North America Sheet Molding Compound And Bulk Molding Compound Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD6057

December 2024

93

About the Report

North America Sheet Molding Compound and Bulk Molding Compound Market Overview

- The North America SMC and BMC market, valued at USD 536.7 million, is driven by the increasing demand for lightweight, high-strength materials in the automotive and aerospace sectors. The versatility of these compounds enables manufacturers to reduce vehicle weight, which improves fuel efficiency and reduces emissions. Moreover, the growing construction and electrical sectors are adopting SMC and BMC materials for insulation and structural components due to their excellent electrical resistance and moldability.

- In North America, the United States is the dominant player in the SMC and BMC market, largely due to its advanced automotive and aerospace industries, as well as its robust manufacturing infrastructure. The regions focus on sustainable materials and energy-efficient solutions further enhances demand. Canada also contributes significantly, especially in the automotive and electrical sectors, where high-quality, cost-effective materials are essential.

- North American emission standards mandate stringent limits on VOC emissions, pushing SMC/BMC manufacturers to adopt low-emission compounds. Regulations stipulate maximum emission levels per compound, driving companies toward sustainable production. Compliance requirements align with the regions 2024 environmental targets, promoting market growth for eco-friendly materials.

North America Sheet Molding Compound and Bulk Molding Compound Market Segmentation

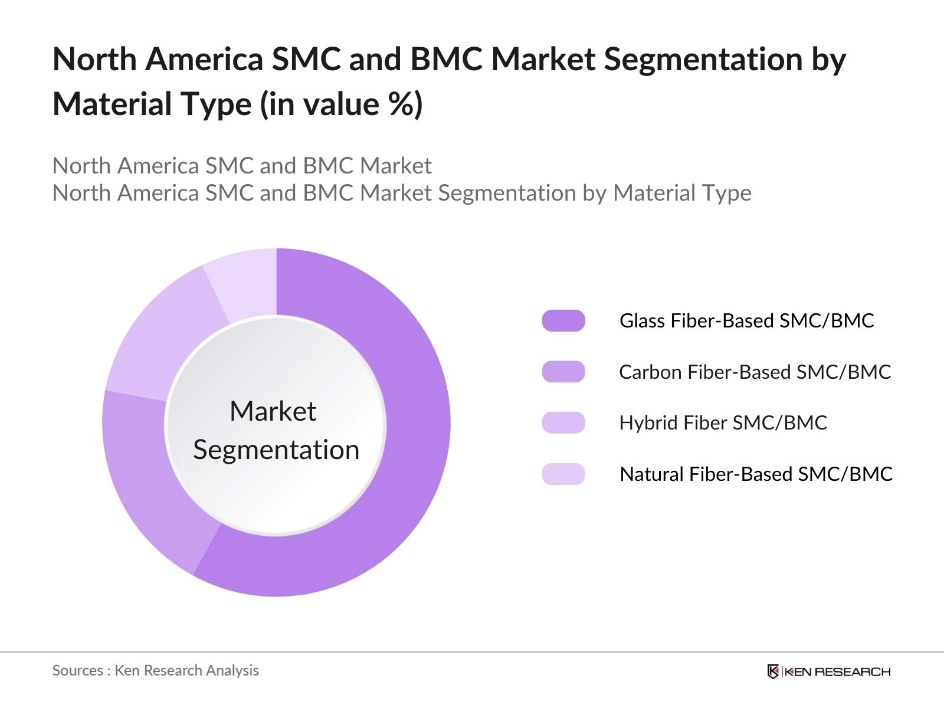

By Material Type: The market is segmented by material type into Glass Fiber-Based SMC/BMC, Carbon Fiber-Based SMC/BMC, Hybrid Fiber SMC/BMC, and Natural Fiber-Based SMC/BMC. The Glass Fiber-Based SMC/BMC currently holds the dominant share in the material type segment, primarily due to its cost-effectiveness, high strength, and widespread usage in automotive and construction applications. Glass fibers enhance durability and provide excellent insulation properties, making them ideal for electrical housings and vehicle body components. This affordability and strength have established glass fiber composites as a preferred choice in several North American industries.

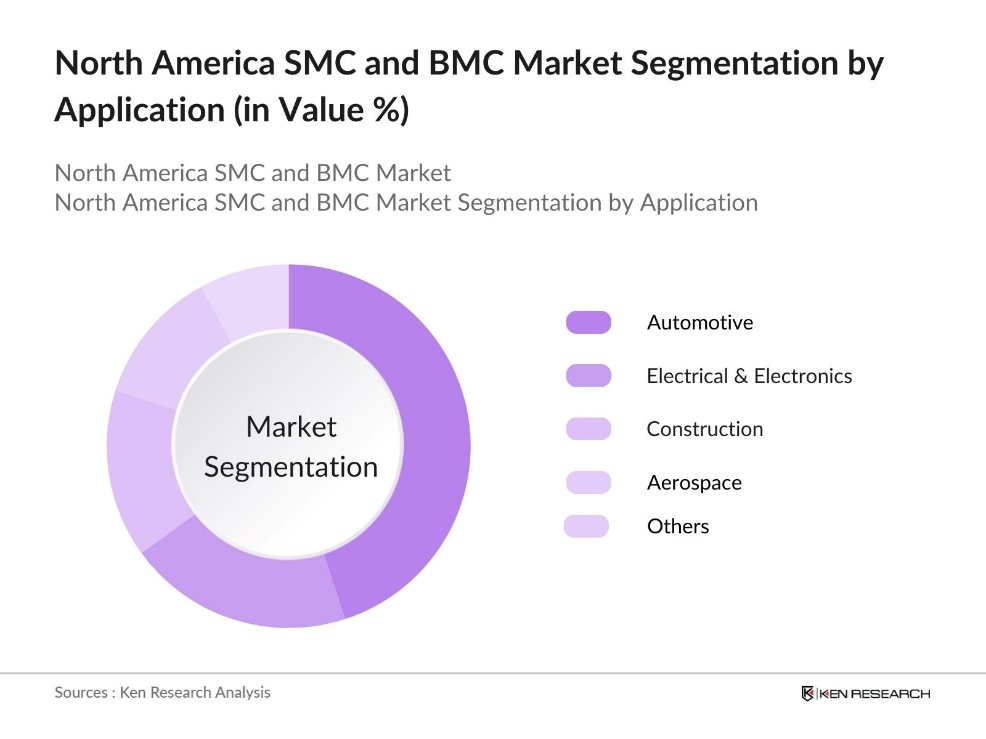

By Application: The market is segmented by application into Automotive, Electrical & Electronics, Construction, Aerospace, and Others. The Automotive segment dominates the application sector in North America, driven by the industry's demand for lightweight, high-strength materials to reduce vehicle emissions and enhance fuel efficiency. This focus aligns with regulatory trends promoting energy efficiency. Additionally, the adoption of electric vehicles is fueling demand for these materials due to their lightweight properties, which are essential for improving battery performance and driving range.

North America Sheet Molding Compound and Bulk Molding Compound Market Competitive Landscape

The North America SMC and BMC market is characterized by a few key players who hold substantial market influence, including companies specializing in automotive and composite materials. These market leaders leverage innovations and partnerships to meet the high demand for durable, lightweight materials.

North America Sheet Molding Compound and Bulk Molding Compound Industry Analysis

Growth Drivers

- Lightweight Material Adoption: Lightweight materials like SMC and BMC are gaining traction as the U.S. automotive sector intensifies efforts to improve vehicle efficiency. In 2024, North American automakers aimed for a minimum of 20% lightweight material incorporation in vehicles, making SMC and BMC preferred materials due to their low weight and high strength. Lightweight material adoption is essential to meet environmental regulations without compromising vehicle performance. This trend is strengthened by incentives and government programs supporting lightweight innovation in manufacturing.

- Electrical Insulation Needs: North Americas demand for SMC/BMC for electrical insulation applications remains robust, driven by advancements in the electrical and electronics sector. The regions insulation needs increased with projected growth in electronics manufacturing and a rising focus on dielectric strength. BMC, with high dielectric properties, is used in several electrical components. Current insulation standards in the U.S. require dielectric strengths that align with BMC/SMC capabilities, supporting sector growth.

- Infrastructure Development: The North American infrastructure sector, with over $1 trillion allocated for various projects in 2024, supports the SMC/BMC market. SMC/BMC's strength and durability make them ideal for applications in construction materials and infrastructure components. This allocation is expected to fuel demand in construction applications, with key projects focusing on high-strength and weather-resistant materials for bridges, buildings, and public works.

Market Challenges

- High Production Costs: The production of SMC/BMC materials requires the use of costly, high-grade resins and fibers, creating a financial challenge for North American manufacturers. These high-quality standards result in elevated production costs per kilogram, which can be a barrier to broader adoption in various industries. Although the U.S. manufacturing sector is working to mitigate these expenses by exploring alternative sourcing options and implementing efficiency measures, the overall cost structure remains a challenge for achieving large-scale, affordable production.

- Volatile Raw Material Prices: The SMC/BMC sector in North America is subject to fluctuations in the prices of essential raw materials, such as resins and fibers, largely due to global supply chain uncertainties. This price volatility impacts manufacturing input costs and poses challenges for companies aiming for cost stability. Manufacturers are often required to adopt strategic cost-management approaches to navigate the unpredictable pricing environment for these critical raw materials.

North America Sheet Molding Compound and Bulk Molding Compound Market Future Outlook

Over the next five years, the North America SMC and BMC market is anticipated to grow significantly. Growth is expected to be driven by rising adoption in automotive and aerospace sectors, driven by regulatory pressure for sustainable materials and energy efficiency. Innovations in composite technology and expanding applications in infrastructure projects will further propel market demand. Government incentives and funding initiatives are expected to bolster research and development efforts within the industry.

Market Opportunities

- Technological Innovations: Advancements in North America's manufacturing sector, particularly in automation and composite molding, are enabling the development of new SMC/BMC products with enhanced performance characteristics. Innovations in material science have allowed the creation of high-temperature-resistant compounds, making them suitable for extreme-use applications across industries such as automotive and aerospace. These technological strides offer promising opportunities for manufacturers to improve production efficiency and meet evolving market demands for advanced materials.

- Growing EV Sector: The expansion of electric vehicle (EV) production in North America is driving demand for lightweight SMC/BMC materials. EV manufacturers are increasingly seeking high-performance composites to reduce vehicle weight and improve efficiency, aligning with industry goals of enhanced energy efficiency and safety standards. This growth in the EV sector positions SMC/BMC materials as vital components, supporting both vehicle performance and sustainability objectives in the automotive industry.

Scope of the Report

|

Material Type |

Glass Fiber-Based SMC/BMC |

|

Application |

Automotive |

|

End-User |

OEMs |

|

Process Type |

Compression Molding |

|

Country |

United States |

Products

Key Target Audience

Automotive Manufacturers

Construction and Infrastructure Companies

Electrical and Electronics OEMs

Renewable Energy Companies

Government and Regulatory Bodies (Environmental Protection Agency, Department of Transportation)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

IDI Composites International

Polynt-Reichhold Group

Core Molding Technologies

Continental Structural Plastics

Menzolit GmbH

Citadel Plastics Holdings Inc.

Showa Denko K.K.

Plastic Omnium

Premix Inc.

Toray Industries Inc.

Table of Contents

1. North America SMC and BMC Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. North America SMC and BMC Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America SMC and BMC Market Analysis

3.1 Growth Drivers

3.1.1 Automotive Industry Demand (Automotive Production Units)

3.1.2 Lightweight Material Adoption (Lightweight Material % in Automotive)

3.1.3 Electrical Insulation Needs (Dielectric Strength Requirements)

3.1.4 Infrastructure Development (Infrastructure Investment Amount)

3.2 Market Challenges

3.2.1 High Production Costs (Cost per Kg Analysis)

3.2.2 Volatile Raw Material Prices (Price Index of Resins and Fibers)

3.2.3 Limited Recycling Infrastructure (Recycling Rate %)

3.2.4 Regulatory Restrictions (Compliance Requirements)

3.3 Opportunities

3.3.1 Technological Innovations (New Product Introductions)

3.3.2 Growing EV Sector (EV Production %)

3.3.3 Increasing Aerospace Applications (Aerospace Parts by Material Type)

3.3.4 Expanding Renewable Energy Sector (Wind Turbine Material Needs)

3.4 Trends

3.4.1 Adoption of High-Performance Compounds (High-Temperature Stability Demand)

3.4.2 Shift towards Bio-based SMC/BMC (Bio-based Material %)

3.4.3 Customization in Automotive Interiors (Customized Compound %)

3.4.4 Integration of Smart Manufacturing (Smart Manufacturing Penetration Rate)

3.5 Government Regulations

3.5.1 Emission Reduction Standards (Emission Limit by Compound)

3.5.2 Safety and Environmental Regulations (Compliance by SMC/BMC Category)

3.5.3 Material Sustainability Goals (Sustainable Material % Target)

3.5.4 Export/Import Tariffs on Raw Materials (Tariff Rates)

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces

3.9 Competitive Landscape

4. North America SMC and BMC Market Segmentation

4.1 By Material Type (In Value %)

4.1.1 Glass Fiber-Based SMC/BMC

4.1.2 Carbon Fiber-Based SMC/BMC

4.1.3 Hybrid Fiber SMC/BMC

4.1.4 Natural Fiber-Based SMC/BMC

4.2 By Application (In Value %)

4.2.1 Automotive

4.2.2 Electrical & Electronics

4.2.3 Construction

4.2.4 Aerospace

4.2.5 Others

4.3 By End-User (In Value %)

4.3.1 OEMs

4.3.2 Aftermarket

4.3.3 Industrial Users

4.4 By Process Type (In Value %)

4.4.1 Compression Molding

4.4.2 Injection Molding

4.4.3 Continuous Molding

4.4.4 Other Custom Processes

4.5 By Country (In Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

5. North America SMC and BMC Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 IDI Composites International

5.1.2 Polynt-Reichhold Group

5.1.3 Continental Structural Plastics

5.1.4 Core Molding Technologies

5.1.5 Premix Inc.

5.1.6 Menzolit GmbH

5.1.7 Citadel Plastics Holdings Inc.

5.1.8 Showa Denko K.K.

5.1.9 Plastic Omnium

5.1.10 Romeo RIM

5.1.11 Huntsman Corporation

5.1.12 Toray Industries Inc.

5.1.13 Lonza Group

5.1.14 Gurit Holding AG

5.1.15 Ashland Inc.

5.2 Cross Comparison Parameters (No. of Employees, Revenue, Production Volume, Manufacturing Capacity, R&D Expenditure, Sustainability Initiatives, Key Market Regions, Product Diversification)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. North America SMC and BMC Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. North America SMC and BMC Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America SMC and BMC Future Market Segmentation

8.1 By Material Type (In Value %)

8.2 By Application (In Value %)

8.3 By End-User (In Value %)

8.4 By Process Type (In Value %)

8.5 By Country (In Value %)

9. North America SMC and BMC Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

We developed an ecosystem map for the North America SMC and BMC market, identifying major stakeholders through in-depth desk research. The analysis aimed to pinpoint variables influencing material selection, application demand, and regulatory impacts across sectors.

Step 2: Market Analysis and Construction

Historical data for the market was compiled to analyze trends and growth patterns. This analysis included examining industry penetration levels and service provider ratios, contributing to reliable revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on market trends and dynamics were validated through interviews with industry experts and market practitioners, which helped refine market estimates and segmentation accuracy.

Step 4: Research Synthesis and Final Output

Final synthesis involved discussions with composite material manufacturers, providing insights on production volumes, consumer demand, and market gaps. This phase ensured a holistic view of the North American SMC and BMC market with robust, validated data.

Frequently Asked Questions

01. How big is the North America SMC and BMC Market?

The North America SMC and BMC market is valued at USD 536.7 million, driven by increasing applications in automotive, construction, and aerospace industries due to their lightweight and high-strength properties.

02. What are the challenges in the North America SMC and BMC Market?

Challenges in North America SMC and BMC market include high production costs, volatility in raw material prices, and limited recycling infrastructure. Additionally, regulatory compliance demands can affect operational flexibility.

03. Who are the major players in the North America SMC and BMC Market?

Key players in North America SMC and BMC market include IDI Composites International, Polynt-Reichhold Group, Core Molding Technologies, Continental Structural Plastics, and Menzolit GmbH. These companies dominate due to their extensive product portfolios and significant production capacities.

04. What are the growth drivers of the North America SMC and BMC Market?

The North America SMC and BMC market growth is driven by demand for lightweight materials in automotive and aerospace, adoption in renewable energy sectors, and increased use in electrical insulation due to their excellent dielectric properties.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.