North America Smart Parcel Locker Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD4093

November 2024

92

About the Report

North America Smart Parcel Locker Market Overview

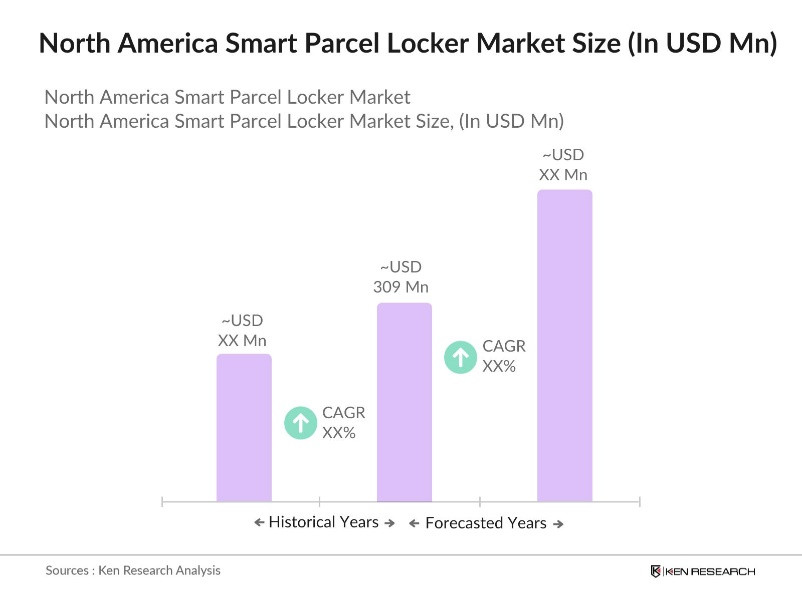

- The North America Smart Parcel Locker Market is valued at USD 309 million, driven primarily by the rapid growth of e-commerce, urbanization, and the demand for contactless deliveries. Over the last five years, e-commerce penetration and consumer demand for convenience have surged, contributing to the growth of smart parcel lockers in residential buildings, retail centers, and commercial areas. Additionally, the rise of smart city initiatives has pushed the adoption of smart parcel lockers as a means to automate and streamline the logistics and delivery process across the region.

- Key cities dominating the market include New York, Los Angeles, and Toronto, primarily due to high population density, a strong e-commerce infrastructure, and the presence of large commercial and residential complexes. These cities also benefit from significant government investment in smart city infrastructure and innovation, which facilitates the integration of smart technologies such as parcel lockers into urban landscapes.

- The U.S. Postal Service's Delivering for America plan focuses on modernizing its infrastructure by consolidating processing centers into Regional Processing and Distribution Centers (RPDCs) and creating Sorting & Delivery Centers (S&DCs). These facilities improve package handling and delivery efficiency, with new self-service kiosks and smart lockers being installed across post offices. The initiative also emphasizes electric vehicle hubs and aims to streamline operations while reducing costs, which is part of the broader effort to enhance service in both urban and rural areas.

North America Smart Parcel Locker Market Segmentation

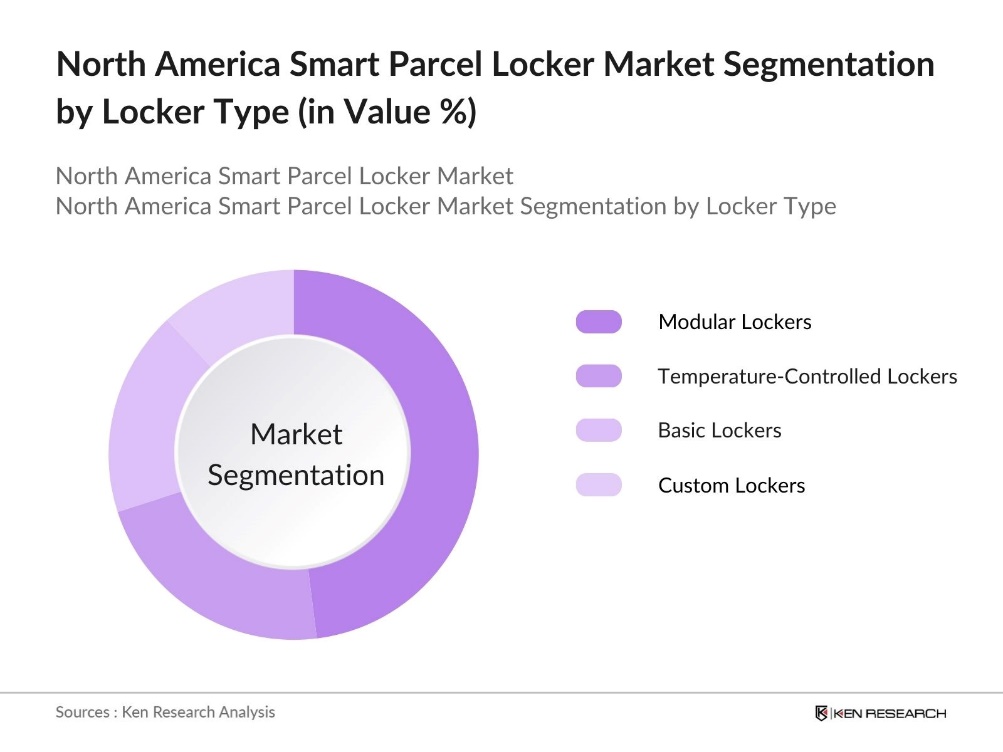

By Locker Type: The North America Smart Parcel Locker market is segmented by locker type into Modular Lockers, Temperature-Controlled Lockers, Basic Lockers, and Custom Lockers. Modular Lockers dominate the market share under this segmentation due to their versatility in being customized according to different spatial and operational requirements. Their modular design allows property managers and businesses to scale locker systems as per their needs, making them the most widely adopted type of smart parcel lockers across commercial, residential, and retail sectors.

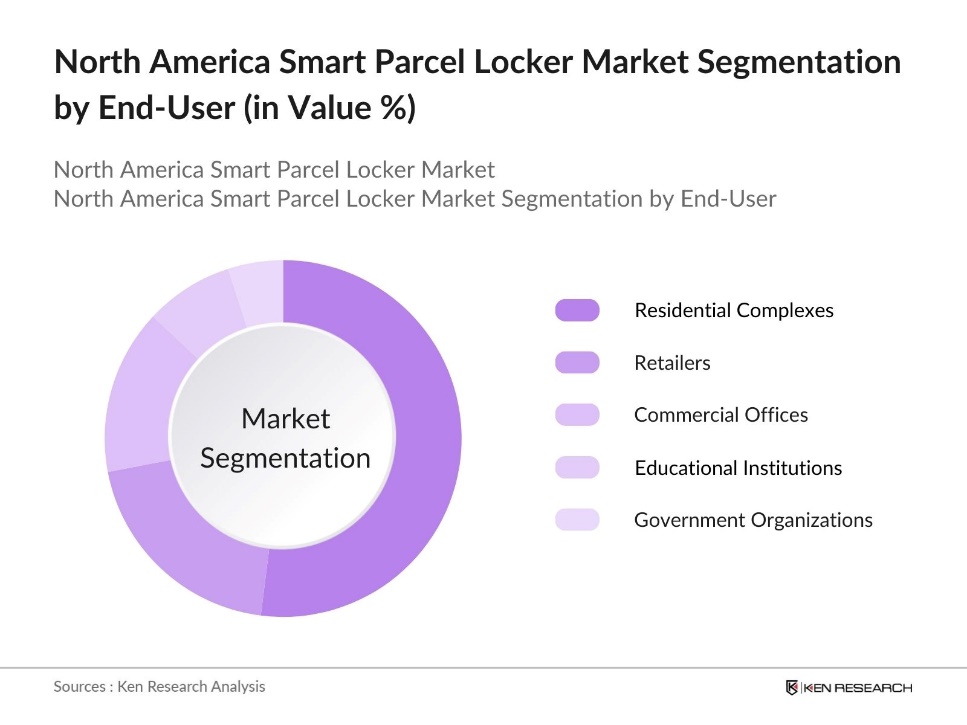

By End-User: The North America Smart Parcel Locker market is further segmented by end-user into Residential Complexes, Retailers, Commercial Offices, Educational Institutions, and Government Organizations. Residential complexes hold the largest market share in this segment due to the increasing demand for automated package management solutions, especially in urban areas with high e-commerce activity. The rising need for secure, efficient, and contactless delivery solutions has driven residential buildings to invest heavily in smart parcel locker systems, enhancing the convenience and security of package deliveries for tenants.

North America Smart Parcel Locker Market Competitive Landscape

The market is dominated by a few key players, with both local and global companies making significant contributions. These players have established strong partnerships with real estate developers, e-commerce firms, and logistics providers, further strengthening their position. The competitive landscape is characterized by strategic product innovations and mergers & acquisitions, aimed at improving service offerings and expanding market presence.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Product Range |

Technology Used |

Market Reach |

Recent Investments |

Strategic Partners |

Expansion Strategy |

|

Quadient |

1999 |

France, USA |

|||||||

|

TZ Limited |

2001 |

Australia |

|||||||

|

Cleveron AS |

2007 |

Estonia, USA |

|||||||

|

Luxer One |

2010 |

United States |

|||||||

|

Parcel Pending |

2013 |

United States |

North America Smart Parcel Locker Industry Analysis

Growth Drivers

- E-commerce Growth Impact: The rapidly expanding e-commerce sector in North America is driving demand for last-mile delivery services, leading logistics companies to adopt smart parcel lockers that enhance efficiency and reduce errors. In response to rising online shopping volumes, the U.S. Postal Service has invested in infrastructure, workforce, and technology, including installing 348 new package sorting machines in 2023, boosting daily package processing capacity to 70 million, and streamlining deliveries during peak seasons.

- Increased Demand for Contactless Deliveries: The demand for contactless deliveries surged due to the COVID-19 pandemic and has become a lasting consumer preference. In 2022, around 60% of online shoppers in the U.S. preferred contactless delivery methods, according to the National Retail Federation. Smart parcel lockers offer a solution by providing touch-free pickup points. By 2024, contactless delivery is expected to remain a dominant choice, supported by growing health concerns and convenience factors. This demand significantly drives the adoption of smart parcel lockers in urban and residential areas.

- Government Support for Smart Infrastructure: Government initiatives across North America are promoting smart city development, which aids in the deployment of smart parcel lockers. Cities are integrating these lockers as part of their urban logistics, enhancing parcel handling efficiency. This governmental backing, along with policies favoring smart infrastructure, plays a critical role in boosting the adoption of parcel lockers, improving urban delivery systems in both public and private sectors. As smart cities evolve, the role of parcel lockers becomes increasingly central to urban logistics solutions.

Market Challenges

- High Installation and Maintenance Costs: The installation of smart parcel lockers comes with substantial upfront expenses. These systems require not only initial setup but also ongoing maintenance, including software updates and repairs, which further adds to the costs. Municipalities and private operators often face challenges in justifying these expenses, especially when the return on investment is not immediate. This financial burden slows the widespread adoption of smart lockers across North America, particularly for smaller entities.

- Network Integration Challenges: Integrating smart parcel lockers into existing logistics systems presents technical difficulties, especially for smaller companies. Compatibility issues and the lack of standardized systems create inefficiencies, making seamless integration challenging. Furthermore, infrastructure limitations, particularly in rural areas, hinder the broader adoption of smart lockers. This leads to delays and operational setbacks in scaling locker systems across different regions.

North America Smart Parcel Locker Market Future Outlook

The North America Smart Parcel Locker market is expected to witness significant growth in the coming years, driven by the increasing adoption of smart city projects, advancements in automation technology, and the growing need for secure, contactless deliveries. The proliferation of e-commerce, combined with changing consumer behavior toward digital shopping and package management, is likely to propel the demand for smart parcel lockers across multiple sectors.

Market Opportunities

- Expansion in Residential Areas: The rise of e-commerce has created significant opportunities for smart parcel lockers in residential areas. Apartment buildings and housing communities benefit from these lockers, as they enhance delivery security and reduce missed packages. With urban populations growing and multi-family housing developments on the rise, demand for these secure delivery systems continues to increase, offering property managers and residents greater convenience and safety.

- Partnerships with Retailers and E-commerce Companies: Parcel locker providers are increasingly forming strategic partnerships with major e-commerce companies. These collaborations enhance the efficiency of last-mile deliveries, reduce costs, and improve customer convenience. By integrating smart lockers into urban and suburban markets, retailers and e-commerce firms streamline package management, making deliveries more accessible and secure for consumers, while driving broader adoption of smart lockers in various locations.

Scope of the Report

|

By Locker Type |

Modular Lockers Temperature-Controlled Lockers Basic Lockers Custom Lockers |

|

By End-User |

Residential Complexes Retailers Commercial Offices Educational Institutions Government Organizations |

|

By Technology |

RFID Technology Barcode Scanning PIN Code Access Biometric Verification |

|

By Deployment Type |

Indoor Outdoor |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience

Property Management Companies

E-commerce and Logistics Firms

Facility Management Companies

Construction Firms

Banks and Financial Institutions

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Postal Service, Canadian Ministry of Innovation, Science and Industry)

Companies

Players Mentioned in the Report

Quadient

TZ Limited

Cleveron AS

Luxer One

Parcel Pending

Amazon Hub Locker

Pitney Bowes

Smartbox

InPost

Snaile Inc.

KEBA AG

Kiosoft Technologies

Zhilai Tech

DeBourgh Lockers

Pudo Inc.

Table of Contents

1. North America Smart Parcel Locker Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Industry Life Cycle Analysis

1.4. Market Segmentation Overview

2. North America Smart Parcel Locker Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Market Milestones and Developments

3. North America Smart Parcel Locker Market Analysis

3.1. Growth Drivers (Urbanization, E-commerce Expansion, Automation in Logistics)

3.1.1. E-commerce Growth Impact

3.1.2. Increased Demand for Contactless Deliveries

3.1.3. Government Support for Smart Infrastructure

3.2. Market Challenges (Operational Costs, Cybersecurity Risks, Infrastructure Limitations)

3.2.1. High Installation and Maintenance Costs

3.2.2. Network Integration Challenges

3.2.3. Consumer Trust in Technology

3.3. Opportunities (Smart City Integration, Partnerships with Delivery Firms, AI Implementation)

3.3.1. Expansion in Residential Areas

3.3.2. Partnerships with Retailers and E-commerce Companies

3.3.3. Enhanced Data Analytics for Operational Efficiency

3.4. Trends (IoT, AI in Logistics, Sustainability)

3.4.1. Internet of Things Integration

3.4.2. Artificial Intelligence for Package Management

3.4.3. Energy-Efficient Lockers

3.5. Government Regulations (Data Privacy Laws, Postal Regulations, Security Compliance)

3.5.1. Data Protection Regulations

3.5.2. U.S. Postal Locker Standards

3.5.3. Security and Surveillance Mandates

3.6. SWOT Analysis

3.7. Value Chain Analysis

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. North America Smart Parcel Locker Market Segmentation

4.1. By Locker Type (In Value %)

4.1.1. Modular Lockers

4.1.2. Temperature-Controlled Lockers

4.1.3. Basic Lockers

4.1.4. Custom Lockers

4.2. By End-User (In Value %)

4.2.1. Residential Complexes

4.2.2. Retailers

4.2.3. Commercial Offices

4.2.4. Educational Institutions

4.2.5. Government Organizations

4.3. By Technology (In Value %)

4.3.1. RFID Technology

4.3.2. Barcode Scanning

4.3.3. PIN Code Access

4.3.4. Biometric Verification

4.4. By Deployment Type (In Value %)

4.4.1. Indoor

4.4.2. Outdoor

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Smart Parcel Locker Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Quadient

5.1.2. TZ Limited

5.1.3. Cleveron AS

5.1.4. Luxer One

5.1.5. Parcel Pending (a division of Quadient)

5.1.6. Amazon Hub Locker

5.1.7. Pitney Bowes

5.1.8. Smartbox

5.1.9. InPost

5.1.10. Snaile Inc.

5.1.11. KEBA AG

5.1.12. Kiosoft Technologies

5.1.13. Zhilai Tech

5.1.14. DeBourgh Lockers

5.1.15. Pudo Inc.

5.2. Cross Comparison Parameters (Revenue, No. of Employees, Product Portfolio, Technological Capabilities)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, New Product Launches, Geographical Expansions)

5.5. Mergers and Acquisitions

5.6. Venture Capital Funding

5.7. Government Grants and Incentives

6. North America Smart Parcel Locker Market Regulatory Framework

6.1. Postal Service Compliance Standards

6.2. Cybersecurity and Data Protection Regulations

6.3. Building and Zoning Laws for Locker Installation

7. North America Smart Parcel Locker Future Market Size (In USD Mn)

7.1. Projections for Market Growth

7.2. Factors Driving Future Growth

8. North America Smart Parcel Locker Future Market Segmentation

8.1. By Locker Type (In Value %)

8.2. By End-User (In Value %)

8.3. By Technology (In Value %)

8.4. By Deployment Type (In Value %)

8.5. By Region (In Value %)

9. North America Smart Parcel Locker Market Analysts Recommendations

9.1. Total Addressable Market (TAM) Analysis

9.2. Strategic Market Entry Recommendations

9.3. Marketing and Go-to-Market Strategies

9.4. Key Opportunities for Expansion

Research Methodology

Step 1: Identification of Key Variables

In the initial stage, we conducted a comprehensive review of the North America Smart Parcel Locker market ecosystem, identifying key stakeholders such as parcel locker providers, e-commerce companies, and logistics firms. Extensive desk research and industry reports were utilized to define the critical variables impacting market growth, including e-commerce penetration, urbanization trends, and logistics advancements.

Step 2: Market Analysis and Construction

This phase involved compiling historical data on market penetration, adoption rates across different sectors, and revenue generation. The research focused on analyzing the influence of major players, adoption trends by end-users, and the ratio of smart parcel lockers to traditional methods. Market trends were also reviewed, particularly with regards to customer satisfaction and service quality.

Step 3: Hypothesis Validation and Expert Consultation

To validate the initial market assumptions, we conducted interviews with industry experts from leading smart parcel locker companies and real estate developers. The insights gathered from these consultations helped refine the market hypotheses and provided valuable data on operational efficiencies and user preferences.

Step 4: Research Synthesis and Final Output

Finally, we synthesized the data collected through the bottom-up approach and engaged with parcel locker manufacturers to verify the accuracy of the findings. This stage ensured a comprehensive and reliable analysis of the North America Smart Parcel Locker market, with emphasis on market size, segmentation, and competitive dynamics.

Frequently Asked Questions

01. How big is the North America Smart Parcel Locker Market?

The North America Smart Parcel Locker Market is valued at USD 309 million, driven by the rise of e-commerce, urbanization, and the demand for contactless deliveries across residential, commercial, and retail sectors.

02. What are the challenges in the North America Smart Parcel Locker Market?

Key challenges in North America Smart Parcel Locker Market include the high cost of installation and maintenance, integration with existing infrastructure, and cybersecurity concerns related to the storage and transfer of package data.

03. Who are the major players in the North America Smart Parcel Locker Market?

The North America Smart Parcel Locker Market is dominated by major players such as Quadient, TZ Limited, Cleveron AS, Luxer One, and Parcel Pending. These companies have a strong foothold due to their extensive product portfolios and strategic partnerships with logistics and e-commerce companies.

04. What are the growth drivers for the North America Smart Parcel Locker Market?

The North America Smart Parcel Locker Market is primarily driven by the expansion of e-commerce, urbanization, and the demand for secure, automated, and contactless delivery solutions. Additionally, smart city initiatives and increasing investments in technological innovations contribute to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.