North America Soju Market Outlook to 2030

Region:North America

Author(s):Sanjeev

Product Code:KROD442

December 2024

97

About the Report

North America Soju Market Overview

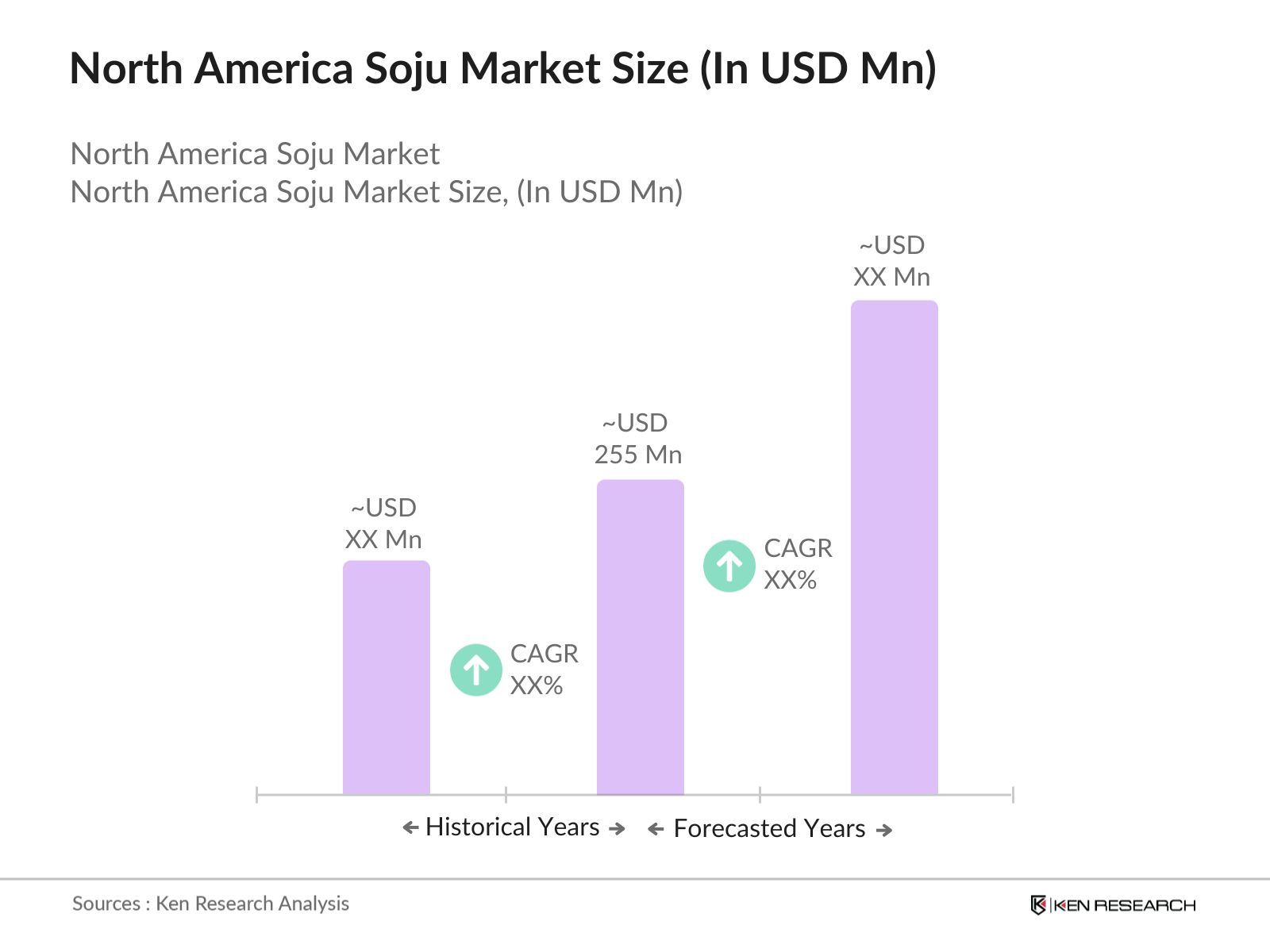

- The North America Soju market, valued at USD 255 million, has grown considerably due to a surge in consumer interest in traditional and exotic alcoholic beverages. The market's expansion is largely driven by the rising popularity of Korean culture, including food and beverages, among younger consumers and urban populations. A focus on low-alcohol content drinks further enhances Soju's appeal, especially in health-conscious demographics. Key players in the market are continuously innovating flavors and packaging to cater to a wider consumer base.

- The Soju market in North America is particularly prominent in metropolitan areas like Los Angeles, New York City, and Chicago. These cities host large Korean-American populations and offer extensive Korean culinary experiences, creating a natural demand for Soju. Additionally, the influence of Korean culture in these cities, coupled with the popularity of Korean restaurants and bars, fosters Soju's market dominance. This trend is further fueled by the increasing number of Asian supermarkets and liquor stores that offer a wide variety of Soju brands and flavors.

- Import tariffs on alcoholic beverages affect sojus market entry and pricing structure. According to the U.S. Department of Commerce, imported spirits, including soju, are subject to tariffs ranging from 2.5% to 10% based on ABV and origin. These tariffs, along with additional compliance standards enforced by customs and trade bureaus, pose financial and logistical challenges for soju importers. Adhering to these standards is crucial for maintaining product availability and competitiveness.

North America Soju Market Segmentation

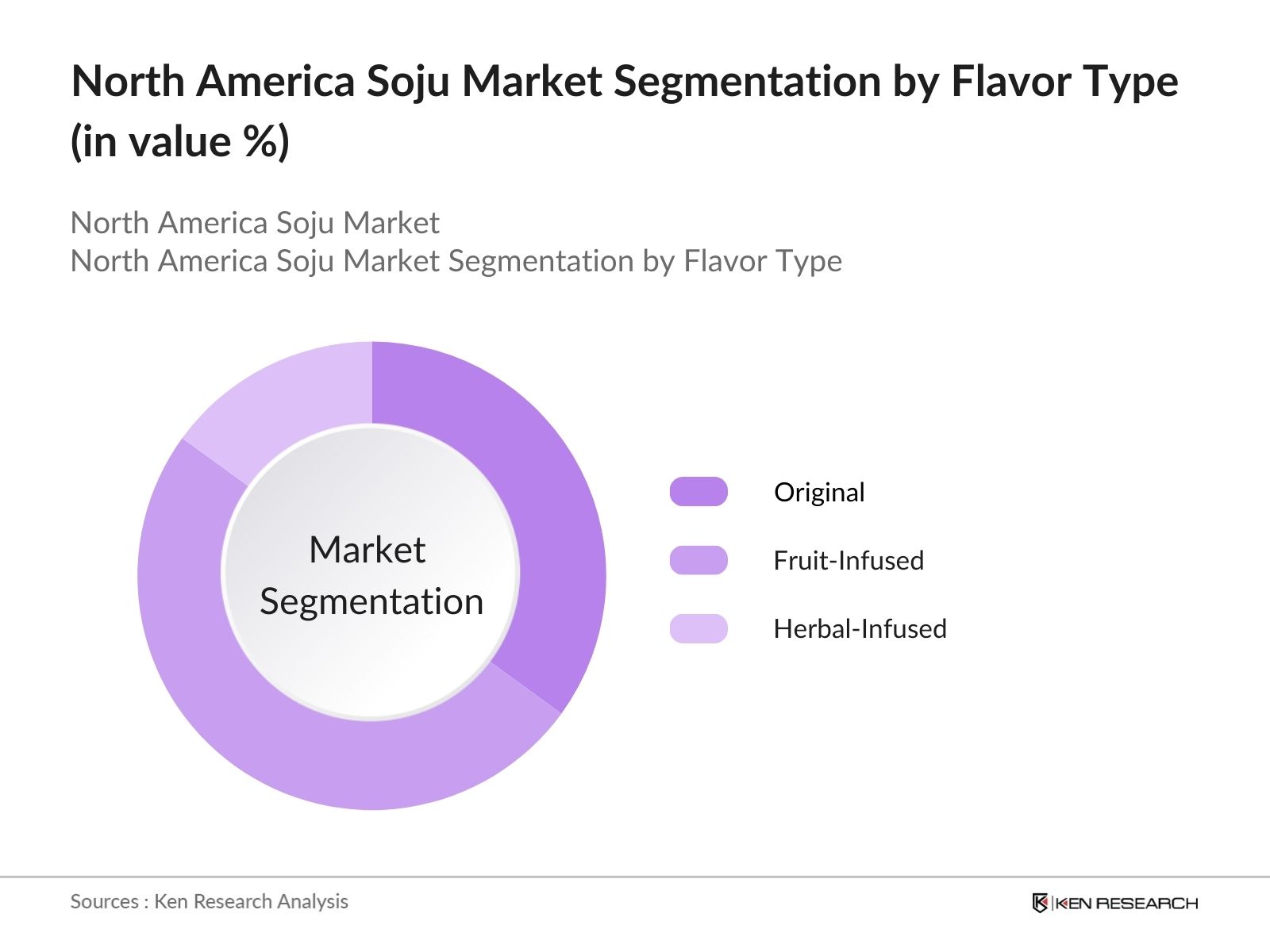

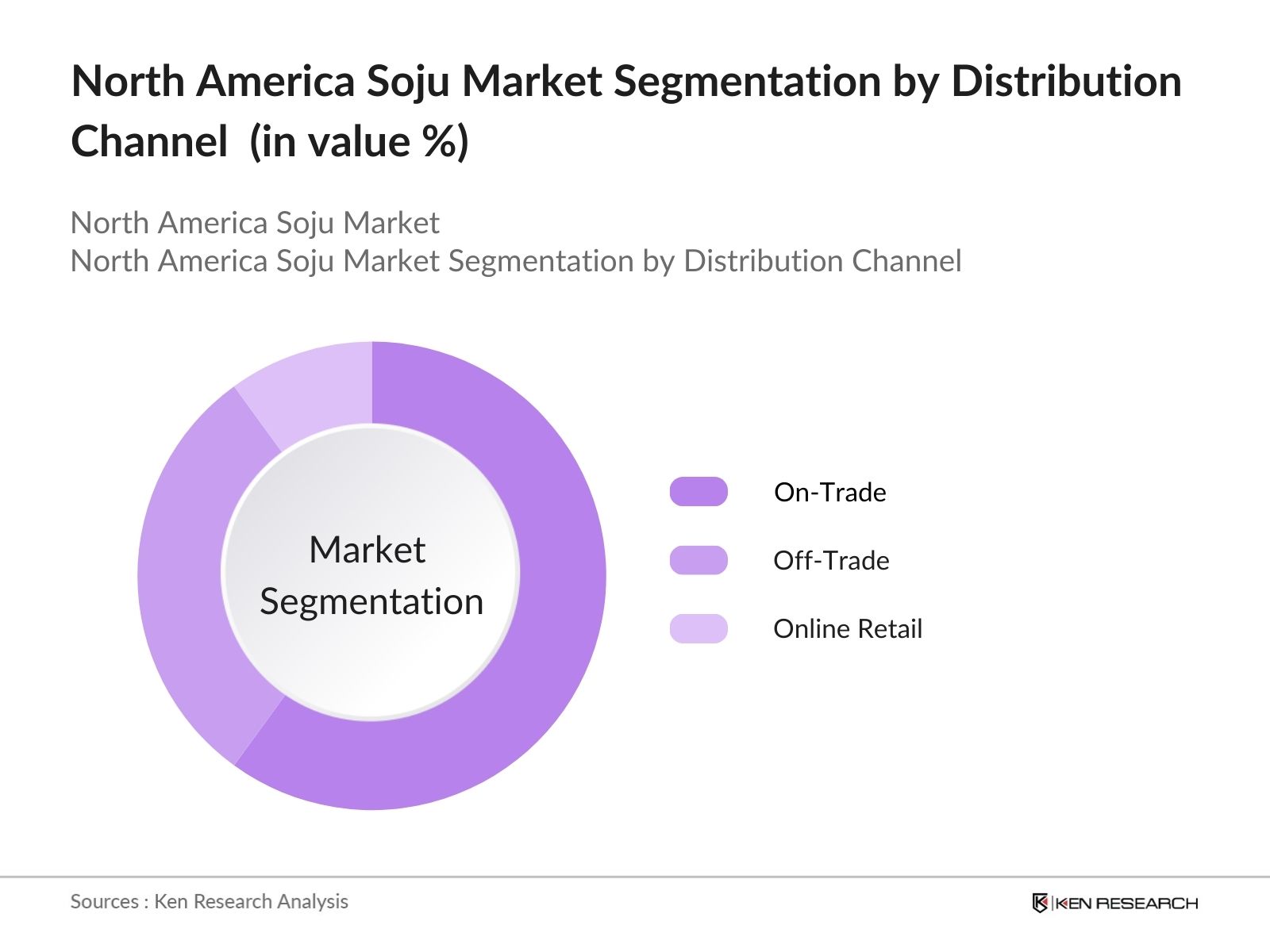

The North America Soju market is segmented by flavor type and by distribution channel.

- By Flavor Type: The North America Soju market is segmented by flavor type, including Original, Fruit-Infused, and Herbal-Infused Soju varieties. Fruit-Infused Soju holds the dominant market share under this segmentation due to its wide appeal across consumer segments. The inclusion of popular flavors such as strawberry, peach, and grapefruit enhances accessibility and appeal, particularly among younger consumers and those seeking lighter, flavored alcoholic options. Brands have strategically positioned fruit-infused options as refreshing, easy-to-drink alternatives, which has been instrumental in their market success.

- By Distribution Channel: The North America Soju market is segmented by distribution channel into On-Trade, Off-Trade, and Online Retail. On-Trade channels, particularly restaurants and bars, dominate this market segment. The presence of Soju in Korean and Asian-themed restaurants, bars, and clubs across North America has established it as a preferred choice for dining out experiences. These establishments frequently serve Soju-based cocktails, boosting its popularity and creating a dedicated consumer base.

North America Soju Market Competitive Landscape

The North America Soju market is dominated by both established and emerging players, with significant contributions from Korean-based and local brands. This competitive landscape is defined by a mix of large and niche players, each leveraging unique flavors and branding to capture consumer attention. The competitive landscape in North America highlights the importance of brand loyalty, innovative flavors, and distribution partnerships with Asian restaurants and grocery chains. Korean brands such as HiteJinro and Lotte Liquor dominate due to their strong brand presence and extensive product lines.

North America Soju Market Analysis

Growth Drivers

- Rise in Demand for Traditional Spirits: The North American market has seen a rise in the popularity of traditional Asian spirits like soju, aligning with consumer trends towards diverse and unique beverage options. A report by the United States Department of Agriculture (USDA) notes a steady increase in the import of Korean alcoholic beverages, with annual imports reaching 1,600,000 liters in 2023. This surge is fueled by consumer demand for lower-ABV options compared to whiskey or vodka, positioning soju favorably among traditional spirits. Korean restaurants and bars across North America have been instrumental in introducing soju, driving its consumption.

- Increased Consumption by Younger Demographics: In 2023, data from research, indicated that 37% of young adults aged 21-34 in North America expressed interest in trying soju due to its low alcohol content and versatility in cocktails. This demographic trend highlights a shift towards lower-alcohol beverages, with soju becoming a popular choice for millennials and Gen Z consumers seeking lighter options that align with healthier lifestyle choices. This shift is supported by the USDAs 2023 report on beverage imports, showing increased demand for beverages with ABVs below 25%.

- Expansion of Korean Food Culture: The Korean food industrys growth in North America, valued at nearly 3 billion USD in 2023, directly supports sojus rising popularity, as reported by the USDA and the Korean Food Promotion Institute. Korean barbecue and fusion restaurants frequently offer soju on their menus, boosting its visibility and integration into North American drinking culture. Cities with large Korean-American populations, such as Los Angeles and New York, have become hotspots for Korean food and beverages, broadening sojus consumer base beyond Korean communities.

Market Challenges

- Competition from Other Spirits (e.g., Sake, Whiskey): Soju faces stiff competition from other established spirits like sake and whiskey. The USDAs 2023 beverage import report shows that Japanese sake imports outpaced soju by 2.4 million liters, revealing the challenge of positioning soju amidst well-entrenched alternatives. With whiskey being a favorite among North Americans, soju needs targeted marketing strategies to distinguish itself within this competitive landscape.

- High Excise Taxes on Imported Alcohol: Excise taxes on imported alcohol pose a significant challenge for sojus affordability in North America. According to the U.S. Department of the Treasury, imported spirits face average excise taxes of around $13.50 per proof gallon, increasing the retail price. In Canada, similar taxes and provincial tariffs further add to the cost, making soju comparatively expensive compared to domestic spirits. These tariffs can deter price-sensitive consumers, making it difficult for soju to penetrate the mainstream market.

North America Soju Market Future Outlook

The North America Soju market is projected to experience steady growth over the next several years. This growth is likely to be driven by expanding consumer awareness of Korean culture, rising interest in low-ABV beverages, and the continued expansion of Korean restaurants and Asian supermarkets across North America. The market is expected to benefit from both consumer preference for traditional alcoholic beverages and product innovations, especially in flavored and ready-to-drink Soju cocktails.

Market Opportunities

- Growth of Low-ABV and Flavored Soju: There is a growing market opportunity for low-ABV and flavored soju in North America. USDA reports highlight a 20% increase in the import of flavored alcoholic beverages in 2023, reflecting a consumer shift towards unique, low-alcohol drinks. Flavored soju, which often has ABVs between 10-15%, resonates with consumers seeking novelty and lighter drinking experiences. This trend indicates a potential area for growth, particularly among younger audiences interested in flavored varieties.

- Market Penetration in Untapped Regions: Several regions in North America remain largely untapped for soju, particularly in areas beyond major metropolitan centers. USDA data reveals that while most soju consumption is concentrated in urban hubs, states like Texas, Florida, and Arizona show rising interest in imported alcoholic beverages. Increasing marketing and distribution efforts in these regions can help reach broader demographics, tapping into local demand for international spirits.

Scope of the Report

| By Flavor Type | - Fruit-Infused (Strawberry, Peach, Grapefruit) - Herbal-Infused |

| By Alcohol Content | - Low ABV (Under 20%) - Regular ABV (20-25%) - High ABV (Above 25%) |

| By Packaging | - Glass Bottles - Plastic Bottles - Canned Soju |

| By Distribution Channel | - On-Trade (Restaurants, Bars, Clubs) - Off-Trade (Retail, Liquor Stores, Supermarkets) - Online Retail |

| By Region | - US - Canada - Mexico |

Products

Key Target Audience

Alcoholic Beverage Distributors

On-Trade Service Providers (Restaurants, Bars)

Off-Trade Retailers (Liquor Stores, Supermarkets)

Asian Supermarkets and Specialty Stores

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Alcohol and Tobacco Tax and Trade Bureau, Canadian Food Inspection Agency)

E-commerce Alcohol Retailers

Brand and Marketing Agencies Specializing in Alcoholic Beverages

Companies

Players Mention in the Report:

HiteJinro Co., Ltd.

Lotte Liquor

Charm Soju

Andong Soju

Jeju Soju

Chamisul Soju

Muhak Soju

C1 Soju

Hwayo

Kumbokju

Baesangmyun Brewery

Hanju Soju

Seoul Night Soju

Daesun Distilling Company

Samhae Soju

Table of Contents

North America Soju Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

North America Soju Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

North America Soju Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Demand for Traditional Spirits

3.1.2. Increased Consumption by Younger Demographics

3.1.3. Expansion of Korean Food Culture

3.1.4. Strong Distribution Network Expansion

3.2. Market Challenges

3.2.1. Competition from Other Spirits (e.g., Sake, Whiskey)

3.2.2. High Excise Taxes on Imported Alcohol

3.2.3. Variability in Regulatory Standards by State

3.3. Opportunities

3.3.1. Growth of Low-ABV and Flavored Soju

3.3.2. Market Penetration in Untapped Regions

3.3.3. Collaborations with Restaurants and Bars

3.4. Trends

3.4.1. Emergence of Ready-to-Drink Soju Cocktails

3.4.2. Increased Focus on Health-Conscious Variants

3.4.3. Online Sales of Alcohol and Direct-to-Consumer Channels

3.5. Government Regulation

3.5.1. Import Tariffs and Compliance Standards

3.5.2. State-Specific Distribution and Licensing Regulations

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

North America Soju Market Segmentation

4.1. By Flavor Type (In Value %)

4.1.1. Original

4.1.2. Fruit-Infused (Strawberry, Peach, Grapefruit)

4.1.3. Herbal-Infused

4.2. By Alcohol Content (In Value %)

4.2.1. Low ABV (Under 20%)

4.2.2. Regular ABV (20-25%)

4.2.3. High ABV (Above 25%)

4.3. By Packaging (In Value %)

4.3.1. Glass Bottles

4.3.2. Plastic Bottles

4.3.3. Canned Soju

4.4. By Distribution Channel (In Value %)

4.4.1. On-Trade (Restaurants, Bars, Clubs)

4.4.2. Off-Trade (Retail, Liquor Stores, Supermarkets)

4.4.3. Online Retail

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

North America Soju Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. HiteJinro Co., Ltd.

5.1.2. Lotte Liquor

5.1.3. Charm Soju

5.1.4. Chamisul Soju

5.1.5. Kumbokju

5.1.6. Andong Soju

5.1.7. Muhak

5.1.8. C1 Soju

5.1.9. Hwayo

5.1.10. Jeju Soju

5.1.11. Hanju

5.1.12. Samhae Soju

5.1.13. Baesangmyun Brewery

5.1.14. Seoul Night Soju

5.1.15. Daesun Distilling Company

5.2. Cross Comparison Parameters (Revenue, Number of Employees, Market Share, Brand Strength, Flavor Range, Regional Presence, Marketing Initiatives, Product Portfolio Diversification)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

North America Soju Market Regulatory Framework

6.1. Import Tariff Guidelines

6.2. State-Specific Licensing Requirements

6.3. Alcohol Content and Labeling Standards

6.4. Health Warnings and Advertisement Regulations

North America Soju Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

North America Soju Future Market Segmentation

8.1. By Flavor Type (In Value %)

8.2. By Alcohol Content (In Value %)

8.3. By Packaging (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

North America Soju Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves creating a comprehensive map of the North America Soju markets ecosystem. Extensive desk research and proprietary database resources are used to identify the primary stakeholders, focusing on manufacturers, distributors, and retail channels. The aim is to capture key factors impacting market growth and consumer preferences.

Step 2: Market Analysis and Data Construction

We analyze historical data to understand Sojus penetration across various distribution channels. Factors such as the increase in Korean restaurants, consumer interest in low-alcohol content drinks, and purchasing behaviors are assessed to provide a reliable market estimate.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts from leading Soju manufacturing and distribution firms. Interviews provide insights into production trends, distribution strategies, and consumer behavior, refining our data analysis and ensuring accuracy.

Step 4: Research Synthesis and Final Output

The final stage synthesizes data gathered from manufacturers, distributors, and consumers to validate our findings. This ensures that the North America Soju market analysis is comprehensive and reflects current market dynamics accurately, providing a robust basis for forecasting future trends.

Frequently Asked Questions

01. How big is the North America Soju Market?

The North America Soju market was valued at USD 255 million, driven by the increasing popularity of Korean culture and the demand for low-alcohol beverages among young and urban consumers.

02. What challenges exist in the North America Soju Market?

North America Soju market Challenges include high excise taxes on imported alcoholic beverages and competition from other low-ABV options like sake and craft cocktails. Additionally, regulatory standards differ by state, adding complexity for distributors.

03. Who are the major players in the North America Soju Market?

North America Soju market Key players include HiteJinro Co., Ltd., Lotte Liquor, Charm Soju, Andong Soju, and Jeju Soju. These companies dominate due to established brand recognition, extensive product lines, and strategic distribution networks.

04. What are the growth drivers of the North America Soju Market?

The North America Soju market growth is fueled by increased interest in Korean culture, a preference for traditional beverages, and Sojus availability in diverse flavors. Growing consumer awareness of low-alcohol options also plays a significant role.

05. Which distribution channels are most prominent in the North America Soju Market?

On-Trade channels, such as restaurants and bars, are most prominent, accounting for a significant portion of sales due to Soju's association with Korean dining experiences.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.