North America Telecom Services Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD7672

November 2024

95

About the Report

North America Telecom Services Market Overview

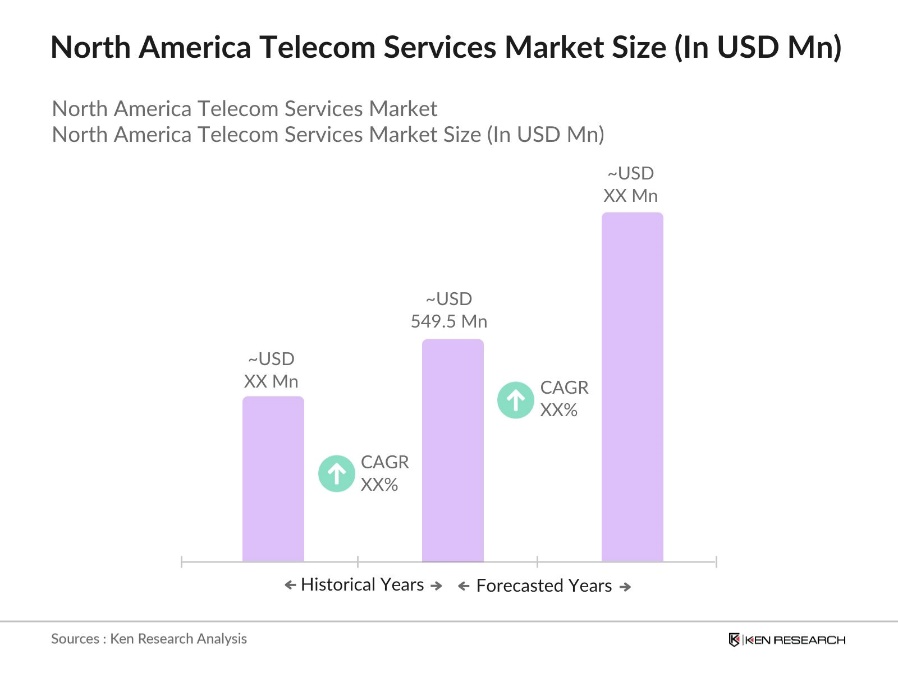

- The North American telecom services market is valued at USD 549.5 billion, a dynamic and integral component of the region's economy. This expansion is primarily driven by the widespread adoption of 5G technology, increasing mobile data consumption, and the proliferation of Internet of Things (IoT) applications. The continuous investment in infrastructure by major service providers further propels market growth.

- The United States stands as the dominant player in the North American telecom services market. This dominance is attributed to its advanced technological infrastructure, substantial investments in 5G deployment, and a high penetration rate of mobile and broadband services. Major cities like New York, Los Angeles, and Chicago serve as significant hubs due to their dense populations and high demand for advanced telecom services. Canada and Mexico also contribute to the market, albeit to a lesser extent, with ongoing developments in their respective telecom sectors.

- The FCC was authorized to auction any spectrum, significant progress has been made in allocating frequencies to support 5G expansion. In 2023, the FCC successfully auctioned mid-band spectrum. This initiative facilitates enhanced network capacities and broader 5G coverage across North America, enabling telecom providers to deploy advanced services and improve connectivity in both urban and rural areas. These spectrum auctions are pivotal in driving the telecom markets growth and technological advancement.

North America Telecom Services Market Segmentation

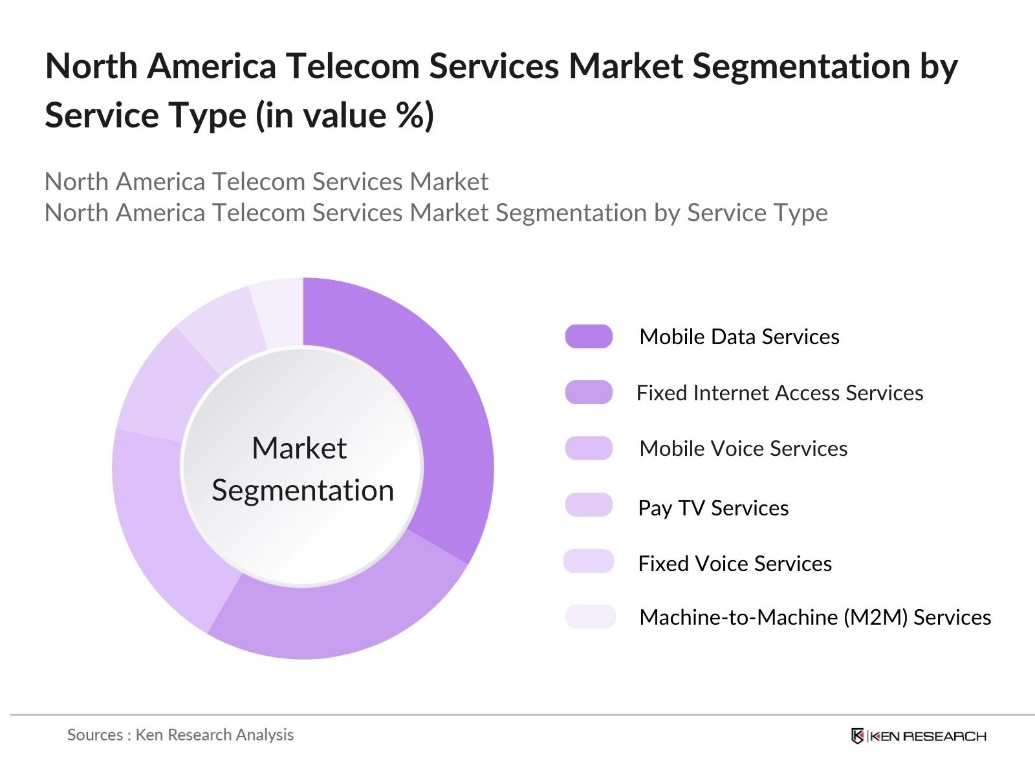

By Service Type: The market is segmented by service type into fixed voice services, fixed internet access services, mobile voice services, mobile data services, pay TV services, and machine-to-machine (M2M) services. Among these, mobile data services hold a dominant market share. This dominance is due to the increasing reliance on smartphones and mobile applications, leading to a surge in data consumption. The rollout of 5G networks has further amplified the demand for high-speed mobile data services, catering to both consumer and business needs.

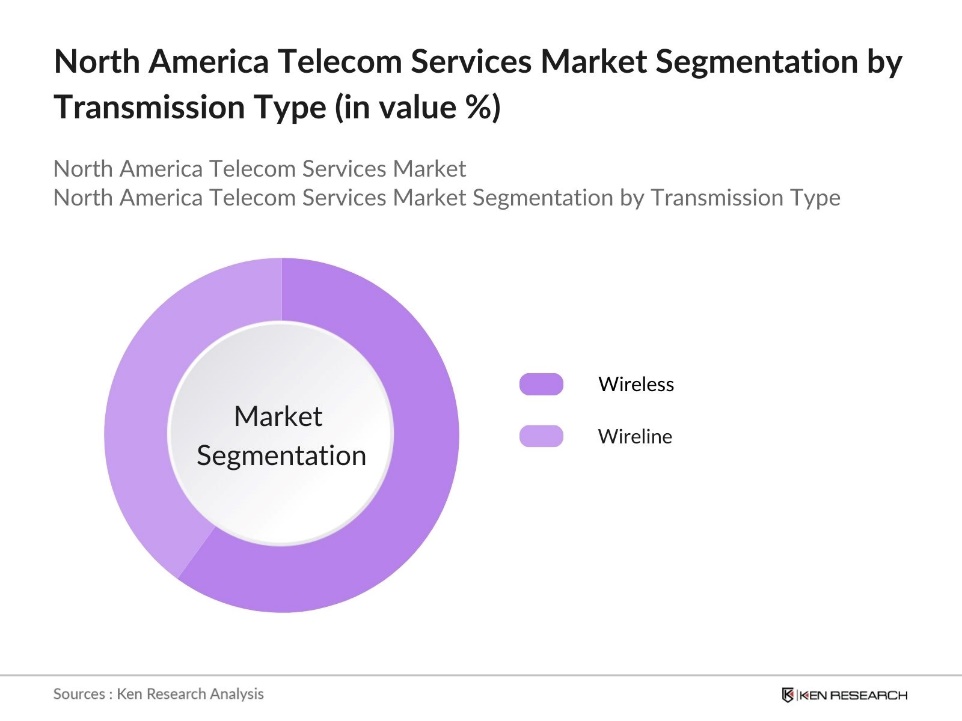

By Transmission: The market is segmented by transmission into wireline and wireless services. Wireless services dominate the market share, driven by the convenience and mobility they offer. The proliferation of mobile devices and the expansion of wireless networks, including 4G and 5G technologies, have made wireless services more accessible and preferred among consumers and businesses alike.

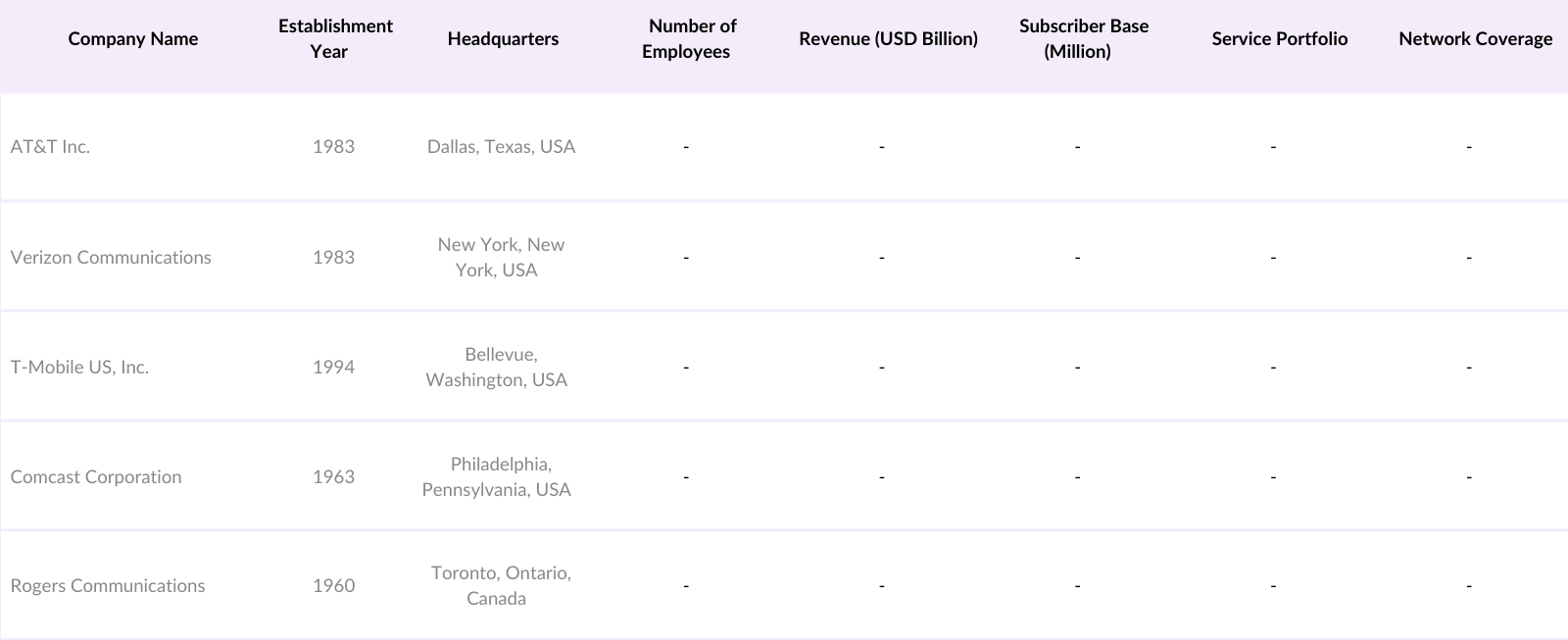

North America Telecom Services Market Competitive Landscape

The North American telecom services market is characterized by the presence of several key players who drive innovation and competition. These companies have established extensive networks and offer a wide range of services to cater to diverse customer needs.

North America Telecom Services Industry Analysis

Growth Drivers

- 5G Network Deployment: As of early 2024, North America has achieved significant milestones in 5G network deployment. In the United States, over 300 million people, representing approximately 90% of the population, are covered by 5G low-band networks from major service providers. Additionally, the individuals have access to 5G mid-band coverage. This extensive coverage facilitates enhanced connectivity and supports the proliferation of advanced applications across various sectors.

- Rising Mobile Data Consumption: Mobile data consumption in North America continues to escalate. The monthly data traffic in the region is projected to reach 1.88 exabytes by 2029, indicating a substantial increase from previous years. This surge is driven by the widespread adoption of smartphones, streaming services, and data-intensive applications, underscoring the growing demand for robust telecom services.

- Expansion of IoT Applications: The Internet of Things (IoT) ecosystem in North America is expanding rapidly, with billions of connected devices enhancing various industries. This growth is bolstered by advancements in 5G technology, which offers the low latency and high bandwidth necessary for IoT applications. The proliferation of IoT devices necessitates reliable and extensive telecom infrastructure to support seamless connectivity and data transmission.

Market Challenges

- High Infrastructure Costs: Deploying and maintaining advanced telecom infrastructure, particularly for the rollout of 5G networks, requires significant financial resources. The expenses involved in acquiring spectrum licenses, building new transmission towers, and upgrading existing infrastructure pose considerable challenges for telecom service providers. These high costs can strain profitability and, in some cases, may lead to delays in expanding services, especially in less populated or rural areas where returns on investment might be lower.

- Regulatory Compliance: Telecom companies operate within a complex regulatory framework, needing to comply with a range of federal, state, and local regulations. This includes adhering to data privacy laws, managing spectrum allocation, and following additional regulatory requirements that can vary widely by region. Compliance is often resource-intensive and can impact operational efficiency, as companies must allocate time and financial resources to ensure that all regulations are consistently met.

North America Telecom Services Market Future Outlook

Over the next five years, the North American telecom services market is expected to experience significant growth. This expansion will be driven by continuous advancements in 5G technology, increasing demand for high-speed internet, and the integration of IoT devices across various sectors. The emphasis on digital transformation and smart city initiatives will further propel the market, creating opportunities for service providers to innovate and expand their offerings.

Market Opportunities

- Emergence of Edge Computing: Edge computing is becoming increasingly prominent, allowing data to be processed closer to its source, which significantly reduces latency. This capability is especially important for applications that require real-time processing, such as autonomous vehicles, industrial automation, and smart city technologies. Telecom companies are well-positioned to capitalize on this trend by developing edge computing solutions that can enhance their service offerings and open up new revenue streams through advanced, low-latency services.

- Growth in Cloud Services: The demand for cloud services is growing rapidly as businesses increasingly seek scalable and flexible IT solutions to support their operations. Telecom providers have a unique opportunity to leverage this trend by expanding their portfolio to include cloud-based services. By utilizing their extensive infrastructure, telecom companies can deliver secure, high-reliability cloud solutions tailored to the needs of enterprise clients, making them valuable partners in the evolving digital landscape.

Scope of the Report

|

Service Type |

Fixed Voice Services Fixed Internet Access Services Mobile Voice Services, Mobile Data Services Pay TV Services Machine-to-Machine (M2M) Services |

|

Transmission |

Wireline Wireless |

|

End-User |

Consumer/Residential Business (IT & Telecom, Manufacturing, Healthcare, Retail, Media & Entertainment, Government & Defense, Education, BFSI, Energy & Utilities, Transportation & Logistics, Travel & Hospitality, Oil & Gas and Mining, Others) |

|

Technology |

2G 3G 4G/LTE 5G |

|

Region |

United States Canada Mexico |

Products

Key Target Audience

Telecom Industry

Network Equipment Manufacturers

Mobile Device Manufacturers

Consumer Electronics Industry

Government and Regulatory Bodies (e.g., Federal Communications Commission, Canadian Radio-television and Telecommunications Commission)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

AT&T Inc.

Verizon Communications Inc.

T-Mobile US, Inc.

Comcast Corporation

Charter Communications, Inc.

Rogers Communications Inc.

BCE Inc. (Bell Canada)

Shaw Communications Inc.

TELUS Corporation

Amrica Mvil, S.A.B. de C.V.

Table of Contents

1. North America Telecom Services Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. North America Telecom Services Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. North America Telecom Services Market Analysis

3.1. Growth Drivers

3.1.1. 5G Network Deployment

3.1.2. Rising Mobile Data Consumption

3.1.3. Expansion of IoT Applications

3.1.4. Government Initiatives and Policies

3.2. Market Challenges

3.2.1. High Infrastructure Costs

3.2.2. Regulatory Compliance

3.2.3. Market Saturation

3.3. Opportunities

3.3.1. Emergence of Edge Computing

3.3.2. Growth in Cloud Services

3.3.3. Expansion into Rural Areas

3.4. Trends

3.4.1. Adoption of AI and Machine Learning

3.4.2. Integration with Smart City Projects

3.4.3. Increased Focus on Cybersecurity

3.5. Government Regulations

3.5.1. Spectrum Allocation Policies

3.5.2. Net Neutrality Regulations

3.5.3. Data Privacy Laws

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. North America Telecom Services Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Fixed Voice Services

4.1.2. Fixed Internet Access Services

4.1.3. Mobile Voice Services

4.1.4. Mobile Data Services

4.1.5. Pay TV Services

4.1.6. Machine-to-Machine (M2M) Services

4.2. By Transmission (In Value %)

4.2.1. Wireline

4.2.2. Wireless

4.3. By End-User (In Value %)

4.3.1. Consumer/Residential

4.3.2. Business

4.3.2.1. IT & Telecom

4.3.2.2. Manufacturing

4.3.2.3. Healthcare

4.3.2.4. Retail

4.3.2.5. Media & Entertainment

4.3.2.6. Government & Defense

4.3.2.7. Education

4.3.2.8. Banking, Financial Services, and Insurance (BFSI)

4.3.2.9. Energy and Utilities

4.3.2.10. Transportation & Logistics

4.3.2.11. Travel & Hospitality

4.3.2.12. Oil & Gas and Mining

4.3.2.13. Others

4.4. By Technology (In Value %)

4.4.1. 2G

4.4.2. 3G

4.4.3. 4G/LTE

4.4.4. 5G

4.5. By Region (In Value %)

4.5.1. United States

4.5.2. Canada

4.5.3. Mexico

5. North America Telecom Services Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. AT&T Inc.

5.1.2. Verizon Communications Inc.

5.1.3. T-Mobile US, Inc.

5.1.4. Comcast Corporation

5.1.5. Charter Communications, Inc.

5.1.6. Rogers Communications Inc.

5.1.7. BCE Inc. (Bell Canada)

5.1.8. Shaw Communications Inc.

5.1.9. TELUS Corporation

5.1.10. Amrica Mvil, S.A.B. de C.V.

5.1.11. Frontier Communications Corporation

5.1.12. Windstream Holdings, Inc.

5.1.13. CenturyLink, Inc.

5.1.14. Cox Communications, Inc.

5.1.15. Altice USA, Inc.

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Subscriber Base, Market Share, Service Portfolio, Network Coverage)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. North America Telecom Services Market Regulatory Framework

6.1. Telecommunications Act

6.2. Federal Communications Commission (FCC) Guidelines

6.3. Canadian Radio-television and Telecommunications Commission (CRTC) Regulations

6.4. Spectrum Licensing Procedures

6.5. Cross-Border Telecommunications Agreements

7. North America Telecom Services Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. North America Telecom Services Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By Transmission (In Value %)

8.3. By End-User (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9.North America Telecom Services Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

9.5. Regional Market Entry Strategies

9.6. Strategic Positioning and Differentiation Opportunities

9.7. Vendor Selection Criteria and RFP Recommendations

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the North America Telecom Services Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the North America Telecom Services Market. This includes evaluating market penetration, service adoption rates, and revenue generation by key segments. Further, an assessment of service quality and infrastructure investments is conducted to ensure reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through in-depth interviews with industry experts across various companies. These discussions provide valuable insights into service demand trends, financial projections, and operational challenges directly from key stakeholders, aiding in refining and corroborating market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with telecom service providers to acquire detailed information on service segments, customer preferences, and emerging technological trends. This engagement ensures a thorough validation of the research data and allows for a comprehensive, accurate analysis of the North America Telecom Services Market.

Frequently Asked Questions

01 How big is the North America Telecom Services Market?

The North America Telecom Services Market is valued at USD 549.5 billion, with steady growth attributed to advancements in network infrastructure, rising mobile data demand, and IoT expansion.

02 What are the growth drivers in the North America Telecom Services Market?

Key growth drivers in North America Telecom Services Market include rapid 5G deployment, increasing consumer demand for mobile data, and technological integration across industries such as IoT and edge computing.

03 Who are the major players in the North America Telecom Services Market?

Leading companies in this North America Telecom Services Market include AT&T, Verizon Communications, T-Mobile US, Comcast, and Charter Communications, each holding substantial influence due to their extensive networks and service offerings.

04 What challenges does the North America Telecom Services Market face?

The North America Telecom Services Market faces challenges such as high infrastructure costs, regulatory compliance requirements, and increased competition in saturated segments like fixed voice services.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.