. This trend is further supported by the U.S. Bureau of Economic Analysis, showing that households in the U.S. allocate approximately $1.2 billion annually on eco-friendly personal care items. With the rise of eco-consciousness, clean beauty products are predicted to remain prominent in consumer spending on skincare.

- Technological Advancements in Formulation: Advances in skincare formulation technology are driving innovation in North Americas skincare market. Developments such as encapsulation technology, which improves active ingredient stability, are enhancing the efficacy of skincare products. The U.S. Patent Office reported a 15% increase in patents filed for skincare formulations that use nanotechnology and encapsulation techniques. Companies focusing on technologically advanced formulations are likely to see higher engagement as these products better address skin concerns and reduce adverse reactions.

- Rise of Digital Shopping Platforms: The rise in digital shopping for skincare products has transformed consumer buying patterns across North America. In 2023, Statista reported that online sales in the skincare segment reached 12 million units, attributed to growing convenience and accessibility. U.S. e-commerce platforms have also noted a 23% increase in skincare-related searches in the past year, reflecting a robust shift to online purchasing. This digital shift is expected to create a seamless shopping experience that encourages a more consistent consumer base for skincare brands.

Challenges

- Pricing Constraints: While the demand for premium skincare is on the rise, pricing constraints remain a challenge in North America. As reported by the Bureau of Labor Statistics, the inflation rate for personal care products has increased by 2.5% in 2024, affecting the affordability of high-end skincare. This rise in costs has limited consumer access to certain luxury brands, particularly as disposable incomes fluctuate. Budget-conscious consumers often opt for alternative brands, which impacts the market share of premium skincare providers.

- Regulatory Standards Compliance: Complying with stringent regulatory standards in North America adds complexity to the skincare industry. The FDA has enforced strict guidelines on ingredient transparency, causing a rise in formulation costs by 7% since 2022, as companies need to re-evaluate ingredients and labeling. The agency has also mandated frequent safety assessments, which further adds to operational costs and affects product rollout timelines. As the demand for clean ingredients grows, adhering to these regulations while maintaining quality remains a challenge for skincare companies.

North America Skincare Market Future Outlook

Over the next five years, the North America skincare market is expected to experience steady growth driven by continued consumer demand for clean and sustainable products, advancements in skincare technology, and increased accessibility of premium skincare through online channels. Additionally, innovations in skincare formulations tailored to specific skin concerns will further propel market growth.

Market Opportunities

- Expansion in Organic and Vegan Skincare: As consumer demand shifts toward organic and vegan skincare, brands have an opportunity to capture a growing niche. According to the USDA, organic personal care imports to the U.S. reached $210 million in 2023, reflecting consumer interest in organic formulations. This market expansion into organic and vegan products is a promising avenue for skincare brands aiming to capitalize on environmentally conscious consumers. With increased import allowances and consumer interest, this sector is projected to experience steady demand.

- Personalized Skincare Solutions: Demand for personalized skincare solutions is growing as consumers seek products tailored to their skin types. A recent survey by the American Academy of Dermatology (AAD) highlights that approximately 63% of U.S. consumers prefer customized skincare products. This trend is being driven by advancements in data analytics and skin diagnostics, making personalized solutions a lucrative segment for brands to explore. Companies that provide bespoke skincare are better positioned to attract and retain consumers by offering targeted results.

Scope of the Report

|

Segments |

Sub-Segments |

|

By Product Type |

Face Care Body Care Sun Care Mens Grooming Anti-Aging Products |

|

By Distribution Channel |

E-Commerce Specialty Stores Department Stores Drugstores and Pharmacies Supermarkets and Hypermarkets |

|

By Skin Type |

Normal Skin Sensitive Skin Dry Skin Oily Skin Combination Skin |

|

By Age Group |

Teenagers Young Adults Middle-Aged Adults Seniors |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience

Skincare and personal care product manufacturers

E-commerce platforms and digital marketplaces

Retail chains and specialty stores

Dermatologists and skin clinics

Formulation and raw material suppliers

Environmental and sustainability organizations

Investors and venture capitalist firms

Government and regulatory bodies (e.g., FDA, Health Canada)

Companies

Players Mentioned in the Report

Este Lauder Companies

L'Oral USA

Procter & Gamble

Johnson & Johnson

Unilever

Shiseido Company

Beiersdorf

Coty Inc.

Colgate-Palmolive Company

Glossier Inc.

Table of Contents

1. North America Skincare Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Evolution and Milestones

1.4. Market Segmentation Overview

2. North America Skincare Market Size (In USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Trends and Consumer Behavior

3. North America Skincare Market Analysis

3.1. Growth Drivers

3.1.1. Increased Consumer Demand for Clean Beauty

3.1.2. Technological Advancements in Formulation

3.1.3. Rise of Digital Shopping Platforms

3.1.4. Skin Health Awareness

3.2. Market Challenges

3.2.1. Pricing Constraints

3.2.2. Regulatory Standards Compliance

3.2.3. Supply Chain and Ingredient Sourcing

3.2.4. High Competition Among Brands

3.3. Opportunities

3.3.1. Expansion in Organic and Vegan Skincare

3.3.2. Personalized Skincare Solutions

3.3.3. Technological Innovations in Skincare Devices

3.3.4. Entry into Emerging Markets

3.4. Trends

3.4.1. Growth in Anti-Aging Products

3.4.2. Increasing Male Grooming Market

3.4.3. Rise of K-Beauty Influence

3.4.4. Skin Microbiome Products

3.5. Government Regulation

3.5.1. FDA and Compliance Standards

3.5.2. Labeling and Claims

3.5.3. Restricted Ingredients List

3.5.4. Environmental Sustainability Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

4. North America Skincare Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Face Care (Moisturizers, Serums, Cleansers, Masks)

4.1.2. Body Care (Lotions, Creams, Exfoliants)

4.1.3. Sun Care (Sunscreens, After-Sun Products)

4.1.4. Mens Grooming (Shaving Creams, Beard Oils, Moisturizers)

4.1.5. Anti-Aging Products (Wrinkle Reduction, Skin Firming)

4.2. By Distribution Channel (In Value %)

4.2.1. E-Commerce

4.2.2. Specialty Stores

4.2.3. Department Stores

4.2.4. Drugstores and Pharmacies

4.2.5. Supermarkets and Hypermarkets

4.3. By Skin Type (In Value %)

4.3.1. Normal Skin

4.3.2. Sensitive Skin

4.3.3. Dry Skin

4.3.4. Oily Skin

4.3.5. Combination Skin

4.4. By Age Group (In Value %)

4.4.1. Teenagers

4.4.2. Young Adults

4.4.3. Middle-Aged Adults

4.4.4. Seniors

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Skincare Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Este Lauder Companies

5.1.2. L'Oral USA

5.1.3. Procter & Gamble

5.1.4. Unilever

5.1.5. Shiseido Company

5.1.6. Johnson & Johnson

5.1.7. Beiersdorf

5.1.8. Colgate-Palmolive Company

5.1.9. Coty Inc.

5.1.10. Glossier Inc.

5.2. Cross Comparison Parameters (Revenue, R&D Investment, Product Range, Sustainability Initiatives, Market Share, Brand Positioning, Innovation Score, Digital Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives and Partnerships

5.5. Mergers and Acquisitions

5.6. Investment and Funding Analysis

6. North America Skincare Market Regulatory Framework

6.1. Labeling and Ingredient Transparency

6.2. FDA Regulations and Compliance Standards

6.3. Environmental and Sustainability Standards

6.4. Restrictions on Marketing and Claims

7. North America Skincare Market Future Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Growth Drivers for Future Market Expansion

8. North America Skincare Market Analysts' Recommendations

8.1. Market Expansion Opportunities

8.2. Digital Marketing and Consumer Engagement Strategies

8.3. Brand Positioning and Product Innovation

8.4. Sustainable Practices and Environmental Initiatives

Research Methodology

Step 1: Identification of Key Variables

The first step involved mapping key stakeholders within the North America skincare market. Extensive desk research and a combination of proprietary databases provided insights into factors driving consumer behavior, technological advancements, and the competitive landscape.

Step 2: Market Analysis and Construction

This phase involved compiling and analyzing historical data on the markets growth, product segmentation, and regional focus. Additional analysis on consumer preference patterns and product demand ensured data accuracy.

Step 3: Hypothesis Validation and Expert Consultation

To validate findings, interviews were conducted with industry experts, including key opinion leaders from skincare brands and dermatologists. These consultations provided insights into emerging trends and consumer preferences.

Step 4: Research Synthesis and Final Output

In the final stage, the data was synthesized, cross-verified, and organized to ensure a detailed, market-specific report. This output was structured to provide a comprehensive and validated analysis of the North America skincare market.

Frequently Asked Questions

01. How big is the North America Skincare Market?

The North America skincare market is valued at USD 32 billion, with growth driven by a demand for organic and dermatologist-backed products.

02. What are the challenges in the North America Skincare Market?

Challenges in North America skincare market include high competition, stringent regulatory standards, and rising costs of natural ingredients, impacting market dynamics.

03. Who are the major players in the North America Skincare Market?

Key players in North America skincare market include Este Lauder, L'Oral, Johnson & Johnson, Procter & Gamble, and Unilever, who dominate due to their established brands and distribution networks.

04. What are the growth drivers of the North America Skincare Market?

Growth drivers in North America skincare market include increased consumer interest in clean beauty, rising awareness about skin health, and advancements in product formulations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.