North America Smart Manufacturing Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD2929

October 2024

94

About the Report

North America Smart Manufacturing Market Overview

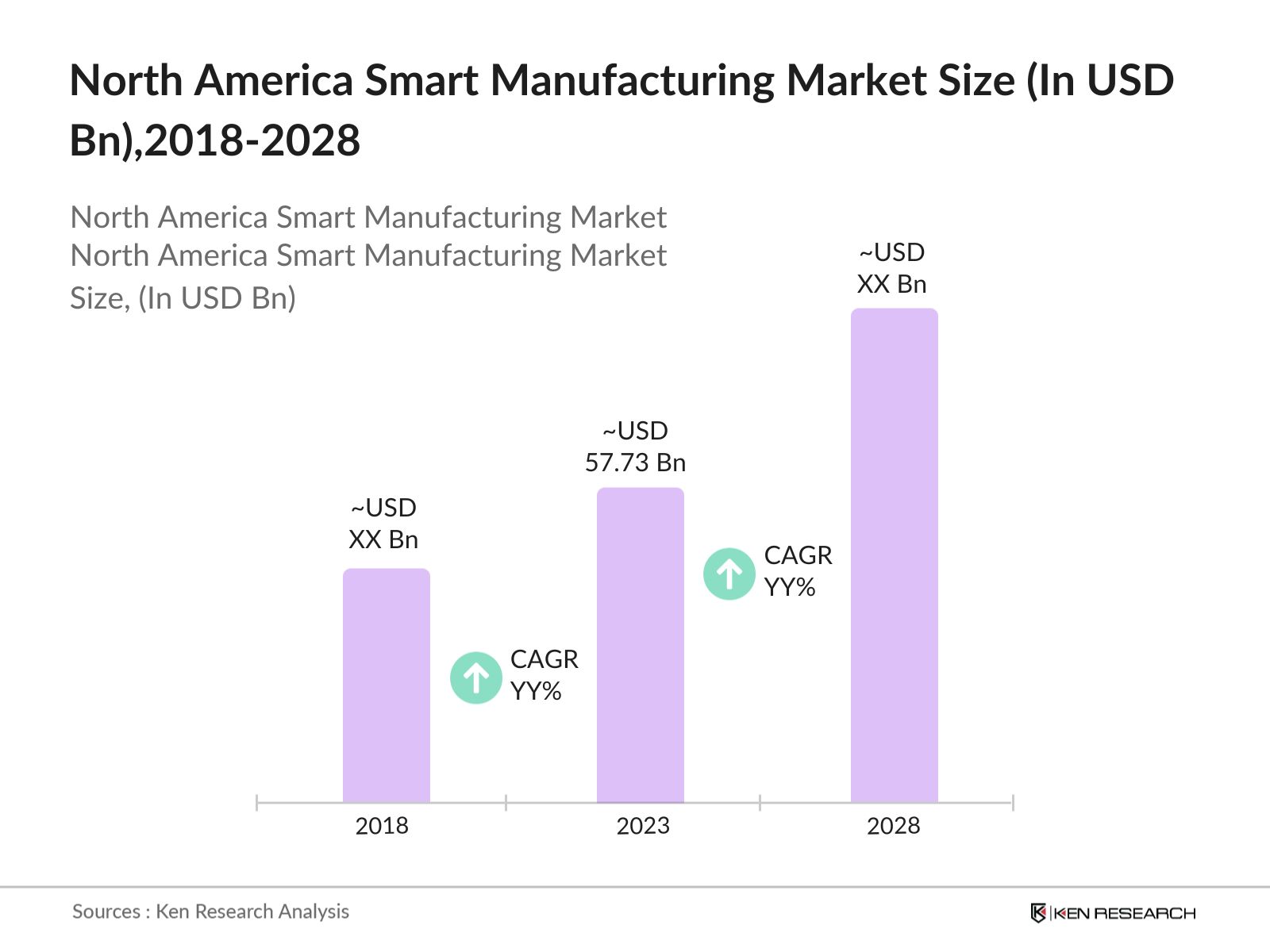

- The North America Smart Manufacturing Market was valued at USD 57.73 billion in 2023. The growth is primarily driven by the increasing adoption of Industry 4.0 technologies, including the Internet of Things (IoT), Artificial Intelligence (AI), and cloud computing. The market's expansion is fueled by the demand for increased production efficiency, reduced operational costs, and enhanced product quality.

- The market is dominated by several key players including Siemens AG, General Electric, Honeywell International Inc., Rockwell Automation, and Emerson Electric Co. These companies have been instrumental in driving the adoption of smart manufacturing technologies across the region.

- In 2023, Honeywell International Inc. announced a strategic partnership with Microsoft to integrate its smart manufacturing solutions with Microsoft Azure. This partnership is expected to enhance data analytics and cloud capabilities for manufacturers, enabling more efficient operations. According to Honeywell, this collaboration has already resulted in an increase in productivity for early adopters.

- The United States is the leading region in the market due to the country's strong industrial base, technological advancements, and government support for innovation. Within the U.S., states like California and Texas are at the forefront, driven by their large manufacturing sectors and strong emphasis on technology integration.

North America Smart Manufacturing Market Segmentation

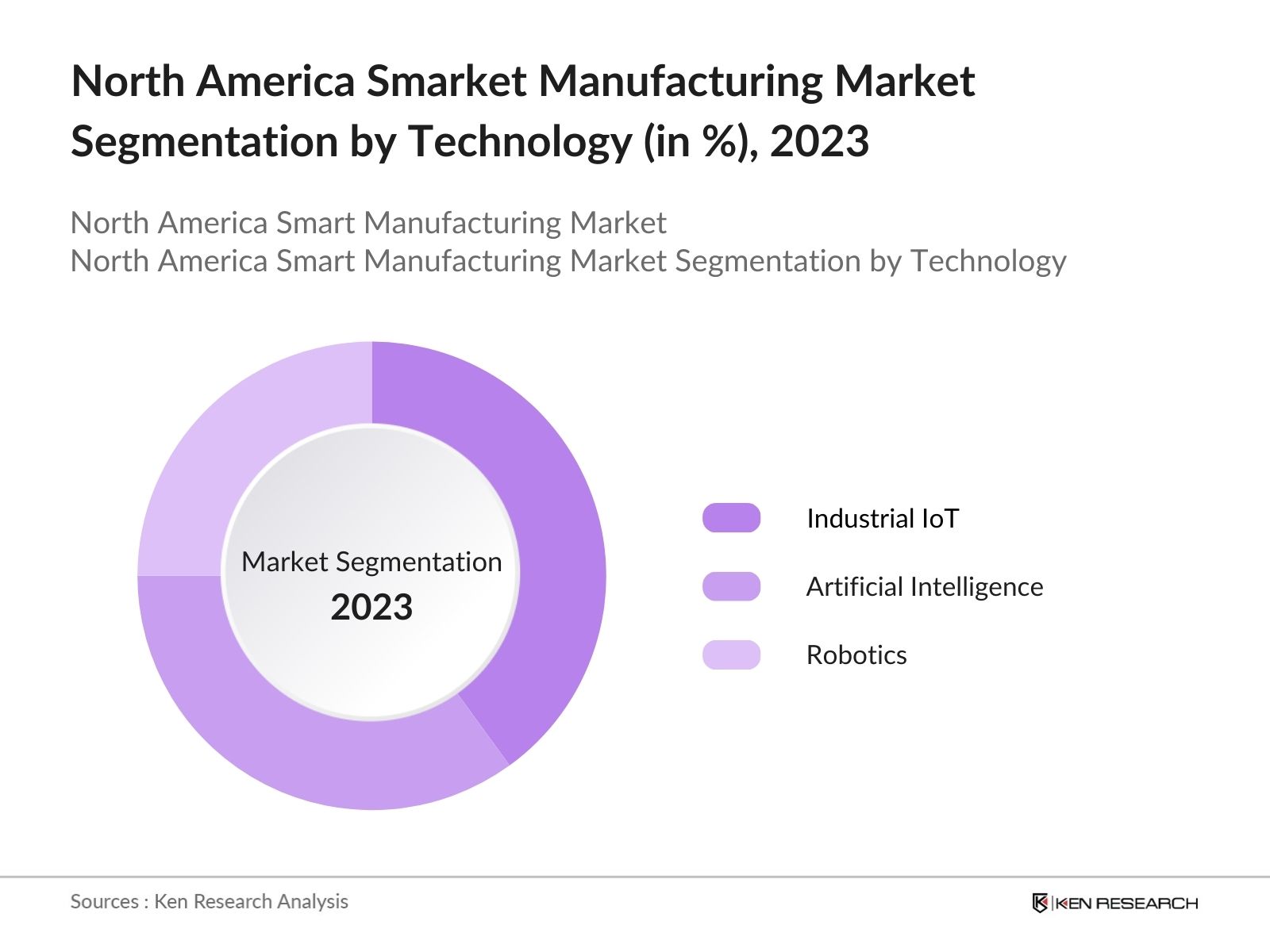

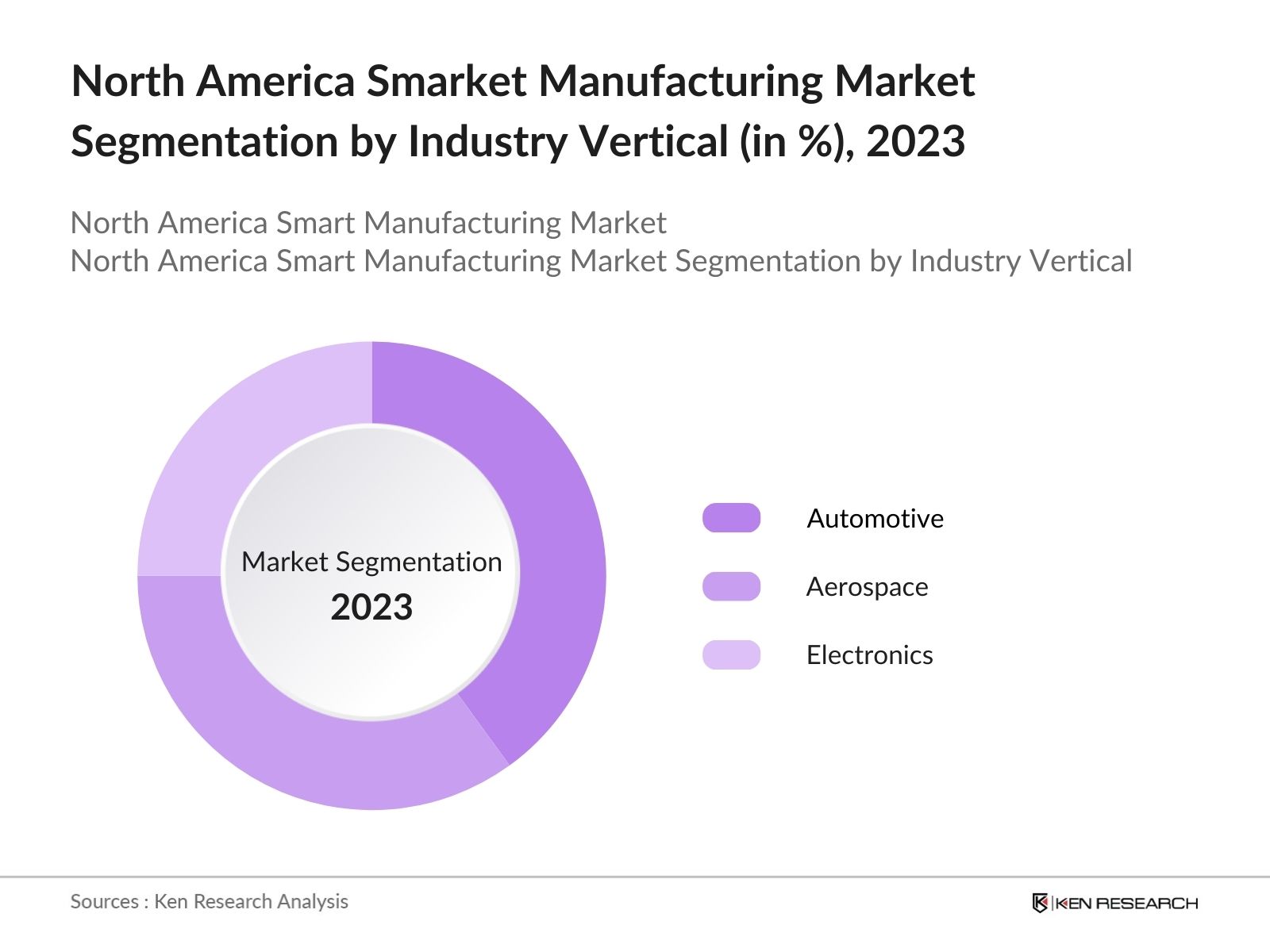

The market is segmented into various factors like technology, industry vertical, and region.

By Technology: The market is segmented by technology into Industrial IoT, Artificial Intelligence, and Robotics. In 2023, the Industrial IoT segment dominated the market with the widespread adoption of IoT solutions that enable real-time monitoring and control of manufacturing processes.

By Industry Vertical: The market is segmented by industry vertical into Automotive, Aerospace, and Electronics. In 2023, the Automotive industry held the largest market due to the industry's early adoption of smart manufacturing technologies to enhance production efficiency and reduce costs.

By Region: The market is segmented by region into United States and Canada. In 2023, the United States is the dominant market, with the country's strong focus on innovation and the presence of major smart manufacturing companies.

North America Smart Manufacturing Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Siemens AG |

1847 |

Munich, Germany |

|

General Electric |

1892 |

Boston, USA |

|

Honeywell International Inc. |

1906 |

Charlotte, USA |

|

Rockwell Automation |

1903 |

Milwaukee, USA |

|

Emerson Electric Co. |

1890 |

St. Louis, USA |

- Siemens: In May 2024, Siemens and Foxconn signed a Memorandum of Understanding (MoU) to advance digital transformation and sustainability in smart manufacturing. This collaboration aims to optimize Foxconn's manufacturing processes through Siemens' Xcelerator portfolio, which includes digital twin technology and AI. The partnership will enhance efficiency and agility across Foxconn's operations, particularly in electronics and electric vehicle production ecosystems.

- Rockwell Automation: Rockwell Automation is advancing its collaboration with NVIDIA to enhance autonomous mobile robots (AMRs) using AI technologies. The partnership aims to improve efficiency and safety in manufacturing logistics. Their recent report indicates that 83% of manufacturers plan to integrate generative AI into their operations by 2024, highlighting the growing importance of AI in smart manufacturing.

North America Smart Manufacturing Market Analysis

Market Growth Drivers

- Adoption of Industry 4.0 Technologies: In 2024, North America saw an increase in the integration of Industry 4.0 technologies such as IoT, AI, and robotics across manufacturing sectors. This adoption is driven by manufacturers need to enhance operational efficiency, reduce downtime, and improve product quality. In the U.S., manufacturers supported AI-based smart manufacturing systems, aiming to automate complex tasks and optimize production processes, according to a 2024 report by the U.S. Department of Commerce.

- Increased Investment in Digital Twins: The U.S. government is investing $285 million in 2024 to advance digital twins for semiconductor manufacturing. This initiative aims to enhance precision and efficiency in smart manufacturing, directly supporting the semiconductor industry. The investment is expected to drive significant advancements in digital twin technology, boosting North America's smart manufacturing capabilities.

- Demand for Sustainable Manufacturing: In 2024, sustainability became a key focus for manufacturers in North America, driven by regulatory pressure and consumer demand for eco-friendly products. The market saw an influx towards sustainable manufacturing practices, including energy-efficient machinery and waste reduction technologies. The push towards sustainability is further supported by government incentives, such as tax credits for companies adopting green technologies.

Market Challenges

- Shortage of Skilled Labor: The adoption of advanced manufacturing technologies has created a demand for highly skilled workers capable of operating and maintaining these systems. In 2024, the U.S. manufacturing sector faced a shortage of around 450,000 skilled workers, which hindered the adoption and optimization of smart manufacturing solutions.

- Cybersecurity Concerns: As smart manufacturing systems become more interconnected, cybersecurity threats have escalated. In 2024, North American manufacturers reported over 1,500 cyberattacks on smart manufacturing systems, leading to losses. The increased use of IoT devices and cloud-based platforms has made manufacturing systems more vulnerable to cyber threats, necessitating robust security measures and investment in cybersecurity infrastructure.

Government Initiatives

- U.S. Department of Energys Smart Manufacturing Initiative: In 2024, the U.S. Department of Energy announced a $33 million funding initiative to advance smart manufacturing technologies, particularly aimed at improving energy efficiency in industrial processes. This initiative supports projects that integrate advanced sensors, data analytics, and AI into manufacturing systems, enhancing the overall productivity and sustainability of North American industries.

- Canadas Advanced Manufacturing Supercluster: In 2024, the Canadian government announced a CAD 177 million investment to advance smart manufacturing technologies across the country. This initiative focuses on boosting innovation in sectors like aerospace, automotive, and advanced materials, aiming to increase manufacturing efficiency and global competitiveness. The investment is expected to benefit over 5,000 manufacturing firms in Canada.

North America Smart Manufacturing Market Future Outlook

The future trends of North America smart manufacturing industry include widespread adoption of AI and machine learning, expansion of digital twin and 5G technologies, and increased investment in cybersecurity measures.

Future Market Trends

- Widespread Adoption of AI and Machine Learning: Over the next five years, the adoption of AI and machine learning in smart manufacturing is expected to increase, with manufacturers investing annually by 2028. These technologies will enable predictive maintenance, process optimization, and real-time decision-making, leading to improved productivity and reduced operational costs across the industry.

- Expansion of 5G-Enabled Smart Manufacturing: By 2028, the deployment of 5G technology in smart manufacturing is expected to be widespread, with mostly of manufacturers in North America utilizing 5G networks. This expansion will enable real-time data transfer and connectivity, enhancing the efficiency and responsiveness of manufacturing operations.

Scope of the Report

|

By Technology |

Industrial IoT Artificial Intelligence Robotics |

|

By Industry Vertical |

Automotive Aerospace Electronics |

|

By Region |

USA Canada |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government Regulatory Bodies

Automotive Manufacturers

Aerospace Manufacturers

Electronics Manufacturers

AI and Machine Learning Companies

Robotics Manufacturers

Industrial Automation Companies

Energy Management Companies

Equipment Manufacturers

Smart Manufacturing Startups

Banks and Financial Institutions

Companies

Players Mentioned in the Report:

Siemens AG

General Electric

Honeywell International Inc.

Rockwell Automation

Emerson Electric Co.

ABB Ltd.

Schneider Electric SE

Mitsubishi Electric Corporation

Bosch Rexroth AG

FANUC Corporation

Yokogawa Electric Corporation

Cisco Systems, Inc.

Intel Corporation

IBM Corporation

PTC Inc.

Table of Contents

1. North America Smart Manufacturing Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Smart Manufacturing Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Smart Manufacturing Market Analysis

3.1. Growth Drivers

3.1.1. Adoption of Industry 4.0 Technologies

3.1.2. Increased Investment in Digital Twins

3.1.3. Demand for Sustainable Manufacturing

3.1.4. Rise of Smart Supply Chain Solutions

3.2. Restraints

3.2.1. High Implementation Costs

3.2.2. Cybersecurity Concerns

3.2.3. Shortage of Skilled Labor

3.2.4. Regulatory Compliance

3.3. Opportunities

3.3.1. Expansion of AI and Machine Learning Applications

3.3.2. Growth of 5G Technology in Manufacturing

3.3.3. Integration of Digital Twins

3.3.4. Sustainable Manufacturing Practices

3.4. Trends

3.4.1. Widespread Adoption of Smart Technologies

3.4.2. Focus on Cybersecurity

3.4.3. Rise of Predictive Maintenance Solutions

3.4.4. Government Support for Innovation

3.5. Government Regulation

3.5.1. U.S. Department of Energys Smart Manufacturing Initiative

3.5.2. Canadas Advanced Manufacturing Supercluster

3.5.3. Federal Tax Incentives for Sustainable Manufacturing

3.5.4. Cybersecurity Framework for Smart Manufacturing

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. North America Smart Manufacturing Market Segmentation, 2023

4.1. By Technology Type (in Value %)

4.1.1. Industrial IoT

4.1.2. Artificial Intelligence

4.1.3. Robotics

4.2. By Industry Vertical (in Value %)

4.2.1. Automotive

4.2.2. Aerospace

4.2.3. Electronics

4.3. By Region (in Value %)

4.3.1. United States

4.3.2. Canada

5. North America Smart Manufacturing Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Siemens AG

5.1.2. General Electric

5.1.3. Honeywell International Inc.

5.1.4. Rockwell Automation

5.1.5. Emerson Electric Co.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. North America Smart Manufacturing Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. North America Smart Manufacturing Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. North America Smart Manufacturing Market Future Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. North America Smart Manufacturing Market Future Segmentation, 2028

9.1. By Technology Type (in Value %)

9.2. By Industry Vertical (in Value %)

9.3. By Region (in Value %)

10. North America Smart Manufacturing Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step:1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building:

Collating statistics on North America Smart Manufacturing industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for North America Smart Manufacturing Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output:

Our team will approach multiple smart manufacturing companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such smart manufacturing companies.

Frequently Asked Questions

01 How big is the North America Smart Manufacturing market?

The North America Smart Manufacturing Market was valued at USD 57.73 billion in 2023. The growth is primarily driven by the increasing adoption of Industry 4.0 technologies, including the Internet of Things (IoT), Artificial Intelligence (AI), and cloud computing.

02 What are the challenges in North America Smart Manufacturing market?

The major challenges in the North America Smart Manufacturing market include high implementation costs, cybersecurity concerns, a shortage of skilled labor, and complex regulatory compliance requirements across different regions.

03 Who are the major players in the North America Smart Manufacturing market?

Key players in the North America Smart Manufacturing market include Siemens AG, General Electric, Honeywell International Inc., Rockwell Automation, and Emerson Electric Co.

04 What are the main growth drivers of the North America Smart Manufacturing market?

The growth of the North America Smart Manufacturing market includes the adoption of Industry 4.0 technologies, increased investment in digital twins, the demand for sustainable manufacturing practices, and the rise of smart supply chain solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.