North America Snack Food Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD4400

December 2024

93

About the Report

North America Snack Food Market Overview

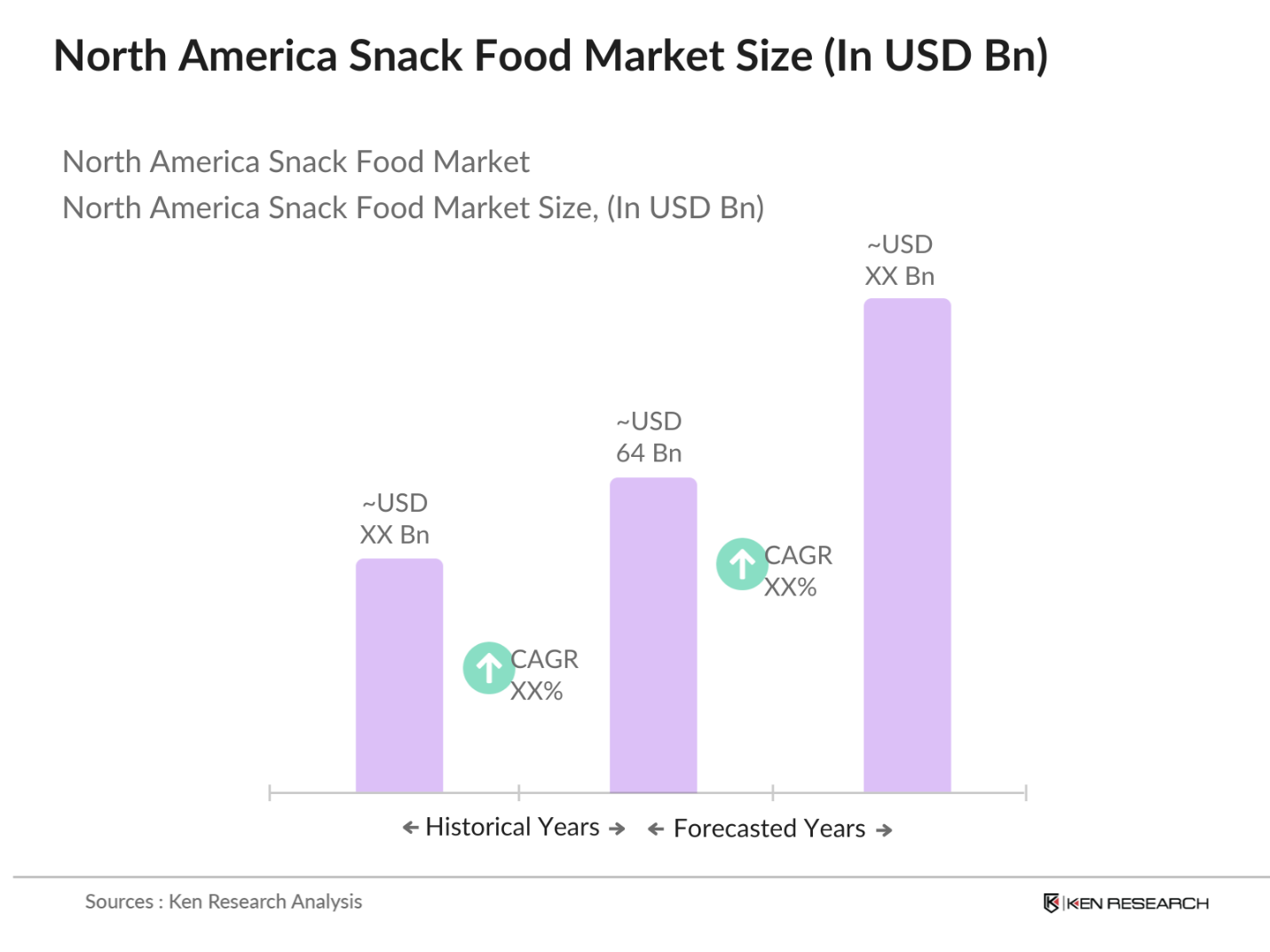

- The North America Snack Food market is valued at approximately USD 64 billion, with a steady growth trajectory observed based on a five-year historical analysis. The markets growth is primarily driven by the increasing demand for convenient and ready-to-eat food products, especially due to changing consumer lifestyles. With an expanding population base of health-conscious individuals, snack products like protein bars, plant-based snacks, and gluten-free offerings have gained significant traction. This shift towards healthier snacking habits is a primary driver behind the market's steady growth.

- Several cities and regions in North America dominate the snack food market due to their robust consumer bases and diverse food cultures. The United States, particularly cities like New York, Los Angeles, and Chicago, lead the market due to their large populations, high disposable incomes, and well-established retail infrastructures. The presence of major players in these regions further strengthens their dominance. Additionally, Canadas urban centers, such as Toronto and Vancouver, are also critical hubs for the snack food industry, driven by rising health trends and growing consumer interest in natural and organic snack options.

- The U.S. Food and Drug Administrations updated nutritional labeling requirements, introduced in 2023, have placed new compliance burdens on snack food manufacturers. The regulations mandate that companies provide clearer labeling on added sugars, calorie content, and serving sizes, ensuring consumers can make informed choices. For snack manufacturers, this means a need to reformulate or relabel products to meet the guidelines. The USDA has reported that approximately 32% of snack products underwent label changes in 2023 to comply with these new rules.

North America Snack Food Market Segmentation

By Product Type: The North America Snack Food market is segmented by product type into savory snacks, sweet snacks, baked goods, frozen snacks, and nuts & seeds.

Savory snacks have a dominant market share due to their popularity across various age groups and the convenience they offer as on-the-go food. The established brands in this category, such as Lays, Doritos, and Ruffles, continue to innovate with new flavors and packaging, contributing to their market strength. The demand for protein-rich and low-carb savory snacks is also surging, driven by health-conscious consumers.

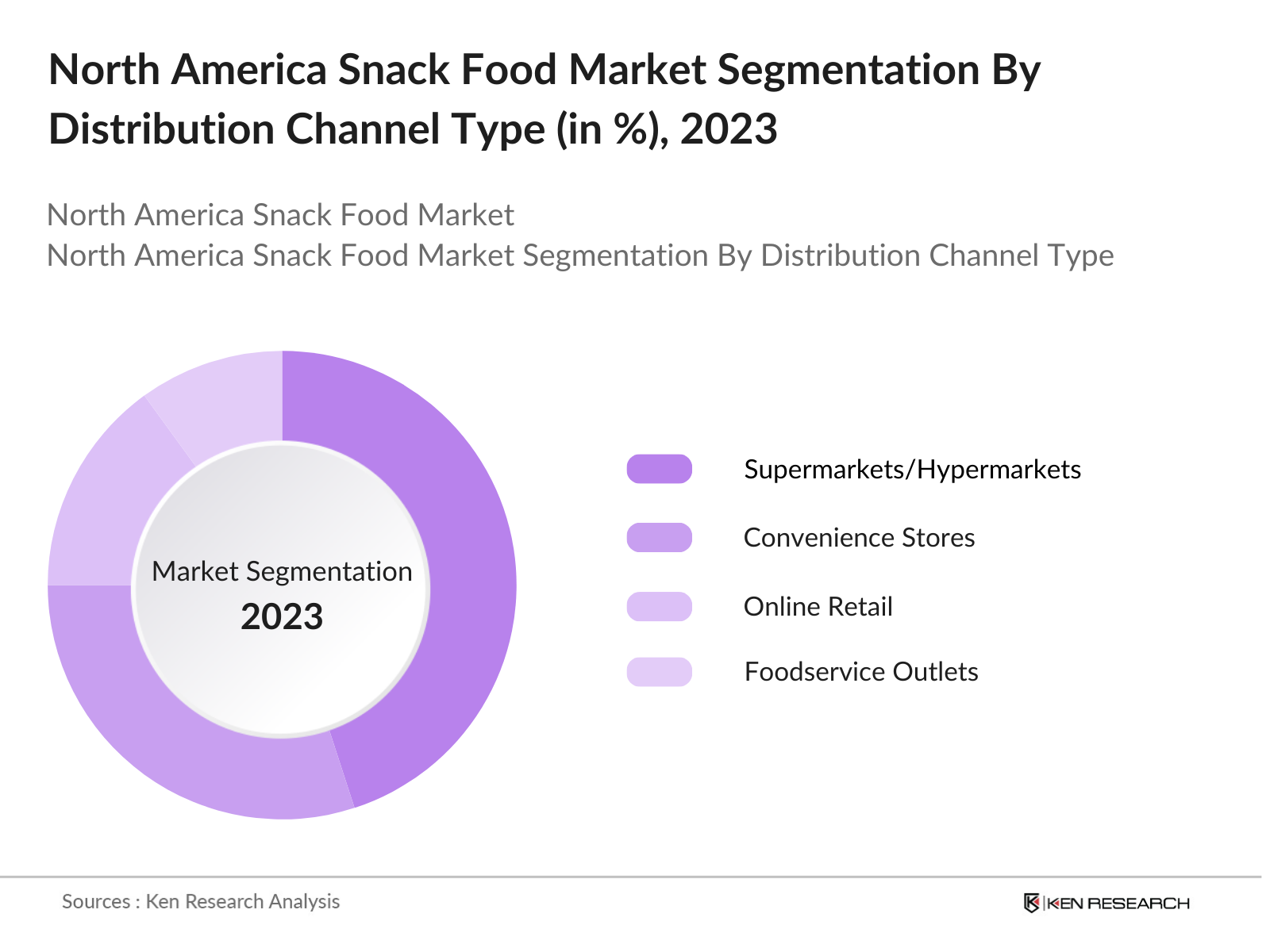

By Distribution Channel: The market is segmented by distribution channels into supermarkets/hypermarkets, convenience stores, online retail, and foodservice outlets.

Supermarkets/hypermarkets hold a dominant market share due to their widespread presence, variety of product offerings, and bulk purchase options. Stores like Walmart, Kroger, and Costco cater to a broad demographic, offering both premium and value-oriented snack brands. The ability to physically inspect products and the frequent availability of promotions make these channels the preferred choice for many consumers.

North America Snack Food Market Competitive Landscape

The North America Snack Food market is dominated by a few major players that continue to consolidate their market share through product innovation, strategic acquisitions, and brand loyalty. These companies invest heavily in R&D to cater to the ever-evolving consumer preferences, particularly towards healthier snack options. Major players such as PepsiCo (Frito-Lay), Mondelz International, and Kelloggs maintain a strong foothold due to their extensive distribution networks and vast product portfolios.

North America Snack Food Industry Analysis

Growth Drivers

- Rise in Health-Conscious Consumers: The increasing awareness of health-related issues has driven demand for healthier snack options across North America. In 2024, about 47% of consumers in the U.S. reported actively seeking snacks with health benefits, according to the U.S. Department of Agriculture. This trend is bolstered by the rise in lifestyle diseases like obesity and diabetes, which affected over 41 million adults in the U.S. in 2023, as reported by the CDC. As a result, demand for snacks with low sugar, organic, and natural ingredients has increased significantly.

- Increase in Ready-to-Eat Snack Demand: The demand for ready-to-eat (RTE) snacks has surged due to changing consumer lifestyles, with more consumers preferring convenience. According to the U.S. Census Bureau, in 2024, over 37 million households in the U.S. have dual-income earners, which boosts the demand for RTE snacks. Additionally, the increased participation of millennials and Gen Z in the workforce, accounting for over 45% of the labor force, has contributed to the growing reliance on quick, convenient snack options.

- Innovations in Plant-Based and Organic Snacks: Innovations in plant-based and organic snacks are driving growth as consumer preferences shift toward more sustainable and ethical products. In 2023, the U.S. Department of Agriculture reported a significant rise in plant-based food sales, with a 22% increase in product launches related to plant-based snacking options. The number of certified organic farms in North America also increased to over 19,000 in 2023, indicating growing demand for organic ingredients in the snack industry. These trends reflect consumer interest in sustainable and healthy options.

Market Challenges

- Rising Raw Material Costs: The snack food industry has faced increased challenges due to rising raw material costs, particularly for ingredients like corn, wheat, and oil. The U.S. Department of Agriculture reported that the cost of wheat surged by 12% from 2022 to 2023, driven by supply chain disruptions and climate-related agricultural issues. This has placed pressure on snack food manufacturers to balance costs without compromising product quality. Ongoing geopolitical conflicts and rising transportation costs have further exacerbated the challenge of maintaining steady production.

- High Competition Among Market Players: The snack food market in North America is highly competitive, with numerous established and emerging brands vying for market share. As of 2024, the U.S. Food and Drug Administration reports that there are over 2,500 registered snack food companies in the U.S. alone, contributing to market saturation. Smaller players often struggle to differentiate themselves in a market dominated by large multinational corporations. This competition drives innovation but also creates challenges for new entrants trying to capture consumer attention.

North America Snack Food Market Future Outlook

The North America Snack Food market is expected to witness substantial growth over the next five years, driven by factors such as increasing consumer interest in healthier snacking options, the rise of e-commerce channels, and innovative product offerings. As more consumers adopt on-the-go lifestyles, snack foods will continue to be a vital part of their diets, especially with the rising demand for plant-based, gluten-free, and low-sugar options. Additionally, companies are likely to focus on sustainable packaging solutions, catering to the growing demand for environmentally friendly products.

Opportunities

- Growing Demand for Sustainable Packaging: The growing consumer demand for sustainable packaging presents a significant opportunity for snack food manufacturers. In 2024, the U.S. Environmental Protection Agency reported that packaging waste accounted for over 80 million tons of waste annually, prompting consumer interest in eco-friendly alternatives. Many companies are now exploring biodegradable and recyclable packaging solutions to meet this demand. Consumer surveys by the USDA show that 63% of snack buyers prefer products with sustainable packaging, creating a market opportunity for brands that prioritize environmental impact.

- Emergence of E-Commerce Platforms for Snack Foods: The shift toward online shopping has revolutionized snack food distribution channels. According to the U.S. Census Bureau, e-commerce sales in the food and beverage sector reached $30 billion in 2023, marking a significant increase from previous years. This growth reflects changing consumer preferences, with more individuals opting for home delivery of snacks. The convenience and accessibility of online platforms like Amazon, Walmart, and specialty food websites have opened new avenues for snack food companies to reach a broader audience.

Scope of the Report

|

Product Type |

Savory Snacks Sweet Snacks Frozen Snacks Baked Snacks Chips & Crackers |

|

Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Channels Specialty Stores Foodservice Outlets |

|

Flavor Type |

Salted Sweet Spicy Combination Flavors |

|

Ingredient Type |

Wheat-Based Corn-Based Potato-Based Fruit and Nut-Based Mixed Grains |

|

Region |

USA Canada Mexico |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, USDA)

Supermarkets and Retail Companies

Health and Nutrition Product Industries

Snack Food Companies

Packaging Material Industries

E-Commerce Companies

Foodservice Companies

Companies

Major Players

PepsiCo (Frito-Lay)

Mondelz International

Kelloggs

General Mills

Conagra Brands

The Hershey Company

Nestl USA

Campbell Soup Company

Snyders-Lance

McCain Foods

Tyson Foods

Blue Diamond Growers

Hormel Foods

J&J Snack Foods

Utz Brands

Table of Contents

1. North America Snack Food Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Snack Food Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Snack Food Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Health-Conscious Consumers

3.1.2. Increase in Ready-to-Eat Snack Demand

3.1.3. Innovations in Plant-Based and Organic Snacks

3.1.4. Increased Consumption During Work-from-Home Trends

3.2. Market Challenges

3.2.1. Rising Raw Material Costs

3.2.2. High Competition Among Market Players

3.2.3. Stringent Government Regulations on Ingredients

3.3. Opportunities

3.3.1. Growing Demand for Sustainable Packaging

3.3.2. Emergence of E-Commerce Platforms for Snack Foods

3.3.3. Expanding Flavors and Ethnic Snacks

3.4. Trends

3.4.1. Increased Demand for Protein-Rich Snacks

3.4.2. Increased Interest in Clean Label Products

3.4.3. Growth of Private Label Brands

3.5. Government Regulation

3.5.1. FDA Nutritional Labeling Requirements

3.5.2. Food Safety Modernization Act (FSMA)

3.5.3. Policies on Sugar and Sodium Content

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. North America Snack Food Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Savory Snacks

4.1.2. Sweet Snacks

4.1.3. Frozen Snacks

4.1.4. Baked Snacks

4.1.5. Chips and Crackers

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Channels

4.2.4. Specialty Stores

4.2.5. Foodservice Outlets

4.3. By Flavor Type (In Value %)

4.3.1. Salted

4.3.2. Sweet

4.3.3. Spicy

4.3.4. Combination Flavors

4.4. By Ingredient Type (In Value %)

4.4.1. Wheat-Based

4.4.2. Corn-Based

4.4.3. Potato-Based

4.4.4. Fruit and Nut-Based

4.4.5. Mixed Grains

4.5. By Region (In Value %)

4.5.1. USA

4.5.2. Canada

4.5.3. Mexico

5. North America Snack Food Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. PepsiCo

5.1.2. Kelloggs

5.1.3. Mondelz International

5.1.4. General Mills

5.1.5. Conagra Brands

5.1.6. The Hershey Company

5.1.7. Nestl

5.1.8. Campbell Soup Company

5.1.9. Snyder's-Lance

5.1.10. McCain Foods

5.1.11. Tyson Foods

5.1.12. Blue Diamond Growers

5.1.13. Hormel Foods

5.1.14. J&J Snack Foods

5.1.15. Utz Brands

5.2. Cross Comparison Parameters

(Revenue, Headquarters, Number of Employees, Product Launches, Market Share, Innovation Score, Global Presence, Sustainability Practices)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. North America Snack Food Market Regulatory Framework

6.1. Food Labeling Standards

6.2. Health Claims and Certifications

6.3. Allergen and Ingredient Transparency

7. North America Snack Food Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Snack Food Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Ingredient Type (In Value %)

8.4. By Flavor Type (In Value %)

8.5. By Region (In Value %)

9. North America Snack Food Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavior Analysis

9.3. White Space Opportunities

9.4. Marketing Initiatives

Research Methodology

Step 1: Identification of Key Variables

In this step, a thorough desk research is conducted to map the ecosystem of the North America Snack Food Market. Key variables such as product types, distribution channels, and consumer preferences are identified through proprietary and secondary research.

Step 2: Market Analysis and Construction

This stage focuses on analyzing historical data and evaluating market penetration and revenue generation across various segments. Service quality and product innovation trends are also assessed to ensure accurate market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses are validated through interviews with industry experts from leading companies in the snack food sector. These consultations help refine data accuracy and provide operational insights.

Step 4: Research Synthesis and Final Output

Final market insights are synthesized through direct engagement with manufacturers, distributors, and retailers. The bottom-up approach ensures the final analysis is accurate, comprehensive, and validated by industry participants.

Frequently Asked Questions

1. How big is the North America Snack Food Market?

The North America Snack Food market is valued at approximately USD 64 billion, driven by the rising demand for convenient, healthy, and ready-to-eat snack products.

2. What are the challenges in the North America Snack Food Market?

Key challenges include rising raw material costs, increased competition, and regulatory hurdles related to ingredient transparency and sustainability initiatives.

3. Who are the major players in the North America Snack Food Market?

Major players include PepsiCo (Frito-Lay), Mondelz International, Kelloggs, General Mills, and Conagra Brands, dominating through their extensive distribution networks and product innovation.

4. What are the growth drivers of the North America Snack Food Market?

The market is driven by factors such as the growing trend of healthy snacking, the rise of e-commerce platforms, and innovative product developments in plant-based and gluten-free snacks.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.