North America Smart Weapons Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD7008

December 2024

91

About the Report

North America Smart Weapons Market Overview

- The North America Smart Weapons Market is valued at USD 6.3 billion, driven by investments in advanced weaponry and defense technologies. This valuation is based on a five-year historical analysis, with technological advancements, including artificial intelligence (AI) and autonomous systems, being key drivers.

- The United States is the dominant country in the North America smart weapons market, mainly due to its extensive defense budget, advanced technological infrastructure, and strategic military operations globally. The U.S. Department of Defense has been consistently investing in upgrading its weapon systems, particularly focusing on AI-driven and autonomous technologies. Canada also holds a considerable share, thanks to its role in defense collaborations with NATO, boosting demand for advanced military technologies across North America.

- Federal Defense Acquisition Regulations (FDAR) outline procurement standards and guidelines for smart weapons in North America. In 2023, the DoD's total obligations for contracts rose significantly, reflecting a strategic shift in response to changing global threats, particularly due to military support for Ukraine. This indicates a growing emphasis on modernizing the defense industrial base, which includes advanced weaponry like smart weapons.

North America Smart Weapons Market Segmentation

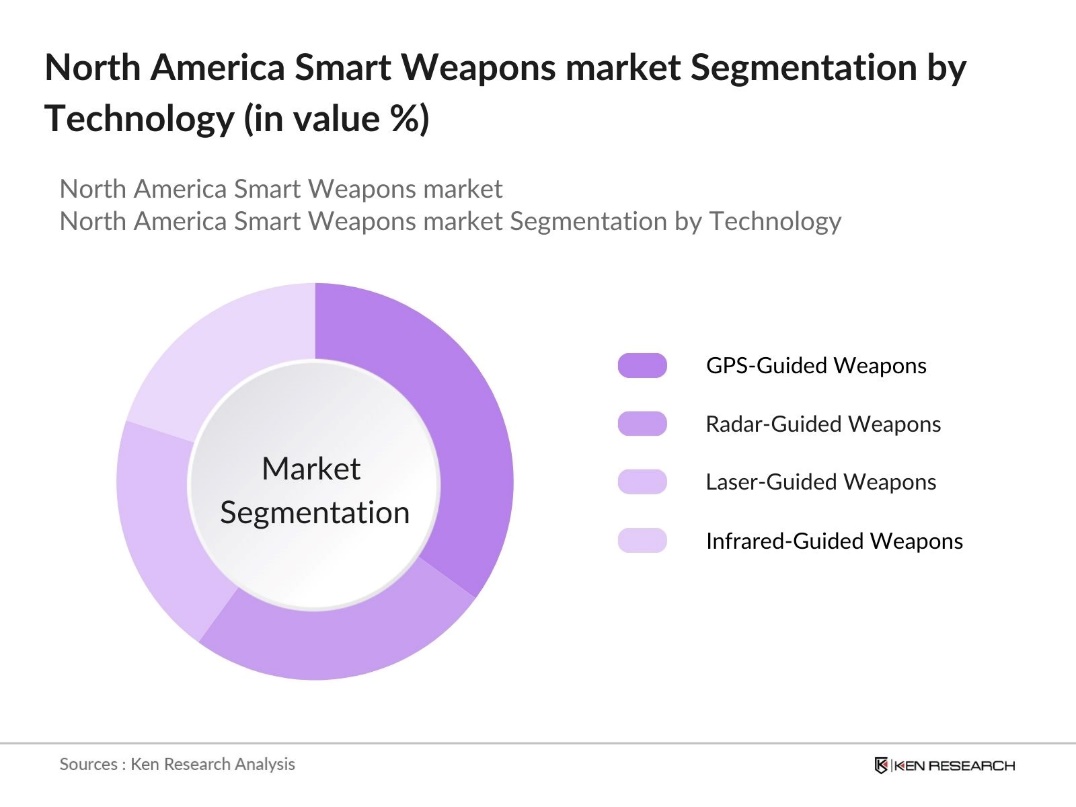

By Technology: The North America Smart Weapons market is segmented by technology into radar-guided weapons, laser-guided weapons, infrared-guided weapons, and GPS-guided weapons. Among these, GPS-guided weapons hold a dominant market share due to their high accuracy and reduced chances of collateral damage. The technology's ability to provide real-time data and ensure target precision has made it a favored choice among military forces. The U.S. military's heavy reliance on GPS-guided munitions in strategic operations across different terrains also supports this segments leadership in the market.

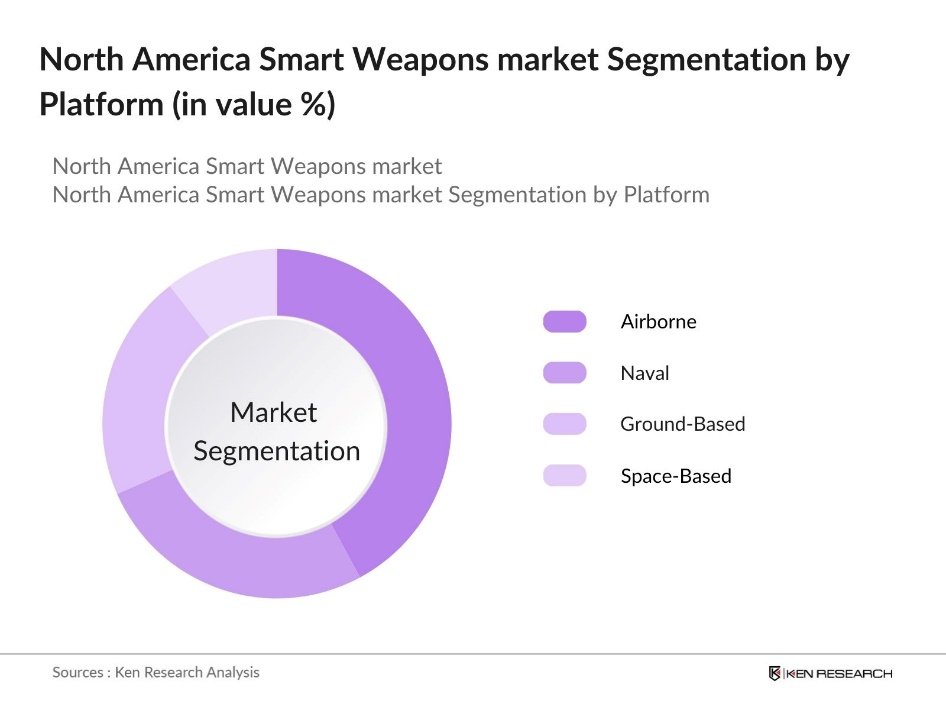

By Platform: The North America Smart Weapons market is also segmented by platform into airborne, naval, ground-based, and space-based platforms. Airborne platforms currently dominate the market, supported by the growing use of UAVs and drones in military operations. These platforms offer enhanced mobility and range, making them essential in modern warfare for surveillance and precise target engagement. The increasing investments in autonomous aerial vehicles by the U.S. Air Force and other defense agencies solidify this segment's strong position.

North America Smart Weapons Market Competitive Landscape

The North America Smart Weapons market is consolidated, with major players including Lockheed Martin Corporation, Raytheon Technologies, and Northrop Grumman Corporation leading the market. These companies benefit from their advanced R&D capabilities, strong defense contracts, and diversified portfolios of smart weapon systems. The competition is driven by continuous technological advancements, large-scale defense projects, and long-term contracts with military forces, both domestic and international.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD Bn) |

R&D Spending |

Global Presence |

Product Portfolio |

Key Contracts |

|

Lockheed Martin Corporation |

1912 |

Bethesda, Maryland |

||||||

|

Raytheon Technologies |

1922 |

Waltham, Massachusetts |

||||||

|

Northrop Grumman Corporation |

1939 |

Falls Church, Virginia |

||||||

|

Boeing Defense, Space & Sec. |

1916 |

Chicago, Illinois |

||||||

|

General Dynamics Corporation |

1952 |

Reston, Virginia |

North America Smart Weapons Industry Analysis

Growth Drivers

- Increased Defense Spending (Military Budget Allocation, % of GDP): North America's defense budget saw a significant allocation towards smart weapons systems. In 2023, the United States allocated approximately $820 billion to its national defense budget, according to the Office of Management and Budget, representing a strategic shift toward modern warfare technologies, including smart weapons. This surge in defense spending highlights North America's commitment to enhancing its military capabilities, driven by ongoing geopolitical tensions and international commitments.

- Technological Advancements in Weaponry (Automation, AI, IoT Integration): The North American smart weapons industry is seeing rapid integration of AI, IoT, and automation technologies. The U.S. Department of Defense (DoD) updated Directive 3000.09 on autonomy in weapon systems reflects this commitment by establishing guidelines for the development and use of such technologies. These advancements are pivotal in reshaping the future battlefield by incorporating real-time data analytics, predictive targeting, and networked communication systems.

- Strategic Military Partnerships (NATO, International Arms Deals): Strategic military partnerships have significantly influenced the North American smart weapons market. Collaborations between the U.S. and NATO allies have focused on arms deals involving advanced smart weapons, such as UAVs and missile defense systems. These partnerships support international security initiatives and enhance interoperability among allied forces, ensuring coordinated defense strategies and efficient use of cutting-edge technologies in global military operations.

Market Challenges

- Regulatory Barriers (Arms Trade Regulations, Export Restrictions): North America's smart weapons market faces significant regulatory challenges due to export restrictions and the need to comply with international arms trade agreements. Strict regulations such as the U.S. Arms Export Control Act (AECA) and International Traffic in Arms Regulations (ITAR) govern the export of advanced military technologies. These rules can create delays and complications in the global distribution of smart weapons, affecting market growth.

- High Development and Maintenance Costs (Unit Cost, Lifecycle Costs): The development and maintenance of smart weapons present major financial challenges. Advanced systems like combat UAVs require significant investment, with high initial costs for production and ongoing expenses for software updates and hardware maintenance. These lifecycle costs can strain defense budgets, making it difficult for even wealthier nations to manage the long-term financial impact of these technologies.

North America Smart Weapons Market Future Outlook

The North America Smart Weapons market is expected to show substantial growth in the coming years, driven by advancements in artificial intelligence, robotics, and automation in warfare. Defense budgets across North America are likely to continue prioritizing smart weapon technologies due to the increasing need for precision and efficiency in military operations. Furthermore, as global tensions and conflicts continue, the demand for autonomous and semi-autonomous weapons is set to rise, leading to notable innovation and development within this sector.

Market Opportunities

- Rising Demand for UAVs and Autonomous Weapons (Combat Drones, AI-Driven Weapons): The demand for UAVs and autonomous weapons is rapidly increasing in North America. These technologies are being widely adopted for military operations, enhancing capabilities in areas like reconnaissance and precision strikes. The development of AI-driven combat drones is advancing quickly, creating new opportunities for defense manufacturers to supply innovative, cutting-edge systems to meet this growing need in the military sector.

- Expanding Military Modernization Programs (Modernization Budgets, Equipment Upgrades): Military modernization programs in North America present significant opportunities for smart weapons manufacturers. These efforts focus on upgrading military equipment by integrating advanced technologies such as AI, IoT, and autonomous systems. The modernization of defense capabilities is a priority for the region, driving demand for next-generation smart weapons and creating a growing market for suppliers of these technologies.

Scope of the Report

|

By Type |

Autonomous Smart Weapons Semi-Autonomous Smart Weapons Man-Portable Smart Weapons |

|

By Technology |

Radar-Guided Weapons Laser-Guided Weapons Infrared-Guided Weapons GPS-Guided Weapons |

|

By Platform |

Airborne Naval Ground-Based Space-Based |

|

By Application |

Defense Law Enforcement Border Security Counter-Terrorism |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience

Defense Contractors

UAV Manufacturers

Security and Surveillance Companies

Border Security Agencies

Government and Regulatory Bodies (NATO, Federal Acquisition Regulation Office)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Lockheed Martin Corporation

Raytheon Technologies Corporation

Northrop Grumman Corporation

Boeing Defense, Space & Security

General Dynamics Corporation

BAE Systems Plc

L3Harris Technologies

Thales Group

Rheinmetall AG

Leonardo S.p.A.

Table of Contents

1. North America Smart Weapons Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Smart Weapons Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Smart Weapons Market Analysis

3.1. Growth Drivers

3.1.1. Increased Defense Spending (Military Budget Allocation, % of GDP)

3.1.2. Technological Advancements in Weaponry (Automation, AI, IoT Integration)

3.1.3. Strategic Military Partnerships (NATO, International Arms Deals)

3.1.4. Government R&D Initiatives (Defense Research Funding)

3.2. Market Challenges

3.2.1. Regulatory Barriers (Arms Trade Regulations, Export Restrictions)

3.2.2. High Development and Maintenance Costs (Unit Cost, Lifecycle Costs)

3.2.3. Cybersecurity Threats (Data Breaches, System Vulnerabilities)

3.2.4. Ethical Concerns in Autonomous Weapons (International Treaties, Human Rights Implications)

3.3. Opportunities

3.3.1. Rising Demand for UAVs and Autonomous Weapons (Combat Drones, AI-Driven Weapons)

3.3.2. Expanding Military Modernization Programs (Modernization Budgets, Equipment Upgrades)

3.3.3. Growth in Non-Lethal Smart Weapons (Crowd Control, Riot Gear)

3.4. Trends

3.4.1. Adoption of AI and Machine Learning in Weapons (Predictive Targeting, Autonomous Combat)

3.4.2. Integration with Communication Systems (Satellite Connectivity, Real-time Data Transfer)

3.4.3. Miniaturization and Portability of Smart Weapons (Wearable Smart Guns, Lightweight Drones)

3.5. Government Regulations

3.5.1. Arms Export Control Act (AECA) (Policy Compliance, Licensing)

3.5.2. International Traffic in Arms Regulations (ITAR) (Export, Trade Restrictions)

3.5.3. Federal Defense Acquisition Regulations (FDAR) (Procurement Standards, Supplier Guidelines)

3.6. SWOT Analysis

3.7. Stake Ecosystem (Industry Participants, Supply Chain)

3.8. Porters Five Forces (Bargaining Power of Suppliers, Threat of Substitutes)

3.9. Competition Ecosystem

4. North America Smart Weapons Market Segmentation

4.1. By Type (In Value %)

4.1.1. Autonomous Smart Weapons

4.1.2. Semi-Autonomous Smart Weapons

4.1.3. Man-Portable Smart Weapons

4.2. By Technology (In Value %)

4.2.1. Radar-Guided Weapons

4.2.2. Laser-Guided Weapons

4.2.3. Infrared-Guided Weapons

4.2.4. GPS-Guided Weapons

4.3. By Platform (In Value %)

4.3.1. Airborne

4.3.2. Naval

4.3.3. Ground-Based

4.3.4. Space-Based

4.4. By Application (In Value %)

4.4.1. Defense

4.4.2. Law Enforcement

4.4.3. Border Security

4.4.4. Counter-Terrorism

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Smart Weapons Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Lockheed Martin Corporation

5.1.2. Raytheon Technologies Corporation

5.1.3. Northrop Grumman Corporation

5.1.4. Boeing Defense, Space & Security

5.1.5. General Dynamics Corporation

5.1.6. BAE Systems Plc

5.1.7. L3Harris Technologies

5.1.8. Thales Group

5.1.9. Rheinmetall AG

5.1.10. Leonardo S.p.A.

5.1.11. Saab AB

5.1.12. MBDA Missile Systems

5.1.13. Textron Inc.

5.1.14. Elbit Systems Ltd.

5.1.15. AeroVironment, Inc.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Market Share, R&D Spending, Major Product Offerings, Global Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Smart Weapons Market Regulatory Framework

6.1. Arms Trade Regulations (Domestic, International)

6.2. Compliance Requirements (Licensing, Documentation)

6.3. Certification Processes (ISO, Military Standards)

7. North America Smart Weapons Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Smart Weapons Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Technology (In Value %)

8.3. By Platform (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. North America Smart Weapons Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves creating an extensive ecosystem map of the North America Smart Weapons market. This is based on secondary research using government databases and proprietary databases, focusing on key stakeholders including military bodies, defense contractors, and technology providers. The objective is to identify the critical factors driving market dynamics.

Step 2: Market Analysis and Construction

This phase focuses on analyzing historical data related to smart weapon adoption rates, defense spending, and major defense contracts. Data on product development cycles and procurement timelines will be evaluated to gauge market penetration levels and operational effectiveness.

Step 3: Hypothesis Validation and Expert Consultation

A series of interviews and consultations with industry experts, including defense analysts and smart weapon manufacturers, will be conducted. These insights will help validate market hypotheses and provide an operational perspective on evolving trends and technological advancements.

Step 4: Research Synthesis and Final Output

Finally, all collected data will be synthesized to provide a holistic view of the North America Smart Weapons market. Engagements with defense contractors and military forces will ensure that the data is accurate, reliable, and aligned with market realities, resulting in a comprehensive final report.

Frequently Asked Questions

01 How big is the North America Smart Weapons market?

The North America Smart Weapons Market is valued at USD 6.3 billion, driven by technological advancements and rising defense budgets across the region.

02 What are the key growth drivers for the North America Smart Weapons market?

Key growth in North America Smart Weapons Market drivers include increased defense spending, advancements in AI and autonomous weapon systems, and the growing demand for precision-guided munitions in military operations.

03 Who are the major players in the North America Smart Weapons market?

Major players in North America Smart Weapons Market include Lockheed Martin, Raytheon Technologies, Northrop Grumman, Boeing Defense, Space & Security, and General Dynamics Corporation.

04 What are the challenges in the North America Smart Weapons market?

Challenges in North America Smart Weapons Market include high development costs, regulatory barriers such as arms export controls, and concerns over cybersecurity threats to weapon systems.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.