North America Smart Transportation Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD9212

December 2024

85

About the Report

North America Smart Transportation Market Overview

- The North America Smart Transportation Market is valued at USD 19.8 billion, based on a five-year historical analysis. This growth is driven by increasing investment in intelligent transport systems (ITS), government-led smart city initiatives, and technological advancements in vehicle-to-everything (V2X) communications. The adoption of electric vehicles, autonomous driving technologies, and enhanced public transportation systems has also contributed to the growth of the smart transportation market.

- Dominant countries in the North American smart transportation market include the United States and Canada. The U.S. dominates due to extensive federal and state investments in smart city projects, advanced infrastructure, and technological expertise. Cities like New York, San Francisco, and Chicago are spearheading intelligent transport projects, integrating advanced traffic management systems, and promoting sustainable urban mobility.

- The Bipartisan Infrastructure Law (BIL) in the U.S. has directed substantial funding toward transportation infrastructure, significantly impacting the smart transportation market. In 2023 alone, $65 billion was allocated to modernize the power grid, expand broadband, and improve transportation infrastructure, which includes smart traffic systems and EV infrastructure. These funds are pivotal for integrating smart technologies into U.S. transportation systems, particularly in urban areas.

North America Smart Transportation Market Segmentation

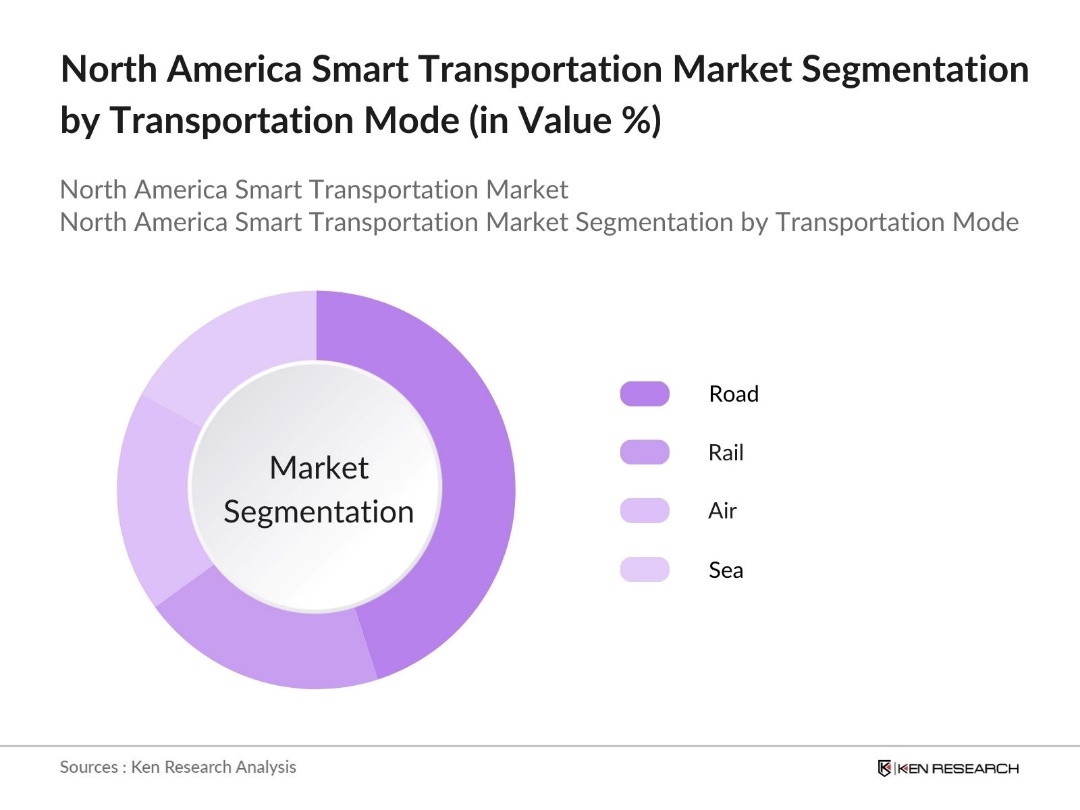

By Transportation Mode: The market is segmented by transportation mode into road, rail, air, and sea. Recently, road transportation has a dominant market share due to the widespread use of smart buses, electric vehicles, and autonomous driving technologies. The growing penetration of intelligent traffic management systems and the increasing number of vehicle-to-everything (V2X) projects in the United States and Canada play a crucial role. Additionally, the rising demand for electric vehicles, encouraged by government subsidies and sustainability initiatives, has enhanced the adoption of smart technologies in road transport.

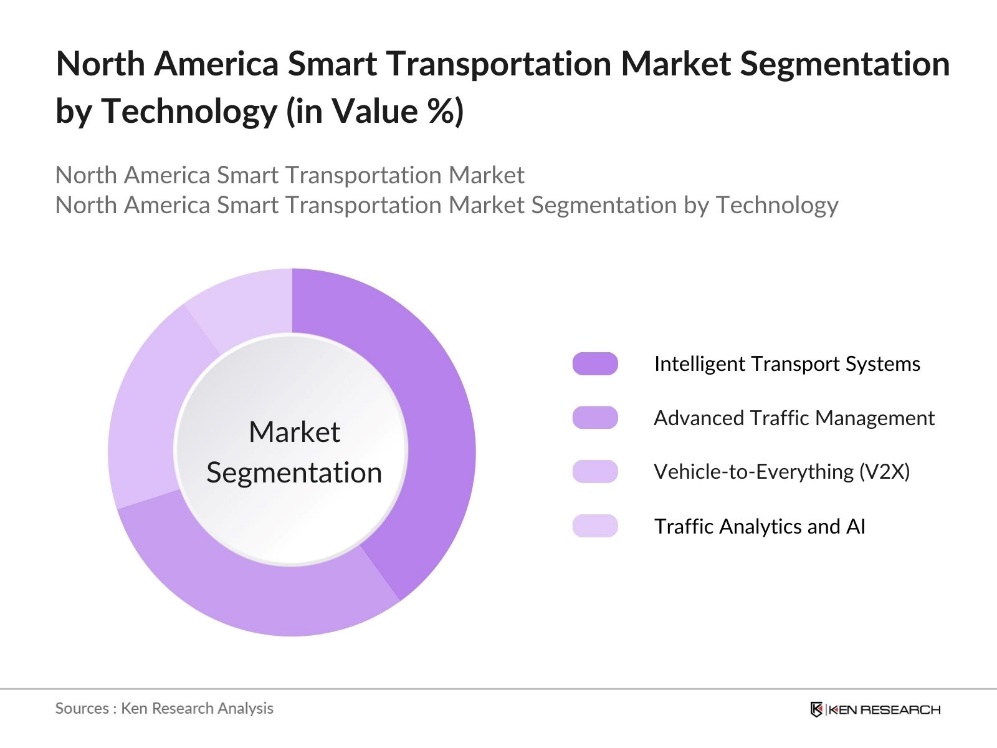

By Technology: The market is segmented by technology into intelligent transport systems (ITS), advanced traffic management systems (ATMS), vehicle-to-everything (V2X) technology, and traffic analytics. Intelligent transport systems hold a dominant position in this segment due to their widespread adoption in urban areas for managing traffic congestion, reducing accidents, and improving overall transportation efficiency. Advanced traffic management systems, which utilize real-time data, play a pivotal role in optimizing traffic flow and are seeing increased adoption in major cities like Los Angeles, New York, and Toronto.

North America Smart Transportation Market Competitive Landscape

The North America Smart Transportation Market is dominated by a few major players, including IBM, Siemens, and Cisco, which have established strong technological expertise and infrastructure capabilities in smart transportation projects. This market consolidation showcases the significant influence these companies have on the industry, largely due to their ability to manage large-scale smart city projects, government collaborations, and extensive R&D efforts.

North America Smart Transportation Industry Analysis

Growth Drivers

- Increasing Urbanization: North America's growing urbanization is a significant driver for smart transportation solutions. According to recent data from the U.S. Census Bureau, as of the 2020 Census, approximately 80% of the U.S. population lived in urban areas. This urban density is straining existing transportation infrastructures, leading to increased demand for smart systems like intelligent transportation systems (ITS), automated traffic management, and real-time mobility services. With urbanization levels continuing to rise, the need for smart, scalable, and efficient transit options is becoming critical to avoid congestion, improve safety, and enhance the overall efficiency of urban transit systems.

- Rising Environmental Concerns (Carbon Emission Regulations, Adoption of Electric Vehicles): Governments across North America are tightening carbon emission regulations to combat climate change, which is pushing smart transportation initiatives forward. The U.S. has pledged to achieve net-zero emissions by 2050. The International Energy Agency (IEA) has forecasted a significant increase in EV sales globally, projecting that the number of electric vehicles could rise from about 3 million to 125 million by 2030. Stringent regulations on vehicle emissions, such as the Clean Air Act, are contributing to the widespread adoption of green mobility solutions.

- Technological Advancements (Autonomous Vehicles, Artificial Intelligence Integration): Autonomous vehicle (AV) technology and artificial intelligence (AI) are reshaping North American transportation. AV pilot programs are growing, while AI-driven innovations like real-time traffic management and predictive maintenance enhance safety and efficiency. Vehicle-to-infrastructure communication, powered by AI, is further streamlining transportation networks, reducing congestion, and improving reliability, driving the shift towards smarter and more sustainable transit solutions across urban environments.

Market Challenges

- High Infrastructure Costs (Smart Infrastructure Costs, Technology Integration): Integrating smart transportation infrastructure presents substantial financial challenges. Developing systems such as smart traffic lights, EV charging stations, and autonomous vehicle networks requires considerable investment. The cost of implementing smart city technologies, including sensor networks, IoT devices, and AI integration, is a significant hurdle for governments and municipalities. These financial constraints make large-scale adoption and modernization efforts challenging, particularly in densely populated urban areas where such technology is most needed.

- Cybersecurity Threats (Data Privacy, Hacking Vulnerabilities): The increasing reliance on connected and autonomous vehicles (CAVs) brings heightened cybersecurity risks. Smart transportation networks, including vehicle software and traffic management systems, are vulnerable to hacking and data breaches. Protecting data privacy and securing communication between connected infrastructure remains a significant challenge. Cyberattacks on transportation systems can lead to compromised safety and disrupted services, making cybersecurity a critical concern in the ongoing development of smart transportation technologies.

North America Smart Transportation Market Future Outlook

Over the next five years, the North America Smart Transportation market is expected to witness significant growth due to increasing investments in green mobility, government-backed smart city initiatives, and advancements in autonomous and electric vehicle technologies. The rise of AI-driven traffic management systems and the adoption of vehicle-to-everything (V2X) technology are set to revolutionize urban transport, improving road safety and reducing congestion. Furthermore, collaborations between government agencies and private tech firms will continue to drive innovation in this sector.

Market Opportunities

- Increased Investment in Green Mobility (Electric Buses, Rail, and Public Transit): Investments in green mobility are gaining momentum across North America as governments focus on sustainable transit solutions. Efforts to electrify public transportation, including buses and rail networks, are a key part of this shift. By promoting low- and zero-emission vehicles, governments are supporting the reduction of greenhouse gas emissions and driving the development of cleaner, more efficient public transit systems, which are essential for future smart transportation projects.

- Expansion of Autonomous Vehicle Technology (AI-Based Transport Networks): Autonomous vehicle (AV) technology is rapidly growing in North America, driven by increased federal support. AV pilot programs are expanding in several cities, integrating AI-based systems to enhance public transit efficiency. As smart cities continue to develop, AVs, including autonomous shuttles, are becoming part of urban transport networks, helping to reduce congestion and improve last-mile connectivity. This growing integration of AV technology is reshaping urban transportation systems.

Scope of the Report

|

By Transportation Mode |

Road Rail Air Sea |

|

By Technology |

Intelligent Transport Systems Advanced Traffic Management Systems V2X AI |

|

By Application |

Urban Transportation Freight and Logistics Public Transit Traffic Management |

|

By Region |

U.S. Canada Mexico |

Products

Key Target Audience

Transportation Network Companies (Uber, Lyft)

Infrastructure Development Firms

Autonomous Vehicle Manufacturers

Government and Regulatory Bodies (U.S. Department of Transportation, Transport Canada)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

IBM Corporation

Siemens Mobility

Cisco Systems, Inc.

Alstom SA

TransCore

Thales Group

Hitachi Ltd.

ABB Group

Bombardier Inc.

Huawei Technologies Co., Ltd.

Table of Contents

1. North America Smart Transportation Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Smart City Integration, Technology Adoption, Green Transportation Initiatives)

1.4 Market Segmentation Overview (By Transportation Mode, Technology, Application, Region)

2. North America Smart Transportation Market Size (In USD Mn)

2.1 Historical Market Size (Adoption of Intelligent Transport Systems (ITS), Government Investment in Smart Mobility)

2.2 Year-On-Year Growth Analysis (Growth Driven by Public-Private Partnerships, Infrastructure Investments)

2.3 Key Market Developments and Milestones (New Transportation Platforms, Key Infrastructure Projects)

3. North America Smart Transportation Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Urbanization

3.1.2 Rising Environmental Concerns (Carbon Emission Regulations, Adoption of Electric Vehicles)

3.1.3 Government Support (Federal Funding for Smart Transportation)

3.1.4 Technological Advancements (Autonomous Vehicles, Artificial Intelligence Integration)

3.2 Market Challenges

3.2.1 High Infrastructure Costs (Smart Infrastructure Costs, Technology Integration)

3.2.2 Cybersecurity Threats (Data Privacy, Hacking Vulnerabilities)

3.2.3 Regulatory Barriers (Regional Variability in Regulations)

3.3 Opportunities

3.3.1 Increased Investment in Green Mobility (Electric Buses, Rail, and Public Transit)

3.3.2 Expansion of Autonomous Vehicle Technology (AI-Based Transport Networks)

3.3.3 Partnerships with Technology Providers (Collaboration for Smart Traffic Management)

3.4 Trends

3.4.1 Growing Adoption of Mobility-as-a-Service (MaaS)

3.4.2 Integration with Smart Cities (Data-Driven Transportation Solutions)

3.4.3 Emergence of Connected Vehicles and IoT-Enabled Systems

3.5 Government Regulations

3.5.1 Federal and State-Level Policies (EV Adoption Mandates, Funding for ITS)

3.5.2 Transportation Infrastructure Funding (Bipartisan Infrastructure Law Impact)

3.5.3 Public-Private Collaborations (Funding Mechanisms for Smart Mobility)

3.6 SWOT Analysis

3.6.1 Strengths (Technological Readiness, Strong Regulatory Framework)

3.6.2 Weaknesses (High Initial Costs, Complex Deployment)

3.6.3 Opportunities (Green Energy Integration, Tech-Driven Mobility Services)

3.6.4 Threats (Cybersecurity Concerns, Evolving Regulatory Environment)

3.7 Stakeholder Ecosystem

3.7.1 Government Agencies (Department of Transportation, Local Authorities)

3.7.2 Private Sector Companies (Tech and Automotive Companies)

3.7.3 End-Users (Citizens, Businesses, Municipalities)

3.8 Porters Five Forces

3.8.1 Threat of New Entrants

3.8.2 Bargaining Power of Suppliers

3.8.3 Bargaining Power of Buyers

3.8.4 Threat of Substitute Products or Services

3.8.5 Intensity of Competitive Rivalry

3.9 Competitive Ecosystem (Key Competitors, Partnerships, Collaborations)

4. North America Smart Transportation Market Segmentation

4.1 By Transportation Mode (In Value %)

4.1.1 Road (Electric and Autonomous Vehicles, Smart Buses)

4.1.2 Rail (Intelligent Rail Systems, Smart Ticketing)

4.1.3 Air (Smart Airports, Drone Transportation)

4.1.4 Sea (Smart Ports, Automated Ships)

4.2 By Technology (In Value %)

4.2.1 Intelligent Transport Systems (ITS)

4.2.2 Advanced Traffic Management Systems (ATMS)

4.2.3 Vehicle-to-Everything (V2X) Technology

4.2.4 Traffic Analytics and AI Solutions

4.3 By Application (In Value %)

4.3.1 Urban Transportation

4.3.2 Freight and Logistics

4.3.3 Public Transit

4.3.4 Traffic Management

4.4 By Region (In Value %)

4.4.1 U.S.

4.4.2 Canada

4.4.3 Mexico

5. North America Smart Transportation Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 IBM Corporation

5.1.2 Siemens Mobility

5.1.3 Cisco Systems, Inc.

5.1.4 Alstom SA

5.1.5 Cubic Corporation

5.1.6 Thales Group

5.1.7 Hitachi Ltd.

5.1.8 ABB Group

5.1.9 TransCore

5.1.10 TomTom N.V.

5.1.11 Bombardier Inc.

5.1.12 Schneider Electric

5.1.13 Huawei Technologies Co., Ltd.

5.1.14 Kapsch TrafficCom AG

5.1.15 AECOM

5.2 Cross Comparison Parameters (Revenue, No. of Patents, Technology Portfolio, R&D Investment, Regional Presence, Partnerships, Innovation Index, Market Leadership)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. North America Smart Transportation Market Regulatory Framework

6.1 Smart Transportation Standards

6.2 Compliance Requirements for Autonomous Vehicles

6.3 Certification and Testing Procedures

7. North America Smart Transportation Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth (Tech Integration, Sustainable Mobility Solutions)

8. North America Smart Transportation Future Market Segmentation

8.1 By Transportation Mode (In Value %)

8.2 By Technology (In Value %)

8.3 By Application (In Value %)

8.4 By Region (In Value %)

9. North America Smart Transportation Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 White Space Opportunity Analysis

9.4 Go-to-Market Strategies for Key Segments

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involves mapping out the entire ecosystem of the North America Smart Transportation Market. Through comprehensive desk research using proprietary databases and secondary resources, we identify key variables such as technological innovations, government policies, and market drivers that influence market dynamics.

Step 2: Market Analysis and Construction

We collect and analyze historical market data to understand key growth trends, penetration of smart technologies, and sectoral developments. Market analysis includes evaluating urbanization patterns, consumer adoption rates, and infrastructure investments across major regions like the U.S., Canada, and Mexico.

Step 3: Hypothesis Validation and Expert Consultation

We consult industry experts through interviews and surveys to validate market hypotheses. These experts represent various segments of the smart transportation ecosystem, such as technology providers, government agencies, and urban planners, offering insights on market dynamics and challenges.

Step 4: Research Synthesis and Final Output

Our final step involves synthesizing the data obtained from stakeholders and experts. We ensure the information aligns with the bottom-up market sizing approach, providing a well-rounded analysis of the North American Smart Transportation Market.

Frequently Asked Questions

01 How big is the North America Smart Transportation Market?

The North America Smart Transportation Market is valued at USD 19.8 billion, driven by substantial government investments, adoption of electric vehicles, and the increasing integration of intelligent transport systems across urban centers.

02 What are the challenges in the North America Smart Transportation Market?

Challenges in North America Smart Transportation Market include high initial infrastructure costs, cybersecurity threats due to the integration of IoT technologies, and the complexity of regulatory frameworks across different regions in the U.S. and Canada.

03 Who are the major players in the North America Smart Transportation Market?

Key players in the North America Smart Transportation Market include IBM Corporation, Siemens Mobility, Cisco Systems, Alstom, and TransCore. These companies dominate the market due to their strong technological capabilities, large-scale smart city projects, and government partnerships

04 What are the growth drivers of the North America Smart Transportation Market?

The North America Smart Transportation Market is driven by government-backed smart city initiatives, rising adoption of electric vehicles, advancements in artificial intelligence for traffic management, and increasing demand for sustainable urban mobility solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.