North America Specialty Chemical Market Outlook to 2030

Region:North America

Author(s):Naman Rohilla

Product Code:KROD5162

December 2024

90

About the Report

North America Specialty Chemical Market Overview

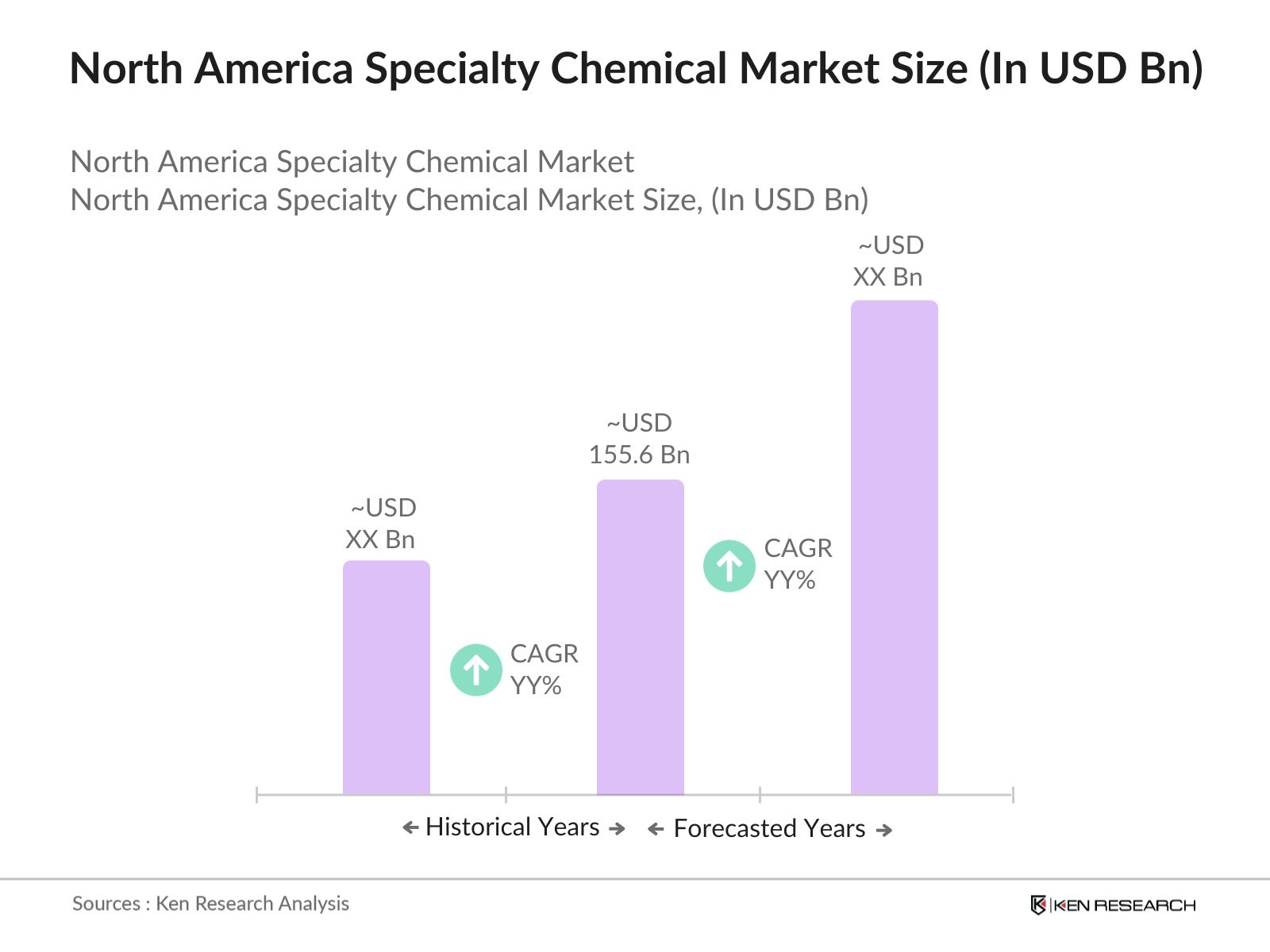

- The North America Specialty Chemical market is valued at USD 155.6 billion, based on a detailed analysis of the past five years. This market has been driven primarily by the increasing demand from various end-use industries such as automotive, construction, and consumer goods. The technological advancements and innovation in specialty chemical production, particularly in sectors like water treatment, agrochemicals, and electronic chemicals, have also contributed to market expansion. Companies are focusing on research and development to create more sustainable and efficient products, further enhancing market growth.

- The USA dominates the North American specialty chemical market due to its advanced industrial infrastructure and high demand for specialty chemicals across diverse industries. Cities like Houston and New York play pivotal roles as hubs for petrochemical manufacturing and industrial activities, which support the specialty chemical market. Additionally, the presence of key manufacturers and well-established supply chains in these regions positions the USA as a dominant force in this market.

- The U.S. specialty chemicals industry has increasingly aligned with the European Union's REACH regulations, despite not being directly bound by them, due to the global nature of the market. U.S. companies exporting chemicals to the EU must comply with these regulations, which require extensive testing and reporting on chemical safety. In 2023, more than 2,500 U.S. chemical manufacturers were registered under REACH, which has driven changes in product formulations and innovation in the development of safer, non-toxic chemicals. Compliance with REACH has also improved the international competitiveness of U.S. specialty chemical companies.

North America Specialty Chemical Market Segmentation

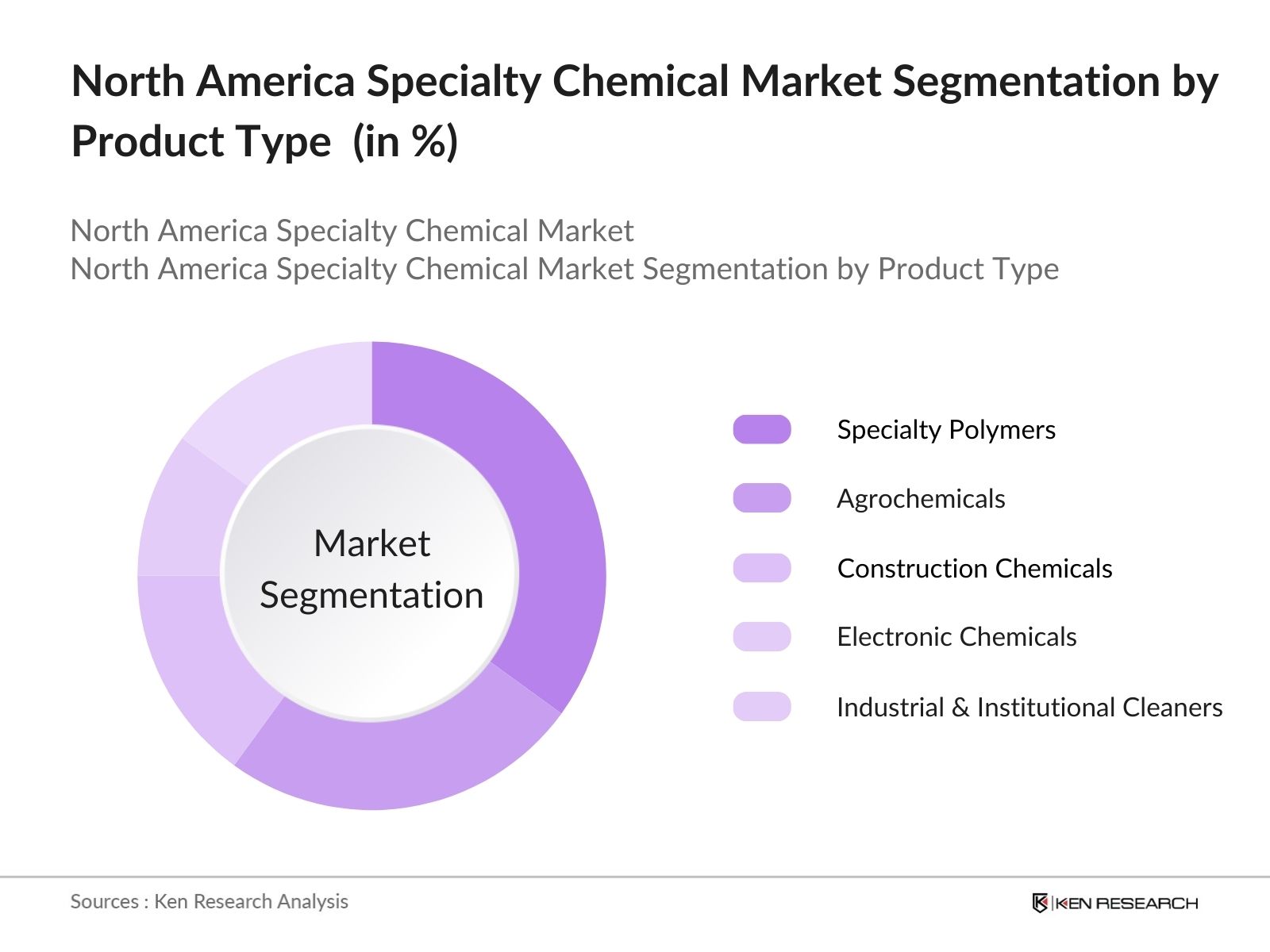

- By Product Type: The North America Specialty Chemical market is segmented by product type into specialty polymers, agrochemicals, construction chemicals, electronic chemicals, and industrial and institutional cleaners. Recently, specialty polymers have held a dominant market share under the product type segment. This dominance is attributed to the widespread application of specialty polymers in industries such as automotive, electronics, and packaging. Their high-performance characteristics, such as thermal stability, chemical resistance, and mechanical properties, make them indispensable in the manufacturing of high-tech products.

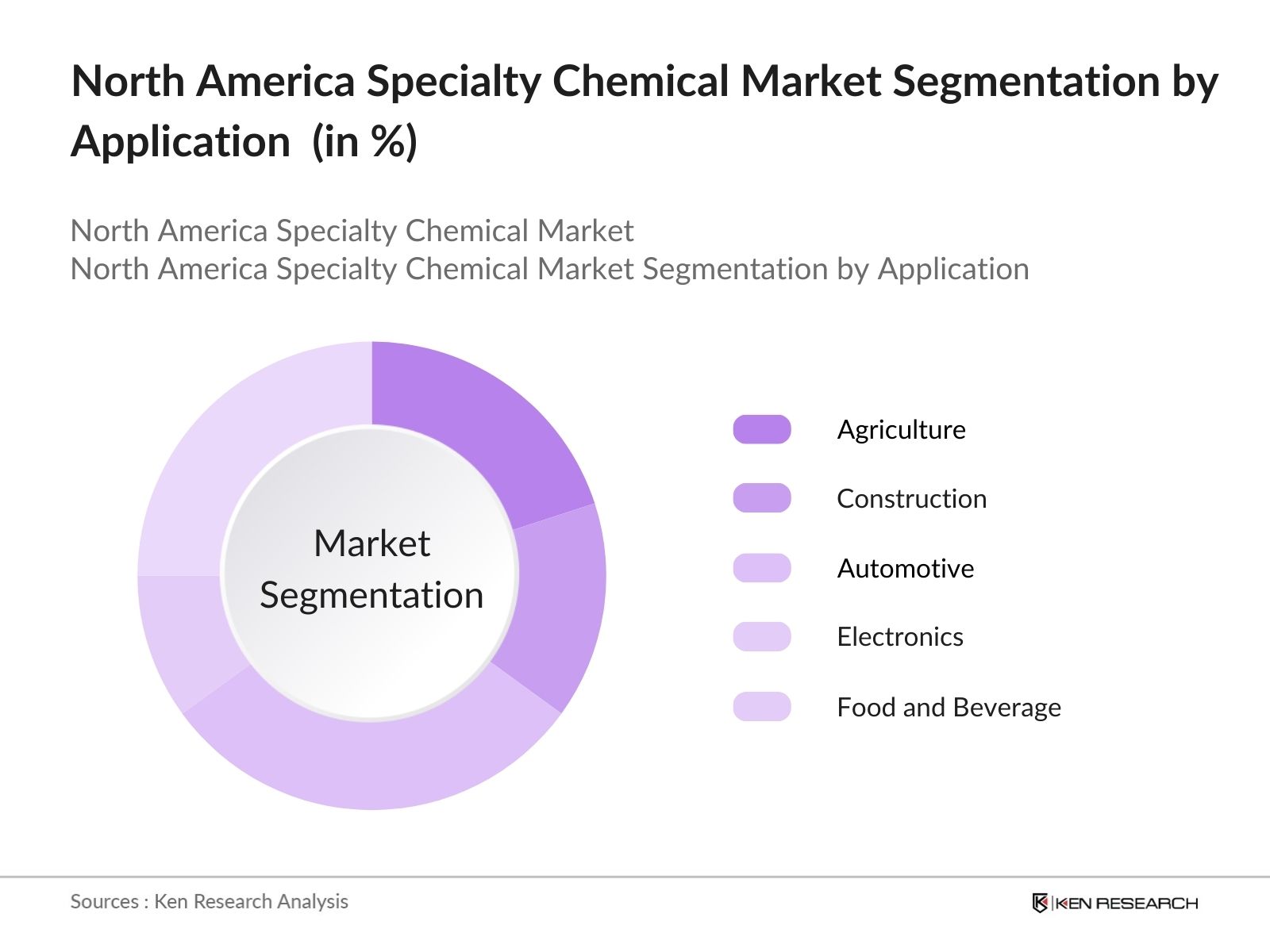

- By Application: The market is also segmented by application into agriculture, construction, automotive, electronics, and food and beverage industries. The automotive industry has been a substantial application segment in the USA Specialty Chemical market due to the high demand for advanced materials that can improve vehicle performance, safety, and fuel efficiency. Specialty chemicals, such as coatings, adhesives, and sealants, are critical in the production and design of modern vehicles, contributing to the sectors growth.

North America Specialty Chemical Market Competitive Landscape

The North America Specialty Chemical market is dominated by several key players who have established a strong foothold through strategic investments, mergers, acquisitions, and product innovations. These companies focus heavily on R&D to cater to industry-specific demands, ranging from environmentally friendly chemicals to advanced materials for electronics and automotive industries.

|

Company Name |

Year Established |

Headquarters |

Revenue (USD bn) |

R&D Spending (%) |

Product Portfolio |

Innovation Initiatives |

Geographic Presence |

Sustainability Focus |

Partnerships |

|

Dow Chemical Company |

1897 |

Midland, MI |

- |

- |

- |

- |

- |

- |

- |

|

BASF Corporation |

1865 |

Florham Park, NJ |

- |

- |

- |

- |

- |

- |

- |

|

DuPont |

1802 |

Wilmington, DE |

- |

- |

- |

- |

- |

- |

- |

|

Huntsman Corporation |

1970 |

The Woodlands, TX |

- |

- |

- |

- |

- |

- |

- |

|

Eastman Chemical Company |

1920 |

Kingsport, TN |

- |

- |

- |

- |

- |

- |

- |

North America Specialty Chemical Market Analysis

North America Specialty Chemical Market Growth Drivers

- Increased Demand from End-Use Industries: In 2024, the specialty chemicals market in the U.S. has seen robust demand from end-use industries like automotive, construction, and consumer goods. The automotive sector, in particular, has benefited from a 15% increase in electric vehicle production compared to 2022, requiring advanced polymers and specialty chemicals for battery components and lightweight materials. The construction industry has also contributed to this growth, with housing starts in the U.S. reaching 1.4 million in 2023, increasing demand for adhesives, coatings, and specialty polymers. Consumer goods manufacturing has remained resilient, with household products requiring enhanced chemical formulations.

- Regulatory Support for Environmental Sustainability: In 2023, the U.S. Environmental Protection Agency (EPA) introduced new sustainability regulations aimed at reducing carbon emissions by 40% from industrial sources, which has created opportunities for the specialty chemical industry. Specialty chemicals are crucial in producing eco-friendly products like biodegradable plastics, which are increasingly in demand due to federal sustainability mandates. Additionally, the Biden Administration's $369 billion investment in clean energy and climate-related programs through the Inflation Reduction Act has incentivized chemical manufacturers to adopt greener practices, leading to increased production of sustainable chemicals such as bio-based polymers and water-soluble detergents.

- Rise in Demand for Specialty Polymers and Chemicals: Specialty polymers have experienced a rise in demand due to their use in sectors like automotive, aerospace, and electronics. The North American polymer demand increased by 8 million tons in 2023 compared to 2021, with specialty chemicals accounting for a substantial portion of this growth. Specialty polymers like polyimides and fluoropolymers are essential for advanced applications in electrical insulation, flexible electronics, and lightweight automotive components. In addition, high-performance specialty chemicals are now integral in manufacturing personal protective equipment (PPE) due to ongoing healthcare needs.

North America Specialty Chemical Market Challenges

- Volatility in Raw Material Prices: The specialty chemical market faces challenges due to the volatility of raw material prices, especially for oil-based derivatives. For example, the average price of crude oil fluctuated between $70 to $100 per barrel in 2023, impacting the cost of raw materials such as ethylene, propylene, and methanol, which are critical inputs for specialty chemical production. This price volatility has affected manufacturers ability to maintain stable pricing structures, complicating cost forecasting and operational budgeting. Supply chain disruptions, exacerbated by geopolitical tensions, have further increased the cost pressures on specialty chemical manufacturers.

- Stringent Environmental Regulations: Stricter environmental regulations have presented operational challenges to the specialty chemical industry. In 2023, the U.S. Environmental Protection Agency (EPA) introduced additional air quality control measures under the Clean Air Act, limiting the permissible levels of volatile organic compounds (VOCs) in industrial emissions. These measures have increased the cost of compliance for chemical manufacturers, requiring investments in cleaner technologies and environmentally friendly formulations. For example, the EPA's new guidelines have forced manufacturers of coatings and paints to adopt water-based solutions instead of solvent-based ones, altering production processes.

North America Specialty Chemical Market Future Outlook

The North America Specialty Chemical market is expected to show growth over the next five years, driven by the increasing demand from sectors such as automotive, construction, and electronics. Advances in sustainable chemical solutions, coupled with regulatory support for eco-friendly practices, will likely shape the market's trajectory. Companies are projected to invest heavily in R&D to create products that cater to the specific needs of high-growth sectors like electronics and pharmaceuticals, which are increasingly relying on specialty chemicals for innovation and development.

North America Specialty Chemical Market Opportunities

- Expansion into Biochemical Markets: The growing interest in biochemicals, driven by the need for sustainable alternatives, has created major opportunities for the specialty chemicals market. In 2023, the global bio-based chemicals market was valued at over $50 billion, with the U.S. playing a leading role in this expansion due to its large agricultural base, which supplies biomass for bio-based chemical production. Government incentives for renewable chemicals, such as tax credits for bioproduct manufacturers, have further propelled the adoption of bio-based specialty chemicals in industries ranging from packaging to automotive, where bio-plastics are increasingly replacing petroleum-based materials.

- Growing Demand for Water Treatment Chemicals: The rising demand for water treatment chemicals has presented a lucrative opportunity for the specialty chemicals market. The U.S. water treatment chemical sector saw growth in 2023, driven by aging water infrastructure and increasing concerns about water contamination. According to the American Society of Civil Engineers (ASCE), $44 billion is needed annually to maintain the U.S. water infrastructure, creating a strong demand for advanced specialty chemicals such as corrosion inhibitors and flocculants. Additionally, increased regulatory pressure to meet EPA water quality standards has fueled the need for chemical solutions that ensure safe and clean water supply.

Scope of the Report

|

Product Type |

Specialty Polymers Agrochemicals Construction Chemicals Electronic Chemicals Industrial and Institutional Cleaners |

|

Application |

Agriculture Construction Automotive Electronics Food and Beverage |

|

Function |

Additives Catalysts Adhesives Coatings Sealants |

|

End-User Industry |

Manufacturing Pharmaceuticals Energy Consumer Goods Water Treatment |

|

Region |

USA Canada Mexico Rest of North America |

Products

Key Target Audience

Automotive Manufacturers

Construction Material Suppliers

Electronics Manufacturers

Chemical Distributors

Water Treatment Companies

Banks and Financial Institutions

Government and Regulatory Bodies (EPA, OSHA)

Investor and Venture Capitalist Firms

Pharmaceutical Companies

Memory updated

Companies

Major Players in the Market

Dow Chemical Company

BASF Corporation

DuPont

Huntsman Corporation

Eastman Chemical Company

Clariant AG

Solvay

Ashland Global Holdings Inc.

Evonik Industries

PPG Industries

Cabot Corporation

Albemarle Corporation

FMC Corporation

Sika AG

Innospec

Table of Contents

1. North America Specialty Chemical Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Specialty Chemical Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Specialty Chemical Market Analysis

3.1. Growth Drivers

3.1.1. Increased Demand from End-Use Industries (e.g., Automotive, Construction, Consumer Goods)

3.1.2. Technological Innovations in Product Development

3.1.3. Regulatory Support for Environmental Sustainability

3.1.4. Rise in Demand for Specialty Polymers and Chemicals

3.2. Market Challenges

3.2.1. Volatility in Raw Material Prices

3.2.2. Stringent Environmental Regulations

3.2.3. Limited Skilled Workforce in Specialty Manufacturing

3.3. Opportunities

3.3.1. Expansion into Biochemical Markets

3.3.2. Growing Demand for Water Treatment Chemicals

3.3.3. Increasing Adoption of Green Chemistry Practices

3.4. Trends

3.4.1. Adoption of Bio-Based Specialty Chemicals

3.4.2. Rise in Contract Manufacturing Services

3.4.3. Digitalization and Automation in Chemical Production

3.5. Government Regulation

3.5.1. Environmental Protection Agency (EPA) Standards

3.5.2. REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) Compliance

3.5.3. Clean Air Act Regulations

3.5.4. OSHA (Occupational Safety and Health Administration) Standards

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. North America Specialty Chemical Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Specialty Polymers

4.1.2. Agrochemicals

4.1.3. Construction Chemicals

4.1.4. Electronic Chemicals

4.1.5. Industrial and Institutional Cleaners

4.2. By Application (In Value %)

4.2.1. Agriculture

4.2.2. Construction

4.2.3. Automotive

4.2.4. Electronics

4.2.5. Food and Beverage

4.3. By Function (In Value %)

4.3.1. Additives

4.3.2. Catalysts

4.3.3. Adhesives

4.3.4. Coatings

4.3.5. Sealants

4.4. By End-User Industry (In Value %)

4.4.1. Manufacturing

4.4.2. Pharmaceuticals

4.4.3. Energy

4.4.4. Consumer Goods

4.4.5. Water Treatment

4.5. By Region (In Value %)

4.5.1. USA

4.5.2. Canada

4.5.3. Mexico

4.5.4. Rest of North America

5. North America Specialty Chemical Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Dow Chemical Company

5.1.2. BASF Corporation

5.1.3. DuPont

5.1.4. Huntsman Corporation

5.1.5. Eastman Chemical Company

5.1.6. Clariant AG

5.1.7. Solvay

5.1.8. Ashland Global Holdings Inc.

5.1.9. Evonik Industries

5.1.10. PPG Industries

5.1.11. Cabot Corporation

5.1.12. Albemarle Corporation

5.1.13. FMC Corporation

5.1.14. Sika AG

5.1.15. Innospec

5.2. Cross Comparison Parameters (Product Portfolio, Geographic Presence, Revenue, Innovation Initiatives, Sustainability Commitments, Market Position, Strategic Partnerships, R&D Spending)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Specialty Chemical Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. North America Specialty Chemical Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Specialty Chemical Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Function (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

9. North America Specialty Chemical Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this stage, we begin by identifying the primary variables that influence the North America Specialty Chemical market. Extensive secondary research is conducted, utilizing industry reports, databases, and governmental publications to construct an ecosystem map that includes all major stakeholders.

Step 2: Market Analysis and Construction

Historical data pertaining to the market is compiled and analyzed to determine market penetration and revenue generation. This involves a detailed examination of the competitive landscape, product offerings, and end-use industry trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through in-depth consultations with industry experts using both CATI (computer-assisted telephone interviews) and face-to-face interviews. These insights help fine-tune our understanding of the market and validate our projections.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing the gathered data to create an actionable report. Multiple stakeholders, including chemical manufacturers and industry professionals, are consulted to ensure accuracy in the final market forecast.

Frequently Asked Questions

01. How big is the North America Specialty Chemical Market?

The North America Specialty Chemical market is valued at USD 155.6 billion, driven by increased demand across industries like automotive, construction, and consumer goods.

02. What are the challenges in the North America Specialty Chemical Market?

Challenges in the North America Specialty Chemical market include volatile raw material prices, stringent environmental regulations, and the high cost of sustainable chemical production, which may hinder profitability in the market.

03. Who are the major players in the North America Specialty Chemical Market?

Key players in the North America Specialty Chemical market include Dow Chemical Company, BASF Corporation, DuPont, Huntsman Corporation, and Eastman Chemical Company. These companies dominate the market due to their extensive R&D initiatives and diverse product portfolios.

04. What are the growth drivers of the North America Specialty Chemical Market?

The North America Specialty Chemical market is driven by technological advancements in chemical production, rising demand for eco-friendly chemicals, and increasing use in automotive and construction industries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.