North America Sports Drink Market Outlook to 2030

Region:North America

Author(s):Naman Rohilla

Product Code:KROD8775

December 2024

84

About the Report

North America Sports Drink Market Overview

- The North America sports drink market, valued at USD 9.2 billion based on a five-year historical analysis, is driven by an increasing focus on fitness and active lifestyles among consumers. With rising urbanization and higher disposable incomes, there is a growing trend toward functional beverages that provide enhanced hydration and recovery for both athletes and everyday consumers. Leading brands continue to expand their product lines, incorporating low-sugar and electrolyte-enriched options that align with consumer health preferences, further fueling market demand.

- In North America, the United States is a major player in the sports drink market, driven by its large consumer base, high levels of sports participation, and a strong presence of established brands. Canada follows due to its rising health awareness and growing consumer interest in functional and low-calorie beverages. These countries benefit from a mature retail landscape and brand visibility, which allows key players to reach a broad consumer demographic effectively.

- Compliance with labeling and nutritional claims remains critical for sports drink manufacturers. In 2024, the FDA revised labeling requirements for food and beverages, mandating clear disclosure of ingredients and nutritional content, particularly sugar and calorie counts. This update ensures that consumers have transparent information to make informed choices, impacting labeling practices in the sports drink industry.

North America Sports Drink Market Segmentation

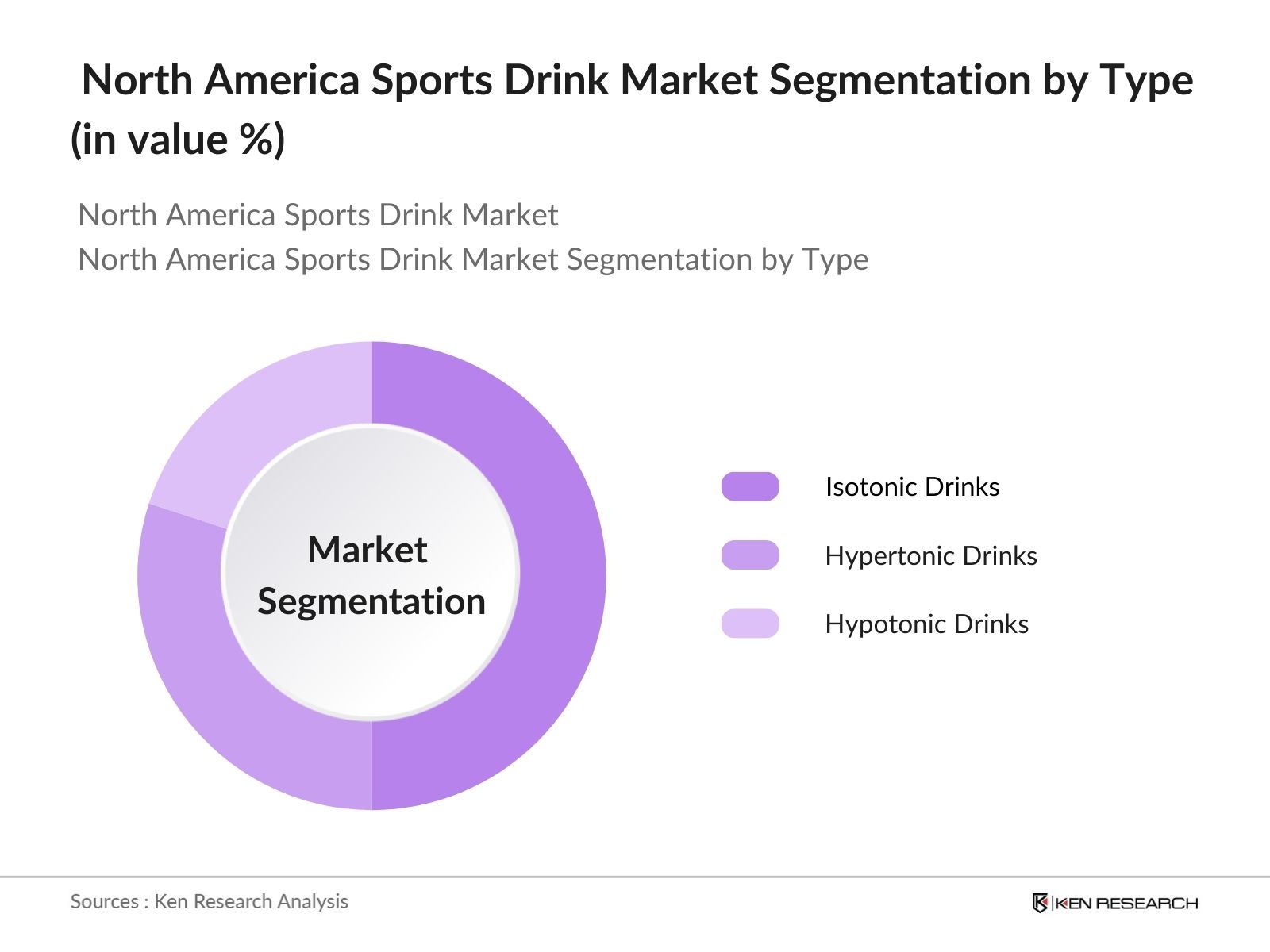

- By Type: The market is segmented by type into isotonic drinks, hypertonic drinks, and hypotonic drinks. Recently, isotonic drinks have gained a dominant market share due to their balanced electrolyte content, which appeals to consumers engaged in moderate to high-intensity activities. Isotonic drinks' formulation supports quick energy recovery, making them popular among athletes and recreational fitness enthusiasts alike.

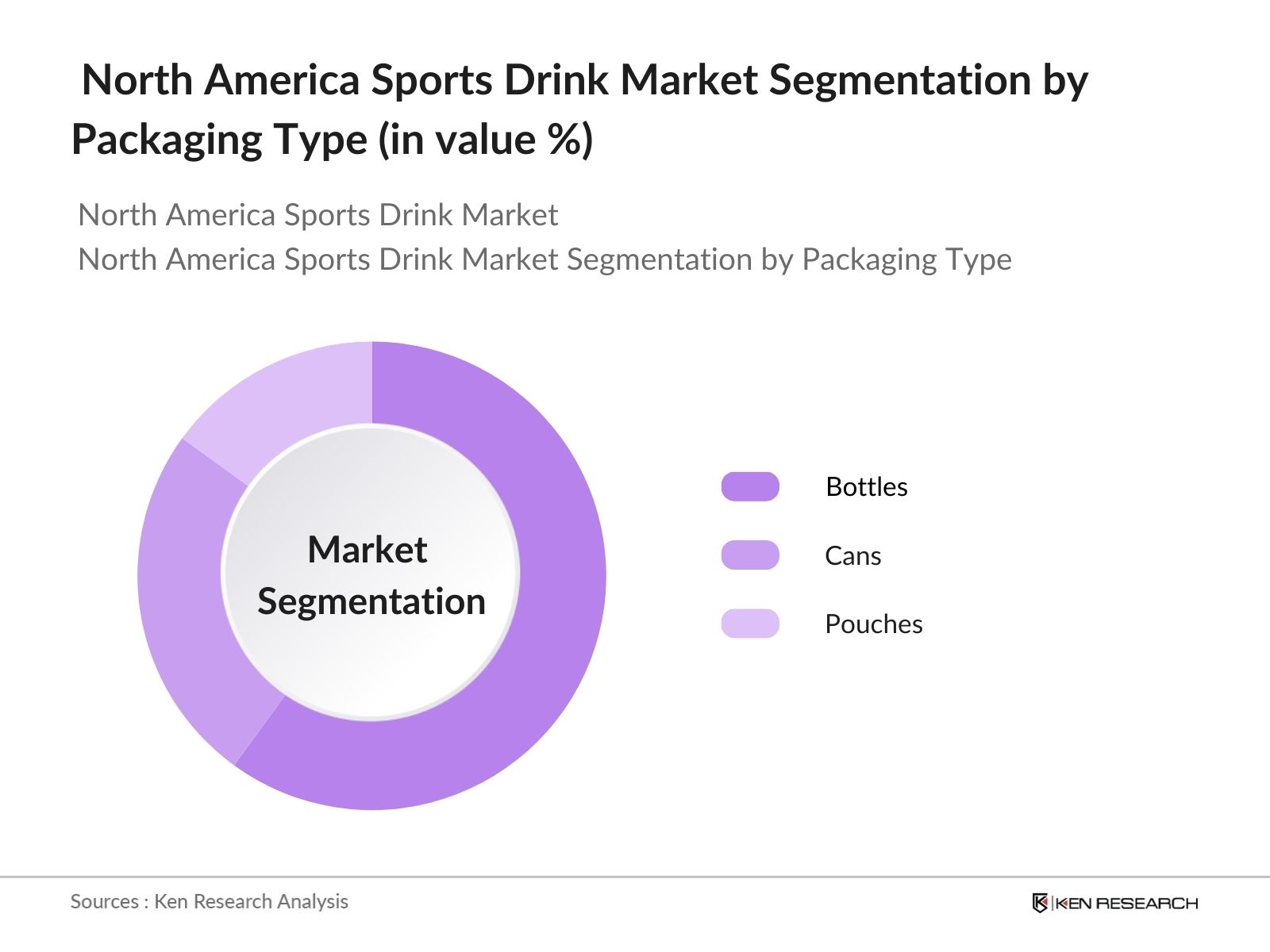

- By Packaging Type: The market is further segmented by packaging type into bottles, cans, and pouches. Bottles hold the largest market share due to their convenience and reusability, making them ideal for on-the-go consumption. The bottle segment also allows brands to offer varying sizes, catering to individual consumer preferences for single or multiple servings.

North America Sports Drink Market Competitive Landscape

The North America sports drink market is dominated by a few major players, including well-established brands like Gatorade, Powerade, and Bodyarmor. These companies leverage extensive distribution networks, strong brand loyalty, and constant product innovation to maintain their market positions. The competitive landscape highlights the influence of these key players and their ability to shape consumer preferences and market trends.

North America Sports Drink Market Analysis

Market Growth Drivers

- Health and Wellness Trends: The North American sports drink market is driven by rising health consciousness, with nearly 85% of U.S. adults aiming to make healthier dietary choices, as per CDC dietary data for 2023. Increased demand for health-promoting products has bolstered sports drinks designed for hydration and performance. The USDAs 2024 data reveals that 60% of Americans are actively purchasing functional foods and beverages, including sports drinks. These health-centric purchases are associated with trends in reducing chronic disease risks and promoting active lifestyles.

- Rise in Sports Participation: Increasing sports participation across North America is also a major growth driver. As of 2024, over 27 million Americans engage in regular sports or fitness activities, reflecting a 10% increase since 2020, as reported by the National Health Statistics Reports. This surge fuels demand for sports drinks, commonly consumed for energy replenishment and hydration. The rising number of sports and wellness events across Canada and the U.S., highlighted in Health Canadas 2023 Physical Activity Reports, further supports this trend

- Expansion in Functional Beverages Market: North America's functional beverages segment, including sports drinks, has gained momentum, supported by consumer demand for performance-enhancing, nutritious drinks. USDA data shows that functional beverage consumption grew by over 15% between 2022 and 2024, reflecting consumer demand for beverages that offer nutritional and performance benefits. Sports drinks, which address hydration and energy needs, are integral within this trend, seeing traction in both retail and on-the-go sales.

Market Challenges

- High Sugar Content Concerns: The high sugar content in many sports drinks is a primary challenge, as consumers become more cautious about their sugar intake. The CDCs 2024 nutrition report indicates that average sugar consumption among Americans is declining, as awareness of its health impacts grows. Given that most traditional sports drinks contain over 30g of sugar per serving, health-conscious consumers may opt for alternatives. Such consumer behavior has led companies to develop sugar-free variants to meet regulatory and consumer expectations.

- Competition from Healthier Alternatives: The rise in competition from healthier hydration options, such as flavored water and low-calorie electrolyte beverages, presents a market challenge. Data from Health Canada shows a 12% rise in low-calorie beverage consumption from 2022 to 2024, as consumers pivot towards options with fewer additives and sugars. This shift is impacting traditional sports drink sales, requiring companies to innovate and address health-conscious preferences to remain competitive.

North America Sports Drink Market Future Outlook

The North America sports drink market is projected to experience steady growth, driven by continuous product innovations, increased focus on hydration, and an expanding consumer base with a preference for functional beverages. Major players are anticipated to invest in R&D to introduce sugar-free and natural ingredient-based sports drinks, meeting the evolving health-conscious trends among North American consumers. The e-commerce channel is also expected to play a pivotal role in driving sales, as more consumers prefer online platforms for convenience.

Market Opportunities

- Development of Sugar-Free and Low-Calorie Variants: There is an expanding opportunity in the development of sugar-free and low-calorie sports drinks to address consumer health concerns. In 2024, the USDA noted that nearly 70% of consumers consider reduced sugar as a key purchasing factor for beverages, reflecting an opportunity for companies to cater to this demand with new formulations. This trend aligns with the decline in average sugar intake observed in the U.S. dietary surveys.

- Targeting Emerging Athletic Demographics: Emerging athletic demographics, including youth and women athletes, present untapped potential for sports drink brands. The National Youth Sports Strategy 2023 highlights that over 60% of American youths actively participate in organized sports, driving demand for hydration and performance-enhancing drinks. Targeted marketing efforts toward these demographics can capitalize on this demand, supporting market expansion.

Scope of the Report

|

By Type |

Isotonic Drinks Hypertonic Drinks Hypotonic Drinks |

|

By Packaging Type |

Bottles Cans Pouches |

|

By Flavor |

Citrus-Based Berry-Based Mixed Fruit Other Flavors |

|

By Distribution Channel |

Supermarkets & Hypermarkets Convenience Stores E-commerce Specialty Stores |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience

Sports Enthusiasts

Professional Athletes

Retail Chains (Supermarkets and Convenience Stores)

Distributors and Wholesalers

E-commerce Retailers

Banks and Financial Institutions

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FDA, Health Canada)

Beverage Industry Stakeholders

Companies

Players Mentioned in the Report

PepsiCo

Coca-Cola

Red Bull

Bodyarmor

Monster Beverage

Nestl

Keurig Dr Pepper

Arizona Beverage Company

Gatorade

Cytosport, Inc.

Table of Contents

1. North America Sports Drink Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Distribution Channels Overview

1.4. Key Consumption Patterns

2. North America Sports Drink Market Size (In USD)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Sports Drink Market Analysis

3.1. Growth Drivers

3.1.1. Health and Wellness Trends

3.1.2. Rise in Sports Participation

3.1.3. Expansion in Functional Beverages Market

3.1.4. Increasing Urbanization

3.2. Market Challenges

3.2.1. High Sugar Content Concerns

3.2.2. Competition from Healthier Alternatives

3.2.3. Regulatory Restrictions on Additives

3.3. Opportunities

3.3.1. Development of Sugar-Free and Low-Calorie Variants

3.3.2. Targeting Emerging Athletic Demographics

3.3.3. Potential in E-commerce Distribution Channels

3.4. Trends

3.4.1. Plant-Based Sports Drink Formulations

3.4.2. Eco-Friendly Packaging Solutions

3.4.3. Product Personalization and Fortification

3.5. Government Regulation

3.5.1. Labeling and Nutritional Claims Compliance

3.5.2. Additive and Preservative Regulations

3.6. Competitive Landscape Overview

4. North America Sports Drink Market Segmentation

4.1. By Type (In Value %)

4.1.1. Isotonic Drinks

4.1.2. Hypertonic Drinks

4.1.3. Hypotonic Drinks

4.2. By Packaging Type (In Value %)

4.2.1. Bottles

4.2.2. Cans

4.2.3. Pouches

4.3. By Flavor (In Value %)

4.3.1. Citrus-Based

4.3.2. Berry-Based

4.3.3. Mixed Fruit

4.3.4. Other Flavors

4.4. By Distribution Channel (In Value %)

4.4.1. Supermarkets & Hypermarkets

4.4.2. Convenience Stores

4.4.3. E-commerce

4.4.4. Specialty Stores

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Sports Drink Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. PepsiCo

5.1.2. The Coca-Cola Company

5.1.3. Red Bull

5.1.4. Monster Beverage Corporation

5.1.5. Nestl

5.1.6. Keurig Dr Pepper

5.1.7. Bodyarmor SuperDrink

5.1.8. Arizona Beverage Company

5.1.9. Gatorade

5.1.10. Cytosport, Inc.

5.1.11. Otsuka Pharmaceutical Co., Ltd.

5.1.12. AJE Group

5.1.13. Suntory Holdings Limited

5.1.14. Lucozade Ribena Suntory

5.1.15. BA Sports Nutrition, LLC

5.2. Cross-Comparison Parameters (Production Capacity, Distribution Network, Market Share, Brand Loyalty, Product Innovation, Marketing Budget, Sustainability Initiatives, Consumer Targeting)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital and Private Equity Funding

6. North America Sports Drink Market Regulatory Framework

6.1. Nutritional Labeling Standards

6.2. Health Claims Certification

6.3. Compliance Requirements for Additives and Ingredients

7. Future Market Segmentation (In Value %)

7.1. By Type

7.2. By Packaging Type

7.3. By Flavor

7.4. By Distribution Channel

7.5. By Region

8. Market Analysts Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Consumer Cohort Analysis

8.3. Market Penetration Strategies

8.4. White Space Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase entails mapping the North America sports drink market ecosystem, which includes extensive desk research across secondary databases to gather industry-level information. The main goal is to pinpoint critical variables that influence market behavior.

Step 2: Market Analysis and Construction

In this stage, we compile historical data and assess market penetration, product distribution ratios, and the associated revenue generation. We also examine consumer engagement statistics to ensure reliable market analysis.

Step 3: Hypothesis Validation and Expert Consultation

Our hypotheses are validated through interviews with industry professionals using computer-assisted telephone interviews (CATIs), offering operational and strategic insights to fine-tune the market data.

Step 4: Research Synthesis and Final Output

In this final stage, we engage with key beverage manufacturers for insights into product performance and consumer preferences. This approach complements the bottom-up data, ensuring a comprehensive analysis of the North America sports drink market.

Frequently Asked Questions

01. How big is the North America Sports Drink Market?

The North America sports drink market is valued at USD 9.2 billion, driven by rising consumer health consciousness and increased sports participation.

02. What are the challenges in the North America Sports Drink Market?

Key challenges include high sugar content in traditional products, increased competition from healthier alternatives, and stringent regulatory requirements on additives.

03. Who are the major players in the North America Sports Drink Market?

Major players include PepsiCo, Coca-Cola, Red Bull, Bodyarmor, and Monster Beverage, dominating through extensive distribution, brand strength, and product innovation.

04. What are the growth drivers in the North America Sports Drink Market?

Growth drivers include a growing preference for active lifestyles, rising disposable incomes, and an expanding market for functional beverages among fitness enthusiasts.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.