North America Small Caliber Ammunition Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD6995

December 2024

81

About the Report

North America Small Caliber Ammunition Market Overview

- The North America small caliber ammunition market is valued at USD 7.1 billion, based on historical trends of steady growth driven by increasing military expenditures and rising demand for civilian firearms, especially for self-defense. The U.S. Department of Defense continues to prioritize investments in modernizing its ammunition and firearms infrastructure to support domestic military requirements and export partnerships.

- In North America, the United States holds a dominance in the small caliber ammunition market, primarily due to its extensive military budget, advanced defense manufacturing, and high civilian gun ownership rates. Canada follows, with growing demand in its military and law enforcement sectors. The U.S. leads due to its diverse demand sourcesfrom law enforcement and self-defense to sporting activitiesmaking it a consistent driver for ammunition manufacturers.

- The U.S. government, through its defense procurement programs, has continued to prioritize funding for small caliber ammunition to support military readiness and operational requirements. The Department of Defense (DoD) has allocated funds in its 2024 budget specifically for ammunition procurement, enhancing the stability of demand for manufacturers in the North American market. These programs aim to ensure a consistent supply chain for ammunition to support national security interests.

North America Small Caliber Ammunition Market Segmentation

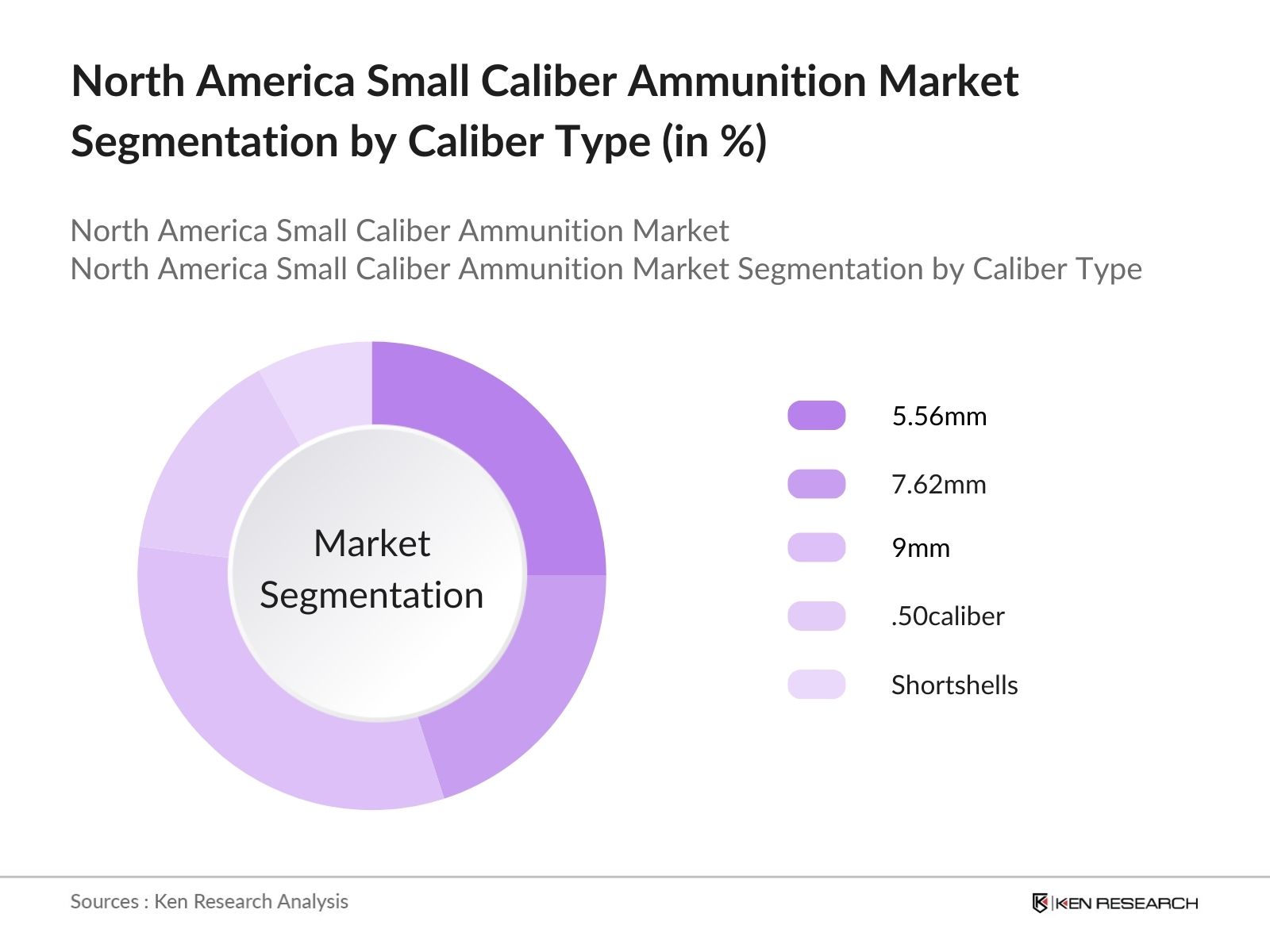

By Caliber Type: The market is segmented by caliber type into 5.56mm, 7.62mm, 9mm, .22LR, and .50 BMG. Among these, 9mm currently dominates market share due to its wide usage across military, law enforcement, and civilian markets. Its popularity stems from its compatibility with a range of pistols and submachine guns, making it a preferred choice for law enforcement in the U.S. and Canada. The 9mms balance of stopping power and control appeals to consumers, positioning it as the dominant caliber in this segment.

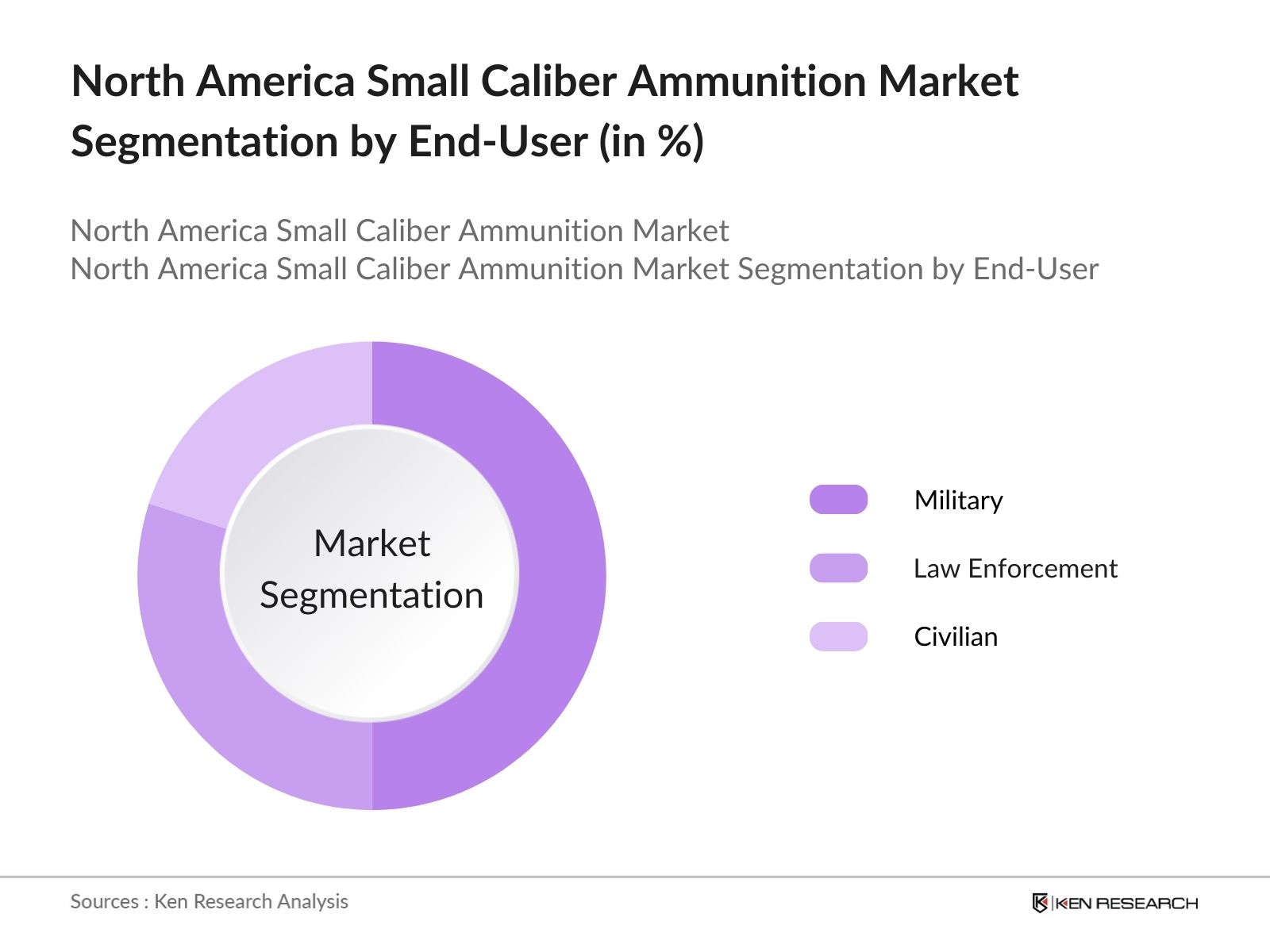

By End-User: The market is segmented by end-user into Military, Law Enforcement, and Civilian. The Military segment holds the largest share due to significant federal spending on ammunition for both domestic and allied defense operations. Military-grade ammunition demand remains high due to ongoing equipment modernization and frequent training exercises. Moreover, strategic stockpiling and upgrades in munitions have continued to drive this segment's dominance in the North America market.

North America Small Caliber Ammunition Market Competitive Landscape

The market is dominated by several major companies, each bringing unique strengths in manufacturing capacity, distribution, and technological advancements. The competitive landscape is shaped by both domestic production and international collaboration.

North America Small Caliber Ammunition Market Analysis

Market Growth Drivers

- Increased Demand from the Military Sector: In 2024, the North American defense sector continues to heavily invest in small caliber ammunition to meet growing demands for both domestic training and international operations. The U.S. military alone is estimated to procure over 500 million rounds of small caliber ammunition annually for operational needs. This demand is driven by military engagements, advanced training programs, and preparedness measures.

- Growing Popularity of Shooting Sports: The popularity of recreational shooting sports has been steadily increasing, with over 17 million individuals in North America participating annually. This activity, including target shooting and hunting, contributes to the demand for small caliber ammunition. Organizations such as the National Shooting Sports Foundation (NSSF) have reported an increase in registered shooting events and hunting licenses issued, translating into heightened ammunition sales.

- Rising Law Enforcement and Homeland Security Needs: North America's law enforcement sector, which includes federal, state, and local agencies, requires a consistent supply of small caliber ammunition for training, qualification, and operational purposes. In 2024, it is estimated that over 900,000 law enforcement personnel across the United States require regular training, creating a sustained demand for small caliber ammunition.

Market Challenges

- Stringent Regulatory Environment: Ammunition manufacturing and distribution face extensive regulations in North America, with compliance requirements for federal and state laws. For instance, the Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF) enforces strict regulations on ammunition production, which can increase compliance costs for manufacturers.

- Environmental Concerns Over Lead-Based Ammunition: Growing environmental concerns over lead-based ammunition have led to calls for stricter regulations and alternatives. Studies have shown that lead-based ammunition contributes to soil and water contamination, especially in hunting and outdoor shooting areas. In response, environmental agencies are advocating for the adoption of non-toxic alternatives.

North America Small Caliber Ammunition Market Future Outlook

Over the next five years, the North America small caliber ammunition industry is expected to see robust growth, spurred by steady military investment, law enforcement demand, and the civilian self-defense market.

Future Market Opportunities

- Increase in Eco-Friendly Ammunition Adoption: Over the next five years, demand for eco-friendly, lead-free ammunition is expected to grow substantially, driven by both environmental concerns and regulatory pressures. Manufacturers are anticipated to introduce new product lines focusing on non-toxic alternatives, with predictions indicating an annual increase in eco-friendly ammunition production across North America.

- Growth in Lightweight Ammunition Demand: With increased military and tactical demand for lightweight solutions, the development of polymer-based small caliber ammunition is expected to gain momentum. The industry is likely to witness the release of ammunition that offers reduced weight by 30% compared to traditional rounds, meeting the mobility requirements of military personnel.

Scope of the Report

|

Caliber |

5.56mm 7.62mm 9mm .22LR .50 BMG |

|

Bullet Type |

Lead Copper Brass Polymer-Coated |

|

End-User |

Military Law Enforcement Civilian/Sporting |

|

Gun Type |

Pistols Rifles Shotguns |

|

Region |

United States Canada Mexico |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies (e.g., Bureau of Alcohol, Tobacco, Firearms, and Explosives)

Military and Defense Organizations (e.g., U.S. Department of Defense)

Ammunition Manufacturers

Private Equity Firms

Investor and Venture Capitalist Firms

Banks and Financial Institution

Companies

Players Mentioned in the Report:

Northrop Grumman Corporation

Olin Corporation (Winchester Ammunition)

General Dynamics Ordnance and Tactical Systems

CBC Global Ammunition

FN Herstal

Remington Ammunition

Vista Outdoor Inc.

Nammo AS

BAE Systems Plc

Elbit Systems Ltd.

Table of Contents

North America Small Caliber Ammunition Market Overview

Definition and Scope

Market Taxonomy

Key Growth Metrics

Overview of Market Segmentation

North America Small Caliber Ammunition Market Size (USD Billion)

Historical Market Analysis

Year-On-Year Growth Overview

Key Milestones and Developments

North America Small Caliber Ammunition Market Analysis

Growth Drivers

Increased Military and Law Enforcement Procurement

Rising Civilian Demand for Self-Defense and Sports Shooting

Government Support for Domestic Manufacturing

Export Opportunities Driven by Global Defense Alliances

Market Challenges

Regulatory Restrictions on Ammunition Sales (Licensing and Permit Requirements)

Supply Chain Disruptions

Environmental Impact Concerns and Compliance Costs

Price Volatility of Raw Materials

Opportunities

Innovations in Ammunition Design (Lightweight and Eco-Friendly Materials)

Expanding Distribution through Online Platforms

Rising Investments in R&D and Advanced Manufacturing

Collaborations with Defense Contractors for Specialty Ammunition

Trends

Growth in Concealed Carry Permits

Use of Non-Lead and Non-Toxic Ammunition

Customization for Competitive Shooting

Rising Use of Modular and Hybrid Ammunition Systems

Government Regulations

Ammunition Background Checks and Compliance Standards

Import and Export Licensing Requirements

Environmental and Health Regulations for Ammunition Production

SWOT Analysis (Market-Specific Insights)

Industry Ecosystem Mapping

Porters Five Forces Analysis

Competitive Landscape Overview

North America Small Caliber Ammunition Market Segmentation

By Caliber Type (In Value %)

5.56mm

7.62mm

9mm

.50 Caliber

Shotshells

By Casing Type (In Value %)

Brass

Steel

By Bullet Type (In Value %)

Full Metal Jacket (FMJ)

Jacketed Hollow Point (JHP)

Soft Point (SP)

By Application (In Value %)

Military

Law Enforcement

Civilian (Hunting, Self-Defense, Sporting)

By Distribution Channel (In Value %)

Retail Stores (Large Outlets, Local Shops)

Online Stores

By Region (In Value %)

Canada

Mexico

USA

North America Small Caliber Ammunition Market Competitive Analysis

Profiles of Key Companies

Northrop Grumman Corporation

General Dynamics Ordnance and Tactical Systems

Nammo AS

CBC Global Ammunition

Olin Corporation

Vista Outdoor Inc.

FN Herstal

Poongsan Corporation

Denel SOC Ltd.

Aguila Ammunition

Sellier & Bellot

PPU USA Ammo

Wolf Performance Ammunition

FIOCCHI MUNIZIONI SPA

MAST Technology Inc.

Cross Comparison Parameters (Headquarters, Inception Year, Revenue, Regional Presence, Employee Count, Product Range, R&D Investment, Key Contracts)

Market Share Analysis

Strategic Developments

Mergers and Acquisitions

Investment and Funding Analysis

North America Small Caliber Ammunition Market Regulatory Framework

Production Standards and Certifications

Safety and Compliance Measures

Export Regulations and Trade Policies

North America Small Caliber Ammunition Future Market Size (USD Billion)

Market Size Forecasts

Key Influencing Factors for Future Growth

North America Small Caliber Ammunition Future Market Segmentation

By Caliber Type

By Casing Type

By Bullet Type

By Application

By Distribution Channel

By Region

North America Small Caliber Ammunition Market Analyst Recommendations

Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

Customer Behavior Analysis

Marketing and Outreach Strategies

Identification of White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive map of stakeholders in the North America small caliber ammunition market. This mapping leverages secondary research from reputable databases to pinpoint variables critical to understanding market trends and customer needs.

Step 2: Market Analysis and Construction

In this stage, historical data on production volumes, regulatory influences, and customer segments is analyzed. This includes evaluating the impact of domestic versus imported ammunition to determine the most accurate market revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Using telephone interviews with industry veterans and consulting defense experts, we validate primary hypotheses on segment performance and future growth. This input refines our revenue estimates and provides additional perspective on market direction.

Step 4: Research Synthesis and Final Output

Our final synthesis incorporates qualitative insights from direct engagement with ammunition manufacturers, providing a holistic view of key production metrics, customer preferences, and regulatory trends.

Frequently Asked Questions

How big is the North America Small Caliber Ammunition Market?

The North America small caliber ammunition market is valued at USD 7.1 billion, largely driven by military demand, civilian gun ownership, and law enforcement agencies.

What are the growth drivers of the North America Small Caliber Ammunition Market?

Key drivers in the North America small caliber ammunition market include federal defense investments, civilian firearm demand for self-defense, and the growing presence of private gun owners across the U.S. and Canada.

Who are the major players in the North America Small Caliber Ammunition Market?

Major players in the North America small caliber ammunition market include Northrop Grumman, Olin Corporation (Winchester), General Dynamics, CBC Global Ammunition, and FN Herstal, each leading due to their extensive product portfolios and government partnerships.

What challenges exist in the North America Small Caliber Ammunition Market?

Challenges in the North America small caliber ammunition market include regulatory restrictions, environmental concerns, and fluctuating material costs, which affect the sustainability and profitability of manufacturers.

Which segment is most prominent in the North America Small Caliber Ammunition Market?

The 9mm caliber segment is prominent due to its compatibility with civilian and law enforcement pistols, widespread availability, and popularity in self-defense applications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.