North America Sustainable Aviation Fuel Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD7868

November 2024

86

About the Report

North America Sustainable Aviation Fuel Market Overview

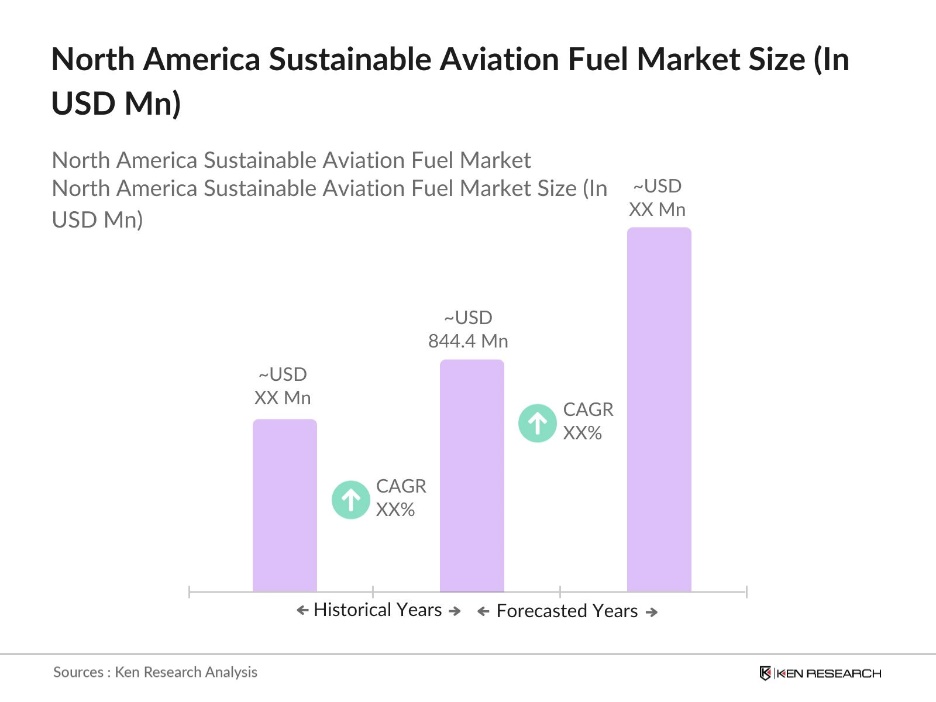

- The North America Sustainable Aviation Fuel market is valued at USD 844.4 million, supported by increasing investments in renewable energy sources and government initiatives aimed at reducing carbon emissions in the aviation sector. The market is driven by advancements in technology for the production of sustainable aviation fuels and the growing commitment of airlines to meet sustainability targets, alongside regulations promoting the use of eco-friendly fuels.

- The United States and Canada dominate the North America Sustainable Aviation Fuel market due to their extensive aviation infrastructure, supportive government policies, and investments in research and development of alternative fuels. Major airlines in these countries are increasingly adopting sustainable aviation fuels to comply with environmental regulations and meet consumer demand for greener travel options, making these nations key players in the market.

- The U.S. federal government has set ambitious emission reduction targets for the aviation sector. The Sustainable Aviation Fuel Grand meet 100% of aviation fuel demand with SAF by 2050. These targets are part of broader efforts to achieve net-zero emissions across the economy, underscoring the critical role of SAF in national climate strategies.

North America Sustainable Aviation Fuel Market Segmentation

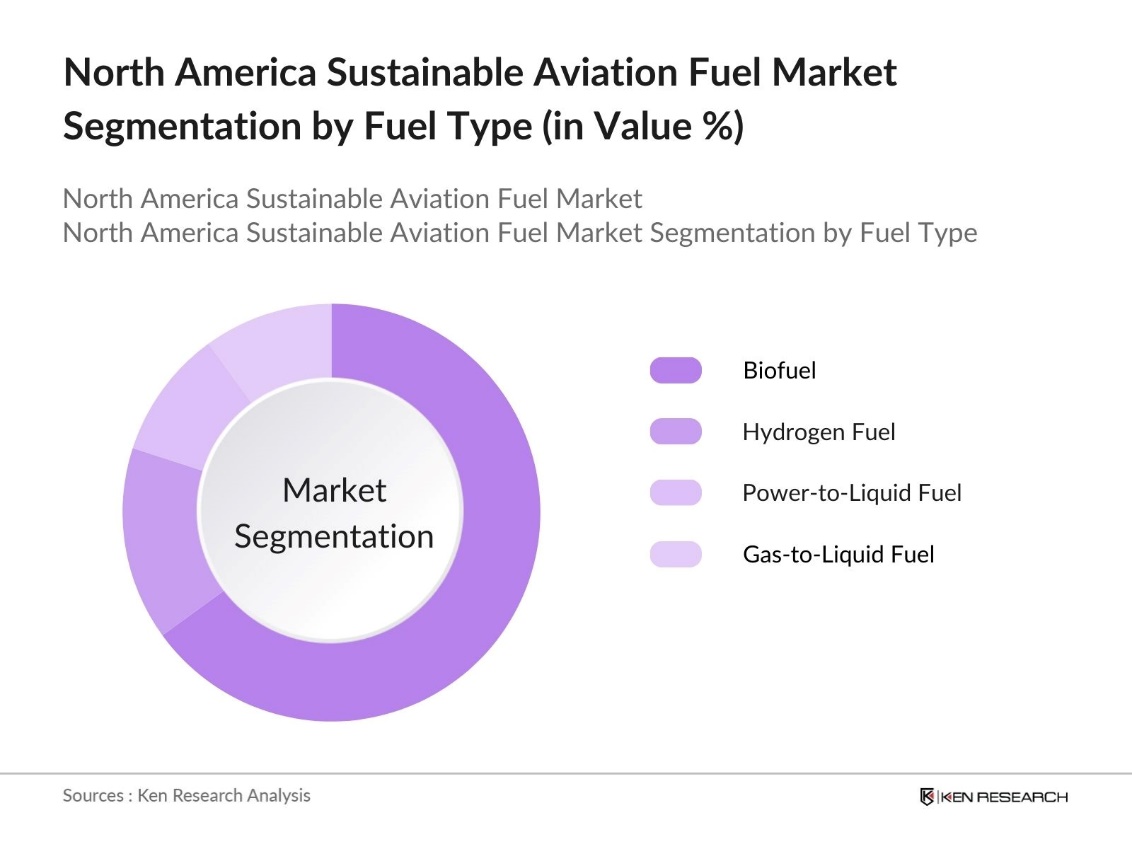

By Fuel Type: The market is segmented by fuel type into biofuel, hydrogen fuel, power-to-liquid fuel, and gas-to-liquid fuel. The biofuel segment currently holds the largest market share due to its established technology and wide acceptance among airlines. Biofuels, particularly those derived from waste and non-food feedstocks, have gained traction as they significantly reduce lifecycle greenhouse gas emissions compared to conventional jet fuels. Major airlines are investing in biofuel partnerships and infrastructure, further solidifying the dominance of this segment.

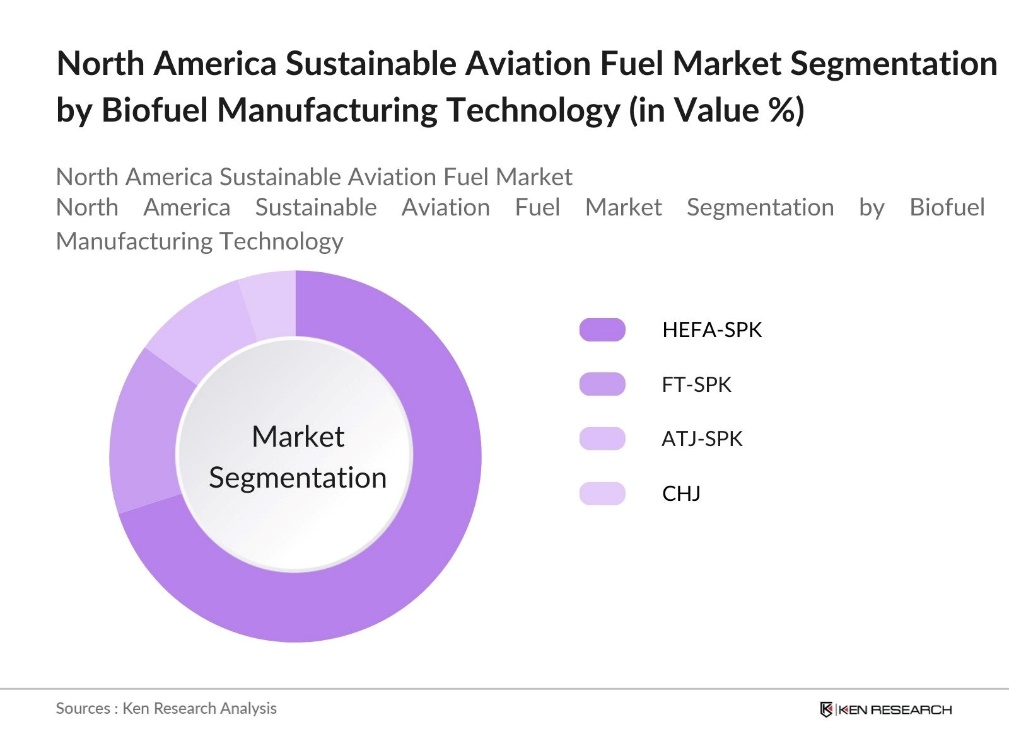

By Biofuel Manufacturing Technology: The market is segmented by biofuel manufacturing technology, which includes hydroprocessed esters and fatty acids synthetic paraffinic kerosene (HEFA-SPK), Fischer-Tropsch synthetic paraffinic kerosene (FT-SPK), alcohol-to-jet synthetic paraffinic kerosene (ATJ-SPK), and catalytic hydrothermolysis jet (CHJ). HEFA-SPK dominates the market due to its compatibility with existing jet engine infrastructure and its established production processes. As airlines seek to blend sustainable fuels with conventional jet fuel, HEFA-SPK offers a practical solution that aligns with regulatory standards and operational needs.

North America Sustainable Aviation Fuel Market Competitive Landscape

The North America Sustainable Aviation Fuel market is characterized by a competitive landscape dominated by a few key players. Major companies include Neste Corporation, Gevo, Inc., World Energy, LLC, Fulcrum BioEnergy, Inc., and LanzaTech, Inc. This consolidation indicates significant influence from these companies, which are leveraging their technological expertise and production capabilities to expand their market presence.

North America Sustainable Aviation Fuel Industry Analysis

Growth Drivers

- Environmental Regulations: The aviation sector is a significant contributor to greenhouse gas emissions, accounting for approximately 2.5% of global CO emissions. In response, North American governments have implemented stringent environmental regulations to mitigate this impact. The United States Environmental Protection Agency (EPA) has established the Renewable Fuel Standard (RFS), mandating the incorporation of renewable fuels into the nation's fuel supply. These regulations are driving the adoption of Sustainable Aviation Fuel (SAF) as a means to comply with emission reduction targets.

- Airline Sustainability Initiatives: Major North American airlines are proactively committing to sustainability goals to address environmental concerns and meet consumer expectations. For instance, United Airlines has pledged to achieve net-zero carbon emissions by 2050 and has invested in SAF production. In 2021, United operated a passenger flight powered entirely by SAF, demonstrating its commitment to sustainable aviation.

- Technological Advancements in Fuel Production: Technological advancements are boosting the feasibility and efficiency of Sustainable Aviation Fuel (SAF) production. Techniques like Hydroprocessed Esters and Fatty Acids (HEFA) and Fischer-Tropsch synthesis are converting waste oils and agricultural residues into SAF at larger scales. Additionally, research into Power-to-Liquid (PtL) technologies, which transform renewable electricity into liquid fuels, shows promise for the future of SAF, furthering aviations shift toward lower emissions and sustainability.

Market Challenges

- High Production Costs: SAF production remains more costly than traditional jet fuel due to expenses in feedstock procurement, advanced processing technologies, and scaling up production facilities. This cost difference challenges broader adoption of SAF in the aviation industry, requiring ongoing government support and technological innovations to reach a more economical level comparable to conventional fuels.

- Feedstock Availability: The limited availability of sustainable feedstocks, such as waste oils and agricultural residues, is a key challenge for SAF production. Competing industry demands and regional supply variations impact the steady production of SAF. Establishing a dependable and sustainable feedstock supply chain is critical to meeting the increasing demand for SAF across North America.

North America Sustainable Aviation Fuel Market Future Outlook

Over the next five years, the North America Sustainable Aviation Fuel market is expected to experience significant growth, driven by continuous government support, advancements in fuel production technologies, and increasing demand from airlines for eco-friendly fuel options. Regulatory frameworks and investment in renewable energy infrastructure are likely to bolster the market further, creating opportunities for innovation and expansion in sustainable aviation fuel production.

Market Opportunities

- Expansion of Production Facilities: Expanding SAF production facilities offers a significant opportunity to meet the growing demand for sustainable aviation fuels. Scaling up production capacity is essential not only to address supply needs but also to achieve cost efficiencies through economies of scale. Such facility expansions play a critical role in advancing the aviation industry's transition to more sustainable fuel sources.

- Strategic Partnerships and Collaborations: Collaborations among airlines, fuel producers, and technology innovators are key to accelerating SAF development and adoption. These partnerships foster knowledge sharing, reduce risks, and pool resources, thereby enhancing the viability and scalability of SAF initiatives. Joint efforts strengthen the industrys capacity to overcome challenges in SAF production and expand its sustainable impact.

Scope of the Report

|

By Fuel Type |

Biofuel |

|

By Biofuel Manufacturing Technology |

Hydroprocessed Esters and Fatty Acids Synthetic Paraffinic Kerosene (HEFA-SPK) |

|

By Blending Capacity |

Below 30% |

|

By Platform |

Commercial Aviation |

|

By Region |

United States |

Products

Key Target Audience

Airlines and Aviation Companies

Renewable Energy Industry

Environmental Organizations

Aircraft Manufacturers

Research and Development Firms

Government and Regulatory Bodies (U.S. Federal Aviation Administration, Environment and Climate Change Canada)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Neste Corporation

Gevo, Inc.

World Energy, LLC

Fulcrum BioEnergy, Inc.

LanzaTech, Inc.

Red Rock Biofuels

Velocys plc

Aemetis, Inc.

SkyNRG

Preem AB

Table of Contents

1. North America Sustainable Aviation Fuel Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. North America Sustainable Aviation Fuel Market Size (USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Sustainable Aviation Fuel Market Analysis

3.1 Growth Drivers

3.1.1 Environmental Regulations

3.1.2 Airline Sustainability Initiatives

3.1.3 Technological Advancements in Fuel Production

3.1.4 Government Incentives and Subsidies

3.2 Market Challenges

3.2.1 High Production Costs

3.2.2 Feedstock Availability

3.2.3 Infrastructure Limitations

3.3 Opportunities

3.3.1 Expansion of Production Facilities

3.3.2 Strategic Partnerships and Collaborations

3.3.3 Advancements in Feedstock Technologies

3.4 Trends

3.4.1 Adoption of Power-to-Liquid Technologies

3.4.2 Integration with Carbon Capture and Storage

3.4.3 Increased Investment in Research and Development

3.5 Government Regulations

3.5.1 Federal Emission Reduction Targets

3.5.2 State-Level Mandates and Incentives

3.5.3 International Agreements and Compliance

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. North America Sustainable Aviation Fuel Market Segmentation

4.1 By Fuel Type (Value %)

4.1.1 Biofuel

4.1.2 Hydrogen Fuel

4.1.3 Power-to-Liquid Fuel

4.1.4 Gas-to-Liquid Fuel

4.2 By Biofuel Manufacturing Technology (Value %)

4.2.1 Hydroprocessed Esters and Fatty Acids Synthetic Paraffinic Kerosene (HEFA-SPK)

4.2.2 Fischer-Tropsch Synthetic Paraffinic Kerosene (FT-SPK)

4.2.3 Alcohol-to-Jet Synthetic Paraffinic Kerosene (ATJ-SPK)

4.2.4 Catalytic Hydrothermolysis Jet (CHJ)

4.3 By Blending Capacity (Value %)

4.3.1 Below 30%

4.3.2 30% to 50%

4.3.3 Above 50%

4.4 By Platform (Value %)

4.4.1 Commercial Aviation

4.4.2 Military Aviation

4.4.3 Business and General Aviation

4.4.4 Unmanned Aerial Vehicles

4.5 By Region (Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

5. North America Sustainable Aviation Fuel Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Neste Corporation

5.1.2 Gevo, Inc.

5.1.3 World Energy, LLC

5.1.4 Fulcrum BioEnergy, Inc.

5.1.5 LanzaTech, Inc.

5.1.6 Red Rock Biofuels

5.1.7 Velocys plc

5.1.8 Aemetis, Inc.

5.1.9 SkyNRG

5.1.10 Preem AB

5.1.11 TotalEnergies SE

5.1.12 Shell plc

5.1.13 BP p.l.c.

5.1.14 Chevron Corporation

5.1.15 Exxon Mobil Corporation

5.2 Cross Comparison Parameters (Revenue, Production Capacity, Geographic Presence, Strategic Initiatives, Technological Capabilities, Partnerships, Certifications, Sustainability Commitments)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. North America Sustainable Aviation Fuel Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. North America Sustainable Aviation Fuel Future Market Size (USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America Sustainable Aviation Fuel Future Market Segmentation

8.1 By Fuel Type (Value %)

8.2 By Biofuel Manufacturing Technology (Value %)

8.3 By Blending Capacity (Value %)

8.4 By Platform (Value %)

8.5 By Region (Value %)

9. North America Sustainable Aviation Fuel Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the North America Sustainable Aviation Fuel market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the North America Sustainable Aviation Fuel market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATI) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple sustainable aviation fuel manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the North America Sustainable Aviation Fuel market.

Frequently Asked Questions

01. How big is the North America Sustainable Aviation Fuel market?

The North America Sustainable Aviation Fuel market is valued at USD 844.4 million, driven by increased investments in renewable energy and government initiatives aimed at reducing carbon emissions in the aviation sector.

02. What are the challenges in the North America Sustainable Aviation Fuel market?

Challenges North America Sustainable Aviation Fuel market include high production costs associated with sustainable fuel technologies, limited feedstock availability, and the need for significant investments in infrastructure to support the distribution and use of sustainable aviation fuels.

03. Who are the major players in the North America Sustainable Aviation Fuel market?

Key players in the North America Sustainable Aviation Fuel market include Neste Corporation, Gevo, Inc., World Energy, LLC, Fulcrum BioEnergy, Inc., and LanzaTech, Inc., which dominate due to their technological expertise and strategic partnerships with airlines.

04. What are the growth drivers of the North America Sustainable Aviation Fuel market?

The North America Sustainable Aviation Fuel market is propelled by factors such as government regulations promoting the use of sustainable fuels, advancements in production technologies, and airlines' commitment to reducing their carbon footprint.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.