North America Spatial Computing Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD5445

October 2024

100

About the Report

North America Spatial Computing Market Overview

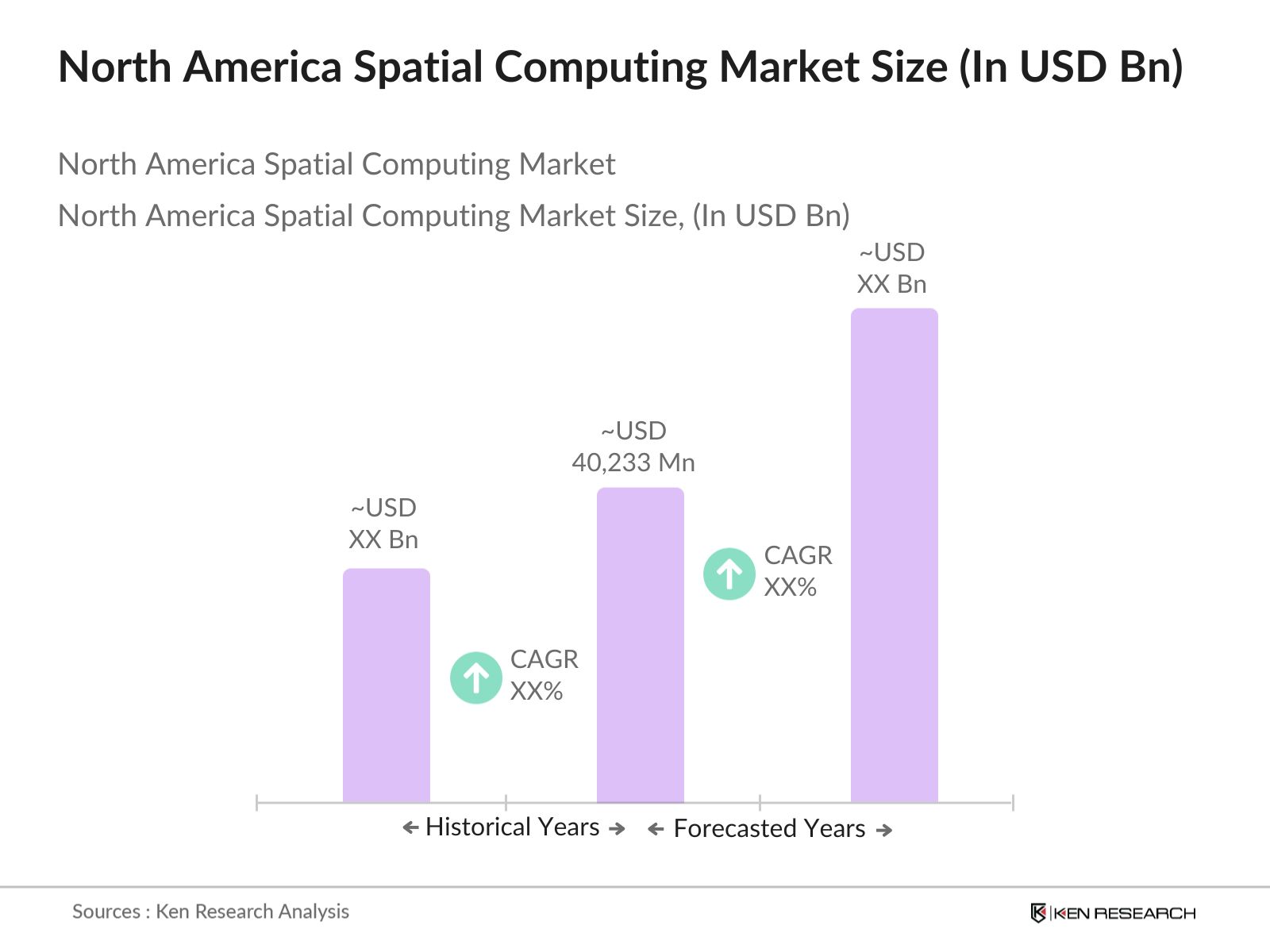

- The North America Spatial Computing market is valued at USD 40,233 million, based on a five-year historical analysis. This market is primarily driven by advancements in augmented reality (AR), virtual reality (VR), and mixed reality (MR) technologies, along with the increasing integration of these solutions in healthcare, education, and manufacturing. Spatial computing's ability to enhance real-time data visualization and immersive experiences is especially beneficial in sectors like medical training, industrial simulation, and urban planning, where detailed 3D mapping and interactive environments are essential for improving efficiency and decision-making.

- In terms of geographical dominance, the United States leads the North American spatial computing market due to its advanced technological infrastructure and a high concentration of major players such as Microsoft, Apple, and Google. The country benefits from a mature technology ecosystem and significant investments in spatial computing by both public and private sectors. Canada also plays a crucial role, especially in VR/AR technology development, backed by government initiatives and a growing tech startup ecosystem.

- North America's spatial computing market is subject to stringent data privacy and security regulations. The U.S. Federal Trade Commission imposed fines totaling $400 million on companies for breaches in AR/VR data privacy in 2023, signaling the importance of robust security frameworks in spatial technologies. These regulations mandate secure data handling, especially in sectors like healthcare and retail, where sensitive personal information is involved.

North America Spatial Computing Market Segmentation

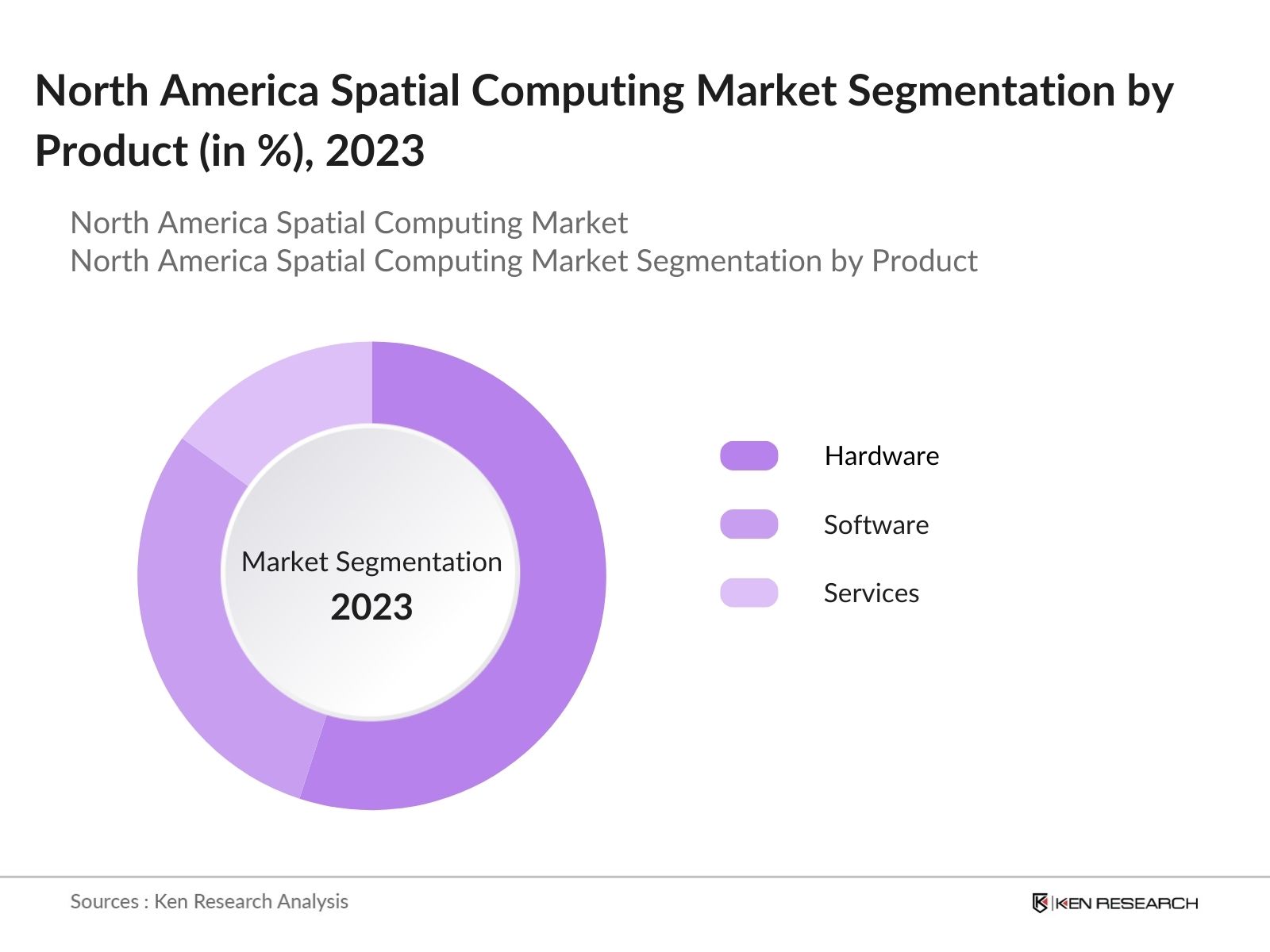

By Product Type: The market is segmented by product type into hardware, software, and services. The hardware segment holds a significant market share, driven primarily by the widespread adoption of AR and VR headsets. Products such as Microsoft HoloLens and Oculus Rift have gained traction due to their advanced features and growing use in industries like gaming, healthcare, and industrial training.

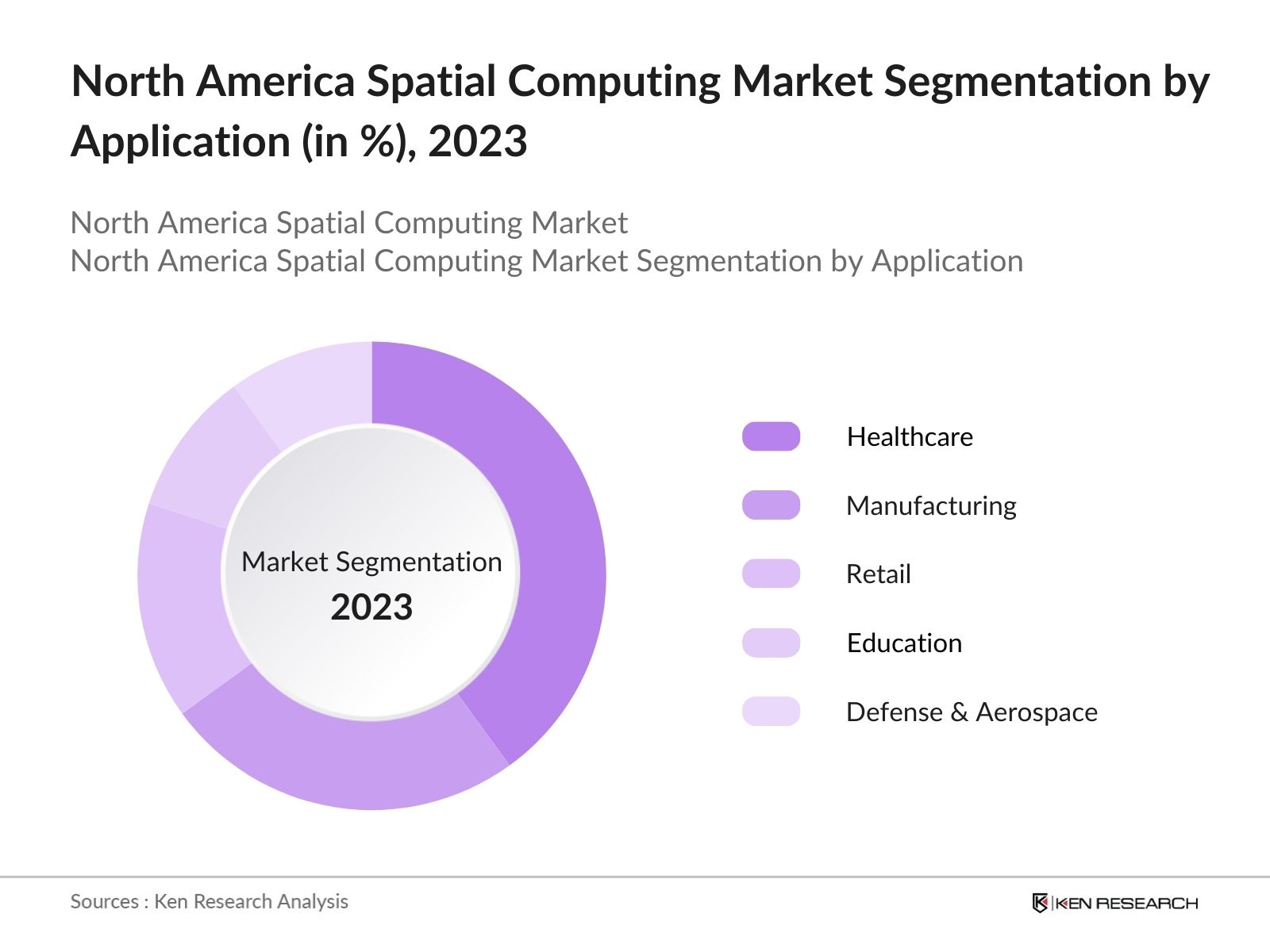

By Application: The market is also segmented by application into healthcare, manufacturing, retail, education, and defense & aerospace. The healthcare sector dominates the application segment, accounting for a substantial market share. The use of spatial computing in healthcare ranges from surgery simulations to patient diagnostics and rehabilitation. VR and AR technologies are improving patient outcomes by providing doctors with enhanced tools for visualization, training, and education.

North America Spatial Computing Market Competitive Landscape

The North America Spatial Computing market is dominated by several key players, with companies like Microsoft, Google, and Apple leading the charge. The market is characterized by a high level of competition due to rapid technological advancements and frequent product launches. Strategic collaborations, mergers, and acquisitions are common as companies seek to enhance their market presence and product portfolios.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Market Penetration |

Product Portfolio |

R&D Spending |

Strategic Initiatives |

Industry Focus |

Regional Presence |

|

Microsoft Corporation |

1975 |

Redmond, WA, USA |

|||||||

|

Google LLC |

1998 |

Mountain View, USA |

|||||||

|

Apple Inc. |

1976 |

Cupertino, USA |

|||||||

|

Meta Platforms, Inc. |

2004 |

Menlo Park, USA |

|||||||

|

Magic Leap, Inc. |

2010 |

Plantation, USA |

North America Spatial Computing Industry Analysis

Growth Drivers

- Advancements in Augmented Reality (AR) and Virtual Reality (VR) Technologies: The North American spatial computing market is witnessing growth due to advancements in AR and VR technologies. By 2024, the U.S. Department of Commerce reports that over $12 billion has been invested in AR/VR infrastructure, specifically in defense and medical applications, driving technological advancements. Furthermore, AR-based solutions in healthcare and retail have increased, with hospitals incorporating AR for surgical planning, reducing surgery times by up to 30 minutes per procedure.

- Integration of Spatial Computing with AI and Machine Learning: AI and machine learning integration into spatial computing systems in North America has significantly enhanced capabilities, particularly in healthcare and logistics. In 2024, the U.S. Bureau of Labor Statistics highlighted AI's role in reducing logistics costs by $2 billion in the U.S., driven by precise spatial analytics. Machine learning algorithms integrated into AR/VR environments are improving data processing in real-time applications such as smart factories, optimizing workflow and safety protocols.

- Increasing Adoption in Manufacturing and Healthcare: Spatial computing adoption is accelerating in North America's manufacturing and healthcare sectors. In 2023, the U.S. healthcare industry invested approximately $6.8 billion in spatial computing technologies to enhance diagnostics, surgeries, and patient monitoring. Additionally, manufacturing giants have integrated spatial technologies for real-time inventory management and production monitoring, reducing operational downtime by 10-15%.

Market Challenges

- High Implementation Costs: The high implementation costs of spatial computing technology remain a significant barrier in North America. According to the U.S. Government Accountability Office, spatial computing integration in manufacturing requires an average investment of $3 million per facility for hardware and software infrastructure, deterring small and medium enterprises. The high costs of skilled labor and ongoing maintenance further complicate widespread adoption, limiting its potential to only high-revenue sectors such as aerospace and healthcare.

- Lack of Standardization Across Platforms: A lack of standardization across spatial computing platforms continues to challenge the market's growth. Different AR/VR and spatial computing solutions in North America rely on proprietary systems that are not interoperable, leading to fragmentation. As per the National Institute of Standards and Technology (NIST), over 65% of U.S. spatial computing developers reported integration issues between platforms in 2023, increasing operational costs by 20%.

North America Spatial Computing Market Future Outlook

Over the next five years, the North America Spatial Computing market is expected to witness significant growth, driven by the increasing adoption of immersive technologies across sectors such as education, healthcare, and retail. The ongoing development of 5G infrastructure is also set to enhance the capabilities of spatial computing, providing faster, more reliable connectivity, which will enable more sophisticated AR/VR applications.

Market Opportunities

- Growing Demand for 3D Visualization and Mapping Solutions: The demand for 3D visualization and mapping solutions is rising in North America, driven by the construction, defense, and real estate industries. The U.S. Department of Defense invested $500 million in spatial computing platforms for enhanced battlefield mapping in 2024, increasing the demand for real-time 3D visualization. The construction sector has also adopted 3D mapping tools for smart city developments, cutting project timelines by 15%.

- Strategic Partnerships with AR/VR Hardware Providers: Strategic partnerships between spatial computing software developers and AR/VR hardware providers present a major opportunity in North America. In 2024, leading tech companies in the U.S. have established partnerships with hardware manufacturers, resulting in joint ventures valued at over $1 billion, aimed at developing advanced wearable devices for spatial computing applications in healthcare and retail.

Scope of the Report

|

Product Type |

Hardware Software Services |

|

Application |

Manufacturing Healthcare Retail Education Defense & Aerospace |

|

Technology |

Augmented Reality Virtual Reality Mixed Reality 3D Imaging and Mapping |

|

End-User |

Commercial Industrial Consumer Government |

|

Region |

USA Canada Mexico |

Products

Key Target Audience

Spatial Computing Device Manufacturers

Augmented Reality (AR) and Virtual Reality (VR) Developers

Healthcare Technology Providers

Defense & Aerospace Industries

Government and Regulatory Bodies (Federal Communications Commission, National Institute of Standards and Technology)

Retail Technology Integrators

Investments and Venture Capitalist Firms

Cloud Service Providers

Companies

Players Mentioned in the Report

Microsoft Corporation

Google LLC

Apple Inc.

Meta Platforms, Inc.

Magic Leap, Inc.

Nvidia Corporation

Vuzix Corporation

Qualcomm Technologies, Inc.

PTC Inc.

Unity Technologies

Table of Contents

1. North America Spatial Computing Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (CAGR, market momentum)

1.4 Market Segmentation Overview (Hardware, Software, Applications, End-Users, Regions)

2. North America Spatial Computing Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Spatial Computing Market Analysis

3.1 Growth Drivers

3.1.1 Advancements in Augmented Reality (AR) and Virtual Reality (VR) Technologies

3.1.2 Integration of Spatial Computing with AI and Machine Learning

3.1.3 Increasing Adoption in Manufacturing and Healthcare

3.1.4 Expanding Use Cases in Education and Retail Sectors

3.2 Market Challenges

3.2.1 High Implementation Costs

3.2.2 Lack of Standardization Across Platforms

3.2.3 Limited Consumer Awareness

3.3 Opportunities

3.3.1 Growing Demand for 3D Visualization and Mapping Solutions

3.3.2 Strategic Partnerships with AR/VR Hardware Providers

3.3.3 Increased Adoption in Defense and Aerospace

3.4 Trends

3.4.1 Adoption of Spatial Computing in Smart Cities

3.4.2 Use of Haptics in Spatial Interfaces

3.4.3 Emergence of Cloud-Based Spatial Computing Solutions

3.5 Government Regulations

3.5.1 Data Privacy and Security Regulations in Spatial Computing

3.5.2 Government Incentives for Innovation in Spatial Technologies

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. North America Spatial Computing Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Hardware

4.1.2 Software

4.1.3 Services

4.2 By Application (In Value %)

4.2.1 Manufacturing

4.2.2 Healthcare

4.2.3 Retail

4.2.4 Education

4.2.5 Defense & Aerospace

4.3 By Technology (In Value %)

4.3.1 Augmented Reality

4.3.2 Virtual Reality

4.3.3 Mixed Reality

4.3.4 3D Imaging and Mapping

4.4 By End-User (In Value %)

4.4.1 Commercial

4.4.2 Industrial

4.4.3 Consumer

4.4.4 Government

4.5 By Region (In Value %)

4.5.1 USA

4.5.2 Canada

4.5.3 Mexico

5. North America Spatial Computing Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Microsoft Corporation

5.1.2 Apple Inc.

5.1.3 Google LLC

5.1.4 Meta Platforms, Inc.

5.1.5 Magic Leap, Inc.

5.1.6 Nvidia Corporation

5.1.7 Vuzix Corporation

5.1.8 Qualcomm Technologies, Inc.

5.1.9 PTC Inc.

5.1.10 Unity Technologies

5.1.11 Varjo Technologies Oy

5.1.12 Ultraleap Ltd.

5.1.13 Snap Inc.

5.1.14 Lenovo Group Ltd.

5.1.15 HTC Corporation

5.2 Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Innovation Index, Partnerships, R&D Spending, Industry Focus, Regional Presence)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. North America Spatial Computing Market Regulatory Framework

6.1 Data Protection Standards

6.2 Industry-Specific Compliance Requirements (Healthcare, Manufacturing, etc.)

6.3 Certification Processes

7. North America Spatial Computing Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America Spatial Computing Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Technology (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. North America Spatial Computing Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step in the research process involves identifying key stakeholders within the North America Spatial Computing Market ecosystem. This phase focuses on gathering industry-level information using proprietary databases and secondary sources, aimed at identifying the variables driving market growth, such as technological innovations and industry-specific applications.

Step 2: Market Analysis and Construction

In this phase, we analyze historical data on the spatial computing market, including market penetration and revenue generation in various sectors. This process involves calculating service provider market shares, analyzing industry-specific demand, and understanding the overall revenue trajectory.

Step 3: Hypothesis Validation and Expert Consultation

We engage with industry experts from leading spatial computing firms to validate market hypotheses. These consultations provide deep operational insights that help in refining our data, ensuring an accurate reflection of market dynamics.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing our research findings into a comprehensive report. This process includes compiling data on product segments, market performance, and industry trends. The data is verified through direct engagement with industry stakeholders, ensuring that our report is a validated and actionable resource for clients.

Frequently Asked Questions

01. How big is the North America Spatial Computing Market?

The North America Spatial Computing market is valued at USD 40,233 million, based on a five-year historical analysis. This market is primarily driven by advancements in augmented reality (AR), virtual reality (VR), and mixed reality (MR) technologies, along with the increasing integration of these solutions in healthcare, education, and manufacturing.

02. What are the challenges in the North America Spatial Computing Market?

Challenges include high implementation costs, the need for extensive R&D, and the lack of standardization across platforms. Additionally, limited consumer awareness of spatial computing applications remains a barrier to widespread adoption.

03. Who are the major players in the North America Spatial Computing Market?

Key players include Microsoft Corporation, Google LLC, Apple Inc., Meta Platforms, and Magic Leap, Inc. These companies dominate the market due to their extensive product portfolios and continuous innovation in AR/VR technologies.

04. What are the growth drivers of the North America Spatial Computing Market?

The market is driven by advancements in spatial computing technologies, growing demand for immersive experiences, and increasing adoption across various industries such as healthcare, education, and defense.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.