North America Speaker Market Outlook to 2030

Region:Global

Author(s):Shubham

Product Code:KROD1931

November 2024

85

About the Report

North America Speaker Market Overview

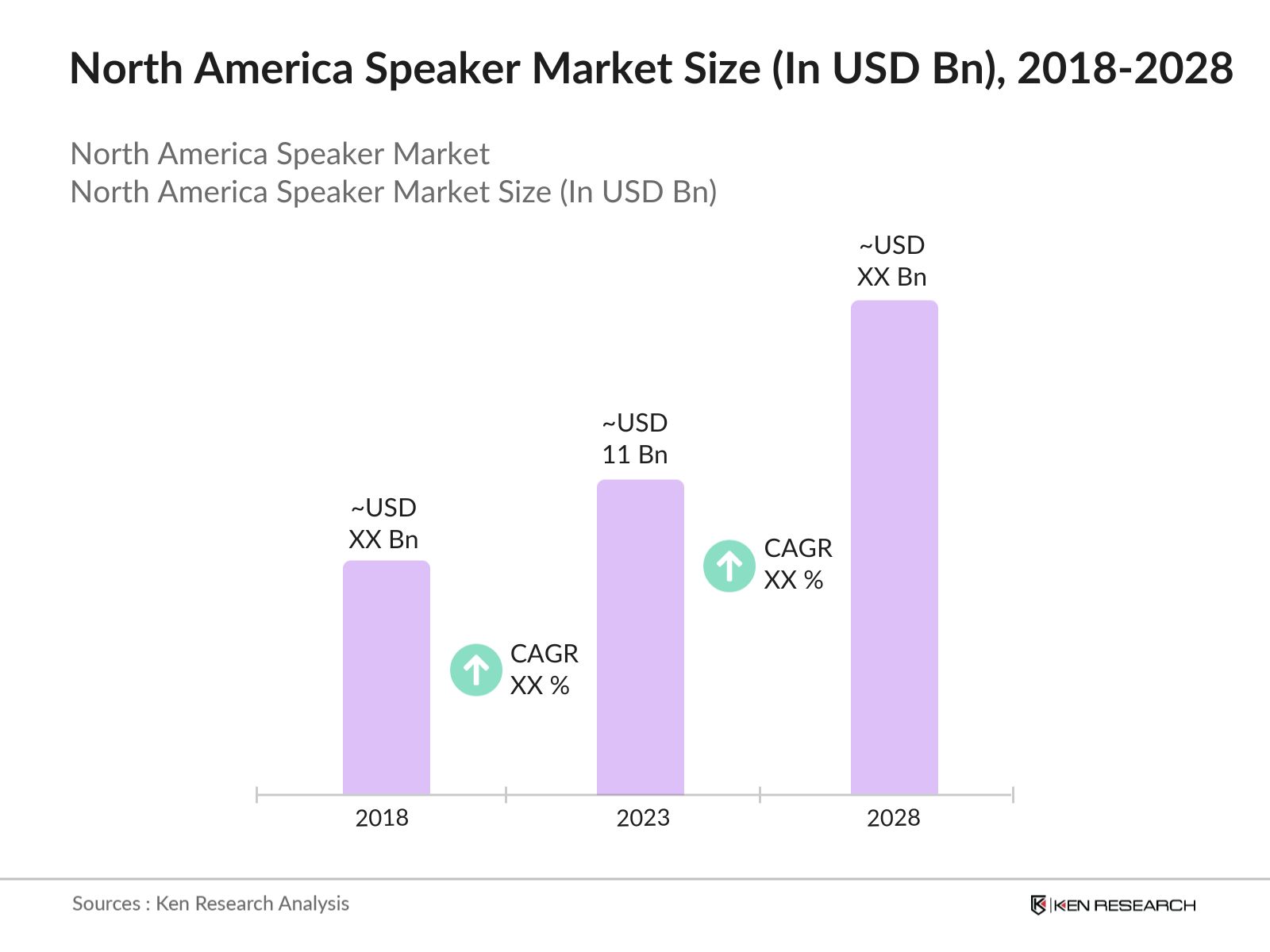

- The North America Speaker Market was valued at USD 11 billion in 2023, driven by increasing demand for smart speakers, advancements in audio technology, and rising consumer preference for high-quality sound systems in home entertainment setups. The speaker market is also benefitting from the proliferation of voice-activated smart devices and the integration of AI in consumer electronics.

- Leading players in the North America speaker market include Bose Corporation, Sonos Inc., Apple Inc., Amazon.com Inc., and Google LLC. These companies are at the forefront of innovation, leveraging advanced technologies such as voice recognition, AI, and IoT to enhance the user experience in both smart and traditional speaker categories.

- Major markets for speakers in North America include the United States, Canada, and Mexico. The United States leads the market due to high disposable income levels, strong adoption of smart home devices, and a tech-savvy consumer base. Canada benefits from a growing middle class and increasing internet penetration, while Mexico shows potential with rising urbanization and demand for smart home solutions.

- In October 2023, Spotify and Sonos announced a partnership allowing Spotify Premium users to control Sonos speakers directly from the Spotify app, without needing the Sonos app. This integration enables seamless streaming, grouping of speakers, and playback controls, enhancing the connected home listening experience for Spotify users with Sonos systems.

North America Speaker Market Segmentation

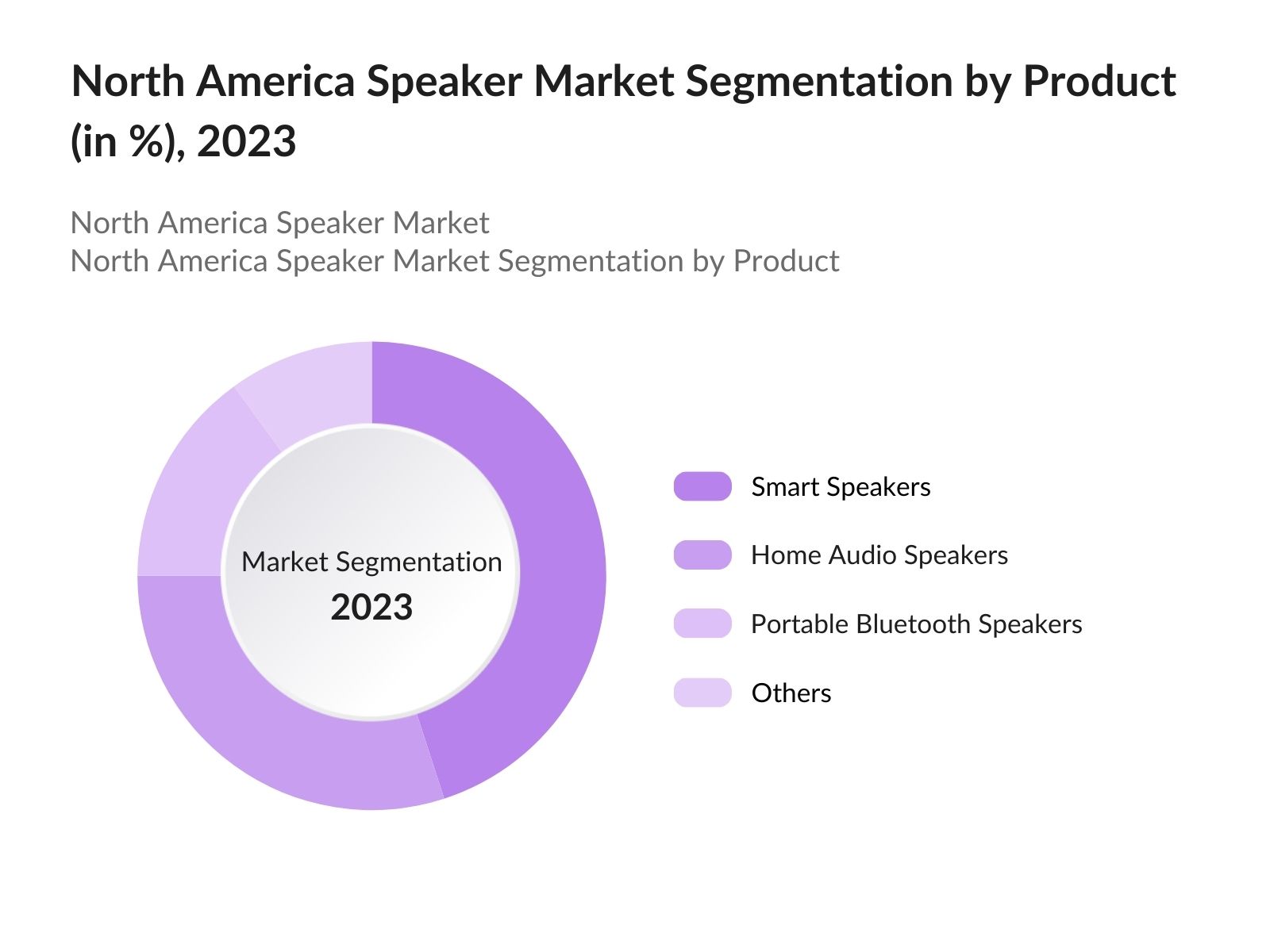

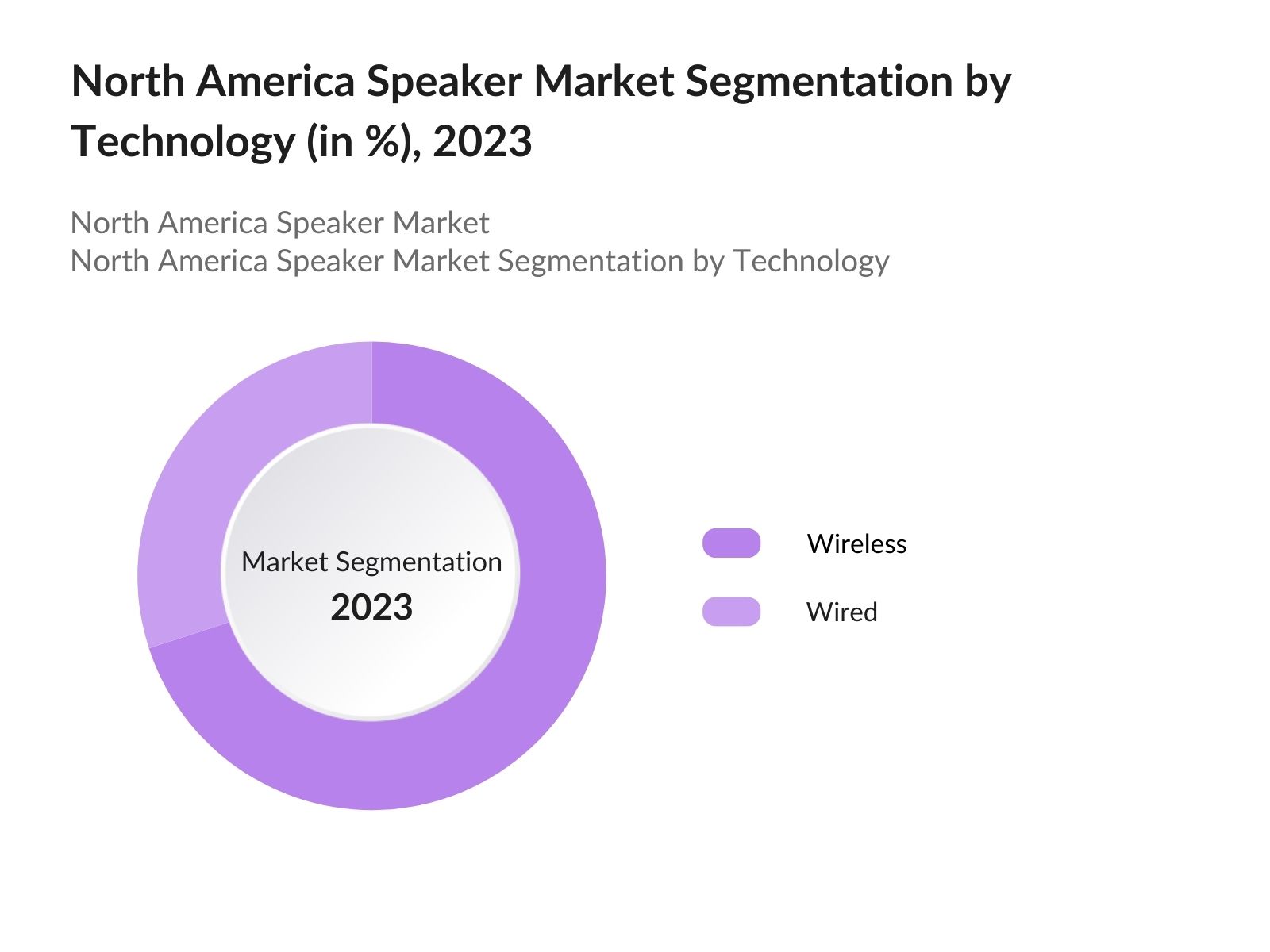

The North America Speaker Market can be segmented based on product type, technology, and region:

- By Product Type: The market is segmented into Smart Speakers, Home Audio Speakers, Portable Bluetooth Speakers, and Others. In 2023, Smart Speakers held a dominant market share in North America under the segmentation by product type. This is due to their integration with smart home devices and advanced voice assistants like Alexa, Google Assistant, and Siri. Consumers increasingly prefer smart speakers for their convenience and functionality, driving market growth in this segment.

- By Technology: The market is segmented into Wired and Wireless Speakers. In 2023, the wireless speakers segment dominated the market, primarily due to the convenience offered by Bluetooth and Wi-Fi connectivity, which allows for seamless integration with smart home systems and portable devices. Additionally, wireless speakers are preferred for their portability and ease of use in various settings, from home entertainment to outdoor activities.

- By Region: The North America market is segmented into the United States, Canada, and Mexico. In 2023, the United States held the largest market share, driven by high adoption rates of smart speakers and strong market presence of key players.

North America Speaker Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Bose Corporation |

1964 |

Framingham, USA |

|

Sonos Inc. |

2002 |

Santa Barbara, USA |

|

Apple Inc. |

1976 |

Cupertino, USA |

|

Amazon.com Inc. |

1994 |

Seattle, USA |

|

Google LLC |

1998 |

Mountain View, USA |

- Bose Corporation: In June 2024, Bose Corporation launched the Bose SoundsLink Max speaker, priced at USD 399. This portable Bluetooth speaker emphasizes superior sound quality and enhanced bass response, making it popular among users. It features an IP67 rating for water and dust resistance, a robust design, and long battery life, catering to the growing demand for high-quality audio solutions in North America.

- Apple Inc.: In October 2023, Apple introduced an updated version of the HomePod, featuring improved sound quality, enhanced Siri capabilities, and seamless integration with other Apple devices. This move aims to strengthen Apple's presence in the competitive smart speaker market, catering to growing consumer demand for high-quality audio and smart home integration.

North America Speaker Market Analysis

Growth Drivers:

- Increasing Adoption of Smart Home Ecosystems: The North America speaker industry has seen a substantial boost due to the rising adoption of smart home ecosystems. In 2024, in total of 69.91 million households are actively using smart home devices in 2024, up from 63.43 million in 2023, indicating a growth rate of 10.2%. This growth is driven by consumer demand for convenience and connectivity, with smart speakers playing a pivotal role in integrating various smart devices, including lighting, security systems, and appliances. Smart speakers, such as Amazon Echo and Google Home, are increasingly used as central hubs for controlling smart home ecosystems, reflecting their crucial role in the market's expansion.

- Advancements in AI and Voice Recognition Technologies: The market's growth is also driven by substantial advancements in AI and voice recognition technologies. In 2024, AI-powered voice assistants like Amazon Alexa and Google Assistant saw a remarkable improvement in natural language understanding capabilities, enhancing user experience and interaction quality. This improvement has led to higher user engagement and increased usage of smart speakers for various applications, such as home automation, music streaming, and information retrieval. As these technologies continue to evolve, they are expected to further drive the adoption of smart speakers across North America.

- Expansion of E-commerce and Online Sales Channels: The growing preference for online shopping is another noteworthy growth driver for the North America Speaker Market. U.S. retail e-commerce sales were projected to be USD 1.26 trillion by the end of 2024, reflecting continued growth from USD 1.12 trillion in 2023, with consumer electronics, including speakers, accounting for a weighty portion of these sales. Online platforms such as Amazon, Best Buy, and Walmart have expanded their product offerings and provided competitive pricing, discounts, and quick delivery options, making it easier for consumers to purchase speakers online. This shift towards e-commerce is driving market growth, as it enables broader product availability and enhances consumer accessibility.

Challenges:

- Supply Chain Disruptions and Component Shortages: The market has also been affected by supply chain disruptions and component shortages, particularly for semiconductor chips and electronic components used in speaker manufacturing. In 2024, several major manufacturers, including Bose and Sony, reported production delays and reduced output due to a shortage of key components, which impacted their ability to meet growing consumer demand.

- Data Privacy and Security Concerns: Growing concerns over data privacy and security have emerged as substantial challenges for the North America Speaker Market. In 2024, a survey conducted by the U.S. Federal Communications Commission revealed that majority of smart speaker users were worried about their devices being hacked or used for unauthorized data collection. These concerns have led to increased scrutiny from regulatory bodies and a demand for stronger data protection measures from manufacturers.

Government Initiatives:

- U.S. Smart Home Innovation Program (2023): In 2023, the U.S. government launched the Smart Home Innovation Program to promote the development and adoption of smart home technologies, including smart speakers. This initiative focuses on enhancing energy efficiency, security, and convenience in homes through advanced technology integration. The program includes funding for research and development, subsidies for smart home device purchases, and public awareness campaigns to encourage the adoption of smart home technologies.

- Canada's Digital Technology Supercluster Initiative (2024): In 2024, Canada's Digital Technology Supercluster, now known as DIGITAL, continued its efforts to accelerate the development and adoption of digital technologies that improve health, address climate change, drive economic productivity, and build digital skills across the country. The program also includes tax incentives and grants for companies developing smart speaker technologies, which is expected to boost the market's growth in Canada.

North America Speaker Market Future Outlook

The North America Speaker Market is projected to experience remarkable growth from 2023 to 2028, driven by technological advancements, increasing smart speaker adoption, and the expanding smart home ecosystem.

Future Market Trends:

- Integration of AI and Machine Learning in Speakers: Over the next five years, the integration of artificial intelligence (AI) and machine learning (ML) into speakers will be a major trend. AI-driven smart speakers will provide more personalized and intuitive user experiences, catering to individual preferences and enhancing overall functionality.

- Expansion of Multi-Room Audio Systems: Multi-room audio systems are expected to gain traction due to their ability to provide seamless audio experiences throughout the home. By 2028, these systems are projected to become standard in high-performance home audio setups, driving demand for compatible speakers.

Scope of the Report

|

By Region |

United States Canada Mexico |

|

By Product |

Smart Speakers Home Audio Speakers Portable Bluetooth Speakers, Others |

|

By Technology |

Wired Wireless |

|

By Application |

Residential Commercial Automotive |

|

By Distribution Channel |

Online, Offline |

Products

Key Target Audience:

Consumer Electronics Manufacturers

Smart Home Device Manufacturers

Audio Equipment Suppliers

Retailers and E-commerce Platforms

Automotive OEMs

Home Automation Companies

Music Streaming Service Providers

Telecommunication Companies

Government and Regulatory Bodies (e.g., U.S. Department of Energy)

Investments and Venture Capitalist Firms

Companies

Players Mentioned in the Report:

Bose Corporation

Sonos Inc.

Apple Inc.

Amazon.com Inc.

Google LLC

Samsung Electronics

Sony Corporation

JBL (Harman International)

Ultimate Ears (Logitech)

Bang & Olufsen

Klipsch Audio Technologies

Yamaha Corporation

LG Electronics

Panasonic Corporation

Pioneer Corporation

Table of Contents

1. North America Speaker Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. North America Speaker Market Size (in USD Bn), 2018-2023

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Speaker Market Analysis

3.1 Growth Drivers

3.2 Challenges

3.3 Opportunities

3.4 Trends

3.5 Government Regulation

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Competition Ecosystem

4. North America Speaker Market Segmentation, 2023

4.1 By Product Type (in Value %)

Smart Speakers

Home Audio Speakers

Portable Bluetooth Speakers

4.2 By Technology (in Value %)

Wired Speakers

Wireless Speakers

4.3 By Application (in Value %)

Residential

Commercial

Automotive

4.4 By Distribution Channel (in Value %)

Online

Offline

4.5 By Region (in Value %)

United States

Canada

Mexico

5. North America Speaker Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.2 Cross Comparison Parameters

6. North America Speaker Market Competitive Landscape

6.1 Market Share Analysis

6.2 Strategic Initiatives

6.3 Mergers and Acquisitions

6.4 Investment Analysis

7. North America Speaker Market Regulatory Framework

7.1 U.S. Smart Home Innovation Program

8. North America Speaker Market Future Size (in USD Bn), 2023-2028

8.1 Future Market Size Projections

8.2 Key Factors Driving Future Market Growth

9. North America Speaker Market Future Segmentation, 2028

9.1 By Product Type (in Value %)

9.2 By Technology (in Value %)

9.3 By Application (in Value %)

9.4 By Distribution Channel (in Value %)

9.5 By Region (in Value %)

10. North America Speaker Market Analysts Recommendations

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables: Ecosystem

Creation for all major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Market Building

Collating statistics on the North America speaker market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for the North America speaker market. We will also review service quality statistics to understand revenue generated to ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts from different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research Output

Our team will approach multiple essential speaker companies to understand product segments and sales, consumer preferences, and other parameters, which will support us in validating statistics derived through a bottom-to-top approach from speaker companies.

Frequently Asked Questions

1. How big is the North America Speaker Market?

The North America Speaker Market was valued at USD 11 billion in 2023, driven by the increasing adoption of smart home devices, advancements in audio technology, and rising consumer demand for high-quality sound systems.

2. What are the challenges in the North America Speaker Market?

Challenges in the North America Speaker Market include intense competition among key players, supply chain disruptions, and data privacy concerns. These factors affect market profitability and consumer trust.

3. Who are the major players in the North America Speaker Market?

Key players in the North America Speaker Market include Bose Corporation, Sonos Inc., Apple Inc., Amazon.com Inc., and Google LLC. These companies dominate due to their innovative product offerings and strong market presence.

4. What are the growth drivers of the North America Speaker Market?

The North America Speaker Market is driven by the rising adoption of smart home ecosystems, advancements in AI and voice recognition technologies, and the expansion of e-commerce and online sales channels, which make speakers more accessible to consumers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.